Fill Out Your Intent To Lien Florida Form

The Intent To Lien Florida form plays a crucial role in the construction and property improvement industries. Utilizing this form, contractors, suppliers, or service providers can effectively notify property owners of their intention to file a Claim of Lien due to non-payment for services rendered. It serves as a written warning, providing details such as the date, names of the parties involved, and a description of the property in question. This notice must be sent at least 45 days before a lien is recorded, ensuring the property owner is aware of the potential legal action. Included is the specific amount owed, which must be settled within 30 days to avoid complications, such as foreclosure proceedings and additional costs like attorney fees. The form also confirms that no waivers or releases of lien have been provided, thereby protecting the filer’s claim. Underscoring the importance of communication, the notice urges the recipient to reach out to arrange payment and avert further legal action.

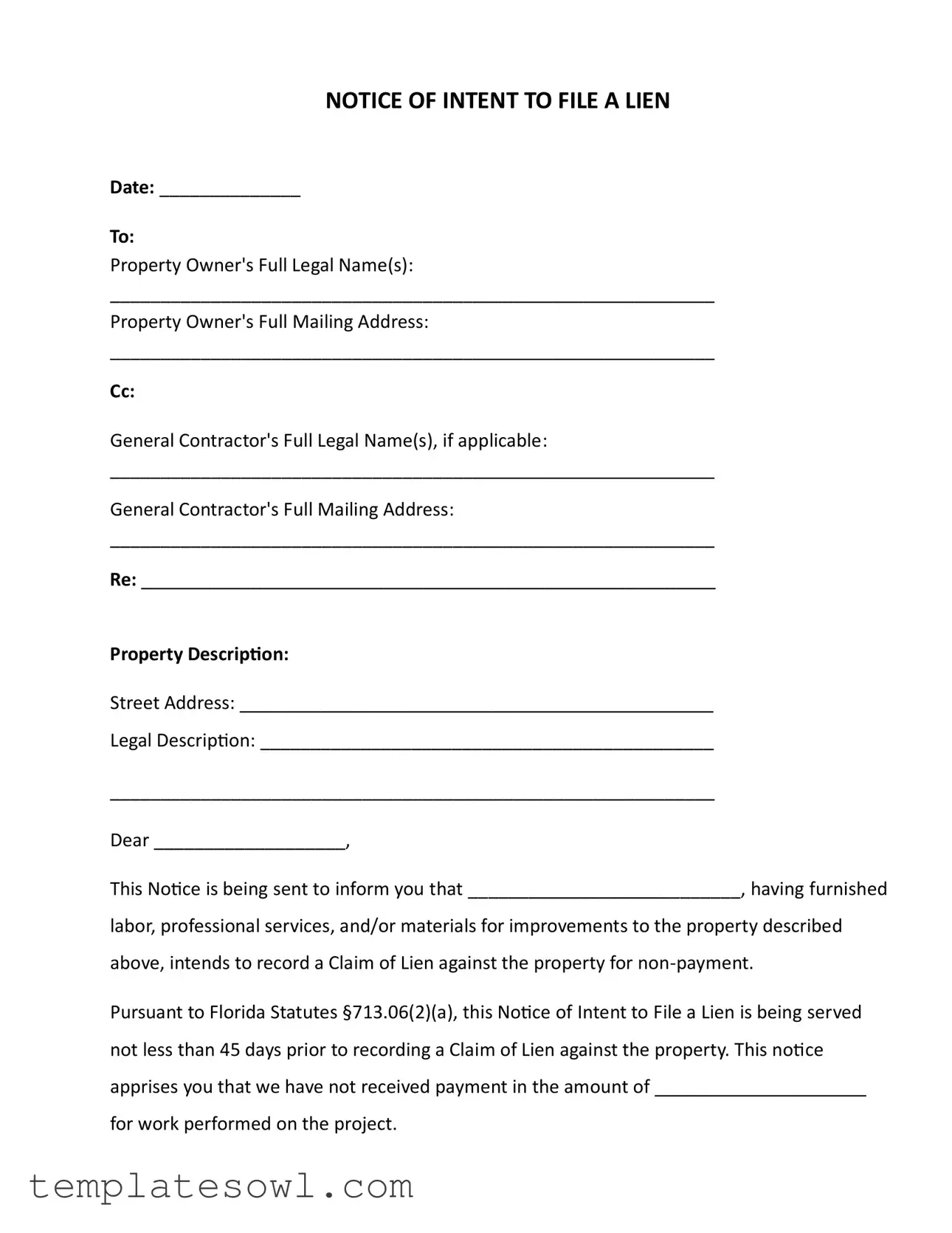

Intent To Lien Florida Example

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of unpaid amounts due for labor, services, or materials provided, warning that a lien may be filed. |

| Governing Laws | This form is guided by Florida Statutes §713.06, which outlines the requirements for sending a Notice of Intent to File a Lien. |

| Timing Requirements | According to §713.06(2)(a), the notice must be served at least 45 days before filing a lien. Further, the property owner has 30 days to respond to avoid further action. |

| Consequences of Inaction | If the property owner fails to pay or respond, the lien may be recorded, potentially leading to foreclosure and additional costs for the owner. |

Guidelines on Utilizing Intent To Lien Florida

Once you have gathered all necessary information, you can proceed to fill out the Intent to Lien form for Florida. This document must be carefully completed to ensure all stipulated details are clear and accurate before it is sent to the property owner and recorded if necessary.

- Date: Write today’s date at the top of the form.

- Property Owner's Name: Fill in the full legal name(s) of the property owner(s).

- Property Owner's Mailing Address: Enter the complete mailing address of the property owner.

- General Contractor's Name: If applicable, include the full legal name(s) of the general contractor; if not applicable, this section can be left blank.

- General Contractor's Mailing Address: Likewise, if there is a general contractor, provide their full mailing address. If not applicable, leave this blank.

- Property Description: Include the street address of the property.

- Legal Description: Write the legal description of the property in question.

- Payment Amount: Specify the unpaid amount for the labor, services, or materials provided.

- Your Details: Sign the document and add your full name, title, phone number, and email address.

- Certificate of Service: Fill in the date the notice was served, the recipient’s name, and address.

- Method of Delivery: Check the appropriate box regarding how the notice was delivered (e.g., certified mail, hand delivery, etc.).

- Name and Signature: Print your name and sign in the appropriate sections at the bottom of the certificate of service.

After completing the form, it should be sent to the property owner and any additional relevant parties. Make sure to keep a copy for your records. This step is crucial for maintaining clear communication and ensuring compliance with legal requirements.

What You Should Know About This Form

What is the Intent To Lien Florida form?

The Intent To Lien Florida form is a document that notifies property owners of a contractor's or service provider's intention to file a lien against their property due to non-payment. Essentially, it serves as a last warning before further legal action takes place. Sending this notice is an essential step for anyone wishing to secure payment for work completed on a property in Florida.

Why is the Intent To Lien important?

This form is significant because it provides the property owner with an official notice of the potential lien. Florida law requires that the notice be sent at least 45 days before filing a lien, offering the owner adequate time to address the outstanding payment. Receiving the notice prompts many property owners to settle their accounts and avoid the hassles of legal complications.

How does the process work?

First, the contractor or service provider completes the Intent To Lien form and sends it to the property owner. If payment is not made or if there is no satisfactory response within 30 days of the notice, the provider can proceed to file the Claim of Lien. This lien can be enforced through legal action, possibly resulting in foreclosure proceedings against the property.

What information is required on the form?

The form needs to include specific details such as the date, the names and addresses of the property owner and general contractor (if applicable), a description of the property, and the amount owed. Clear, accurate information is crucial to ensure the notice is legally effective and properly served.

What should homeowners do upon receiving the notice?

Homeowners should take the notice seriously and address the outstanding payment as soon as possible. It’s advisable to communicate with the contractor or service provider to clarify any misunderstandings. If necessary, consulting with an attorney might also be beneficial to understand rights and obligations at this stage.

Can the Intent To Lien be contested?

Yes, if a homeowner believes the claim is unjustified, they can contest it. Working directly with the contractor to resolve disputes often yields the best results. If a resolution cannot be reached, legal avenues may be explored. It’s crucial to document any communication and efforts to resolve the issue should it escalate.

What happens if a lien is eventually filed?

Once a lien is recorded, it becomes a public notice that the property is collateral for the debt owed. The property owner may face foreclosure, and they could also become responsible for additional costs such as attorney fees and court expenses. That’s why addressing the notice promptly is essential.

How can one avoid the possibility of receiving an Intent To Lien?

The best way to avoid receiving an Intent To Lien is to stay current with payments for any services rendered or materials supplied on a property. Maintaining clear communication with contractors regarding payments and project expectations can foster a positive relationship and reduce misunderstandings.

Common mistakes

Filling out the Intent to Lien form in Florida can present challenges, and errors can lead to delays or complications. One common mistake occurs when individuals fail to include the correct property owner's full legal name. Accurate and complete identification of the property owner is crucial to ensure the lien is enforceable. Omitting or incorrectly entering this information can invalidate the document.

Another frequent error is neglecting to provide a detailed property description. The form requires both a street address and a legal description. Missing these specifics can make it difficult to ascertain which property the lien pertains to. Without clarity, enforcing the lien could become problematic.

People often forget to clearly state the amount owed for services rendered. This is a vital component of the form. If the owed amount is not explicitly listed, it may lead to confusion, disputes, or even complications in subsequent legal proceedings. Ensuring that this figure is precise and visible can prevent misunderstandings.

The timing of the notice also plays a significant role in the completion of this form. Some individuals do not pay attention to the 45-day notice requirement. It’s essential to send this notice at least 45 days before intending to record the lien. Failing to adhere to this timeframe can jeopardize the validity of the lien altogether.

Proper service of the notice is another area where mistakes frequently occur. Sometimes, the sender does not accurately complete the Certificate of Service section. This part verifies that the notice was delivered correctly. If it is not filled out properly, the recipient may deny receiving the notice, potentially undermining the claims made in the lien.

Lastly, individuals sometimes overlook signature and contact information. Both the name and title of the person filing the lien, along with a reachable phone number and email address, should always be included. This information is necessary for any further communication regarding the lien. Omitting this information can lead to additional frustration and delays in resolving payment issues.

Documents used along the form

The Intent to Lien Florida form is an important document for contractors and suppliers who have not been paid for their services or materials. Along with this form, there are other documents that may be necessary to support your claim. Below are some common forms that are often used in conjunction with the Intent to Lien.

- Claim of Lien: This is the official document that is filed with the county clerk's office to formally assert the right to claim a lien against a property. Once the required time period has passed after the Intent to Lien notice, this document serves to secure payment for the services rendered or materials provided.

- Notice of Commencement: This document is typically filed by the property owner to declare the start of a construction project. It provides essential information about the project and is often required to be posted at the job site. Having this notice can help establish the timeline of events related to the work performed on the property.

- Affidavit of Non-Payment: This is a sworn statement that confirms payment has not been received for services or materials provided. It can be used in legal proceedings to demonstrate that efforts to collect a debt were made and that non-payment occurred.

- Release of Lien: This document is issued once payment has been received, releasing the property from any claims made by the lien. It should be filed with the same office where the Claim of Lien was recorded, ensuring that the property is no longer encumbered.

Being aware of these documents can help you manage the lien process effectively. Understanding each form's role might provide you with peace of mind during a challenging situation. It is essential to act promptly to protect your rights and ensure you receive the payment you are owed.

Similar forms

The Notice of Intent to File a Lien in Florida shares similarities with various other documents related to construction and property liens. Each of the following documents serves a specific purpose in protecting the rights of individuals or companies that have provided services or materials. Below is a list of eight such documents and their similarities to the Intent to Lien form.

- Notice of Lien: This document formally claims a right to the property due to non-payment. Similar to the Intent to Lien, it notifies the property owner of the creditor's intent to take action if payment is not made.

- Mechanic's Lien: A mechanic's lien is a legal claim against a property for unpaid work performed. Like the Intent to Lien, it provides a way for contractors to secure their interests in a situation where payment is delayed.

- Claim of Lien: This document is used to assert a lien on a property. It operates similarly to the Intent to Lien by serving as a precursor to a more formal claim and aims to inform the property owner of outstanding payments.

- Preliminary Notice: This notice is used to inform property owners and general contractors that services or materials have been provided. It is similar in its proactive approach to notifying stakeholders before further action is taken.

- Notice of Non-Payment: This document addresses the specific situation of non-payment for services rendered. It aligns with the Intent to Lien in conveying the urgency of the matter and the potential consequences of continued non-payment.

- Notice of Completion: This is a formal declaration that a project is finished. While its purpose differs, it similarly provides information to involved parties and can affect the time limits for claims and liens.

- Sworn Statement: Used to provide verification of work performed and payments due, a sworn statement can accompany the Intent to Lien. Both documents aim to provide clarity on financial transactions related to construction projects.

- Final Waiver of Lien: A final waiver certifies that all claims against the property have been released. While it serves to confirm payment has been made, it contrasts with the Intent to Lien, which signals impending legal action due to non-payment.

Dos and Don'ts

When filling out the Intent To Lien Florida form, it is essential to adhere to specific guidelines to ensure the document is processed correctly. Here is a list of do's and don'ts.

- Do provide the complete name and mailing address of the property owner.

- Do include the general contractor's details if applicable.

- Do clearly describe the property, including both street address and legal description.

- Do specify the amount owed for the work performed.

- Don't leave any sections of the form blank; all necessary information must be provided.

- Don't forget to sign and date the document; it must be officially recognized.

- Don't send the notice without sending a copy to the proper authorities, such as through certified mail.

- Don't neglect to keep a record of the notice served for future reference.

Misconceptions

- Misconception 1: The Notice of Intent to Lien is the same as a lien.

- Misconception 2: Sending the Notice of Intent to Lien guarantees payment.

- Misconception 3: The notice must be sent only to the property owner.

- Misconception 4: The form can be sent at any time.

- Misconception 5: A response from the property owner is not necessary.

- Misconception 6: You can ignore the Notice of Intent to Lien.

This form is a preliminary notice that signals the intent to file a lien. However, it does not create a lien itself. A lien is only established once it is officially recorded with the relevant authorities.

While this notice serves as a warning and may encourage prompt payment, it does not guarantee that the property owner will pay the outstanding amount. It is a step in the process, not a resolution.

In some cases, it is also necessary to send a copy of the notice to the general contractor. This ensures that all parties involved are aware of the potential lien, fostering transparency.

According to Florida law, this notice must be sent at least 45 days before filing a lien. Failing to adhere to this timeline could jeopardize the lien's enforceability.

Receiving a response is crucial. If the property owner does not address the notice within 30 days, the sender may proceed with filing a lien. Communication is key in resolving payment issues.

Ignoring this notice can lead to significant consequences, including the possibility of foreclosure. It's important to take such notices seriously and address any issues promptly.

Key takeaways

When filling out and using the Intent To Lien Florida form, keep the following key takeaways in mind:

- Timeliness is crucial. You must serve this notice at least 45 days before intending to record a Claim of Lien.

- Proper identification is essential. Include the property owner’s full legal names and their mailing addresses accurately.

- Include detailed property information. Clearly provide both the street address and a legal description of the property.

- Be specific about payment issues. State the exact amount owed for work performed to ensure transparency.

- Set a clear deadline for response. The property owner has 30 days to address the payment issue before a lien may be recorded.

- Understand the potential consequences. If a lien is recorded, the property may face foreclosure, and additional costs could be incurred.

- Document your service method. Indicate how you delivered the notice, whether by mail, hand delivery, or another method.

- Maintain a professional tone. Use respectful and clear language throughout the notice to promote effective communication.

Browse Other Templates

Kansas Child Support Calculator - Clear communication between parents regarding adjustments can avoid potential conflicts.

Fire Department Pre Plan Form - Includes space for diagrams and maps of the facility.