Fill Out Your Independent Business Cancellation Form

When it comes to stepping back from an independent business opportunity, the Independent Business Cancellation form serves as a vital tool for individuals wishing to formally end their association. Designed for those who may find that the business model doesn't align with their goals, this form must be completed accurately and promptly to facilitate the cancellation process. Key elements include filling out personal details such as your name, address, representative ID number, and start date. One crucial aspect to note is that the completed form must be faxed within 10 business days from your start date to qualify for a refund of $499. By providing your current date and ensuring your signature is included, you pave the way for a smooth cancellation. Additionally, this process emphasizes the importance of acting quickly and following the required steps to ensure you receive your refund back to the credit card that was originally charged. Understanding these specifics is essential to navigate the cancellation successfully.

Independent Business Cancellation Example

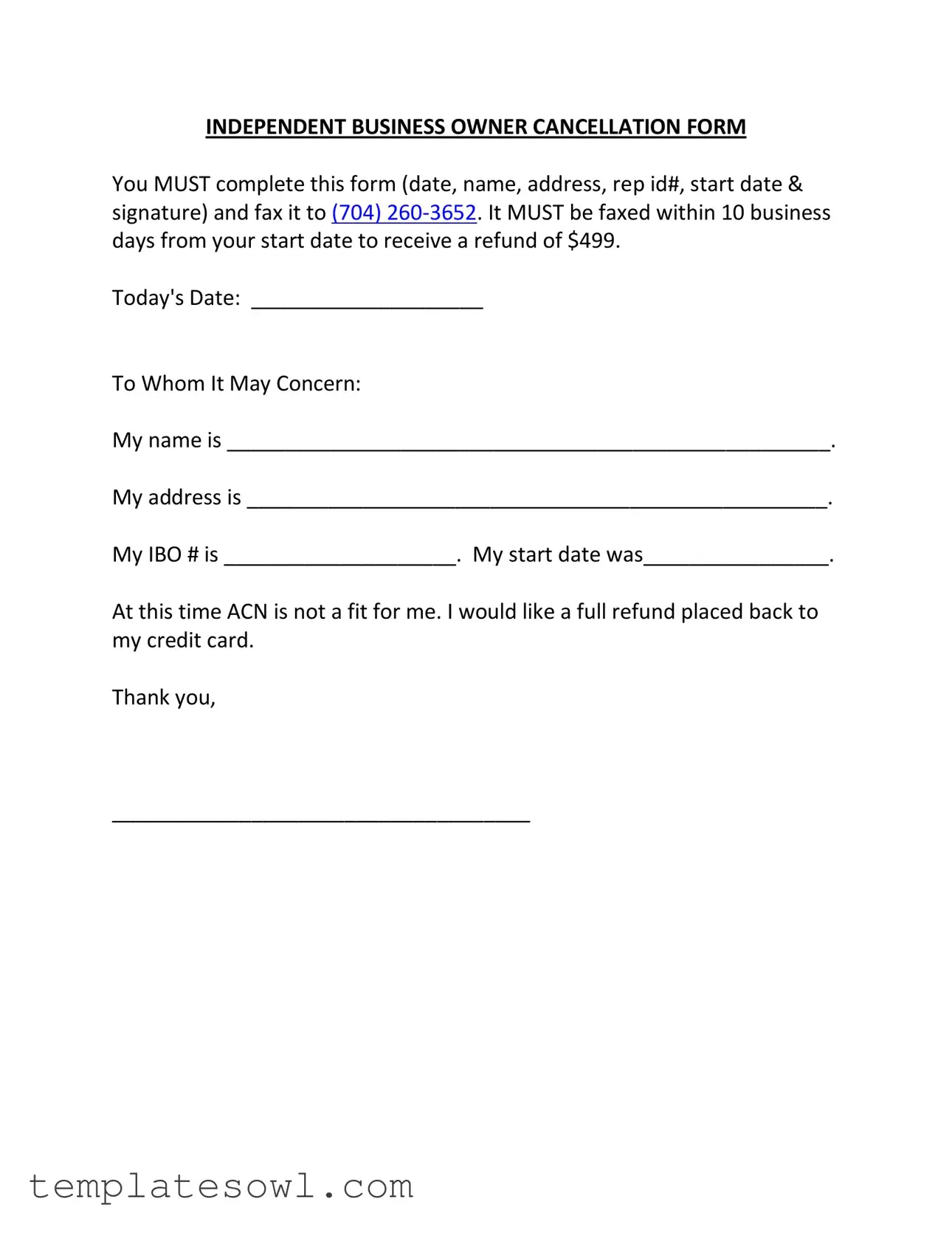

INDEPENDENT BUSINESS OWNER CANCELLATION FORM

You MUST complete this form (date, name, address, rep id#, start date & signature) and fax it to (704)

Today's Date: ____________________

To Whom It May Concern:

My name is ____________________________________________________.

My address is __________________________________________________.

My IBO # is ____________________. My start date was________________.

At this time ACN is not a fit for me. I would like a full refund placed back to my credit card.

Thank you,

____________________________________

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | Independent Business Owner Cancellation Form |

| Completion Requirements | The form requires completion of date, name, address, representative ID number, start date, and signature. |

| Submission Method | This form must be faxed to (704) 260-3652. |

| Deadline for Submission | The form must be faxed within 10 business days of the start date to qualify for a refund. |

| Refund Amount | Submitting the form within the required timeframe allows for a full refund of $499. |

| Signature Requirement | A signature is necessary to process the cancellation request. |

| Cancellation Reason | The form states that the individual is canceling because ACN is not a fit for them. |

| Governing Law | This cancellation process is governed by the terms set forth in the independent business agreement. |

Guidelines on Utilizing Independent Business Cancellation

Once you’ve decided to cancel your Independent Business relationship, it’s important to complete the cancellation form correctly. Filling it out is straightforward, but accuracy is key to ensure you receive your refund promptly. Below are the steps to guide you through the process.

- Write today’s date in the designated space.

- Fill in your name where it states "My name is."

- Provide your address in the appropriate field.

- Enter your Independent Business Owner (IBO) number where it says "My IBO # is."

- Indicate your start date by filling in the section that reads "My start date was."

- Clearly state that you would like a refund by writing, "At this time ACN is not a fit for me. I would like a full refund placed back to my credit card."

- Sign your name at the bottom where it says "Thank you."

- Fax the completed form to (704) 260-3652 within 10 business days of your start date to ensure your refund request is processed.

Make sure to keep a copy of the fax confirmation for your records. This will serve as proof that you submitted your cancellation request within the necessary timeframe.

What You Should Know About This Form

What is the Independent Business Cancellation form?

The Independent Business Cancellation form is a document that allows individuals who want to cancel their membership with ACN to formally request a refund. It contains essential information such as your name, contact details, and membership details.

How do I complete the cancellation form?

To fill out the cancellation form, provide the date, your name, address, IBO (Independent Business Owner) number, start date, and signature. Ensure all details are correct before submission.

Where should I send the completed form?

You must fax the completed cancellation form to (704) 260-3652. Make sure you use a reliable fax machine to avoid any issues with transmission.

What is the deadline for submitting the cancellation form?

The completed form must be faxed within 10 business days from your start date. If you miss this timeframe, you may not be eligible for a refund.

How much refund will I receive?

If you successfully submit the cancellation form within the required time, you will receive a full refund of $499 back to your credit card.

What happens if I don't submit the form in time?

If the form is not submitted within 10 business days, you will likely forfeit your right to a refund. It is crucial to act quickly to ensure your request is processed.

Is there any specific information I need to have on hand?

Yes, you will need your personal details such as your name, address, IBO number, and your start date readily available to complete the form accurately.

Do I need to keep a copy of the cancellation form?

It is a good idea to keep a copy of the completed cancellation form for your records. This can serve as proof of your request in case of any issues later on.

Will I receive confirmation once my cancellation is processed?

You may not receive immediate confirmation, but you should keep an eye on your credit card statement for the refund. If it does not appear within a reasonable time, follow up with ACN directly for clarification.

Can I cancel my membership for any reason?

While you can cancel your membership, the refund policy states that it must be submitted within the specified timeline. Your reason for cancellation is not questioned, but timely submission is crucial for obtaining the refund.

Common mistakes

Filling out the Independent Business Cancellation form seems straightforward, but many people make errors that can delay their refund or even cause it to be denied. One common mistake is not including all necessary personal information. If you forget to fill in the name, address, IBO number, or start date, the form may be rejected outright. Every piece of information is crucial for the processing of your cancellation.

Another frequent error is failing to sign the form. An unsigned document lacks authenticity and cannot be processed. Always remember to include your signature at the bottom of the form. This simple yet vital step is often overlooked, leading to unnecessary delays.

Many individuals also overlook the importance of timing. The form must be faxed within 10 business days of your start date to qualify for the $499 refund. Waiting too long can make it impossible to receive your money back. Double-check the deadlines and ensure the timing is crucial when submitting your request.

Additionally, some people forget to include the fax number. The form specifically states that it should be sent to (704) 260-3652. Not using the correct number could result in your cancellation not being processed correctly, leaving you in limbo.

Moreover, it’s essential to stay organized. Keeping a copy of the filled-out form for your records is a mistake many make. Documentation can help resolve any disputes about whether your cancellation was submitted on time and can serve as proof if needed.

Another oversight occurs when people do not specify the nature of their request clearly. The form states that you wish for a full refund to be placed back to your credit card, but if this is not explicitly stated, there could be confusion regarding your intentions. Clarity can save you a lot of hassle.

Furthermore, some submitters rush through the form. Taking the time to carefully review each section will ensure you don’t miss any critical details. Submitting an incomplete form may lead to automatic rejection, causing more frustration down the line.

Finally, communication with ACN is crucial after submitting your cancellation. Failing to follow up can leave you without an update on the status of your refund. A quick check-in can confirm that your cancellation is in process and may provide peace of mind.

Documents used along the form

The Independent Business Cancellation form is an essential document for individuals wishing to cancel their business registration. However, several other forms and documents may also be required during this process for clarity and compliance. Below is a list of related documents that can assist in successfully managing the cancellation.

- Confirmation of Cancellation Receipt: This document confirms that the cancellation request has been received and processed. It provides a record for both the individual and the company.

- Refund Request Form: This form specifically outlines the details of the refund, including the amount and payment method, ensuring that a formal request is made for the refund.

- Identification Verification: A document that verifies the identity of the business owner. It may include a copy of a driver’s license or social security card.

- Dispute Resolution Form: In case there are issues with the cancellation or refund, this form outlines the procedure for resolving disputes.

- Business Registration Cancellation Policy: A document that explains the company's policies regarding the cancellation of business registrations, including any fees or requirements.

- Final Statement of Business Account: This statement details any outstanding payments or fees associated with the business account to ensure all financial matters are settled.

- Acknowledgment of Terms and Conditions: A form that confirms the individual understands the terms associated with the cancellation and refund process.

- Exit Interview Document: This document may outline feedback regarding the business experience to help the company improve its offerings.

- Tax Documents: Any necessary tax documentation that needs to be addressed due to the cancellation of the business. This may include final earnings statements or tax liability forms.

- Customer Account Closure Form: If applicable, this document formally closes the customer account associated with the independent business.

Having these documents ready ensures a smoother cancellation process. It is advisable to check with the company for any specific requirements that may apply to your situation.

Similar forms

The Independent Business Cancellation form shares similarities with several other important documents related to business transactions and cancellations. Below is a list of those documents and their connections to the Independent Business Cancellation form:

- Notice of Intent to Cancel: This document serves to inform a company of a customer's decision to withdraw from a contract or agreement. Like the Independent Business Cancellation form, it requires the individual's personal information and specifies the intent to cancel.

- Refund Request Form: A Refund Request Form is utilized when an individual seeks reimbursement for a specific transaction. Similar to the cancellation form, it mandates details such as the transaction date, amount, and reasons for requesting a refund.

- Membership Cancellation Form: This form is commonly used for canceling memberships with clubs or organizations. It parallels the cancellation form by documenting the member's decision and providing relevant personal information.

- Contract Termination Letter: A Contract Termination Letter formally notifies a party of the intent to terminate a contract. Much like the Independent Business Cancellation form, it specifies the parties involved and the effective date of termination.

- Service Termination Notice: A Service Termination Notice informs a service provider that a client will discontinue their services. This document shares the same purpose of communication as the cancellation form, detailing the client's information and termination reasons.

- Withdrawal Request Form: Typically used in business or academic settings, this form allows individuals to formally withdraw from certain programs or agreements. It mirrors the Independent Business Cancellation form in requiring identification details and a clear statement of withdrawal.

Dos and Don'ts

When filling out the Independent Business Cancellation form, it's important to keep certain guidelines in mind. Here are some things you should and shouldn't do:

- Do fill in the current date at the top of the form.

- Don't leave any required fields blank, like your name and address.

- Do include your IBO number accurately.

- Don't forget to write your start date.

- Do sign the form at the bottom.

- Don't fax the form after the 10 business days deadline.

- Do send the form to the correct fax number: (704) 260-3652.

- Don't assume that an incomplete form will be accepted.

- Do request a refund explicitly in your message.

- Don't forget to provide a contact number for any questions.

Following these guidelines will help ensure the cancellation process goes smoothly. Be thorough and attentive to detail to avoid any potential issues.

Misconceptions

There are several misconceptions about the Independent Business Cancellation form. Understanding these can help ensure a smooth cancellation process.

- It can be faxed any time after cancellation. The form must be sent within 10 business days from your start date to qualify for a refund.

- Only a signature is needed. Each section of the form, including the date, name, address, IBO number, and start date, must be completed.

- Simplifying the form is acceptable. It's essential to fill out every required part accurately to avoid delays or issues.

- A phone call is enough. Faxing the completed form is the only way to officially submit your cancellation.

- The refund is automatic. You must specifically request a refund in the cancellation form, or it may not be processed.

- Late submissions can still get refunds. If you miss the 10 business day window, you will not receive a refund.

- Providing an email address is mandatory. The form does not require an email address, but it can be beneficial for communication.

- The form can be filled out by anyone. Only the Independent Business Owner must complete and submit the form.

- There's no follow-up needed after sending. It’s wise to confirm that the fax was received to ensure your cancellation is processed.

Key takeaways

Completing the Independent Business Cancellation form accurately is crucial for processing your request efficiently. Below are some key takeaways to keep in mind:

- You must provide all required information, including your name, address, IBO number, start date, and signature.

- The form must be faxed to (704) 260-3652 within 10 business days of your start date to ensure eligibility for a refund.

- The maximum refund available is $499, and it will be credited back to your credit card upon successful processing of your form.

- Be sure to write the date on the form to confirm when you are submitting your cancellation request.

- Retain a copy of the fax confirmation as proof of submission for your records.

Following these steps will help ensure a smooth cancellation process and minimize any potential delays in receiving your refund.

Browse Other Templates

When Do You Need Probate - The applicant seeks four specific outcomes from the court, such as being appointed as personal representative without having to post a bond.

Supreme Court Original Jurisdiction - The motion for leave to proceed should not indicate a case number initially.

Aig Beneficiary Change Form - Clarifies who is responsible for the insured if needed.