Fill Out Your Insurance Quote Form

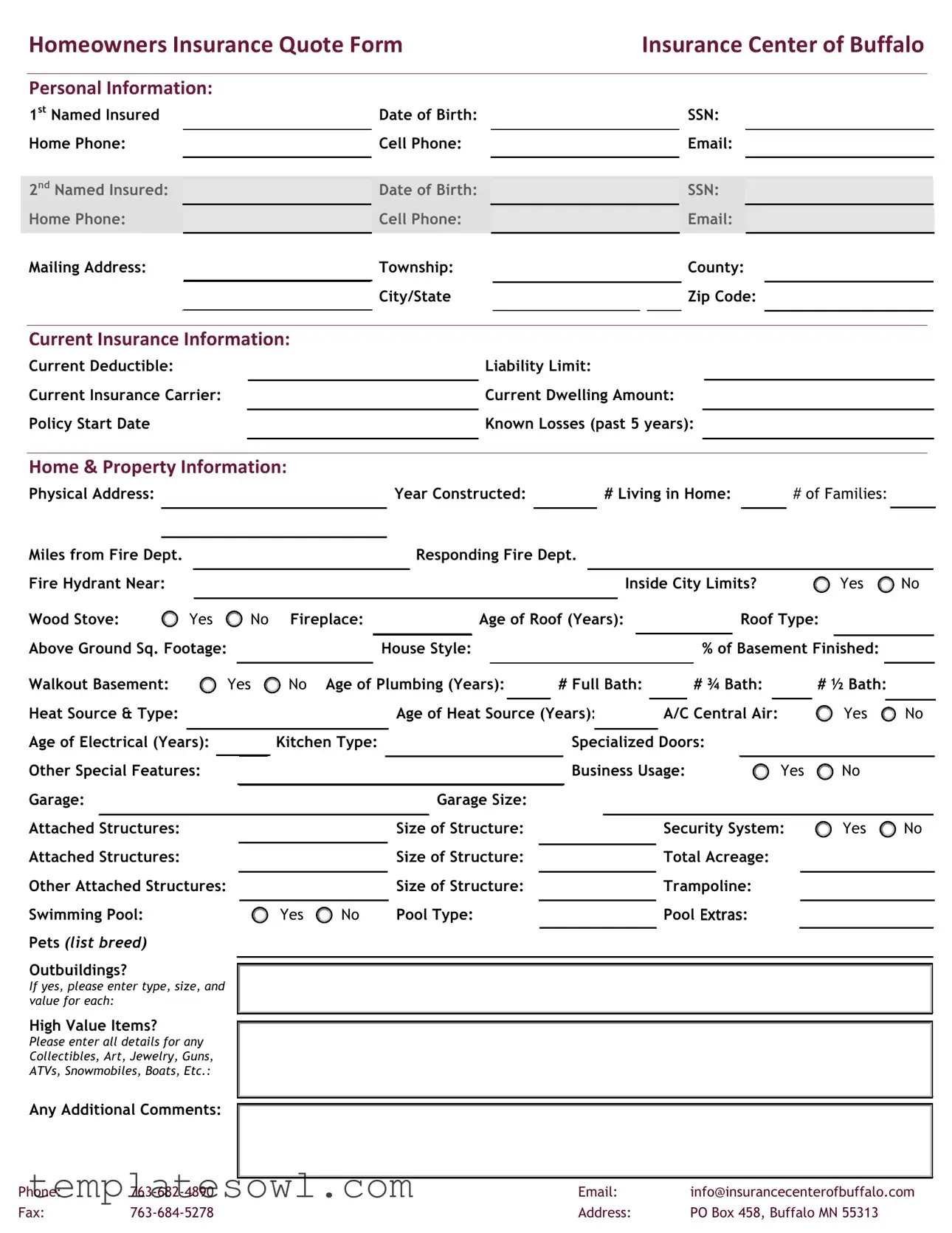

When considering homeowners insurance, completing an Insurance Quote form is an essential first step toward protecting your property and assets. This document collects detailed personal information about you and any additional insured parties. You'll provide vital contact information such as your phone numbers and email, alongside the mailing address where policies and communications will be sent. The form also requires specifics about your current insurance, including your deductible and liability limits. This helps ensure any new quote is an accurate reflection of your needs. Additionally, detailed home and property information is essential, including the physical address, year the home was constructed, and any special features like a fireplace, central air conditioning, or security systems. The form dives deeper by asking about the age and type of your roof, plumbing, and electrical systems to better assess risk factors. You'll also note any unique aspects such as business usage or the presence of a swimming pool. Completing this comprehensive form not only streamlines the quoting process but also aids in establishing an optimal insurance coverage level tailored just for you.

Insurance Quote Example

|

|

Homeowners Insurance Quote Form |

|

Insurance Center of Buffalo |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Information: |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Named Insured |

|

|

Date of Birth: |

|

|

|

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone: |

|

|

Cell Phone: |

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2nd Named Insured: |

|

|

|

Date of Birth: |

|

|

|

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Phone: |

|

|

|

Cell Phone: |

|

|

|

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address: |

|

|

Township: |

|

|

|

|

County: |

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/State |

|

|

|

|

Zip Code: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Insurance Information:

Current Deductible: |

|

Liability Limit: |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Insurance Carrier: |

|

|

Current Dwelling Amount: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Policy Start Date |

|

|

Known Losses (past 5 years): |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home & Property Information:

Physical Address:  Year Constructed:

Year Constructed:  # Living in Home:

# Living in Home:  # OF FAMILIES:

# OF FAMILIES:

Miles from Fire Dept. |

|

|

|

|

|

|

|

Responding Fire Dept. |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fire Hydrant Near: |

|

|

|

|

|

|

|

|

|

|

|

|

Inside City Limits? |

YES |

NO |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Wood Stove: |

YES |

NO Fireplace: |

|

|

|

Age of Roof (Years): |

|

|

|

Roof Type: |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Above Ground Sq. Footage: |

|

|

House Style: |

|

|

% of Basement Finished: |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Walkout Basement: |

YES |

NO Age of Plumbing (Years): |

# Full Bath: |

# ¾ Bath: |

|

# ½ Bath: |

|

||

Heat Source & Type: |

|

|

|

Age of Heat Source (Years): |

A/C Central Air: |

|

YES |

NO |

|

Age of Electrical (Years): |

|

Kitchen Type: |

|

Specialized Doors: |

|

|

|

||

Other Special Features: |

|

|

|

|

Business Usage: |

YES |

NO |

|

|

Garage: |

|

|

|

Garage Size: |

|

|

|

|

|

Attached Structures: |

|

|

|

Size of Structure: |

|

Security System: |

YES |

NO |

|

Attached Structures: |

|

|

|

Size of Structure: |

|

Total Acreage: |

|

|

|

Other Attached Structures: |

|

|

|

Size of Structure: |

|

Trampoline: |

|

|

|

Swimming Pool: |

|

YES |

NO |

Pool Type: |

|

Pool ([WUDV: |

|

|

|

Pets (LIST BREED) |

|

|

|

|

|

|

|

|

|

Outbuildings? |

|

|

|

|

|

|

|

|

|

If yes, please enter type, size, and value for each:

High Value Items?

Please enter all details for any

Collectibles, Art, Jewelry, Guns,

ATVs, Snowmobiles, Boats, Etc.:

Any Additional Comments:

PHONE: |

EMAIL: |

INFO@INSURANCECENTEROFBUFFALO.COM |

|

FAX: |

ADDRESS: |

PO BOX 458, BUFFALO MN 55313 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Homeowners Insurance Quote Form collects personal and property information to provide potential insurance quotes. |

| Governing Law | This form complies with Minnesota state insurance regulations. |

| Contact Information | Individuals fill in their contact details, including home and cell phone numbers, and email addresses. |

| Property Details | Homeowners provide information about their property, including age, size, and special features such as pools or security systems. |

| Insurance History | The form asks for details about current insurance, including deductible amounts and liability limits. |

| High-Value Items | People need to list high-value items like collectibles or jewelry, helping insurers assess risk accurately. |

Guidelines on Utilizing Insurance Quote

After gathering the necessary information, proceed to complete the Insurance Quote form. This document contains various sections requiring personal details, current insurance information, and specifics about your home and property. Clarity and accuracy are crucial, as the information provided will be used to tailor your insurance quote.

- Personal Information: Fill out the names, dates of birth, Social Security numbers (SSN), and contact information (home phone, cell phone, email) for both the first and second named insured.

- Mailing Address: Enter the complete mailing address, including township, county, city, state, and zip code.

- Current Insurance Information: Provide details regarding your current insurance policy, including the deductible, liability limit, the insurance carrier, dwelling amount, policy start date, and any known losses in the past five years.

- Home & Property Information: Indicate the physical address of the property and provide information about the year it was constructed, the number of people living in the home, and the number of families in the residence.

- Answer questions about the property, such as the distance from the nearest fire department, proximity to a fire hydrant, and whether the property is inside city limits.

- Indicate the presence of a wood stove or fireplace and provide details about the roof, including its age and type.

- List the square footage above ground, the style of the house, and the percentage of the basement that is finished. Note if there is a walkout basement.

- Provide details on plumbing, including its age and the number of baths (full, three-quarter, and half baths).

- Describe the heat source, its type, and age, as well as details about air conditioning (e.g., central air) and electrical systems.

- Specify the kitchen type, any specialized doors, and other special features of the property.

- Indicate if the property has business usage and describe the garage, including its size and whether it is attached.

- Provide details about attached structures, including their sizes and total acreage, if applicable.

- List features such as trampolines, swimming pools (including type), and pets (by breed).

- If there are any outbuildings, describe each one with type, size, and value.

- Detail any high-value items such as collectibles, art, jewelry, guns, ATVs, snowmobiles, and boats.

- Finally, include any additional comments that may be relevant.

Once all fields have been completed accurately, review the form for correctness before submitting it via the provided contact methods. This will ensure efficient processing and prompt delivery of your insurance quote.

What You Should Know About This Form

What information do I need to provide for the Insurance Quote form?

To complete the Insurance Quote form, you should gather personal information for both the first and second named insured, including dates of birth, social security numbers, and contact details. You'll also need to provide the current insurance information, such as the current deductible, liability limit, insurance carrier, and dwelling amount. Details about your home and property will be required as well, including the physical address, year constructed, size, and any special features like security systems or swimming pools.

How is my insurance quote calculated?

Insurance quotes are based on various factors including the information provided in your quote form. Insurers assess the risk associated with your property, taking into account its age, condition, location, and features. Elements such as your previous insurance history, loss history over the past five years, and the types of coverage you request will influence the final quote. Quotes will reflect your coverage needs and can vary widely depending on these factors.

Can I make changes to my quote after submission?

Yes, you can make changes to your quote even after submission. If you need to update any information, such as changes to your home's features or personal details, it's best to contact the insurance provider directly. Provide them with the updated information and they will recalculate your quote accordingly. Clear communication helps ensure you receive the most accurate and tailored coverage for your needs.

What should I do if I don’t understand a specific question on the form?

If you encounter a question on the Insurance Quote form that you don't understand, don’t hesitate to reach out for assistance. You can contact the insurance center via phone or email. The team is there to help clarify any confusing terms or concepts. Providing accurate information is crucial for getting the best quote, so asking questions is encouraged.

Common mistakes

Many individuals underestimate the importance of accuracy when completing an insurance quote form. One common mistake is providing incomplete personal information. This includes missing details such as a date of birth or Social Security number. Incomplete information can slow down the processing of the quote and potentially lead to issues during the underwriting process.

Another frequent error relates to the current insurance information section. People often fail to disclose their current insurance carrier or the amount of their current dwelling coverage. This oversight can significantly affect the quote provided, leading to discrepancies that might result in inadequate coverage options or higher premiums.

A third mistake is overlooking critical home and property information. Essential details such as the year the home was constructed or the age of the heating source can impact the insurance rates. Many forget to include aspects like the percentage of the basement that is finished or the presence of features like swimming pools or trampolines. These factors can significantly influence risk assessment and premium calculations.

In addition, some individuals might inaccurately assess the risk level posed by their properties. For instance, failing to indicate whether a security system is in place can lead to higher quotes. Not mentioning potential hazards or past losses, such as frequent claims, also misrepresents the property’s risk to insurers and can result in surprise rate increases later.

Finally, people often leave out high-value items and additional comments that may be relevant to the quote. Information about collectibles, jewelry, or significant outbuildings should always be provided. This omission may lead to insufficient coverage in the policy, leaving homeowners exposed in case of a loss. Providing comprehensive information not only expedites the quoting process but also ensures more accurate coverage tailored to the homeowner's needs.

Documents used along the form

In addition to the Homeowners Insurance Quote Form, there are several essential documents that often accompany the request for an insurance quote. These documents provide necessary details to help insurers assess the risk and determine the appropriate coverage. Here’s a list of forms you might encounter.

- Declarations Page: This document outlines the coverage offered under an insurance policy. It includes information about the insured property, coverage limits, and deductibles.

- Loss Run Report: A summary of an insurance policyholder's claims history, this report is vital for insurers to evaluate the risk. It details any past claims and their impacts on potential premiums.

- Property Inspection Report: Often conducted by an insurance adjuster or inspector, this report assesses the condition of the home and identifies any potential hazards that could affect insurability.

- Proof of Ownership: This may include a deed or mortgage statement confirming the homeowner's legal ownership. It is essential for the insurer to verify who is responsible for the property.

- Credit Report: Insurers may request a credit report to evaluate the financial stability of the applicant. A strong credit score can lead to better insurance rates.

- Application for Homeowners Insurance: Besides the quote form, an application is thoroughly completed by potential policyholders, providing more in-depth details about the property and its occupants.

- Additional Coverage Endorsements: These forms specify any additional coverages or modifications to a standard policy and may be presented to customize the insurance to the homeowner's needs.

- Estimator Sheet: This document breaks down the estimated value of the home's contents and any high-value items, assisting in determining the total necessary coverage.

Gathering and reviewing these documents alongside the Insurance Quote Form helps ensure a smoother process in obtaining home insurance. Having accurate and complete information readily available can expedite the quoting phase and facilitate a better understanding of coverage options.

Similar forms

Application for Health Insurance: Like the Insurance Quote form, this document collects personal information, including names, contact details, and health history. Both forms require details about existing coverage and desired benefits.

Auto Insurance Quote Form: This form functions similarly by requiring information about the insured vehicle, driver details, and current coverage. Both forms assess risk to calculate premiums and coverage options.

Life Insurance Application: Both documents gather personal information, including health history and financial details. The life insurance application assesses the applicant's risk profile to provide quotes.

Mortgage Application: Similar to the Insurance Quote form, a mortgage application collects financial and personal information. Each document evaluates risk based on the homeowner's financial status and property details.

Loan Application Form: This form requests personal and financial information, assessing the borrower's creditworthiness. Similar to the Insurance Quote form, both documents evaluate factors that influence approvals and rates.

Property Rental Application: Like the Insurance Quote form, this document gathers personal details and rental history. Both documents aim to evaluate risk and suitability in relation to occupancy.

Credit Card Application: This application asks for personal information and financial status. Both forms assess an individual's credit risk for determining eligibility and terms.

Pest Control Service Agreement: This form collects personal and property information necessary to assess treatment needs. It’s similar in that both documents determine appropriate services based on client disclosure.

Warranty Registration Form: Like the Insurance Quote form, this document collects specific details about ownership and the item being covered, allowing for evaluation of coverage terms.

Property Appraisal Form: This form addresses property information and characteristics that impact value. Similar to the Insurance Quote form, both focus on data that evaluates risk and potential costs.

Dos and Don'ts

When filling out an Insurance Quote form, it’s crucial to provide accurate and complete information. Here’s a guide on what you should and shouldn’t do.

- Do double-check all your personal details for accuracy.

- Do use your legal name as it appears on your identification.

- Do include all residents living in your home.

- Do specify any known losses from the past five years.

- Do provide your current insurance details, including deductible and coverage limits.

- Do mention any special features of your home, such as a swimming pool or security system.

- Don’t leave any fields blank if they are required.

- Don’t provide misleading information, as it may affect your coverage.

- Don’t forget to review your contact information for errors before submission.

Misconceptions

Misconception 1: The form is too complicated.

Many people believe that the Homeowners Insurance Quote Form is overly complex. While it does ask for a variety of personal and property details, each section is designed to collect essential information to ensure you receive an accurate quote. Familiarizing yourself with the questions can simplify the process.

Misconception 2: Only homeowners need to fill out the form.

It's common to think that only homeowners can benefit from filling out this form. However, renters and those considering purchasing a home can also find value in the process. By understanding what coverage options are available, you can make informed decisions about your insurance needs.

Misconception 3: Providing sensitive information isn't necessary.

Some may feel hesitant to provide personal details, such as Social Security numbers and contact information. However, this information is crucial for verifying identity and creating an accurate insurance policy. Insurers take privacy seriously and use secure methods to protect your data.

Misconception 4: The quote will not change after submission.

A common belief is that the initial quote is final. In reality, many factors can influence your premium, such as changes in property value or updates to your home's features. Once you receive the quote, it is always wise to review it and discuss any adjustments or additional coverage that may suit your needs better.

Key takeaways

Filling out an Insurance Quote form is a crucial step in securing the appropriate coverage for your home. Here are key takeaways for completing and utilizing this form effectively:

- Personal Information: Ensure all personal details are accurate. This includes the names, dates of birth, Social Security numbers, phone numbers, and email addresses of all insured parties.

- Current Insurance Information: Clearly state your current insurance details, including the deductible and liability limit. Provide the name of your current insurance carrier and the coverage amount for your dwelling.

- Known Losses: List any known losses or claims from the past five years. This can impact the quote you receive.

- Home & Property Information: Be thorough in providing details about your property. This includes the physical address, year the home was constructed, occupancy, and distance from the nearest fire department.

- Special Features: Indicate any special features of your home, such as a fireplace, wood stove, or security system. These features can affect your insurance needs.

- High Value Items: Itemize any high-value items like collectibles or jewelry. This information helps ensure adequate coverage is quoted.

- Additional Comments: Use the comments section to share any other pertinent information that may assist in generating an accurate quote.

- Check for Accuracy: After filling out the form, review all entries for accuracy to avoid delays or issues in processing your request.

- Contact Information: Use the provided contact details for any questions or clarifications. They are available via phone, email, or fax for assistance.

By addressing each of these areas carefully, you facilitate a smoother and more effective insurance quoting process.

Browse Other Templates

Printable Eye Prescription Template - Timely submission of this form is important for prompt service delivery.

Lic 308 - Public agencies must identify the specific services they are providing under this application.