Fill Out Your Indiabulls Ventures Account Closer Form

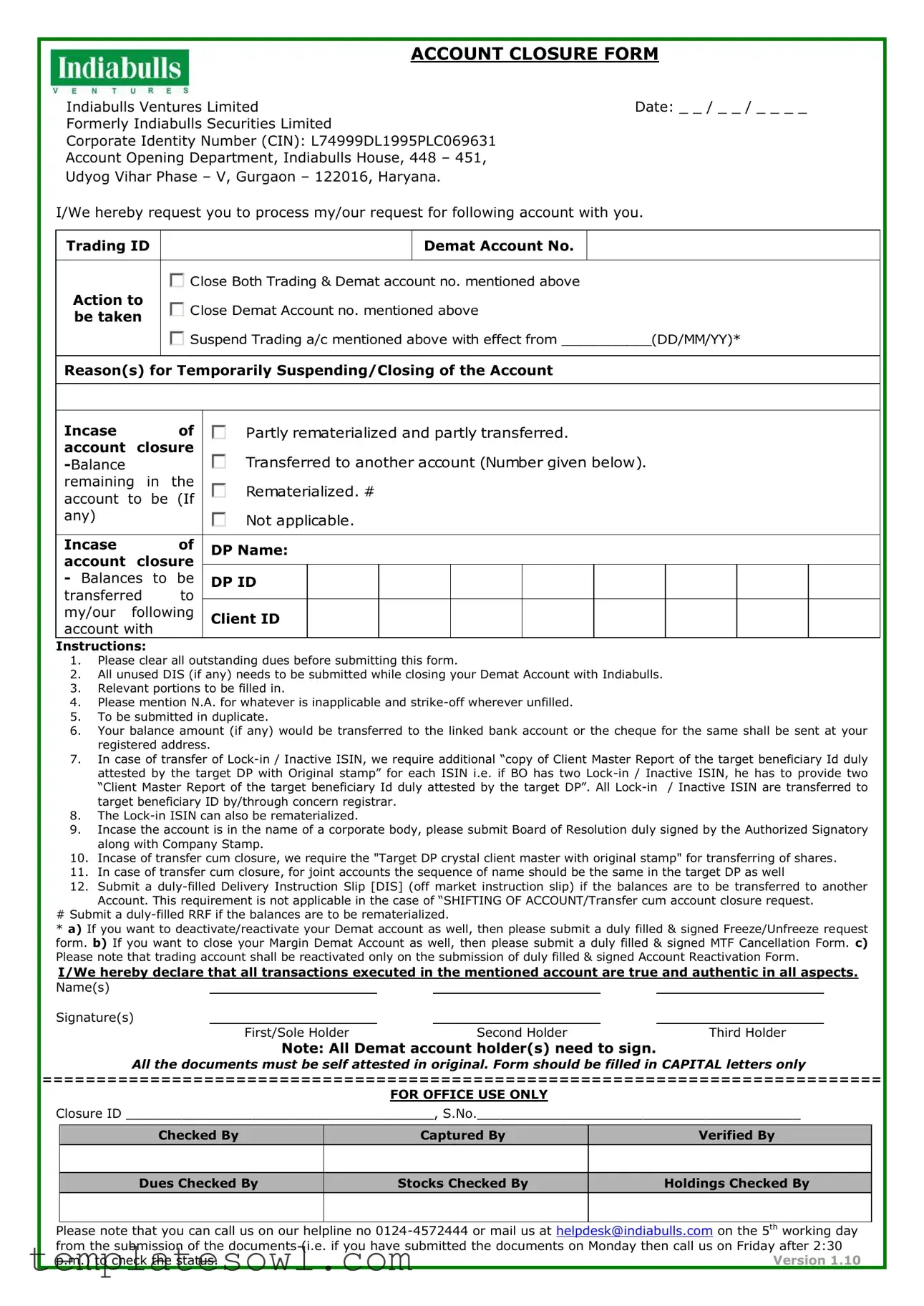

When closing an account with Indiabulls Ventures Limited, it is essential to complete the Indiabulls Ventures Account Closer form accurately and thoroughly. This form is designed to ensure that all necessary details are captured during the account closure process. Key elements include the individual's Trading ID and Demat Account Number, which help identify the specific accounts for closure. Customers can choose to close both accounts or just one, depending on their needs. It's also important to state the reason for the closure or temporary suspension of the trading account. Additionally, the form outlines vital instructions such as clearing outstanding dues and submitting any unused Delivery Instruction Slips (DIS). If balances exist, these will be transferred to the linked bank account or sent as a cheque to the registered address. The specifics may vary in cases involving joint accounts, corporate bodies, or transfers, which require additional documentation. Compliance with these guidelines will streamline the process and avoid unnecessary delays, highlighting the urgency of submitting complete and accurate information when requesting account closure.

Indiabulls Ventures Account Closer Example

|

ACCOUNT CLOSURE FORM |

Indiabulls Ventures Limited |

Date: _ _ / _ _ / _ _ _ _ |

Formerly Indiabulls Securities Limited

Corporate Identity Number (CIN): L74999DL1995PLC069631

Account Opening Department, Indiabulls House, 448 – 451,

Udyog Vihar Phase – V, Gurgaon – 122016, Haryana.

I/We hereby request you to process my/our request for following account with you.

Trading ID |

|

Demat Account No. |

|

|

|

|

|

|

|

|

Close Both Trading & Demat account no. mentioned above |

|||

Action to |

Close Demat Account no. mentioned above |

|||

be taken |

||||

|

|

|

||

|

Suspend Trading a/c mentioned above with effect from ___________(DD/MM/YY)* |

|||

|

|

|||

Reason(s) for Temporarily Suspending/Closing of the Account |

||||

Incase |

|

|

of |

Partly rematerialized and partly transferred. |

|||||||||

account |

closure |

|

|

|

|

|

|

|

|

|

|||

|

|

|

Transferred to another account (Number given below). |

||||||||||

remaining |

in |

the |

Rematerialized. # |

||||||||||

account |

to |

be |

(If |

||||||||||

|

|

|

|

|

|

|

|

|

|||||

any) |

|

|

|

Not applicable. |

|||||||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incase |

|

|

of |

DP Name: |

|||||||||

account |

closure |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||||

- Balances |

to |

be |

DP ID |

|

|

|

|

|

|

|

|

||

transferred |

|

to |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||

my/our |

following |

Client ID |

|

|

|

|

|

|

|

|

|||

account with |

|

|

|

|

|

|

|

|

|

|

|||

Instructions: |

|

|

|

|

|

|

|

|

|

|

|

||

1.Please clear all outstanding dues before submitting this form.

2.All unused DIS (if any) needs to be submitted while closing your Demat Account with Indiabulls.

3.Relevant portions to be filled in.

4.Please mention N.A. for whatever is inapplicable and

5.To be submitted in duplicate.

6.Your balance amount (if any) would be transferred to the linked bank account or the cheque for the same shall be sent at your registered address.

7.In case of transfer of

8.The

9.Incase the account is in the name of a corporate body, please submit Board of Resolution duly signed by the Authorized Signatory along with Company Stamp.

10.Incase of transfer cum closure, we require the "Target DP crystal client master with original stamp" for transferring of shares.

11.In case of transfer cum closure, for joint accounts the sequence of name should be the same in the target DP as well

12.Submit a

Account. This requirement is not applicable in the case of “SHIFTING OF ACCOUNT/Transfer cum account closure request.

#Submit a

*a) If you want to deactivate/reactivate your Demat account as well, then please submit a duly filled & signed Freeze/Unfreeze request form. b) If you want to close your Margin Demat Account as well, then please submit a duly filled & signed MTF Cancellation Form. c) Please note that trading account shall be reactivated only on the submission of duly filled & signed Account Reactivation Form.

I/We hereby declare that all transactions executed in the mentioned account are true and authentic in all aspects. Name(s)

Signature(s)

First/Sole Holder |

Second Holder |

Third Holder |

Note: All Demat account holder(s) need to sign.

All the documents must be self attested in original. Form should be filled in CAPITAL letters only

==============================================================================

FOR OFFICE USE ONLY

Closure ID _______________________________________, S.No._________________________________________

Checked By

Captured By

Verified By

Dues Checked By

Stocks Checked By

Holdings Checked By

Please note that you can call us on our helpline no

p.m.) to check the status. |

Version 1.10 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The form is titled "Indiabulls Ventures Account Closer Form". |

| Submission Date | Users must provide the date of submission in the format DD/MM/YYYY. |

| Corporate Identity Number | The Corporate Identity Number (CIN) is L74999DL1995PLC069631. |

| Address | The form must be sent to Indiabulls House, located in Gurgaon, Haryana. |

| Account Actions | Holders can request to close either the Trading account or both Trading and Demat accounts. |

| Outstanding Dues | All outstanding dues must be cleared prior to submitting the form. |

| Document Requirements | Documentation includes a duly filled Delivery Instruction Slip for transfers. |

| Signature Requirement | All Demat account holders need to sign the form. |

| Helpline Information | Users can call the helpline number at 0124-4572444 for status updates after 5 working days. |

Guidelines on Utilizing Indiabulls Ventures Account Closer

Filling out the Indiabulls Ventures Account Closer form is the necessary step before closing your trading and demat accounts. Make sure you have all your documents ready and follow these clear steps to complete the form accurately.

- Begin by entering the date at the top of the form in the format _ _ / _ _ / _ _ _ _.

- Fill in your Trading ID and Demat Account Number in the provided fields.

- Choose whether you want to close both the accounts or just the Demat account by checking the corresponding option.

- If suspending the trading account, specify the effective date in the format (DD/MM/YY).

- Indicate the reason for temporarily suspending or closing the account.

- If transferring any balances, list the new account number below.

- If you are closing due to a DP account closure, provide the DP Name and DP ID.

- Read the instructions carefully and ensure all outstanding dues are cleared before submission.

- Submit all unused DIS, if applicable.

- Fill in all relevant portions of the form and write "N.A." for anything that does not apply.

- Sign the form under the appropriate name sections for all account holders.

- Make sure the form is filled out in capital letters.

- Prepare two copies of the form to submit, as required.

- Keep in mind that documents must be self-attested.

- Lastly, confirm all details are correct before submitting the form to the address provided.

After completing the form, you can track the status of your closure request by contacting Indiabulls Ventures on their helpline or via email five working days after submitting your documents. Be sure to reach out after 2:30 p.m. for the most accurate updates.

What You Should Know About This Form

What is the Indiabulls Ventures Account Closer form?

The Indiabulls Ventures Account Closer form is a document that clients fill out when they wish to close their trading or demat accounts with Indiabulls Ventures Limited. It allows clients to formally request the closure of their accounts while ensuring that all necessary conditions are met. Various parts of the form must be filled out, which include the trading ID, demat account number, and reasons for closing the account. It helps streamline the process and ensures that all required information is captured.

What should I do before submitting the form?

Before you submit the Indiabulls Ventures Account Closer form, ensure all outstanding dues are cleared. This means paying off any fees or charges associated with your account. Additionally, if you have any unused Delivery Instruction Slips (DIS), they must be submitted alongside the closure form. Make sure to complete all required sections of the form and indicate anything that may not apply by writing "N.A." in those spaces. Finally, it’s essential to submit the form in duplicate.

How will my remaining balance be handled after account closure?

Once your account is closed, any remaining balance will be processed. It can either be transferred to your linked bank account or issued as a cheque, which will be sent to your registered address. It is important to ensure that your bank details are current and accurate to avoid any delays. If the account closure involves transferring shares, additional documentation may be required to ensure proper execution of the transfer.

What if my account is in the name of a corporate body?

If the account to be closed is under a corporate name, the process includes submitting a Board Resolution that has been signed by an authorized signatory. This document is necessary to confirm the closure request is approved by the relevant authorities within the corporation. Additionally, ensure that the company stamp is included on the resolution for it to be considered valid.

Common mistakes

Filling out the Indiabulls Ventures Account Closer form can be straightforward, but mistakes are common. One frequent error is incomplete information. Many individuals forget to fill in essential sections, such as the Trading ID or Demat Account number. Missing this information can hold up the process and lead to unnecessary frustration.

Another mistake often encountered is not adhering to formatting requirements. The form explicitly states that it needs to be filled in capital letters only. Writing in lower case or mixed case can result in confusion or rejection of the application. Ensure that all entries follow this rule for a smoother closure experience.

People may also overlook the requirement to clear all outstanding dues before submission. This step is crucial. If you have any unpaid fees, the closure request may be delayed or denied outright. It’s wise to double-check for any pending transactions before you send the form.

Many applicants misunderstand the need to submit unused Delivery Instruction Slips (DIS). This document is essential for closing your Demat Account. Failing to include it could complicate the process. Always include all unused DIS to avoid delays.

Submitting the form in an incorrect number of copies is a common error as well. The guidelines specify that the form should be submitted in duplicate. Omitting this step can cause setbacks. Make sure you have two completed copies ready for submission.

Finally, some individuals neglect to ensure that all signatures are present. Each Demat account holder needs to sign the form. If you’re submitting the form for a joint account, missing signatures will definitely lead to delays in processing. It is important to check all signatures before finalizing your submission.

Documents used along the form

The Indiabulls Ventures Account Closer form is essential for individuals wishing to close their trading or demat accounts. To ensure a smooth closure process, several additional documents may be required. Here is a brief overview of five documents often used in conjunction with the account closure request.

- Delivery Instruction Slip (DIS): This slip authorizes the withdrawal of funds or the transfer of securities to another account. It is crucial to fill this out if there are any balances that need to be transferred during the closure process.

- Client Master Report: A document that shows details of the account holder, including the Client ID and DP ID. If transferring shares, an attested copy of this report is needed from the target Depository Participant (DP).

- RRF (Rematerialization Request Form): If account holders wish to convert their electronic shares back into physical form, they must submit this form, along with the Account Closer form.

- Board Resolution: For corporate account holders, this document, signed by authorized signatories, is necessary. It confirms the decision of the corporate body to close the account.

- Freeze/Unfreeze Request Form: If deactivating or reactivating a demat account, this form must be filled out and submitted along with the Account C loser form.

Submitting these documents correctly helps facilitate the closure of your Indiabulls Ventures account. Ensuring each is accurately completed can prevent delays and complications in the process, making the transition smoother for all users.

Similar forms

- Account Transfer Request Form: This document is used to request the transfer of account ownership. Similar to the Indiabulls Ventures Account Closer form, it requires details of both the current account holder and the new account holder, as well as instructions on how to handle any existing balances.

- Account Reactivation Form: When an account has been temporarily closed, this form allows the account holder to request reactivation. It shares a common purpose with the Account Closer form, as both involve managing account statuses, though one reinstates the account while the other terminates it.

- Demat Account Closure Request: This specific request is made to close a Demat account, similar to the Indiabulls Ventures Account Closer form which covers both trading and Demat accounts. It typically requires information about holdings and the reason for closure.

- Margin Account Cancellation Form: Utilizing this form allows an account holder to request cancellation of their margin account. Like the Indiabulls form, it requires the account holder's identification information and signatures, and ensures all outstanding dues are addressed prior to closure.

Dos and Don'ts

- Do: Clear all outstanding dues before submitting the form.

- Do: Submit all unused Delivery Instruction Slips (DIS) when closing your Demat Account.

- Don't: Leave any relevant portions unfilled; ensure all applicable sections are completed.

- Don't: Forget to submit the form in duplicate, as required.

Misconceptions

Here are seven common misconceptions about the Indiabulls Ventures Account Closer form, along with clarifications for each:

- Account closure is instantaneous. Many believe that once the form is submitted, the account will close immediately. In reality, processing can take some time, and it is essential to wait for the confirmation from Indiabulls Ventures.

- All account holders need to be present to close the account. It is a common thought that all signatories must be physically present. However, as long as all required signatures are on the form, the closure can be processed without everyone being there.

- You can ignore outstanding dues. Some mistakenly think they can close their account without settling any outstanding dues. In fact, all dues must be cleared prior to submission for processing.

- Fees are not applicable during account closure. Many assume that there are no fees involved in closing an account. However, be aware that certain fees or charges might still apply, depending on the account specifics.

- You do not need to submit unused DIS. A misconception exists that unused Delivery Instruction Slips (DIS) can be left out when closing an account. It is actually a requirement to submit all unused DIS along with the closure form.

- Transferring shares is easy and does not require extra documentation. Some believe that transferring shares to another account is straightforward. Unfortunately, additional documentation may be required, especially for Lock-in or Inactive ISINs.

- The closure process is the same for all account types. It is often assumed that the procedure for closing trading accounts and demat accounts is identical. However, there are specific steps and requirements that differ between these types of accounts.

Key takeaways

Filling out the Indiabulls Ventures Account Closure form requires attention to detail. Here are some key takeaways to ensure a smooth process:

- Clear Outstanding Dues: Before submitting the form, it is essential to settle any outstanding dues associated with your account.

- Complete Required Sections: Fill in all relevant portions of the form. If certain sections do not apply to your situation, simply write "N.A." and strike off any unfilled areas.

- Submission Requirements: Remember to submit the form in duplicate. This means you should prepare two copies of your completed form.

- Signature Mandate: All Demat account holders must sign the form. Make sure to provide signatures for all individuals listed on the account.

- Documentation for Special Cases: If your account is linked to a corporate body or involves transfers, additional documents like a Board Resolution or Client Master Report may be necessary. Ensure you have these ready.

Following these takeaways will help mitigate delays and facilitate the closure of your Indiabulls Ventures account effectively.

Browse Other Templates

Colorado W4 - It is available online through the Colorado Department of Revenue's website.

Itr 1 or Itr 2 - This form serves as an official request, so the information provided must be truthful.

Dd2765 - This identification can be a vital tool for dependents seeking assistance or resources.