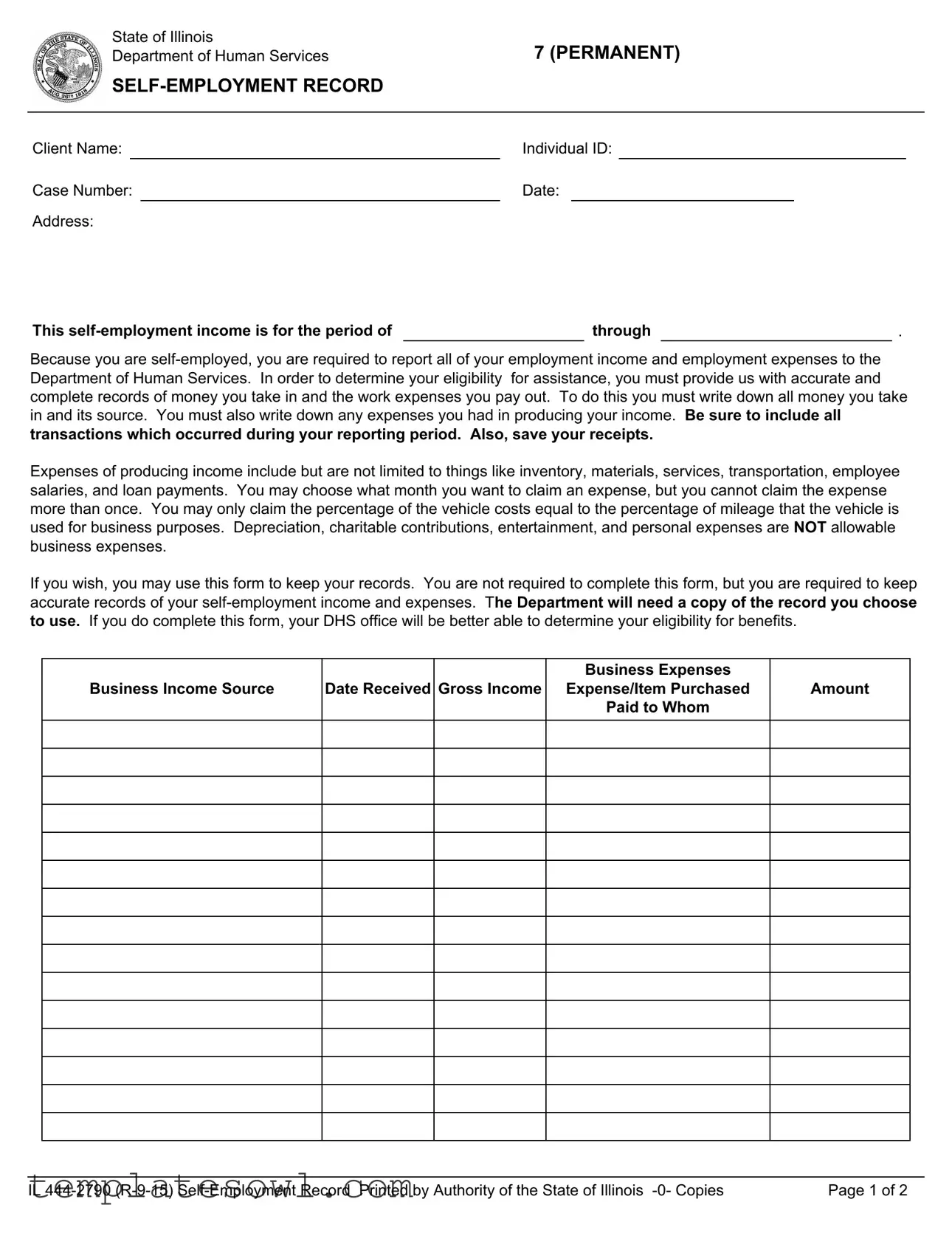

Fill Out Your Il 444 2790 Self Employment Record Form

The IL 444 2790 Self Employment Record form is an essential document for individuals in Illinois who are self-employed and seeking assistance from the Department of Human Services. This form enables users to systematically report their income and expenses during a specific reporting period. To properly complete the form, users must capture all sources of income and detailed accounts of expenses incurred in generating that income. This ensures the Department can assess eligibility for various assistance programs effectively. Important to note is that allowable business expenses include items such as inventory, transportation, and employee salaries, but exclude depreciation, charitable contributions, and personal costs. Furthermore, while completion of the form is not mandatory, maintaining accurate records is required. The form also provides guidance on claiming business-related vehicle expenses based on the percentage of mileage dedicated to business use. It is crucial for individuals to save all receipts and keep thorough records, as these contribute to a more accurate evaluation of their financial standing and eligibility for support. Completing this form not only aids individuals in managing their self-employment finances but also plays a vital role in determining their eligibility for benefits.

Il 444 2790 Self Employment Record Example

State of Illinois |

7 (PERMANENT) |

|||||

Department of Human Services |

||||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Client Name: |

Individual ID: |

|

|

|||

Case Number: |

|

Date: |

|

|

||

Address: |

|

|

|

|

|

|

This |

|

through |

|

. |

Because you are

Expenses of producing income include but are not limited to things like inventory, materials, services, transportation, employee salaries, and loan payments. You may choose what month you want to claim an expense, but you cannot claim the expense more than once. You may only claim the percentage of the vehicle costs equal to the percentage of mileage that the vehicle is used for business purposes. Depreciation, charitable contributions, entertainment, and personal expenses are NOT allowable business expenses.

If you wish, you may use this form to keep your records. You are not required to complete this form, but you are required to keep accurate records of your

Business Income Source

Date Received Gross Income

Business Expenses

Expense/Item Purchased

Paid to Whom

Amount

IL |

Page 1 of 2 |

State of Illinois |

7 (PERMANENT) |

Department of Human Services |

|

|

|

|

|

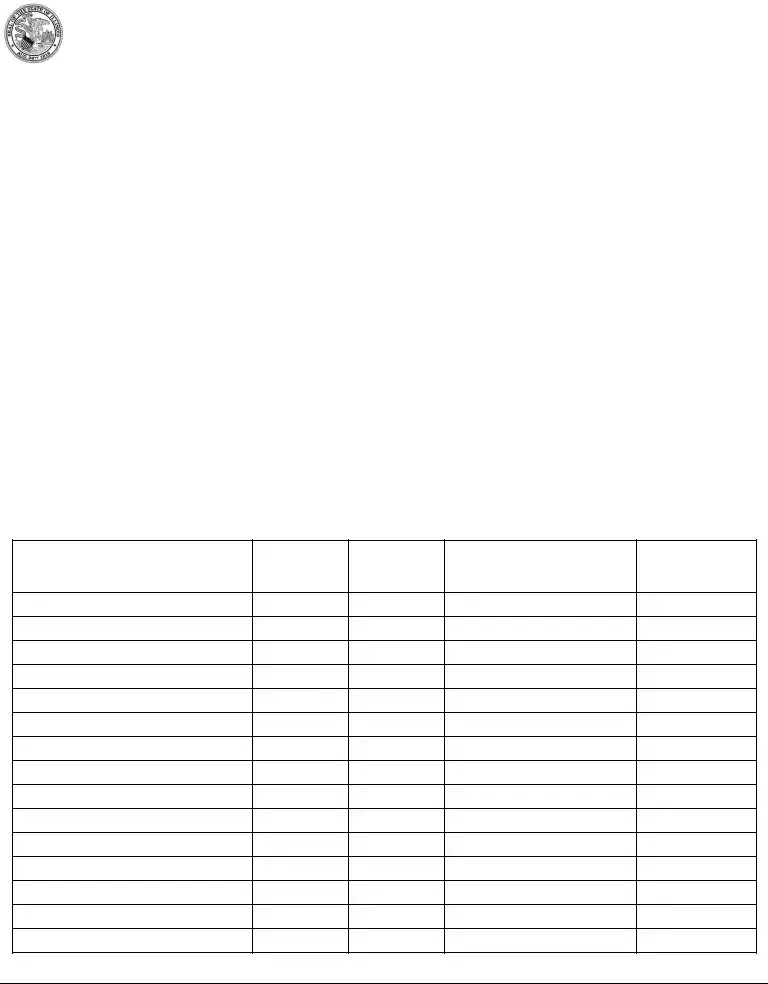

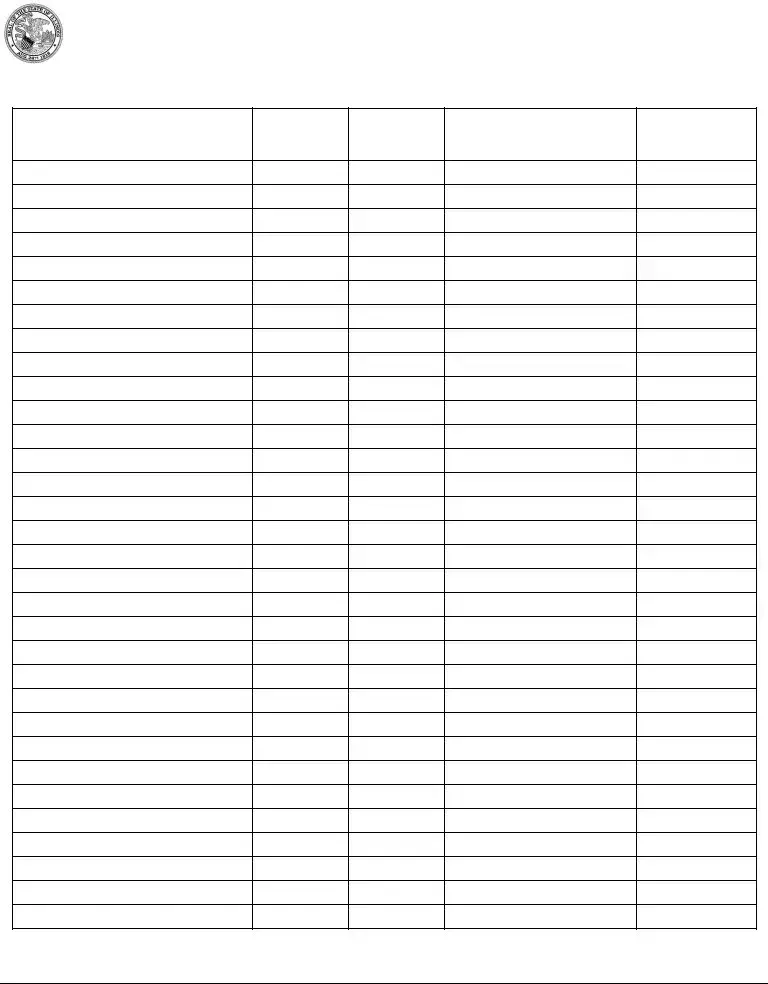

Business Income Source

Date Received Gross Income

Business Expenses

Expense/Item Purchased

Paid to Whom

Amount

IL |

Page 2 of 2 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The IL 444 2790 form is used for recording self-employment income and expenses, which helps individuals report their financial activities to the Department of Human Services in Illinois. |

| Governing Law | This form is governed by Illinois state laws related to public assistance and eligibility requirements as outlined by the Illinois Department of Human Services. |

| Required Reporting | Individuals are required to report all self-employment income and associated expenses during their reporting period to determine eligibility for assistance. |

| Record Keeping | Accurate and complete records of income and expenses must be maintained, and all receipts should be kept as proof of transactions. |

| Expenses Explanation | Allowable expenses include inventory, materials, transportation, and employee salaries. Personal and non-business costs, such as entertainment and charitable donations, cannot be claimed. |

| Expense Claiming | Expenses can be claimed in the month the individual chooses, but must not be reported more than once. |

| Vehicle Expenses | Claims for vehicle costs can only include the proportionate share based on business-related mileage. |

| Form Usage | Though using the IL 444 2790 form is not mandatory, utilizing it can assist in maintaining better records and facilitate the eligibility determination process. |

| Form Version | The current version of the form is IL 444-2790 (R-9-15) and the document is printed by the authority of the State of Illinois. |

Guidelines on Utilizing Il 444 2790 Self Employment Record

Completing the IL 444 2790 Self Employment Record form is an important step for self-employed individuals to accurately report their income and expenses. By doing so, you provide necessary information to the Department of Human Services, which will help in determining your eligibility for assistance. Here are the steps to fill out this form accurately.

- Gather Required Information: Before starting, collect your business income records and any relevant receipts for expenses during the reporting period.

- Client Details: On the top section of the form, fill in your Client Name, Individual ID, Case Number, and Date.

- Address: Enter your current address in the designated area.

- Reporting Period: Specify the dates for the reporting period by filling in the start and end dates.

- Income Section: For each source of business income you received during that period:

- List the Source of the income.

- Indicate the Date Received.

- Enter the Gross Income amount.

- Expense Section: Next, record any business expenses:

- Write down the Expense/Item Purchased.

- Notate who you Paid to Whom.

- Include the Amount spent on that expense.

- Review: After completing all fields, double-check your entries for accuracy. Make sure all sources of income and expenses are accounted for.

- Save Documentation: Keep copies of your receipts and any records used while filling out the form.

- Submit Your Form: Once you are satisfied with the information provided, submit this form and keep a copy for your records.

Your completed IL 444 2790 form will serve as an official record for your self-employment income and expenses. It's essential for maintaining compliance and ensuring your eligibility for any assistance you may need. Taking the time to fill it out carefully will benefit you in the long run.

What You Should Know About This Form

What is the purpose of the IL 444 2790 Self Employment Record form?

The IL 444 2790 Self Employment Record form is designed to help individuals who are self-employed keep track of their income and expenses. This information is important for the Department of Human Services (DHS) to assess your eligibility for assistance programs. By providing accurate records of your earnings and costs, you enable the DHS to make informed decisions about your support needs.

Who needs to complete this form?

If you are self-employed and receiving or applying for assistance from the Department of Human Services in Illinois, you should consider using this form. It is not mandatory to complete the form itself, but you must maintain thorough documentation of your self-employment income and expenses to qualify for benefits.

What information is required on the form?

When filling out the form, you need to provide various details, such as your name, Individual ID, Case Number, and address. You must record your self-employment income during the specified period, including the sources and gross earnings. You should also document any expenses related to your business operations, including what you purchased, who you paid, and the amounts involved.

How should I track my business expenses?

What types of expenses are not allowed?

It's important to know that certain types of expenses cannot be claimed as business deductions. These include personal expenses, charitable contributions, entertainment costs, and depreciation. Always focus on expenses that directly relate to your business operations to ensure compliance with DHS requirements.

Do I need to submit this form to the DHS?

You are not required to submit the IL 444 2790 form itself, but if you choose to use it to keep your records, you should provide a copy to your DHS office. Doing so will help them assess your situation and determine your eligibility for assistance more efficiently.

Can I choose which month to claim my expenses?

Yes, you can choose which month to claim an expense; however, you cannot claim the same expense more than once. Keep careful track of when expenses were incurred and claim them accordingly, ensuring that your reports remain accurate and transparent.

Common mistakes

Completing the IL 444 2790 Self Employment Record form accurately is crucial for self-employed individuals applying for assistance. However, many people make mistakes that can lead to delays or denials of benefits. Here are five common pitfalls to avoid.

First, one of the biggest mistakes is failing to report all income sources. It's important to capture every dollar earned. Even small amounts can add up and affect eligibility. Be thorough when listing your income sources to ensure accurate reporting. Missing small sources of income can result in an incomplete application.

Another frequent error occurs in the reporting of business expenses. Some individuals omit necessary receipts or fail to document all expenses adequately. Each expense should be supported with receipts or thorough notes. This not only helps substantiate the claims but also ensures that the Department has complete records to work with. By neglecting to keep receipts or to report all eligible expenses, applicants could lose out on entitled benefits.

The third mistake involves double counting expenses. While it might be tempting to claim certain expenses more than once, this approach can lead to serious complications. It's vital to track each expense only once during the designated reporting period. Keep your records organized to avoid the temptation to duplicate claims.

Additionally, it's important to pay attention to the specific rules regarding business-related vehicle expenses. Often, applicants do not calculate the business mileage accurately. Remember that you can only claim the percentage of vehicle costs that corresponds to business use. This means keeping a detailed mileage log can save time and prevent inaccuracies.

Lastly, some people misunderstand which expenses are allowable. Many individuals mistakenly categorize personal expenses as business expenses. Claims for depreciation, charitable contributions, entertainment, and personal expenses won't be accepted. Understanding what constitutes a business expense can prevent rejection of the form and ensure a smoother application process.

Avoiding these common mistakes can simplify the process of completing the IL 444 2790 Self Employment Record form. By being thorough, accurate, and informed, individuals can enhance their eligibility for assistance while maintaining a clear record of their self-employment income and expenses.

Documents used along the form

The IL 444 2790 Self Employment Record form is an essential document for individuals self-employed in Illinois. It provides a structured way to report income and expenses, which is crucial for determining eligibility for assistance programs. However, several other forms and documents often accompany it, helping to create a comprehensive financial profile. Below is a list of additional forms that you may need to consider.

- Business License - This document proves that a business has been officially registered and is operating in compliance with local regulations. It is essential to have proper licensing to avoid legal issues.

- IRS Schedule C (Form 1040) - This form allows self-employed individuals to report their income or loss from business operations. It is an integral part of filing personal taxes for those operating independently.

- Profit and Loss Statement - A Profit and Loss Statement summarizes the revenues, costs, and expenses incurred during a specified period, providing a clear picture of business performance.

- Expense Receipts - These documents serve as proof of all business-related expenses. Keeping detailed records of receipts is critical for accurate reporting and potential audits.

- 1099-MISC Form - If you have received payments as a contractor or freelancer, this form will be used to report the income. You must report this income on your tax return.

- Sales Tax Permit - This document is required if your business sells taxable goods or services. It enables you to collect tax from customers and remit it to the state.

- Bank Statements - Monthly bank statements help track business income and expenses. They can also serve as supplementary evidence during audits or financial reviews.

- Employee Payroll Records - If you have employees, maintaining payroll records is crucial. These records include wages paid, tax withholdings, and other compensation-related documents.

- Health Insurance Documentation - If you are self-employed, maintaining proof of health insurance coverage is necessary, especially if you’re applying for certain assistance programs.

- Business Plan - A business plan outlines the strategy and roadmap for your business. While not always mandatory, it can be beneficial for securing loans or attracting investors.

Having these forms and documents organized and accessible can significantly impact financial management and eligibility for various assistance programs. It is advisable to keep all records up to date and accurate. This proactive approach not only ensures compliance but also aids in maintaining your business’s financial health.

Similar forms

IRS Form Schedule C: This form is used by sole proprietors to report income or loss from a business. Similar to the Self Employment Record, it requires details about income and expenses over the year, helping the IRS determine net profit or loss.

1099-MISC Form: Independent contractors receive this form to report various kinds of income other than wages, salaries, and tips. Like the Self Employment Record, it requires accurate income reporting but focuses on reporting to the IRS rather than a government assistance program.

Business Mileage Log: This keeps track of business-related mileage for vehicle expenses. Both documents require precise record-keeping to validate business expenses, although the mileage log is specific to travel, while the Self Employment Record covers broader costs.

Profit and Loss Statement: Often used in business accounting, this statement summarizes revenues and expenses. Both documents aim to capture an accurate financial picture of self-employment, but the Profit and Loss Statement is more comprehensive over a specific time period.

Expense Report: Employees submit this to get reimbursed for business-related expenses. This is similar to the expenses recorded in the Self Employment Record, as both documents necessitate detailing what was spent for business purposes in order to maintain accurate financial records.

W-2 Form: Employers provide this form to report wage and salary information. While it’s for traditional employment, the accuracy of income reporting mirrors what is required in the Self Employment Record for income received during self-employment.

Sales Tax Return: Required for businesses collecting sales tax, it summarizes taxable sales and tax collected. This document also requires meticulous record-keeping, much like the Self Employment Record for tracking all income earned.

Profit and Loss Projection: This document forecasts a business’s future profitability based on income and expenses. Both templates require estimation and tracking, as accurate projections depend on reliable record-keeping of income and expenses.

Operating Statement: Used primarily by corporations, this summarizes revenues and expenses to show profitability. Both statements aim to produce a clear view of financial activities, though the Operating Statement often caters to a larger scale.

Budget Sheet: Helping businesses plan and control finances, this sheet outlines estimated income and expenses. Like the Self Employment Record, it requires detailed tracking but is usually more focused on future financial planning rather than historical data.

Dos and Don'ts

When filling out the IL 444 2790 Self Employment Record form, keep these important do's and don'ts in mind:

- Do provide your full name, Individual ID, and Case Number.

- Do clearly state the reporting period for your self-employment income.

- Do list all sources of income and the total amount received.

- Do keep copies of receipts for every expense you plan to report.

- Do accurately record all business expenses you incurred during the reporting period.

- Don’t claim any personal expenses as business expenses.

- Don’t report the same expense more than once.

- Don’t forget to note the proportion of vehicle use for business if claiming vehicle costs.

- Don’t ignore the Department's requirement for accurate records; this is crucial for determining your eligibility.

Misconceptions

There are several misconceptions surrounding the IL 444 2790 Self Employment Record form that can lead to confusion. Understanding what this form entails can help self-employed individuals manage their records more effectively. Here are six common misconceptions:

- It is mandatory to use the form. While you can use the IL 444 2790 to keep your records, you are not required to complete it. However, accurate records are crucial for determining your eligibility for benefits.

- You can claim any expense related to your business. Not all expenses qualify as deductible. Expenses like depreciation, personal expenses, and entertainment are explicitly not allowed.

- Once an expense is recorded, it can be claimed multiple times. Each expense can only be claimed once. This means keeping track of what you've already reported is essential.

- Only cash transactions need to be recorded. It's important to document all transactions, including any forms of payment, along with your income sources.

- You can claim any percentage of vehicle costs. You can only claim the portion of vehicle costs that corresponds to business-related mileage.

- Receipts are not necessary if using the form. Even if you use the IL 444 2790, keeping receipts for all transactions is critical for substantiating your records.

Addressing these misconceptions can help ensure accurate reporting and a smoother experience when dealing with assistance programs. If you have further questions, it’s essential to reach out to the Department of Human Services for clarification.

Key takeaways

Filling out and using the IL 444 2790 Self Employment Record form effectively can aid in managing your self-employment income for assistance eligibility. Here are key takeaways to consider:

- Provide your Client Name, Individual ID, and Case Number accurately to avoid processing delays.

- Report the period of self-employment income correctly; specify the start and end dates.

- Document all income you receive, including detailed records of its source.

- Keep a comprehensive list of all work-related expenses such as inventory and transportation.

- Save your receipts as they are vital for verifying your expenses.

- Claim expenses in the month you incur them, but do not claim the same expense more than once.

- Only report vehicle expenses based on the percentage of business use; personal and entertainment expenses are not allowed.

- Consider using the form to maintain your records, although completing it is optional.

- Submit a copy of the form or your records to your DHS office to support your eligibility for benefits.

Browse Other Templates

Smith Warranty Claim - Using a traceable shipping method is highly recommended for your return.

How to Transfer Transcript From College to College - Make sure to sign and date the form for authorization.