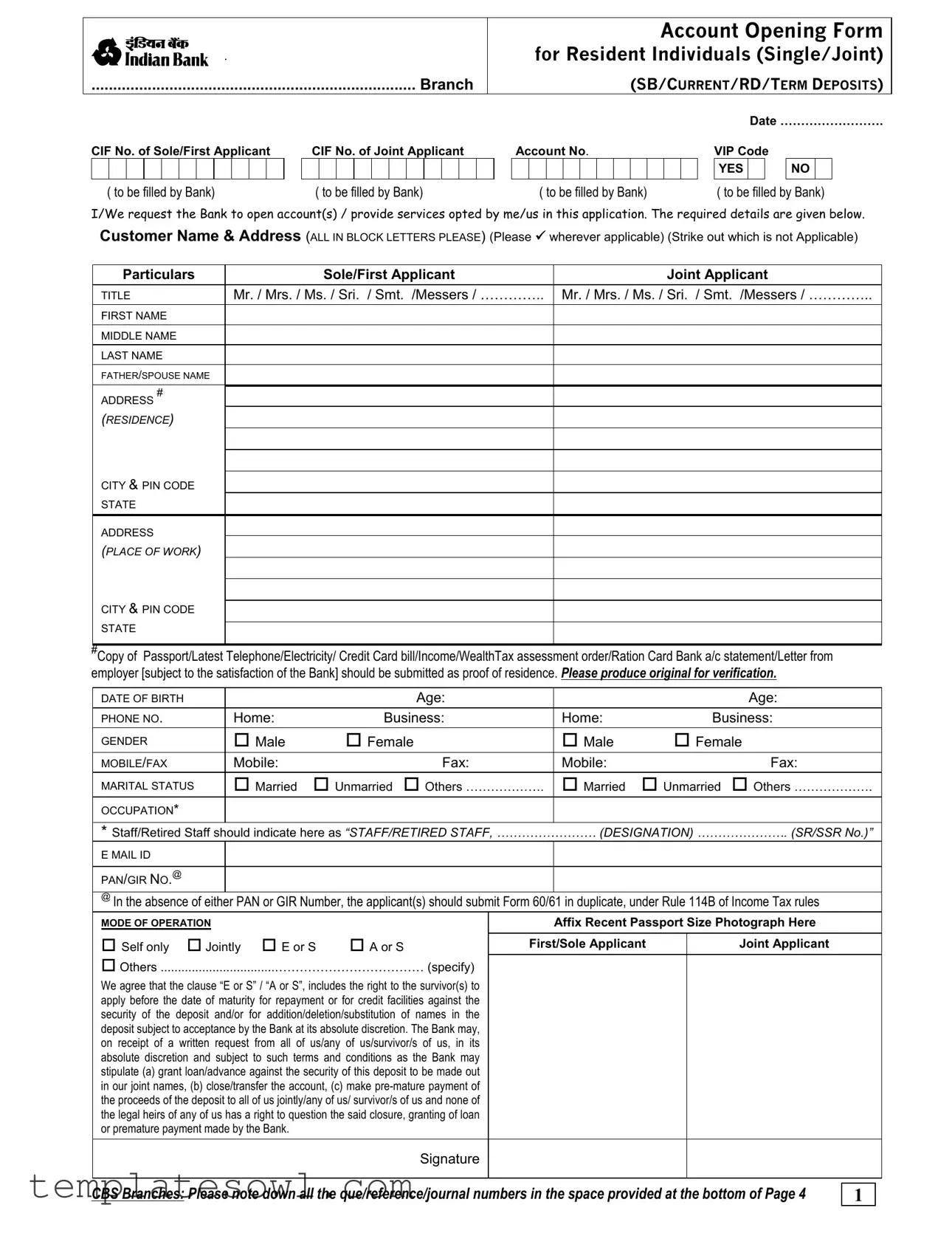

Fill Out Your Indian Bank Account Opening Form

The Indian Bank Account Opening Form serves as a comprehensive document for individuals looking to establish a new account with the institution, whether it be for savings, current, recurring, or term deposits. This form captures essential personal details, such as names, addresses, dates of birth, and contact information, ensuring accurate identification and communication between the bank and its customers. Applicants need to specify their type of account, along with any additional services they wish to opt for, like internet banking, debit cards, or mobile banking. A crucial aspect of this form is the requirement for proof of identity and residence, where applicants must provide documentation that may include government-issued IDs or recent utility bills. Additionally, this form addresses the operations allowed within joint accounts, stipulating how funds may be accessed or managed, particularly in instances of death or incapacity. Furthermore, it includes sections for nominee details, ensuring that account holders can designate individuals who will inherit the funds in the event of their passing. Each applicant must acknowledge the bank’s terms and conditions, thereby establishing a mutual understanding of the rights and responsibilities involved in managing their accounts. Overall, the form encapsulates both the administrative and customer service functions of the bank, enabling a structured and secure account opening process.

Indian Bank Account Opening Example

A.

........................................................................... Branch

Account Opening Form

for Resident Individuals (Single/Joint)

(SB/CURRENT/RD/TERM DEPOSITS)

Date …………………….

CIF No. of Sole/First Applicant |

|

CIF No. of Joint Applicant |

|

Account No. |

|

VIP Code |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO

( to be filled by Bank) |

( to be filled by Bank) |

( to be filled by Bank) |

( to be filled by Bank) |

I/We request the Bank to open account(s) / provide services opted by me/us in this application. The required details are given below.

CuStomer Name & Address (ALL IN BLOCK LETTERS PLEASE) (Please |

wherever applicable) (Strike out which is not Applicable) |

||

|

|

|

|

Particulars |

Sole/First Applicant |

|

Joint Applicant |

|

|

|

|

TITLE |

Mr. / Mrs. / Ms. / Sri. / Smt. /Messers / ………….. |

|

Mr. / Mrs. / Ms. / Sri. / Smt. /Messers / ………….. |

|

|

|

|

FIRST NAME |

|

|

|

|

|

|

|

MIDDLE NAME |

|

|

|

|

|

|

|

LAST NAME |

|

|

|

|

|

|

|

FATHER/SPOUSE NAME |

|

|

|

|

|

|

|

ADDRESS # |

|

|

|

(RESIDENCE) |

|

|

|

CITY & PIN CODE |

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

|

|

|

|

ADDRESS |

|

|

|

(PLACE OF WORK) |

|

|

|

CITY & PIN CODE |

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

|

|

|

|

|

|

|

|

#Copy of Passport/Latest Telephone/Electricity/ Credit Card bill/Income/WealthTax assessment order/Ration Card Bank a/c statement/Letter from employer [subject to the satisfaction of the Bank] should be submitted as proof of residence. Please produce original for verification.

DATE OF BIRTH |

|

Age: |

|

Age: |

|

|

|

|

|

PHONE NO. |

Home: |

Business: |

Home: |

Business: |

|

|

|

|

|

GENDER |

Male |

Female |

Male |

Female |

MOBILE/FAX |

Mobile: |

Fax: |

Mobile: |

Fax: |

MARITAL STATUS |

Married |

Unmarried Others ………………. |

Married |

Unmarried Others ………………. |

OCCUPATION* |

|

|

|

|

|

|

|

|

|

* Staff/Retired Staff should indicate here as “STAFF/RETIRED STAFF, …………………… (DESIGNATION) …………………. (SR/SSR No.)”

E MAIL ID

PAN/GIR NO.@

@ In the absence of either PAN or GIR Number, the applicant(s) should submit Form 60/61 in duplicate, under Rule 114B of Income Tax rules

MODE OF OPERATION |

|

Affix Recent Passport Size Photograph Here |

|

Self only Jointly E or S |

A or S |

|

|

First/Sole Applicant |

Joint Applicant |

||

Others .................................……………………………… (specify)

We agree that the clause “E or S” / “A or S”, includes the right to the survivor(s) to apply before the date of maturity for repayment or for credit facilities against the security of the deposit and/or for addition/deletion/substitution of names in the deposit subject to acceptance by the Bank at its absolute discretion. The Bank may, on receipt of a written request from all of us/any of us/survivor/s of us, in its absolute discretion and subject to such terms and conditions as the Bank may stipulate (a) grant loan/advance against the security of this deposit to be made out in our joint names, (b) close/transfer the account, (c) make

Signature

CBS Branches: Please note down all the que/reference/journal numbers in the space provided at the bottom of Page 4

1

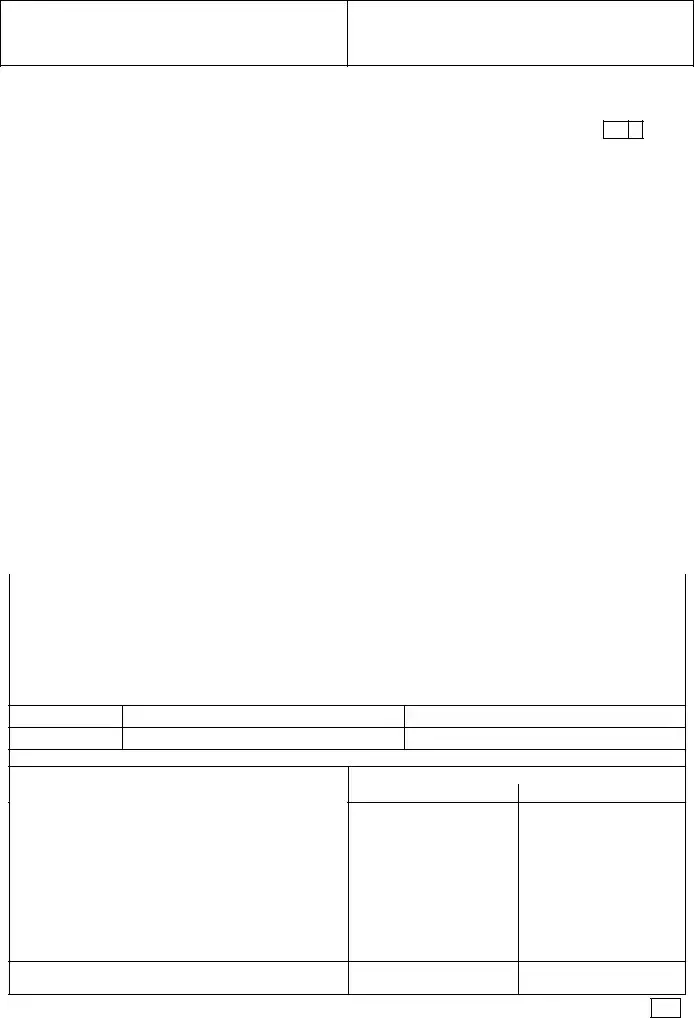

Account No.

BAccount Opening Form – for Individuals For SB/Current/RD/Term Deposits

Customer Identification Details (Please refer to page 3 for the list of documents of identification)

Particulars |

|

Sole/First Applicant |

|

Joint Applicant |

|

|

|

|

|

|

|

FIRST ID – TYPE |

|

|

|

|

|

|

|

|

|

|

|

ID ISSUED AT |

|

|

|

|

|

|

|

|

|

|

|

ID NUMBER & DATE |

No. |

Date: |

|

No. |

Date: |

SECOND ID – TYPE |

|

|

|

|

|

|

|

|

|

|

|

ID ISSUED AT |

|

|

|

|

|

|

|

|

|

|

|

ID NUMBER & DATE |

No. |

Date: |

|

No. |

Date: |

Account Type / Products / Services (Please |

wherever applicable) (Strike out which is not Applicable) |

||||

SAVINGS BANK

Without Cheque Book

With Cheque Book

Initial Amount Rs.

Scheme: PAFA Health Plus

Scheme: PAFA Health Plus

Others |

(specify) |

Please issue me/us a cheque book

TERM DEPOSIT

Fixed Deposit Re Investment Plan

Others |

|

|

|

|

|

|

|

|

(specify) |

||

Amount Rs. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period: |

Years/ |

|

Months/ |

|

|

Days |

|||||

CURRENT ACCOUNT Individuals (Single/Joint) only

Scheme: Advantage A/c

Others |

....................................... (specify) |

Please issue me/us a cheque book |

|

containing |

............ leaves |

RECURRING DEPOSIT Scheme : Variable RD Special RD |

Others |

(specify) |

Period

Months |

Monthly Instalment Rs |

PRODUCTS/SERVICES - Please ( ) (Available at select Centres/Branches – Terms & Conditions can be obtained from Branch Manager)

Internet Banking ATM Card Telebanking |

Mobile Banking |

Debit/Maestro Card IndBank Billpay |

Any Branch Banking through Multicity Cheque |

Others (Specify) .....………… |

|

Senior Citizens (completed 60 years of age): Please provide copy of Secondary School Leaving Certificate/LIC Policy/Voter’s Identity Card/Pension Payment Order/Birth Certificate issued by the competent authority/Passport/Any other relevant document providing proof for age.

Declaration for Minor (In case * first/ * joint applicant is a Minor)

I declare that the minor |

(name) is my |

(relation) and I am his/her *natural and lawful guardian / * |

|

guardian appointed in terms of Court’s order dated |

(copy attached). I shall represent the said minor in all future transactions of any |

||

description in respect to the above deposit account until the said minor attains majority. I certify that the minor was born on |

(date). I |

||

shall indemnify the Bank against the claim of above minor for any withdrawal/transaction made by me in his/her account. |

|

||

Name of Guardian |

Signature |

|

|

Operating Instructions for Joint SB/Current Accounts: We request and authorise you , until any one of us shall give you notice in writing to

the contrary, to honour all cheques or other orders drawn or Bills of Exchange accepted or notes made on our behalf signed by 1) ....................

........................................................ 2) |

of us jointly and/or severally and to debit such |

|

cheques to our account with you, whether such account be |

for the time being in credit or overdrawn. We also request you to accept the |

|

endorsement by 1) |

2) |

.................................................................................... of us jointly and/or |

severally on cheques, orders, bills or notes payable to us. We shall be jointly and severally liable to you for any monies owing to you from time to time in case the account is overdrawn and debit balance is caused including your commission, interest at the appropriate rate and other incidental charges. In the event of death, insolvency or withdrawal of any of us, the survivor/s of us shall have full control of any monies then and thereafter standing to our credit in our account with you, and in that event the survivor/s will have full powers to operate the account and/ or to close the account.

Interest on FD: Please credit the interest payable every

RIP/Cash Certificate Deposit: I/We understand that the interest earned every quarter will be reinvested in the RIP/Cash Certificate a/c until maturity date as provided in the scheme.

SWAP: I/We authorise you to transfer amounts in excess of Rs |

in my/our SB/Current account No |

|

on any day into a fixed deposit of |

days tenor in units of Rs…………. I/We further authorise that inadequacy of funds in my/our |

|

SB/current account referred above is met any time by prematurely breaking the fixed deposit in units of Rs.1000 and transferring the required amount into the said SB/current account.

Recurring Deposit: Please debit my/our SB/Current account No. |

............................... with Rs |

every month on …………………(date) |

and credit to my RD / Variable RD account No |

towards the periodical installments upto ……………………. (date) |

|

Variable Deposit: I/We hereby declare that the core deposit for my/our variable deposit account is Rs |

and I/We hereby agree that |

|

the maximum amount of instalment paid in my/our account shall not exceed 10 times of core deposit or Rs.10,000 whichever is less. Due Date Notice: Please *send / *do not send due date notice to my/our above address. (* strikeout which is not applicable)

Auto Renewal for Term Deposits: Unless the Bank receives a demand for payment or instructions to the contrary from me/us on or before the date of maturity, please renew/continue to renew the deposit *including/ *excluding interest at the Bank’s discretion for similar period, subject to a maximum of one year, under the same scheme, at the then prevailing rate of interest, without insisting on production of the deposit receipt.

Tax Deduction at Source: Form No.15G/15H for exemption from TDS is enclosed.(for applicant seeking exemption from TDS)

In the event of my/our seeking

term deposits/RD prevailing on the date of my/our request for such

2

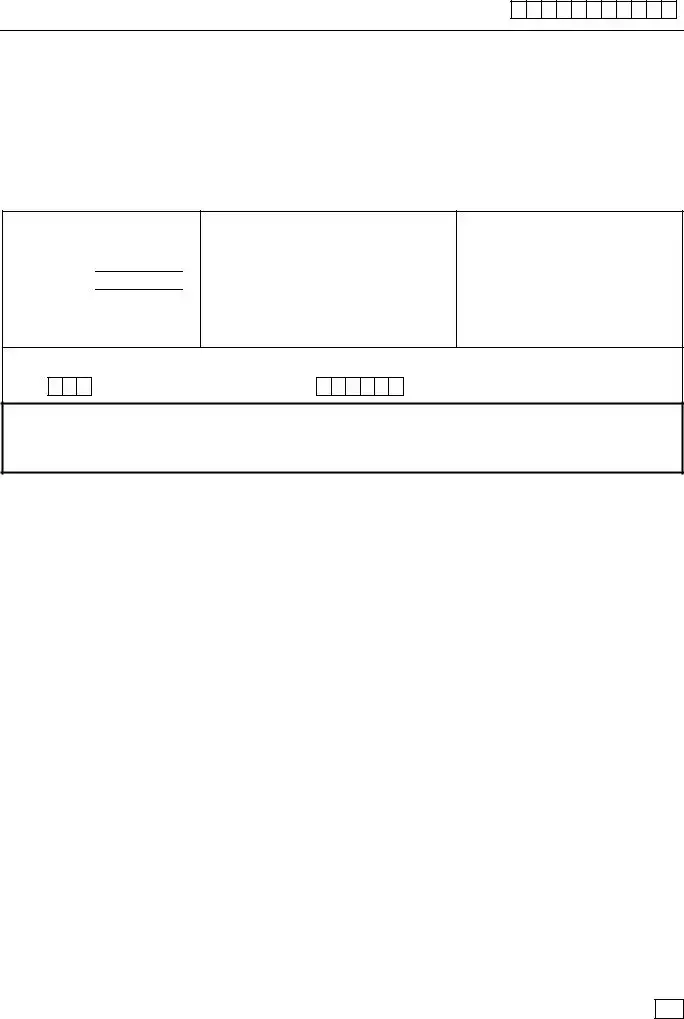

Account No.

BAccount Opening Form – for Individuals For SB/Current/RD/Term Deposits

For Current Accounts (Individuals only)

i.* At present I/We do not enjoy any credit facility with any bank/branch. I/We undertake to inform you as and when credit facilities are availed by me/us with other bank(s)/branch(es) of your bank

ii.* At present, I am/We are having account with the following other bank(s)/branch(es)and enjoying facilities

Name of the Bank/Branch

Nature of Facility

Limit Sanctioned

Balance outstanding

Securities

(* strikeout which is not applicable)

Staff: I/We declare that the monies deposited or which may from time to time be deposited hereafter into above mentioned account in my/our name(s) belong to me/us.

Nomination: Nomination is required for this account/deposit as per details given in Form DA 1 (enclosed) Nomination is not required

I/We have read the terms and conditions for providing the products/services opted by me/us and I/we agree to abide by and be bound by them as they are in force now and from time to time in force for such products/ facilities. I/We request you to provide me/us the initital password/ PIN which I/we shall change periodically for maintaining secrecy of my/our account level information. I/We undertake to keep my password/ PIN with myself/ourselves without giving any room for disclosure of the same to any third party. Further, I/we shall be responsible for any disclosure of my/our password/PIN to any third party and the Bank shall not be held responsible for any loss/ damage caused to me/us on account of such disclosures. I/We shall be availing this product/service at my/our request without any liability, either expressed or implied , to the Bank. I/We have read/understood the Bank’s rules pertaining to the account/deposit scheme opted by me/us and the terms & conditions governing the same. I/We agree to comply with and be bound by them as they are in force and from time to time in force for such accounts/ deposits/ products/services. The Bank may use the details furnished above for opening any other account for me/us in future with the Bank

Yours faithfully |

Signature of Sole/ First Applicant |

|

Signature of Joint Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Particulars of Introduction / Identification (Provide A or B or C)

A.If the applicant(s) is/are already a customer of the branch,

Nature/Type of account |

Account Number |

Customer ID/PIN |

Sole/First Applicant |

.......................................... |

.......................................... |

Second Applicant |

.......................................... |

.......................................... |

B.Introduction from an existing account holder of the branch

Name of the Introducer |

Type of account and a/c No |

........................................................... |

|

Address of the introducer |

|

||

..................................................................... |

PIN CODE |

Phone No |

Account held since |

I hereby introduce the above named applicant(s) and certify that I know Mr/Ms |

|||

for the past |

months/years and confirm his/her |

occupation and address as stated in |

this application. I also attest his/her |

signature(s). |

|

|

|

.......................................................................

Signature of the Introducer

Signature of the introducer verified by me.

Signature of the verifying Official .................................................................

Name of the verifying officer with SS No. ............................................................

C. |

i. Copy of the Passport alone where the address on the passport is the same as the address on the account |

|

|

opening form |

(OR) |

ii.Any one document from each of the

List I (latest/recent) |

First appl. |

Jt. applcnt |

List II (latest/recent) |

First appl. |

Jt. applcnt |

||

1. |

Passport where the address differs |

|

|

1. |

Telephone Bill |

|

|

2. |

Voter’s Identity Card |

|

|

2. |

Bank Account Statement |

|

|

3. |

PAN Card |

|

|

3. |

Income/Wealth tax assessment order |

|

|

4. |

Driving Licence |

|

|

4. |

Credit Card Statement |

|

|

5. |

Govt. /Defence ID card |

|

|

5. |

Electricity Bill |

|

|

6. |

ID cards of reputed employers |

|

|

6. |

Ration Card |

|

|

7. |

* Letter from a recognised public authority or Public |

|

|

7. |

* Letter from Employer |

|

|

servant verifying the identity and residence of the applicant

*subject to the Bank’s satisfaction

3

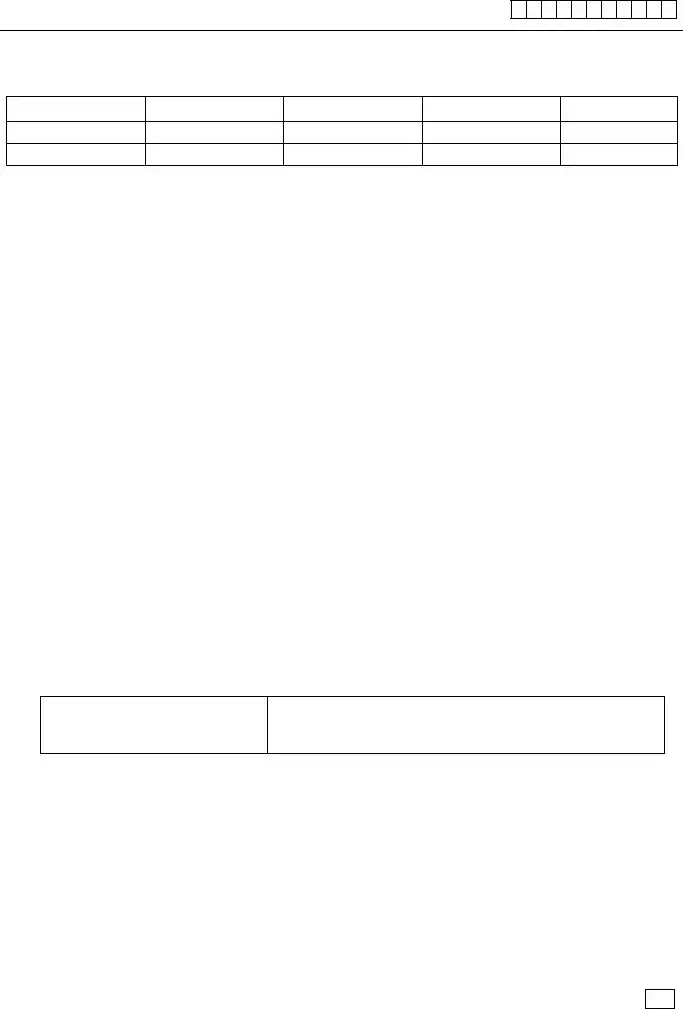

Account No.

BAccount Opening Form – for Individuals For SB/Current/RD/Term Deposits

FOR BANK’S USE

1.Applicant(s) interviewed and the purpose of opening a/c as ascertained is .............................................................................

…………………………………………………………….

2.Introducer called at the branch and interviewed (or) Introducer did not call at the branch but confirmation obtained by

............................. ............................................... (mode of confirmation) / Particulars of identification verified with the

originals and copies obtained

Signature of the official .................................................................... Name and SS No. ..........................................................

3. Authorisation for Account Opening

Eligible for Internet Banking ATM Card Telebanking Mobile Banking Debit/Maestro Card Multicity Cheque Others ……………………………………………………………….. (specify)

Account may be opened |

Signature of BM/ ABM/ |

|

Authorised Signatory |

Cheque Book may be / need not be issued |

Name and SS No. …………………………………… |

Date: ..............................

4. Account opened on ……………………… (Date) in the system by |

First Applicant CIF No. |

Second Applicant CIF No. |

|

|

|

Mr/Ms………………… ……………………………………(Name of staff). |

|

|

|

|

|

5.Verified the opening of the account in the system. Letter of thanks sent to the customer on ………………… and to introducer on ………………………

6.Acknowledgement received from customer on …………………………. and from introducer on …………………………….

7.Passbook/TDR/ STD Receipt No. ……………………………. delivered to the customer on …………………………

8.The specimen signature(s) of the applicant/s was scanned and linked to the account by……………………………………….. (staff name). Verified the scanning of the specimen signature(s) and linking to the account.

9. |

Nomination details entered in the system/ nomination register on |

vide Registration No |

10.ATM/Debit/Maestro Card No.....................................…………............... / Internet Banking/Telebanking ID despatched on

...................................... (if sent subsequent to date of opening, to be filled in immediately after despatch)

Risk Classification and Fixing of Threshold Limit (Refer HO: O&M Division Circular on KYC -

11.Potential activity expected in the Account (Monthly/ Annual turnover) Rs.

12.Source(s) of Funds:

13. |

Annual Income Rs……………………………. |

The threshold limit is fixed at Rs. ………………………………….. |

||

14. |

Risk Classification |

Low |

Medium |

High |

15. |

Reasons for risk classification made: |

|

|

|

Signature of the official |

Name and SS No |

Date: …………………………… |

|

Space for Noting the que/reference/journal numbers in CBS branches

4

A

................................................................................................ BRANCH

NOMINATION FORM - DA 1

Note: (i). Only one person can be appointed as nominee (ii). Where deposit is made in the name of a minor, the nomination should be signed by a person lawfully entitled to act on behalf of the minor (iii). If the applicant(s) is/are illiterate, his/her thumb impression(s) shall be attested by two witnesses.

I/We..........................................................................................................................................................................................................................

..................................................................................................................................................................................... [Name(s) and Address(es)]

nominate the following person to whom in the event of my/our/minor’s death, the amount of Savings Banks/ Term Deposit/ Current Account

(Individuals & Sole Proprietor only) may be returned by Indian Bank |

Branch. |

Please * mention / * do not mention the nominee’s name in the passbook/deposit receipt/acknowledgement (* strikeout which is not applicable)

Nominee Particulars

Name and Address

Relationship with

depositor if any

Age

If minor $

date of birth

Deposit Particulars

Type / Scheme |

Account / Receipt No. |

Date |

|

|

|

|

|

|

Amount

Maturity Date

$As the nominee is a minor on this date, I/We appoint Mr/Ms.. ..............................................................................................................................

....................................................................................................................................................................................... (Name, Address and age)

to receive the amount in the account on behalf of the nominee in the event of my/our/minor’s death during the minority of the nominee. |

|||

(Delete this para if the nominee is not a minor) |

|

|

1 |

Place : |

|

|

2 |

Date : |

|

|

Signature / @Thumb impression of the Depositor/s |

@ Witnesses for Thumb Impression(s) |

|

|

|

1. Signature : |

|

2. Signature |

: |

Name : |

|

Name : |

|

Address : |

|

Address : |

|

Place : |

Date : |

Place : |

Date : |

Nomination accepted and registered vide Registration. No.............................

dated |

and details noted in the Nomination Register |

..................................................................................

Signature of Asst. Manager/Manager

|

||||

|

Acknowledgement (To be returned to the depositor) |

|

|

|

|

|

|

|

|

Name and Address of the depositor |

|

Name of the Nominee ( fill up only if opted for ) |

Regn. No. |

Registered on |

|

|

|

|

|

|

|

|

|

|

For Indian Bank

SB/CA/TDR a/c No |

Asst. Manager / Manager |

Branch Seal |

5

Form Characteristics

| Fact Name | Details |

|---|---|

| Applicant Types | The form accommodates both single and joint account applicants. |

| Identification Requirements | Applicants must present proofs of identity and residence as specified in the guidelines. |

| Account Types | Options include Savings Bank, Current, Recurring Deposits, and Term Deposits. |

| Governing Laws | Account opening is subject to the regulations outlined by the Reserve Bank of India. |

| Nomination Facility | Nomination can be availed, enabling a designated person to claim the account balance in case of the depositor's death. |

Guidelines on Utilizing Indian Bank Account Opening

Filling out the Indian Bank Account Opening form is a crucial first step in establishing your banking relationship. This document captures your personal information and sets the terms for your account. Take your time to ensure accuracy, as this will streamline your account setup process.

- Enter the date at the top of the form.

- Provide your CIF (Customer Identification File) numbers for both the sole/first applicant and the joint applicant, if applicable.

- Indicate the account type you wish to open by marking the appropriate box.

- Fill in your name and address in block letters. Include your title, first name, middle name, last name, and father's or spouse's name.

- List your residential address, city, pin code, and state. Also, provide a work address if applicable.

- Submit the required proof of residence, like a utility bill or bank statement, by attaching a copy.

- State the date of birth for all applicants and their ages.

- Include contact details, including phone numbers and mobile numbers, for both home and business.

- Select gender and marital status options for both applicants.

- Provide occupation details, if necessary, and include your email ID and PAN/GIR number.

- Choose the mode of operation for the account and attach recent passport-sized photographs as required.

- List any desired additional products or services, like Internet Banking or ATM cards.

- Provide identification details for both the sole applicant and joint applicant, including types of identification and issue dates.

- If applicable, fill out details regarding other bank accounts and credit facilities you currently hold.

- Complete the nomination section if you wish to designate a nominee for the account.

- Review the form for any errors or missing information before signing at the bottom.

What You Should Know About This Form

What is the purpose of the Indian Bank Account Opening form?

The Indian Bank Account Opening form is used to request the opening of various types of accounts, including savings, current, recurring deposit, and term deposit accounts. This form collects essential information about the individual or individuals wishing to open the account, facilitating the bank's verification process.

What documents do I need to submit with the application?

To successfully open an account, you need to provide proof of identity and residence. Acceptable documents include a passport, voter’s ID, utility bills, bank statements, or any other recognized identification. Ensure you have original documents for verification, as copies will not suffice.

Can both joint applicants sign the form?

Yes, if you are applying for a joint account, both applicants must sign the form. Each applicant should also provide their identification details. The signatures authorize the bank to process requests related to the account.

Is there an age requirement for account holders?

Yes, account holders must be at least 18 years old. However, minors can have accounts under the guardianship of a natural or a legally appointed guardian, who must complete a declaration on the form.

What should I do if I do not have a PAN or GIR number?

If you do not possess a PAN or GIR number, you must submit Form 60 or Form 61 in duplicate, according to the Income Tax rules. This is vital for tax identification purposes and ensures compliance with financial regulations.

How can I specify the mode of operation for my account?

The account opening form includes a section where you can choose the mode of operation. Options include 'Self only', 'Jointly', 'Either or Survivor', and 'Any or Survivor'. Indicate your preferred arrangement clearly on the form to avoid any confusion.

What are the options for account types offered?

Various account types are available, including Savings Bank, Current Account, Recurring Deposit, and Term Deposit. Each type may have additional schemes or conditions, so ensure you select the one that meets your needs properly.

What happens if I want to withdraw or close my account before maturity?

Should you wish to withdraw or close your account before maturity, there may be penalties or specific terms related to pre-closure as stated by the bank. Review these terms carefully when completing the form to understand potential ramifications.

Can I apply for internet banking and debit card services on the form?

Yes, the application form has options to apply for internet banking and debit card services among other offerings. Make sure to check the relevant boxes to indicate your preferences, and the bank will process these requests as part of your account setup.

Who can offer an introduction for my account opening?

An introduction can be provided by an existing customer of the bank or through appropriate identification documents. The form includes a section for an introducer’s details if applicable. Ensure your introducer is willing to confirm your identity and relationship.

Common mistakes

When filling out the Indian Bank Account Opening form, individuals often encounter several common pitfalls that can lead to delays or even rejections. One frequent mistake is omitting required identification documents. Applicants must submit valid proof of identity and residency, such as a passport or utility bill; failing to include these documents can halt the application process.

Another common error involves improper completion of personal details. For instance, applicants often forget to fill in important fields like the date of birth or gender. Such omissions can cause confusion and may require the applicant to start over, wasting time and effort.

Inaccurate entries in the contact information section frequently occur as well. Applicants may accidentally write down the wrong phone number or email address. This oversight prevents the bank from reaching out for any necessary clarifications or updates, prolonging the overall process.

A lack of clarity in signatures is also a recurring issue. Sometimes, individuals may not provide a clear and consistent signature matching their identification documents. Discrepancies can raise red flags and complicate verification, leading to further delays in account activation.

Additionally, choosing the wrong account type can be detrimental. For example, some applicants may select a savings account when they intended to apply for a current account. This mistake necessitates another round of paperwork and can delay access to necessary banking services.

Finally, the decision regarding nominee details often gets overlooked. Many applicants fail to assign a nominee or mistakenly leave blank fields regarding nominee information. This is crucial, especially for joint accounts, as it can affect the disposition of funds in the event of the account holder’s death.

Documents used along the form

When opening an Indian bank account, several documents accompany the account opening form to ensure compliance with regulatory standards and to establish the identity and residency of the applicants. Below is a list of essential forms and documents required during this process, along with a brief description of each.

- Proof of Identity: This document verifies the identity of the account holder. Acceptable forms include a passport, voter ID, PAN card, or any government-issued identification. It must contain a clear photograph and signature.

- Proof of Address: Applicants need to present documents that confirm their current address. Acceptable documents may include recent utility bills, bank statements, or a rental agreement. The address should match that on the application form.

- PAN Card: The Permanent Account Number (PAN) card is issued by the Income Tax Department and is essential for tax identification and compliance with financial regulations.

- Form 60/61: If an applicant does not have a PAN, they must submit Form 60 or Form 61, filled out in duplicate, to comply with tax regulations.

- Nomination Form (DA 1): This form allows the account holder to nominate a beneficiary for the account. It specifies who will receive the account funds in the event of the account holder's death.

- Photograph: A recent passport-sized photograph of each account applicant is needed, which will be used for account verification and documentation purposes.

- Employment Verification Letter: Employed applicants may need to provide a letter from their employer confirming their job title, duration of employment, and income details.

- Income Proof: Documents such as salary slips, tax returns, or bank statements may be required to verify the applicant's financial standing and income.

- Senior Citizen Documents: For applicants aged 60 years or older, additional identification such as a birth certificate or passport may be required as proof of age.

- Introduction Letter: If applicable, an introduction from an existing account holder of the same bank may be needed to establish credibility and confirm the identity of the new account holder.

Gathering these documents is crucial for a smooth account opening process. Always check with the specific bank for any additional requirements or variations in documentation, as these may differ based on local regulations or bank policies. Being well-prepared will expedite the process and help avoid potential delays.

Similar forms

Loan Application Form: Much like the bank account opening form, a loan application form collects personal and financial information needed to process the loan request. It requires details on income, employment, and credit history.

Credit Card Application Form: This document requires personal identification, income verification, and employment details. It aims to assess creditworthiness, similar to how the bank account form evaluates applicant eligibility.

Mortgage Application Form: This form gathers essential information about the applicant's financial background and property details. Both documents require verification of identity and residence.

Insurance Application Form: An insurance form collects personal and health information to determine coverage eligibility. Like the bank account opening form, it involves authorizing information verification.

Employment Application Form: This form requires detailed personal information, including education and work history, similar to the identification needs of the bank account opening form.

Service Application Form: When applying for services like internet or phone plans, this form gathers identification and address information for service setup, akin to the bank account process.

Vehicle Registration Form: This document requires owner identification, proof of address, and vehicle information. The need for verifying identity mirrors that of the bank account form.

Residency Application Form: For new residents, this form collects personal details and proof of residence, much like the documentation needed in the bank account opening form.

Dos and Don'ts

Things You Should Do

- Fill out the form using block letters to ensure clarity.

- Provide accurate details, especially your name and address, as they will be verified with supporting documents.

- Attach the required proof of residence, like a utility bill or bank statement.

- Sign and date the form to confirm that the information you provided is complete and accurate.

Things You Shouldn't Do

- Do not leave any sections blank; fill in all relevant areas.

- Avoid using nicknames; always provide your legal name.

- Do not forget to provide a mobile number for communication regarding your account.

- Refrain from providing any false or misleading information, as this can delay your application.

Misconceptions

Understanding the nuances of the Indian Bank Account Opening form can help make the process smoother. However, there are several misconceptions that people often have. Here are seven of those misconceptions explained.

- Only Indian Citizens can open an account. Many people believe that only Indian citizens are eligible to open bank accounts. In reality, foreign nationals residing in India can also apply for an account, provided they meet specific requirements.

- All documents must be submitted in original. There’s a common notion that original documents must always be provided. However, photocopies of certain documents may suffice, as long as the originals are presented for verification.

- All accounts require a minimum deposit. Many assume that every type of account has a minimum deposit requirement. While some accounts do, there are also options like zero-balance accounts available for individuals.

- Joint accounts are only for married couples. Another misconception is that joint accounts can only be opened by married couples. In fact, joint accounts can be held by any two individuals, including friends or family members.

- It’s easier to open an account online than in person. Some believe that the online process is streamlined compared to traditional methods. However, both processes can be equally efficient, and preferences may vary based on individual comfort levels.

- The form is the only requirement to open an account. People often think that filling out the form is all that is needed. In reality, various supporting documents must also be submitted for verification.

- There are no penalties for providing incorrect information. Finally, some individuals mistakenly assume that inaccuracies on the form won't matter. In truth, providing false information can lead to legal consequences and account closure.

By understanding and addressing these misconceptions, you can navigate the account opening process with greater confidence.

Key takeaways

When filling out the Indian Bank Account Opening form, it’s essential to follow these key takeaways to ensure a smooth process:

- Provide accurate information: Ensure all sections of the form are filled out completely and correctly. Mistakes can delay account opening.

- Use block letters: Write the customer name and address in block letters for clarity.

- Documents for proof of residence: Submit acceptable proof of residence documents like a passport or utility bill. Originals should be presented for verification.

- Choose the right account type: Indicate the specific type of account you wish to open, such as savings or current account, along with any features (cheque book, debit card, etc.).

- Signatures required: Ensure all applicants provide valid signatures where indicated. This is crucial for processing your request.

- Nomination details: Specify if a nominee is required and provide their details, making sure to follow the guidelines for minors if applicable.

- Bank's discretion: Understand that the bank has discretion regarding various operations like closures or loans, depending on the account type.

- Review terms and conditions: Familiarize yourself with the account's terms and conditions. Signing the form indicates your agreement to abide by these terms.

Following these pointers will help ensure that you fill out the Indian Bank Account Opening form correctly and reduce the chances of delays in processing your application.

Browse Other Templates

Make Your Own Playing Cards - Create a personalized card deck as a corporate gift.

Physician Statement Form Pdf - The form provides a structured way for medical professionals to convey information to the insurer.

Hpd Section 8 Apartments Listings - Within 60 days of receiving your voucher, if you haven't found a housing unit, you may apply for an extension.