Fill Out Your Independent Contractor Application Form

The Independent Contractor Application form plays a crucial role in establishing the relationship between independent contractors and the organizations that seek their services. This form includes essential sections that collect background information from applicants such as their name, address, phone numbers, and email, alongside detailed professional history and references. Notably, it encompasses space for listing previous positions, obligations related to existing contractor relationships, and a description of their primary business. Importantly, the form emphasizes non-discrimination policies, ensuring that all applicants are considered regardless of race, color, religion, sex, national origin, age, or disability, aligning with state and federal laws. Applicants must also provide specific details regarding their anticipated rates and availability, along with information about their legal eligibility to work in the United States. Furthermore, the form prompts applicants to confirm their understanding of the implications of contractor status, including tax responsibilities and the absence of benefits such as unemployment insurance. In addition, a signature and certification section holds contractors accountable for the accuracy of their application. Collectively, these elements reflect both the procedural and legal frameworks that govern independent contracting, thereby facilitating informed decisions by organizations looking to engage contractors.

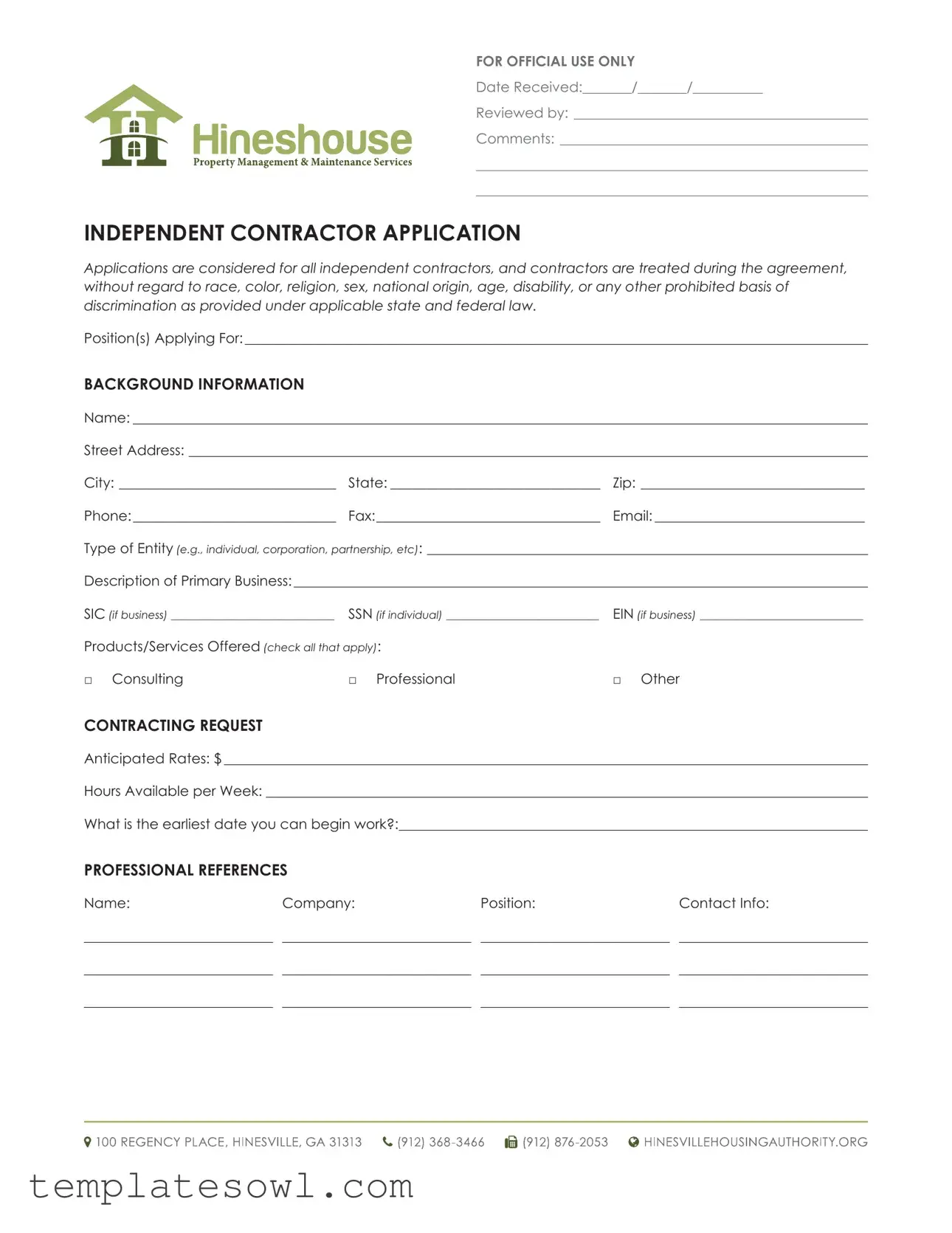

Independent Contractor Application Example

FOR OFFICIAL USE ONLY

Date Received:_______/_______/__________

Reviewed by:___________________________________________

Comments:_____________________________________________

________________________________________________________

________________________________________________________

INDEPENDENT CONTRACTOR APPLICATION

Applications are considered for all independent contractors, and contractors are treated during the agreement, without regard to race, color, religion, sex, national origin, age, disability, or any other prohibited basis of discrimination as provided under applicable state and federal law.

Position(s) Applying For:__________________________________________________________________________________________

BACKGROUND INFORMATION

Name:__________________________________________________________________________________________________________

Street Address:__________________________________________________________________________________________________

City:________________________________ State:_______________________________ Zip:_________________________________

Phone:______________________________ Fax:________________________________ Email:_______________________________

Type of Entity (e.g., individual, corporation, partnership, etc):________________________________________________________________

Description of Primary Business:___________________________________________________________________________________

SIC (if business)_______________________________ SSN (if individual)_____________________________ EIN (if business)_______________________________

Products/Services Offered (check all that apply): |

|

|

□ Consulting |

□ Professional |

□ Other |

CONTRACTING REQUEST

Anticipated Rates: $_____________________________________________________________________________________________

Hours Available per Week:_______________________________________________________________________________________

What is the earliest date you can begin work?:___________________________________________________________________

PROFESSIONAL REFERENCES

Name: |

Company: |

Position: |

Contact Info: |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

___________________________ |

PREVIOUS POSITIONS (Please begin with most recent)

Company:__________________________ Phone:______________________________ Contact:____________________________

Address:________________________________________________________________________________________________________

Employment Dates: |

Pay or Salary: |

Reason for leaving: |

Position & Duties |

From_______________________ |

Start_______________________ |

___________________________ |

___________________________ |

To_ ________________________ |

Final_______________________ |

___________________________ |

___________________________ |

Company:__________________________ Phone:______________________________ Contact:____________________________

Address:________________________________________________________________________________________________________

Employment Dates: |

Pay or Salary: |

Reason for leaving: |

Position & Duties |

From_______________________ |

Start_______________________ |

___________________________ |

___________________________ |

To_ ________________________ |

Final_______________________ |

___________________________ |

___________________________ |

Company:__________________________ Phone:______________________________ Contact:____________________________

Address:________________________________________________________________________________________________________

Employment Dates: |

Pay or Salary: |

Reason for leaving: |

Position & Duties |

From_______________________ |

Start_______________________ |

___________________________ |

___________________________ |

To_ ________________________ |

Final_______________________ |

___________________________ |

___________________________ |

EXISTING CONTRACTUAL RELATIONSHIPS (Please list all current independent contractor relationships)

Company:______________________________________________________________________________________________________

Address:____________________________ |

Obligations:_________________________ |

Industry Type:_ ______________________ |

____________________________________ |

____________________________________ |

____________________________________ |

Phone:______________________________ |

Effective Date:______________________ |

Monthly Hours Worked:______________ |

Contact:____________________________ |

End of Term:________________________ |

____________________________________ |

|

|

|

Company:______________________________________________________________________________________________________

Address:____________________________ |

Obligations:_________________________ |

Industry Type:_ ______________________ |

____________________________________ |

____________________________________ |

____________________________________ |

Phone:______________________________ |

Effective Date:______________________ |

Monthly Hours Worked:______________ |

Contact:____________________________ |

End of Term:________________________ |

____________________________________ |

Company:______________________________________________________________________________________________________ |

||

Address:____________________________ |

Obligations:_________________________ |

Industry Type:_ ______________________ |

____________________________________ |

____________________________________ |

____________________________________ |

Phone:______________________________ |

Effective Date:______________________ |

Monthly Hours Worked:______________ |

Contact:____________________________ |

End of Term:________________________ |

____________________________________ |

ADDITIONAL INFORMATION

Are you legally eligible for work in the U.S.A.? |

□ |

Yes (verification required) |

□ |

No |

Have you ever contracted with HHA before? |

□ |

Yes |

□ |

No |

If yes, when? (Please attach previous contract application)_________________________________________________________________

Do you have liability and/or malpractice insurance? |

□ Yes |

□ No |

If yes, please attach proof of insurance to application.

Do you agree to obtain any and all licenses that may be |

|

|

|

|

required to do business as an independent contractor or |

|

|

|

|

□ |

Yes |

□ |

No |

|

Do you understand that as an independent contractor, |

|

|

|

|

you would not be eligible for unemployment benefits at |

|

|

|

|

the end of any contract with HHA? |

□ |

Yes |

□ |

No |

Do you understand that as an independent contractor, |

|

|

|

|

you would be responsible for payment of any and all |

|

|

|

|

state and/or federal income taxes, Social Security, |

|

|

|

|

|

|

|

|

|

payroll taxes and you will receive a form 1099 for |

|

|

|

|

service provided to HHA by you? |

□ |

Yes |

□ |

No |

|

|

|

|

|

SIGNATURE/CERTIFICATION

I certify that the facts set forth in this application are true, complete, and correct to the best of my knowledge. I understand that any misrepresentations, falsifications, or omissions on this application can be grounds for immediate denial of my appointment or removal from consideration or, if I have entered into a contract with this company, for immediate termination of that contract. I authorize HHA to make any necessary inquiries and investigations into my education, references, or employment history. I further authorize, unless otherwise indicated on this application, the release of my information to HHA by any of the schools, services, or employers listed on this application.

I also hereby release from liability HHA and its representatives for seeking, gathering, and using such information to make decisions concerning my status as an independent contractor for HHA and all other persons or organizations for providing such information.

THIS IS NOT AN APPLICATION FOR EMPLOYMENT. I understand and agree that if this application is accepted, my status will be that of an independent contractor and as such, I will be solely responsible for all tax liabilities pertaining to monies received in the course of services I perform.

If I am retained by HHA as an independent contractor I will:

•Not be entitled to workers compensation benefits.

•Not be entitled to unemployment insurance benefits unless unemployment coverage is provided by me or some other entity.

•Be obligated to pay federal and state income tax on any moneys paid pursuant to the contract.

•Be required to provide professional and liability insurance.

I represent and warrant that I have read and fully understand the foregoing, and that I seek to become and independent contractor under these conditions.

Signature:_______________________________________________________________________Date:_______/_______/__________

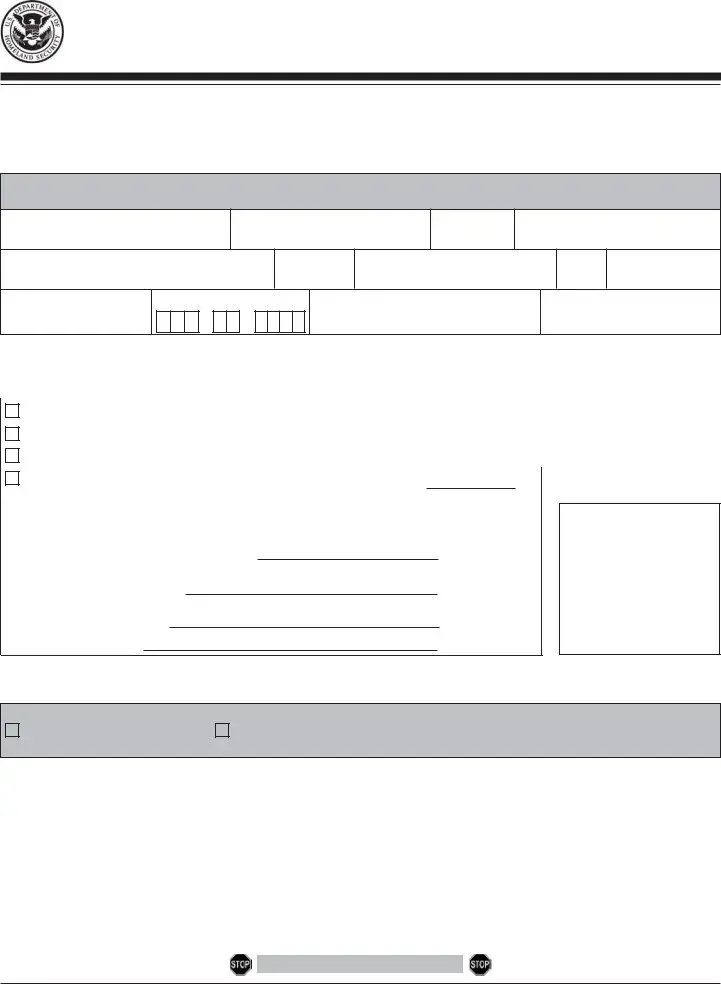

Employment Eligibility Verification |

USCIS |

|

Department of Homeland Security |

Form |

|

OMB No. |

||

U.S. Citizenship and Immigration Services |

||

Expires 08/31/2019 |

►START HERE: Read instructions carefully before completing this form. The instructions must be available, either in paper or electronically, during completion of this form. Employers are liable for errors in the completion of this form.

Section 1. Employee Information and Attestation (Employees must complete and sign Section 1 of Form

Last Name (Family Name)

First Name (Given Name)

Middle Initial

Other Last Names Used (if any)

Address (Street Number and Name)

Apt. Number

City or Town

State

ZIP Code

Date of Birth (mm/dd/yyyy)

U.S. Social Security Number

- -

Employee's

Employee's Telephone Number

I am aware that federal law provides for imprisonment and/or fines for false statements or use of false documents in connection with the completion of this form.

I attest, under penalty of perjury, that I am (check one of the following boxes):

1. |

A citizen of the United States |

|

|

|

|

|

|

|

|

2. |

A noncitizen national of the United States (See instructions) |

|||

|

|

|

|

|

3. |

A lawful permanent resident |

(Alien Registration Number/USCIS Number): |

||

|

|

|

|

|

|

|

|

|

|

4. |

An alien authorized to work |

until (expiration date, if applicable, mm/dd/yyyy): |

||

Some aliens may write "N/A" in the expiration date field. (See instructions)

Aliens authorized to work must provide only one of the following document numbers to complete Form

An Alien Registration Number/USCIS Number OR Form

1.Alien Registration Number/USCIS Number:

OR

2.Form

OR

3.Foreign Passport Number: Country of Issuance:

QR Code - Section 1

Do Not Write In This Space

Signature of Employee |

Today's Date (mm/dd/yyyy) |

|

|

Preparer and/or Translator Certification (check one):

|

I did not use a preparer or translator. |

|

A preparer(s) and/or translator(s) assisted the employee in completing Section 1. |

(Fields below must be completed and signed when preparers and/or translators assist an employee in completing Section 1.)

I attest, under penalty of perjury, that I have assisted in the completion of Section 1 of this form and that to the best of my knowledge the information is true and correct.

Signature of Preparer or Translator |

|

|

Today's Date (mm/dd/yyyy) |

|||

|

|

|

|

|

|

|

Last Name (Family Name) |

|

First Name (Given Name) |

|

|

|

|

|

|

|

|

|

|

|

Address (Street Number and Name) |

City or Town |

|

State |

ZIP Code |

||

|

|

|

|

|

|

|

Employer Completes Next Page

Form |

Page 1 of 3 |

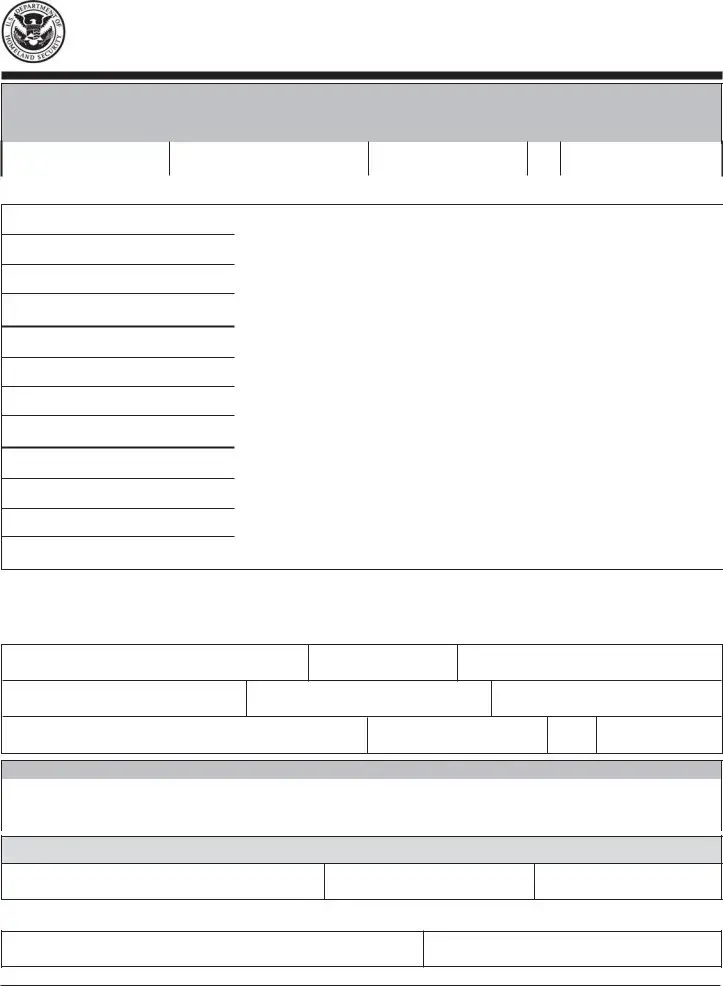

Employment Eligibility Verification |

USCIS |

|

Department of Homeland Security |

Form |

|

OMB No. |

||

U.S. Citizenship and Immigration Services |

||

Expires 08/31/2019 |

Section 2. Employer or Authorized Representative Review and Verification

(Employers or their authorized representative must complete and sign Section 2 within 3 business days of the employee's first day of employment. You must physically examine one document from List A OR a combination of one document from List B and one document from List C as listed on the "Lists of Acceptable Documents.")

Employee Info from Section 1 |

Last Name (Family Name) |

First Name (Given Name) |

M.I. Citizenship/Immigration Status |

|

|

|

List A |

OR |

List B |

AND |

List C |

Identity and Employment Authorization |

|

Identity |

|

Employment Authorization |

Document Title

Issuing Authority

Document Number

Expiration Date (if any)(mm/dd/yyyy)

Document Title

Issuing Authority

Document Number

Expiration Date (if any)(mm/dd/yyyy)

Document Title

Issuing Authority

Document Number

Expiration Date (if any)(mm/dd/yyyy)

|

|

Document Title |

|

|

Document Title |

|

|||

|

|

|

|

|

|

|

|||

|

|

Issuing Authority |

|

|

Issuing Authority |

|

|||

|

|

|

|

|

|

|

|||

|

|

Document Number |

|

|

Document Number |

|

|||

|

|

|

|

|

|

|

|||

|

|

Expiration Date (if any)(mm/dd/yyyy) |

|

|

Expiration Date (if any)(mm/dd/yyyy) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Information |

|

|

|

|

QR Code - Sections 2 & 3 |

|

|

|

|

|

|

|

|

Do Not Write In This Space |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certification: I attest, under penalty of perjury, that (1) I have examined the document(s) presented by the

(2)the

The employee's first day of employment (mm/dd/yyyy): |

|

(See instructions for exemptions) |

Signature of Employer or Authorized Representative

Today's Date (mm/dd/yyyy)

Title of Employer or Authorized Representative

Last Name of Employer or Authorized Representative

First Name of Employer or Authorized Representative

Employer's Business or Organization Name

Employer's Business or Organization Address (Street Number and Name)

City or Town

State

ZIP Code

Section 3. Reverification and Rehires (To be completed and signed by employer or authorized representative.)

A. New Name (if applicable) |

|

|

B. Date of Rehire (if applicable) |

Last Name (Family Name) |

First Name (Given Name) |

Middle Initial |

Date (mm/dd/yyyy) |

|

|

|

|

C. If the employee's previous grant of employment authorization has expired, provide the information for the document or receipt that establishes continuing employment authorization in the space provided below.

Document Title

Document Number

Expiration Date (if any) (mm/dd/yyyy)

I attest, under penalty of perjury, that to the best of my knowledge, this employee is authorized to work in the United States, and if the employee presented document(s), the document(s) I have examined appear to be genuine and to relate to the individual.

Signature of Employer or Authorized Representative |

Today's Date (mm/dd/yyyy) |

|

|

Name of Employer or Authorized Representative

Form |

Page 2 of 3 |

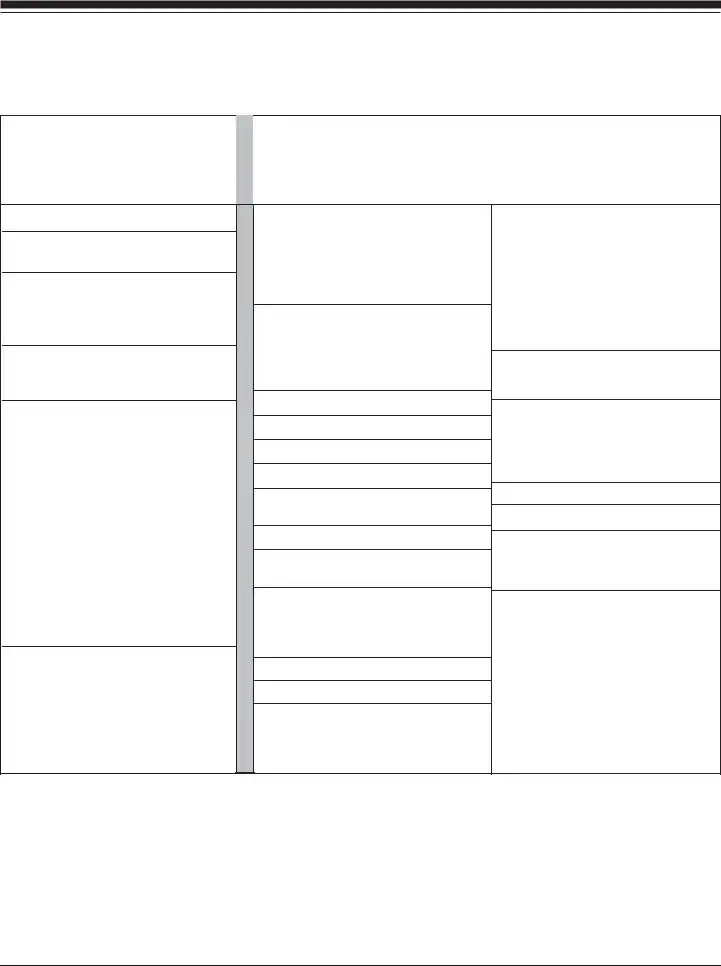

LISTS OF ACCEPTABLE DOCUMENTS

All documents must be UNEXPIRED

Employees may present one selection from List A

or a combination of one selection from List B and one selection from List C.

LIST A |

LIST B |

LIST C |

Documents that Establish |

Documents that Establish |

Documents that Establish |

Both Identity and |

Identity |

Employment Authorization |

Employment Authorization |

OR |

AND |

1.U.S. Passport or U.S. Passport Card

2.Permanent Resident Card or Alien Registration Receipt Card (Form

3.Foreign passport that contains a temporary

4.Employment Authorization Document that contains a photograph (Form

5.For a nonimmigrant alien authorized to work for a specific employer because of his or her status:

a.Foreign passport; and

b.Form

(1)The same name as the passport; and

(2)An endorsement of the alien's nonimmigrant status as long as that period of endorsement has not yet expired and the proposed employment is not in conflict with any restrictions or limitations identified on the form.

6.Passport from the Federated States of Micronesia (FSM) or the Republic of the Marshall Islands (RMI) with Form

1.Driver's license or ID card issued by a State or outlying possession of the United States provided it contains a photograph or information such as name, date of birth, gender, height, eye color, and address

2.ID card issued by federal, state or local government agencies or entities, provided it contains a photograph or information such as name, date of birth, gender, height, eye color, and address

3.School ID card with a photograph

4.Voter's registration card

5.U.S. Military card or draft record

6.Military dependent's ID card

7.U.S. Coast Guard Merchant Mariner Card

8.Native American tribal document

9.Driver's license issued by a Canadian government authority

For persons under age 18 who are

unable to present a document

listed above:

10.School record or report card

11.Clinic, doctor, or hospital record

12.

1.A Social Security Account Number card, unless the card includes one of the following restrictions:

(1)NOT VALID FOR EMPLOYMENT

(2)VALID FOR WORK ONLY WITH INS AUTHORIZATION

(3)VALID FOR WORK ONLY WITH DHS AUTHORIZATION

2.Certification of report of birth issued by the Department of State (Forms

3.Original or certified copy of birth certificate issued by a State, county, municipal authority, or territory of the United States bearing an official seal

4.Native American tribal document

5.U.S. Citizen ID Card (Form

6.Identification Card for Use of Resident Citizen in the United States (Form

7.Employment authorization document issued by the Department of Homeland Security

Examples of many of these documents appear in Part 13 of the Handbook for Employers

Refer to the instructions for more information about acceptable receipts.

Form |

Page 3 of 3 |

Form |

Request for Taxpayer |

Give Form to the |

(Rev. November 2017) |

Identification Number and Certification |

requester. Do not |

Department of the Treasury |

▶ Go to www.irs.gov/FormW9 for instructions and the latest information. |

send to the IRS. |

Internal Revenue Service |

|

1Name (as shown on your income tax return). Name is required on this line; do not leave this line blank.

2Business name/disregarded entity name, if different from above

3. |

3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of the |

4 Exemptions (codes apply only to |

||||||||||||||||||||

page |

||||||||||||||||||||||

|

following seven boxes. |

|

|

|

|

|

|

|

|

|

certain entities, not individuals; see |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

instructions on page 3): |

|||||||||||

on |

|

Individual/sole proprietor or |

C Corporation |

S Corporation |

Partnership |

Trust/estate |

|

|

|

|

|

|

|

|

|

|

||||||

type.orPrint InstructionsSpecific |

|

|

|

|

|

|

|

|

|

|

Exempt payee code (if any) |

|||||||||||

|

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership) ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Note: Check the appropriate box in the line above for the tax classification of the |

Exemption from FATCA reporting |

|||||||||||||||||||

|

|

LLC if the LLC is classified as a |

code (if any) |

|

|

|

|

|

|

|||||||||||||

|

|

another LLC that is not disregarded from the owner for U.S. federal tax purposes. Otherwise, a |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

is disregarded from the owner should check the appropriate box for the tax classification of its owner. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Other (see instructions) ▶ |

|

|

|

|

|

|

|

|

|

(Applies to accounts maintained outside the U.S.) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

5 Address (number, street, and apt. or suite no.) See instructions. |

|

Requester’s name and address (optional) |

|||||||||||||||||||

See |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 City, state, and ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 List account number(s) here (optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Part |

I |

Taxpayer Identification Number (TIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid |

|

|

Social security number |

|

|

|

|

|

|

|||||||||||||

backup withholding. For individuals, this is generally your social security number (SSN). However, for a |

|

|

|

|

|

|

– |

|

|

– |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

entities, it is your employer identification number (EIN). If you do not have a number, see How to get a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

TIN, later. |

|

|

|

|

|

|

or |

|

|

|

|

|

|

|

|

|

|

|||||

Note: If the account is in more than one name, see the instructions for line 1. Also see What Name and |

|

|

Employer identification number |

|

||||||||||||||||||

Number To Give the Requester for guidelines on whose number to enter. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

–

Part II Certification

Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and

2.I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and

3.I am a U.S. citizen or other U.S. person (defined below); and

4.The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later.

Sign |

Signature of |

|

Here |

U.S. person ▶ |

Date ▶ |

General Instructions |

• Form |

|

|

||

Section references are to the Internal Revenue Code unless otherwise |

funds) |

|

• Form |

||

noted. |

||

proceeds) |

||

Future developments. For the latest information about developments |

||

• Form |

||

related to Form |

||

transactions by brokers) |

||

after they were published, go to www.irs.gov/FormW9. |

||

• Form |

||

Purpose of Form |

||

• Form |

||

An individual or entity (Form |

• Form 1098 (home mortgage interest), |

|

information return with the IRS must obtain your correct taxpayer |

||

• Form |

||

identification number (TIN) which may be your social security number |

||

(SSN), individual taxpayer identification number (ITIN), adoption |

• Form |

|

taxpayer identification number (ATIN), or employer identification number |

Use Form |

|

(EIN), to report on an information return the amount paid to you, or other |

||

alien), to provide your correct TIN. |

||

amount reportable on an information return. Examples of information |

||

If you do not return Form |

||

returns include, but are not limited to, the following. |

||

• Form |

be subject to backup withholding. See What is backup withholding, |

|

later. |

||

|

Cat. No. 10231X |

Form |

Form |

Page 2 |

By signing the

1.Certify that the TIN you are giving is correct (or you are waiting for a number to be issued),

2.Certify that you are not subject to backup withholding, or

3.Claim exemption from backup withholding if you are a U.S. exempt payee. If applicable, you are also certifying that as a U.S. person, your allocable share of any partnership income from a U.S. trade or business is not subject to the withholding tax on foreign partners' share of effectively connected income, and

4.Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. See What is FATCA reporting, later, for further information.

Note: If you are a U.S. person and a requester gives you a form other than Form

Definition of a U.S. person. For federal tax purposes, you are considered a U.S. person if you are:

•An individual who is a U.S. citizen or U.S. resident alien;

•A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States;

•An estate (other than a foreign estate); or

•A domestic trust (as defined in Regulations section

Special rules for partnerships. Partnerships that conduct a trade or business in the United States are generally required to pay a withholding tax under section 1446 on any foreign partners’ share of effectively connected taxable income from such business. Further, in certain cases where a Form

In the cases below, the following person must give Form

•In the case of a disregarded entity with a U.S. owner, the U.S. owner of the disregarded entity and not the entity;

•In the case of a grantor trust with a U.S. grantor or other U.S. owner, generally, the U.S. grantor or other U.S. owner of the grantor trust and not the trust; and

•In the case of a U.S. trust (other than a grantor trust), the U.S. trust (other than a grantor trust) and not the beneficiaries of the trust.

Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person, do not use Form

Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause.” Exceptions specified in the saving clause may permit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes.

If you are a U.S. resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from U.S. tax on certain types of income, you must attach a statement to Form

1.The treaty country. Generally, this must be the same treaty under which you claimed exemption from tax as a nonresident alien.

2.The treaty article addressing the income.

3.The article number (or location) in the tax treaty that contains the saving clause and its exceptions.

4.The type and amount of income that qualifies for the exemption from tax.

5.Sufficient facts to justify the exemption from tax under the terms of the treaty article.

Example. Article 20 of the

If you are a nonresident alien or a foreign entity, give the requester the appropriate completed Form

Backup Withholding

What is backup withholding? Persons making certain payments to you must under certain conditions withhold and pay to the IRS 28% of such payments. This is called “backup withholding.” Payments that may be subject to backup withholding include interest,

You will not be subject to backup withholding on payments you receive if you give the requester your correct TIN, make the proper certifications, and report all your taxable interest and dividends on your tax return.

Payments you receive will be subject to backup withholding if:

1.You do not furnish your TIN to the requester,

2.You do not certify your TIN when required (see the instructions for Part II for details),

3.The IRS tells the requester that you furnished an incorrect TIN,

4.The IRS tells you that you are subject to backup withholding

because you did not report all your interest and dividends on your tax return (for reportable interest and dividends only), or

5.You do not certify to the requester that you are not subject to backup withholding under 4 above (for reportable interest and dividend accounts opened after 1983 only).

Certain payees and payments are exempt from backup withholding. See Exempt payee code, later, and the separate Instructions for the Requester of Form

Also see Special rules for partnerships, earlier.

What is FATCA Reporting?

The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all United States account holders that are specified United States persons. Certain payees are exempt from FATCA reporting. See Exemption from FATCA reporting code, later, and the Instructions for the Requester of Form

Updating Your Information

You must provide updated information to any person to whom you claimed to be an exempt payee if you are no longer an exempt payee and anticipate receiving reportable payments in the future from this person. For example, you may need to provide updated information if you are a C corporation that elects to be an S corporation, or if you no longer are tax exempt. In addition, you must furnish a new Form

Penalties

Failure to furnish TIN. If you fail to furnish your correct TIN to a requester, you are subject to a penalty of $50 for each such failure unless your failure is due to reasonable cause and not to willful neglect.

Civil penalty for false information with respect to withholding. If you make a false statement with no reasonable basis that results in no backup withholding, you are subject to a $500 penalty.

Form |

Page 3 |

Criminal penalty for falsifying information. Willfully falsifying certifications or affirmations may subject you to criminal penalties including fines and/or imprisonment.

Misuse of TINs. If the requester discloses or uses TINs in violation of federal law, the requester may be subject to civil and criminal penalties.

Specific Instructions

Line 1

You must enter one of the following on this line; do not leave this line blank. The name should match the name on your tax return.

If this Form

a.Individual. Generally, enter the name shown on your tax return. If you have changed your last name without informing the Social Security Administration (SSA) of the name change, enter your first name, the last name as shown on your social security card, and your new last name.

Note: ITIN applicant: Enter your individual name as it was entered on your Form

b.Sole proprietor or

c.Partnership, LLC that is not a

d.Other entities. Enter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown on the charter or other legal document creating the entity. You may enter any business, trade, or DBA name on line 2.

e.Disregarded entity. For U.S. federal tax purposes, an entity that is disregarded as an entity separate from its owner is treated as a “disregarded entity.” See Regulations section

Line 2

If you have a business name, trade name, DBA name, or disregarded entity name, you may enter it on line 2.

Line 3

Check the appropriate box on line 3 for the U.S. federal tax classification of the person whose name is entered on line 1. Check only one box on line 3.

IF the entity/person on line 1 is |

THEN check the box for . . . |

|

a(n) . . . |

|

|

|

|

|

• |

Corporation |

Corporation |

• |

Individual |

Individual/sole proprietor or single- |

• |

Sole proprietorship, or |

member LLC |

• |

|

|

company (LLC) owned by an |

|

|

individual and disregarded for U.S. |

|

|

federal tax purposes. |

|

|

|

|

|

• |

LLC treated as a partnership for |

Limited liability company and enter |

U.S. federal tax purposes, |

the appropriate tax classification. |

|

• |

LLC that has filed Form 8832 or |

(P= Partnership; C= C corporation; |

2553 to be taxed as a corporation, |

or S= S corporation) |

|

or |

|

|

• |

LLC that is disregarded as an |

|

entity separate from its owner but |

|

|

the owner is another LLC that is |

|

|

not disregarded for U.S. federal tax |

|

|

purposes. |

|

|

|

|

|

• |

Partnership |

Partnership |

|

|

|

• |

Trust/estate |

Trust/estate |

|

|

|

Line 4, Exemptions

If you are exempt from backup withholding and/or FATCA reporting, enter in the appropriate space on line 4 any code(s) that may apply to you.

Exempt payee code.

•Generally, individuals (including sole proprietors) are not exempt from backup withholding.

•Except as provided below, corporations are exempt from backup withholding for certain payments, including interest and dividends.

•Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions.

•Corporations are not exempt from backup withholding with respect to attorneys’ fees or gross proceeds paid to attorneys, and corporations that provide medical or health care services are not exempt with respect to payments reportable on Form

The following codes identify payees that are exempt from backup withholding. Enter the appropriate code in the space in line 4.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Independent Contractor Application form is used to collect information needed to evaluate potential independent contractors for hiring purposes. |

| Anti-Discrimination Policy | The application specifies that contractors are considered without regard to race, color, religion, sex, national origin, age, disability, or any other prohibited discrimination basis under applicable state and federal law. |

| Disclosure of Taxes | Applicants must acknowledge their responsibility for federal and state income taxes, Social Security taxes, and self-employment taxes, and will receive a Form 1099 for services rendered. |

| Insurance Requirement | The form requires that contractors provide proof of liability and/or malpractice insurance, if applicable. |

| Eligibility Confirmation | Applicants must confirm their legal eligibility to work in the U.S. and disclose any prior contracting relationships with the organization. |

| Governing Laws | This form complies with federal and state regulations, including anti-discrimination laws and tax obligations. States may have specific laws applicable to contractor agreements. |

Guidelines on Utilizing Independent Contractor Application

Completing the Independent Contractor Application form is a straightforward process that involves providing personal information, describing professional experiences, and acknowledging certain conditions related to independent contractor status. Follow the steps outlined below carefully to ensure all necessary information is accurately captured.

- Begin by filling in the date you are submitting the application at the top of the form.

- In the section labeled Position(s) Applying For, list the specific roles or projects you are interested in.

- Under Background Information, enter your full name, address (including city, state, and zip code), phone number, fax number, and email address.

- Report the type of entity you are (individual, corporation, partnership) and provide a brief description of your primary business.

- If applicable, include your Standard Industrial Classification (SIC), Social Security Number (SSN) for individuals, or Employer Identification Number (EIN) for businesses.

- Check the boxes next to the Products/Services Offered that apply, including consulting or professional services, or other.

- Specify your anticipated rates and the number of hours you are available to work each week.

- Indicate the earliest date you can begin work.

- Provide Professional References by listing names, companies, positions, and contact information for at least three references.

- Under Previous Positions, outline your employment history, starting with your most recent job. Include company name, contact details, employment dates, rationale for leaving, and responsibilities.

- List your Existing Contractual Relationships with other companies, including obligations and industry type, along with effective dates and hours worked.

- Respond to the Additional Information questions regarding your work eligibility, previous contracting history, insurance coverage, and understanding of contractor responsibilities.

- Finally, sign and date the Signature/Certification section, acknowledging that the provided information is accurate and complete.

What You Should Know About This Form

What is the purpose of the Independent Contractor Application form?

The Independent Contractor Application form serves as a formal request for individuals looking to work as independent contractors. This form collects essential information, including the applicant's background, anticipated rates, and work eligibility. It helps the contracting organization assess potential candidates to ensure they are a suitable fit for available positions.

What kind of information do I need to provide on the application?

When filling out the application, you will need to provide your personal details, such as your name, address, and contact information. Additionally, you should describe your business or profession, including services offered and relevant experience. You will also specify your anticipated rates, availability, and any existing contractual relationships you may have. Professional references can help validate your qualifications, and proof of relevant insurance may also be required.

Are there requirements regarding my eligibility to work in the U.S.?

Yes, during the application process, you must indicate whether you are legally eligible to work in the United States. This verification is a crucial step, as independent contractors must comply with U.S. labor laws. If you are not eligible for work, this could affect your application negatively.

How does the application handle discrimination?

The application explicitly states that all applicants will be considered without regard to race, color, religion, sex, national origin, age, disability, or any other prohibited basis of discrimination. This commitment aligns with applicable state and federal laws, ensuring fairness in the hiring process.

What should I do if I have previous experience as an independent contractor?

If you have previously contracted with HHA or any other organization, disclose that information on the application. This experience can be beneficial in demonstrating your qualifications. If applicable, you may need to attach a previous contract application as a reference point for your work history.

Will I have to pay taxes as an independent contractor?

As an independent contractor, you are responsible for all state and federal income taxes, self-employment taxes, and payroll taxes. Unlike employees, independent contractors do not receive benefits such as unemployment insurance. Consequently, it’s essential to keep accurate records of earnings for proper tax filing, as you will receive a Form 1099 for services rendered.

What happens if I misrepresent my information on the application?

It is crucial to ensure that all information provided in the application is accurate and complete. Misrepresentations, whether intentional or not, can lead to immediate denial of your application or termination of a contract if you are already engaged. It’s always best to double-check your responses and provide truthful information to maintain your integrity and professionalism.

Common mistakes

When filling out the Independent Contractor Application form, individuals often make several common mistakes that can hinder the application process. The first mistake often involves incomplete information. Applicants may fail to provide essential details such as their full name, address, or contact information. This omission can delay the evaluation of their application and lead to unnecessary communication back and forth.

Another common error is in the description of business entities. Many applicants do not specify the correct type of entity they represent, such as an individual, corporation, or partnership. Providing inaccurate entity information can result in misunderstandings regarding the nature of their business and eligibility for certain contractual agreements.

Inaccurate or incomplete details in the background information section can also be detrimental. Applicants sometimes leave out their Social Security Number or Employer Identification Number, which are vital for verifying their identity and tax obligations. Inconsistent information can raise red flags and lead to questioning of their credibility.

Additionally, applicants frequently misjudge the anticipated rates they list. Providing a rate that is too high or too low may indicate a misunderstanding of industry standards. This could negatively impact their chances of being selected, as clients often look for reasonable rates consistent with market expectations.

The fifth mistake involves reference information. Not including complete contact details for professional references can hinder the verification process. Listing only a name without a means of contact can cause delays, as potential employers may struggle to reach out for validation of experience and reliability.

Another overlooked aspect is the additional information section. Some applicants fail to adequately address their eligibility for work in the U.S., misunderstand existing contractual relationships, or neglect to disclose prior experiences with the hiring organization. This lack of transparency can be problematic and may lead to disqualification.

Moreover, failing to sign the application form can render the entire submission invalid. Many applicants are so focused on ensuring they provide accurate data that they forget to complete the signature and certification section, which is critical for affirming the truthfulness of the information provided.

Lastly, applicants often do not pay attention to deadlines or fail to clearly indicate their availability to begin work. They might leave this section blank or provide vague answers. Precise availability information is essential for employers to determine if they can match the contractor's timeline with their project needs, and failure to provide it can impact hiring decisions.

Documents used along the form

When applying as an independent contractor, several other forms and documents may be required to complete the application process. Each of these documents plays a vital role in ensuring that all necessary information is collected accurately and thoroughly. Below is a list of common forms and their purposes.

- W-9 Form: This form is used to provide your taxpayer identification number to the hiring entity. It ensures that the contractor’s earnings are reported to the IRS accurately for tax purposes.

- Contract Agreement: This document outlines the terms and conditions of the work to be performed by the contractor. It specifies payment, duration, and the responsibilities of both parties.

- Proof of Insurance: Contractors may need to submit evidence of their liability and malpractice insurance. This protects both the contractor and the client from potential legal issues that could arise during the project.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information. If the contractor will be handling confidential data, this agreement ensures that they will not disclose any proprietary information to others.

- Resume or CV: A resume or curriculum vitae serves as a summary of the contractor’s professional experience and qualifications. Hiring entities review this to assess the contractor’s suitability for the position.

- Background Check Authorization: This document allows the hiring entity to conduct a background check on the contractor. It may include verifying employment history, education, and criminal history.

- Independent Contractor Tax Guide: This guide provides information on tax obligations specific to independent contractors. It helps individuals understand their responsibilities for income tax, self-employment tax, and other financial requirements.

Completing and submitting these documents alongside the Independent Contractor Application can facilitate a smoother application process. Ensure that all information is accurate and up to date, as this can impact your potential work agreements.

Similar forms

- Job Application Form: This document collects personal and professional information about a candidate applying for a job, similar to the Independent Contractor Application, but it typically focuses more on employment benefits and workplace policies.

- Vendor Application Form: Designed for businesses to assess potential vendors, this form gathers similar background information. Both forms seek details about the business structure and previous experiences that could impact the potential working relationship.

- Business License Application: This document requires detailed information about the applicant's business, akin to the contracting request section of the Independent Contractor Application, which gathers information about the services offered.

- Insurance Application Form: Like the Independent Contractor Application, the insurance application requires personal and business details. Specifically, both set out financial responsibilities and require proof of financial stability.

- Service Agreement: This document outlines the terms of engagement and similar to the Independent Contractor Application, it clarifies the scope of work and responsibilities of the service provider, indicating the mutual expectations of both parties.

- W-9 Form: The W-9 collects taxpayer information from independent contractors for tax purposes. Both documents require identification numbers like the SSN or EIN, affirming the contractual relationship.

- Reference Check Form: Often used to verify the qualifications of a candidate, this form requests information from previous employers. Both the reference check process and the independent contractor application emphasize past job performance as a predictor of future success.

Dos and Don'ts

Things You Should Do:

- Read the entire application carefully before starting to fill it out.

- Provide accurate and complete information in each section.

- Attach any required documents, such as proof of insurance or previous contracts, if applicable.

- Sign and date the application to certify the information you provided is true.

- Double-check your contact details to ensure you can be reached easily.

Things You Shouldn't Do:

- Do not leave any mandatory fields blank.

- Avoid providing false or misleading information.

- Do not forget to include required documentation, as this may delay processing.

- Do not rush through the application; take your time to ensure accuracy.

- Do not use incorrect names or titles for prior employers or references.

Misconceptions

Misconceptions about the Independent Contractor Application form can lead to confusion and challenges in the application process. Here are seven common misconceptions along with clarifications:

- Independent contractors are eligible for employee benefits. This application clearly states that independent contractors are not entitled to benefits such as workers' compensation or unemployment insurance unless they provide those themselves.

- The application form is for employment. The form explicitly states, "THIS IS NOT AN APPLICATION FOR EMPLOYMENT." It is for independent contractor agreements, meaning a different set of rules and benefits applies.

- All contractor applications are treated the same. Applications are considered on a case-by-case basis. Factors like previous experience and specific contract needs can influence the decision-making process.

- Liability insurance is optional. The form raises a critical point regarding liability insurance, indicating that proof of such insurance is required for contractors wishing to engage in business.

- There are no eligibility requirements. Applicants must confirm they are legally able to work in the U.S. If this is misrepresented, it could lead to serious consequences.

- Contractors do not need to pay taxes. The application makes it very clear that independent contractors are responsible for their own tax liabilities, including federal and state taxes.

- Previous contracts with HHA do not matter. If you have contracted before, the application requires you to disclose this. It may be relevant for your current application and could influence decisions.

By addressing these misconceptions, applicants can approach the Independent Contractor Application process with a clearer understanding, leading to smoother completion and submission.

Key takeaways

1. Understand the Purpose: The Independent Contractor Application is designed to provide essential information for evaluating potential independent contractors. It’s not a job application for traditional employment, so expectations around benefits and employment rights differ.

2. Provide Accurate Information: Complete all sections of the application truthfully. Misrepresentation can lead to denial of your application or termination if a contract is already in place.

3. Specify Your Position: Clearly indicate the position(s) you are applying for. This helps streamline the review process and ensures that your application is considered for the right opportunities.

4. List Relevant Experience: Include your most recent employment information first. Detail your previous positions, duties, and reasons for leaving to give reviewers a complete picture of your background.

5. Include Professional References: Provide references who can vouch for your expertise and work ethic. Include their contact information to facilitate easy communication.

6. Anticipate Questions on Legal Eligibility: Be prepared to answer questions regarding your eligibility to work in the U.S. and your contracting history with the organization. If asked, supply proof of insurance if applicable.

7. Clarify Financial Expectations: Clearly state your anticipated rates and the hours you are available to work. Transparency regarding financial matters is key to establishing a cooperative relationship.

8. Review the Contractual Obligations: Familiarize yourself with the responsibilities and obligations as an independent contractor. This includes tax liabilities and insurance requirements, which differ significantly from those of employees.

9. Sign with Care: When you complete the signature and certification section, ensure you truly understand the terms. This agreement outlines your status as an independent contractor and emphasizes your responsibility for taxes and liability insurance.

Browse Other Templates

Do You Have to Have a Front License Plate in Missouri - It must be submitted within 30 days of the loan date to protect the lienholder's rights.

Bunker Hill Community College Admissions - State your intentions clearly when submitting the voluntary statement.

Nj Family Care Login - Follow-up will occur within 1-2 weeks after submitting your application.