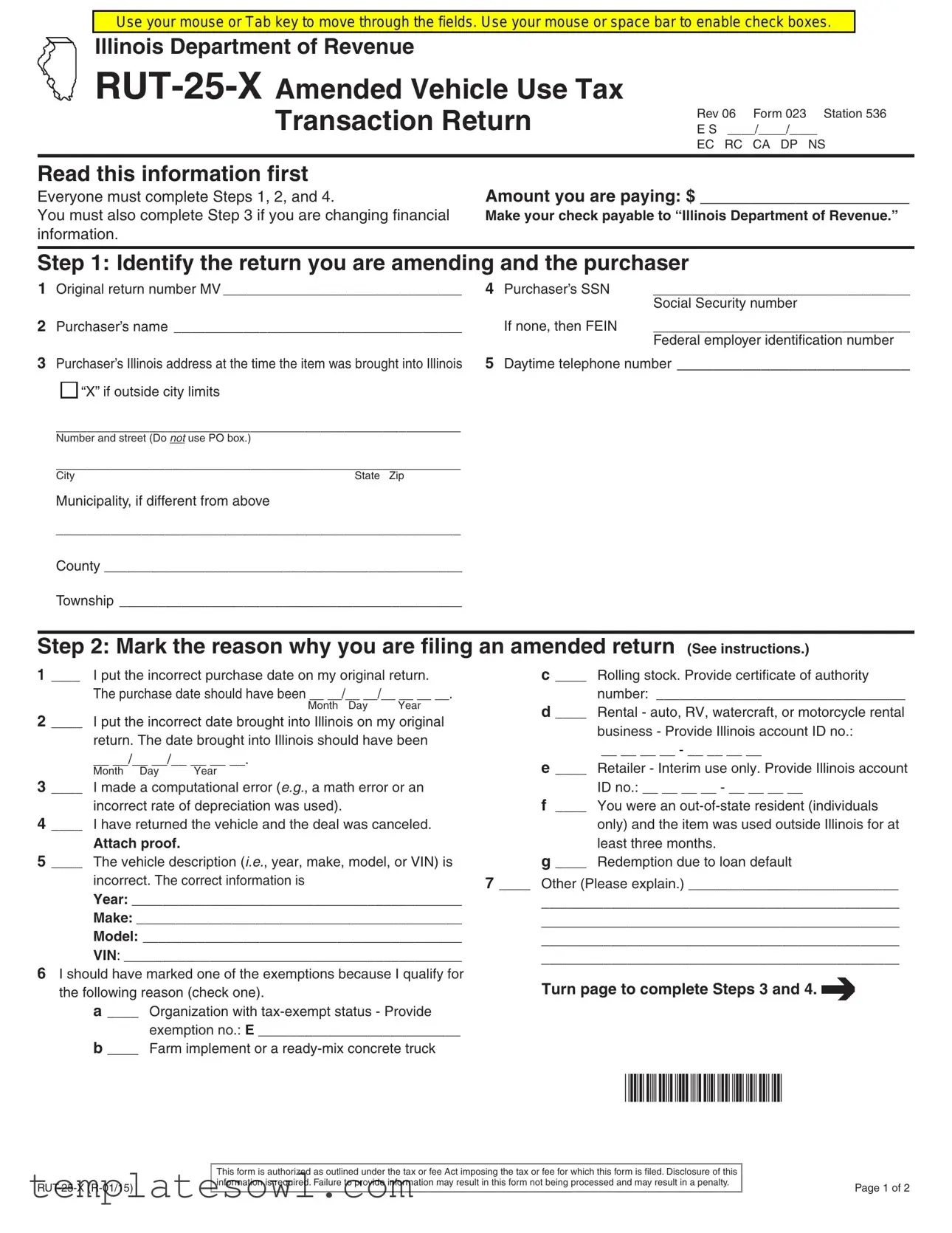

Fill Out Your Illinois Rut 25 X Form

The Illinois RUT-25-X form serves as an amended vehicle use tax transaction return. It is utilized by individuals who need to correct information submitted in an original vehicle use tax return. The form requires the completion of several key steps to ensure accurate processing. First, users must identify the return they are amending, including details such as the original return number, the purchaser’s name, and their Social Security or federal employer identification number. An important part of the process is selecting the reason for filing the amended return, which may include correcting purchase dates or computational errors. If financial information is being amended, additional calculations may be necessary to determine the correct taxable amount. Finally, the form must be signed and dated by the purchaser, confirming the accuracy of the provided information. Accurate submission of the RUT-25-X is crucial for compliance with tax obligations in Illinois.

Illinois Rut 25 X Example

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Rev 06 Form 023 Station 536 E S ____/____/____

EC RC CA DP NS

Read this information first

Everyone must complete Steps 1, 2, and 4. |

Amount you are paying: $ ______________________ |

You must also complete Step 3 if you are changing financial |

Make your check payable to “Illinois Department of Revenue.” |

information. |

|

Step 1: Identify the return you are amending and the purchaser

1 Original return number MV _______________________________ |

4 |

Purchaser’s SSN |

_________________________________ |

|

|

|

|

|

Social Security number |

2 |

Purchaser’s name _____________________________________ |

|

If none, then FEIN |

__________________________________ |

|

|

|

|

Federal employer identification number |

3 |

Purchaser’s Illinois address at the time the item was brought into Illinois |

5 |

Daytime telephone number _________________________ |

|

“X” if outside city limits

____________________________________________________

Number and street (Do not use PO box.)

____________________________________________________

City |

State Zip |

Municipality, if different from above |

|

____________________________________________________

County ______________________________________________

Township ____________________________________________

Step 2: Mark the reason why you are filing an amended return (See instructions.)

1 ____ |

I put the incorrect purchase date on my original return. |

c ____ |

Rolling stock. Provide certificate of authority |

|||

|

The purchase date should have been __ __/__ __/__ __ __ __. |

|

number: ________________________________ |

|||

2 ____ |

|

Month Day |

Year |

d ____ |

Rental - auto, RV, watercraft, or motorcycle rental |

|

I put the incorrect date brought into Illinois on my original |

||||||

|

business - Provide Illinois account ID no.: |

|||||

|

return. The date brought into Illinois should have been |

|

||||

|

|

__ __ __ __ - __ __ __ __ |

||||

|

__ __/__ __/__ __ __ __. |

|

|

|||

|

|

e ____ |

Retailer - Interim use only. Provide Illinois account |

|||

3 ____ |

Month Day |

Year |

|

|||

I made a computational error (e.g., a math error or an |

|

ID no.: __ __ __ __ - __ __ __ __ |

||||

|

incorrect rate of depreciation was used). |

|

f ____ |

You were an |

||

4 ____ |

I have returned the vehicle and the deal was canceled. |

|

only) and the item was used outside Illinois for at |

|||

|

Attach proof. |

|

|

|

least three months. |

|

5 ____ |

The vehicle description (i.e., year, make, model, or VIN) is |

g ____ |

Redemption due to loan default |

|||

|

incorrect. The correct information is |

|

7 ____ Other (Please explain.) ___________________________ |

|||

|

Year: __________________________________________ |

______________________________________________ |

||||

|

Make: _________________________________________ |

______________________________________________ |

||||

|

Model: _________________________________________ |

______________________________________________ |

||||

|

VIN: ___________________________________________ |

______________________________________________ |

||||

6 I should have marked one of the exemptions because I qualify for |

Turn page to complete Steps 3 and 4. |

|||||

the following reason (check one). |

|

|||||

a ____ Organization with

exemption no.: E __________________________

b ____ Farm implement or a

*502361110*

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is required. Failure to provide information may result in this form not being processed and may result in a penalty.

Page 1 of 2

Step 3: Correct your financial information

Complete this step only if you are changing financial information. Otherwise, go to Step 4 and sign your return. Remember the following:

•round to the nearest whole dollar.

•attach a copy of the bill of sale to this return.

•use 6.25 percent as your tax rate for Line 6 unless the address listed in Step 1 is one of the following locations:

Cook County |

7.25 percent (7.50 percent in Bensenville, Elmhurst, Hinsdale, Oak Brook, Roselle, and Woodridge) |

DuPage County |

7.25 percent (7.0 percent outside of DuPage Water Commission territory and in West Chicago) |

Will County |

7.0 percent (7.25 percent in Naperville or Woodridge) |

Kane, Lake, and McHenry Counties |

7.0 percent |

Madison and St. Clair Counties |

6.5 percent (6.25 percent outside the Metro East Mass Transit District) |

|

|

|

Column A |

|

Column B |

|

|

Most recent figures filed |

|

Figures as they should |

|

|

|

|

|

|

have been filed |

1 |

Purchase price - before |

1 |

____________ |

1 |

____________ |

2 |

2 |

____________ |

2 |

____________ |

|

3 |

Net purchase price. Subtract Line 2 from Line 1. |

3 |

____________ |

3 |

____________ |

4 |

Depreciation for |

4 |

____________ |

4 |

____________ |

5 |

Taxable amount. Subtract Line 4 from Line 3. |

5 |

____________ |

5 |

____________ |

6 |

Tax. Multiply Line 5 by the tax rate ________. (See the rates listed above.) |

6 |

____________ |

6 |

____________ |

7Credit for tax previously paid to another state or to a retailer. (See instructions.)

|

Enter the state or the name of the retailer ____________________. |

7 |

____________ |

7 |

____________ |

8 |

Tax due. Subtract Line 7 from Line 6. |

8 |

____________ |

8 |

____________ |

9 |

Total amount paid. |

|

|

9 |

____________ |

|

Compare Line 8, Column B, and Line 9. |

|

|

|

|

•If Line 9 is greater than Line 8, Column B, enter the difference on Line 10.

•If Line 9 is less than Line 8, Column B, enter the difference on Line 11.

10 Overpayment — This is the amount you have overpaid. Go to Step 4 and sign this return. |

10 ____________ |

11Underpayment — This is the amount you have underpaid. Pay this amount.

Go to Step 4 and sign this return. |

11 ____________ |

Make your check payable to “Illinois Department of Revenue.”

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

__________________________________________________________________________________ _____________________________________________________________________________________

Purchaser’s signatureDateCo-owner’s signatureDate

__________________________________________________________________________________ _____________________________________________________________________________________

Purchaser’s Current mailing address |

City |

State |

ZIP |

Mail to: ILLINOIS DEPARTMENT OF REVENUE PO BOX 19034

SPRINGFIELD IL

Enter the amount you are paying on the line provided in the “Read this information first” section on the front of this return.

*502362110*

Page 2 of 2

Reset

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Governing Law | The RUT-25-X form is governed by the Illinois Vehicle Use Tax Act. |

| Filing Requirement | All filers must complete Steps 1, 2, and 4. Step 3 is required only if financial information is changing. |

| Amended Returns | This form is specifically for filing amended vehicle use tax transaction returns. |

| Tax Rates | The standard tax rate is 6.25%. Higher rates apply for Cook, DuPage, and some other counties. |

| Payment Instructions | Make checks payable to “Illinois Department of Revenue” for the amount specified on the form. |

| Filing Location | Mailed returns go to the Illinois Department of Revenue, PO Box 19034, Springfield IL 62794-9034. |

Guidelines on Utilizing Illinois Rut 25 X

Completing the Illinois Rut 25 X form is essential for ensuring your amended vehicle use tax transaction is processed accurately. After gathering all necessary information, it's important to follow each step carefully. This will help avoid potential delays in processing.

- Step 1: Identify the return you are amending and the purchaser.

- Fill in the original return number of your Motor Vehicle.

- Provide the purchaser’s name and corresponding Social Security number (or FEIN if applicable).

- Write down the Illinois address where the purchaser was located when the vehicle was brought into Illinois.

- Enter the daytime telephone number.

- Mark the box if outside the city limits.

- List the number and street without using a P.O. box.

- Provide city, state, zip, and additional municipal or county info if it differs.

- Step 2: Mark the reason for filing an amended return.

- Choose the reason for your amendment from the options provided and fill in any required corrections (purchase dates, vehicle descriptions, etc.).

- Step 3: Correct your financial information (only if applicable).

- Make sure to round amounts to the nearest dollar.

- Attach a copy of the bill of sale with the return.

- Fill in the current figures under Columns A and B, ensuring accurate calculation for each step (purchase price, trade-ins, taxes, credits, and total amount due).

- Step 4: Sign below.

- Sign and date the form, providing necessary details for both the purchaser and co-owner if applicable.

- Update the current mailing address if different.

- Mail to the specified address, ensuring your payment is attached as directed on the form.

After completing these steps, double-check for any errors. Then, mail the form to the Illinois Department of Revenue as instructed. Keeping a copy for your records can also be helpful. By following these guidelines, you'll ensure your amendment is processed smoothly.

What You Should Know About This Form

What is the Illinois Rut 25 X form used for?

The Illinois Rut 25 X form is used to amend a Vehicle Use Tax Transaction Return. If there are errors or changes needed on your original return, this form allows you to correct those mistakes.

Who needs to complete the Rut 25 X form?

Anyone who wants to amend their original vehicle use tax return must complete this form. It’s important for both individuals and businesses making corrections to their previously filed returns.

What steps must be completed to fill out the Rut 25 X form?

First, everyone must complete Steps 1, 2, and 4. If you are changing financial information, you will also need to fill out Step 3. Make sure to follow the instructions carefully to ensure proper processing.

What information is required in Step 1?

In Step 1, you will need to provide details such as your original return number, your name and Social Security number, your Illinois address, and some additional identifying information. This helps to identify the return you are amending.

What should I do if I made a computational error?

If there was a computational mistake on your original return, such as a math error, you should indicate this in Step 2. You will then outline your previous and corrected figures in Step 3.

Do I need to provide any supporting documents?

Yes, you must attach a copy of the bill of sale to your return. This helps to substantiate any changes you are claiming in your amended return.

What should I do if I overpay or underpay the tax?

In Step 3, you will compare your calculated tax due to what you have already paid. If you have overpaid, you will enter the amount in Line 10. If you have underpaid, you will enter that amount in Line 11, which must then be paid.

Can I make payments by check?

Yes, you should make your check payable to the “Illinois Department of Revenue.” Ensure you write the amount you are paying on the line provided in the “Read this information first” section.

Where do I send the completed Rut 25 X form?

You should mail your completed form to the Illinois Department of Revenue at PO Box 19034, Springfield, IL 62794-9034. Make sure everything is filled out correctly before sending it in.

Common mistakes

Filling out the Illinois Rut 25 X form can be complicated, and it’s easy to make mistakes. One common mistake occurs when individuals neglect to complete all required steps. Steps 1, 2, and 4 must be filled out by everyone, yet it is not uncommon for filers to skip one of these important sections.

Another frequent error is related to identifying personal information. Many people do not provide the correct purchaser's name or Social Security number. Always ensure that the name matches exactly with what is on file with the IRS. Additionally, the Social Security number must be accurate to avoid delays in processing.

In Step 2, choosing the appropriate reason for filing an amended return can lead to mistakes. Filers sometimes select the incorrect checkbox, which can result in misunderstandings about the nature of the amendment. Carefully review all options and select the one that accurately reflects your situation.

Incomplete or inaccurate vehicle descriptions are another issue. This can occur when individuals do not accurately state the make, model, year, or Vehicle Identification Number (VIN). It’s crucial to double-check this information because any discrepancies can hinder processing and lead to penalties.

Moving to financial information, many fail to round the figures properly or make arithmetic errors. It is vital to include accurate financial details in Step 3, particularly when calculating tax amounts. Remember to round to the nearest whole dollar, as rounding errors can lead to incorrect tax due amounts.

Additionally, failing to attach necessary documentation, such as the bill of sale, is a mistake that can delay the processing of the return. Ensure that all required attachments are included when submitting the form. This simple step can prevent unnecessary complications.

Another frequent oversight involves the payment of the correct tax amount. Some individuals do not consider the appropriate tax rate based on their address, which can lead to overpayment or underpayment of taxes. Reviewing the tax rates specific to your county is essential for accurate calculations.

People also tend to neglect the signature requirement in Step 4. An unsigned form is not valid, so it’s important to ensure both the purchaser and co-owner sign and date the return. Missing signatures can result in processing delays and legal issues.

Finally, not mailing the form to the correct address is a common issue. The return must be sent to the Illinois Department of Revenue at the specified address. Check the details to avoid misdirecting your form.

Documents used along the form

The Illinois RUT-25-X Form is an essential document for those needing to amend their Vehicle Use Tax Transaction Return. However, several other forms and documents often accompany it to ensure a smooth and complete filing process. Each of these documents serves a specific purpose and may be required based on individual circumstances.

- Bill of Sale: This document provides proof of the transaction between the buyer and the seller. It typically includes essential details such as the vehicle's make, model, purchase price, and the signatures of both parties involved in the sale.

- Form RUT-50: Also known as the Vehicle Use Tax Transaction Return, this form is the original document filed when an individual purchases or acquires a vehicle for use in Illinois. It's crucial for establishing tax responsibilities before an amendment is made.

- Exemption Certificate: If the purchaser qualifies for a tax exemption, this form must be filled out and submitted. It confirms the individual's eligibility for tax-exempt status, often needed for nonprofit organizations or government entities.

- Form CRT-1: This is the Certificate of Tax Paid on Out-of-State Vehicle Registration. If applicable, it proves payment of taxes in another state and may reduce the tax liability when registering the vehicle in Illinois.

- Proof of Residency: Documents such as utility bills or lease agreements can serve as proof of residence in Illinois, which is essential for determining tax rates applicable to the vehicle purchase.

- Power of Attorney: If someone is filing on behalf of the purchaser, this document grants them the authority to act in tax matters. It must be signed by the individual who owns the vehicle or is responsible for tax filings.

- Refund Request Form: If an overpayment occurred, this form is used to request a refund from the Illinois Department of Revenue, ensuring any excess taxes collected are returned to the purchaser.

These forms and documents play a critical role in the process of amending tax returns and ensuring compliance with Illinois tax laws. Properly completing and submitting the RUT-25-X form, along with the relevant supporting documents, will help mitigate any potential issues or delays in processing. Addressing these matters promptly is in the best interest of all parties involved to avoid penalties and ensure legal adherence.

Similar forms

- Illinois RUT-25: This form is used for the Vehicle Use Tax Transaction Return. Like the RUT-25-X form, it requires the filer to report vehicle purchase details and tax calculations. It serves the purpose of initially documenting the vehicle use tax owed upon purchase.

- Illinois RUT-1: This document functions as the general transaction return for the Vehicle Use Tax. It results in a similar process of amending vehicle tax information and is used for filing the initial vehicle tax return, similar to how RUT-25-X is used for amendments.

- IRS Form 1040: This form is the U.S. Individual Income Tax Return. While different in purpose, both forms require accurate financial disclosure and the option to amend previous entries, ensuring compliance with tax regulations.

- Illinois ST-1: The Sales Tax Transaction Return shares similarities in its function of documenting specific tax liabilities owed on sales. Both forms require crucial customer and transaction information to be reported.

- Illinois Form IL-1040-X: This form is an amended individual income tax return. Like the RUT-25-X form, it is intended for correcting previously submitted information, ensuring accurate tax reporting.

- IRS Form 1099: Although it serves a different purpose, the 1099 form must report various income types. Both forms demand attention to detail and adherence to specific filing requirements to prevent penalties.

- Illinois Form CR: This is the Credit for Tax Paid to Another State form. Like the RUT-25-X, it allows for adjustments relating to tax credits and requires supporting documentation for transactions made within and outside of the state.

Dos and Don'ts

When filling out the Illinois RUT-25-X form, ensuring accuracy and compliance is crucial. Here are ten essential do's and don'ts to consider:

- Do: Read the instructions thoroughly before starting to avoid mistakes.

- Do: Complete all necessary steps as outlined, specifically Steps 1, 2, and 4.

- Do: Use clear and accurate information for the purchaser’s name and address.

- Do: Pay special attention to the correct purchase and brought-in dates.

- Do: Attach the required documentation, such as the bill of sale, when necessary.

- Don’t: Ignore the tax rates applicable to your jurisdiction; ensure they are correctly applied.

- Don’t: Leave any required fields blank; this can delay processing.

- Don’t: Use a PO box for your address; a physical address is required.

- Don’t: Forget to sign the form; signatures are essential for validation.

- Don’t: Submit without first double-checking all calculations for accuracy.

Being diligent in these areas protects you from potential penalties and ensures your form is processed promptly. Act swiftly and thoroughly to avoid any delays in your tax matters.

Misconceptions

- Amending the form is optional. Many people believe they can ignore filing an amended return. However, if you realize an error on your original return, it's crucial to amend it to correct the record and avoid penalties.

- You only need to file if you owe additional tax. Some think they need to file an amended return only when they owe more tax. This is not true. You should also file if you are due a refund or need to correct errors for any reason.

- The exemption options are limited. A common misconception is that there are few reasons to claim an exemption. In reality, there are several conditions under which you may qualify for an exemption, and it's worth reviewing those closely.

- Only individuals can file the RUT-25-X. Many believe that only individual purchasers need to file this form. However, businesses can also be required to submit this amended return in certain situations.

- Filing doesn't require supporting documents. Some assume they can submit the form without any additional paperwork. In fact, you must attach documents like a bill of sale if you're changing financial information or claiming an exemption.

- All errors are treated the same. It's a misconception that all mistakes on the original form will have the same ramifications. Different types of errors may lead to different penalties or refunds, so it’s important to be specific about what was incorrect.

- You can file it anywhere. Many believe they can send the form to any address. It is vital to mail it to the correct location, which is the Illinois Department of Revenue at the specified PO Box in Springfield.

Key takeaways

- Understanding Purpose: The Illinois RUT-25-X form is designed for amending a previous Vehicle Use Tax transaction return.

- Complete Required Steps: Everyone must complete Steps 1, 2, and 4, while Step 3 is necessary only if there are changes to financial information.

- Identify the Return: Clearly identify the original return number and provide essential purchaser details, including name, address, and Social Security number or Federal Employer Identification Number.

- Check the Reason: Choose the correct reason for filing an amended return in Step 2 to ensure proper processing.

- Financial Information: In Step 3, only complete this section if financial details need correction; otherwise, proceed to Step 4.

- Tax Rates: Be mindful of varying tax rates based on location. For example, Cook County has a higher rate than other areas, which must be applied to the calculations.

- Attach Documentation: Always include a copy of the bill of sale with your return to facilitate the review process.

- Sign and Date: It is essential to sign and date the form; failing to do so may delay processing or result in penalties.

- Mailing Information: Submit the completed form to the Illinois Department of Revenue at the designated mailing address for processing.

Browse Other Templates

Printable Blank Frayer Model Template - It is suitable for students in grades 4 through 12.

Salon Fundamentals Cosmetology Textbook Pdf - Find all the necessary tools for a comprehensive education in the beauty sector.