Fill Out Your Illinois Crt 61 Form

Understanding the Illinois CRT-61 form is essential for both sellers and buyers engaged in wholesale transactions within the state. This form, known as the Certificate of Resale, plays a crucial role in ensuring that sales tax is appropriately handled. Sellers must verify the purchaser’s Illinois account ID or resale number, which affirms that the buyer is authorized to make tax-exempt purchases. The CRT-61 certifies that a buyer is not required to pay sales tax on goods purchased for resale, rather than personal use. It is important for sellers to keep these certificates on file as proof of compliance should the Illinois Department of Revenue request documentation regarding tax-exempt sales. While the CRT-61 is specifically outlined for this purpose, alternative documents can also serve as proof, provided they include the requisite information about both parties, the nature of the purchase, and the purchaser's signature. There are situations where a blanket certificate can be issued, allowing purchasers to declare all—or a percentage—of their purchases from a seller as tax-exempt for resale, thus simplifying the process for ongoing business relationships. Keeping your certificates updated is key; ensure they reflect any changes in purchasing patterns every few years to stay compliant.

Illinois Crt 61 Example

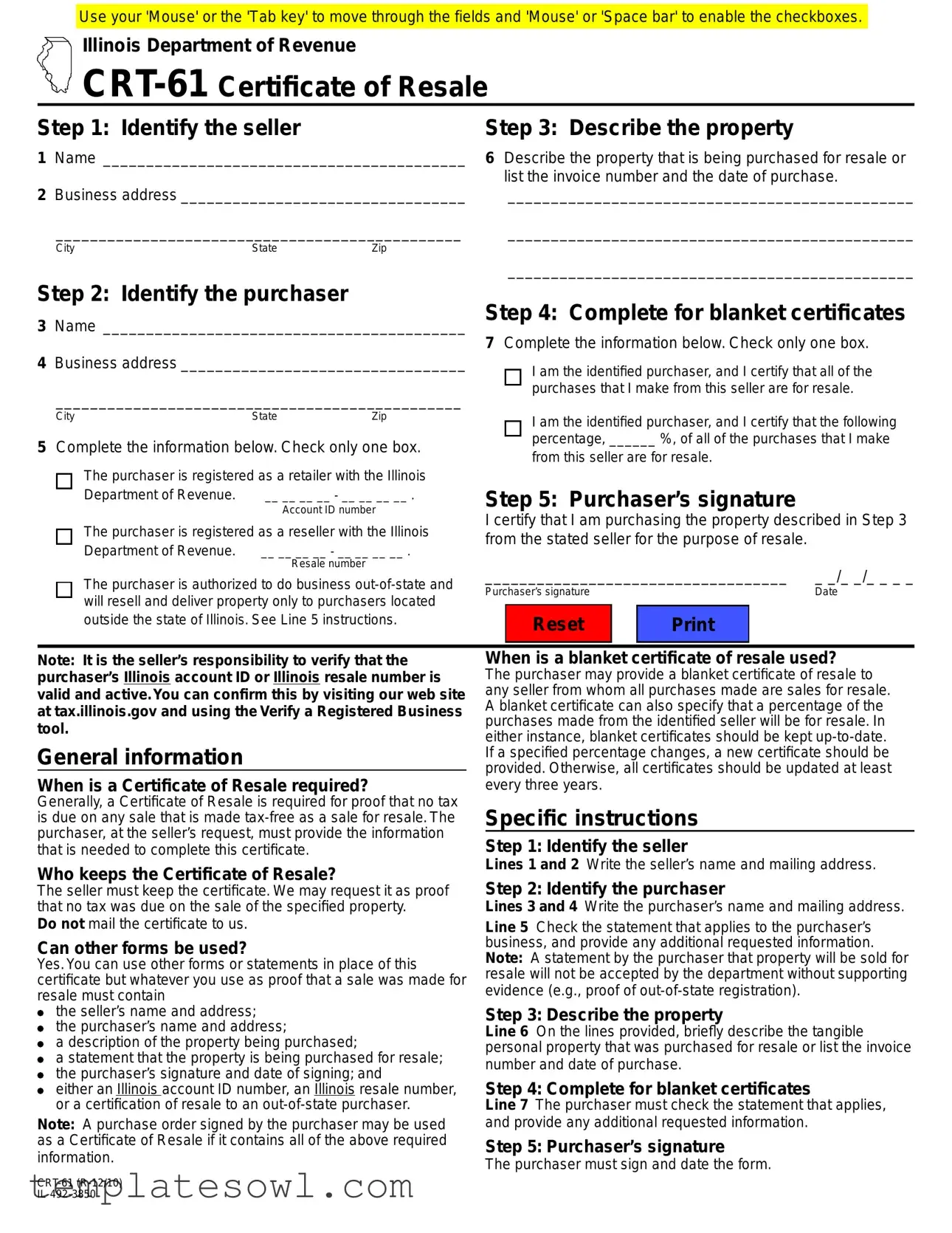

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

Step 3: Describe the property

6 Describe the property that is being purchased for resale or list the invoice number and the date of purchase.

_______________________________________________

_______________________________________________

_______________________________________________

Step 4: Complete for blanket certificates

3 Name __________________________________________

7 Complete the information below. Check only one box.

4 Business address _________________________________ |

I am the identified purchaser, and I certify that all of the |

||||

|

|

|

|||

_______________________________________________ |

purchases that I make from this seller are for resale. |

||||

|

|

||||

|

State |

Zip |

I am the identified purchaser, and I certify that the following |

||

|

|

|

|||

5 Complete the information below. Check only one box. |

percentage, ______ %, of all of the purchases that I make |

||||

from this seller are for resale. |

|

||||

|

|

|

|

||

The purchaser is registered as a retailer with the Illinois |

|

|

|||

Department of Revenue. |

__ __ __ __ - __ __ __ __ . |

Step 5: Purchaser’s signature |

|

||

|

|

Account ID number |

|

||

|

|

I certify that I am purchasing the property described in Step 3 |

|||

The purchaser is registered as a reseller with the Illinois |

|||||

from the stated seller for the purpose of resale. |

|

||||

Department of Revenue. |

__ __ __ __ - __ __ __ __ . |

|

|||

|

|

||||

|

|

Resale number |

___________________________________ |

_ _/_ _/_ _ _ _ |

|

|

|

|

|||

|

|

|

Purchaser’s signature |

Date |

|

Reset

When is a blanket certificate of resale used?

The purchaser may provide a blanket certificate of resale to any seller from whom all purchases made are sales for resale. A blanket certificate can also specify that a percentage of the purchases made from the identified seller will be for resale. In either instance, blanket certificates should be kept

Specific instructions

Step 1: Identify the seller

Lines 1 and 2 Write the seller’s name and mailing address.

Step 2: Identify the purchaser

Lines 3 and 4 Write the purchaser’s name and mailing address.

Line 5 Check the statement that applies to the purchaser’s business, and provide any additional requested information. Note: A statement by the purchaser that property will be sold for resale will not be accepted by the department without supporting evidence (e.g., proof of

Step 3: Describe the property

Line 6 On the lines provided, briefly describe the tangible personal property that was purchased for resale or list the invoice number and date of purchase.

Step 4: Complete for blanket certificates

Line 7 The purchaser must check the statement that applies, and provide any additional requested information.

Step 5: Purchaser’s signature

The purchaser must sign and date the form.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The CRT-61 form serves as a Certificate of Resale to show that no tax is due on sales made for resale. |

| Seller's Responsibility | It is the seller's duty to verify the purchaser’s Illinois account ID or resale number is valid and active. |

| Retention of Certificate | Sellers must retain the certificate as proof that no tax was owed on the sale. |

| Alternative Forms | Other forms or statements may replace the CRT-61, provided they include required information. |

| Required Information | Essentials include names, addresses, property description, purpose of purchase, signatures, and identification numbers. |

| Blanket Certificate | A blanket certificate can be provided for multiple purchases, indicating the intended percentage of resale. |

| Validity Period | Blanket certificates should be updated every three years or whenever the specified percentage changes. |

| Governing Laws | The Illinois Department of Revenue regulates the use of the CRT-61 under state sales tax laws. |

Guidelines on Utilizing Illinois Crt 61

After completing the Illinois CRT-61 form, ensure everything is accurate before keeping it with your records. This form is crucial for transactions that involve tax-free sales. Follow these steps carefully to fill it out correctly.

- Identify the seller: In lines 1 and 2, provide the seller’s name and mailing address.

- Identify the purchaser: In lines 3 and 4, write the purchaser’s name and mailing address.

- Complete purchaser information: In line 5, check the statement that fits the purchaser’s business status. Add any requested information.

- Describe the property: In line 6, briefly describe the property being purchased for resale or list the invoice number and date of purchase.

- Complete blanket certificate details: In line 7, check the statement that applies regarding blanket certificates and provide any necessary information.

- Sign and date: The purchaser must sign at the bottom of the form and include the date.

What You Should Know About This Form

What is the Illinois CRT-61 Form?

The Illinois CRT-61 Form, also known as the Certificate of Resale, is a document used by sellers and purchasers in Illinois. This form serves as proof that a sale is tax-exempt, as it is considered a sale for resale. When a purchaser buys goods intended for resale, they must provide the seller with this certificate to avoid paying sales tax on those items.

When is a Certificate of Resale required?

A Certificate of Resale is generally required whenever a buyer makes a purchase that is intended for resale. This form verifies that the seller should not collect sales tax on the transaction. The purchaser must provide this certificate upon request to complete the sale without incurring tax charges.

Who is responsible for keeping the Certificate of Resale?

The seller is responsible for retaining the Certificate of Resale. In the event of an audit, the Illinois Department of Revenue may request this certificate as proof that the sale was exempt from tax. It is important to note that sellers should not send the certificate to the tax authority; it must be kept on file by the seller instead.

Can other forms be used in place of the CRT-61?

Yes, other documents can serve as proof of a tax-exempt sale as long as they include specific required information. Any substitute form must feature the seller's and purchaser's names and addresses, a description of the purchased property, a declaration that the property is for resale, and the purchaser’s signature. Additionally, the form must include either an Illinois account ID number, a resale number, or a resale certification for out-of-state purchasers.

What is a blanket certificate of resale?

A blanket certificate of resale allows a purchaser to make all their purchases from a seller tax-exempt, as long as those purchases are for resale. It can also indicate that a specific percentage of purchases will be for resale. Purchasers should ensure these certificates are current; it is advisable to update them every three years or immediately when any percentage of sales changes.

What steps are involved in completing the CRT-61 Form?

Completing the CRT-61 Form involves a series of clear steps. First, identify the seller by filling in their name and address. Next, provide the purchaser’s information. Outline the purchased property or include the invoice number and date. If a blanket certificate applies, further specify if the full or a partial percentage of the purchases will be for resale. Finally, the purchaser must sign and date the form to attest to the accuracy of the information provided.

Why is it important to verify the purchaser’s Illinois account ID or resale number?

Verifying the purchaser’s Illinois account ID or resale number is crucial because it ensures that the proper documentation is in place for tax compliance. It protects the seller from being held liable for unpaid sales tax. Purchasers can confirm the validity of their ID or number by visiting the Illinois Department of Revenue's website and using the "Verify a Registered Business" tool.

Common mistakes

When filling out the Illinois CRT-61 form, one of the most common mistakes is failing to verify the purchaser’s Illinois account ID or resale number before submitting. It is essential to ensure that this information is valid and active. The seller carries the responsibility of this verification. Not taking this crucial step can lead to complications down the road, including potential tax liabilities.

Many people also neglect to provide accurate and complete seller and purchaser information. Lines 1 through 4 specifically ask for the names and addresses of both parties. Double-checking these details is necessary. Missing or incorrect information can delay processing or, worse, result in the form being rejected altogether.

A frequent error occurs in the description of the property being purchased for resale. On Line 6, it is vital to either provide a clear description of the goods or list the invoice number and purchase date. Some individuals simply skip this section or give vague descriptions. This omission renders the document incomplete and may lead to compliance issues later.

Additionally, some users mistakenly believe that they can submit the CRT-61 form through mail. However, the instructions explicitly state not to send it through the postal service. Understanding this procedural requirement is vital to avoid unnecessary delays.

On the topic of blanket certificates, another common error is failing to keep these documents up to date. If the percentage of purchases that are for resale changes, a new certificate is required. Not doing so can create confusion and potential tax obligations that the purchaser may have initially been exempt from.

Another pitfall is the misunderstanding of what constitutes proof of a sale for resale. Some people think that any statement indicating the intention to resell suffices. However, the form must accompany adequate evidence, such as proof of out-of-state registration. This criterion cannot be overlooked.

Finally, the necessity of a signature on the form is often ignored. Line 5 requires the purchaser’s signature and date of signature for validity. A failure to complete this final step leaves the entire submission without the necessary authentication, which can result in the rejection or denial of the resale certificate.

Documents used along the form

The Illinois CRT 61 form, or Certificate of Resale, is crucial for enabling businesses to purchase goods tax-free, provided they intend to resell those items. Alongside this form, there are several other documents that are often necessary for a smooth resale process. Here’s a brief overview of four key forms commonly used in conjunction with the CRT 61.

- Blanket Certificate of Resale: This document allows a purchaser to declare that all their purchases from a seller are for resale. It can also specify that a certain percentage of the purchases will be for resale. Keeping this certificate updated is essential, especially if the percentage changes.

- Purchase Order: A purchase order can serve as a Certificate of Resale if it contains the seller’s and purchaser’s information, a description of the property, and a statement confirming the property is for resale. It acts as an agreement that outlines the terms of the purchase.

- Sales Tax Exemption Certificate: This certificate can be used by buyers who qualify for sales tax exemptions under certain conditions. It’s a way to assert that the buyer is exempt from paying sales tax on their purchases, further documenting their intent to resell.

- Illinois Business Tax Registration (IBT) Certificate: This certificate proves that a business is registered with the Illinois Department of Revenue. It includes key identifiers like the account ID number, which helps sellers verify the purchaser's tax status.

Understanding these documents is essential for both sellers and purchasers in Illinois. They facilitate proper tax management and ensure compliance with state regulations, ultimately helping businesses thrive in a fair marketplace.

Similar forms

- Certificate of Exemption: Similar to the CRT-61 form, this document allows a purchaser to claim an exemption from sales tax. It requires the purchaser to provide their details and the reason for the exemption.

- Purchase Order: A purchase order can serve as proof of tax-exempt status when it includes the seller's and purchaser's names, a description of the item, signatures, and indicates the nature of the purchase.

- Resale Certificate: This document verifies that a buyer is purchasing items for resale. Like the CRT-61, it requires buyer and seller information and must state that the items are for resale.

- Blanket Certificate of Resale: This is provided by the purchaser to certify that multiple purchases from the same seller are for resale. The CRT-61 also allows for blanket certifications, making them closely connected.

- Illinois Sales Tax Registration Certificate: This document confirms that a seller is registered to collect sales tax. It may be used alongside CRT-61 to clarify tax-exempt sales.

- Tax Exempt Form: This form is used by certain organizations to claim exemption from sales tax on purchases. Like CRT-61, it requires details about the organization and the items purchased.

- Sales Tax Return: This document is filed by sellers to report sales tax collected. It serves as supporting evidence that the seller is complying with tax regulations.

- Out-of-State Sales Tax Registration Certificate: This document indicates that a purchaser is registered to collect taxes in another state. It is similar as it identifies the purchaser's status related to sales tax collection.

Dos and Don'ts

When filling out the Illinois CRT-61 form, it is important to be diligent and precise. Here’s a list of what you should and shouldn’t do:

- Do verify the purchaser’s Illinois account ID or resale number before completing the form.

- Do provide all required information, including names, addresses, and property description.

- Do ensure the purchaser signs and dates the form to validate the certificate.

- Do retain the completed certificate as the seller for your records.

- Don’t mail the completed certificate to the Illinois Department of Revenue.

- Don’t assume that a verbal statement about resale will satisfy requirements; supporting evidence is necessary.

Completing the CRT-61 correctly protects both the seller and purchaser from future tax liabilities. Stay organized and attentive to detail.

Misconceptions

Understanding the Illinois CRT-61 form can sometimes be challenging. Here are five common misconceptions that may arise:

- The form must be mailed to the state. Many people mistakenly believe that the CRT-61 form should be submitted to the Illinois Department of Revenue. In reality, it is the seller’s responsibility to keep this form as proof that no tax is due on the sale. You do not need to send it anywhere.

- Only specific forms can serve as proof of resale. While the CRT-61 form is commonly used, it is a misconception that it is the only acceptable proof. Other forms or statements can be utilized, as long as they include key information such as the seller's name, description of the property, and a declaration that the property is for resale.

- The seller is not responsible for verifying the purchaser's ID. It is often assumed that the seller has no role in confirming the purchaser's validity. However, the seller must verify that the purchaser’s Illinois account ID or resale number is both valid and active. Failing to do so can lead to penalties down the line.

- Any signed document will suffice. Some believe that a simple signature on any document is enough to confirm a tax-free sale. However, official documentation must include specific elements: the seller's and purchaser's names, property description, and an Illinois account ID or resale number, among others.

- A blanket certificate is permanent once issued. It is important to understand that blanket certificates of resale need to be current. They should be reviewed and updated every three years or sooner if the stated percentage of resale purchases changes. This ensures compliance and helps avoid potential misunderstandings with tax authorities.

Clarifying these misconceptions can greatly assist both sellers and purchasers in navigating the resale process more effectively.

Key takeaways

Filling out the Illinois CRT-61 form can seem daunting, but understanding its key components can simplify the process. Here are important takeaways to keep in mind:

- Responsibility of the Seller: It’s crucial for the seller to verify that the purchaser’s Illinois account ID or resale number is valid. This verification can be done online at tax.illinois.gov.

- When is a Certificate of Resale Needed? This certificate is required to prove that no tax is owed on sales made for resale. Without it, sales may be subject to tax.

- Retention of the Certificate: The seller must keep the Certificate of Resale on file. It serves as proof of tax-exempt sales and should not be mailed to the state.

- Alternative Proof: Other forms can be used as proof of resale. They must include essential details like the seller's and purchaser's names and addresses, a description of the property, and the purchaser’s signature.

- Using Purchase Orders: A signed purchase order can also fulfill the requirements of a Certificate of Resale, provided it contains all the necessary information.

- Identifying Information: Each section of the form focuses on specific information. Ensure that both the seller and purchaser details are entered accurately in the designated fields.

- Blanket Certificates: A blanket certificate allows a purchaser to authorize that all purchases from a seller are for resale. Percentages can also be specified.

- Updating Certificates: Keep blanket certificates up-to-date. If the percentage of resales changes, adjust the certificate accordingly, and review all certificates at least every three years.

- Signature Requirement: The purchaser must sign and date the form to complete it. This is a critical step that authenticates the Certificate of Resale.

- Local Regulations: Familiarize yourself with any additional local regulations or requirements that may apply, as these can vary by jurisdiction.

Understanding these aspects of the Illinois CRT-61 form will not only help streamline the process but also ensure compliance with the state's tax laws. Stay informed and meticulous in filling out these forms to avoid any unexpected issues down the line.

Browse Other Templates

Pa Duplicate Title - This application reflects vehicle ownership laws and regulations specific to Pennsylvania.

Va 26-8937 - This form helps establish if a veteran is exempt from paying the VA Funding Fee.

Property Tax Refund Request,Montgomery County Tax Refund Application,Taxpayer Refund Application,Property Tax Reimbursement Form,Montgomery County Refund Request Form,Tax Refund Claim Form,Taxpayer Reimbursement Application,Refund Application for Pro - A legal description of the property must be included or a copy of the tax bill attached.