Fill Out Your Ira Withholding Form

The IRA Withholding form, also known as Form 2312, is an important document that allows individuals to elect state income tax withholding from their Individual Retirement Accounts (IRAs). This form is particularly relevant for those living in certain states, as it includes specific withholding rates and options tailored to their respective tax laws. For instance, residents of states like Iowa, Kansas, and Massachusetts have designated rates that depend on whether federal income tax is withheld. The form guides users through a structured process to select their desired withholding amount or percentage, enabling them to manage their tax responsibilities more effectively. Additionally, it includes an important disclaimer, clarifying that the responsibility for any tax implications falls on the individual completing the form, not the financial organization. Furthermore, the form provides flexibility, allowing individuals to change their withholding election at any time, ensuring that it aligns with their current financial and tax situation. Each state listed on the form has specific rules that applicants must read and understand, making it essential for individuals to familiarize themselves with the requirements in their area before submitting the election.

Ira Withholding Example

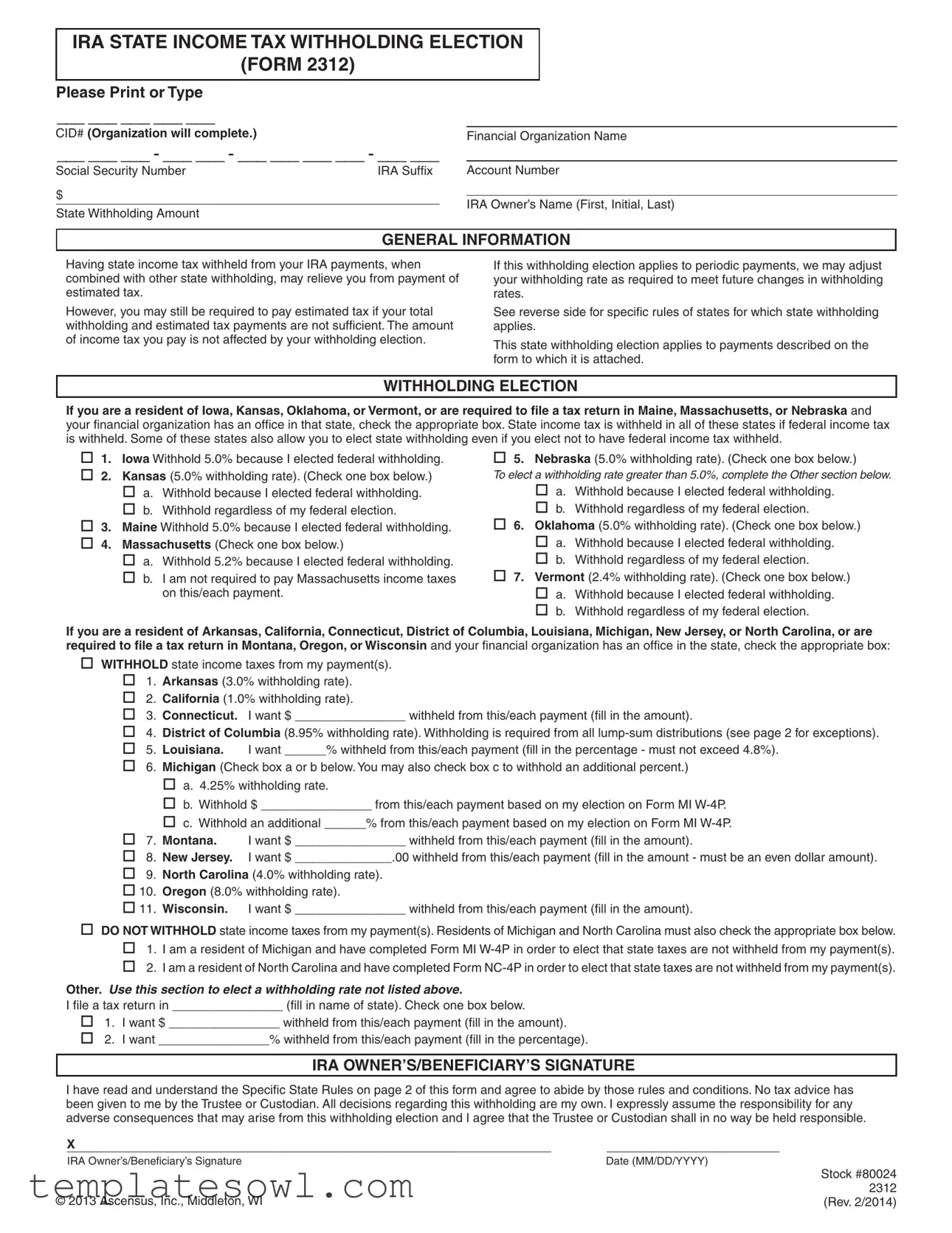

IRA STATE INCOME TAX WITHHOLDING ELECTION

(FORM 2312)

Please Print or Type

___ ___ ___ ___ ___

CID# (Organization will complete.) |

|

Financial Organization Name |

___ ___ ___ - ___ ___ - ___ ___ ___ ___ - ___ ___ |

|

|

Social Security Number |

IRA Suffix |

Account Number |

$

IRA Owner’s Name (First, Initial, Last)

State Withholding Amount

GENERAL INFORMATION

Having state income tax withheld from your IRA payments, when combined with other state withholding, may relieve you from payment of estimated tax.

However, you may still be required to pay estimated tax if your total withholding and estimated tax payments are not sufficient. The amount of income tax you pay is not affected by your withholding election.

If this withholding election applies to periodic payments, we may adjust your withholding rate as required to meet future changes in withholding rates.

See reverse side for specific rules of states for which state withholding applies.

This state withholding election applies to payments described on the form to which it is attached.

WITHHOLDING ELECTION

If you are a resident of Iowa, Kansas, Oklahoma, or Vermont, or are required to file a tax return in Maine, Massachusetts, or Nebraska and your financial organization has an office in that state, check the appropriate box. State income tax is withheld in all of these states if federal income tax is withheld. Some of these states also allow you to elect state withholding even if you elect not to have federal income tax withheld.

o1. Iowa Withhold 5.0% because I elected federal withholding.

o2. Kansas (5.0% withholding rate). (Check one box below.) o a. Withhold because I elected federal withholding. o b. Withhold regardless of my federal election.

o3. Maine Withhold 5.0% because I elected federal withholding.

o4. Massachusetts (Check one box below.)

oa. Withhold 5.2% because I elected federal withholding.

ob. I am not required to pay Massachusetts income taxes on this/each payment.

o5. Nebraska (5.0% withholding rate). (Check one box below.)

To elect a withholding rate greater than 5.0%, complete the Other section below.

oa. Withhold because I elected federal withholding.

ob. Withhold regardless of my federal election.

o6. Oklahoma (5.0% withholding rate). (Check one box below.) o a. Withhold because I elected federal withholding.

o b. Withhold regardless of my federal election.

o7. Vermont (2.4% withholding rate). (Check one box below.) o a. Withhold because I elected federal withholding. o b. Withhold regardless of my federal election.

If you are a resident of Arkansas, California, Connecticut, District of Columbia, Louisiana, Michigan, New Jersey, or North Carolina, or are required to file a tax return in Montana, Oregon, or Wisconsin and your financial organization has an office in the state, check the appropriate box:

oWITHHOLD state income taxes from my payment(s). o 1. Arkansas (3.0% withholding rate).

o 2. California (1.0% withholding rate).

o 3. Connecticut. I want $ ________________ withheld from this/each payment (fill in the amount).

o 4. District of Columbia (8.95% withholding rate). Withholding is required from all

o5. Louisiana. I want ______% withheld from this/each payment (fill in the percentage - must not exceed 4.8%).

o6. Michigan (Check box a or b below. You may also check box c to withhold an additional percent.)

oa. 4.25% withholding rate.

ob. Withhold $ ________________ from this/each payment based on my election on Form MI

oc. Withhold an additional ______% from this/each payment based on my election on Form MI

o7. Montana. I want $ ________________ withheld from this/each payment (fill in the amount).

o 8. New Jersey. I want $ |

.00 withheld from this/each payment (fill in the amount - must be an even dollar amount). |

o9. North Carolina (4.0% withholding rate).

o10. Oregon (8.0% withholding rate).

o11. Wisconsin. I want $ ________________ withheld from this/each payment (fill in the amount).

oDO NOT WITHHOLD state income taxes from my payment(s). Residents of Michigan and North Carolina must also check the appropriate box below. o 1. I am a resident of Michigan and have completed Form MI

Other. Use this section to elect a withholding rate not listed above.

I file a tax return in ________________ (fill in name of state). Check one box below.

o1. I want $ ________________ withheld from this/each payment (fill in the amount).

o2. I want ________________% withheld from this/each payment (fill in the percentage).

IRA OWNER’S/BENEFICIARY’S SIGNATURE

I have read and understand the Specific State Rules on page 2 of this form and agree to abide by those rules and conditions. No tax advice has been given to me by the Trustee or Custodian. All decisions regarding this withholding are my own. I expressly assume the responsibility for any adverse consequences that may arise from this withholding election and I agree that the Trustee or Custodian shall in no way be held responsible.

X |

_________________________ |

IRA Owner’s/Beneficiary’s Signature |

Date (MM/DD/YYYY) |

|

Stock #80024 |

|

2312 |

© 2013 Ascensus, Inc., Middleton, WI |

(Rev. 2/2014) |

SPECIFIC STATE RULES

Arkansas: Any payment from an IRA is subject to Arkansas withholding at 3.0% of the gross payment unless you elect no withholding. Complete this form to elect either withholding or no withholding. If you do not complete this form, then Arkansas income taxes will be withheld. You may change your withholding election at any time, applicable to payments made after the change. Arkansas withholding applies to Arkansas residents only.

California: Any payment from an IRA is subject to California withholding at 1.0% of the gross payment unless you elect no withholding (1.0% is equal to 10.0% of the amount computed for federal withholding). Complete this form to elect either withholding or no withholding. If you do not complete this form, then California income taxes will be withheld. You may change your withholding election at any time, applicable to payments made after the change. California withholding applies to California residents only.

Connecticut: Any payment from an IRA is subject to Connecticut withholding when you elect withholding and specify an amount. If you elect withholding, we are not required to withhold the amount you specify if it would result in a net payment of less than $10. You may change your withholding election at any time, applicable to payments made after the change. Connecticut withholding applies to Connecticut residents only.

District of Columbia: Any

Iowa: Any payment from an IRA is subject to Iowa withholding at 5.0% of the gross payment if federal income taxes are withheld from that payment. Complete this form only if federal income taxes are withheld. Iowa withholding applies to Iowa residents only.

Kansas: Any payment from an IRA is subject to Kansas withholding at 5.0% of the gross payment if federal income taxes are withheld from that payment or if you request Kansas withholding in writing even if federal income taxes are not withheld from the payment. Kansas withholding applies to Kansas residents only.

Louisiana: Any payment from an IRA is subject to Louisiana withholding only if you elect withholding and specify a percentage not to exceed 4.8% of the gross payment. Complete this form to elect withholding. If you do not complete this form, then Louisiana income taxes will not be withheld. Louisiana withholding applies to Louisiana residents only.

Maine: Any payment from an IRA is subject to Maine withholding at 5.0% of the gross payment if federal income taxes are withheld from that payment. Complete this form only if federal income taxes are withheld.

Massachusetts: Any payment from an IRA is subject to Massachusetts withholding at 5.2% of the gross payment if federal income taxes are withheld from that payment. (EXCEPTION:

A payment is not subject to Massachusetts withholding if it is excluded from taxation under Massachusetts law.) Complete this form only if federal income taxes are withheld.

Michigan: Any taxable payment from an IRA received by an IRA owner or beneficiary born after December 31, 1945, is subject to Michigan withholding at 4.25% of the gross payment, unless you furnish the IRA Trustee or Custodian with a Form MI

distributions from Roth IRAs. You may obtain Form MI

MI

Montana: Any payment from an IRA is subject to Montana withholding when you elect withholding and specify an amount. If you elect withholding, we are not required to withhold the amount you specify if it would result in a net payment of less than $10. You may change your withholding election at any time, applicable to payments made after the change.

Nebraska: Any payment from an IRA is subject to Nebraska withholding at 5.0% of the gross payment if federal income taxes are withheld from that payment or if you request Nebraska withholding in writing even if federal income taxes are not withheld from the payment. To specify a withholding rate greater than 5.0%, complete the Other section of the form to indicate your desired withholding percentage.

New Jersey: Any payment from an IRA is subject to New Jersey withholding when you elect withholding and specify an amount. If you elect withholding, we are not required to withhold the amount you specify if the withheld amount would be less than $10 (per payment). You may change your withholding election at any time, applicable to payments made after the change. New Jersey withholding applies to New Jersey residents only.

North Carolina: Any payment from an IRA is subject to

North Carolina withholding at 4.0% of the gross payment unless you elect no withholding on form

Oklahoma: Any payment from an IRA is subject to Oklahoma withholding at 5.0% of the gross payment if federal income taxes are withheld from that payment or if you request Oklahoma withholding in writing even if federal income taxes are not withheld from the payment. Oklahoma withholding applies to Oklahoma residents only.

Oregon: Any payment from an IRA is subject to Oregon withholding at 8.0% of the gross payment unless you elect no withholding. You may change your withholding election at any time, applicable to payments made after the change.

Vermont: Any payment from an IRA is subject to Vermont withholding at 2.4% of the gross payment if federal income taxes are withheld from that payment or if you request Vermont withholding in writing even if federal income taxes are not withheld from the payment. Vermont withholding applies to Vermont residents only.

Wisconsin: Any payment from an IRA is subject to

Wisconsin withholding when you elect withholding and specify an amount. If you elect withholding, we are not required to withhold the amount you specify if the withheld amount would be less than $5 (per payment). You may change your withholding election at any time, applicable to payments made after the change.

Other: Your financial organization will receive notification to use this section if additional states require withholding from IRA distributions.

Form Characteristics

| Fact Name | Description |

|---|---|

| Withholding Election Requirement | For residents of certain states, completing the IRA Withholding Election form (Form 2312) is essential to determine whether state income tax should be withheld from IRA disbursements. |

| State-Specific Withholding Rates | States like Iowa, Kansas, and Vermont have specific withholding rates of 5.0%, while Massachusetts mandates a 5.2% rate, creating variance in tax responsibilities based on location. |

| Future Changes Adaptation | The financial organization may adjust withholding rates in response to any future changes in state tax laws, ensuring compliance and accurate withholding. |

| Responsibility and Acknowledgment | By signing the form, IRA owners acknowledge their responsibility for the withholding election and accept that the financial institution is not liable for any tax-related consequences. |

Guidelines on Utilizing Ira Withholding

After completing the IRA State Income Tax Withholding Election Form (Form 2312), the next step involves submitting the form to your financial organization. They will process your withholding election based on the information provided. This may help with estimated tax payments, but the ultimate responsibility lies with you to ensure your withholding covers your tax obligations.

- Print or type your CID number if applicable.

- Enter the name of your financial organization in the designated space.

- Provide your Social Security number and IRA Suffix Account number.

- Fill in your name (first, middle initial, last).

- Indicate the amount of state withholding you want, if applicable.

- Check the appropriate box to select your state if you're a resident of a state requiring withholding. For states such as Iowa, Kansas, Oklahoma, or Vermont, follow the specific instructions for that state.

- If you reside in any of the following states: Arkansas, California, Connecticut, District of Columbia, Louisiana, Michigan, New Jersey, North Carolina, Montana, Oregon, or Wisconsin, check the appropriate box for the withholding amount or percentage you have decided on.

- If you want to set a withholding rate not covered by the earlier listed options, fill in the state and the desired amount or percentage in the 'Other' section.

- Sign and date the form, confirming you understand the specifics and accept responsibility for your withholding election.

What You Should Know About This Form

What is the purpose of the IRA Withholding Form?

The IRA Withholding Form, also known as Form 2312, allows you to specify how much state income tax should be withheld from your IRA payments. Completing this form is crucial for managing your tax obligations effectively. It serves to ensure that the right amount of taxes are withheld from your distributions, which can help prevent underpayment penalties at tax time.

Who needs to complete the IRA Withholding Form?

Residents or individuals who need to file tax returns in certain states, including Iowa, Kansas, Oklahoma, Vermont, Maine, Massachusetts, and Nebraska, are required to complete this form if they want state income tax withheld from their IRA distributions. If you reside in one of these states or your financial organization has a presence there, this form is pertinent to you.

Can I choose not to have state taxes withheld?

Yes, you can opt out of having state taxes withheld by selecting the appropriate option on the form. However, keep in mind that not completing the form may result in mandatory withholding of state income taxes based on your state’s regulations. It's essential to understand your specific state rules regarding withholding.

What happens if I choose to withhold but have no federal withholding?

In some states, specific conditions allow residents to request state withholding even if they do not elect federal withholding. Each state has unique rules for this situation. For instance, Kansas allows state withholding regardless of your federal election. Review the instructions carefully to ensure compliance.

How do I change my withholding election after it has been established?

You can change your withholding election at any time by submitting a new IRA Withholding Form. Ensure that your new election is in effect for future payments by submitting the updated form to your financial institution before the next payment is processed. This flexibility allows you to adjust your withholding based on your financial situation.

What is the minimum amount that can be withheld if I elect to withhold?

The minimum withholding amount can vary by state. For example, while some states may allow for withholding amounts as low as $5, others may have a minimum threshold of $10 for the withholding election. Be sure to check your specific state’s requirements when completing the form to ensure compliance.

What are the consequences of not completing the form?

If you do not complete the IRA Withholding Form and reside in a state that mandates withholding, your financial organization may withhold state income taxes automatically as per state regulations. This can lead to higher-than-expected tax payments and possible complications during tax season if your withholding does not align with your actual tax liability.

Common mistakes

Completing the IRA Withholding form can present challenges. One common mistake occurs when individuals fail to read the instructions thoroughly. The form contains specific details about state requirements and withholding percentages. Shunning this guidance can lead to incorrectly filling out the form, resulting in unexpected tax consequences down the line.

Another frequent error is neglecting to indicate the correct withholding option for their state. Each state listed has unique criteria for withholding. For instance, residents of Kansas may check a box indicating withholding based solely on federal elections, while others might seek a different rate. Inattention to these nuances can create discrepancies, leading to under-withholding or over-withholding.

Many people also mistakenly underestimate the importance of indicating the correct Social Security number. Omitting this information or recording it inaccurately can lead to significant processing delays and potential issues with state tax authorities. This clerical error can create unnecessary complications for the individual and their financial organization.

Lastly, some individuals may fail to keep a copy of the completed form for their records. Having documentation of the withholding election is essential for future reference. Neglecting to do so might result in confusion or conflicts regarding past withholding decisions. It is crucial to maintain a clear record for personal financial management and compliance.

Documents used along the form

The IRA withholding form (Form 2312) is not the only document you may encounter in managing your retirement funds. There are several other key forms and documents that can accompany this form, especially when dealing with state income tax withholding and distributions. Understanding these documents is essential for effective retirement planning.

- W-4P (Withholding Certificate for Pension or Annuity Payments): This form allows you to indicate how much federal income tax you want withheld from your pension or annuity payments. It is an important document for tax planning, especially if you opt for federal taxation on your IRA distributions.

- Form 1099-R: This is a tax form used to report distributions from retirement accounts. It provides information about how much money was distributed and how much tax was withheld, helping you accurately file your income taxes.

- Form MI W-4P: Specific to residents of Michigan, this form is required if you wish to modify the withholding of state income taxes on your IRA distributions. It ensures compliance with state tax regulations.

- Form NC-4P: This North Carolina-specific form needs to be submitted if you want to alter the withholding of state income tax from your IRA distributions. You can choose to withhold or not based on your selections on this form.

- State Income Tax Withholding Certificate: Each state may have its own withholding certificate for state income tax. This document allows IRA owners to specify how much state tax they wish to withhold, ensuring compliance with state laws.

- Financial Institution's Withdrawal Request Form: This form is needed to authorize your financial institution to process a withdrawal from your IRA. It often requires details about the amount to be withdrawn and may need to accompany the withholding form.

- Rollover Form: If you plan to move funds from one retirement account to another, this form is needed. It specifies the details of the transfer and ensures that you comply with tax rules governing rollovers.

- Transfer Request Form: Similar to the rollover form, this document allows the transfer of IRA assets from one custodian to another. It includes necessary information to facilitate the transfer and maintain tax compliance.

- Tax Return Form: While not exclusively connected to IRA distributions, your annual tax return is crucial for reporting any distributions and tax withheld. It ensures that you account for any potential taxes you owe on withdrawals.

- Beneficiary Designation Form: This form allows you to specify who will inherit your IRA upon your death. It is vital for ensuring your assets are distributed according to your wishes and can help minimize tax implications for your beneficiaries.

Careful attention to these forms will enable IRA owners to navigate complex rules and regulations more effectively. Proper documentation ensures compliance with state and federal laws while optimizing your retirement distributions and associated tax implications.

Similar forms

-

Form W-4: Similar to the IRA Withholding form, Form W-4 allows employees to dictate how much federal income tax should be withheld from their paychecks. Both forms involve making decisions regarding withholding amounts that influence future tax obligations. While W-4 focuses on employment income, both serve a purpose in managing tax due and ensuring compliance with tax regulations.

-

Form 1040-ES: This document is used for estimating and paying quarterly federal estimated tax. When individuals anticipate owing a significant amount of tax, they can make estimated payments to avoid penalties. Like the IRA Withholding form, it helps taxpayers manage their liabilities proactively but is tailored toward income from self-employment or other non-W-2 sources.

-

State Tax Withholding Forms: Each state has its own form similar to the federal IRS forms, allowing residents to specify state tax withholding preferences. Just as the IRA Withholding form addresses state-specific tax rules, these state forms dictate how much state income tax will be withheld from wages or distributions.

-

Form 1099-R: This form reports distributions from retirement accounts, including IRAs. While it doesn't allow for withholding elections, it provides the information needed to reconcile and report taxes owed on distributions. Both forms deal with the same source of income, highlighting the importance of tax planning for both the payer and payee.

-

Form MI W-4P (for Michigan): This state-specific form allows IRA owners or beneficiaries in Michigan to choose how much tax to withhold from their distributions, similar to the IRA Withholding form. It provides additional options and flexibility for those receiving distributions from their IRAs and reinforces the idea that taxation is often a localized concern.

-

Form NC-4P (for North Carolina): Just like its Michigan counterpart, the NC-4P provides information for North Carolina residents to decide on withholding amounts from IRA distributions. This form shares the same underlying concept of managing tax liabilities, emphasizing the need for residents to engage with their state tax regulations thoughtfully.

Dos and Don'ts

When filling out the IRA Withholding form, it is essential to follow specific guidelines to ensure accuracy and compliance with state laws. Below is a list of actions to consider.

- Do fill in all required personal information, including your Social Security number and the account number.

- Do check the appropriate boxes for state withholding based on your residency status.

- Do specify the amount or percentage you wish to withhold if applicable.

- Do review the specific state rules for withholding to understand your obligations.

- Do sign and date the form to validate your withholding election.

- Don’t leave any essential fields blank, as this may delay processing.

- Don’t elect a withholding amount that would result in less than the minimum required payment, as this may cause issues.

- Don’t provide incorrect information regarding your residency, as this will affect your withholding rate.

- Don’t forget to update your withholding election if your circumstances change.

Misconceptions

Misconceptions about the IRA Withholding Form can lead to confusion and potentially costly mistakes. Here are four common misconceptions:

- Withholding is mandatory for all states. Many people believe that state income tax must always be withheld from their IRA distributions. However, this is not true. Some states allow you to choose whether or not to withhold taxes. In certain situations, especially for residents of states like California or Louisiana, you must actively elect to have withholding take place.

- Withholding affects the total amount of tax owed. A common misconception is that the amount of tax withheld directly influences what you ultimately owe at tax time. While withholding can help manage your tax liability, it does not change the total amount of tax due based on your overall income. So, even if you have a lot withheld, your actual tax obligation could be higher or lower depending on your total income and deductions.

- Changing your withholding rate is complicated. Some individuals think that adjusting their withholding rate is a difficult process. In reality, many states allow you to modify your withholding simply by submitting a new IRA Withholding Form. You can change it at any time to better align with your expected tax liability.

- Only certain states require this form. While it is true that this form is critical for residents in specified states, there is often a misunderstanding that only a few states have specific requirements. In fact, many states have their own withholding rules, and it's essential to review your state’s requirements to ensure compliance.

Key takeaways

Understanding the process of filling out and using the IRA withholding form is crucial for making informed financial decisions. Here are several key takeaways that can help you navigate this important task.

- Provide Accurate Information: Ensure all personal details, including your name, Social Security Number, and account number, are entered correctly. Inaccuracies could lead to delays or errors in your tax withholding.

- State-Specific Requirements: Be aware that laws vary by state regarding tax withholding. Familiarize yourself with specific requirements to ensure compliance and avoid unexpected tax liabilities.

- Withholding Can Mitigate Tax Burden: Having state income tax withheld from your IRA payments may help relieve you from making estimated tax payments. However, keep in mind that sufficient withholding is necessary to avoid any potential shortfalls.

- Election Flexibility: You may change your withholding election at any time. Changes will apply to payments made after the new election takes effect. This flexibility allows you to adjust your withholding based on your financial situation.

- Signature and Agreement: It is essential to sign the form, confirming your understanding of the rules and your responsibility for the elected withholding. This acknowledgment indicates that you accept any consequences arising from your decisions.

These takeaways serve as a guide to help you navigate the IRA withholding form with confidence. Make sure to consult a tax professional if you have specific questions or concerns about your financial situation.

Browse Other Templates

Can an Llc Be Taxed as an S Corp - Taxpayers must be aware of the implications of any previous tax assessments in conjunction with the application.

Rental Laws in Florida - If you plan to e-file, ensure compliance with relevant rules and procedures.

G 28 - This document is vital for maintaining transparency and accountability in the immigration process.