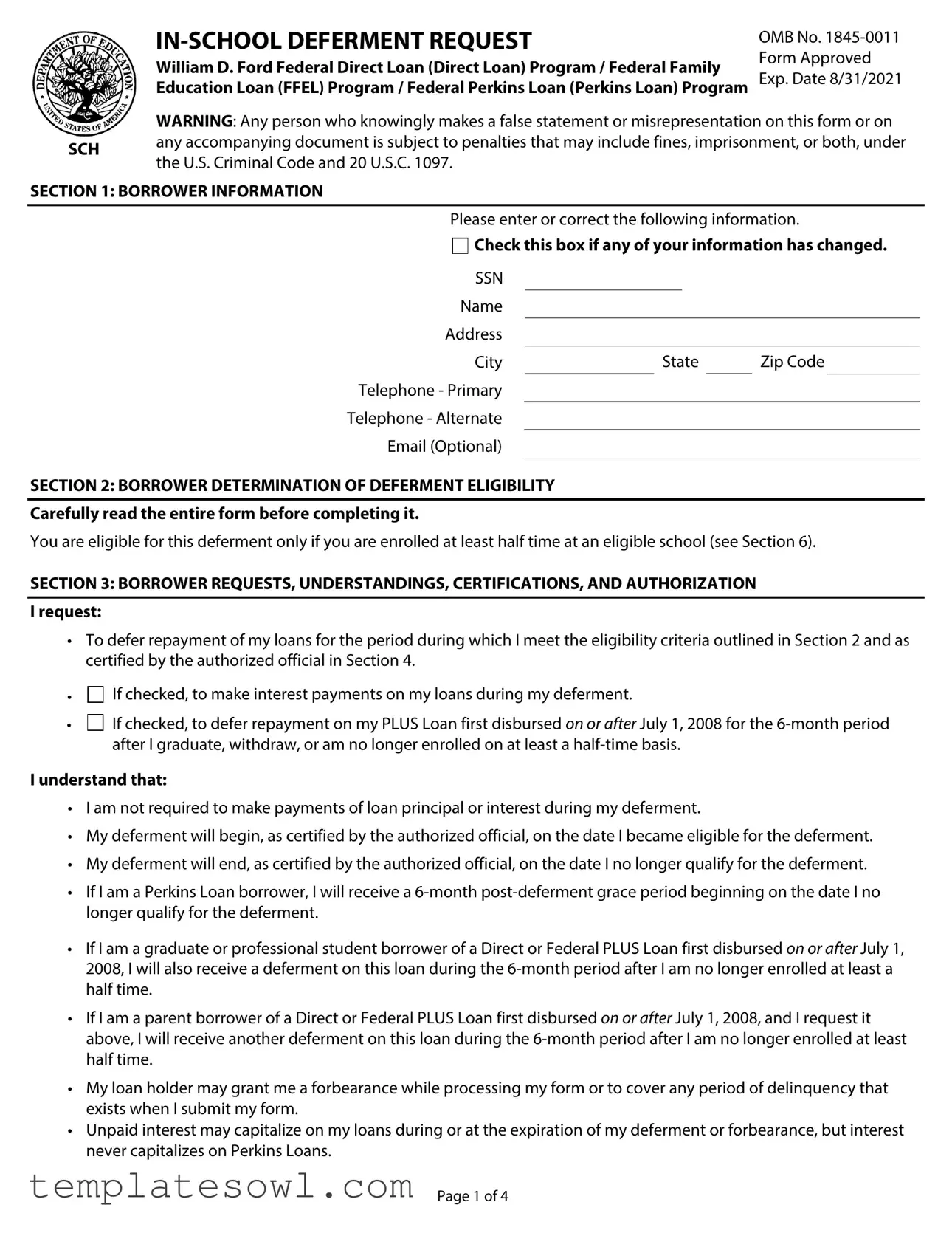

Fill Out Your In School Deferment Request Form

Navigating student loans can be overwhelming, but understanding the In-School Deferment Request form is crucial for borrowers who are currently enrolled in school. This form allows eligible students to temporarily pause their loan payments, which can provide some much-needed financial relief during their studies. To qualify for deferment, students must be enrolled at least half-time at an approved educational institution. The form consists of several sections that require borrowers to provide personal information, confirm their enrollment status, and acknowledge their rights and responsibilities during the deferment period. Additionally, the form outlines important aspects, such as the option to continue making interest payments and the details surrounding grace periods for various loan types. Importantly, the borrower must ensure that all information is accurate and notify their loan holder if their eligibility status changes. Understanding every part of this form is vital; it not only assists in maintaining good financial health but also ensures compliance with federal regulations regarding student loans.

In School Deferment Request Example

OMB No. |

||

William D. Ford Federal Direct Loan (Direct Loan) Program / Federal Family |

Form Approved |

|

Exp. Date 8/31/2021 |

||

Education Loan (FFEL) Program / Federal Perkins Loan (Perkins Loan) Program |

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on

SCH any accompanying document is subject to penalties that may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

SECTION 1: BORROWER INFORMATION

Please enter or correct the following information.

Check this box if any of your information has changed.

Check this box if any of your information has changed.

SSN |

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

City |

|

|

State |

|

Zip Code |

|

|

Telephone - Primary |

|

|

|

|

|

|

|

Telephone - Alternate |

|

|

|

|

|

|

|

Email (Optional) |

|

|

|

|

|

|

|

SECTION 2: BORROWER DETERMINATION OF DEFERMENT ELIGIBILITY

Carefully read the entire form before completing it.

You are eligible for this deferment only if you are enrolled at least half time at an eligible school (see Section 6).

SECTION 3: BORROWER REQUESTS, UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION

Irequest:

•To defer repayment of my loans for the period during which I meet the eligibility criteria outlined in Section 2 and as certified by the authorized official in Section 4.

•

•

If checked, to make interest payments on my loans during my deferment.

If checked, to defer repayment on my PLUS Loan first disbursed on or after July 1, 2008 for the

I understand that:

•I am not required to make payments of loan principal or interest during my deferment.

•My deferment will begin, as certified by the authorized official, on the date I became eligible for the deferment.

•My deferment will end, as certified by the authorized official, on the date I no longer qualify for the deferment.

•If I am a Perkins Loan borrower, I will receive a

•If I am a graduate or professional student borrower of a Direct or Federal PLUS Loan first disbursed on or after July 1, 2008, I will also receive a deferment on this loan during the

•If I am a parent borrower of a Direct or Federal PLUS Loan first disbursed on or after July 1, 2008, and I request it above, I will receive another deferment on this loan during the

•My loan holder may grant me a forbearance while processing my form or to cover any period of delinquency that exists when I submit my form.

•Unpaid interest may capitalize on my loans during or at the expiration of my deferment or forbearance, but interest never capitalizes on Perkins Loans.

Page 1 of 4

Borrower NameBorrower SSN

SECTION 3: BORROWER REQUESTS, UNDERSTANDINGS, CERTIFICATIONS, AND AUTHORIZATION (CONTINUED)

I certify that:

•The information I have provided on this form is true and correct.

•I will provide additional documentation to my loan holder, as required, to support my deferment eligibility.

•I will notify my loan holder immediately when my eligibility for the deferment ends.

•I have read, understand, and meet the eligibility requirements in Section 2.

I authorize the entity to which I submit this request and its agents to contact me regarding my request or my loans at any cellular telephone number that I provide now or in the future using automated telephone dialing equipment or artificial or prerecorded voice or text messages.

Borrower's Signature |

|

Date |

SECTION 4: AUTHORIZED OFFICIAL'S CERTIFICATION |

|

|

Note: As an alternative to completing this section, you may attach separate documentation from an authorized official that includes all of the information requested below or have your school report your enrollment to the National Student Loan Data System (NSLDS) at nsldsfap.ed.gov.

•The student is/was enrolled at the school below:

Full time

Full time

At least half time, but less than full time

At least half time, but less than full time

•Is the student enrolled at the school below as a regular student?

Yes

Yes

No

No

•The student's enrollment status begins/began on:

•The student's enrollment status ends/ended on:

•The student is expected to complete his/her program requirements on:

I certify, to the best of my knowledge and belief, that the information that I have provided in this section is accurate.

Name of School |

|

|

|

|

OPEID |

|

|

|

|||||

Address |

|

City |

|

|

State |

|

|

Zip Code |

|

||||

Official's Name/Title |

|

|

|

Telephone |

|

|

|

|

|||||

Official's Signature |

|

|

|

|

Date |

|

|

|

|

||||

SECTION 5: INSTRUCTIONS FOR COMPLETING THE DEFERMENT REQUEST

Type or print using dark ink. Enter dates as

Page 2 of 4

SECTION 6: DEFINITIONS

|

The William D. Ford Federal Direct Loan (Direct Loan) |

A deferment is a period during which you are entitled to |

||||||||

Program includes Federal Direct Stafford/Ford (Direct |

postpone repayment of your loans. Interest is not generally |

|||||||||

Subsidized) Loans, Federal Direct Unsubsidized Stafford/ |

charged to you during a deferment on your subsidized loans. |

|||||||||

Ford (Direct Unsubsidized) Loans, Federal Direct PLUS |

Interest is always charged to you during a deferment on your |

|||||||||

(Direct PLUS) Loans, and Federal Direct Consolidation |

unsubsidized loans. On loans made under the Perkins Loan |

|||||||||

(Direct Consolidation) Loans. |

|

|

Program, all deferments are followed by a |

|||||||

|

The Federal Family Education Loan (FFEL) Program |

grace period of 6 months, during which time you are not |

||||||||

|

required to make payments. |

|

|

|

||||||

includes Federal Stafford Loans, Federal PLUS Loans, Federal |

|

|

|

|||||||

An eligible school is a school that has been approved by |

||||||||||

Consolidation Loans, and Federal Supplemental Loans for |

||||||||||

Students (SLS). |

|

|

the Department to participate in the Department's Federal |

|||||||

|

The Federal Perkins Loan (Perkins Loan) Program |

Student Aid programs, even if the school does not participate |

||||||||

includes Federal Perkins Loans, National Direct Student |

in those programs. |

|

|

|

|

|||||

Loans (NDSL), and National Defense Student Loans (Defense |

A forbearance is a period during which you are permitted |

|||||||||

Loans). |

|

|

||||||||

|

|

to postpone making payments temporarily, allowed an |

||||||||

|

An authorized official who may complete Section 4 is |

|||||||||

|

extension of time for making payments, or temporarily |

|||||||||

an official of the school where you are/were enrolled. |

allowed to make smaller payments than scheduled. |

|||||||||

|

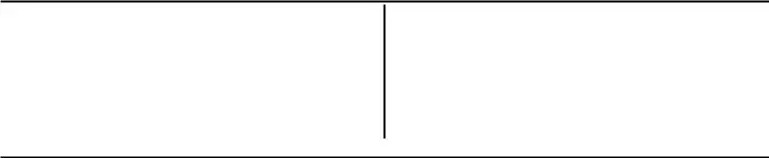

Capitalization is the addition of unpaid interest to the |

The holder of your Direct Loans is the Department. The |

||||||||

principal balance of your loan. Capitalization causes more |

holder of your FFEL Program loans may be a lender, guaranty |

|||||||||

interest to accrue over the life of your loan and may cause |

agency, secondary market, or the Department. The holder of |

|||||||||

your monthly payment amount to increase. Interest never |

your Perkins Loans is an institution of higher education or the |

|||||||||

capitalizes on Perkins Loans. Table 1 (below) provides an |

Department. Your loan holder may use a servicer to handle |

|||||||||

example of the monthly payments and the total amount |

billing and other communications related to your loans. |

|||||||||

repaid for a $30,000 unsubsidized loan. The example loan |

References to “your loan holder” on this form mean either |

|||||||||

has a 6% interest rate and the example deferment or |

your loan holder or your servicer. |

|

|

|||||||

forbearance lasts for 12 months and begins when the loan |

A regular student is a person who is enrolled or accepted |

|||||||||

entered repayment. The example compares the effects of |

||||||||||

for enrollment at an institution for the purpose of obtaining a |

||||||||||

paying the interest as it accrues or allowing it to capitalize. |

||||||||||

degree, certificate, or other recognized educational credential |

||||||||||

|

A |

|||||||||

|

offered by the institution. |

|

|

|

||||||

borrowers on a Direct or Federal Consolidation Loan or a |

A subsidized loan is a Direct Subsidized Loan, a Direct |

|||||||||

Federal PLUS Loan. Both borrowers are equally responsible |

||||||||||

Subsidized Consolidation Loan, a Federal Subsidized Stafford |

||||||||||

for repaying the full amount of the loan. |

|

|||||||||

|

Loan, portions of some Federal Consolidation Loans, a Federal |

|||||||||

|

|

|

|

|||||||

|

|

|

|

Perkins Loan, an NDSL, and a Defense Loan. |

|

|

||||

|

|

|

|

An unsubsidized loan is a Direct Unsubsidized Loan, a |

||||||

|

|

|

|

Direct Unsubsidized Consolidation Loan, a Direct PLUS Loan, a |

||||||

|

|

|

|

Federal Unsubsidized Stafford Loan, a Federal PLUS Loan, a |

||||||

|

|

|

|

Federal SLS, and portions of some Federal Consolidation |

||||||

|

|

|

|

Loans. |

|

|

|

|

||

Table 1. Capitalization Chart |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Treatment of Interest with |

Loan |

Capitalized |

Outstanding |

|

Monthly |

Number of |

Total |

||

|

Deferment/Forbearance |

Amount |

Interest |

Principal |

|

Payment |

Payments |

Repaid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest is paid |

$30,000 |

$0 |

$30,000 |

|

$333 |

120 |

$41,767 |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized at the |

$30,000 |

$1,800 |

$31,800 |

|

$353 |

120 |

$42,365 |

|

|

|

end |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Interest is capitalized |

$30,000 |

$1,841 |

$31,841 |

|

$354 |

120 |

$42,420 |

|

|

|

quarterly and at the end |

|

|

|||||||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 4

SECTION 7: WHERE TO SEND THE COMPLETED DEFERMENT REQUEST

Return the completed form and any documentation to: |

If you need help completing this form, call: |

(If no address is shown, return to your loan holder.) |

(If no phone number is shown, call your loan holder.) |

SECTION 8: IMPORTANT NOTICES

Privacy Act Notice. The Privacy Act of 1974 (5 U.S.C. |

|

To assist program administrators with tracking refunds |

|

552a) requires that the following notice be provided to you: |

and cancellations, disclosures may be made to guaranty |

||

The authorities for collecting the requested information |

agencies, to financial and educational institutions, or to |

||

federal or state agencies. To provide a standardized method |

|||

from and about you are §421 et seq., §451 et seq., or §461 |

|||

for educational institutions to efficiently submit student |

|||

et. seq. of the Higher Education Act of 1965, as amended (20 |

|||

enrollment statuses, disclosures may be made to guaranty |

|||

U.S.C. 1071 et seq., 20 U.S.C. 1087a et seq., or 20 U.S.C. |

|

||

|

agencies or to financial and educational institutions. To |

||

1087aa et seq.) and the authorities for collecting and using |

|||

counsel you in repayment efforts, disclosures may be made |

|||

your Social Security Number (SSN) are §§428B(f) and 484(a) |

|||

to guaranty agencies, to financial and educational |

|||

(4) of the HEA (20 U.S.C. |

|

||

|

institutions, or to federal, state, or local agencies. |

||

U.S.C. 7701(b). Participating in the William D. Ford Federal |

|||

|

|||

Direct Loan (Direct Loan) Program, Federal Family Education |

In the event of litigation, we may send records to the |

||

Loan (FFEL) Program, or Federal Perkins Loan (Perkins Loan) |

Department of Justice, a court, adjudicative body, counsel, |

||

Program and giving us your SSN are voluntary, but you must |

party, or witness if the disclosure is relevant and necessary |

||

provide the requested information, including your SSN, to |

to the litigation. If this information, either alone or with |

||

participate. |

|

other information, indicates a potential violation of law, we |

|

The principal purposes for collecting the information on |

may send it to the appropriate authority for action. We may |

||

send information to members of Congress if you ask them |

|||

this form, including your SSN, are to verify your identity, to |

|||

to help you with federal student aid questions. In |

|||

determine your eligibility to receive a loan or a benefit on a |

|||

circumstances involving employment complaints, |

|||

loan (such as a deferment, forbearance, discharge, or |

|

||

|

grievances, or disciplinary actions, we may disclose relevant |

||

forgiveness) under the Direct Loan, FFEL, or Federal Perkins |

|||

records to adjudicate or investigate the issues. If provided |

|||

Loan Programs, to permit the servicing of your loans, and, if |

|||

for by a collective bargaining agreement, we may disclose |

|||

it becomes necessary, to locate you and to collect and |

|

||

|

records to a labor organization recognized under 5 U.S.C. |

||

report on your loans if your loans become delinquent or |

|

||

|

Chapter 71. Disclosures may be made to our contractors for |

||

default. We also use your SSN as an account identifier and to |

|||

the purpose of performing any programmatic function that |

|||

permit you to access your account information |

|

||

|

requires disclosure of records. Before making any such |

||

electronically. |

|

||

|

disclosure, we will require the contractor to maintain Privacy |

||

The information in your file may be disclosed, on a case- |

|||

Act safeguards. Disclosures may also be made to qualified |

|||

|

|||

|

researchers under Privacy Act safeguards. |

||

third parties as authorized under routine uses in the |

|

||

|

Paperwork Reduction Notice. According to the |

||

appropriate systems of records notices. The routine uses of |

|||

Paperwork Reduction Act of 1995, no persons are required |

|||

this information include, but are not limited to, its disclosure |

|||

to respond to a collection of information unless such |

|||

to federal, state, or local agencies, to private parties such as |

|||

collection displays a valid OMB control number. The valid |

|||

relatives, present and former employers, business and |

|

||

|

OMB control number for this information collection is |

||

personal associates, to consumer reporting agencies, to |

|

||

|

|||

financial and educational institutions, and to guaranty |

|

||

|

information is estimated to average 10 minutes per |

||

agencies in order to verify your identity, to determine your |

|||

response, including time for reviewing instructions, |

|||

eligibility to receive a loan or a benefit on a loan, to permit |

|||

searching existing data sources, gathering and maintaining |

|||

the servicing or collection of your loans, to enforce the |

|

||

|

the data needed, and completing and reviewing the |

||

terms of the loans, to investigate possible fraud and to verify |

|||

collection of information. The obligation to respond to this |

|||

compliance with federal student financial aid program |

|

||

|

collection is required to obtain a benefit in accordance with |

||

regulations, or to locate you if you become delinquent in |

|

||

|

34 CFR 674.34, 674.35, 674.36, 674.37, 682.210, or 685.204. |

||

your loan payments or if you default. To provide default rate |

|||

If you have comments or concerns regarding the |

|||

calculations, disclosures may be made to guaranty agencies, |

|||

status of your individual submission of this form, please |

|||

to financial and educational institutions, or to state |

|

||

|

contact your loan holder directly (see Section 7). |

||

agencies. To provide financial aid history information, |

|

||

|

|

||

disclosures may be made to educational institutions. |

Page 4 of 4 |

||

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | The In-School Deferment Request form is used to request a temporary pause in loan repayment while a borrower is enrolled at least half-time in an eligible educational institution. |

| Eligibility Criteria | To qualify for deferment, borrowers must be enrolled at least half-time at an eligible school. This information is outlined in Section 2 of the form. |

| Certification Requirement | Borrowers must certify that the information provided on the form is accurate and complete, and that they will provide any further documentation as needed. |

| Authorized Official Certification | An authorized official from the borrower’s school must complete certification regarding the borrower's enrollment status. This is detailed in Section 4. |

| Interest Accrual | While in deferment, interest will not accrue on Direct Subsidized Loans. However, it will accrue on unsubsidized loans, potentially capitalizing at the end of the deferment period. |

| Grace Period | Borrowers of Perkins Loans are entitled to a six-month grace period following the end of deferment. |

| Submission Requirements | Borrowers must submit the completed form to their loan holder, along with any required documentation as indicated in Section 7. |

| Privacy Act Compliance | The form includes notices regarding the collection and use of personal information, aligned with the Privacy Act of 1974. |

| Federal Regulations | The deferment process is regulated under various federal laws including the Higher Education Act. Specific sections applicable include 20 U.S.C. 1071 and 20 U.S.C. 1097. |

| Potential Penalties | False statements or misrepresentations on the form can lead to serious penalties, including fines and imprisonment, as stated in the warning on the form. |

Guidelines on Utilizing In School Deferment Request

Completing the In School Deferment Request form is an important step in managing your education loans while you are enrolled in school. After you finish filling out the form, you will need to submit it along with any required documentation to your loan holder for processing.

- Gather your personal information. You'll need your Social Security Number (SSN), full name, address, and contact information.

- Indicate any changes. Check the box if any of your information has changed since the last time you provided it.

- Verify eligibility. Make sure you meet the eligibility requirements outlined in Section 2, specifically that you are enrolled at least half-time.

- Complete the borrower requests section. Read and check the boxes for deferment requests and any additional options regarding interest payments.

- Sign and date the form. Your signature certifies that the information you provided is accurate and that you understand your responsibilities.

- Have an authorized official complete Section 4. This section must be filled out by someone from your school, confirming your enrollment status.

- Review instructions in Section 5. Ensure that you are completing the form correctly, particularly regarding date formats.

- Submit the form. Return the completed form and any required documentation to the address listed in Section 7.

What You Should Know About This Form

What is the purpose of the In School Deferment Request form?

The In School Deferment Request form is designed for borrowers to formally request a temporary suspension of loan repayment while they are enrolled at least half-time in an eligible educational institution. This deferment helps students manage their financial obligations as they pursue their education. By postponing loan payments, borrowers have the ability to focus on their studies without the pressure of immediate debt repayment.

How do I determine if I qualify for an in-school deferment?

To qualify for an in-school deferment, you must be enrolled at least half-time in a program at an eligible school. Ongoing enrollment status verification is typically required, which involves your educational institution certifying your enrollment status on the form. It is vital to read the eligibility criteria carefully and ensure that you meet all requirements outlined in the form before submitting your request.

What happens after I submit the deferment request?

Once you have submitted the completed In School Deferment Request form, your loan holder will review it. They will verify your enrollment status with the information provided by your educational institution. The deferment will be granted if you meet the eligibility criteria. You should expect to receive notification from your loan holder about the status of your request, which may take some time to process. If you have any pending payments during this period, you may want to check with your loan holder for guidance on managing those payments.

Will interest accrue during the deferment period?

During a deferment, interest generally does not accrue on subsidized loans; however, it is charged on unsubsidized loans. This distinction is important for borrowers to understand as it can significantly impact the total amount to be repaid after the deferment period ends. If you are eligible and choose to make interest payments on your loans during this time, it may help reduce the overall cost when repayment resumes.

What should I do if my situation changes and I am no longer eligible for the deferment?

If your enrollment status changes and you no longer meet the deferment eligibility criteria, you must inform your loan holder immediately. It is essential to keep them updated to avoid misunderstandings or potential default on your loans. Having a plan in place for managing repayments once the deferment ends can help ease the transition back into repayment.

Common mistakes

Filling out the In School Deferment Request form can be a straightforward task, but many people make common mistakes that can delay their requests. One frequent error is not updating personal information. Borrowers often forget to check the box indicating their information has changed. This can lead to miscommunication or denial of the deferment.

Another common mistake is not providing adequate documentation. Many applicants fail to include necessary supporting documents with their requests. This oversight can result in processing delays. Always check that you've submitted all required paperwork to support your eligibility.

Some individuals overlook the importance of correctly completing Section 1. Inaccuracies in entering name, Social Security number, or address can cause your request to be rejected. Take a moment to review every detail before submitting the form.

In Section 2, individuals often misinterpret their enrollment status. It’s critical to understand that eligibility for deferment requires at least half-time enrollment. Neglecting to confirm this status can lead to an unexpected denial.

Certification failures are another area where mistakes frequently happen. Borrowers must understand that they are responsible for reporting any changes in their eligibility. Some forget to include their signature and date in Section 3, leaving the form incomplete. This step may seem minor but is crucial.

Additionally, borrowers often mistakenly believe they are eligible without proper certification from their academic institution. It’s essential for schools to verify enrollment in Section 4. If the school hasn’t certified your status, the request may be denied.

A lot of individuals also miss out on reviewing the instructions in Section 5. The guidelines for completing the form are there for a reason. Ignoring them can lead to format errors, such as incorrect date entries. Following instructions carefully can help avoid unnecessary complications.

Lastly, address confusion is another prevalent issue. People should double-check the address listed in Section 7 for sending completed requests. Sending it to the wrong location can cause significant delays. Make sure you return the request to the right loan holder.

Documents used along the form

The In School Deferment Request form is a key document utilized by students seeking to postpone loan repayments while enrolled in an eligible educational program. To support this request, several other forms and documents may need to be prepared and submitted. Here is a list of these associated documents along with a brief description of each.

- Certification of Enrollment: This document, often filled out by an authorized official from the school, verifies the student’s enrollment status. It confirms whether the student is enrolled full-time or at least half-time and indicates the relevant dates of enrollment.

- Loan Holder Documentation: In some cases, students may be required to submit a statement from their loan holders. This document provides details about the loans held, including information on the type of loans and current payment status.

- Post-Deferment Payment Plan: After the deferment period ends, this plan outlines how the borrower will repay the loan balance. It may include repayment options and schedules tailored to the borrower's financial situation.

- Financial Aid Transcript: This transcript summarizes all financial aid received by the student. It may be necessary to demonstrate ongoing eligibility for deferments and other financial assistance beyond the initial loan.

Collectively, these documents help streamline the deferment process, ensuring that all necessary information is available for review by the loan servicer. This thoroughness facilitates compliance with financial aid regulations and contributes to efficient loan management for the borrower.

Similar forms

Loan Forgiveness Application: This document allows borrowers to apply for forgiveness of their student loans under specific programs. Like the In School Deferment Request form, it requires verifying education status and may need documentation from the educational institution to confirm eligibility.

Forbearance Request Form: Similar to the In School Deferment Request, this form allows borrowers to temporarily reduce or postpone loan payments. Both forms require borrowers to provide financial information and the reason for the request.

Student Loan Consolidation Application: This form enables borrowers to consolidate multiple federal education loans into one. Just like the deferment request, it involves assessment of enrollment status and potential interest changes based on the borrower’s education status.

Income-Driven Repayment Plan Request: This document helps borrowers apply for a repayment plan that considers their income. Both it and the In School Deferment Request require income information and can involve formal verification of education status.

Dos and Don'ts

When filling out the In School Deferment Request form, it's essential to pay attention to detail. Here are some important dos and don'ts to consider:

- Do read the entire form carefully before starting. Understanding all sections is crucial.

- Do ensure that your personal information, such as your name and Social Security Number, is accurate.

- Do provide any required documentation to support your eligibility for deferment.

- Do check the correct box if your information, like enrollment status, has changed.

- Do sign and date the form. An unsigned form may be rejected.

- Don't leave any sections blank unless instructed otherwise. Incomplete forms can lead to delays.

- Don't assume eligibility without verifying your enrollment status meets the criteria.

- Don't forget to submit a separate request for each loan holder if you have multiple loans.

- Don't use light ink or an unclear handwriting style. Clarity is important for processing.

Misconceptions

Many individuals misunderstand the process and implications of the In School Deferment Request form. Addressing these misconceptions is crucial for borrowers aiming to manage their student loans effectively. Below are six common misconceptions:

- Deferment means I won’t owe anything. Some people believe that once their deferment is approved, they will not owe any amount on their loans. While loan payments may be paused, it’s important to note that interest can still accrue during deferment, especially on unsubsidized loans.

- All schools qualify for deferment. Not every school meets the eligibility criteria outlined in the form. Borrowers must attend an eligible school, which has been approved by the Department of Education, to qualify for deferment.

- Deferment applies automatically upon enrollment. Enrollment in school does not guarantee automatic deferment of loan payments. Borrowers must actively submit the In School Deferment Request form and ensure it is processed by the loan holder.

- All types of loans are treated the same. There are distinct differences between types of loans, such as Direct Loans and Perkins Loans. Each has its specific rules regarding deferment eligibility, including how interest accrues during deferment.

- I don’t need to communicate with my loan holder during deferment. This is a misconception. Borrowers are responsible for notifying their loan holder about any changes in enrollment status and should maintain communication to ensure their deferment remains valid.

- Submitting the form is the end of the process. Completing and submitting the In School Deferment Request form is only the first step. Borrowers must also provide any additional documentation the loan holder may require, and monitor the approval status of their request.

Understanding these misconceptions can help borrowers navigate the deferment process more effectively, ensuring they make informed decisions regarding their student loans.

Key takeaways

Filling out the In School Deferment Request form can be an essential step in managing student loans while pursuing education. Here are key takeaways to consider:

- Eligibility Confirmation: You must be enrolled at least half-time at an eligible school to qualify for deferment.

- Information Accuracy: Ensure that all personal information provided in Section 1 is correct and up to date.

- Interest Payments: You have the option to continue making interest payments during deferment if desired.

- Grace Periods: Benefits may include a 6-month grace period after your deferment ends, especially for Perkins Loans.

- Documentation Requirements: Additional documentation may be necessary to verify your eligibility; always check with your loan holder.

- Signature Importance: Don’t forget to sign and date the form to ensure its validity when submitting.

- Multiple Loan Holders: If you have loans with different lenders, submit a separate deferment request to each one.

- Prompt Submission: Complete and return the form promptly to avoid any potential payment issues while awaiting processing.

Being informed about these details helps you take the right actions regarding your loans and ensures you’re prepared during the deferment process.

Browse Other Templates

Bojangles Online Application - State when you can begin working.

Michigan Underpayment Penalty - Filers are advised to maintain copies of their submissions for their records.

Modor Forms - The form requires the applicant's signature and printed name for validation.