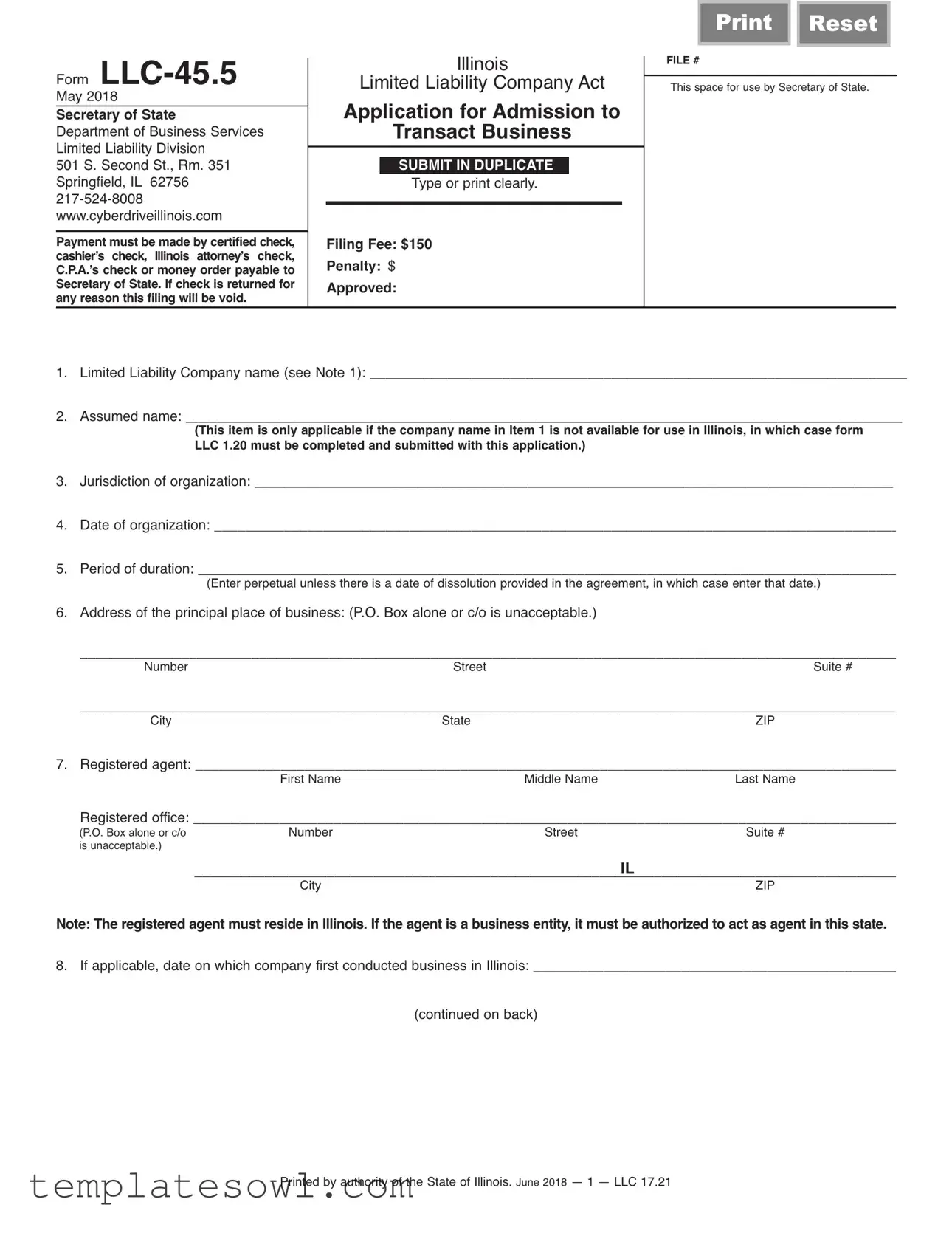

Fill Out Your Illinois Llc 45 5 Form

The Illinois LLC Form 45.5 is a crucial document for Limited Liability Companies looking to conduct business in the state. Filing this form serves as an application for admission to transact business, allowing an LLC that is organized outside Illinois to legally operate within its jurisdiction. The form requires essential information, including the name of the LLC, its assumed name if the original name is unavailable, and the jurisdiction of its organization. Applicants must also provide the date of organization, the duration of the LLC, and the address of the principal place of business. Importantly, the form stipulates that a registered agent must be designated, who must reside in Illinois or be an authorized business entity within the state. Along with these details, the LLC must outline the purpose of its business activities and whether it will be managed by members or managers. Applicants are reminded to include a Certificate of Good Standing or Existence that verifies their company's status. Completing the form accurately is essential, as a single error can result in penalties or the denial of the application. The filing fee for Form 45.5 is $150, and payment methods are strictly defined, requiring certified checks or money orders made to the Secretary of State. Understanding the importance and the requirements of Form 45.5 ensures that businesses can navigate the registration process smoothly and start operating legally in Illinois.

Illinois Llc 45 5 Example

Form

May 2018

Secretary of State

Department of Business Services Limited Liability Division

501 S. Second St., Rm. 351 Springfield, IL 62756

Payment must be made by certified check, cashier’s check, Illinois attorney’s check, C.P.A.’s check or money order payable to Secretary of State. If check is returned for any reason this filing will be void.

Illinois

Limited Liability Company Act

Application for Admission to

Transact Business

Type or print clearly.

Filing Fee: $150

Penalty: $

Approved:

Print Reset

FILE #

This space for use by Secretary of State.

1.Limited Liability Company name (see Note 1): _____________________________________________________________________

2.Assumed name: ____________________________________________________________________________________________

(This item is only applicable if the company name in Item 1 is not available for use in Illinois, in which case form LLC 1.20 must be completed and submitted with this application.)

3.Jurisdiction of organization: __________________________________________________________________________________

4.Date of organization: ________________________________________________________________________________________

5.Period of duration: __________________________________________________________________________________________

(Enter perpetual unless there is a date of dissolution provided in the agreement, in which case enter that date.)

6.Address of the principal place of business: (P.O. Box alone or c/o is unacceptable.)

_________________________________________________________________________________________________________ |

||

Number |

Street |

Suite # |

_________________________________________________________________________________________________________ |

||

City |

State |

ZIP |

7. Registered agent: ___________________________________________________________________________________________ |

||

First Name |

Middle Name |

Last Name |

Registered office: ___________________________________________________________________________________________ |

||||

(P.O. Box alone or c/o |

Number |

Street |

|

Suite # |

is unacceptable.) |

|

|

IL |

|

|

City |

|

ZIP |

|

|

|

|

||

Note: The registered agent must reside in Illinois. If the agent is a business entity, it must be authorized to act as agent in this state.

8.If applicable, date on which company first conducted business in Illinois: _______________________________________________

(continued on back)

Printed by authority of the State of Illinois. June 2018 — 1 — LLC 17.21

9.Purpose(s) for which the company is organized and proposes to conduct business in Illinois (see Note 2):

10.The Limited Liability Company: (check one)

n is managed by the manager(s) or n has management vested in the member(s):

11.List names and business addresses of all managers and any member with the authority of manager:

12.The Illinois Secretary of State is hereby appointed the agent of the Limited Liability Company for service of process under circumstances set forth in subsection (b) of Section

13.This application is accompanied by a Certificate of Good Standing or Existence, duly authenticated within the last 60 days, by the officer of the state or country wherein the LLC is formed.

14.The undersigned affirms, under penalties of perjury, having authority to sign hereto, that this application for admission to transact business is to the best of my knowledge and belief, true, correct and complete.

Dated: ____________________________________________Month, Day, Year

_________________________________________________Signature

_________________________________________________Name and Title (type or print)

_________________________________________________If applicant is signing for a company or other entity,

state name of company or entity.

Note 1: The name must contain the term Limited Liability Company, LLC or L.L.C. The name cannot contain any of the following terms: “Corporation,” “Corp.” “Incorporated,” “Inc.,” “Ltd.,” “Co.,” “Limited Partnership” or “LP.” However, a limited liability company that will provide services licensed by the Illinois Department of Financial and Professional Regulation must instead contain the term Professional Limited Liability Company, PLLC or P.L.L.C. in the name.

Note 2: A professional limited liability company must state the specific professional service or related professional services to be rendered by the professional limited liability company.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The LLC-45.5 form is used to apply for admission to transact business in Illinois for limited liability companies that are organized outside of Illinois. |

| Filing Fee | A fee of $150 must be submitted along with the LLC-45.5 form. This payment can only be made via certified check, cashier’s check, or money order payable to the Secretary of State. |

| Registered Agent Requirement | The designated registered agent must reside in Illinois. If a business entity is chosen as the agent, it must be authorized to serve in this capacity within the state. |

| Certificate of Good Standing | To accompany the application, a Certificate of Good Standing or Existence must be provided. This certificate must be authenticated within the last 60 days by the appropriate state or country officer. |

| Governing Law | The form is governed by the Illinois Limited Liability Company Act, which outlines the procedures and requirements for LLCs operating in the state. |

Guidelines on Utilizing Illinois Llc 45 5

Filling out the Illinois LLC 45.5 form is a crucial step for any limited liability company wishing to operate in Illinois. Properly completing this form helps ensure that your application is processed without delays. Below are clear steps to guide you through the process. Follow them carefully to meet all requirements.

- Enter the name of your limited liability company in Item 1. Make sure it includes "Limited Liability Company," "LLC," or "L.L.C."

- In Item 2, provide an assumed name, if needed. This is necessary only if your chosen name isn't available.

- Fill in the jurisdiction where your company was organized in Item 3.

- Complete the date of organization in Item 4.

- For Item 5, state the duration of your LLC. If it’s intended to last indefinitely, simply write "perpetual."

- List the principal business address in Item 6. Ensure it’s not just a P.O. Box.

- Identify a registered agent for your LLC in Item 7. This person must reside in Illinois.

- If applicable, include the date when your company first began conducting business in Illinois in Item 8.

- In Item 9, briefly describe the purpose of your LLC's business operations.

- Indicate the management structure of your LLC in Item 10, either by managers or members.

- Provide names and business addresses of all managers or relevant members in Item 11.

- Confirm the Illinois Secretary of State's role as the company's agent for service of process in Item 12.

- Attach a Certificate of Good Standing or Existence from your state of formation in Item 13. This must be recently authenticated.

- Finally, sign and date the application in Item 14, affirming its truth and completeness.

Completing the form accurately is essential for successful processing. After submission, your application will be reviewed, and you should receive confirmation of your status as an admitted entity in Illinois.

What You Should Know About This Form

What is the purpose of the Illinois LLC 45.5 form?

The Illinois LLC 45.5 form is primarily used for an application for admission to transact business in the state of Illinois. To officially conduct business as a limited liability company, entities from other jurisdictions must complete this form. It not only registers the LLC but also sets forth essential information regarding its management, address, and purpose.

What is the filing fee for the Illinois LLC 45.5 form?

The filing fee for submitting the Illinois LLC 45.5 form is $150. This fee must be paid using specific methods such as a certified check, a cashier's check, an Illinois attorney's check, a CPA’s check, or a money order made payable to the Secretary of State. If the payment method fails for any reason, the filing could be rendered void.

Is it possible to use a P.O. Box for the company’s address?

No, using a P.O. Box alone or designating "c/o" is unacceptable for the principal place of business or the registered office address on the form. The LLC must provide a complete street address to ensure compliance with the filing requirements.

What information is needed about the registered agent?

Section 7 of the form requires specifying a registered agent who must reside in Illinois. If the agent is a business entity, it must be authorized to operate within the state. The form requires the agent's full name and the corresponding registered office address, which cannot be just a P.O. Box.

What happens if I select an unapproved name for my LLC?

If the chosen name for your limited liability company is unavailable or does not comply with Illinois naming regulations, the form will necessitate the use of an assumed name. In such cases, you will need to complete the LLC 1.20 form and submit it along with the LLC 45.5 application.

What documents must accompany the Illinois LLC 45.5 form?

Along with the completed form, a Certificate of Good Standing or Existence is required. This certificate must be duly authenticated within the last 60 days by the appropriate officer in the state or country where the LLC was originally formed. This document verifies the entity’s compliance with applicable laws before it can conduct business in Illinois.

Can the LLC be managed by its members?

Yes, the form allows you to choose between having management vested in member(s) or in manager(s). You will need to indicate your choice in item 10 of the form, which reflects how the LLC will operate and be governed.

What statement of affirmation is included in the form?

The individual signing the form must affirm that they possess the authority to do so and that, to the best of their knowledge, the information provided is accurate and complete. This affirmation is also a declaration of the penalties for perjury, ensuring that the application is taken seriously and submitted with integrity.

How long does it take for the Illinois LLC 45.5 application to be processed?

The processing time for the Illinois LLC 45.5 form can vary depending on the volume of applications being handled by the Secretary of State. However, businesses typically expect a response within a few weeks. For those needing expedited processing, it is advisable to check with the Department of Business Services for available options.

Common mistakes

Filling out the Illinois LLC Form LLC-45.5 can be straightforward, but many people make common mistakes that could derail their application. One frequent error occurs in the name selection process. The name of the Limited Liability Company must include the term "Limited Liability Company," "LLC," or "L.L.C." Some applicants overlook this requirement and may instead use terms like "Corp." or "Inc.," which are not permitted. As a result, the form gets rejected, and applicants must start over.

Another mistake often made involves the address of the principal place of business. The form requires a physical address; a P.O. Box alone or a c/o address is unacceptable. Individuals sometimes list only a P.O. Box, thinking it will suffice. This can lead to delays or outright rejection of the application, as a valid physical address is crucial for the records.

People sometimes fail to appoint a registered agent correctly. The form states that the registered agent must reside in Illinois. If the agent is a business entity, it must be authorized to act in the state. Individuals sometimes assume that a friend or out-of-state relative can serve as a registered agent, only to realize later that this is not permissible. Missing this requirement can cause complications in receiving official communications from the Secretary of State.

Lastly, one of the more crucial steps that applicants overlook is the inclusion of a Certificate of Good Standing or Existence. This certificate must be authenticated within the last 60 days by the officer of the state where the LLC was formed. Failure to attach this document can compromise the application. Potential business owners often underestimate the importance of this step, leading to unnecessary delays in their business operations.

Documents used along the form

The Illinois LLC 45.5 form is essential for companies wishing to conduct business in Illinois. Alongside this application, several other documents may be necessary to complete the filing process. Here’s a brief overview of those additional forms and documents.

- Certificate of Good Standing: This document verifies that the LLC is compliant with state regulations. It must be obtained from the state where the company is originally formed and should be less than 60 days old.

- Form LLC 1.20: This form is required if the chosen LLC name is not available in Illinois. It allows the business to use an assumed name instead.

- Operating Agreement: Although not mandatory, this internal document outlines the management structure, roles, and responsibilities of members. It helps avoid disputes and clarifies operational procedures.

- Registered Agent Consent Form: This documentation confirms that the appointed registered agent has agreed to act on behalf of the LLC in Illinois. It can be a simple letter or a specific form if the agent is a business entity.

- Certificate of Formation: Also known as the Articles of Organization, this document establishes the LLC and is filed in the state of formation. It typically includes basic company information.

- Illinois Business Registration Application (Form REG-1): Required for tax purposes, this application registers the business with the Illinois Department of Revenue for sales tax, employer taxes, and other state taxes.

- Business License or Permit: Depending on the type of business activity, various local, state, or federal licenses may be necessary to operate legally.

Ensure all necessary documents are prepared and submitted accurately. This can avoid delays in your application and help establish your business presence smoothly in Illinois.

Similar forms

The Illinois LLC-45.5 form, which is used for businesses seeking to operate as a Limited Liability Company in Illinois, shares similarities with several other important business documents. Each of these documents has its own specific function within business registration and compliance. Here’s a breakdown of nine other documents it is similar to:

- Articles of Organization: This document is essential for forming a Limited Liability Company. Like the LLC-45.5, it outlines the basic information about the LLC, including its name and address, and is filed with the state.

- Certificate of Good Standing: Required alongside the LLC-45.5, this certificate confirms that a company is compliant with state regulations. It validates the company's existence and legal status.

- Operating Agreement: While not mandatory, this internal document describes how the LLC will be managed. It provides a structure for decision-making similar to the management details required in the LLC-45.5.

- Application for Authority to Transact Business: This form is needed when an LLC formed in one state wants to do business in another. Both documents ensure compliance with state laws before activities commence.

- DBA Registration (Doing Business As): If an LLC chooses to operate under a name different from its registered name, it must file a DBA registration. It addresses name validity, like the assumed name section of the LLC-45.5.

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). It is crucial for tax purposes and is often filled out alongside the LLC-45.5 when establishing a business.

- Annual Report: LLCs must file this document, usually annually, to keep their status active. This is similar in purpose to the ongoing compliance aspects required in the LLC-45.5.

- Registered Agent Designation: This document identifies a registered agent for service of process, which is also an essential requirement on the LLC-45.5 form.

- Foreign Qualification Registration: This is necessary for LLCs based in other states if they wish to operate in Illinois. Like the LLC-45.5, it confirms intent to do business legally in Illinois.

Dos and Don'ts

When filling out the Illinois LLC 45.5 form, it’s essential to approach the task carefully and thoroughly. Here are five key things to remember to ensure your application is accurate and complete:

- Do type or print clearly. Clear writing reduces mistakes and misinterpretations that could delay your application.

- Don’t use a P.O. Box for your principal address. The form requires a physical address to ensure accurate processing.

- Do include the correct filing fee. A payment of $150 is required, so make sure you use the appropriate payment method.

- Don’t forget to appoint a registered agent. Ensure that the registered agent resides in Illinois or is authorized to operate there.

- Do affirm the accuracy of your application. Signing under penalties of perjury indicates that the information provided is true and complete.

By following these guidelines, you help to ensure that your filing process goes smoothly. Mistakes can lead to delays, so taking the time to double-check your form is vital.

Misconceptions

Misconception 1: The Illinois LLC-45.5 form is only necessary for new LLCs.

This form is required for any LLC that intends to conduct business in Illinois, regardless of when it was formed. Existing LLCs that wish to expand their operations into Illinois must complete this form.

Misconception 2: You can use a P.O. Box as your registered office address.

An actual physical address is needed for both the principal place of business and the registered office. P.O. Boxes or “c/o” addresses will not be accepted.

Misconception 3: A registered agent can be anyone from any state.

The registered agent must be a person or business that resides in Illinois. This ensures that there is a reliable point of contact within the state.

Misconception 4: There is no fee associated with submitting the form.

A filing fee of $150 is required when submitting the LLC-45.5 form. Payment must be made using specific payment methods like certified checks or money orders.

Misconception 5: You do not need to submit a Certificate of Good Standing with your application.

A Certificate of Good Standing or Existence must accompany the form, authenticated within the last 60 days. This confirms that your LLC is valid in its original jurisdiction.

Misconception 6: Once the application is submitted, it cannot be changed.

While changes are not ideal, they can be made. If you notice an error after submission, it is important to contact the Secretary of State's office to see how to proceed.

Key takeaways

Understanding the Illinois LLC 45.5 form is crucial for anyone looking to establish their Limited Liability Company in the state. Here are four key takeaways to keep in mind when filling it out:

- Clear and Accurate Information: Always type or print legibly. The form requires specific details such as the LLC name, jurisdiction, and address of the principal place of business. Ensuring accuracy avoids delays in processing.

- Payment Requirements: It is essential to note that payment can only be made by certified checks, cashier’s checks, Illinois attorney’s checks, C.P.A.’s checks, or money orders. Regular personal checks will render your filing void if returned.

- Registered Agent Requirement: The registered agent must reside in Illinois. If the agent is a business entity, it must be authorized to operate in the state. This stipulation is important for maintaining compliance with local laws.

- Accompanying Documentation: A Certificate of Good Standing or Existence must accompany the form, authenticated within the last 60 days. This certificate verifies that your LLC is in good standing with its home state, holding significant importance during the application process.

By adhering to these points, applicants can ensure a smoother experience when completing the LLC 45.5 form. Attention to detail and a clear understanding of the requirements can lead to successful establishment in Illinois.

Browse Other Templates

Texas Vehicle Information Request,Motor Vehicle Records Access Form,TxDMV Record Inquiry Form,Vehicle Title and Registration Request,Personal Vehicle Information Application,Motor Vehicle Data Request Form,Texas Driver Privacy Record Request,Vehicle - VTR 275 also requires the applicant to indicate the government entity or relevant business for requested vehicle information.

Az Nursing Board - Important information regarding disciplinary actions in nursing programs is covered.