Fill Out Your Illinois Realtor Contract Form

The Illinois Realtor Contract form is a crucial document in the real estate transaction process, particularly for those involved in buying or selling property in the state. This contract outlines the agreement between the purchaser and seller, detailing essential aspects such as the purchase price, property description, and earnest money deposit. It specifies the obligations of the seller, including the requirement to deliver a current plat of survey and title commitment. Furthermore, the form addresses the closing timeline and the handling of any applicable real estate commissions. Importantly, it includes provisions related to the condition of the property, warranties provided by the seller, and any existing leases or tenancies. The document also outlines what to do in case of contract termination and provides clarity on how taxes and other financial adjustments will be addressed. Familiarity with this contract helps ensure that all parties involved understand their rights and responsibilities, paving the way for a smoother transaction.

Illinois Realtor Contract Example

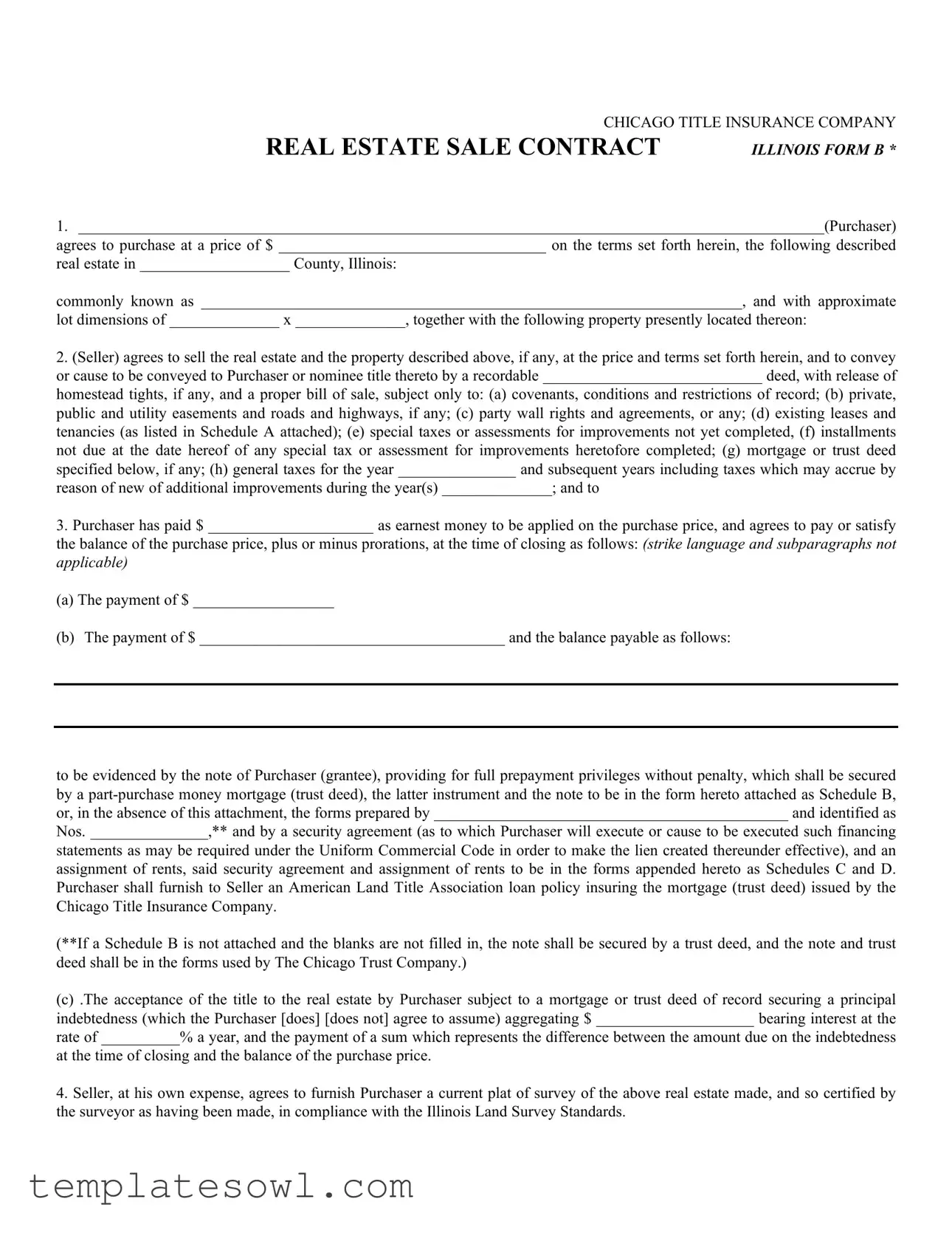

CHICAGO TITLE INSURANCE COMPANY

REAL ESTATE SALE CONTRACT

ILLINOIS FORM B *

1._______________________________________________________________________________________________(Purchaser) agrees to purchase at a price of $ __________________________________ on the terms set forth herein, the following described real estate in ___________________ County, Illinois:

commonly known as _____________________________________________________________________, and with approximate

lot dimensions of ______________ x ______________, together with the following property presently located thereon:

2.(Seller) agrees to sell the real estate and the property described above, if any, at the price and terms set forth herein, and to convey or cause to be conveyed to Purchaser or nominee title thereto by a recordable ____________________________ deed, with release of homestead tights, if any, and a proper bill of sale, subject only to: (a) covenants, conditions and restrictions of record; (b) private, public and utility easements and roads and highways, if any; (c) party wall rights and agreements, or any; (d) existing leases and tenancies (as listed in Schedule A attached); (e) special taxes or assessments for improvements not yet completed, (f) installments not due at the date hereof of any special tax or assessment for improvements heretofore completed; (g) mortgage or trust deed specified below, if any; (h) general taxes for the year _______________ and subsequent years including taxes which may accrue by reason of new of additional improvements during the year(s) ______________; and to

3.Purchaser has paid $ _____________________ as earnest money to be applied on the purchase price, and agrees to pay or satisfy the balance of the purchase price, plus or minus prorations, at the time of closing as follows: (strike language and subparagraphs not applicable)

(a)The payment of $ __________________

(b)The payment of $ _______________________________________ and the balance payable as follows:

to be evidenced by the note of Purchaser (grantee), providing for full prepayment privileges without penalty, which shall be secured by a

Nos. _______________,** and by a security agreement (as to which Purchaser will execute or cause to be executed such financing

statements as may be required under the Uniform Commercial Code in order to make the lien created thereunder effective), and an assignment of rents, said security agreement and assignment of rents to be in the forms appended hereto as Schedules C and D. Purchaser shall furnish to Seller an American Land Title Association loan policy insuring the mortgage (trust deed) issued by the Chicago Title Insurance Company.

(**If a Schedule B is not attached and the blanks are not filled in, the note shall be secured by a trust deed, and the note and trust deed shall be in the forms used by The Chicago Trust Company.)

(c).The acceptance of the title to the real estate by Purchaser subject to a mortgage or trust deed of record securing a principal indebtedness (which the Purchaser [does] [does not] agree to assume) aggregating $ ____________________ bearing interest at the rate of __________% a year, and the payment of a sum which represents the difference between the amount due on the indebtedness at the time of closing and the balance of the purchase price.

4.Seller, at his own expense, agrees to furnish Purchaser a current plat of survey of the above real estate made, and so certified by the surveyor as having been made, in compliance with the Illinois Land Survey Standards.

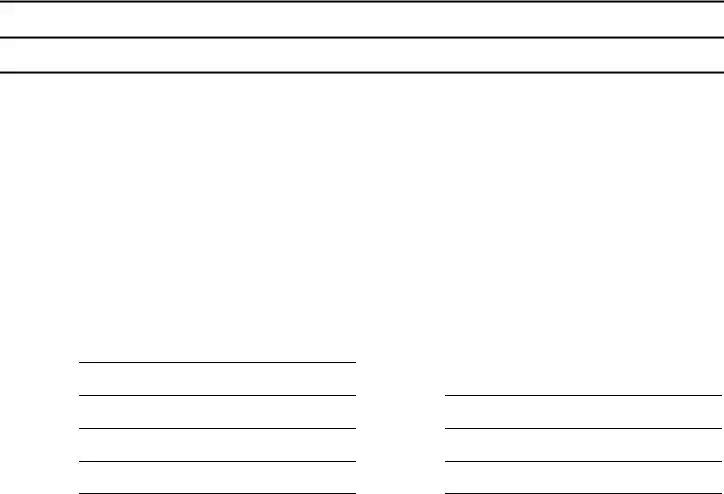

5.The time of closing shall be on ____________________________ or on the date, if any, to which such time is extended by reason of paragraphs 2 or 10 of the Conditions and Stipulations hereafter becoming operative (whichever date is later), unless subsequently mutually agreed otherwise, at the office of ________________________________________________________ or of the mortgage lender, if any, provided title is shown to be good or is accepted by Purchaser.

6.Seller agrees to pay a broker's commission to _______________________________________________________________ in the amount set forth in the broker's listing contract or as follows:

7.The earnest money shall be held by ________________________________________________________________ for the mutual benefit of the parties.

8.Seller warrants that Seller, its beneficiaries or agents of Seller or of its beneficiaries have received no notices from any city, village or other governmental authority of zoning, building, fire or health code violations in respect to the real estate that have not been heretofore corrected.

9.A duplicate original of this contract, duly executed by the Seller and his spouse, if any, shall be delivered to the Purchaser within

____________ days from the date hereof, otherwise, at the Purchaser's option, this contract shall become null and void and the earnest money shall be refunded to the Purchaser.

This contract is subject to the Conditions and Stipulations set forth on the following pages, which Conditions and Stipulations are made a part of this contract.

Dated:

Purchaser:Address:

Purchaser:Address:

Seller:Address:

Seller:Address:

*Form normally used for sale of property improved with

ADV. VI.O R2/95 K3773

CONDITIONS AND STIPULATIONS

1.Seller shall deliver or cause to be delivered to Purchaser or Purchaser's agent, not less than 5 days prior to the time of closing, the plat of survey (If one is required to be delivered under the terms of this contract) and a title commitment for an owner's title insurance policy issued by the Chicago Title Insurance Company in the amount of the purchase price, covering title to the real estate on or after the date hereof, showing title in the intended grantor subject only to (a) the general exceptions contained in the policy, (b) the title exceptions set forth above, and (c) title exceptions pertaining to liens or encumbrances of a definite or ascertainable amount which may be removed by the payment of money at the time of closing and which the Seller may so remove at that time by using the funds to be paid upon the delivery of the deed (all of which are herein referred to as the permitted exceptions). The title commitment shall be conclusive evidence of good title as therein shown as to all matters insured by the policy, subject only to the exceptions as therein stated. Seller also shall furnish Purchaser an affidavit of title in customary form covering the date of closing and showing title in Seller subject only to the permitted exceptions in foregoing items (b) and (c) and unpermitted exceptions or defects in the title disclosed by the survey, if any, as to which the title insurer commits to extend insurance in the manner specified in paragraph 2 below.

2.If the title commitment or plat of survey (if one is required to be delivered under the terms of this contract) discloses either unpermitted exceptions or survey matters that render the title unmarketable (herein referred to as "survey defects"), Seller shall have

30days from the date of delivery thereof to have the exceptions removed from the commitment or to correct such survey defects or to have the title insurer commit to insure against loss or damage that may be occasioned by such exceptions or survey defects, and, in such event, the time of closing shall be 35 days after delivery of the commitment or the time expressly specified in paragraph 5 on the second page hereof, whichever is later. If Seller fails to have the exceptions removed or correct any survey defects, or in the alternative, to obtain the commitment for title insurance specified above as to such exceptions or survey defects within the specified time, Purchaser may terminate this contract or may elect, upon notice to Seller within 10 days after the expiration of the

3.Rents, premiums under assignable insurance policies, water and other utility charges, fuels, prepaid service contracts, general taxes, accrued interest on mortgage indebtedness, if any, and other similar items shall be adjusted ratably as of the time of closing. The amount of the current general taxes not then ascertainable shall be adjusted on the basis of (a), (b), or (c) below (Strike subparagraphs not applicable):

(a) ___________% of the most recent ascertainable taxes;

(b)The most recent ascertainable taxes and subsequent readjustment thereof pursuant to the terms of reproration letter attached hereto and incorporated herein by reference.

(c)[Other] _________________________________________________________________________________________________

The amount of any general taxes which may accrue by reason of new or additional improvements shall be adjusted as follows:

All prorations are final unless otherwise provided herein. Existing leases and assignable insurance policies, if any, shall then be assigned to Purchaser. Seller shall pay the amount of any stamp tax imposed by State law on the transfer of the title, and shall furnish a completed Real Estate Transfer Declaration signed by the Seller or the Seller's agent in the form required pursuant to the Real Estate Transfer Tax Act of the State of Illinois and shall furnish any declaration signed by the Seller or the Seller's agent or meet other requirements as established by any local ordinance with regard to a transfer or transaction tax; such tax required by local ordinance shall be paid by the party upon whom such ordinance places 'responsibility therefor. If such ordinance does not so place responsibility, the tax shall be paid by the (Purchaser) (Seller). (Strike one.)

4. The provisions of the Uniform Vendor and Purchaser Risk Act of the State of Illinois shall be applicable to this contract.

5.If this contract is terminated without Purchaser's fault, the earnest money shall be returned to the Purchaser, but if the termination is caused by the Purchaser's fault, then upon notice to the Purchaser, the earnest money shall be forfeited to the Seller and applied first to the payment of Seller's expenses and then to payment of broker's commission; the balance, If any, to be retained by the Seller as liquidated damages.

6.At the election of Seller or Purchaser upon notice to the other party not less than 5 days prior to the time of closing, this sale shall be closed through an escrow with Chicago Title and Trust Company, in accordance with the general provisions of the usual form of Deed and Money Escrow Agreement then in use by Chicago Title and Trust Company, with such special provisions inserted in the escrow agreement as may be required to conform with this contract. Upon the creation of such an escrow, anything herein to the contrary notwithstanding, payment of purchase price and delivery of deed shall be made through the escrow and this contract and the earnest money shall be deposited in the escrow. The cost of the escrow shall be divided equally between Seller and Purchaser. (Strike paragraph if inapplicable.)

7.Time is of the essence of this contract.

8.All notices herein required shall be in writing and shall be served on the parties at the addresses following their signatures. The mailing of a notice by registered or certified mail, return receipt requested, shall be sufficient service.

9.Alternative 1:

Seller represents that he is not a "foreign person" as defined in Section 1445 of the Internal Revenue Code and is therefore

exempt from the withholding requirements of said Section. Seller will furnish Purchaser at closing the Exemption Certification set forth in said Section.

Alternative 2:

Purchaser represents that the transaction is exempt from the withholding requirements of Section 1445 of the Internal Revenue Code because Purchaser intends to use the subject real estate as a qualifying residence under said Section and the sales price does not exceed $300,000.

Alternative 3:

With respect to Section 1445 of the Internal Revenue Code, the parties agree as follows:

(Strike two of the three alternatives.)

10.(A) Purchaser and Seller agree that the disclosure requirements of the Illinois Responsible Property Transfer Act (do) (do not) apply to the transfer contemplated by this contract. (If requirements do not apply, strike (B) and (C) below.)

(B) Seller agrees to execute and deliver to Purchaser and each mortgage lender of Purchaser such disclosure documents as may be required by the Illinois Responsible Property Transfer Act.

(C) Purchaser agrees to notify Seller in writing of the name and post office address of each mortgage lender who has issued a commitment to finance the purchase hereunder, or any part thereof; such notice shall be furnished within 10 days after issuance of any such commitment, but in no event less than 40 days prior to delivery of the deed hereunder unless waived by such lender or lenders. Purchaser further agrees to place of record, simultaneously with the deed recorded pursuant to this contract, any disclosure statement furnished to Purchaser pursuant to paragraph 10(B) and, within 30 days after delivery of the deed hereunder, to file a true and correct copy of said disclosure document with the Illinois Environmental Protection Agency.

Form Characteristics

| Fact Name | Description |

|---|---|

| Contract Type | This is the Chicago Title Insurance Company's Real Estate Sale Contract for Illinois, commonly used for multi-family, commercial, and industrial property transactions. |

| Purchaser Details | The form requires the Purchaser's name and the price they agree to pay, along with the property details. |

| Seller Responsibilities | The Seller must convey the property title to the Purchaser via a recordable deed, ensuring specific restrictions and conditions are met. |

| Earnest Money | Purchasers submit earnest money, to be applied towards the purchase price, which is typically held for mutual benefit. |

| Closing Date | The closing date must be specified within the contract, with provision for potential extensions. |

| Current Plat of Survey | Sellers are responsible for providing a current plat of survey, certified in compliance with Illinois standards. |

| Broker's Commission | The contract stipulates the Seller's obligation to pay a broker's commission, as set out in the listing agreement. |

| Title Insurance | Purchasers must receive a title commitment for an owner's title insurance policy covering the property. |

| Conditions and Stipulations | The contract includes specific conditions and stipulations that govern the rights and responsibilities of both parties. |

| Applicable Illinois Law | This contract operates under Illinois law, including the Uniform Vendor and Purchaser Risk Act and the Illinois Responsible Property Transfer Act. |

Guidelines on Utilizing Illinois Realtor Contract

Getting ready to fill out the Illinois Realtor Contract form requires careful attention to detail. This step-by-step guide will walk you through the process, making sure you have everything you need for a smooth transaction. Follow these steps closely to ensure your contract is completed correctly.

- Enter Purchaser Information: Start by filling in the name of the purchaser at the top of the form. Include the full name as it will appear on the contract.

- Purchase Price: Write in the agreed purchase price in the designated space. Be precise with your figures.

- Property Description: Fill in the county, the common address, and the approximate lot dimensions of the property being purchased.

- Seller Information: Provide the seller's name and agree to the terms outlined. Ensure it matches their legal name.

- Earnest Money: Include the amount of earnest money provided by the purchaser, as well as the manner of payment.

- Financing Details: Specify the payments to be made and any applicable notes or mortgages. Detail any agreement to assume a mortgage or trust deed.

- Closing Information: Indicate the proposed closing date and location, noting any potential extensions.

- Broker's Commission: State the broker's name and the commission arrangement, based on the listing contract.

- Earnest Money Holder: Indicate who will hold the earnest money for mutual benefit.

- Warranties by Seller: Include assurances that the seller has no outstanding notices regarding zoning or other violations.

- Duplicate Originals: Mention that a duplicate original of the contract should be delivered to the purchaser within a specified time frame.

- Signatures: Ensure that both purchaser and seller, including their addresses, sign the contract in the appropriate spaces.

Once you have completed these steps, review the entire document for any errors or omissions. This careful attention will help prevent misunderstandings and protect both parties in the transaction. After that, you will be ready to move forward with the closing process.

What You Should Know About This Form

What is the Illinois Realtor Contract form used for?

The Illinois Realtor Contract form is primarily used for real estate transactions in Illinois. This form outlines the terms and conditions under which a seller agrees to sell and a buyer agrees to purchase a specific property. It details the purchase price, property description, and various contractual obligations for both parties involved.

What information is required to complete the contract?

The contract requires essential details such as the purchase price, description of the property, names and addresses of both the seller and purchaser, and the closing date. Additionally, it includes terms regarding earnest money, financing, and possible easements or restrictions affecting the property.

What happens if the seller fails to deliver a title commitment and survey?

If the seller does not deliver a title commitment or survey within the specified time frame, they have an additional 30 days to correct this. If they fail to do so, the buyer can either terminate the contract or elect to proceed with the purchase while accounting for any unpermitted exceptions in the title.

How is earnest money handled under this contract?

Earnest money is held by a third party, such as an escrow agent, for the benefit of both the buyer and seller. If the contract is terminated without the buyer's fault, the earnest money is refunded. However, if the termination is due to the buyer's fault, the seller may keep the earnest money as liquidated damages.

What are the seller's obligations regarding property condition?

The seller must disclose any known zoning, building, or health code violations that have not been corrected. Additionally, they are required to provide a current plat of survey certified in compliance with Illinois Land Survey Standards prior to closing.

What is included in the title commitment?

The title commitment must show clear title to the property subject only to permissible exceptions. It assures the buyer that any liens or encumbrances will either be cleared or addressed before the sale is finalized.

Can the closing date be extended?

Yes, the closing date can be extended if certain conditions arise, such as unresolved title issues or other stipulations in the contract. However, both parties must mutually agree to any changes to the established timeline.

What options are available for buyers regarding mortgage assumption?

In the contract, the buyer has the option to assume the seller's existing mortgage or trust deed. The buyer must indicate whether they agree to assume this debt, which affects the overall financing structure of the transaction.

How are taxes adjusted during the closing process?

Taxes are prorated between the buyer and seller as of the closing date. They are adjusted based on the most recent ascertainable tax amounts or through other agreed-upon methods. This ensures that both parties pay their fair share of property taxes up to the time of the sale.

Common mistakes

Filling out the Illinois Realtor Contract form requires careful attention to detail. One common mistake is failing to accurately complete the property description. The property address must be filled out in its entirety, including the county name and lot dimensions. Omitting this information can lead to confusion about which property is under contract and may complicate the transaction.

Another frequent error occurs when purchasers do not indicate the correct earnest money amount. This amount serves as a demonstration of commitment to purchase the property, and it should be substantial enough to reflect the seriousness of the buyer's intentions. Incomplete or incorrect earnest money figures can jeopardize the contract and the good faith of the parties involved.

A third mistake involves neglecting to specify the closing date and location clearly. This section is crucial for ensuring that both the seller and buyer have a mutual understanding of when the property transaction will occur. If left blank or poorly defined, it could lead to disputes over timelines and conditions of the sale.

Additionally, failing to notarize signatures can invalidate the agreement. Both the seller and purchaser must sign the contract to confirm their acceptance of the terms. If these signatures are not properly verified by a notary public, the contract could be contested later, leading to potential legal challenges.

Finally, overlooking the stipulations and conditions that pertain to the sale may result in significant complications. It's essential for both parties to review these carefully and ensure that any necessary amendments are made beforehand. Ignoring this step can lead to misunderstandings or an incomplete contract that may not provide adequate legal protection for either party.

Documents used along the form

The Illinois Realtor Contract Form is a key document in real estate transactions within the state. However, it is often accompanied by various other forms and documents that help clarify and support the terms of the agreement. Understanding these additional documents is essential for both buyers and sellers as they navigate the complexities of real estate deals. Below is a list of important forms commonly used alongside the Illinois Realtor Contract Form.

- Earnest Money Agreement: This document details the amount of money the buyer deposits as a show of good faith toward the purchase. It specifies how this money will be handled and what happens if the deal falls through.

- Title Commitment: Issued by a title insurance company, this document provides a preliminary report on the ownership of the property. It outlines any liens, encumbrances, or defects in the title that the buyer should be aware of before proceeding.

- Plat of Survey: A detailed map of the property, prepared by a licensed surveyor. It shows the property lines, structures, easements, and any other relevant geographic features.

- Disclosure Statements: Various disclosures, such as lead paint disclosures, may be required by law, depending on the property and its age. These documents inform the buyer about potential issues with the property.

- Real Estate Transfer Declaration: This form is used to report the sale of the property to local authorities. It includes information about the sale price and property details, ensuring transparency in the transaction.

- Closing Statement: A comprehensive document that outlines the final financial terms of the sale. It details all costs, credits, and adjustments that will occur at closing, ensuring both parties understand the financial implications of the transaction.

- Homeowner’s Association (HOA) Documents: If the property is part of an HOA, these documents outline the rules, fees, and regulations that govern the community. Understanding them is crucial for potential buyers.

- Security Agreement: This document can detail any personal property being sold alongside the real estate, specifying how it will be financed and secured.

Familiarity with these forms can lead to a smoother transaction process and help all parties involved make informed decisions. It’s always recommended to consult with a qualified real estate professional to ensure that every document is in order and properly understood.

Similar forms

The Illinois Realtor Contract form shares similarities with several other real estate documents. Here’s a detailed comparison:

- Residential Purchase Agreement: Similar in structure, this document outlines the terms of selling and buying residential property, including price, earnest money, and closing details.

- Commercial Purchase Agreement: Like the Illinois Realtor Contract, it specifies terms for commercial properties, addressing issues such as tenant leases and zoning requirements.

- Lease Agreement: Both documents cover the obligations of parties involved in a real estate transaction, but a lease agreement pertains to renting property rather than purchasing it.

- Option to Purchase Agreement: This document offers a buyer the right to purchase property under specific conditions, similar to how purchases are outlined in the Realtor contract.

- Listing Agreement: A listing agreement lays out the terms under which a real estate agent will sell a property, including commissions and duration of the agreement, mirroring commission details in the Realtor contract.

- Real Estate Purchase and Sale Agreement: Often used for more complex transactions, this agreement includes similar elements regarding the transfer of property and obligations of both buyer and seller.

- Title Insurance Commitment: This document ensures that property title issues are resolved, much like the prerequisites established in the Illinois Realtor Contract regarding title issues and surveys.

- Counteroffer Form: Similar in its function to amend and negotiate terms, this form adjusts proposals just as addendums or modifications might within the Realtor Contract.

Dos and Don'ts

When filling out the Illinois Realtor Contract form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are five things you should do and five things you should avoid.

- Double-check all figures: Ensure that the purchase price, earnest money, and any dates are accurate and clearly written to avoid confusion later.

- Provide complete information: Fill in all blank fields with specific details about the buyer, seller, and property to eliminate any ambiguity.

- Review the terms: Understand and confirm all contractual obligations and agreements laid out within the contract before signing.

- Consult a professional: If uncertain about any terms, seek legal or professional advice to clarify and avoid potential pitfalls.

- Keep copies: Retain copies of the signed contract and any agreements related to the transaction for your records.

- Do not rush: Take your time to ensure that all information is correct; haste can lead to mistakes.

- Avoid leaving blank fields: Unfilled sections can create misunderstandings and legal issues down the line.

- Do not ignore stipulations: Pay close attention to the conditions and stipulations included at the end of the contract.

- Do not make assumptions: If a requirement or term is unclear, seek clarification rather than guessing.

- Avoid informal correspondence: All communications regarding the contract should be in writing and properly documented.

Misconceptions

- Misconception 1: The Illinois Realtor Contract form cannot be modified in any way.

- Misconception 2: Earnest money is always forfeited if the sale does not go through.

- Misconception 3: The seller is responsible for all title issues prior to closing.

- Misconception 4: Closing must occur on a specific date with no exceptions.

This contract provides certain areas where parties can strike out or fill in blanks according to their specific needs. While the core structure remains the same, there is flexibility in customizing terms to fit the unique circumstances of the transaction.

In fact, if a contract is terminated without the purchaser's fault, the earnest money must be returned to the purchaser. The terms specify conditions under which earnest money is retained, primarily focusing on the purchaser's fault.

While the seller must provide a title commitment and rectify any unpermitted exceptions or property defects identified in the title commitment, the purchaser also has rights if these issues persist. The contract outlines clear responsibilities for both parties in resolving title issues.

The closing date is somewhat flexible. The contract states that closing can be extended based on specific conditions or mutual agreement between the parties. This means that parties have the ability to adjust timelines as necessary.

Key takeaways

Here are some key takeaways for filling out and using the Illinois Realtor Contract form:

- The contract clearly defines the roles of the Purchaser and Seller, along with the specific terms of the sale, including the purchase price and payment structure.

- It is crucial to conduct due diligence on any exceptions to the title, as outlined in the contract. The Seller must provide a title commitment that details any potential issues that could affect the sale.

- Earnest money plays a significant role in the transaction. Ensure that the amount, holding party, and conditions for refund or forfeiture are understood and clearly stated in the contract.

- Timely delivery of necessary documents is essential. The Seller is required to provide key documents, including the plat of survey and title commitment, at least 5 days before closing.

Browse Other Templates

VA Education Program Change Request,Veterans Training Program Modification Form,Change of Educational Benefits Application,VA Program Transition Form,Request for Training Program Adjustment,Veteran's Educational Change Form,Application for Program Ch - Your goals can be educational, professional, or vocational; be as specific as possible in Part IV.

Ohio Real Estate Disclosure Form - The form includes sections for addressing defects in mechanical systems and their current operational status.