Fill Out Your Illinois Calculating Support Form

Navigating the complexities of child support can be challenging, particularly for parents who find themselves entangled in the legal system. In Illinois, the Calculating Support form serves as a crucial tool for determining child support obligations. This form allows the non-custodial parent to transparently assess their financial responsibilities by providing a structured way to document and calculate their income. Using a straightforward process, the form captures various income sources, including gross income from employment and any additional income that may contribute to the financial picture. It further delineates allowable deductions, such as federal and state tax withholding, FICA contributions, mandatory retirement deductions, and other relevant costs, ensuring an accurate depiction of one's net income. After establishing this financial foundation, the form applies a percentage based on the number of children involved, outlining the expected support payments due. By navigating these steps, parents can engage with the process in a constructive manner, paving the way for clearer financial arrangements that prioritize the well-being of their children.

Illinois Calculating Support Example

State of Illinois

Department of Healthcare and Family Services

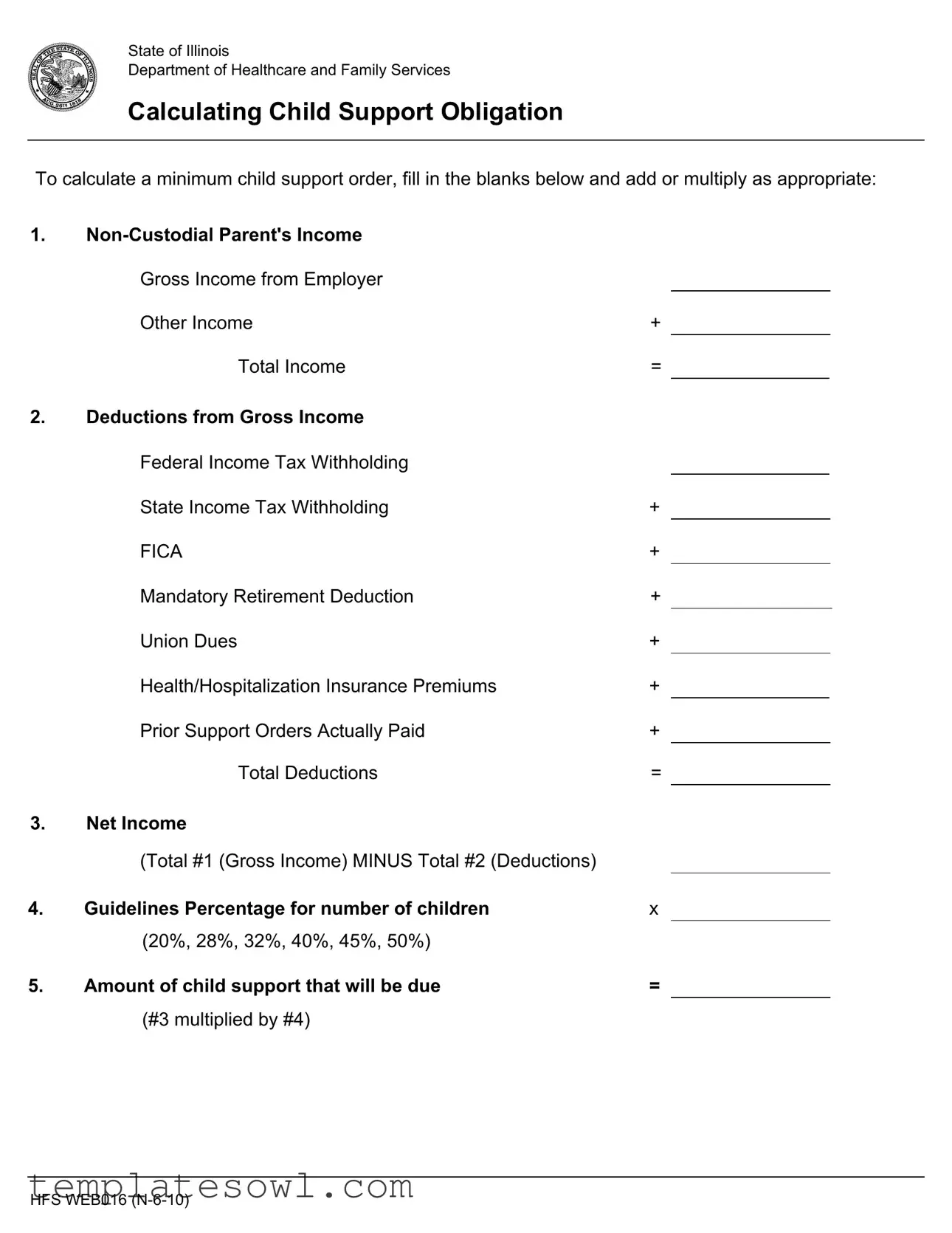

Calculating Child Support Obligation

To calculate a minimum child support order, fill in the blanks below and add or multiply as appropriate:

1. |

|

|

|

Gross Income from Employer |

|

|

Other Income |

+ |

|

Total Income |

= |

2.Deductions from Gross Income

|

Federal Income Tax Withholding |

|

|

State Income Tax Withholding |

+ |

|

FICA |

+ |

|

Mandatory Retirement Deduction |

+ |

|

Union Dues |

+ |

|

Health/Hospitalization Insurance Premiums |

+ |

|

Prior Support Orders Actually Paid |

+ |

|

Total Deductions |

= |

3. |

Net Income |

|

|

(Total #1 (Gross Income) MINUS Total #2 (Deductions) |

|

4. |

Guidelines Percentage for number of children |

x |

|

(20%, 28%, 32%, 40%, 45%, 50%) |

|

5. |

Amount of child support that will be due |

= |

|

(#3 multiplied by #4) |

|

HFS WEB016

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | Child support calculations in Illinois are governed by the Illinois Marriage and Dissolution of Marriage Act, specifically 750 ILCS 5/505. |

| Purpose of the Form | The Illinois Calculating Support form is designed to help non-custodial parents determine the appropriate amount of child support they may owe. |

| Components of Income | The calculation begins with the non-custodial parent's gross income, which includes earnings from employment and any other sources of income. |

| Deductions | Various deductions from gross income can be subtracted. These include taxes, mandatory retirement contributions, union dues, and health insurance premiums. |

| Calculating Net Income | The formula to obtain net income involves subtracting total deductions from gross income, resulting in the non-custodial parent's net income. |

| Guidelines Percentage | The child support obligation is calculated based on a percentage of net income, varying according to the number of children, ranging from 20% to 50%. |

| Final Calculation | The final amount of child support due is determined by multiplying the net income by the appropriate guidelines percentage. |

| Form Reference | This form is identified as HFS WEB016 (N-6-10) within the Illinois Department of Healthcare and Family Services documentation. |

Guidelines on Utilizing Illinois Calculating Support

Filling out the Illinois Calculating Support form is an essential step in determining child support obligations. This process involves collecting necessary income information and applying specific calculations to reach an accurate support amount. By following these steps, you can complete the form effectively.

- Gather income information for the non-custodial parent, including gross income from their employer and any additional income.

- Calculate the total income by adding the gross income from the employer and any other sources of income.

- List and calculate deductions from gross income, including:

- Federal Income Tax Withholding

- State Income Tax Withholding

- FICA

- Mandatory Retirement Deduction

- Union Dues

- Health/Hospitalization Insurance Premiums

- Prior Support Orders Actually Paid

- Sum all deductions to find the total deductions amount.

- Subtract the total deductions from the total income to calculate net income.

- Determine the guidelines percentage based on the number of children, which corresponds to 20%, 28%, 32%, 40%, 45%, or 50%.

- Finally, multiply the net income by the guidelines percentage to calculate the amount of child support that will be due.

What You Should Know About This Form

What is the purpose of the Illinois Calculating Support form?

The Illinois Calculating Support form helps determine the minimum child support order for non-custodial parents. By calculating the net income of the non-custodial parent and applying the appropriate guidelines percentage, the form provides a straightforward method to ensure that child support obligations are fairly assessed.

How do I calculate net income using the form?

To calculate net income, first, total the non-custodial parent's gross income, which includes wages and any other sources of income. Next, identify and sum up all deductions from gross income, such as federal and state taxes, FICA, and health insurance premiums. Subtract the total deductions from the gross income to arrive at the net income.

What percentage of income should be used for calculating child support?

The guidelines percentage depends on the number of children requiring support. The scale is as follows: for one child, use 20%; for two children, 28%; for three children, 32%; for four children, 40%; for five children, 45%; and for six or more children, 50%. This percentage is then multiplied by the net income to determine the child support amount owed.

What deductions are allowed when calculating gross income?

Allowed deductions include federal income tax withholding, state income tax withholding, FICA contributions, any mandatory retirement deductions, union dues, and health or hospitalization insurance premiums. Additionally, prior support orders that have been paid can also be deducted from gross income.

Can child support amounts be adjusted after the initial calculation?

Yes, child support amounts can be adjusted due to changes in circumstances. If the non-custodial parent's income fluctuates, or if there is a change in the number of children or their needs, a petition can be filed to recalculate and modify the support obligation through the appropriate legal channels.

Where can I access the Illinois Calculating Support form?

The Illinois Calculating Support form can typically be obtained from the State of Illinois Department of Healthcare and Family Services website. It may also be available at local family court offices or through legal aid organizations that assist with family law matters.

Common mistakes

Filling out the Illinois Calculating Support form can be complicated, and many people make errors that affect the final child support obligation. One common mistake is miscalculating the non-custodial parent's income. Ensure that every source of income is included. Gross income should encompass not just salary but also bonuses, commissions, and any other forms of compensation.

Another frequent error is neglecting to account for all applicable deductions. Deductions can significantly lower the gross income and ultimately affect the net income calculation. Many overlook items such as prior support orders paid and union dues. Failing to include these can lead to inflated net income, resulting in a higher child support obligation.

Some people misunderstand the guidelines percentage based on the number of children. It’s essential to apply the correct guideline, as each scenario takes into account different percentages. Misapplying this percentage can lead to substantial discrepancies in the final support amount.

It’s also not uncommon to mistakenly add instead of subtracting when calculating net income. The form specifically instructs to subtract total deductions from gross income. This error will lead to an inaccurate net income figure, which will affect all subsequent calculations.

Additionally, a lack of clarity in reporting additional income can create problems. Other income includes various sources like rental income or dividends. Not fully disclosing these can result in penalties later on, as the court expects full transparency regarding financial resources.

Similarly, failure to update the form regularly can lead to outdated information. Income can fluctuate, and individuals need to reflect these changes promptly. Whether it's a new job, a raise, or a decrease in income, timely updates are necessary to ensure the support aligns with the current situation.

Obstructions can also arise from incorrect arithmetic. Simple calculation errors can lead to larger misconceptions about the actual obligation. Double-check all entries, especially when multiplying or adding totals, to ensure accuracy throughout the process.

Lastly, rushing through the form can result in oversights. Careful review is crucial. Take time to go through the entire calculation step-by-step. Each detail counts, and a comprehensive check after completion ensures everything is in order before submission.

Documents used along the form

When navigating child support issues in Illinois, several important forms accompany the Illinois Calculating Support form. Each document plays a critical role in determining obligations and ensuring compliance with the law. Understanding these forms can help achieve a fair resolution more efficiently.

- Illinois Child Support Order Form: This form officially outlines the court's order regarding child support payments. It specifies the amount the non-custodial parent must pay and can include health insurance provisions.

- Income Verification Form: This document is often necessary to confirm the income of both parents. It may require pay stubs, tax returns, or other financial documents to establish reliable income figures.

- Parenting Plan: While not directly related to support calculations, this form details custody arrangements and visitation schedules. It helps ensure that both parents understand their roles and responsibilities, which can influence support decisions.

- Modification Petition: If circumstances change, this form is used to request a review and possible modification of the existing child support order. It allows parents to address any changes in income or needs.

- Financial Affidavit: This is a sworn statement of a parent’s financial situation. It includes income, expenses, assets, and liabilities, aiding the court in evaluating support needs.

- Dependency Exemption Form: This form allows a parent to claim a child as a dependent on tax returns. It is essential for determining financial support obligations and can impact tax liabilities.

Utilizing the correct combination of these documents will help clarify financial responsibilities and support arrangements. Each form contributes uniquely to the process, ensuring fair treatment for all parties involved. Pay attention to each requirement to avoid delays and complications.

Similar forms

The Illinois Calculating Support form is essential for determining child support obligations. It bears similarities to several other documents that serve similar purposes in family law. Here is a list detailing these comparable forms:

- Child Support Worksheet: This document outlines income and deductions in a structured format, allowing parents to calculate support payments based on their financial situation.

- Financial Affidavit: Often required in divorce proceedings, a financial affidavit presents a complete overview of an individual's income, expenses, assets, and debts, supporting the determination of child support obligations.

- Income Verification Form: This form provides evidence of an individual's income, often requested in child support cases to confirm financial data reported in other documents.

- Child Support Guidelines Chart: Similar to the Illinois form, this chart details the percentage of income that should be allocated for child support, depending on the number of children involved in the case.

- Notice of Child Support Payment: This document tracks payments made by the non-custodial parent, helping to ensure that obligations are met and providing a record for both parties.

- Modification Request Form: When there are changes in circumstances, this form allows parents to request adjustments in the child support order, reflecting new income levels or other relevant factors.

Dos and Don'ts

When completing the Illinois Calculating Support form, it is vital to be thorough and accurate. Here are five key do's and don'ts to keep in mind.

- Do accurately report the non-custodial parent's gross income from all sources.

- Do ensure all deductions are legitimate and well-documented.

- Do double-check calculations at each stage to prevent errors.

- Do seek assistance if unsure about the form or calculations.

- Do keep copies of all completed forms for your records.

- Don't underestimate any income sources, as this may affect the support obligation.

- Don't omit any legitimate deductions you are entitled to claim.

- Don't leave any blank spaces; fill in every section of the form.

- Don't delay filing the form, as this can hinder timely support assessments.

- Don't provide inaccurate information, as this can lead to legal penalties.

Misconceptions

Misconceptions about the Illinois Calculating Support form can lead to confusion and potentially incorrect child support calculations. Here are seven common misunderstandings:

- 1. The form is only for custodial parents. Many believe that this form only applies to custodial parents. In fact, the form is crucial for both custodial and non-custodial parents to determine a fair support obligation.

- 2. Only income from employment counts. Some individuals think that only salary or wages are considered. However, all sources of income, such as rental income, investments, or bonuses, must be included.

- 3. Deductions are optional. A common misconception is that deductions from gross income can be ignored. Accurate deductions must be accounted for, as they directly affect the final support amount.

- 4. The percentages for child support are fixed. People often believe that child support percentages are set in stone. In reality, guidelines adjust based on the number of children involved, leading to varying obligations.

- 5. The calculations are simple and straightforward. While the form outlines a clear process, many find the calculations complex. Incorrect calculations can occur if all components are not carefully considered.

- 6. Child support payments remain the same indefinitely. Some assume that once established, child support amounts do not change. Child support can be modified based on changes in income or other significant circumstances.

- 7. The form only needs to be completed once. It is a misconception that the form only needs to be filled out during the initial calculation. Ongoing changes in circumstances may require periodic reassessment and adjustment of the support amount.

Understanding these misconceptions can ensure that all parties fulfill their obligations correctly and equitably.

Key takeaways

When filling out the Illinois Calculating Support form, several important points should be considered to ensure accuracy and compliance with state guidelines.

- Complete Income Section Thoroughly: Document all sources of income for the non-custodial parent. Include gross earnings from employment as well as any additional income received.

- Factor in Deductions: Clearly list all allowable deductions from gross income. This includes federal and state taxes, FICA contributions, mandatory retirement deductions, union dues, health insurance premiums, and prior support payments.

- Calculate Net Income Accurately: Subtract the total deductions from the gross income to arrive at the net income. This figure is crucial for determining the support obligation.

- Understand Guidelines Percentages: Familiarize yourself with the percentages applicable based on the number of children, as this will directly influence the final support amount. For example, the percentage increases with the number of children.

- Calculate Support Due: Multiply the net income by the appropriate guidelines percentage to find the amount of child support that will be owed. This calculation must be precise to avoid future disputes.

- Keep Documentation Handy: Maintain all relevant documents, such as income statements and deduction records, as they may be needed for verification or future reference.

- Review for Errors: After completing the form, review each section for accuracy. An error in any part of the calculation can lead to complications in child support obligations.

Browse Other Templates

Macomb Community College Transcript - Make sure to enter your 7-digit Macomb ID number.

Massachusetts Nonresident Filing Requirements - Include taxable pensions or annuities and related 1099 forms.

West Virginia Incident Report Form,WV State Police Report Request,WV Criminal and Crash Record Form,West Virginia Accident and Criminal Report,WVSP Traffic and Crime Disclosure Form,West Virginia Law Enforcement Report Application,WV Police Incident - Information about parking and pedestrian incidents is also captured in the report.