Fill Out Your Insurance Policy Declaration Page Form

The Insurance Policy Declaration Page is a crucial document that outlines important aspects of automobile insurance coverage between a contractor and the City of San Diego. This declaration serves as a formal acknowledgment by the contractor regarding their current vehicle ownership status and the insurance policies they are mandated to maintain throughout the duration of their contract. First and foremost, the contractor confirms they do not own any vehicles. However, they commit to securing and maintaining automobile insurance specifically for “hired autos” and “non-owned autos,” ensuring coverage remains effective during the entire contractual period. Additionally, if the contractor acquires any vehicles while the agreement is in force, they must promptly obtain insurance that covers “any auto” and provide the City with proof of such coverage. The definitions of the insurance terms are equally important. “Any Auto” coverage applies to vehicles owned by the contractor, those rented, hired, or borrowed, and other non-owned vehicles used in business operations. Meanwhile, “Hired Autos” refers to rental vehicles used for business purposes, while “Non-owned Autos” cover vehicles not owned or leased by the contractor, which includes those owned by employees or household members, but only while being used for business or personal matters. This clarity ensures mutual understanding and protection for both parties involved in the agreement.

Insurance Policy Declaration Page Example

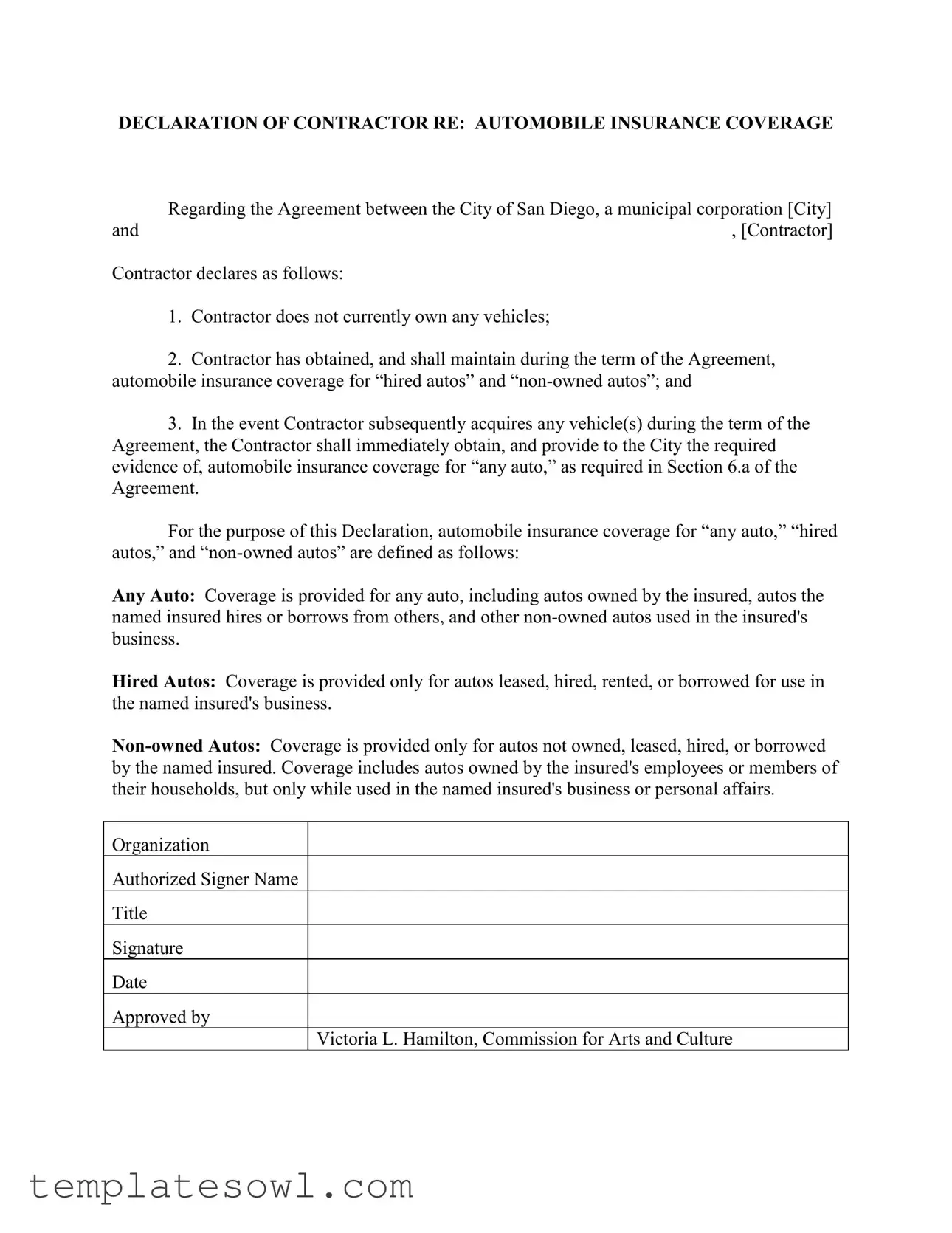

DECLARATION OF CONTRACTOR RE: AUTOMOBILE INSURANCE COVERAGE

|

Regarding the Agreement between the City of San Diego, a municipal corporation [City] |

and |

, [Contractor] |

Contractor declares as follows:

1.Contractor does not currently own any vehicles;

2.Contractor has obtained, and shall maintain during the term of the Agreement, automobile insurance coverage for “hired autos” and

3.In the event Contractor subsequently acquires any vehicle(s) during the term of the Agreement, the Contractor shall immediately obtain, and provide to the City the required evidence of, automobile insurance coverage for “any auto,” as required in Section 6.a of the Agreement.

For the purpose of this Declaration, automobile insurance coverage for “any auto,” “hired autos,” and

Any Auto: Coverage is provided for any auto, including autos owned by the insured, autos the named insured hires or borrows from others, and other

Hired Autos: Coverage is provided only for autos leased, hired, rented, or borrowed for use in the named insured's business.

Organization

Authorized Signer Name

Title

Signature

Date

Approved by

Victoria L. Hamilton, Commission for Arts and Culture

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of the Declaration | This form serves as a declaration from the contractor regarding their automobile insurance coverage in relation to an agreement with the City of San Diego. |

| Contractor Vehicle Ownership | The contractor indicates that they do not currently own any vehicles as part of the terms outlined. |

| Insurance Requirement | The contractor is required to maintain automobile insurance coverage for "hired autos" and "non-owned autos" throughout the duration of the agreement. |

| Acquisition of New Vehicles | If the contractor acquires any vehicles during the agreement term, they must obtain coverage for "any auto" immediately and provide evidence of such to the City. |

| Definition of "Any Auto" | This coverage includes any autos owned by the insured, hired or borrowed autos, and non-owned autos used for business purposes. |

| Definition of "Hired Autos" | This term refers specifically to vehicles that are leased, hired, rented, or borrowed for use in the contractor's business. |

| Definition of "Non-owned Autos" | Coverage extends to vehicles not owned by the contractor, including those owned by employees or their household members, while used for business or personal affairs. |

Guidelines on Utilizing Insurance Policy Declaration Page

Completing the Insurance Policy Declaration Page form accurately is essential for ensuring compliance with the requirements set forth by the City of San Diego. Follow these steps to fill out the form correctly.

- Start with the title section of the form. Write the name of the contractor in the space provided where it states "(Contractor)".

- Indicate if the contractor currently owns any vehicles. If the answer is 'no,' this is straightforward. If an exception applies, you may need to clarify this later.

- In the next section, affirm that the contractor has obtained automobile insurance coverage for “hired autos” and “non-owned autos.” If applicable, check or fill in the appropriate boxes to confirm this coverage.

- Provide a statement committing to obtain coverage for “any auto” if any vehicle is acquired during the duration of the Agreement. Include any specific language as required.

- Next, identify the individual authorized to sign on behalf of the organization. Fill in their name and title in the designated fields.

- Sign the form where indicated. The signature must be from the previously mentioned individual.

- Date the form by entering the current date in the specified section.

- Lastly, ensure that the form is reviewed and approved by Victoria L. Hamilton, or the designated approver if necessary. If there is a signature or approval line for them, ensure it is left blank for them to fill in.

Once completed, the form should be submitted as required by the City of San Diego, ensuring all sections are accurately filled and no details are overlooked. Keep a copy for your records.

What You Should Know About This Form

What is an Insurance Policy Declaration Page?

The Insurance Policy Declaration Page serves as a formal document that outlines the automobile insurance coverage that a contractor holds. It is crucial for both the contractor and the City of San Diego, as it ensures that adequate insurance protection is in place during the term of their agreement. This page specifies what types of vehicle coverage the contractor possesses, detailing coverage for “any auto,” “hired autos,” and “non-owned autos.” It provides a summary of obligations that the contractor must follow regarding insurance coverage throughout the duration of the agreement.

What types of automobile coverage are defined in the declaration?

In this declaration, three types of automobile coverage are clearly defined. "Any Auto" covers any vehicle, including those owned by the insured, as well as borrowed or leased cars used in business. "Hired Autos" refers specifically to vehicles that are rented or borrowed for the contractor's business purposes. Lastly, "Non-owned Autos" includes vehicles not owned or leased by the insured but may involve cars owned by employees. This type of coverage applies when those vehicles are used in connection with the contractor's business or personal affairs.

What should a contractor do if they acquire a vehicle during the agreement?

If a contractor acquires a vehicle during the term of the agreement, they must act promptly. The contractor is required to obtain automobile insurance coverage for “any auto” without delay. It is essential to provide evidence of this coverage to the City of San Diego to ensure compliance with the agreement's requirements. Prompt action helps maintain the integrity and protection of both the contractor and the city during the contract period.

Who is responsible for signing the declaration?

The declaration must be signed by an authorized representative of the contractor. This individual should have the authority to confirm the details and compliance of the insurance coverage outlined in the declaration. Additionally, the declaration requires approval from a designated figure within the city, in this case, Victoria L. Hamilton from the Commission for Arts and Culture. This dual-signature requirement reinforces the accountability of both parties involved in the agreement.

Common mistakes

Completing the Insurance Policy Declaration Page form can seem straightforward, yet many individuals make common errors that can have significant consequences. It is crucial to approach this form with attention to detail, as inaccuracies can lead to confusion about coverage and potential disputes down the line. Here, we explore nine mistakes often encountered when filling out this form.

One frequent error involves failing to provide complete information about the contractor. Leaving out the contractor's full name or official designation may complicate verification of insurance and create barriers to communication. Completeness fosters clarity, so including every relevant detail is essential.

Another mistake people commonly make is incorrectly claiming ownership of vehicles. It is vital that the contractor accurately indicates whether they own any vehicles. A misleading declaration, whether intentional or accidental, can render the insurance policy void if an accident occurs involving a vehicle not disclosed in the form.

Additionally, individuals often overlook the requirement to specify coverage types. Neglecting to clearly identify that they have coverage for "hired autos" and "non-owned autos" creates ambiguity. This oversight may result in an inadequate insurance plan that does not meet the contractual obligations established with the city.

Some contractors mistake the definition of "any auto." This term encompasses a broad range of vehicles. After acquiring a new vehicle, the contractor must ensure to immediately obtain and provide the City with evidence of coverage. Ignoring this step can lead to gaps in coverage at critical moments.

Another common error lies in failing to update the insurance information promptly. The contractor is obliged to maintain updated insurance details throughout the term of the agreement. If any vehicle is acquired post-agreement, quick action is necessary to ensure compliance with the city’s requirements.

People also tend to skip the review of required signatures and dates. Failure to provide a signature or omitting the date may result in processing delays or the rejection of the entire submission. Ensuring that all signature lines are filled out properly is an essential step.

In some instances, contractors misinterpret the terms “hired” and “non-owned” vehicles. A lack of clarity can lead to misunderstanding regarding which vehicles are covered under the policy. Therefore, it is beneficial for individuals to review these definitions carefully to fully grasp their implications.

Moreover, some individuals neglect to attach proof of insurance coverage. Providing required documentation alongside the declaration form is crucial for compliance with the city's expectations. Without proper evidence, the contractor may face complications when claims need to be processed.

Finally, failing to seek clarification when uncertain can lead to critical mistakes. If parts of the form are confusing, reaching out for assistance can prevent errors that could have far-reaching consequences. Maintaining open lines of communication can ensure that the declaration aligns precisely with the requirements outlined by the city.

Overall, taking the time to avoid these common pitfalls can significantly ease the process of completing the Insurance Policy Declaration Page. By being diligent and thorough, contractors will not only protect their interests but will also foster a productive relationship with the City of San Diego.

Documents used along the form

The Insurance Policy Declaration Page is an important document in the realm of automobile insurance. However, it often accompanies various other forms and documents that play a crucial role in providing a comprehensive understanding of the coverage involved. Below is a list of these essential forms and documents.

- Insurance Policy: This document outlines the specific terms, conditions, and coverage limits of the insurance policy. It provides detailed information about the insured parties, covered risks, and any exclusions that apply.

- Certificate of Insurance: A certificate issued by the insurance company that serves as proof of insurance coverage. It summarizes the key aspects of the policy, including coverage types and effective dates, and is often required by third parties, such as clients or regulatory bodies.

- Claims Form: A form that enables policyholders to report an incident and request compensation for losses under the policy. It typically requires details about the accident or incident, damages incurred, and any relevant documentation to support the claim.

- Endorsements: These are modifications to the original insurance policy that add, change, or remove coverage. They clarify the scope of the policy and may be issued at the request of the policyholder or as mandated by changes in law or circumstances.

- Declarations Page (generic): While specific to automobile coverage, a general declarations page for other types of insurance includes similar information summarizing the essential details of the policy, such as coverage limits and the insured property or risks.

- Exclusions List: A document that details specific situations, risks, or perils that are not covered by the insurance policy. Understanding exclusions is crucial to knowing what protections are absent from the coverage.

- Policyholder’s Agreement: This document outlines the responsibilities and obligations of the policyholder as stipulated by the insurance provider. It often requires the signature of the policyholder to confirm acknowledgment of these terms.

In summary, these documents work together with the Insurance Policy Declaration Page to provide clarity and assurance regarding coverage. Understanding each of these forms helps individuals and organizations navigate the complexities of automobile insurance more effectively.

Similar forms

- Insurance Policy Schedule: Similar to the declaration page, this document provides an overview of the specific coverages included in an insurance policy, outlining essential details like effective dates and premiums.

- Certificate of Insurance: This document serves as proof of insurance coverage, detailing the insured parties, coverage limits, and the duration of the policy. It is often required by third parties.

- Coverage Summary: A high-level outline of the coverage offered under the insurance policy. It highlights the key aspects and exclusions, similar to how the declaration page outlines types of coverage.

- Declarations and Endorsements: These documents provide specific details about additions or changes to the original policy. Like the declaration page, they clarify coverage terms and conditions.

- Policy Jacket: This is the cover document of the entire insurance policy that includes the declaration page. It outlines the policy number, effective dates, and insurer information, similar in purpose to a declaration.

- Excess Liability Policy: This policy is similar as it also includes declarations related to additional liability coverage over primary insurance limits. It specifies the terms of excess coverage.

- Auto Insurance Application: This document provides details provided by the contractor when applying for coverage. It summarizes essential information relevant to determining eligibility and coverage options.

- Insurance Quote: This preliminary document gives an estimate of premiums and coverage options. The information is important as it parallels the summary nature of the declaration page.

Dos and Don'ts

When filling out the Insurance Policy Declaration Page form, it's essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of five important things to do and avoid during this process.

- Do provide accurate identifying information about the contractor and the insurance coverage.

- Do ensure that the declaration reflects the correct types of automobile insurance coverage being maintained.

- Do read the terms of the Agreement thoroughly to understand the coverage requirements.

- Do sign and date the declaration clearly, ensuring that the authorized signer’s title is included.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections of the form blank; incomplete forms may lead to delays in approval.

- Don’t provide misleading or false information, as it can result in complications or denial of coverage.

- Don’t forget to update the declaration if new vehicles are acquired during the agreement term.

- Don’t ignore any instructions or definitions provided in the form, as they are crucial for proper completion.

- Don’t submit the form without verifying all details for accuracy.

Misconceptions

Here are nine common misconceptions about the Insurance Policy Declaration Page form:

- Only vehicle owners need insurance. Many believe that only those who own vehicles must have insurance. However, contractors often need coverage for hired and non-owned vehicles as well.

- Hired autos and non-owned autos are the same. This is incorrect. Hired autos refer specifically to cars rented or leased, while non-owned autos include vehicles not owned by the contractor, such as those driven by employees.

- Insurance is not required if vehicles are not currently owned. The declaration emphasizes that even without ownership, insurance for hired and non-owned vehicles is mandatory during the agreement's term.

- Immediate insurance coverage is unnecessary. Some may think there's no rush to obtain coverage for any newly acquired vehicles. The form states that immediate action is required if a vehicle is acquired during the contract.

- Coverage for “any auto” is automatic. This varies depending on the specific terms of the policy. Contractors must ensure they meet the defined requirements to secure this broader coverage.

- The insurance policy only protects against accidents. In reality, insurance covers a range of liabilities, including damages or losses related to the use of both rented and non-owned vehicles.

- Providing evidence of insurance can wait. Delaying evidence submission can lead to breaches in contract. Contractors must provide documentation promptly upon acquiring coverage.

- The insurance declaration is irrelevant for small businesses. All businesses, regardless of size, must adhere to insurance requirements stated in agreements to protect against potential liabilities.

- Signing the declaration is a mere formality. In fact, signing the declaration carries legal implications. It confirms that the contractor understands and agrees to maintain necessary insurance coverage.

Key takeaways

When filling out the Insurance Policy Declaration Page form, keep these key points in mind:

- The form affirms that the Contractor does not own any vehicles at the time of submission.

- It is essential for the Contractor to maintain automobile insurance for "hired autos" and "non-owned autos" throughout the duration of the Agreement.

- If the Contractor acquires any vehicle during the agreement period, they must obtain coverage for "any auto" and provide proof to the City immediately.

- Understanding the definitions of the coverage types is crucial: "any auto," "hired autos," and "non-owned autos" each have specific inclusions.

- "Any auto" coverage includes vehicles owned by the Contractor, those hired, and non-owned autos used for business.

- "Hired autos" is limited to vehicles leased, hired, rented, or borrowed specifically for business use.

- For "non-owned autos," coverage applies to vehicles not owned by the Contractor but owned by employees or household members when used for business or personal affairs.

- Ensure that the organization member responsible for signing the document includes their title, signature, and the date of approval.

Browse Other Templates

W-2 Summary Report,New York State Wage Summary,NYC Income Summary,Tax Withholding Summary,W-2 Statement Compilation,State Tax Wage Report,Employee Income Record,W-2 Earnings Summary,New York Tax Compliance Form,Tax File Summary - Additional IT-2 forms are required if you have more than one federal W-2.

Mn Background Check Form - It is important to maintain documentation of the submission and any accompanying materials.