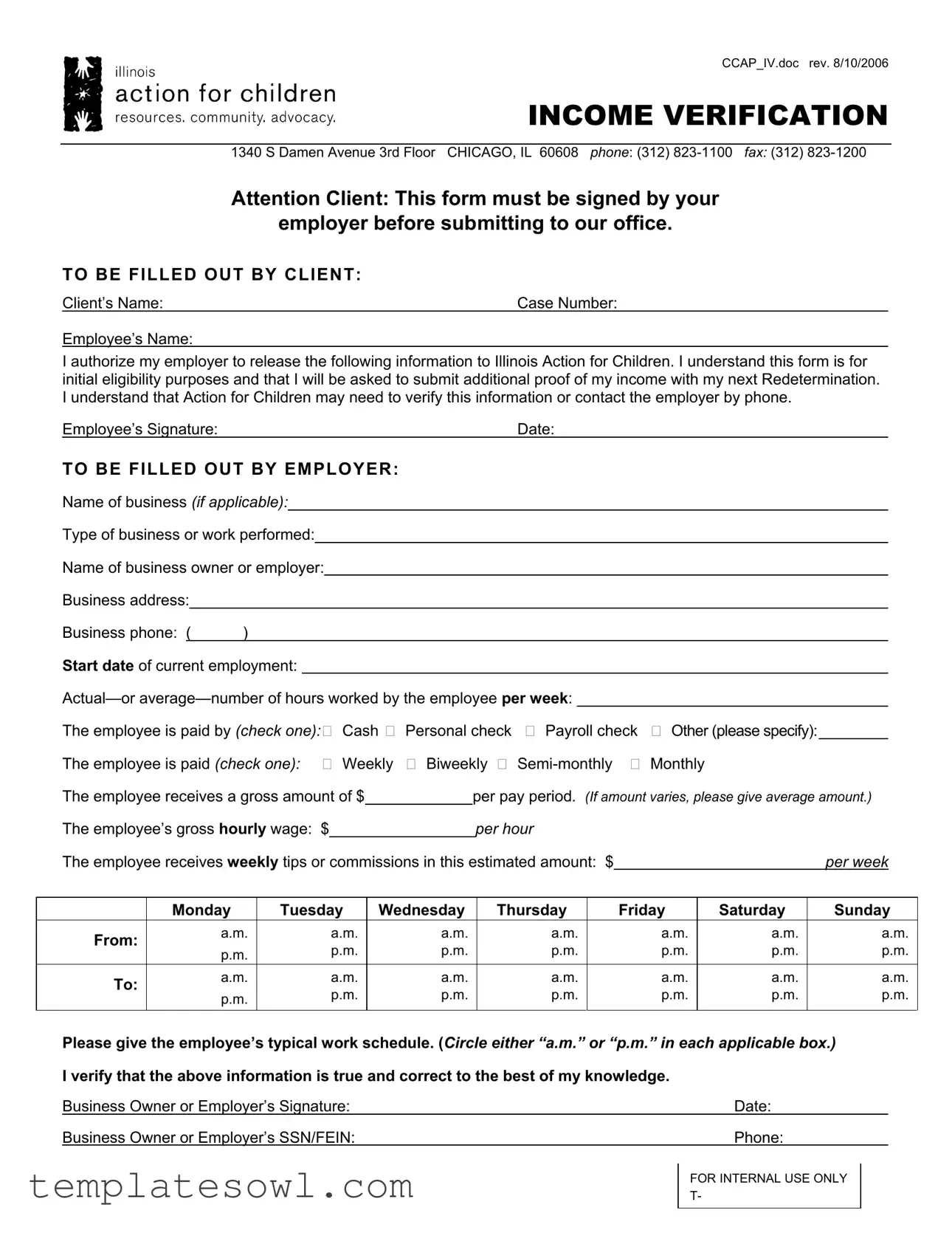

Fill Out Your Illinois Income Verification Form

The Illinois Income Verification form is an essential document used primarily to assess an employee's eligibility for assistance programs, specifically through Illinois Action for Children. This form must be filled out by both the employee and their employer, ensuring that accurate income information is provided. For employees, the process begins with providing personal details, including their name and case number, as well as authorizing their employer to disclose necessary income details. The employee must understand that this form serves as an initial step for eligibility, with further income verification required at the next redetermination stage. Employers play a crucial role as well, as they are responsible for submitting detailed information about the employee’s position, employment duration, compensation structure, and work schedule. A signature from the employer verifies the accuracy of the reported information. Given the significance of this form in determining eligibility for vital resources, it’s crucial that both parties complete their sections thoughtfully and honestly, as any discrepancies could delay or jeopardize the employee's access to benefits.

Illinois Income Verification Example

CCAP_IV.doc rev. 8/10/2006

INCOME VERIFICATION

1340 S Damen Avenue 3rd Floor CHICAGO, IL 60608 phone: (312)

Attention Client: This form must be signed by your

employer before submitting to our office.

TO BE FILLED OUT BY CLIENT:

Client’s Name: |

Case Number: |

Employee’s Name:

I authorize my employer to release the following information to Illinois Action for Children. I understand this form is for initial eligibility purposes and that I will be asked to submit additional proof of my income with my next Redetermination. I understand that Action for Children may need to verify this information or contact the employer by phone.

Employee’s Signature: |

Date: |

TO BE FILLED OUT BY EMPLOYER:

Name of business (if applicable):

Type of business or work performed:

Name of business owner or employer:

Business address:

|

|

Business phone: ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Start date of current employment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

The employee is paid by (check one): Cash Personal check Payroll check Other (please specify): |

|

|

|

|

|||||||||||||||||

|

|

The employee is paid (check one): |

Weekly Biweekly |

Monthly |

|

|

|

|

|||||||||||||||

|

|

The employee receives a gross amount of $ |

|

|

per pay period. (If amount varies, please give average amount.) |

||||||||||||||||||

|

|

The employee’s gross hourly wage: $ |

|

|

|

|

per hour |

|

|

|

|

|

|

|

|

|

|||||||

|

|

The employee receives weekly tips or commissions in this estimated amount: $ |

|

|

|

|

|

per week |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Monday |

|

Tuesday |

|

Wednesday |

|

Thursday |

|

Friday |

|

Saturday |

|

Sunday |

|

|||||||

|

|

From: |

|

a.m. |

|

|

a.m. |

|

a.m. |

|

a.m. |

|

a.m. |

|

a.m. |

|

|

a.m. |

|

||||

|

|

|

p.m. |

|

|

p.m. |

|

p.m. |

|

p.m. |

|

p.m. |

|

p.m. |

|

|

p.m. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

To: |

|

a.m. |

|

|

a.m. |

|

a.m. |

|

a.m. |

|

a.m. |

|

a.m. |

|

|

a.m. |

|

||||

|

|

|

p.m. |

|

|

p.m. |

|

p.m. |

|

p.m. |

|

p.m. |

|

p.m. |

|

|

p.m. |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please give the employee’s typical work schedule. (Circle either “a.m.” or “p.m.” in each applicable box.) |

|||||||||||||||||||||

|

|

I verify that the above information is true and correct to the best of my knowledge. |

|

|

|

|

|

|

|

||||||||||||||

|

|

Business Owner or Employer’s Signature: |

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

|

|||||||

|

|

Business Owner or Employer’s SSN/FEIN: |

|

|

|

|

|

|

|

|

|

Phone: |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR INTERNAL USE ONLY |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T- |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The form is designed to verify income for eligibility for Illinois Action for Children services. |

| Employer Signature Requirement | The employer must sign the form before submission to ensure accuracy of the reported income. |

| Initial Eligibility | This form serves for initial eligibility; additional proof of income is required at the next Redetermination. |

| Contact Information | Illinois Action for Children can be contacted at 1340 S Damen Avenue, 3rd Floor, Chicago, IL 60608. |

| Business Information | Employers must provide various details about the business, including name, type, address, and phone. |

| Governing Law | The form is governed by the Illinois Department of Human Services regulations pertaining to benefits verification. |

| Work Schedule | Employers are required to specify the employee's typical work schedule on the form. |

Guidelines on Utilizing Illinois Income Verification

Completing the Illinois Income Verification form involves filling out details about your income and employment. Be sure to have your employer review and sign the form before submitting it to the designated office. Follow the steps below to accurately fill out the form.

- Client Information: Fill in your name and case number at the top of the form.

- Employee’s Name: Write your name again in the designated space.

- Authorization: Read the statement carefully. You are granting permission for your employer to share your income information with Illinois Action for Children.

- Signature: Sign and date the form in the provided spaces, confirming you understand the information will be verified.

- Employer Details: Your employer should complete this section. It requires the business name, type of business, and the owner's name.

- Business Address and Phone: Ensure the employer includes this for contact purposes.

- Employment Information: Your employer needs to list your start date and average hours worked per week.

- Payment Method: Your employer will check the box that matches how you receive your pay—whether it's by cash, personal check, payroll check, or other means.

- Payment Frequency: Your employer must indicate how often you are paid: weekly, biweekly, semi-monthly, or monthly.

- Gross Pay: Include the amount you earn during each pay period. If the amount changes, provide an average.

- Hourly Wage: State your gross hourly wage, if applicable.

- Tips or Commissions: Your employer should provide an estimate of any tips or commissions you earn weekly.

- Work Schedule: Your employer needs to fill in your usual working hours for each day of the week, specifying a.m. or p.m.

- Verification: The employer must sign and date the form, affirming that the information is accurate. They should also provide their Social Security Number or Employer Identification Number (SSN/FEIN) and phone number.

Ensure that both you and your employer have completed the respective sections thoroughly. Once finished, submit the signed form as instructed to Illinois Action for Children.

What You Should Know About This Form

What is the Illinois Income Verification form?

The Illinois Income Verification form is a document used to confirm an employee's income and employment information. It is typically required for determining eligibility for programs managed by Illinois Action for Children. The form must be filled out and signed by both the employee and the employer to ensure accuracy of the provided information.

Why do I need to complete this form?

This form is essential for establishing your eligibility for specific assistance programs. By providing your income verification, you help Illinois Action for Children assess your situation and determine the resources for which you may qualify.

Who needs to sign the Illinois Income Verification form?

The form must be signed by both the employee and the employer. The employee provides authorization for the employer to disclose the necessary information, and the employer attests to the accuracy of the details filled out in the form.

How is the information collected on this form used?

The information from this form is utilized to evaluate an individual’s eligibility and continued qualification for assistance programs. It serves as an initial step in the verification process, and you may be required to provide additional proof of income during the next redetermination.

What if my hours and pay vary from week to week?

If your pay or hours fluctuate, report your average weekly hours worked and provide an estimated average of your gross income per pay period. Employers are encouraged to provide their best estimates to ensure a comprehensive assessment.

How do I submit the completed form?

Once the form is fully filled out and signed, it should be faxed or mailed to the designated office at Illinois Action for Children. Ensure that all sections are complete before submission to prevent delays in processing.

Can I verify my income by other means if I don’t have this form?

While the Illinois Income Verification form is the preferred method for income verification, alternative documentation such as pay stubs, bank statements, or tax returns may also be acceptable. However, it's advisable to check with Illinois Action for Children regarding their specific requirements.

What happens after I submit the Illinois Income Verification form?

Once submitted, your information will be reviewed by Illinois Action for Children. They may reach out to your employer for additional verification if needed. Following the review, you will be informed about your eligibility status and any next steps in the process.

Common mistakes

Filling out the Illinois Income Verification form can be a straightforward process, but many people make common mistakes that can delay processing or even result in denial of benefits. Understanding these mistakes can help ensure a smoother experience.

One significant error occurs when the client fails to obtain the necessary employer signature. The form explicitly states that it must be signed by the employer before submission. Without this signature, the form may be deemed incomplete, leading to delays in the verification process.

Many clients also overlook providing accurate information in the “Employee’s Name” section. It is essential to match the name with the name used in other legal documents. If there are discrepancies, this could raise questions and complicate matters further.

Another common mistake is not indicating the correct pay frequency. Clients may mistakenly check multiple boxes or fail to check any box in the section that asks how often the employee is paid. This oversight can create confusion and may prompt additional requests for clarification.

Providing an incorrect gross income amount is also a frequent issue. Some clients either exaggerate or underestimate their earnings. This inconsistency not only undermines credibility but can also influence the eligibility determination process.

People sometimes forget to fill out the employee's standard work hours accurately. This information is crucial for assessing eligibility, and any inconsistencies may require the employer to clarify or amend their original statement.

Clients may neglect to document their work schedule properly. This section asks for a breakdown of hours worked each week. Failure to provide this may lead to questions and could delay the final decision on eligibility.

Missing essential details about the employer’s business is another common oversight. The form requires specifics such as the business name and address. Incomplete information can result in the inability to verify employment properly.

Lastly, the employer must sign and date the verification section. If the employer forgets to do this, the verification process cannot proceed, requiring the client to return with a completed form, wasting time for both parties.

By avoiding these pitfalls, clients can present a complete Illinois Income Verification form, easing the path toward securing necessary support.

Documents used along the form

In the process of income verification, particularly in Illinois, several other forms and documents often accompany the Illinois Income Verification form. Each of these documents serves a specific purpose, ensuring that the information provided is accurate and comprehensive. Below is a list of commonly used forms and documents.

- Pay Stub: A document provided by the employer that summarizes an employee’s earnings and deductions for a specific pay period. This can confirm income reported on the Illinois Income Verification form.

- W-2 Form: An annual statement provided by employers reporting an employee's total wages and taxes withheld. It aids in validating overall income from the previous year.

- Tax Returns: A form that individuals submit to report their income for tax purposes. Previous years' returns, such as the 1040, can serve as a detailed record of income.

- Bank Statements: Documents that show monthly transactions and balances in an individual's bank account, providing insight into income deposits and spending habits.

- Employer Verification Letter: A letter from an employer confirming employment status, duration, and salary. This document adds an additional layer of verification.

- Social Security Income Verification Letter: A letter from the Social Security Administration confirming monthly benefits. This is relevant for individuals relying on Social Security income.

- Unemployment Benefit Statement: A notification from the unemployment office detailing received benefits. It assists in providing clarity on income levels during periods of unemployment.

- Child Support Verification: Documentation confirming child support payments received or made, which may contribute to total household income.

- Pension or Retirement Benefit Statement: A statement indicating the amount and frequency of pension benefits received by retirees, relevant for assessing income stability in older clients.

- Self-Employment Income Statement: A detailed account of earnings for individuals who are self-employed, often requiring additional documentation to verify irregular incomes.

Gathering these documents enhances the ability to verify an applicant's income thoroughly, facilitating the assessment process for various assistance programs. A comprehensive verification process not only supports the applicant but also ensures that resources are allocated appropriately within the community.

Similar forms

The Illinois Income Verification form is an important document used to assess a client's income for eligibility purposes. Here are ten other documents that are similar to the Illinois Income Verification form, along with their specific functions:

- W-2 Form: This document is provided by employers to report annual wages and taxes withheld. Like the Illinois form, it establishes income verification for various financial applications.

- Pay Stubs: These are issued periodically by employers and show the gross and net income, along with deductions. They serve the same purpose of documenting income as the Illinois Income Verification form.

- Self-Employment Income Statements: Freelancers and independent contractors often use these to summarize their earnings from various clients, similar to the Illinois form requiring income details from employers.

- IRS Tax Return: A comprehensive document detailing all income sources and deductions over the past year. This can be used for income verification like the Illinois form but includes a wider financial overview.

- Social Security Income Statement: This statement outlines the benefits received by an individual, serving to verify income just as the Illinois form verifies employment income.

- Bank Statements: They show deposits and withdrawals over a period. Regular deposits can reflect income and aid in verifying income information, similar to the purpose of the Illinois form.

- Nformation from the Unemployment Office: This documentation provides details about unemployment benefits received, verifying income sources like the Illinois form would.

- Child Support Payment Records: These records outline the amounts received or given in child support, similar to how the Illinois Income Verification form collects income-related information.

- Rental Income Documentation: This can include lease agreements or income affidavits that establish earnings from rental properties, aligned with the income verification purpose of the Illinois form.

- Government Assistance Verification Letters: These letters confirm receipt of food stamps or other assistance programs, helping to establish income eligibility similar to the intentions of the Illinois Income Verification form.

Dos and Don'ts

When filling out the Illinois Income Verification form, being thorough and attentive can make a big difference. Here’s a list of things to do and avoid while completing the form.

- Do read the instructions carefully. Understanding what information is needed can streamline the process.

- Do provide accurate information. Ensure all names, case numbers, and financial details are correct to avoid delays.

- Do have your employer sign the form. Without a signature, your submission may be rejected.

- Do keep a copy for your records. Having a personal copy can help in future dealings or inquiries.

- Do reach out for help if needed. Contacting the helpline can clarify any confusing sections.

- Don't leave any fields blank. Incomplete forms may not be processed.

- Don't use estimates unless necessary. Providing exact figures helps ensure accuracy.

- Don't rush through the process. Taking your time to double-check everything can prevent mistakes.

- Don't forget to date the form. An undated document may confuse processing timelines.

Following these guidelines will help make the process smoother. Good luck with your submission!

Misconceptions

Misconceptions about the Illinois Income Verification form can lead to confusion and mistakes. Below are some common misunderstandings and clarifications to help navigate the process:

- Only low-income individuals need to fill it out. This form is required for determining eligibility for various programs, not just for low-income individuals.

- It doesn’t need to be signed by my employer. The form must be signed by your employer before you submit it, as their verification is crucial.

- One form is enough for all future submissions. You will need to submit this form again during your next redetermination, along with additional proof of income.

- My employer can refuse to complete the form. While an employer is not obligated to verify income, they typically provide this information to support their employees.

- This form is only used for government assistance. Many programs, including educational and charitable ones, may also require this verification.

- Providing inaccurate information is okay as long as it’s estimated. It is essential to provide accurate information. Misrepresentation can lead to serious consequences.

- All employers know how to fill out this form. Not all employers are familiar with this process, so it may be necessary to guide them through it.

- Submitting this form guarantees approval. Even with this form, the approval process involves multiple factors, including income level and program requirements.

- I can modify the form once I receive it back. Altering any information after it has been signed can invalidate the form and cause issues.

Key takeaways

The Illinois Income Verification form is a crucial document in determining eligibility for services from Illinois Action for Children.

Clients must ensure that their employers complete the employer section of the form before submission.

The form is only for initial eligibility; clients will need to provide additional proof of income during the next Redetermination.

Employers are required to verify the accuracy of the income information provided by the employee.

All information in the form, including gross income and hours worked, must be filled out accurately to avoid delays.

Clients authorize their employers to release income information; employers must comply with this request.

Keep a copy of the completed form for your records before sending it to Illinois Action for Children.

Browse Other Templates

Employee Profiling Template - Indicating your previous employment specifics helps track your career path.

Ohio Secretary of State Business Name Search - Filing preclearance allows for feedback before formal submissions take place.

Victoria Secret Model Application Form - List your salary expectations in the application form.