Fill Out Your Ira Beneficiary Disclaimer Form

When a loved one passes away, handling their Individual Retirement Account (IRA) can be challenging, especially for beneficiaries. The IRA Beneficiary Disclaimer Form is a vital document that facilitates this process for beneficiaries of LPL Financial LLC sponsored IRA accounts. It allows individuals to either claim their benefits or disclaim them entirely, depending on their needs and circumstances. Carefully selecting the right option is crucial; beneficiaries can transfer assets to their own IRA, open a Beneficiary IRA, or opt to receive a lump sum payment. The form also requires detailed information, including the deceased IRA owner's details, the beneficiary's relationship to the decedent, and tax identification numbers. Additional documentation, such as a certified death certificate, is necessary to support the request. Special procedures apply for unique beneficiary types like estates or trusts, which might involve court-certified documents. Timeliness is essential; the disclaimer must be made within nine months of the decedent's death to be valid. Understanding these requirements is critical to ensuring compliance with IRS regulations and making informed decisions that align with individual tax situations.

Ira Beneficiary Disclaimer Example

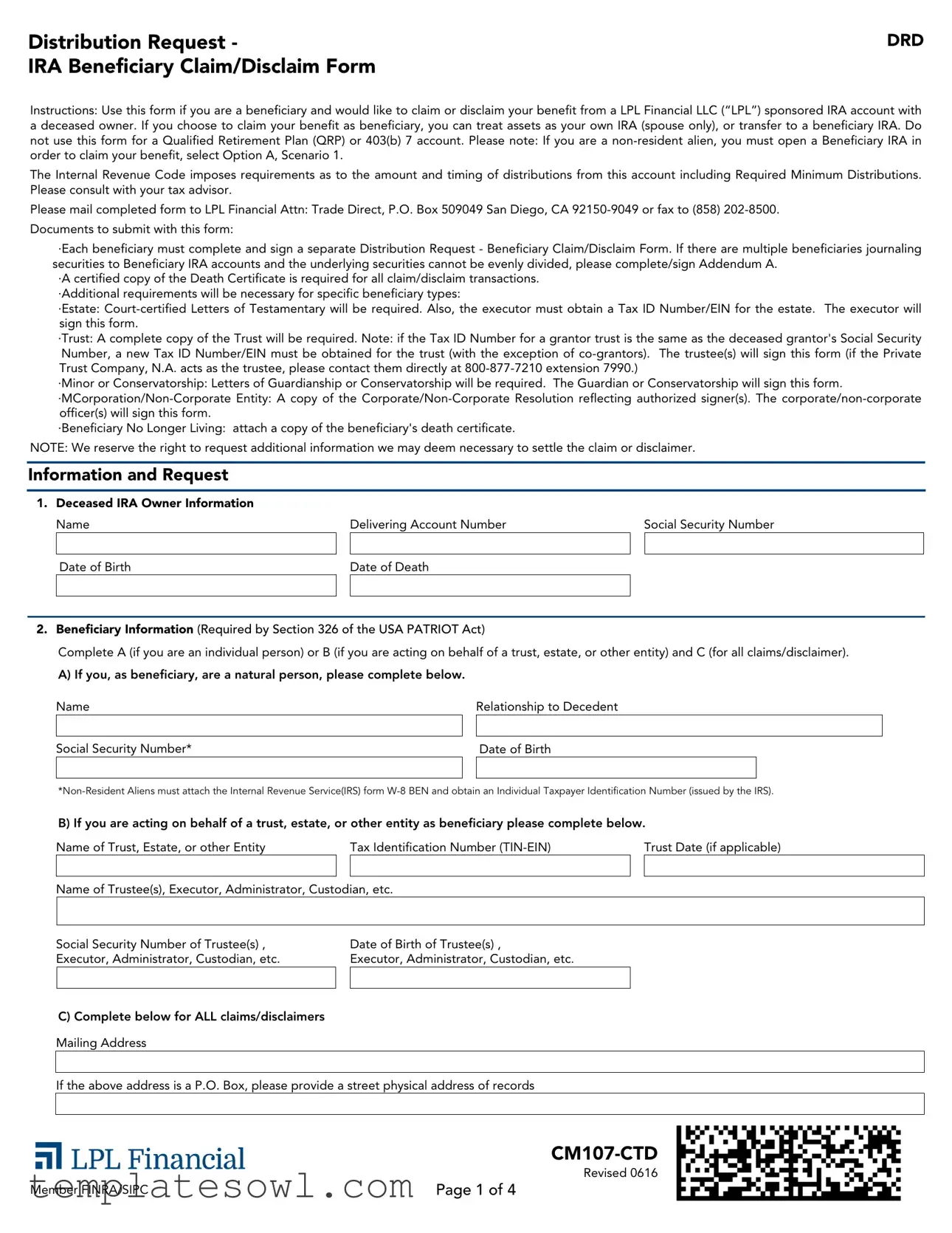

Distribution Request - |

DRD |

IRA Beneficiary Claim/Disclaim Form |

|

Instructions: Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a LPL Financial LLC (“LPL”) sponsored IRA account with a deceased owner. If you choose to claim your benefit as beneficiary, you can treat assets as your own IRA (spouse only), or transfer to a beneficiary IRA. Do not use this form for a Qualified Retirement Plan (QRP) or 403(b) 7 account. Please note: If you are a

The Internal Revenue Code imposes requirements as to the amount and timing of distributions from this account including Required Minimum Distributions. Please consult with your tax advisor.

Please mail completed form to LPL Financial Attn: Trade Direct, P.O. Box 509049 San Diego, CA

·Each beneficiary must complete and sign a separate Distribution Request - Beneficiary Claim/Disclaim Form. If there are multiple beneficiaries journaling securities to Beneficiary IRA accounts and the underlying securities cannot be evenly divided, please complete/sign Addendum A.

·A certified copy of the Death Certificate is required for all claim/disclaim transactions. ·Additional requirements will be necessary for specific beneficiary types:

·Estate:

·Trust: A complete copy of the Trust will be required. Note: if the Tax ID Number for a grantor trust is the same as the deceased grantor's Social Security Number, a new Tax ID Number/EIN must be obtained for the trust (with the exception of

·Minor or Conservatorship: Letters of Guardianship or Conservatorship will be required. The Guardian or Conservatorship will sign this form.

·Beneficiary No Longer Living: attach a copy of the beneficiary's death certificate.

NOTE: We reserve the right to request additional information we may deem necessary to settle the claim or disclaimer.

Information and Request

1. Deceased IRA Owner Information |

|

|

|

||

|

Name |

Delivering Account Number |

Social Security Number |

||

|

|

|

|

|

|

|

Date of Birth |

Date of Death |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Beneficiary Information (Required by Section 326 of the USA PATRIOT Act)

Complete A (if you are an individual person) or B (if you are acting on behalf of a trust, estate, or other entity) and C (for all claims/disclaimer).

A) If you, as beneficiary, are a natural person, please complete below.

Name |

|

Relationship to Decedent |

|

|

|

|

|

Social Security Number* |

|

Date of Birth |

|

|

|

|

|

B) If you are acting on behalf of a trust, estate, or other entity as beneficiary please complete below.

Name of Trust, Estate, or other Entity |

|

Tax Identification Number |

|

Trust Date (if applicable) |

|

|

|

|

|

Name of Trustee(s), Executor, Administrator, Custodian, etc.

Social Security Number of Trustee(s) , |

|

Date of Birth of Trustee(s) , |

Executor, Administrator, Custodian, etc. |

|

Executor, Administrator, Custodian, etc. |

|

|

|

C) Complete below for ALL claims/disclaimers

Mailing Address

If the above address is a P.O. Box, please provide a street physical address of records

Revised 0616

Member FINRA/SIPC |

Page 1 of 4 |

DRD

3. Beneficiary Options (Choose and Complete one - A, B, or C)

Option A: Direct Transfer to a Beneficiary IRA

Scenario 1:

As designated beneficiary under the above listed descendent account, I wish my portion to be transferred to a Beneficiary IRA under the name of the descendent, for the benefit of me and my social security number. Please transfer the following assets to LPL beneficiary IRA account

__________________________ (enter account number). Note: the current investment allocation on the decedent's IRA will be carried over to the

new inherited IRA for the beneficiary.

Scenario 2:

As trustee/executor of the trust/estate, I direct LPL to affect a transfer, in the name of the trust/estate. Please transfer ________% of the

deceased account to the LPL Beneficiary IRA account __________________________ (enter account number). Note: the current investment

allocation on the decedent's IRA will be carried over to the new inherited IRA for the trust/estate.

Scenario 3:

As Trustee/Executor of a

__________________________ (enter account number). Note: the current investment allocation on the decedent's IRA will be carried over to the

new inherited IRA for the beneficiary.

Note: to transfer your benefit of a Beneficiary IRA at another company, please contact the receiving company to determine the paperwork they require to perform the request. It is your responsibility to confirm that the receiving firm accepts these types of requests.

If selecting Option B, please go directly to and complete the following sections:

4. Your Signature(s)

Option B: Spousal Transfer

I certify that I was the sole beneficiary of the deceased IRA or if the deceased IRA has multiple beneficiaries as of September 30 of the year following the IRA owner's death, the beneficiaries have been separated into separate accounts by December 31 of the year following the year of the IRA owner's death in order for me to treat the IRA as my own. Please select the scenario that best applies to your situation:

Scenario 1: As spouse beneficiary, I elect to treat the decedent IRA as my own. Please transfer all assets to my own LPL IRA account

__________________________ (enter account number). Note: the current investments held in the decedent's IRA will be carried over to the new

IRA account.

Scenario 2: As spouse beneficiary of a

must comply with the IRS Minimum Required Distribution rules. For more information please see page 865, Q&A5, at http://www.irs.gov/pub/

If selecting Option A, please go directly to and complete, the following sections:

4. Your Signature(s)

Option C: Beneficiary Disclaimer - Qualified disclaimers are governed by Internal Revenue Code and the applicable state probate code. The model qualified language below satisfies the Internal Revenue Code, but may not meet all the requirements of state law. Therefore, LPL recommends the disclaimant seek competent legal advice to ensure that all of the state's requirements have been met.

General Requirements: The disclaimant is a beneficiary who was specifically designated by the deceased, or a beneficiary determined under the custodial agreement's default beneficiary provisions. The disclaimant must have not expressly or implicitly accepted the benefit before making the disclaimer. The disclaimer is irrevocable once made. The disclaimer must be made and delivered to the custodian within nine (9) months of the deceased date of death.

As a designated beneficiary, in accordance with the provisions of Section 2518 of the Internal Revenue Code, hereby irrevocably disclaim my interest of the above listed descendent account (listed in Section 1) in the following manner:

Scenario 1: Any and all Property.

If you are selecting Scenario 1 of Option C, please go directly to and complete, the following section: 5. Your Signature(s)

Scenario 2: Partial percentage of Property _____% (list percentage to disclaim).

If you are selecting Scenario 2 of Option C, please go directly to and complete Option A or B of this section for your remaining designated share.

Account Number |

Revised 0616 |

|

Page 2 of 4

DRD

4. Signature

Your signature below indicates that you have received and read the Beneficiary Information Guide for beneficiaries. I understand the tax implications of disclaimers, transfers, rollovers, and distributions. I further certify that no tax advice has been given to me by LPL. All decisions regarding any authorization herein are my own. I expressly assume responsibility for tax implications and adverse consequences, which may arise, and I agree that LPL shall in no way be held responsible.

•I certify that I am a US person (including US resident Alien) unless I have attached an Internal Revenue Service (IRS) Form

•I certify that if the beneficiary is for an Estate, Charity, Corporation, LLC, or Trust, that I have the authorization to complete and sign this form.

•If the beneficiary is a “look through trust or estate” as checked in Section 3, I certify the trust or estate is a look though trust or estate as described in Treasury Regulation 1.401(a)(9) and take full responsibility for my direction. Should any negative tax or other consequences arise from this direction, I will not hold Private Trust Company N.A. ("PTC") or LPL responsible in any way.

•If a distribution is selected above, I certify that I am the proper party to receive payment(s) form this account and the information is true and accurate. I understand the tax implications of distributions and understand that it is my responsibility to determine the taxable amount of any distribution made under this authorization.

•I have reviewed and accept the below statement:

(A)All parties to this agreement are giving up the right to sue each other in court, including the right to a trial by jury, except as provided by the rules of the arbitration forum in which a claim is filed.

(B)Arbitration awards are generally final and binding; a party's ability to have a court reverse or modify an arbitration award is very limited.

(C)The ability of the parties to obtain documents, witness statements and other discovery is generally more limited in arbitration than in court proceedings.

(D)The arbitrators do not have to explain the reason(s) for their award, unless, in an eligible case, a joint request for an explained decision has been submitted by all parties to the panel at least 20 days prior to the first hearing date.

(E)The Panel of Arbitrators will typically include a minority of arbitrators who were or are affiliated with the securities industry.

(F)The rules of some arbitration forums may impose time limits for bringing a claim in arbitration. In some cases, a claim that is ineligible for arbitration may be brought in court.

(G)The rules of the arbitration forum in which the claim is filed, and any amendments thereto, shall be incorporated into this agreement.

Account Holder Signature |

Account Holder Name (print) |

Date |

Account Number |

Revised 0616 |

|

Page 3 of 4

Do Not Return This Page |

DRD |

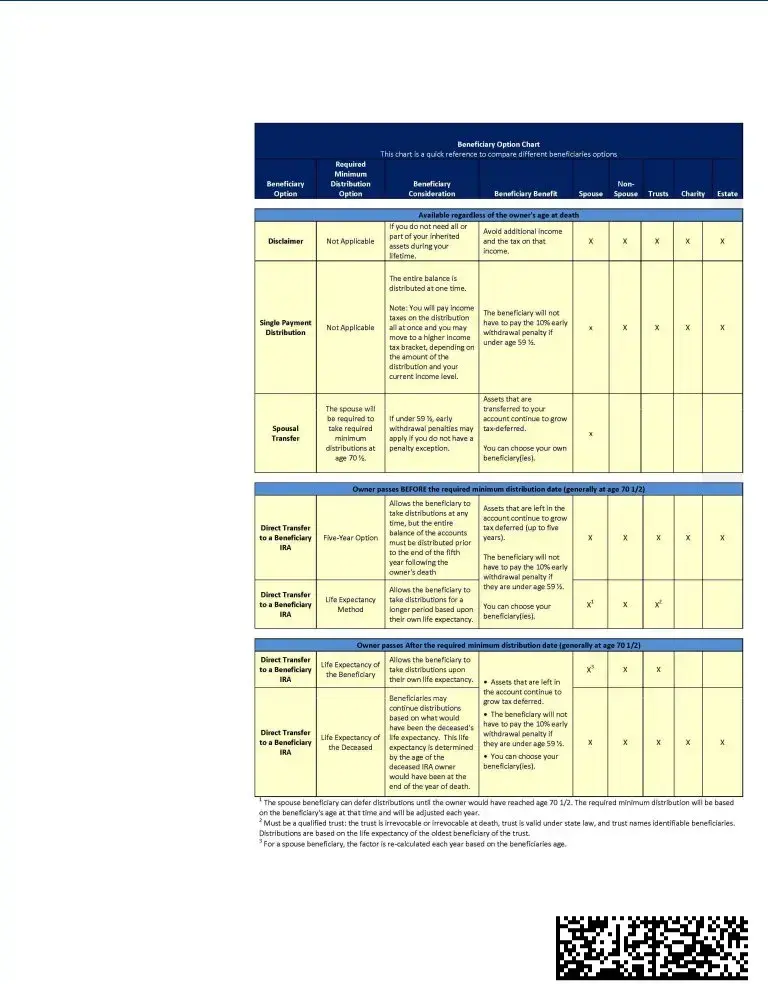

Beneficiary Information Guide Introduction

The Beneficiary Information Guide outlines the options available to beneficiaries of an Individual Retirement Account (IRA). LPL presents this information based on our understanding of the applicable tax laws as a guide to you, but we suggest that you consult with your tax advisor to discuss your individual tax circumstance. The Internal Revenue Code imposes requirements as to the amount and timing of distributions from this account including Required Minimum Distributions. Please consult with your tax advisor.

Review of Your Options As Beneficiary

Option A. Direct Transfer to a Beneficiary IRA

You can open an account called a Beneficiary IRA and transfer the inherited IRA to this new account. The assets will keep growing tax- deferred, and the required minimum distributions generally depend upon whether the original IRA holder died before or after his/ her required beginning date (generally April 1 of the year following the year when the original IRA owner reaches at 70 ½ years old) and whether you are a spouse beneficiary, non- spouse beneficiary, trust, charity or estate.

Option B. Single Payment Distribution

If the beneficiary has an immediate financial need

·The distribution may increase the beneficiary's taxes in the year they are taken

·The beneficiary will lose the

·A

Option C. Spousal Transfer

If you are a spouse beneficiary, you can transfer the inherited IRA into your own existing IRA or establish a new one in your own name. The monies in the account are available to you at any time and will be subject to the normal distribution rules for all IRA owners.

Option D. Disclaimer

If you find that you do not need or want your inherited assets, you may choose to disclaim or refuse to inherit all or part of your inherited assets. A qualified disclaimer allows you as the beneficiary to refuse all or a portion of the inherited IRA, avoiding additional income and taxes on that income.

A beneficiary who disclaims an IRA cannot dictate to whom the benefit will be paid. Once disclaimed, the payout will go to the next designated beneficiary, whether that beneficiary is primary or contingent. Once made, an effective disclaimer is irrevocable.

Note: A disclaimer must be filed within nine months of the account owner's death and before any benefits of the disclaimed assets are accepted. LPL recommends the disclaimant seek legal advice to ensure that the Internal Revenue Code and the applicable state probate codes have been met before any decision is made.

Revised 0616

Do Not Return

ADDENDUM A |

DRD |

-Use this attachment when there are multiple beneficiaries to a Retirement account journaling securities to a Beneficiary IRA and the underlying securities cannot be evenly divided.

-Include any cash portions / distributions to be split as well. If more pages are needed, use additional copies of this form, but all beneficiaries must sign each page.

-Note: LPL Financial cannot accept percentages. Specific share amounts must be listed for each security. Mutual Funds can only be moved in share values to the 3rd decimal point.

|

|

|

Receiving A/C# |

|

L |

|

Receiving A/C# |

|

L |

|

Receiving A/C# |

|

L |

|

Receiving A/C# |

|

L |

Receiving A/C# |

|

L |

||||||

|

|

|

Registration |

L |

|

Registration |

L |

|

Registration |

L |

|

Registration |

L |

Registration |

L |

|||||||||||

|

|

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Security / Cash |

Symbol or CUSIP |

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

|

Share Amount to Journal |

|

||||||||||

|

(or ALL) |

|

|

(or ALL) |

|

|

(or ALL) |

|

|

(or ALL) |

|

|

(or ALL) |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All beneficiaries receiving a portion of this account must sign below: I/we hereby finally and irrevocably release and discharge you of any claims by me or my legal representatives with reference to the foregoing, including the proceeds of the sale or other disposition thereof. I/we authorize LPL Financial to initiate credit or debit entries and adjustments.

Account Holder Signature |

Account Holder Name (print) |

Date |

||

|

|

|

|

|

Account Holder Signature |

Account Holder Name (print) |

Date |

||

|

|

|

|

|

Account Holder Signature |

Account Holder Name (print) |

Date |

||

|

Revised 0616 |

Member FINRA/SIPC |

Page 0 of 4 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRA Beneficiary Disclaimer Form is used by beneficiaries to claim or disclaim benefits from a deceased individual's IRA account. |

| Eligibility | This form is specifically for beneficiaries of LPL Financial LLC sponsored IRA accounts and is not applicable for Qualified Retirement Plans or 403(b) accounts. |

| Non-Resident Alien Requirements | Non-resident aliens must open a Beneficiary IRA to claim their benefits and adhere to specific IRS forms for tax identification. |

| Tax Implications | The form includes provisions that require beneficiaries to consult with a tax advisor regarding the tax consequences of distributions. |

| Filing Deadline | A disclaimer must be filed within nine months of the account owner's date of death to be considered valid. |

| State Law Considerations | Qualified disclaimers are governed by both the Internal Revenue Code and applicable state probate laws, which may have additional requirements. |

| Documentation Required | Beneficiaries must submit a certified copy of the death certificate, and additional documentation may be necessary based on the beneficiary type, such as an estate or trust. |

| Irrevocability | Once a disclaimer is made, it is irrevocable, meaning beneficiaries cannot later change their decision after filing. |

Guidelines on Utilizing Ira Beneficiary Disclaimer

After gathering the necessary information and documents, you can start filling out the IRA Beneficiary Disclaimer Form. This form allows you to formally disclaim a benefit from a deceased owner's IRA account. Once completed, the form needs to be mailed or faxed to LPL Financial.

- Begin with the deceased IRA owner information. Fill in the following details:

- Name

- Delivering Account Number

- Social Security Number

- Date of Birth

- Date of Death

- Next, provide your beneficiary information. You need to complete either section A, B, or C depending on your status:

- A) If you are an individual beneficiary, enter:

- Your name

- Relationship to the decedent

- Your Social Security Number

- Your Date of Birth

- B) If acting on behalf of an estate or trust, complete:

- Name of Trust or Estate

- Tax Identification Number (TIN)

- Trust Date (if applicable)

- Name of Trustee(s) or Executor(s)

- Social Security Number and Date of Birth for Trustee(s)/Executor(s)

- C) Complete for all claims/disclaimers:

- Mailing Address

- Street physical address if applicable

- Choose and complete one of the options available for the Beneficiary Options section:

- Option A: Direct transfer to a Beneficiary IRA

- Option B: Spousal transfer (for spouse beneficiaries only)

- Option C: Beneficiary disclaimer

- For your selected option, fill out the required details precisely, ensuring all information is correct.

- Sign the form and date it. By signing, you confirm your understanding of the information you provided and your responsibilities regarding tax implications.

- Gather additional necessary documents, such as:

- Certified copy of the Death Certificate

- Other specific documents based on your beneficiary type (e.g., court-certified Letters of Testamentary for estates)

- Finally, submit the completed form and documents by mailing them to the provided address or faxing them to the specified number.

What You Should Know About This Form

What is an IRA Beneficiary Disclaimer Form?

The IRA Beneficiary Disclaimer Form allows a beneficiary of a deceased IRA owner to refuse their inheritance. It is a formal way to indicate that a beneficiary does not want the inherited assets, which can provide tax benefits by avoiding income tax on the disclaimed assets. By completing this form, the beneficiary states that they are not accepting the inheritance and it will then pass to the next eligible beneficiary according to the decedent’s designated beneficiaries.

Who should use the IRA Beneficiary Disclaimer Form?

This form is intended for individuals who have been designated as beneficiaries of an IRA and wish to disclaim their benefits. It is particularly useful in situations where a beneficiary doesn’t need or want the assets due to financial or personal reasons. Only designated beneficiaries can disclaim benefits, and it must be done within nine months of the deceased's passing.

What are the qualifications for making a disclaimer?

To make a valid disclaimer, the beneficiary must officially decline any assets. The disclaimer must be submitted to the custodian within nine months of the deceased's death and before any acceptance of the benefits. Additionally, the beneficiary cannot accept any part of the asset before officially disclaiming. The disclaimer process is irrevocable, meaning once it is executed, it cannot be withdrawn.

Are there any potential tax implications when disclaiming an IRA?

By disclaiming an inherited IRA, individuals may avoid additional income tax on the disclaimed assets. However, understanding the specific tax implications requires careful consideration, as other factors like the heir's total taxable income can impact the overall tax responsibility. Beneficiaries should consult a tax professional to understand fully how a disclaimer affects their tax situation.

What documents must accompany the IRA Beneficiary Disclaimer Form?

A certified copy of the death certificate is required. In cases where the beneficiary is a trust or an estate, additional documentation such as court-certified Letters of Testamentary or a complete copy of the Trust must be submitted. Each beneficiary must also complete their own disclaimer form, as multiple beneficiaries cannot use one form.

Can a non-resident alien use the IRA Beneficiary Disclaimer Form?

Yes, non-resident aliens may disclaim their inherited benefits. However, they must first open a Beneficiary IRA to fully process their claim. It is essential for non-resident aliens to provide additional documentation, such as IRS Form W-8 BEN, and they should seek advice to navigate the tax implications effectively.

What are the options available to beneficiaries aside from disclaiming?

Beneficiaries typically have several options besides disclaiming, including transferring the assets to a Beneficiary IRA or treating the inherited IRA as their own. There are different pathways available depending on whether the beneficiary is a spouse or a non-spouse, and each option has distinct tax implications and requirements.

How do I submit the completed IRA Beneficiary Disclaimer Form?

Once the form is completed, it should be mailed or faxed to LPL Financial. The mailing address is Attn: Trade Direct, P.O. Box 509049, San Diego, CA 92150-9049, while the fax number is (858) 202-8500. Be sure to keep a copy of the completed form for your personal records.

Common mistakes

When filling out the IRA Beneficiary Disclaimer form, many individuals make common mistakes that can complicate or delay their claims. These errors can lead to misunderstandings or even legal implications. Here are ten mistakes to avoid.

One prevalent mistake occurs when beneficiaries fail to provide all required documents. Each beneficiary must submit a separate Distribution Request form, and a certified copy of the death certificate is essential for any claim. Forgetting these documents can stall the process significantly.

Another error is selecting the incorrect option on the form. Beneficiaries have multiple options—including direct transfer, spousal transfer, or disclaimer—but selecting an inapplicable option can render the form invalid. It's crucial to read the instructions thoroughly and choose the right path based on individual circumstances.

Some beneficiaries overlook the deadlines associated with disclaimers. A disclaimer must be filed within nine months of the owner's death. Failing to meet this timeline means losing the right to disclaim interest in the IRA.

Additionally, leaving out critical personal information is a frequent issue. For instance, beneficiaries must provide their social security numbers and mailing addresses. Neglecting this information will delay processing and could lead to additional queries.

Another common mistake is not consulting with a tax advisor. The tax implications surrounding IRA benefits can be complex, and overlooking this step can result in unexpected tax liabilities that could have been avoided.

Some beneficiaries mistakenly believe that they can dictate who receives the assets after disclaiming. Once a disclaimer is filed, the assets go to the next designated beneficiary as indicated in the IRA owner's records. Understanding this hierarchy is vital to avoid confusion.

Omitting signatures from the form is also a common error. Each beneficiary must sign and date the form to confirm their understanding and acceptance of the terms. Without this, the form may be rejected by LPL Financial.

Another serious mistake involves misunderstanding the implications of transferring assets to a Beneficiary IRA versus treating the inherited IRA as one's own. Beneficiaries should be precise about their intentions, as the treatment affects future distributions and tax obligations.

Failing to provide a physical address when only a P.O. Box is listed is another oversight. The form requires a street address, and missing this detail can prevent timely communication from LPL Financial.

Finally, some individuals do not seek proper legal advice. The consequences of incorrect form submission can be far-reaching, especially regarding estate matters. Consulting with an attorney can help ensure that all legal requirements are satisfied and that personal interests are protected.

Documents used along the form

Along with the IRA Beneficiary Disclaimer Form, various other documents may need to be prepared to effectively manage the distribution of benefits from an IRA account after the owner's death. Below is a list of forms and documents often utilized in conjunction with the disclaimer form.

- Distribution Request - Beneficiary Claim/Disclaim Form: This form must be completed by each beneficiary who wishes to claim or disclaim their share of the inherited IRA. Each beneficiary needs to fill out their individual form, even when multiple individuals are involved.

- Addendum A: This document is used when there are multiple beneficiaries who cannot evenly divide the assets. It provides a mechanism for specifying share amounts that are to be transferred to different accounts.

- Death Certificate: A certified copy of the deceased owner's death certificate is necessary to complete the claims process. This document serves as official proof of the account owner's passing.

- Letters of Testamentary: Required when the beneficiary is the estate of the deceased. This legal document confirms the authority of the designated executor to manage the estate's assets, including the IRA.

- Trust Document: If the IRA is to be claimed by a trust, a complete copy of the trust document is essential. This outlines how assets should be distributed according to the trust's terms.

- Letters of Guardianship: For claims by minors or in cases of conservatorship, this document is needed. It signifies that the individual claiming the benefits has legal authority to do so on behalf of the minor or impaired individual.

Having these documents prepared will help ensure a smooth and orderly process in managing the inherited IRA benefits. It's essential to consult with a qualified professional to address individual circumstances and ensure compliance with relevant regulations.

Similar forms

The IRA Beneficiary Disclaimer Form shares similarities with several other financial and legal documents. Each serves specific purposes regarding asset distribution, but they may function in comparable ways to address beneficiary rights and responsibilities. Below are nine documents that are similar to the IRA Beneficiary Disclaimer Form:

- Last Will and Testament: This document specifies how an individual’s assets should be distributed after their death, similar to a disclaimer which allows a beneficiary to refuse an inherited asset.

- Trust Documents: These outline how assets placed in a trust are managed and distributed upon the grantor’s death. Like a disclaimer, trust documents provide guidance on distributions and can include specific instructions for beneficiaries.

- Power of Attorney (POA): A POA allows an appointed individual to manage financial or medical decisions on behalf of another. It can be comparable to an IRA beneficiary’s right to make decisions regarding asset acceptance or distribution.

- Beneficiary Designation Forms: These forms specify who will inherit assets from accounts such as life insurance or retirement accounts. They serve a similar purpose to the disclaimer form in defining beneficiary rights.

- Transfer on Death (TOD) Deeds: These deeds allow individuals to transfer real estate directly to beneficiaries upon their death, much like disclaiming an IRA allows for a reallocation of assets.

- Gift Tax Return (Form 709): Similar to disclaimers that manage inherited assets, this form is used to report gifts made during the donor's lifetime to avoid tax complications.

- Estate Tax Returns: Like disclaimers, these document the assets of a deceased person and ensure that any tax liabilities are appropriately handled before distribution to beneficiaries.

- Charitable Contribution Forms: These can outline the intent to transfer specific assets to charities and reflect a donor's wishes, similar to how a beneficiary may choose to disclaim an inheritance in favor of another heir.

- Revocation of Beneficiary Designation: This document allows individuals to change their designated beneficiaries. It’s akin to the irrevocability of a disclaimer, which also impacts beneficiary rights.

Dos and Don'ts

When filling out the IRA Beneficiary Disclaimer form, it is essential to approach the process with care and attention. Below are some guidelines to help ensure that you correctly complete this important document.

- Do: Read the entire form thoroughly before starting to fill it out. Understanding all sections will help avoid potential errors.

- Do: Ensure that you are a qualified beneficiary eligible to make a disclaimer under both federal and state laws.

- Do: Provide accurate information regarding the deceased IRA owner and your relationship to them.

- Do: Submit a certified copy of the death certificate along with your completed form.

- Do: Consult a tax advisor to understand the implications of disclaiming your interest in the IRA.

- Don't: Assume you can accept benefits before disclaiming; doing so may void your ability to disclaim.

- Don't: Forget to complete the form in its entirety; missing information can lead to delays in processing.

- Don't: Wait too long. You must submit the disclaimer within nine months of the account owner's death.

- Don't: Neglect to keep copies of all documents you submit for your records.

Misconceptions

Misconception 1: A beneficiary can easily change their mind about accepting an IRA distribution.

Once a beneficiary has made a decision to disclaim an IRA, this decision is irrevocable. This means that the beneficiary cannot later choose to accept the inheritance after having disclaimed it. Understanding this is crucial for beneficiaries considering their options.

Misconception 2: Filing a beneficiary disclaimer is a straightforward process.

The disclaimer must meet specific requirements set by the Internal Revenue Code and possibly state laws. These include making the disclaimer in a timely manner and ensuring no benefits from the IRA are accepted before filing the disclaimer. Consulting a legal expert can help navigate these complexities.

Misconception 3: All beneficiaries can treat the inherited IRA the same way.

Different options apply based on the beneficiary's relationship to the deceased. For example, spouses may transfer the assets into their own IRA, while non-spouse beneficiaries have different options for handling the inherited IRA. Each type of beneficiary has different tax implications and distribution rules.

Misconception 4: A beneficiary can dictate who receives an IRA after their disclaimer.

When a beneficiary disclaims their interest, the benefit automatically passes to the next designated beneficiary. The disclaiming beneficiary cannot influence who receives the assets after they have chosen to refuse them. This can affect estate planning decisions significantly.

Key takeaways

When filling out and utilizing the IRA Beneficiary Disclaimer form, keep these key takeaways in mind:

- Purpose of the Form: This form is intended for beneficiaries of an LPL Financial LLC sponsored IRA of a deceased owner to either claim or disclaim their benefits.

- Eligibility: Eligible individuals include spouses, non-spousal beneficiaries, and specific entities such as trusts or estates. Be aware that non-resident aliens must open a Beneficiary IRA.

- Documentation Required: Each beneficiary must submit a separate completed form along with a certified copy of the death certificate.

- Additional Requirements: Different beneficiary types may need to provide additional documents, such as court-certified Letters of Testamentary for estates or trust documentation if applicable.

- Transfer Options: Beneficiaries can select from multiple options, including direct transfer to a Beneficiary IRA or electing a lump-sum payment, depending on their needs and circumstances.

- Disclaiming Benefits: If a beneficiary chooses to disclaim their inherited assets, they must do so within nine months of the decedent's death, and the disclaimer is irrevocable once made.

- Consult a Professional: Due to tax implications and various regulations involved, it is advisable to consult a tax advisor or legal professional before making decisions regarding the disclaimer or claiming benefits.

- Signature is Crucial: The form requires the beneficiary's signature, indicating that they understand the tax implications and accept responsibility for any consequences resulting from their decisions.

- Mailing Instructions: Completed forms should be mailed or faxed to the designated LPL Financial address or number, ensuring the submission is properly sent for processing.

Always review the specific instructions and seek assistance if needed to ensure compliance with the requirements of the form.

Browse Other Templates

Washington Quest Card Balance - Update your profile to ensure all information is accurate.

CMS-1450 - The form requires the date range of services to be clearly defined to streamline processing.