Fill Out Your Indian Overseas Bank Form

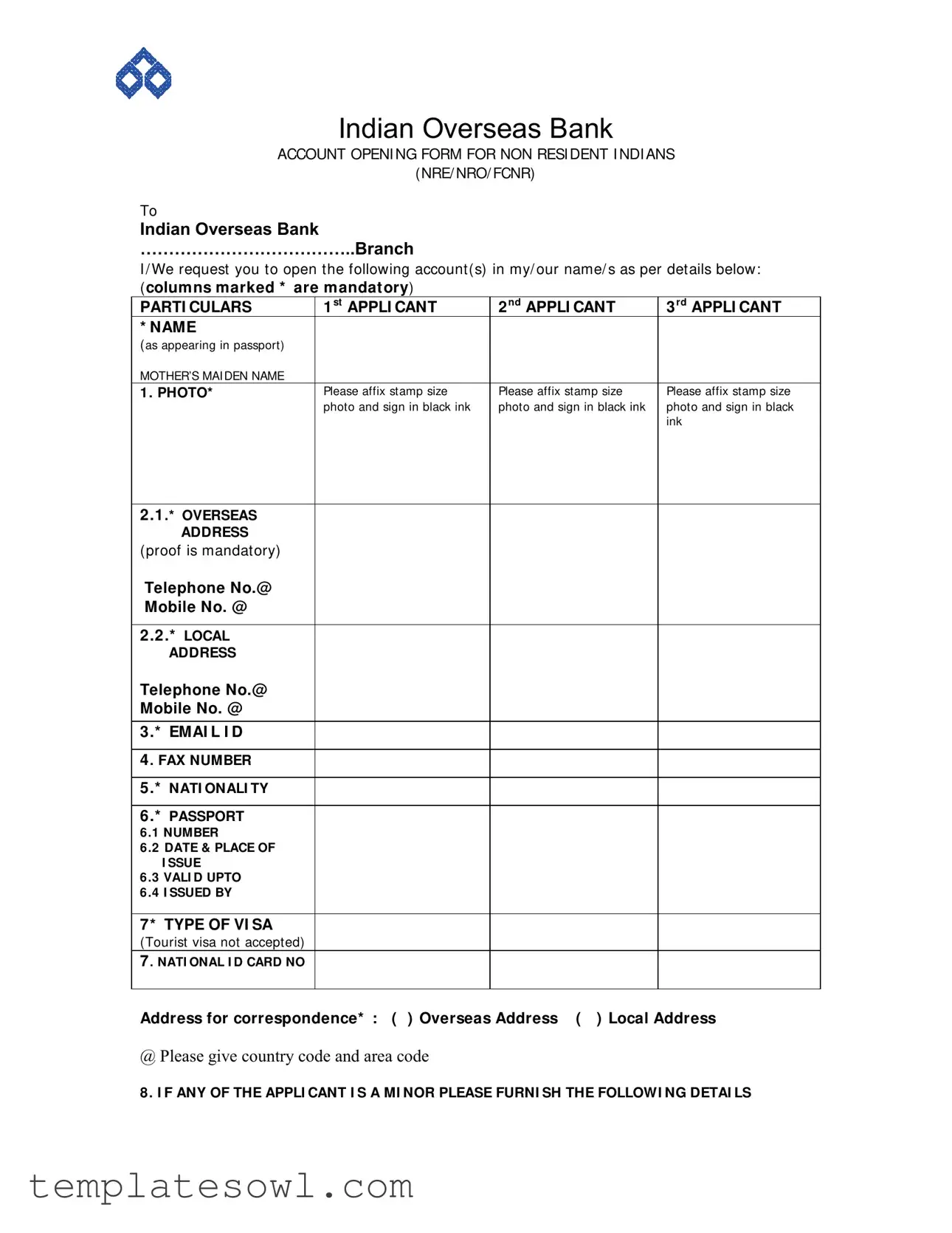

The Indian Overseas Bank account opening form is an essential document designed for Non-Resident Indians (NRIs) looking to establish banking relations with the bank. This form facilitates the creation of accounts such as Non-Resident External (NRE), Non-Resident Ordinary (NRO), and Foreign Currency Non-Resident (FCNR) accounts. The first section of the form requires personal particulars, including mandatory information like names, overseas and local addresses, nationality, and passport details of all applicants. Additionally, the form mandates the submission of attested documents to verify identity and residency status. It also encompasses critical elements such as account types, operational preferences, and instructions for interest payment. The applicants are required to make a declaration of their non-resident status and agree to the terms and conditions governing the account, including tax implications and account operation mandates. With comprehensive sections addressing various operational needs, this document serves as a pathway for NRIs to manage their financial assets in India effectively.

Indian Overseas Bank Example

INDIAN OVERSEAS BANK

ACCOUNT OPENI NG FORM FOR NON RESI DENT I NDI ANS

(NRE/ NRO/ FCNR)

To

INDIAN OVERSEAS BANK

………………………………..BRANCH

I / We request you to open the following account(s) in my/ our name/ s as per details below: ( columns marked * are mandatory)

PARTI CULARS |

1 st APPLI CANT |

2 nd APPLI CANT |

3 rd APPLI CANT |

|

* NAME |

|

|

|

|

( as appearing in passport) |

|

|

|

|

MOTHER’S MAI DEN NAME |

|

|

|

|

1 . PHOTO* |

Please affix stamp size |

Please affix stamp size |

Please affix stamp size |

|

|

|

photo and sign in black ink |

photo and sign in black ink |

photo and sign in black |

|

|

|

|

ink |

|

|

|

|

|

2 |

.1 .* OVERSEAS |

|

|

|

|

ADDRESS |

|

|

|

(proof is mandatory) |

|

|

|

|

Telephone No.@ |

|

|

|

|

Mobile No. @ |

|

|

|

|

|

|

|

|

|

2 |

.2 .* LOCAL |

|

|

|

|

ADDRESS |

|

|

|

Telephone No.@ |

|

|

|

|

Mobile No. @ |

|

|

|

|

|

|

|

|

|

3 |

.* EMAI L I D |

|

|

|

|

|

|

|

|

4 |

. FAX NUMBER |

|

|

|

|

|

|

|

|

5 |

.* NATI ONALI TY |

|

|

|

|

|

|

|

|

6 |

.* PASSPORT |

|

|

|

6 .1 NUMBER |

|

|

|

|

6 .2 DATE & PLACE OF |

|

|

|

|

|

I SSUE |

|

|

|

6 .3 VALI D UPTO |

|

|

|

|

6 .4 I SSUED BY |

|

|

|

|

|

|

|

|

|

7* TYPE OF VI SA |

|

|

|

|

(Tourist visa not accepted) |

|

|

|

|

7 |

. NATI ONAL I D CARD NO |

|

|

|

|

|

|

|

|

Address for correspondence* : ( ) Overseas Address ( ) Local Address

@ Please give country code and area code

8 . I F ANY OF THE APPLI CANT I S A MI NOR PLEASE FURNI SH THE FOLLOWI NG DETAI LS

Name : |

Date of Birth : |

|

|

|

Name & Address of Parent/ Guardian : |

|

|

|

|

Relationship w ith the Minor : |

|

|

|

|

9 . TYPE OF ACCOUNTS * ( Please tick whichever is applicable) |

|

|

||

Nature of Deposit |

|

|

Currency & |

Period (for Term |

|

|

Type(Savings/ |

Amount |

Deposits only) |

|

|

Current/Term) |

|

|

Non Resident (External) Account |

|

|

|

|

|

|

|

|

|

Non Resident (Ordinary) Account |

|

|

|

|

|

|

|

|

|

Foreign Currency (Non Resident) Account |

|

|

|

|

|

|

|

|

|

I/We agree that if the premature withdrawal is permitted at my/our request, the payment of interest will be as per the guidelines pertaining to such payment.

I/We authorise the bank to automatically renew the deposit on the due date for an identical period, unless any instruction to the contrary from me/us, is received by the bank before maturity. I/We further understand that the interest applicable on renewals will be at applicable rates on the dates of maturity and that the renewal(s) will be noted on the deposit receipt on my/our presenting the same on maturity date or later for renewal/payment.

(Full details and interest rates of the schemes are available in our web site www.iob.in)

10 . ACCOUNT TO BE OPERATED BY* ( Please t ick whichever is applicable)

Single

Any one of us

Either or Survivor

Former or Survivor

Jointly

Others (specify)

11 . I NTEREST PAYMENT* ( Please advise for disposal of interest payments |

|

||

for NRE/NRO - monthly/quarterly/half yearly/maturity |

|

||

for FCNR |

- maturity interest) |

|

|

Please credit ( ) SB ( ) Current Acct |

No. |

with |

branch |

In the name of ……………………………………………………………………………..

12 . OTHER FACI LI TI ES REQUI RED ( Available only for Single and E or S accounts)

a) |

( ) Yes ( ) No |

|

b) |

ATM/International Debit Card |

( ) Yes ( ) No |

(Please mail the PIN mailer and ATM card to my overseas address in separate envelopes)

c) SMS confirmation( ) Yes ( ) No (Please provide mobile number) I/We agree to abide by the terms and conditions as applicable and acknowledge it is my/our responsibility to obtain and read the same

13 . OTHER I NSTRUCTI ONS ( Kindly extend the facilities subject to conditions governing the same) ( ) Deposit receipt to be kept in safe custody/to be mailed to my local/overseas address/others (specify)

( ) Maturity notice to be sent to local/overseas address by post/may be advised through email/need not be

sent/others (specify)

() Deposit to be renewed on maturity with interest/principal only/may be credited to SB/Current account/proceeds may be sent by draft to overseas/local address

14 . DECLARATI ON

I/We hereby declare that I am/we are non resident Indian(s) person(s) of Indian origin. I/We understand that the above account will be opened on the basis of statement/declaration made by me/us and I/we also agree that if any of the statements / declarations made herein is found to be not correct in material particulars, you are not bound to pay any interest on the deposit made by me/us. I/We agree that no claim will be made by me/us for any interest on the deposit(s) for any period after the date(s) of maturity of the deposit(s). I/we agree to abide by the provisions, terms and conditions governing the deposit(s) opened by me/us. I/We also undertake to intimate the Bank about my/our return to India for permanent residence immediately on arrival.

I/We agree that the Bank may at its absolute discretion, discontinue any of the services completely or partially without any notice to me/us. I/We agree that the Bank may debit my account for service charges as applicable from time to time. I/We understand that the operations in our account are subject to the provisions of FEMA and other RBI/GOI notifications from time to time.

15 . Applicable to Non Resident ( Ordinary) Accounts

I/We are aware that Tax will be deducted at source on the interest paid/accrued as per income tax laws in force.

16 . Collection of I nstruments paid into the account

From time to time I/We may deposit into the account, instruments for collection. I/We authorise the bank to collect and credit the proceeds of the same subject to conditions for such collections including arranging a correspondent of its choice in case of foreign currency cheques. In case any overdraft is created by return of such instruments for whatsoever reason, I/We are liable to the bank for such overdrafts. The Bank will not be responsible for any loss, damage, miscarriage of cheques, any delay in collection, transmission and otherwise of any remittance howsoever caused.

17 . Mandate for operations ( optional)

I/We are desirous of authorising a person in India to operate our account for local payments by ( ) mandate letter ( ) power of attorney.

18 . NOMI NATI ON ( I f nomination not required please give a separate letter to that effect)

I/We nominate the following person to receive the amount deposit in the unfortunate event of my/our death

Name |

Address |

Relationship with depositor |

Age (yrs) |

|

|

|

|

As the nominee is a minor, I/We appoint Mr./Mrs. ……………………………………….. to receive the

amount of deposit on behalf of the nominee

Signature of 1st Applicant |

Signature of 2nd Applicant |

Signature of 3rd Applicant |

Name and signature of witness (in case nominee is a minor) :

Note: Signature to be attested by the Bank/Indian Embassy/High Commission/Consulate/Notary Public/Account holder of the bank

|

|

|

Stamp and signature of attesting person |

|

We attach the following attested document (indicate by ticking) |

||||

( ) Passport Copy (mandatory) ( ) Visa ( ) Work Permit |

( ) National ID card ( ) Others (specify) |

|||

FOR BRANCH USE : Indian Overseas Bank |

|

Branch |

||

|

|

|

|

|

Letter of thanks sent |

to |

Account opened on |

|

Authorised by |

Customer/Introducer on |

|

by |

|

Name: |

|

|

Name: |

|

Signature : |

|

|

Signature : |

|

Date: |

|

|

Date : |

|

|

|

|

|

|

|

|

|

|

|

|

KYC : CROP |

|

INDIAN OVERSEAS BANK ………………………………………………. BRANCH |

|

|

|

||||||||

|

|

|

|||||||||

|

|

KNOW YOUR CUSTOMER – CUSTOMER RECORD OF PROFILE |

|||||||||

|

{TO BE FILLED IN BY THE APPLICANT/S IN COMPLIANCE OF KYC REQUIREMENT} |

||||||||||

|

|

Particulars |

|

|

1st Applicant |

2nd Applicant |

|

3rd Applicant |

|

||

1. Name |

|

|

|

|

|

|

|

|

|

|

|

2. Nationality |

|

|

|

|

|

|

|

|

|

||

3. Father/spouse name |

|

|

|

|

|

|

|

|

|

||

4. Date of birth |

|

|

|

|

|

|

|

|

|

||

5. Whether PEP # (see below) |

|

|

|

|

|

|

|

|

|||

6. Marital Status |

|

|

|

|

|

|

|

|

|

||

7. If married no of children |

|

|

|

|

|

|

|

|

|

||

8. Educational qualification |

|

|

|

|

|

|

|

|

|

||

8.1 |

Non graduate |

|

|

|

|

|

|

|

|

|

|

8.2 |

Graduate 8.3 Post |

|

|

|

|

|

|

|

|

|

|

Graduate |

8.4 Professional |

|

|

|

|

|

|

|

|

|

|

9. Occupation (refer table |

|

|

|

|

|

|

|

|

|

||

below and furnish serial |

|

|

|

|

|

|

|

|

|

||

numbers as appropriate |

|

|

|

|

|

|

|

|

|

||

10. |

Annual Income |

|

|

|

|

|

|

|

|

|

|

11. |

Source of funds |

|

|

|

|

|

|

|

|

|

|

12. |

Vehicle owned |

|

|

|

|

|

|

|

|

|

|

12.1 Car |

12.2 Two wheeler |

|

|

|

|

|

|

|

|

||

12.3 Others 12.4 None |

|

|

|

|

|

|

|

|

|

||

13. |

Residence |

|

|

|

|

|

|

|

|

|

|

13.1 Own |

13.2 Rented |

|

|

|

|

|

|

|

|

|

|

14. |

Details of credit cards held |

|

|

|

|

|

|

|

|

||

15. |

Details of deposit/loan |

|

|

|

|

|

|

|

|

|

|

accounts/credit facilities at |

|

|

|

|

|

|

|

|

|

||

other branches of IOB/other |

|

|

|

|

|

|

|

|

|

||

banks |

|

|

|

|

|

|

|

|

|

|

|

16. |

Details of foreign countries |

|

|

|

|

|

|

|

|

||

visited during the last 3 years |

|

|

|

|

|

|

|

|

|

||

17. |

Any other information |

|

|

|

|

|

|

|

|

|

|

which you would like to |

|

|

|

|

|

|

|

|

|

||

record with the bank |

|

|

|

|

|

|

|

|

|

||

18. |

I/We declare that the above |

|

|

|

|

|

|

|

|

||

particulars furnished by me are |

|

|

|

|

|

|

|

|

|||

correct |

|

|

|

Signature |

Signature |

|

Signature |

|

|||

|

9.a Service |

|

|

9.b Professional |

9.c Others |

|

|

|

|||

8.a.1 Government |

|

|

8.b.1. Lawyer |

|

8.c.1. Pensioner |

|

|

|

|||

8.a.2 Public Sector Undertaking |

8.b.2. Doctor |

|

8.c.2. Retired Non pensioner |

|

|||||||

8.3.3. Private Sector |

|

|

8.b.3. Chartered/Cost Accountant |

8.c.3. Home maker |

|

||||||

(Furnish |

designation |

and |

8.b.4. Engineer |

|

8.c.4. Student |

|

|

|

|||

employer name) |

|

|

8.b.5 Information Technology |

8.c.5. Farmer/Trader |

|

||||||

|

|

|

|

|

8.b.6. Others (specify) |

|

8.c.6. Vendor/Business |

|

|||

|

|

|

|

|

|

|

8.c.7. Others (specify) |

|

|||

|

|

||||||||||

FOR USE AT BRANCH: 1. Identify and verify genuineness of address as per instructions in force. |

|

||||||||||

2. Remarks: |

|

|

|

|

|

|

|

|

|

||

Date: |

|

|

|

Branch Seal |

Name and signature of Authorised Officer |

|

|||||

#Politically Exposed Person (PEP) include individuals entrusted with prominent public functions in a foreign country, their family members and close associates

MANDATE FORM

To

The Branch Manager

Indian Overseas Bank

Branch

Place

Date

Dear Sir

Referring to the NRE/NRO SB account number and various term deposits/FCNR deposits going to be deposited with you in my/our name(s), I/We request and authorise you to honour all cheques drawn on the said account as well as for operating the term deposits both existing and future for local payments by……………………………………

whose signature(s) are hereunder written, notwithstanding such cheques may create or increase an overdraft to any extent and we authorise the said person on our behalf to make, draw, accept, endorse and negotiate cheques, hundies, bills and other negotiable instruments.

This authority shall continue in force until we have expressly revoked it by a notice in writing to be delivered to you.

Dated this |

day of two thousand |

Yours faithfully,

(Account Holder(s)) |

|

Specimen signature of |

authorized to sign as |

above mentioned |

|

………………………………………. |

|

………………………………………. |

|

confirmed |

|

(Account holder(s)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to open an account with Indian Overseas Bank for Non-Resident Indians (NRE/NRO/FCNR). It is designed to gather essential information from applicants. |

| Mandatory Information | Key details such as names, addresses, nationality, and passport information must be provided. Fields marked with an asterisk (*) are mandatory. |

| Photograph Requirement | Applicants must affix a recent stamp-sized photograph, signing it in black ink. This requirement applies to all applicants listed in the form. |

| Account Types | Applicants can choose between various types of accounts, including Non-Resident (External) Accounts, Non-Resident (Ordinary) Accounts, and Foreign Currency (Non-Resident) Accounts. |

| Visa Type | Applicants must disclose the type of visa they hold, as tourist visas are not accepted for the account opening process. |

| Interest Payment Options | The form requests information on preferred interest payment frequencies, including monthly, quarterly, half-yearly, or at maturity. |

| Nomination Facility | Applicants can nominate a person to receive the account funds in the event of their death. Special provisions apply if the nominee is a minor. |

| Applicable Laws | Operations of the account will comply with the Foreign Exchange Management Act (FEMA) and relevant guidelines from the Reserve Bank of India (RBI). |

Guidelines on Utilizing Indian Overseas Bank

Filling out the Indian Overseas Bank account opening form requires careful attention to detail and accuracy. The various sections of the form must be completed to provide the necessary information for processing the application. This guide outlines the steps for correctly filling out the form.

- Download and print the Indian Overseas Bank account opening form for Non-Resident Indians (NRE/NRO/FCNR).

- Provide your name as it appears in your passport in the section for the first, second, and third applicants.

- Affix a passport-sized photograph in the designated areas for each applicant and sign in black ink.

- Fill out your overseas address in the specified section. Proof of this address is required.

- Provide your local address and contact information, including telephone and mobile numbers.

- Input your email address and fax number, if applicable.

- Indicate your nationality and fill in the passport details, including number, date and place of issue, validity, and issuing authority.

- Select the type of visa you hold, ensuring it is not a tourist visa.

- If applicable, provide details for any minor applicants, including their date of birth and parent or guardian information.

- Select the type of account you wish to open by ticking the appropriate options.

- Specify how the account will be operated by ticking the preferred choice.

- Advise on interest payment preferences for NRE/NRO accounts.

- Indicate any additional facilities required, such as internet banking or debit cards.

- Complete any other instructions regarding the management of the deposit.

- Read and sign the declaration acknowledging your status as a non-resident Indian and understanding the terms of the account.

- Provide nomination details for the account, if desired, including information about the nominee.

- Attach the required documents, like a passport copy, and any other necessary identification.

- Review the entire form for accuracy before submitting it to the bank.

What You Should Know About This Form

What is the purpose of the Indian Overseas Bank Account Opening Form?

This form is designed for Non-Resident Indians (NRIs) who wish to open accounts such as Non-Resident External (NRE), Non-Resident Ordinary (NRO), or Foreign Currency Non-Resident (FCNR) accounts in Indian Overseas Bank. By completing this form, applicants can provide necessary personal details and preferences for their banking services.

Who can fill out this account opening form?

The account opening form can be filled out by Non-Resident Indians (NRIs) or persons of Indian origin. It is specifically structured to accommodate the unique needs of individuals living outside India who wish to maintain banking relationships within the country.

What information is mandatory on the form?

Entries marked with an asterisk (*) are mandatory. Key details include the applicants' names as they appear in their passports, overseas and local addresses, nationality, passport number, and the type of accounts they wish to open. Missing this information could delay the processing of the application.

What types of accounts can be opened using this form?

Applicants can choose to open several types of accounts: Non-Resident External (NRE) accounts for deposits in Indian rupees, Non-Resident Ordinary (NRO) accounts for income earned in India, and Foreign Currency Non-Resident (FCNR) accounts for deposits in foreign currencies. Each account has its own specific benefits and features.

Is it necessary to provide proof of overseas address?

Yes, providing proof of your overseas address is mandatory when filling out the form. This can include documents like a utility bill, bank statement, or lease agreement. The bank needs this information to comply with regulations and verify your residency status.

What should I do if I am a minor applicant?

If any applicant is a minor, additional details must be provided, including the name and address of the parent or guardian and their relationship to the minor. This ensures legal representation for the minor’s banking needs.

How will my interest payments be handled?

The form requires you to specify how you would like your interest payments to be managed, whether monthly, quarterly, half-yearly, or at maturity. It is important to declare your preference to ensure accurate processing by the bank.

What happens if I return to India for permanent residence?

You must inform the bank immediately upon your return to India for permanent residence. This is important as it could affect the status and operation of your NRE/NRO accounts, and you may need to update your application and fulfill other compliance requirements.

Is a nomination required for the account?

While nomination is not mandatory, it is highly recommended to designate a nominee to inherit the funds in your account in the event of your death. If you choose not to nominate anyone, a separate letter must be submitted to the bank stating your intention.

Common mistakes

When filling out the Indian Overseas Bank account opening form, many applicants make simple yet avoidable mistakes that can delay the process or even lead to their application being rejected. One common error is failing to provide the required overseas address proof. This proof is mandatory, and applicants must attach appropriate documentation. Leaving this section incomplete can halt the application process, causing unnecessary frustration.

Another frequent mistake occurs in the section requiring photographs. Applicants often neglect to affix photos of the correct size or forget to sign in black ink. It's essential to adhere to the specifications outlined in the instructions completely, as discrepancies here can result in the bank rejecting the submission.

Incomplete personal details present another challenge. Applicants sometimes skip parts of their passport information, such as the date of issue or the place of issue. Providing incorrect passport numbers or missing this information can also complicate matters, as these details are crucial for verifying identity and residency status.

Moreover, applicants frequently misinterpret the type of account they wish to open. Choosing the wrong account type could lead to issues with eligibility or fund management. It is vital to carefully read the options available and select the one that truly fits your needs, whether it's an NRE, NRO, or FCNR account.

Another common oversight is mislabeling contact preferences for interest payments. Whether payments are to be credited to a savings or current account must be specified correctly. Leaving this blank or selecting an incorrect option can result in automatic delays in receiving funds.

Furthermore, applicants sometimes forget to include their nominee details. In the unfortunate event of the applicant's demise, the omission of this information can burden the family with extra procedures. Properly filling out this section ensures that the deposit will be managed according to the applicant's wishes, creating smoother transitions during tough times.

Lastly, not reading the terms and conditions can lead to misunderstandings later. Some applicants acknowledge these terms without actually reviewing them. Understanding your rights and obligations, including how to handle premature withdrawals or changes in residence, is crucial for a positive banking experience.

Documents used along the form

The Indian Overseas Bank account opening form for non-resident Indians is often accompanied by several other important documents. Each serves a specific purpose in ensuring compliance and facilitating the banking process for clients residing outside India. Below is a list of commonly used forms and documents that may be required along with the main account opening form.

- Passport Copy: A clear photocopy of the passport is mandatory. This serves as proof of identity and nationality, verifying the applicant's non-resident status.

- Visa or Work Permit: Evidence of a valid visa or work permit may be required to confirm the applicant's legal status in their country of residence.

- Proof of Overseas Address: This can include utility bills, bank statements, or lease agreements. It must clearly show the applicant's name and current address abroad.

- Our KYC Form: The Know Your Customer (KYC) form collects detailed information about the applicant's identity, financial status, and the source of funds.

- Tax Identification Number (TIN): Some applicants may need to provide their TIN or equivalent from their country of residence, assisting in tax compliance and regulation.

- Nomination Form: This document names an individual to receive the funds in the event of the account holder’s death. This is crucial for ensuring the timely distribution of assets.

- Power of Attorney (if applicable): If authority is designated to someone else in India to manage the account, a Power of Attorney document must be provided.

- Declaration of Tax Residency: A statement indicating the applicant’s tax residency status in relation to foreign earnings may be needed to comply with international tax regulations.

These documents collectively help establish the applicant's identity, residency, and compliance with banking regulations. Proper documentation ensures that the account opening process is efficient and meets all legal requirements.

Similar forms

- Bank Account Opening Form: This document serves a similar purpose in various banks across the United States. It gathers essential personal information, addresses, and identification details from customers wishing to open new accounts. Just like the Indian Overseas Bank form, it often requires supporting documentation to verify identity and address.

- Application for Foreign Bank Account: Similar to the Indian Overseas Bank form, this application is used by non-residents seeking to open a bank account in foreign countries. It requests various personal information, proof of residency, and identification documents, maintaining similar verification standards.

- Non-Resident Alien Waiver Form: This document is used by non-resident aliens in the U.S. to apply for certain tax benefits and exemptions. Like the Indian Overseas Bank form, it requires information about residency status and personal identification, emphasizing the importance of correct residency declarations.

- IRS Form W-8BEN: Used by foreign individuals and entities, this form certifies foreign status and is essential for tax purposes in relation to income from U.S. sources. It requests information akin to the Indian Overseas Bank form about nationality, identification, and declarations of residency status.

- Visa Application Form: When applying for a visa, applicants provide personal information, address details, and identification similar to that on the Indian Overseas Bank form. The purpose is different, but the need for accurate information and identification to establish residency or travel eligibility is a commonality.

Dos and Don'ts

When filling out the Indian Overseas Bank form for Non-Resident Indians, following guidelines can help avoid mistakes. Here are nine essential do's and don'ts:

- Do: Ensure all mandatory fields are marked with an asterisk (*) are completed accurately.

- Do: Use black ink for signing the form and affixing the photographs.

- Do: Attach valid proof for your overseas address to avoid delays.

- Do: Provide your most recent passport number and expiration date.

- Do: Review all information for accuracy before submission.

- Don't: Leave any mandatory fields blank; this could lead to rejection of your application.

- Don't: Use a tourist visa; only valid visas are accepted for account opening.

- Don't: Forget to disclose any minor applicants or their guardians’ details.

- Don't: Submit documents that are expired or illegible.

- Don't: Ignore the terms and conditions set by the bank; be sure to read and sign where necessary.

Misconceptions

- Misconception: All applicants need to provide local addresses. In fact, only the overseas address is mandatory for non-resident Indians opening an account. Local addresses may be required for certain types of accounts but are not necessary for everyone.

- Misconception: A tourist visa can be used to open an NRE or NRO account. This is misleading because the form explicitly states that a tourist visa is not accepted for account openings. Permanent or long-term visas are required to establish eligibility.

- Misconception: Minor applicants cannot be included in the account form. Conversely, the form allows for the inclusion of minors, provided that the details about the minor’s guardian are filled out correctly. This ensures that all necessary information is captured.

- Misconception: Interest on deposits is guaranteed regardless of the accuracy of the application. This is incorrect. The form clearly states that if any information provided is found to be incorrect, there is no obligation for the bank to pay interest on the deposits. Thus, accurate information is essential.

Key takeaways

Always fill in mandatory fields: Be sure to complete all fields marked with an asterisk (*), as these are required for processing your application.

Provide accurate information: Ensure that names, addresses, and other personal details are accurate. This helps avoid any delays or issues with your account.

Attach necessary documents: Include copies of your passport and any other required documents. This is essential for verification.

Select your account type carefully: Choose the type of account you wish to open and tick the applicable option. Options include NRE, NRO, and FCNR accounts.

Leave instructions for interest payments: Specify how you want your interest payments handled, and which account to credit them to.

Understand the conditions: Review the terms and conditions carefully. This includes information about premature withdrawals and account operation mandates.

Browse Other Templates

Can I Get My Drivers License Online - Pursue quality scans for enhanced record integrity.

Dental Class - The dentist’s assessment influences the readiness for worldwide duty.

Caregiver Certification Illinois - The 445103 form includes criteria that must be met for licensing various agency types.