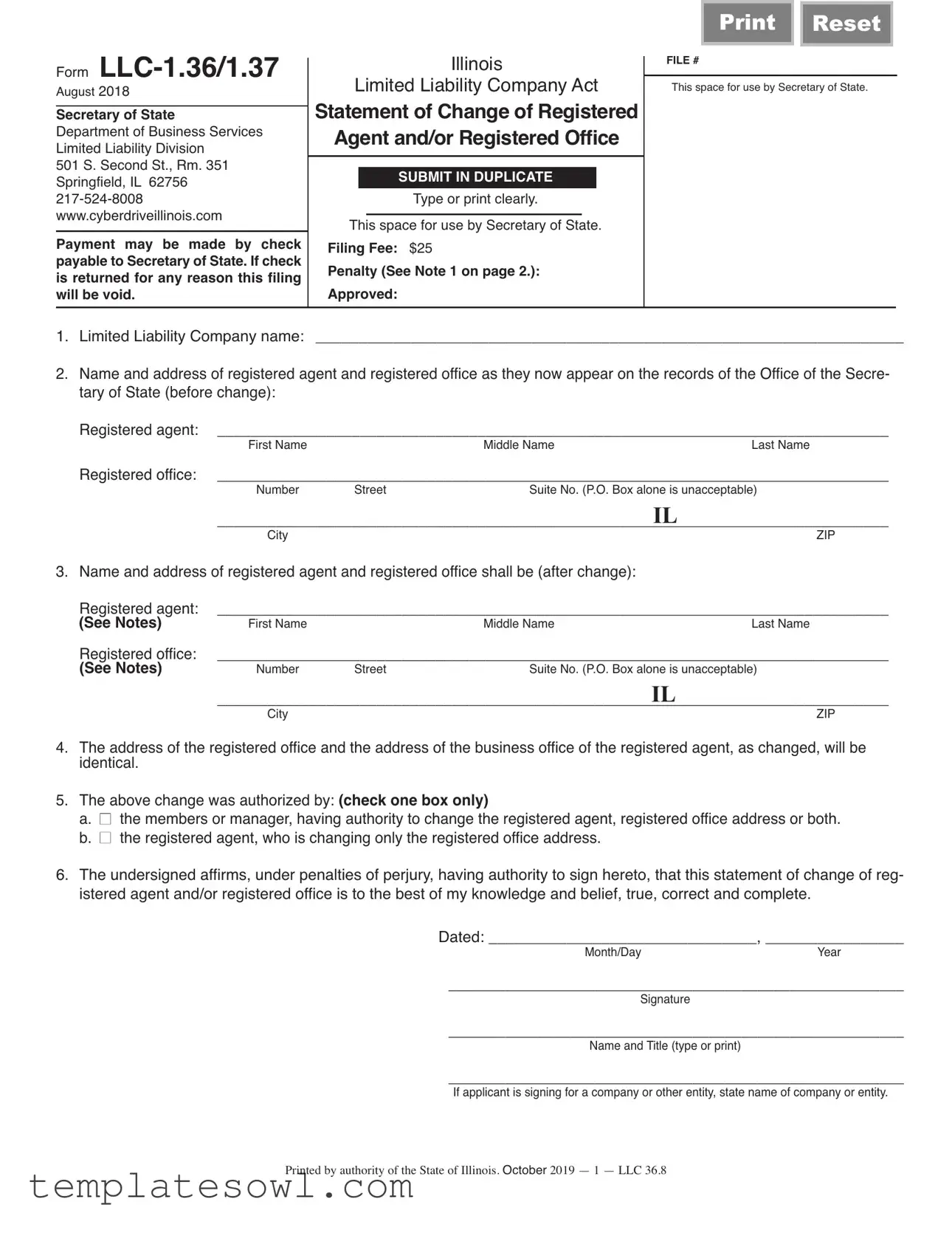

Fill Out Your Illinois Statement Of Change Form

The Illinois Statement of Change form, officially known as Form LLC-1.36/1.37, serves a crucial purpose for Limited Liability Companies (LLCs) operating in the state. This form is utilized when an LLC needs to update its registered agent or registered office address, ensuring that its records remain accurate with the Secretary of State. It requires clear and concise information regarding the existing and new details of the registered agent and office location. Alongside collecting this vital information, the form mandates that an authorized individual, typically a member or manager of the LLC, affirms the accuracy of the provided details. Filing the form incurs a nominal fee, which underscores the importance of timely submission. If a company fails to adhere to regulations regarding its registered agent, a significant penalty may arise. Although the form appears straightforward, its completion is vital for maintaining the integrity of business operations and compliance within Illinois's legal framework.

Illinois Statement Of Change Example

Form |

|

Illinois |

This |

|

Reset |

|

|||

|

space for use by Secretary of State. |

|

|||||||

August 2018 |

Limited Liability Company Act |

|

FILE # |

|

|

|

|

||

|

|

|

|

|

|

||||

Secretary of State |

Statement of Change of Registered |

|

|

|

|

|

|||

Limited Liability Division |

Agent and/or Registered Office |

|

|

|

|

|

|||

Department of Business Services |

|

|

|

|

|

|

|

|

|

501 S. Second St., Rm. 351 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Springfield, IL 62756 |

|

Type or print clearly. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

www.cyberdriveillinois.com |

This space for use by Secretary of State. |

|

|

|

|

|

|||

Payment may be made by check |

Filing Fee: $25 |

|

|

|

|

|

|||

payable to Secretary of State. If check |

Penalty (See Note 1 on page 2.): |

|

|

|

|

|

|||

is returned for any reason this filing |

|

|

|

|

|

||||

will be void. |

Approved: |

|

|

|

|

|

|||

1.Limited Liability Company name: ____________________________________________________________________

2.Name and address of registered agent and registered office as they now appear on the records of the Office of the Secre- tary of State (before change):

Registered agent: |

________________________________________________________________________________ |

||||||

Registered office: |

First Name |

|

Middle Name |

Last Name |

|

||

________________________________________________________________________________ |

|||||||

|

|

|

Number |

Street |

Suite No. (P.O. Box alone is unacceptable) |

|

|

|

|

|

|

|

|

IL |

|

|

|

|

________________________________________________________________________________ |

||||

|

|

|

City |

|

|

|

ZIP |

3. Name and address of registered agent and registered office shall be (after change): |

|

|

|||||

Registered agent: |

________________________________________________________________________________ |

||||||

(See Notes) |

First Name |

|

Middle Name |

Last Name |

|

||

Registered office: |

________________________________________________________________________________ |

||||||

(See Notes) |

Number |

Street |

Suite No. (P.O. Box alone is unacceptable) |

|

|||

|

|

|

|

|

|

IL |

|

|

|

|

________________________________________________________________________________ |

||||

|

|

|

City |

|

|

|

ZIP |

4. The address of the registered office and the address of the business office of the registered agent, as changed, will be |

|||||||

identical. |

|

|

|

|

|

||

5. The above change was authorized by: (check one box only) |

|

|

|||||

a. |

n |

the members or manager, having authority to change the registered agent, registered office address or both. |

|||||

b. |

n |

the registered agent, who is changing only the registered office address. |

|

|

|||

6. The undersigned affirms, under penalties of perjury, having authority to sign hereto, that this statement of change of reg- istered agent and/or registered office is to the best of my knowledge and belief, true, correct and complete.

Dated: _______________________________, ________________

Month/DayYear

________________________________________________________

Signature

________________________________________________________

Name and Title (type or print)

________________________________________________________

If applicant is signing for a company or other entity, state name of company or entity.

Printed by authority of the State of Illinois. October 2019 — 1 — LLC 36.8

NOTES

1. A $100 penalty applies when the limited liability company fails to appoint and maintain a registered agent within 60 days of notification of the Secretary of State by the resigning agent.

2. The registered agent must reside in Illinois. A business entity acting as agent must be registered with the Secretary of State. The LLC may not act as its own registered agent.

3. The registered office must include the number and the street or road address (a PO Box with the

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Type | The Illinois Statement of Change is officially known as Form LLC-1.36/1.37. |

| Governing Law | This form is governed by the Limited Liability Company Act of Illinois. |

| Filing Fee | A $25 filing fee is required, payable to the Secretary of State. |

| Agent Requirements | The registered agent must reside in Illinois and cannot be the LLC itself. |

| Office Address | The registered office must include a physical address; P.O. Boxes alone are not acceptable. |

Guidelines on Utilizing Illinois Statement Of Change

Filling out the Illinois Statement of Change form is an important step for a Limited Liability Company (LLC) when there is a modification involving its registered agent or registered office. Completing this form correctly ensures that the Secretary of State has up-to-date information. After filling it out, you will submit it along with the necessary filing fee to the appropriate office.

- Begin with the Limited Liability Company Name at the top of the form. Enter the full legal name of your LLC.

- Next, provide the Name and Address of the registered agent and registered office as they currently appear in the Secretary of State's records:

- Registered Agent: Write the full name of the current registered agent.

- Registered Office: Enter the complete address including number, street, city, and ZIP code. Avoid using only a P.O. Box.

- Now, fill in the Name and Address of the new registered agent and registered office after the change:

- Registered Agent: Write the name of the new registered agent.

- Registered Office: Enter the new full address, ensuring it is a physical address and not just a P.O. Box.

- Confirm that the address of the registered office and the address of the business office of the registered agent will be identical.

- Indicate how the change was authorized by checking the appropriate box:

- Option (a) for authorization from the members or manager of the LLC.

- Option (b) if the registered agent is only changing the registered office address.

- Sign and date the form. Ensure the signature is from someone with authorization. Include the date in the month/day/year format and type or print the name and title of the person signing at the bottom.

- If applicable, state the name of the company or entity if the applicant is signing on behalf of another organization.

Once the form is completed, double-check for accuracy before submitting it along with a check for the filing fee of $25. Keep in mind that the check should be made payable to the Secretary of State. Processing changes promptly will help maintain compliance with state regulations.

What You Should Know About This Form

What is the Illinois Statement of Change form?

The Illinois Statement of Change form, also called Form LLC-1.36/1.37, is used by limited liability companies (LLCs) to update their registered agent and/or registered office address with the Secretary of State. This form must be completed and filed when there are changes to ensure that the company’s contact information is current and that legal documents can be served correctly.

Why do I need to update my registered agent or office?

Updating your registered agent or office is essential for maintaining compliance with Illinois law. The registered agent is responsible for receiving legal documents and official correspondence on behalf of the LLC. Keeping this information current helps avoid penalties and ensures that important notices reach the appropriate individuals in a timely manner.

How much does it cost to file the Statement of Change form?

The filing fee for the Illinois Statement of Change form is $25. This payment must be made to the Secretary of State. If a check is returned for any reason, the filing will be voided, and it is crucial to ensure that funds are available.

How do I file the Illinois Statement of Change form?

You can file the Statement of Change form by completing it and sending it to the Department of Business Services at the Secretary of State's office in Springfield. The mailing address is 501 S. Second St., Rm. 351, Springfield, IL 62756. Make sure to print clearly and include your payment along with the form.

Can I use a P.O. Box for the registered office address?

A P.O. Box alone is not acceptable for the registered office address. You must provide a physical street address, including the number and street. A P.O. Box may be added to the physical address, but it cannot stand alone.

Who can sign the Statement of Change form?

The form must be signed by an individual who has the authority to make changes on behalf of the LLC. This could be a member or manager of the LLC, depending on who is authorized to address such changes. It is important to ensure that the person signing has the proper authority to avoid issues later.

What happens if I don’t file this form in a timely manner?

If you fail to appoint and maintain a registered agent within 60 days after receiving notification from the Secretary of State, a $100 penalty may be imposed. Additionally, not updating your registered agent can lead to difficulties in receiving legal notices, which may harm your business.

Can the LLC act as its own registered agent?

No, the LLC cannot act as its own registered agent in Illinois. The registered agent must either be an individual who resides in Illinois or a business entity that is registered with the Secretary of State. This requirement ensures there is a reliable point of contact for legal matters.

What is the maximum character limit for the registered office address?

The registered office address has a limit of 30 characters, including spaces. It is important to adhere to this limit while ensuring that the address is formatted correctly. Consulting the USPS website can help with understanding proper address formatting.

Where can I find more information about the filing process?

For more information on the filing process, you can visit the website www.cyberdriveillinois.com. The site contains resources and guidance on completing the Statement of Change form and provides additional information about LLC compliance in Illinois.

Common mistakes

Filling out the Illinois Statement of Change form may seem straightforward, but many people overlook critical details that can lead to complications. One common mistake is failing to provide complete names and addresses. When filling out the form, every field must be filled in clearly. Names without middle initials or incomplete addresses can result in the form being rejected. It's essential to include the full name of the registered agent and the complete physical address, including the street number, street name, and city, in addition to the state and ZIP code. Incomplete details can create confusion and lead to unnecessary delays.

Another frequent issue arises from misunderstanding the rules regarding the registered agent. Many applicants mistakenly believe that they can act as their own registered agent, unaware that this is prohibited for LLCs in Illinois. The registered agent must be a person or business entity with a physical address in the state. Individuals often overlook this requirement, thinking that any address will suffice. To prevent errors, double-check that your registered agent meets this criterion, as failing to do so can lead to a rejection of your filing.

Additionally, miscommunication regarding the authorization of the change is also prevalent. The form requires a specific declaration about who authorized the change. Many people mistakenly check the wrong box. Understanding whether the change was authorized by the members or manager or just the registered agent is crucial. This aspect appears minor, but it can invalidate the submission if not filled out correctly. Clear communication within your organization about who has the authority can mitigate this problem.

Finally, neglecting to sign the document or misdating it are mistakes that commonly occur and may seem trivial but can have serious implications. The form must be signed and dated by an authorized person, and it is vital to ensure that the date reflects the current time. Applications lacking a proper signature or accurate date will face rejection. Taking the extra moment to review your form's completion can significantly impact the processing of your request.

Documents used along the form

When changing a registered agent or office for an LLC in Illinois, several other forms and documents may come into play. Each document serves a different purpose to ensure that the transition is recorded correctly and meets state regulations. Understanding these documents can help streamline the process.

- LLC Articles of Organization - This document is filed to create the LLC. It lays out the company’s basic structure, including name, purpose, and registered agent information.

- Registered Agent Acceptance - This form confirms that the new registered agent agrees to serve in that capacity. It should be completed and kept for records.

- Annual Report - LLCs in Illinois must file this report each year. It provides updated information on the business, including any changes in registered agent or office.

- Bylaws or Operating Agreement - These internal documents outline how the LLC operates. They may include provisions on how changes to the registered agent or office should be made.

- Statement of Information (Form LLC-12) - This is required to maintain the LLC’s good standing. It must include accurate details about the registered agent and other significant changes.

- Certificate of Good Standing - This document proves that the LLC is compliant with state laws and regulations. It may be needed in various business dealings.

- Resignation of Registered Agent - If the existing registered agent is stepping down, this document formally notifies the state of their resignation.

- Change of Address Form - If the registered office or agent’s address is changing, this form officially updates that information with the Secretary of State.

- Power of Attorney - In some cases, an LLC may need to grant someone the authority to act on its behalf during the change process. This document provides that authorization.

- Written Consent of Members - This may be needed to show approval of the change, especially if the LLC has multiple members or managers involved in decision-making.

Having these documents in order will help ensure a smooth transition when making changes to your LLC's registered agent or office in Illinois. Being prepared and knowledgeable about what is required can save time and potential complications down the road.

Similar forms

The Illinois Statement of Change form is a critical document for managing changes regarding a company's registered agent and registered office. Several other documents serve similar purposes but in different contexts. Below is a list of eight documents that share similarities with the Illinois Statement of Change form, demonstrating various aspects of organizational compliance and registration updates:

- Articles of Amendment: This document is used to officially change information in the original incorporation or organization documents, such as the name or purpose of the entity, similar to how the Statement of Change updates registered agent and office information.

- Change of Address Form: Organizations use this form to notify relevant authorities about a change in business location, akin to the process of updating the registered office address on the Illinois Statement of Change.

- Registered Agent Change Notice: This specific notice is filed to officially designate a new registered agent, paralleling the functionality of the Illinois form in terms of agent updates.

- Annual Report: Many states require corporations and LLCs to submit annual reports that often include current registered agent information, reflecting the need for accurate data similar to the Statement of Change.

- Certificate of Good Standing: This certificate verifies that a company is compliant with state requirements, including maintaining an up-to-date registered agent, much like the compliance enforced by the Statement of Change.

- Application for Authority: When foreign entities wish to do business in a state, they file this application, which includes appointing a registered agent. This mirrors the Illinois form's focus on the registered agent's role.

- Notice of Intent to Dissolve: This document informs the state of a company's decision to dissolve, which may involve updating registered agent details, drawing a parallel with the Statement of Change's necessity in maintaining official records.

- Merger Documents: When companies merge, they often need to change their registered agent and office information, similar to the updates made through the Illinois Statement of Change form.

Each of these documents plays a significant role in ensuring that corporate compliance is maintained and that accurate information is readily available to regulatory bodies and stakeholders.

Dos and Don'ts

When filling out the Illinois Statement of Change form, it is essential to follow specific guidelines to avoid delays or rejections. Here’s a concise list of do's and don'ts:

- Do: Type or print clearly to ensure legibility.

- Do: Provide complete and accurate information to prevent errors.

- Do: Include the proper filing fee of $25, payable to the Secretary of State.

- Do: Confirm that the registered agent resides in Illinois.

- Do: Sign and date the form appropriately to validate the submission.

- Do: Use the complete address, including street numbers and zip codes.

- Don’t: Use a P.O. Box alone for the registered office address; it is unacceptable.

- Don’t: Leave any sections blank; incomplete forms can lead to processing issues.

- Don’t: Forget to check the authority under which the change is authorized.

- Don’t: Try to act as your own registered agent if you are an LLC; this is not allowed.

- Don’t: Submit the form without ensuring it complies with all formatting requirements.

- Don’t: Ignore the penalties for failing to maintain a registered agent.

Misconceptions

- Misconception 1: The Statement of Change can be submitted without a registered agent.

- Misconception 2: Changing the registered agent is a complicated process.

- Misconception 3: An LLC can serve as its own registered agent.

- Misconception 4: A P.O. Box can be used as a registered office address.

- Misconception 5: The form must be notarized to be valid.

- Misconception 6: There is no penalty for late filing of the Statement of Change.

- Misconception 7: The filing fee is optional.

- Misconception 8: Any address can be used as the registered office without restrictions.

- Misconception 9: The Statement of Change is only for changing the registered agent.

- Misconception 10: Submitting the form guarantees that the changes will be approved.

This form is specifically designed to update information related to the registered agent or office. A registered agent is necessary for any LLC in Illinois, so submitting the form without one is not permissible.

In reality, the process is straightforward. The form requires basic information and can be completed easily if all necessary details are provided accurately.

This is incorrect. According to Illinois law, the LLC cannot act as its own registered agent. A separate individual or business entity must be designated for this role.

While it’s tempting to use a P.O. Box, Illinois regulations specify that a physical street address is required. A P.O. Box can be added to the physical address but cannot stand alone.

This is not true. The form only requires a signature affirming the information provided is correct; notarization is not necessary.

Filing late can incur a $100 penalty, particularly if the LLC fails to appoint a new registered agent within 60 days of notification from the Secretary of State.

The $25 filing fee is mandatory when submitting the Statement of Change. Failure to pay this fee will result in the filing being rejected.

Addresses must meet specific guidelines, including being a physical location in Illinois. The registered office address is also limited to 30 characters, including spaces.

This form can be used to update either the registered agent or the registered office address, or both. It’s versatile in that regard.

While submitting the form is necessary, it must still be reviewed and accepted by the Secretary of State. Any errors or omissions could result in the form being rejected.

Key takeaways

The Illinois Statement of Change form is crucial for managing your Limited Liability Company (LLC) information. Filling it out correctly ensures your business remains in good standing.

- Understand the Purpose: This form is used to update your registered agent or registered office address.

- Filing Fee: A fee of $25 is required. Payments can be made by check payable to the Secretary of State.

- Keep Records Accurate: The information provided must be true, correct, and complete, as stated in the affirmation.

- Penalties for Non-Compliance: Failing to appoint a registered agent within 60 days can result in a $100 penalty.

- Registered Agent Requirements: The registered agent must reside in Illinois or be a registered business entity.

- P.O. Box Restrictions: The registered office must include a physical address; a P.O. Box alone is not acceptable.

- Signature Requirement: The form must be signed by someone with authority, affirming the statement is accurate.

- Use of Spaces: The registered office address is limited to 30 characters, including spaces. Formatting matters.

- Authorization: The change must be authorized either by the members/managers or the registered agent.

- Stay Updated: Regularly review and update your registered agent and office information to avoid penalties.

Browse Other Templates

5914 - Units are encouraged to maintain a digital and physical record of this form.

Seperation Notice - All sections of the notice must be filled out completely for it to be valid.

Enlisted Performance Assessment,Airman Evaluation Form,Service Member Performance Report,Military Performance Review,Air Force Duty Evaluation,Enlisted Duty Performance Summary,AF Enlisted Performance Record,Service Member Review Document,Airman Effe - Future roles for the ratee can be recommended to support individual development.