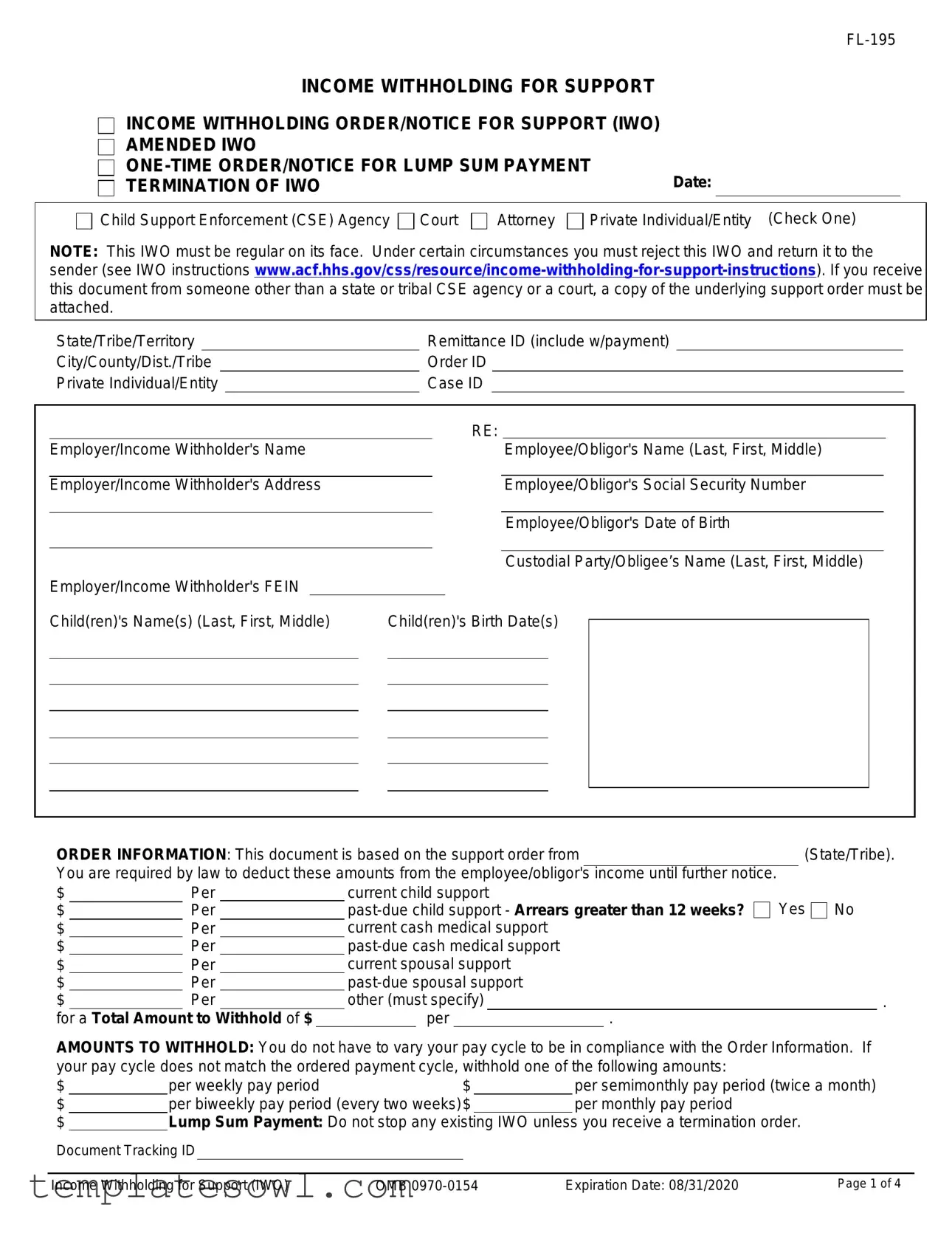

Fill Out Your Income Withholding Form

The Income Withholding form is a critical document that streamlines the process of collecting child and spousal support payments directly from an employee's paycheck. It serves as a legal notice to employers, instructing them to withhold specific amounts from an employee’s income in order to fulfill support obligations. The form includes significant details such as the employee’s name, Social Security number, and the amounts to be withheld for current and past-due support, which can include multiple categories like child support and medical support. It is essential for employers to understand their obligations outlined in the form, including when to start withholding payments and how to remit those payments to the appropriate authorities. Additionally, the form specifies what to do in cases of inconsistent information and the priority that Support Withholding has over other legal processes. Compliance is not just a responsibility; it also protects employers from potential liability for failing to withhold correctly. Understanding each section of the form can help employers navigate this process efficiently and ensure that all required information is sent to the relevant Child Support Enforcement agency or tribal authority. This form is vital in ensuring that children and families receive the support they need while also clarifying the employer's role in the process.

Income Withholding Example

INCOME WITHHOLDING FOR SUPPORT

INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT (IWO)

AMENDED IWO |

|

Date: |

|

TERMINATION OF IWO |

Child Support Enforcement (CSE) Agency

Child Support Enforcement (CSE) Agency  Court

Court

|

Attorney |

|

Private Individual/Entity (Check One) |

|

|

NOTE: This IWO must be regular on its face. Under certain circumstances you must reject this IWO and return it to the sender (see IWO instructions

State/Tribe/Territory |

|

Remittance ID (include w/payment) |

|

|||

City/County/Dist./Tribe |

|

Order ID |

|

|||

Private Individual/Entity |

|

Case ID |

|

|||

|

|

|

|

|

|

RE: |

|

||||||||

|

Employer/Income Withholder's Name |

|

|

|

|

|

|

Employee/Obligor's Name (Last, First, Middle) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer/Income Withholder's Address |

|

|

|

|

|

|

Employee/Obligor's Social Security Number |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee/Obligor's Date of Birth |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Custodial Party/Obligee’s Name (Last, First, Middle) |

|

|

||||

|

Employer/Income Withholder's FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Child(ren)'s Name(s) (Last, First, Middle) |

|

Child(ren)'s Birth Date(s) |

|

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ORDER INFORMATION: This document is based on the support order from |

|

|

|

(State/Tribe). |

|||||||||||

You are required by law to deduct these amounts from the employee/obligor's |

income until further notice. |

|

|

|

|

||||||||||

$ |

|

Per |

current child support |

|

|

Yes |

No |

||||||||

$ |

|

Per |

|

|

|

||||||||||

$ |

|

Per |

|

|

|

current cash medical support |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||||

$ |

|

Per |

|

|

|

|

|

|

|

|

|

||||

$ |

|

Per |

|

|

|

current spousal support |

|

|

|

|

|

|

|||

$ |

|

Per |

|

|

|

|

|

|

|

|

|

||||

$ |

|

Per |

|

|

|

other (must specify) |

|

|

|

|

. |

||||

for a Total Amount |

to Withhold of $ |

|

|

per |

|

|

|

. |

|

|

|

|

|||

AMOUNTS TO WITHHOLD: You do not have to vary your pay cycle to be in compliance with the Order Information. If your pay cycle does not match the ordered payment cycle, withhold one of the following amounts:

$ |

|

per weekly pay period |

$ |

|

|

per semimonthly pay period (twice a month) |

|||

$ |

|

per biweekly pay period (every two weeks)$ |

|

|

per monthly pay period |

|

|||

$ |

|

Lump Sum Payment: Do not stop any existing IWO unless |

you receive a termination order. |

|

|||||

Document Tracking ID |

|

|

|

|

|

|

|

||

|

|

|

|

||||||

Income Withholding for Support (IWO) |

OMB |

Expiration Date: 08/31/2020 |

Page 1 of 4 |

||||||

Employer's Name: |

|

|

|

|

|

Employer FEIN: |

|

|

|

|

|

|

|

|||||

Employee/Obligor's Name: |

|

|

|

|

|

|

|

|

SSN: |

|

||||||||

Case Identifier: |

|

|

|

|

|

Order Identifier: |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||||||

REMITTANCE INFORMATION: If the employee/obligor's principal place of employment is |

|

|

||||||||||||||||

(State/Tribe), you must begin withholding no later than the first pay period that occurs |

|

|

days after the date |

|||||||||||||||

of |

|

|

. Send payment within |

|

business days of the pay date. If you cannot withhold the full amount of |

|||||||||||||

support for any or all orders for this employee/obligor, withhold |

|

|

% of disposable income for all orders. If the obligor is |

|||||||||||||||

a |

Information. If the employee/obligor's principal place of |

|||||||||||||||||

employment is not |

|

|

(State/Tribe), obtain withholding limitations, time requirements, |

|||||||||||||||

and any allowable employer fees from the jurisdiction of the employee/obligor's principal place of employment. State- specfic withholding limit information is available at

For electronic payment requirements and centralized payment collection and disbursement facility information [State Disbursement Unit (SDU)], see

Include the Remittance ID with the payment and if necessary this locator code: |

. |

|||

|

|

|

|

|

Remit payment to |

California State Disbursement Unit |

(SDU/Tribal Order Payee) |

||

at |

P.O. Box 989067, West Sacramento, CA |

(SDU/Tribal Payee Address) |

||

|

|

|

|

|

Return to Sender (Completed by Employer/Income Withholder). Payment must be directed to an SDU in accordance with sections 466(b)(5) and (6) of the Social Security Act or Tribal Payee (see Payments to SDU below). If payment is not directed to an SDU/Tribal Payee or this IWO is not regular on its face, you must check this box and return the IWO to the sender.

Return to Sender (Completed by Employer/Income Withholder). Payment must be directed to an SDU in accordance with sections 466(b)(5) and (6) of the Social Security Act or Tribal Payee (see Payments to SDU below). If payment is not directed to an SDU/Tribal Payee or this IWO is not regular on its face, you must check this box and return the IWO to the sender.

If Required by State or Tribal Law:

Signature of Judge/Issuing Official:

Print Name of Judge/Issuing Official:

Title of Judge/Issuing Official:

Date of Signature:

If the employee/obligor works in a state or for a tribe that is different from the state or tribe that issued this order, a copy of this IWO must be provided to the employee/obligor.

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor.

If checked, the employer/income withholder must provide a copy of this form to the employee/obligor.

ADDITIONAL INFORMATION FOR EMPLOYERS/INCOME WITHHOLDERS

Employers/income withholders may use OCSE's Child Support Portal (https://ocsp.acf.hhs.gov/csp/) to provide information about employees who are eligible to receive a lump sum payment, have terminated employment, and to provide contacts, addresses, and other information about their company.

Priority: Withholding for support has priority over any other legal process under State law against the same income (section 466(b)(7) of the Social Security Act). If a federal tax levy is in effect, please notify the sender.

Combining Payments: When remitting payments to an SDU or tribal CSE agency, you may combine withheld amounts from more than one employee/obligor's income in a single payment. You must, however, separately identify each employee/obligor's portion of the payment.

Payments To SDU: You must send child support payments payable by income withholding to the appropriate SDU or to a tribal CSE agency. If this IWO instructs you to send a payment to an entity other than an SDU (e.g., payable to the custodial party, court, or attorney), you must check the box above and return this notice to the sender. Exception: If this IWO was sent by a court, attorney, or private individual/entity and the initial order was entered before January 1, 1994 or the order was issued by a tribal CSE agency, you must follow the “Remit payment to” instructions on this form.

Income Withholding for Support (IWO) |

Page 2 of 4 |

Employer's Name: |

|

|

|

Employer FEIN: |

|

|

|||

Employee/Obligor's Name: |

|

|

|

|

SSN: |

|

|

||

Case Identifier: |

|

|

Order Identifier: |

|

|

||||

Reporting the Pay Date: You must report the pay date when sending the payment. The pay date is the date on which the amount was withheld from the employee/obligor's wages. You must comply with the law of the state (or tribal law if applicable) of the employee/obligor's principal place of employment regarding time periods within which you must implement the withholding and forward the support payments.

Multiple IWOs: If there is more than one IWO against this employee/obligor and you are unable to fully honor all IWOs due to federal, state, or tribal withholding limits, you must honor all IWOs to the greatest extent possible, giving priority to current support before payment of any

Lump Sum Payments: You may be required to notify a state or tribal CSE agency of upcoming lump sum payments to this employee/obligor such as bonuses, commissions, or severance pay. Contact the sender to determine if you are required to report and/or withhold lump sum payments.

Liability: If you have any doubts about the validity of this IWO, contact the sender. If you fail to withhold income from the employee/obligor's income as the IWO directs, you are liable for both the accumulated amount you should have withheld and any penalties set by state or tribal law/procedure.

Withholding Limits: You may not withhold more than the lesser of: 1) the amounts allowed by the Federal Consumer Credit Protection Act (CCPA) [15 USC §1673 (b)]; or 2) the amounts allowed by the law of the state of the employee/ obligor's principal place of employment, if the place of employment is in a state; or the tribal law of the employee/obligor's principal place of employment if the place of employment is under tribal jurisdiction. Disposable income is the net income after mandatory deductions such as: state, federal, local taxes; Social Security taxes; statutory pension contributions; and Medicare taxes. The federal limit is 50% of the disposable income if the obligor is supporting another family and 60% of the disposable income if the obligor is not supporting another family. However, those limits increase 5%

Depending upon applicable state or tribal law, you may need to consider amounts paid for health care premiums in determining disposable income and applying appropriate withholding limits.

Arrears Greater Than 12 Weeks? If the Order Information section does not indicate that the arrears are greater than 12 weeks, then the employer should calculate the CCPA limit using the lower percentage.

Supplemental Information:

Income Withholding for Support (IWO) |

Page 3 of 4 |

Employer's Name: |

|

|

|

Employer FEIN: |

|

|

|||

Employee/Obligor's Name: |

|

|

|

|

SSN: |

|

|

||

Case Identifier: |

|

|

Order Identifier: |

|

|

||||

NOTIFICATION OF EMPLOYMENT TERMINATION OR INCOME STATUS: If this employee/obligor never worked for you or you are no longer withholding income for this employee/obligor, you must promptly notify the CSE agency and/or the sender by returning this form to the address listed in the contact information below:

This person has never worked for this employer nor received periodic income.

This person has never worked for this employer nor received periodic income.

This person no longer works for this employer nor receives periodic income.

This person no longer works for this employer nor receives periodic income.

Please provide the following information for the employee/obligor: |

|

|

|

|

|

|

||||||||||||||||

Termination date: |

|

|

|

|

|

|

Last known telephone number: |

|

|

|

|

|

|

|||||||||

Last known address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Final payment date to SDU/Tribal Payee: |

|

|

|

Final payment amount: |

|

|

|

|

|

|

||||||||||||

New employer's name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

New employer's address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

To Employer/Income Withholder: If you have questions, contact |

|

|

(issuer name) |

||||||||||||||||||

|

by telephone: |

|

, by fax: |

|

, by email or website: |

|

|

. |

||||||||||||||

Send termination/income status notice and other correspondence to:

|

|

|

|

|

|

|

|

(issuer address). |

|

To Employee/Obligor: If the employee/obligor has questions, contact |

|

|

(issuer name) |

||||||

by telephone: |

|

, by fax: |

|

, by email or website: |

|

|

. |

||

IMPORTANT: The person completing this form is advised that the information may be shared with the employee/obligor.

Encryption Requirements:

When communicating this form through electronic transmission, precautions must be taken to ensure the security of the data. Child support agencies are encouraged to use the electronic applications provided by the federal Office of Child Support Enforcement. Other electronic means, such as encrypted attachments to emails, may be used if the encryption method is compliant with Federal Information Processing Standard (FIPS) Publication

The Paperwork Reduction Act of 1995

This information collection and associated responses are conducted in accordance with 45 CFR 303.100 of the Child Support Enforcement Program. This form is designed to provide uniformity and standardization. Public reporting for this collection of information is estimated to average two to five minutes per response. An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number.

Income Withholding for Support (IWO) |

Page 4 of 4 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Income Withholding Order/Notice for Support (IWO) is designed to facilitate the collection of child support, spousal support, and medical support by requiring employers to withhold specified amounts from an employee's income. |

| Governing Law | The IWO must comply with section 466 of the Social Security Act. Additionally, state and tribal laws may impose further requirements regarding income withholding procedures. |

| Withholding Limitations | Employers cannot withhold more than the lesser of the federal limits (50-60% of disposable income, increased by 5% if arrears exceed 12 weeks) or state/tribal law limits applicable at the employee's principal place of employment. |

| Remittance Information | Employers are required to send withheld payments to a designated State Disbursement Unit (SDU) within a specified timeframe after the pay date. Relevant contact details and procedures may vary by state or tribe. |

| Multiple IWOs | When faced with multiple IWOs for the same employee, employers must prioritize current support over past-due payments and allocate amounts per the applicable state or tribal laws if the total withholdable amount exceeds limits. |

Guidelines on Utilizing Income Withholding

Filling out the Income Withholding form can seem daunting, but knowing the steps to follow can make the process much smoother. After completing the form, it is essential to understand that your next actions will likely involve processing payments and maintaining communication with the involved parties to ensure compliance with legal obligations.

- Begin with the Date field. Enter the current date when you fill out the form.

- Indicate whether the request is from a Child Support Enforcement (CSE) Agency, Court, or Attorney/Private Individual/Entity by checking the appropriate box.

- Fill in the State/Tribe/Territory and the Remittance ID in their respective fields.

- Enter the City/County/Dist./Tribe and the Order ID for identification purposes.

- Provide the Employer/Income Withholder's Name and the Employer/Income Withholder's Address.

- Include the Employee/Obligor's Name, ensuring to write their name as Last, First, Middle—along with their Social Security Number and Date of Birth.

- Fill in the Custodial Party/Obligee’s Name and any Child(ren)'s Names along with their Birth Dates.

- In the Order Information section, specify the amounts to withhold for current child support, past-due child support, cash medical support, spousal support, etc. Be sure to include a detailed total.

- Indicate your pay cycle by selecting weekly, biweekly, semimonthly, or monthly from the options provided.

- Complete the Remittance Information section with the date you will start withholding and the timeframe for sending payments.

- Ensure you report the pay date when remitting payments for accuracy.

- If necessary, note the termination date and provide the last known details for the employee/obligor, if applicable.

- Sign and date the document, with the required print name and title of the issuing official.

After completing these steps, ensure to copy the information provided on the form to retain a record for your own files. This completion allows for accurate processing of payments while maintaining compliance with applicable laws and regulations. Supporting such efforts fosters a seamless communication pathway with the involved parties, ultimately benefiting everyone involved.

What You Should Know About This Form

What is the purpose of the Income Withholding form?

The Income Withholding form is designed to ensure that child support payments are deducted directly from an employee's wages. This helps custodial parents receive the financial support they are owed without delay. It provides a standardized process for employers to follow, minimizing confusion and ensuring compliance with state and federal laws regarding child support enforcement.

Who is required to comply with the Income Withholding Order (IWO)?

Employers are required to comply with the Income Withholding Order. Once notified through the IWO, employers must deduct specified amounts from the employee's paycheck until further notice. This applies to all employers, regardless of size or industry, and non-compliance may result in legal consequences for failing to withhold the required amounts.

How should payments be sent once amounts are withheld?

Payments must be sent to the appropriate State Disbursement Unit (SDU) or a tribal Child Support Enforcement agency, as specified in the IWO. Payments should include any required identifiers, such as the Remittance ID. Employers must also report the pay date when submitting payments, ensuring that they follow any state-specific laws regarding payment timelines. This helps streamline the support payment process and ensures funds reach the custodial party promptly.

What should an employer do if the employee no longer works for them?

If an employee subject to an IWO no longer works for the employer or never worked for them, the employer must complete the notification section of the form and return it to the sender or the Child Support Enforcement agency. They should provide necessary information such as the termination date and any available contact information for the former employee. Timely reporting of employment status helps to update records and allows for proper enforcement of support obligations.

Common mistakes

When filling out the Income Withholding form, mistakes can lead to complications and delays in processing. It’s essential to be attentive to detail. Here are some common errors people make.

One mistake is failing to provide accurate employer information. If the employer’s name or address is incorrect, it can result in payments being sent to the wrong place. Always double-check these details before submission.

Another common error is not including the Social Security number of the employee or obligor. This number is crucial for identification and tracking payments. Omitting it can lead to confusion and may delay the withholding process.

Some individuals forget to indicate the proper amounts to withhold. Whether it is child support, spousal support, or any other type of payment, accurate figures are needed. Be certain to fill in all relevant monetary amounts, as this section directly impacts the withholding process.

People often overlook the need for signatures. Either the judge or the issuing official must sign the form. Without a signature, the document may be considered invalid, delaying necessary actions significantly.

Additionally, it is a mistake to ignore the reporting requirements. The form requires clear documentation of the pay date when sending the payment. Missing this step can create issues in payment tracking and accountability.

Finally, some users are not conscious of the different state or tribal regulations regarding withholding. Each jurisdiction may have specific rules that need to be followed. Familiarizing yourself with these can prevent errors and ensure compliance.

Documents used along the form

The Income Withholding form is just one piece of a larger puzzle in the child support enforcement process. Several other documents often accompany it to ensure compliance and proper management of child support payments. Each of these plays a crucial role in helping maintain systematic financial support for children and families.

- Child Support Order: This document lays out the original agreement or court order which specifies the amount of support that needs to be paid. It establishes the legal obligation of the non-custodial parent.

- Payment History Record: This document tracks all payments made toward child support. It serves as a detailed history that can help resolve disputes regarding past payments.

- Notice of Delinquency: If support payments are missed, this form alerts the obligor that they are behind on payments. It typically includes details about the outstanding amount and potential penalties.

- Affidavit of Support: This sworn statement may be required, confirming that a party is providing necessary financial support as mandated by court order. It can also outline any changes in circumstances that could affect payment amounts.

- Termination Notice: Used to officially notify the parties involved that the Income Withholding Order is ending. This may occur due to the child turning 18, or other legal reasons.

- Request for Review and Adjustment: If circumstances change, this document allows either parent to request a review of the current support order for potential modification, ensuring payment amounts reflect current financial situations.

- Income Verification Form: This form collects income information from the obligor to verify their earning situation, often needed if the paying parent requests a modification of the support amount.

- State Disbursement Unit (SDU) Forms: These forms facilitate the payment of child support through centralized state collections. They ensure that payments are processed correctly before reaching the custodial parent.

- Employer Notification Form: This document notifies the employer of the obligation to withhold child support from an employee’s paycheck, serving as an official order to begin withholding.

- Income Withholding Order (IWO) Transmittal Form: This form is used to transmit the IWO alongside the necessary details, ensuring that all pertinent information is available to the employer for proper withholding.

Understanding these forms and their purposes is essential for anyone involved in the child support system. Each document enhances the effectiveness and fairness of the child support enforcement process, enabling those who rely on such support to receive it in a timely and systematic manner.

Similar forms

When exploring legal documents related to income withholding for support, several forms share similar purposes or characteristics with the Income Withholding form (IWO). Below are six documents that are analogous in various aspects:

- Garnishment Order: Similar to the IWO, this document directs an employer to withhold a portion of an employee's earnings to satisfy a debt. It includes details on the amount to be withheld and pertinent information about the employee and creditor.

- Child Support Order: This document establishes the obligation to pay child support and outlines the amounts, frequency, and terms of payment. It serves as the basis for the IWO, ensuring that payments are made consistently.

- Spousal Support Order: Like a child support order, a spousal support order specifies the conditions under which one spouse may be required to provide financial assistance to the other. It can also serve as a basis for income withholding similar to the IWO.

- Wage Assignment Agreement: This agreement allows an employee to voluntarily assign a portion of their wages to a creditor. It operates similarly to an IWO but is typically based on mutual agreement rather than a legal order.

- Levy Notice: Issued by a court or tax authority, this document instructs an employer to withhold wages or bank funds to pay off a debt. The similarities with the IWO lie in the requirement for the employer to enforce withholding from an employee’s income.

- Payment Terminology Notification: This document informs an employer of any changes in the support payment situation or amendments to the withholding amounts. Like the IWO, it is essential for ensuring the proper handling of support payments.

Dos and Don'ts

When filling out the Income Withholding form, following specific guidelines can help ensure that the process is smooth and compliant. Here’s a list of dos and don’ts to consider:

- Do carefully read through all the instructions provided with the form to understand your responsibilities.

- Do ensure that the form is signed and dated by the appropriate official, as this validates the order.

- Do include all required identifiers such as Remittance ID and Case ID to avoid delays in processing.

- Do promptly notify the sender if the employee has terminated employment or no longer receives income.

- Do retain a copy of the completed form for your records to maintain documentation of compliance.

- Don’t disregard the withholding limits; make sure the amounts do not exceed federal or state thresholds.

- Don’t withhold amounts from an employee’s income without confirming the accuracy of the order.

- Don’t combine payments from multiple employees in a way that obscures individual amounts being withheld.

- Don’t send payments to unauthorized entities; always follow the instructions regarding where to remit payments.

Observing these guidelines can help mitigate potential issues and ensure compliance with legal requirements related to income withholding for support.

Misconceptions

Here are nine common misconceptions about the Income Withholding form:

- It's only for child support. Many believe the Income Withholding Order (IWO) applies solely to child support. In reality, it can also be used for spousal support and medical support, among other obligations.

- Employers can ignore the IWO. Some employers think they can disregard the form if they find it confusing. However, the law mandates compliance with the IWO unless there are specific grounds to reject it.

- Withholding amounts do not need to match pay cycles. Many assume if the pay cycle differs from the withholding schedule, they can withhold any amount. In fact, the amounts must be adjusted according to the employee's pay cycle.

- Employers must comply immediately. Some employers believe they need to start withholding right away. There is usually a grace period defined by state law within which the withholding must begin.

- Payments can be sent to any entity. There’s a misconception that payments can be sent to any recipient. Payments under the IWO must go strictly to the specified State Disbursement Unit or designated recipient.

- All IWOs are the same. Many think each IWO has the same requirements and procedures. Each IWO can vary based on the state or tribe's regulations involved and the specific circumstances of the case.

- Employers have the discretion to change withholding amounts. Some employers believe they can adjust the withholding based on their preferences. In truth, employers must withhold the exact amounts indicated on the IWO.

- There are no consequences for failure to comply. A common belief is that failing to withhold amounts will go unnoticed. In reality, employers can face legal penalties and be held liable for the amounts they failed to withhold.

- Informing employees about IWOs is optional. Employers may think they can keep IWOs private. In fact, employees generally must receive notice of the IWO when it is issued against them.

Understanding these misconceptions can help ensure compliance and protect the rights of everyone involved.

Key takeaways

- Fill out the form accurately, ensuring all required fields are completed.

- Know your obligations. The IWO requires deductions from the employee's income.

- Submit the IWO to the correct agency or entity to ensure proper processing.

- Report the pay date when sending payments to meet legal requirements.

- Withhold amounts based on the employee's pay cycle and the specified order amounts.

- Understand withholding limits, which are based on federal and state laws.

- If there are multiple IWOs, prioritize current support payments when possible.

- Maintain communication with the child support agency if there are employment terminations or income status changes.

Browse Other Templates

Schedule 6 - The grading scale ranges from unsatisfactory to outstanding for each section.

Tn Enhanced Carry Permit Class Online - Keep track of firearm details including make, model, and serial number.

Repossession Affidavit Arizona - Completing each section of the affidavit is crucial for legal efficacy.