Fill Out Your Ing Beneficiary Form

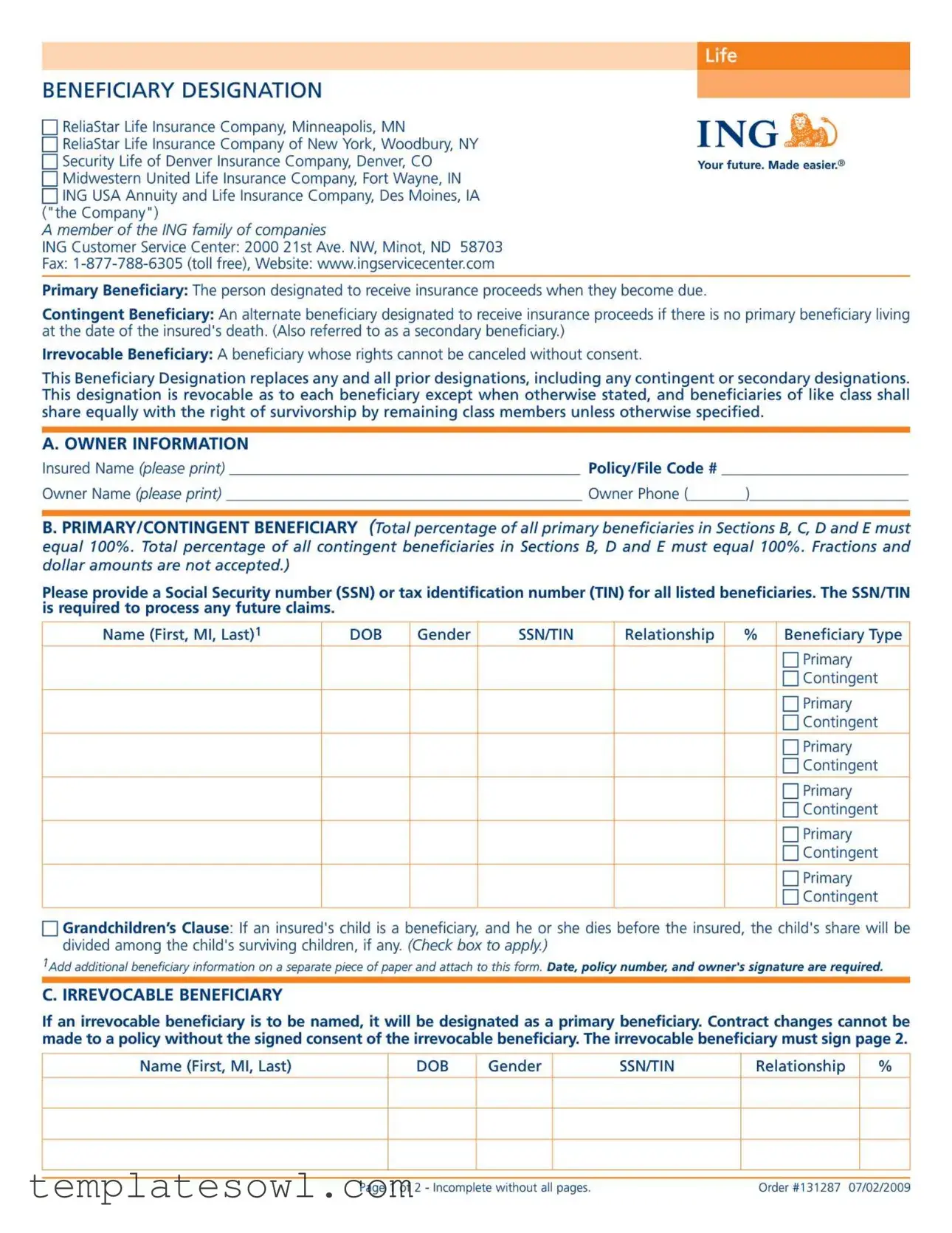

Understanding the ING Beneficiary form is a vital step in ensuring your life insurance or annuity proceeds are distributed according to your wishes after your passing. This form allows you to designate individuals or entities to receive benefits from your policy. The designated beneficiaries can be categorized into primary and contingent beneficiaries. A primary beneficiary is the first in line to receive benefits, while a contingent beneficiary will step in if the primary beneficiary is not living at the time of your death. Interestingly, you can also name irrevocable beneficiaries, whose rights cannot be changed without their consent, adding a layer of security to your estate planning. Importantly, the form requires not only the names and relationships of beneficiaries but also their Social Security numbers to process future claims efficiently. Another feature of the self-explanatory form is the Grandchildren's Clause, which ensures that if a beneficiary predeceases you, their share will be redistributed among their surviving children. It’s essential to make sure that the total percentages assigned to primary and contingent beneficiaries equal 100%, and any changes made to beneficiary designations must be recorded accurately. Furthermore, if a trust is designated as a beneficiary, specific documentation is required to validate the designation. Overall, the ING Beneficiary form is a straightforward yet powerful tool in personal and financial planning, ensuring that your loved ones or chosen entities receive the support they need when it matters most.

Ing Beneficiary Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Primary Beneficiary | The individual designated to receive insurance proceeds upon the death of the insured. |

| Contingent Beneficiary | An alternate beneficiary who receives the proceeds if the primary beneficiary is not alive at the time of the insured's death. |

| Irrevocable Beneficiary | This type of beneficiary's rights cannot be altered without their consent, ensuring their interests are protected. |

| Beneficiary Designation Replacement | By completing this form, you replace any previous beneficiary designations. Be aware this is legally binding. |

| Percentage Distribution | The form requires that the total percentages for primary and contingent beneficiaries must equal 100% each. |

| Trust Beneficiary | Trusts can be named as beneficiaries, but a copy of the trust's signature and title pages is mandatory. |

| Payment to Minors | Payments to minor beneficiaries will typically go to their legally appointed guardians unless specified otherwise by law. |

Guidelines on Utilizing Ing Beneficiary

Completing the ING Beneficiary form is an important step in ensuring that your designated beneficiaries are properly recorded. This document will guide you through the necessary information needed to finalize your designations. After filling out the form, it is crucial to submit it promptly to the ING Customer Service Center to ensure that your preferences are registered effectively.

- Gather Required Information: Collect the names, dates of birth, social security numbers (SSN or TIN), and relationships for all primary and contingent beneficiaries.

- Fill Out Owner Information: Print the Insured Name, Owner Name, Policy/File Code, and Owner Phone in the designated sections of the form.

- Designate Beneficiaries: In Section B, clearly indicate who the primary and contingent beneficiaries are. Ensure that the total percentages for all primary beneficiaries equal 100% and that the same applies to contingent beneficiaries.

- Complete the Irrevocable Beneficiary Section: If naming an irrevocable beneficiary, provide their information in Section C and remember they must sign the form.

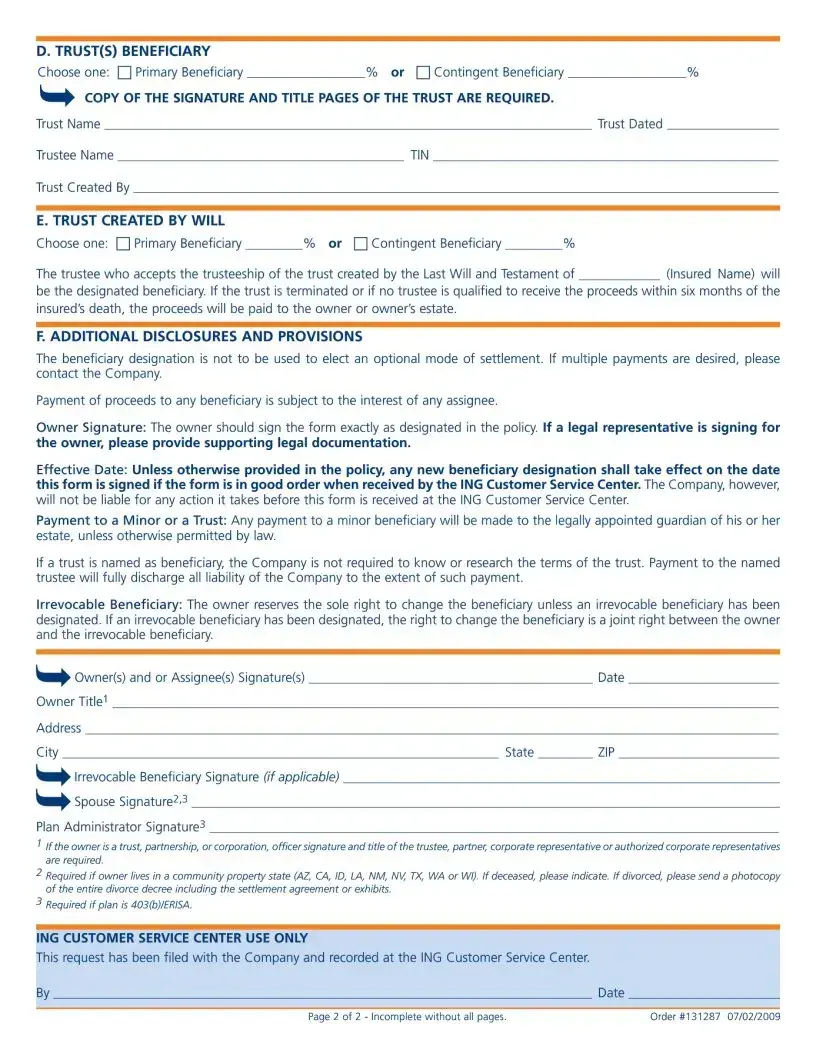

- Fill Out Trust Information: If a trust is part of the designation, complete Section D with the trust’s name, trustee, and relationship, along with a percentage designation.

- Sign the Form: The owner must sign the form as stated in the policy. If a legal representative is signing, attach relevant documentation.

- Review for Accuracy: Double-check all entries for completeness and accuracy before submitting.

- Submit the Form: Mail or fax the filled form to the ING Customer Service Center at the address or fax number provided on the form.

What You Should Know About This Form

What is the purpose of the ING Beneficiary form?

The ING Beneficiary form is used to designate beneficiaries for life insurance policies. The primary beneficiary is the main person who will receive the insurance proceeds upon the insured’s death. If the primary beneficiary is not alive, the contingent beneficiary will receive the proceeds. It allows the owner to specify how the benefits should be distributed, ensuring that the intended persons are financially supported in the event of the owner’s passing.

What is the difference between a primary and a contingent beneficiary?

A primary beneficiary is the first person entitled to receive the insurance proceeds. If there is no primary beneficiary living at the time of the insured's death, the contingent beneficiary steps in to receive the benefits. This setup ensures that there is always a designated recipient for the funds, offering peace of mind regarding financial support for loved ones.

Can I change my designated beneficiaries?

What happens if a beneficiary passes away before the insured?

If a beneficiary dies before the insured, the ING Beneficiary form includes a Grandchildren's Clause. This means that if the deceased was a child of the insured, their share will be divided among their surviving children (the insured's grandchildren). This provision ensures that the benefits are passed down within the family instead of reverting to the estate.

How is the percentage of beneficiaries determined on the form?

The total percentage designated for all primary beneficiaries must equal 100%. Similarly, the total percentage for all contingent beneficiaries must also equal 100%. You cannot use fractions or specify dollar amounts; only whole percentages are allowed. This structure keeps the distribution clear and uncomplicated for processing claims in the future.

Common mistakes

Filling out the ING Beneficiary form is an important step in ensuring that your loved ones receive the intended insurance proceeds. However, several mistakes can arise during this process, which may lead to complications down the line. Understanding these common pitfalls can help you avoid them.

One frequent error occurs when individuals fail to designate both a primary and a contingent beneficiary. In the event that the primary beneficiary is no longer living at the time of the insured's passing, the lack of a contingent beneficiary can delay payouts and create unnecessary legal challenges. Clearly outlining both beneficiaries on the form is essential for smooth processing.

Another mistake involves incorrect or incomplete social security numbers (SSNs) or tax identification numbers (TINs). Each beneficiary must have this information accurately recorded. If a claim needs to be processed and the documentation is lacking, it can lead to significant delays. Even simple typos can thwart the entire process, underscoring the importance of double-checking these details.

A third common issue is failing to indicate the percentage distribution among beneficiaries. The total percentage for primary beneficiaries must equal 100%, just as the total for contingent beneficiaries should also reach 100%. Omitting or inaccurately calculating these distributions can cause confusion or disputes later on. Each beneficiary’s share should be carefully calculated and clearly specified to prevent any ambiguity.

Additionally, some people neglect to sign the form correctly. The owner’s signature should match exactly how their name is designated in the policy. If a legal representative is signing on behalf of the owner, relevant documentation should be attached. Failing to comply with these requirements can render the form ineffective and delay the process of benefit distribution.

There are also those who do not consider the implications of naming an irrevocable beneficiary. If an irrevocable beneficiary is designated, the owner can only change this status with the irrevocable beneficiary's consent. Understanding this limitation is important, as it can affect future decisions regarding the beneficiary designation.

Lastly, attaching necessary additional documents is often overlooked. If you are naming a trust or another third party as a beneficiary, copies of the relevant legal documents must accompany the form. This ensures that your wishes are honored and can prevent further complications during the claims process.

Taking the time to avoid these common mistakes can significantly ease the process of managing the ING Beneficiary form. By being thorough and precise in your completions, you can help ensure that your loved ones are properly cared for, without unnecessary delays or confusion.

Documents used along the form

The Beneficiary Designation form is an essential document often used in conjunction with several other forms when managing insurance policies, trusts, or financial arrangements. Below is a list of documents commonly associated with this process, along with brief descriptions of each.

- Owner Information Form: Captures key details about the policy owner, including their name, contact information, and relationship to the insured.

- Beneficiary Consent Form: Ensures that the irrevocable beneficiary's consent is obtained before any changes can be made to the policy.

- Trust Documentation: Includes copies of trust agreements that outline the terms and designations related to trusts named as beneficiaries.

- Change of Beneficiary Form: Used to officially update or alter existing beneficiary designations on a policy.

- Power of Attorney: Grants authority to another individual to make decisions regarding the insurance policy on behalf of the owner, which may include beneficiary changes.

- Death Certificate: Required for claiming benefits upon the death of the insured to validate the claim and facilitate payments to designated beneficiaries.

- Minor Beneficiary Designation Form: Provides instructions and legal recognition for any assets allocated to minors, often requiring a guardian to manage the funds until the child reaches adulthood.

- Tax Identification Number (TIN) Form: Collects necessary tax identification information for all beneficiaries to ensure compliance with tax regulations when benefits are distributed.

- Exemption for Community Property States Form: Ensures that the policy account holder complies with community property laws, particularly when the owner resides in states that recognize such laws.

- Policy Change Request Form: A formal request to the insurance company to make changes to the policy features, including premium payments or coverage amounts.

Each of these documents plays a vital role in the proper administration of insurance policies and the distribution of benefits. It is crucial to ensure all forms are completed accurately to facilitate smooth transactions and compliance with legal standards.

Similar forms

The following documents share some similarities with the ING Beneficiary form, particularly regarding designating beneficiaries and the management of insurance or trusts. Each serves a unique purpose, yet they all center around identifying who will receive benefits or assets after an individual's passing.

- Life Insurance Beneficiary Designation Form: Like the ING form, this document names primary and contingent beneficiaries for a life insurance policy. It outlines the rights and percentages assigned to each beneficiary, ensuring clarity on who receives the proceeds.

- Retirement Account Beneficiary Designation Form: This form allows individuals to specify who will inherit the assets of their retirement accounts, such as 401(k) or IRA. Similar to the ING Beneficiary form, it typically includes options for naming primary and contingent beneficiaries.

- Will: A will provides instructions regarding how a person's assets should be distributed upon death. While it can be more comprehensive than the ING form, it also articulates beneficiaries and sometimes appoints guardians for minors.

- Trust Document: A trust creates an arrangement for managing assets during a person's life and directing their distribution after death. While it may detail a broader array of assets, it also includes beneficiary designations similar to those outlined in the ING form.

- Payable on Death (POD) Designation: This is a bank account feature that allows account holders to name beneficiaries who will receive the assets upon their death, much like the way the ING form allocates proceeds from a life insurance policy.

- Transfer on Death (TOD) Registration: This registration allows individuals to designate beneficiaries for securities, directing how stocks and bonds are transferred upon death. Similar to the ING Beneficiary form, it ensures beneficiaries receive the assets without needing to go through probate.

Dos and Don'ts

When filling out the ING Beneficiary form, there are certain best practices to follow. Adhering to these can help ensure the process goes smoothly.

- Review the form thoroughly before filling it out to understand what is required.

- Provide complete information for each beneficiary, including Social Security numbers or tax identification numbers, to avoid delays.

- Clearly indicate the primary and contingent beneficiaries, making sure the total percentages equal 100% for each category.

- Sign and date the form as the owner, ensuring your signature matches the designation in the policy.

- Keep a copy of the completed form for your records, in case you need to refer back to it later.

However, there are also some things to avoid while completing this important document.

- Do not leave any sections blank, as this may cause your form to be considered incomplete.

- Avoid using nicknames; provide full legal names for all beneficiaries.

- Don't forget to include the required documentation if an irrevocable beneficiary is named.

- Do not submit the form without reviewing it one last time to catch any errors or omissions.

Misconceptions

Here are eight common misconceptions about the ING Beneficiary form along with explanations to clarify each point:

- Only one primary beneficiary can be named. Many people believe that they can designate only one primary beneficiary. In reality, you can name multiple primary beneficiaries and assign specific percentages to each, as long as the total equals 100%.

- An irrevocable beneficiary cannot be changed. While it is true that an irrevocable beneficiary must consent to any changes, the owner can change the overall beneficiary designation if they have one or more revocable beneficiaries included.

- Social Security numbers are optional. Some individuals think providing a Social Security number (SSN) for beneficiaries is optional. However, the SSN is required for processing future claims.

- Beneficiaries automatically receive payment. People often assume that beneficiaries will receive payments immediately upon the insured's death. Payments are subject to verification and may take time depending on the circumstances, including any claims processes.

- Changing beneficiaries is simple. While updating beneficiaries can be straightforward, it’s important to remember that if there is an irrevocable beneficiary, their consent is necessary for any changes.

- The form must be notarized. Some believe that the ING Beneficiary form requires notarization. This is not the case, but the owner's signature and any applicable legal confirmation are required.

- Payment can be made directly to a minor beneficiary. It is a misconception that minors can receive payments directly. Payments to minors are typically made to the legally appointed guardian of their estate.

- The beneficiary designation is set in stone once submitted. People might think once they submit the form, they cannot make any changes later. In fact, the beneficiary designation can be updated or changed by submitting a new form, as long as it is not irrevocable.

Key takeaways

Filling out the ING Beneficiary form accurately is crucial for ensuring that the right individuals receive insurance proceeds in the event of your death. Here are some key takeaways to consider:

- Designate a Primary Beneficiary: This person will receive the insurance proceeds when they become due. It's essential to clearly indicate this individual on the form.

- Contingent Beneficiaries Matter: Designate alternate beneficiaries. If your primary beneficiary is no longer living, the contingent beneficiary will receive the benefits.

- Irrevocable Beneficiary: If you name someone as an irrevocable beneficiary, their rights cannot be canceled without their agreement. This step adds a layer of protection for that beneficiary.

- Equal Shares: When designating multiple beneficiaries within the same class (primary or contingent), they will share the proceeds equally unless specified otherwise.

- Social Security Numbers Required: For processing future claims, include the Social Security Number or tax identification number for all listed beneficiaries.

- Grandchildren's Clause: If the designated primary beneficiary (like your child) dies before you, their share will automatically pass on to their surviving children, if applicable.

- Trusts Can Be Beneficiaries: If you wish to name a trust as a beneficiary, ensure you provide the name of the trust, the trustee's name, and a copy of the trust's signature and title pages.

- Signatures Matter: The owner must sign the form exactly as indicated in the policy. Ensure that any legal representative signatures are accompanied by appropriate documentation.

- Effective Date: New beneficiary designations typically take effect on the date you sign, provided the form is correctly filled out and received by the ING Customer Service Center promptly.

- Payments to Minors or Trusts: Payments made to a minor will go to their legally appointed guardian. If a trust is named, the insurance company is not responsible for verifying the trust's terms.

By keeping these key points in mind, you can effectively navigate the process of completing the ING Beneficiary form, ensuring your wishes are honored and your beneficiaries are appropriately identified.

Browse Other Templates

Ca Dept of Consumer Affairs - The Gold Shield Program supports environmentally friendly practices in the automotive industry.

20 Team Double Elimination Bracket - Documentation may include cancelled checks or receipts to verify payments made.