Fill Out Your Iris Worker Timesheet Form

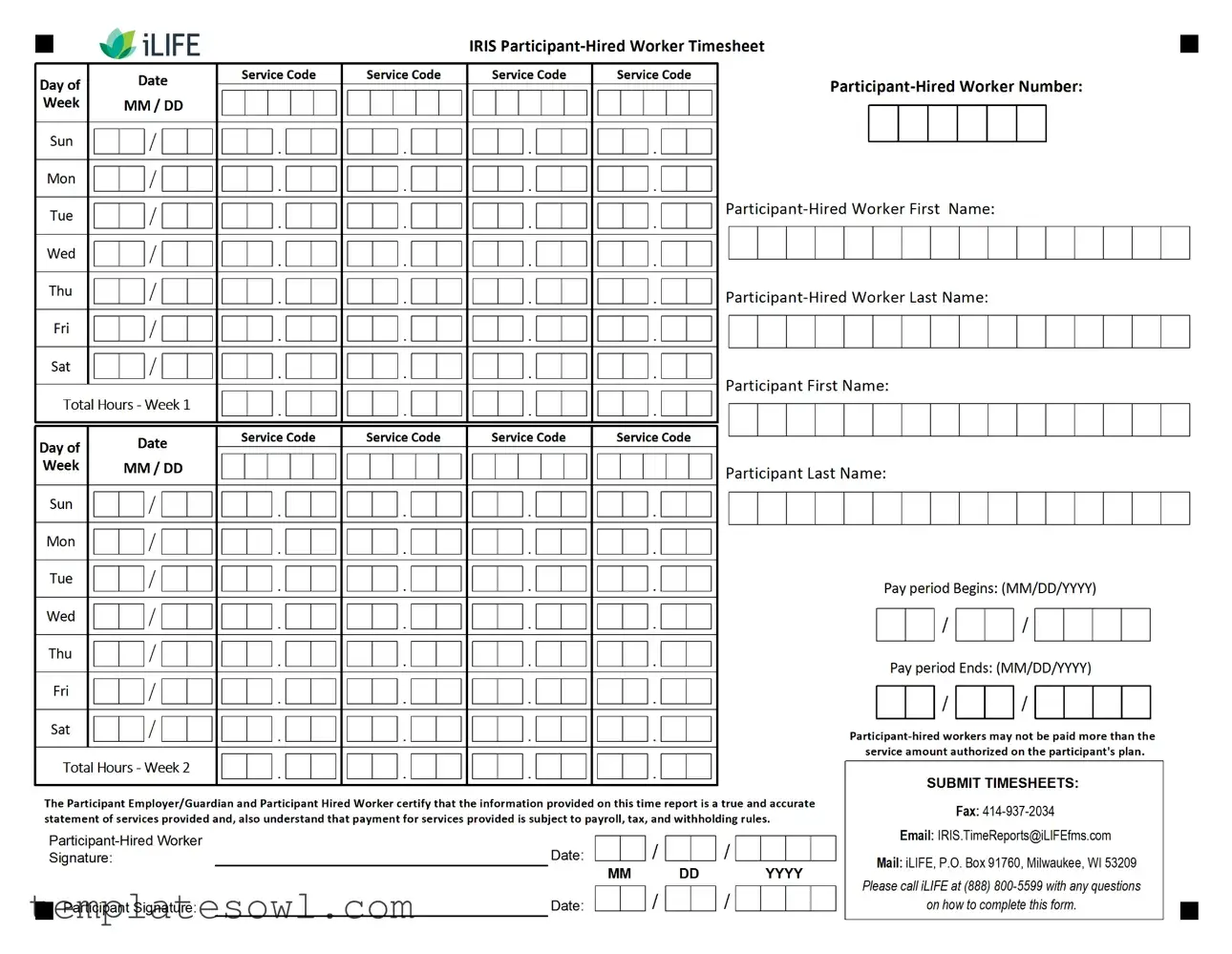

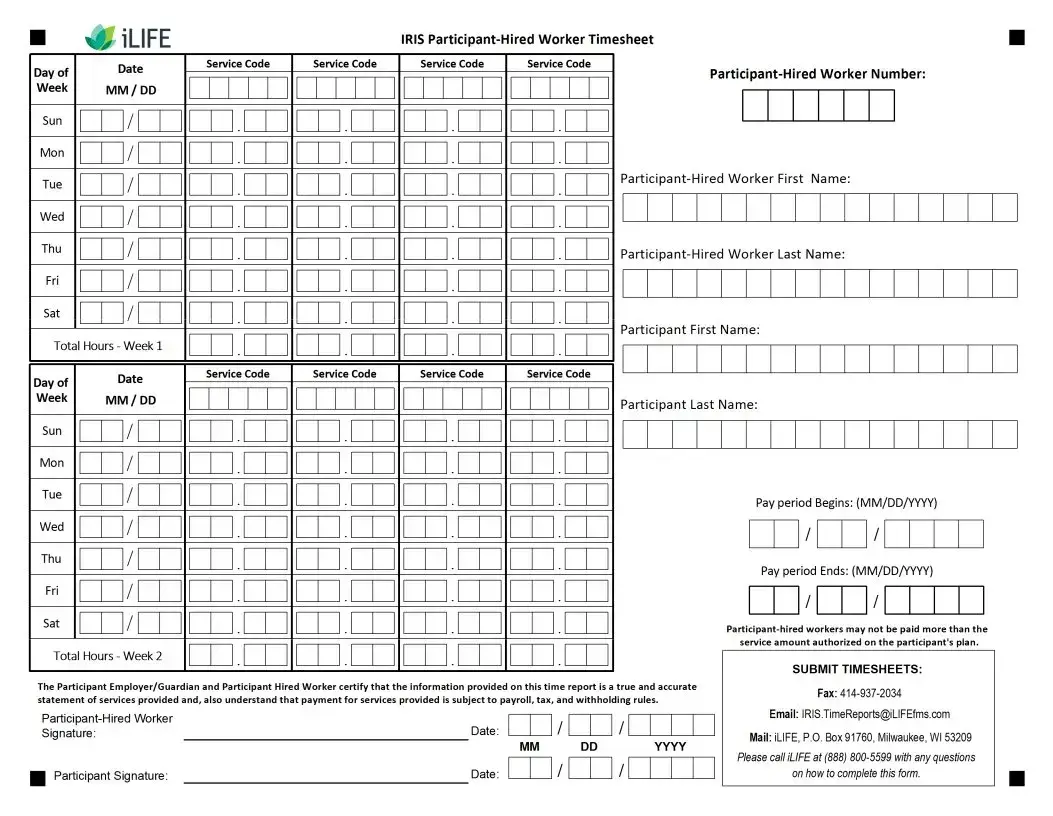

The Iris Worker Timesheet form plays a crucial role in the efficient management of payroll for individuals providing care and support services. This form serves as a vital record of hours worked by each caregiver or employee during a specific pay period. It incorporates essential elements such as the dates of service, total hours worked, and the corresponding service codes that classify the type of assistance rendered. Designed for clarity and ease of use, it requires caregivers to document their time accurately, ensuring that all necessary information is submitted in adherence to payroll schedules. Each timesheet must be signed by both the service participant and the employer, indicating that the recorded hours are correct. Those responsible for completing the form are also instructed to use specific ink colors and avoid marking in pencil to maintain the integrity of the document. As caregivers navigate their responsibilities, it is vital to consult the included codes that specify the types of services, such as Respite Care, Personal Care, and Supportive Home Care. This attention to detail fosters accountability and ensures that caregivers receive timely payment for their dedicated work.

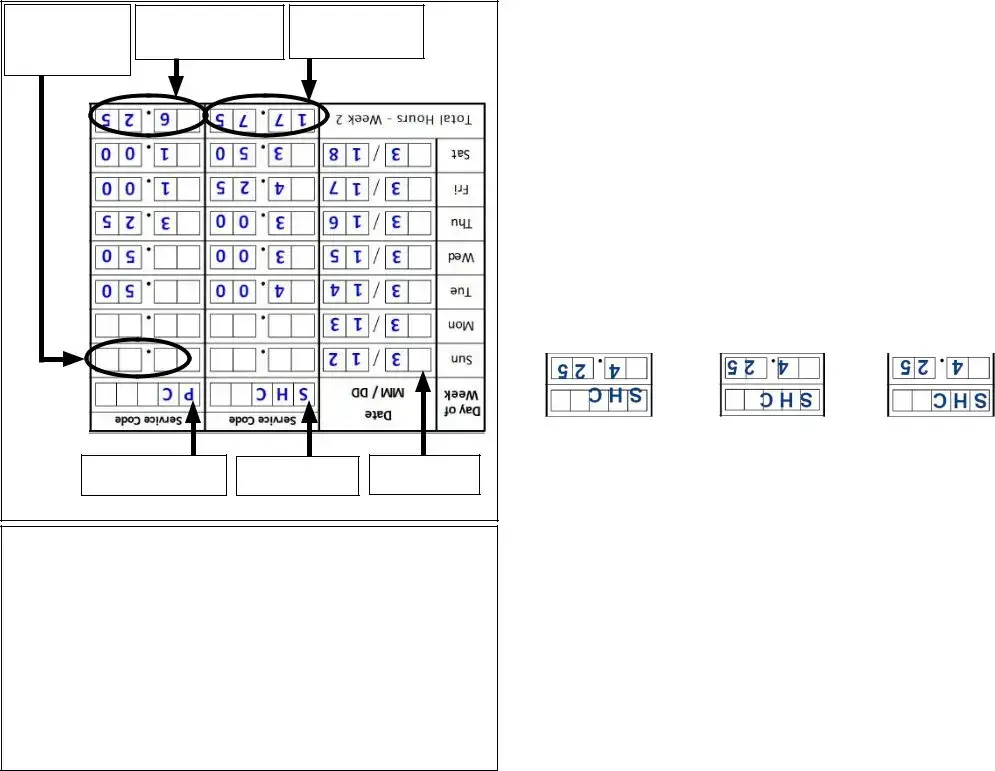

Iris Worker Timesheet Example

3/1 |

2.) |

.week the for |

.week the for (SHC) |

|

||

(Sunday, day that for |

(PC) column this in service |

column this in service |

|

|||

column this in service |

|

the for hours Total |

the for hours Total |

|

||

the for hours otalT |

|

|

|

|

|

|

.provided service next |

.provided service |

.workweek |

|

|||

for abbreviation Code |

for abbreviation Code |

that for Dates |

|

|||

|

|

|

|

Area Timesheet Sample |

||

.date pay the after days business (5) five until request payment stop a process to |

|

|||||

unable are We .mail the in check paper your receive to days business |

• |

|||||

|

|

|

|

).Friday other every be typically |

|

|

will (This .schedule payroll the on listed date due the by submitted be must Timesheets |

• |

|||||

|

|

.period pay each for employer participant each |

|

|||

for timesheet different a need will he/she participants, multiple for works employee |

|

|||||

an If .timesheet per period pay per employer/employee one only for hours Record |

• |

|||||

|

|

|

|

|

.schedule payroll |

|

the see dates, period pay For .timesheet per period pay one only for hours Record |

• |

|||||

.worked day last the after or on dated be must signatures Both .timesheet |

|

|||||

the date and sign must worker |

• |

|||||

|

|

.authorized those beyond worked hours any for |

|

|||

payment guarantee not does IRIS .hours authorized exceed not should worked Hours |

• |

|||||

|

|

|

|

|

Guidelines |

|

|

|

|

|

.Consultant IRIS your contact abbreviations, and types service of list full a For |

|

||

|

|

|

|

R |

|

Respite |

|

PC |

|

Care Personal |

|

C |

|

Chores - Care Home Supportive |

|

CC |

|

Care Companion - Care Home Supportive |

|

SS |

|

Supervision - Care Home Supportive |

|

SHC |

|

Routine - Care Home Supportive |

|

Abbreviation |

Type Service |

|

|

Timesheet |

|

|

|

|

|

|

|

|

|

Abbreviations Code Service Common |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

414 |

|

|

|

53209 WI GlendaleBox:Road,DropBaker |

.N |

|

|

53209 WI Milwaukee, 91760, Box .O.P iLIFE, Mail: |

|

|

|

com.TimeReports@iLIFEfms.IRIS Email: |

|

|

|

Submit to Ways |

|

INCORRECT |

û |

INCORRECT |

û |

ü |

|

|

|

CORRECT |

|

||

|

|

|

|

.them of outside |

|

extending or boxes the of sides the touching without possible as large as Write |

• |

||||

|

|

.pencil use not Do .only ink BLUE or BLACK in Write |

• |

||

|

|

|

|

Instructions Marking |

|

|

|

|

|

|

|

|

|

.date due the by iLIFE to timesheet the Submit .4 |

|||

|

|

|

|

.bottom) |

|

the (at timesheet the date and sign participant and worker |

|||||

|

|

|

.information requested all in Fill .a |

|

|

|

|

right): the (on area information worker/participant the In .2 |

|||

.Code Service each for worked hours total the write row, Hours Total the In .d |

|

||||

|

|

.column Code Service appropriate the |

|

||

in service each for worked hours of numbers total the write worked, day each For .c |

|

||||

|

|

|

|

.provided |

|

service each for abbreviation code service the write columns, Code Service the In .b |

|

||||

.period pay the of day each for dates the write column, Date the In .a |

|

||||

|

|

left): the (on area reporting time the In .1 |

|||

|

|

|

|

Instructions Timesheet |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Submission Deadline | Timesheets must be submitted by the due date specified on the payroll schedule. |

| Signature Requirement | Both the employee and the employer participant must sign and date the timesheet. |

| Hours Worked | Employees must not exceed the authorized hours worked as this could jeopardize payment. |

| Multiple Participants | If an employee works for multiple participants, a separate timesheet is required for each one. |

| Consultation for Codes | Consultants can reference a list of service types and abbreviations by contacting their IRIS representative. |

| Governing Laws | Specific state laws may govern submission and approval processes; always consult local guidelines. |

Guidelines on Utilizing Iris Worker Timesheet

Filling out the Iris Worker Timesheet form involves several essential steps to ensure accurate reporting of hours worked. Once filled out, this form enables proper processing of payments for the services provided. Following these instructions will help you complete the form correctly and avoid any delays.

- In the left area labeled "Date," write down the dates for each day of the pay period.

- In the "Service Code" column, enter the appropriate abbreviation code for the type of service you provided each day.

- Next, in the "Hours Total" column, record the total hours worked for each type of service you documented.

- After that, ensure all requested information is filled in accurately throughout the form.

- At the bottom of the timesheet, both the hired participant and the employer must sign and date the document to verify its accuracy.

- Finally, ensure that you submit the completed timesheet to iLIFE by the deadline indicated on the payroll schedule.

By following these steps diligently, you can help guarantee that payment requests are processed without any issues. Remember to keep a copy for your records as well.

What You Should Know About This Form

What is the Iris Worker Timesheet form used for?

The Iris Worker Timesheet form is used by employees who provide services under the IRIS program. Each employee must complete a timesheet to report the hours they worked for the corresponding pay period. This ensures accurate record-keeping for payroll processing and facilitates payment to the worker for the services rendered.

How should I fill out the Iris Worker Timesheet?

To fill out the Iris Worker Timesheet, begin by entering the date for each day worked in the appropriate column. Next, write the total hours worked for each type of service provided, using the designated service abbreviation codes. It is essential to date and sign the timesheet, both by the employer participant and the hired worker. Ensure all information is complete before submission to avoid delays in payment.

What happens if I submit the timesheet late?

Submitting the timesheet late may result in payment delays. It is crucial to adhere to the submission deadline outlined in the payroll schedule. If the timesheet is not submitted by the due date, the payment process cannot begin until the next payroll cycle, which could extend the time you wait to receive payment for your services.

Who should I contact for assistance with the timesheet?

If you need assistance with the Iris Worker Timesheet, you should reach out to your IRIS consultant. They can provide guidance on completing the form correctly and answer any questions about service abbreviations or the payroll process. For further questions, you may also contact the appropriate support office as indicated on the timesheet.

Common mistakes

Filling out the Iris Worker Timesheet form can be straightforward, but many make common mistakes. One of the most frequent errors is neglecting to enter each day's date accurately in the designated column. Without precise dates, tracking worked hours becomes problematic, leading to potential payment delays.

Another mistake occurs when workers attempt to use pencil for writing their timesheets. The form requires that entries be made in blue or black ink. Using pencil undermines the clarity and permanence of the entries, which could result in the timesheet being rejected.

People often forget to fill out all the requested information. Each section of the form demands specific details, such as the total hours worked and the corresponding service codes. Omitting any of this information can delay the payment process, as incomplete forms usually require follow-up actions.

It's essential to mark the correct service codes in the appropriate columns. Workers sometimes write service codes incorrectly, leading to confusion about what services were provided. This mistake can complicate records and is likely to slow down payment processing.

Dates on the timesheet should reflect the actual worked days. Some individuals submit timesheets with dates that do not match the work period. This inconsistency makes it difficult to verify hours and can lead to disputes over unpaid wages.

Both the participant and the hired worker must sign the timesheet. Failing to provide these signatures is a frequent oversight. Without both signatures, the timesheet is considered invalid, and payment is not guaranteed.

Another common error is exceeding authorized work hours. People sometimes fail to consult guidelines, overreporting hours that weren't actually worked. This overstatement not only violates policies but can lead to disciplinary actions and a loss of trust.

Finally, many employees forget to review the payroll schedule. Submitting timesheets after the indicated due date can cause significant delays. Adhering to this schedule is crucial for ensuring timely payment. Keeping track of due dates helps avoid the chaos associated with late submissions.

Documents used along the form

When managing employee records and payroll processes, it's essential to have a solid understanding of the various documents that work alongside the Iris Worker Timesheet form. Each of these forms plays a critical role in ensuring accurate record-keeping and appropriate payment for services rendered. Understanding their purpose can streamline processes and prevent confusion. Below is a list of commonly used documents in conjunction with the Iris Worker Timesheet.

- Payroll Summary Report: This document summarizes all payments made during a specific pay period. It includes details such as employee hours worked, their pay rates, and any deductions, providing a clear overview for both employers and employees.

- W-4 Form: Employees complete this form to indicate their tax withholding preferences. It helps the employer determine how much federal income tax to withhold from an employee's paycheck.

- Direct Deposit Authorization Form: Employees fill out this form to authorize their employer to deposit their paychecks directly into a specified bank account, making payroll process smoother and faster.

- Employee Information Form: This is used to collect essential information about new hires, including contact details, tax information, and emergency contacts. It’s crucial for maintaining updated employee records.

- Time-off Request Form: Employees submit this form to request approval for time off, such as vacation or sick leave. It ensures proper planning for employee absences and helps manage workloads effectively.

- Performance Evaluation Form: This document is used during performance reviews to assess an employee's job performance. Feedback can affect future raises, promotions, and career development opportunities.

- Incident Report Form: When incidents occur in the workplace, this form is filled out to document what happened. It's crucial for maintaining a safe work environment and for insurance purposes.

- Service Agreement: This form outlines the terms of employment or services provided. It includes details such as job responsibilities and compensation, ensuring that both parties understand their commitments.

- Expense Reimbursement Form: Employees use this form to claim reimbursement for out-of-pocket expenses incurred while performing job duties. Proper documentation is needed to facilitate these reimbursements accurately.

Understanding and utilizing these accompanying forms are crucial for smooth payroll and HR processes. Each document not only provides essential information but also helps maintain clear communication between employers and employees. Proper management of these documents can prevent misunderstandings and foster a more efficient workplace.

Similar forms

-

Payroll Register: Like the Iris Worker Timesheet, a payroll register is used to track employee hours worked and calculate wages for a specific pay period. Both documents provide essential information for payroll processing.

-

Employee Work Schedule: This document outlines the days and hours an employee is scheduled to work. Similar to the timesheet, it is essential for managing attendance and ensuring that payroll aligns with the actual hours worked.

-

Leave Request Form: When employees take leave, they often fill out a leave request form. This form, like the timesheet, serves as an official record of hours not worked, ensuring accurate payroll calculations and compliance with company policies.

-

Activity Log: An activity log records the specific tasks an employee undertakes during work hours. In much the same way as the timesheet, it helps in monitoring productivity and ensuring proper documentation of work hours.

-

Project Time Tracking Sheet: This sheet helps track the time spent on different projects. It shares similarities with the timesheet in that accurate records are crucial for billing clients and assessing project timelines.

-

Expense Report: Employees submit expense reports to outline costs incurred while performing their duties. This document parallels the timesheet by providing detailed accounts for reimbursement purposes, necessitating clear records.

Dos and Don'ts

When filling out the Iris Worker Timesheet form, follow these guidelines to ensure accuracy and compliance.

- Write in blue or black ink only. Avoid using pencil for clarity.

- Fill in all requested information. Ensure every field is completed accurately.

- Date the timesheet properly. Include the date when the last day was worked.

- Sign the timesheet. Both the worker and the employer must sign.

- Record hours only for the pay period. Do not exceed the authorized hours.

- Do not submit the timesheet late. Ensure it is sent by the due date.

- Do not leave boxes empty. Every section needs to be completed.

- Do not use abbreviations or codes not listed in the instructions.

- Do not write over the edges or touch the sides of the boxes.

Misconceptions

Misunderstandings about the Iris Worker Timesheet form can lead to confusion among users. Below is a list of common misconceptions along with clarifications to ensure proper understanding and utilization.

- The timesheet can be submitted at any time during the pay period. This is incorrect. Timesheets must be submitted by the employer participant by the due date specified in the payroll schedule to ensure payment processing.

- Multiple timesheets are needed if an employee supports more than one participant. This is a misconception. An employee working for multiple participants needs only one timesheet per pay period for hours worked for each participant.

- Hours worked can be entered in any order on the timesheet. This is misleading. Hours must be recorded in accordance with the days worked, and the overall structure of the form should be followed.

- Timesheets do not require signatures from both the worker and employer participant. In fact, both signatures are mandatory. The timesheet must be signed and dated by both parties to authenticate the hours recorded.

- All hours worked are automatically authorized for payment. This is not true. Only hours worked within the agreed-upon limits are authorized for payment. Exceeding these limits does not guarantee payment.

- The timesheet can be completed in pencil. This is incorrect. To ensure clarity and permanence, timesheets must only be filled out using blue or black ink.

- There is no need to write the date on the timesheet. This is a common error. The date worked must be recorded for each day to maintain accurate records for payment and services rendered.

- Any additional notes or information should be included on the back of the timesheet. This is not advisable. It is best to keep notes to a minimum, sticking strictly to the designated areas provided on the timesheet for clarity and compliance.

Understanding these aspects of the Iris Worker Timesheet form can help streamline the process and ensure timely and accurate payments for services provided. Adhering to the guidelines not only benefits the workers but also fosters better communication between participants and employers.

Key takeaways

The Iris Worker Timesheet form is essential for accurately documenting working hours. Below are key takeaways for effectively completing and using the form.

- Use blue or black ink only when filling out the timesheet. Pencil should be avoided.

- Ensure to write the participant's and worker's names and dates at the bottom of the timesheet.

- The timesheet must be submitted by the due date to iLIFE.

- Record total hours worked for each day in the appropriate service code row.

- Multiple employers or participants require separate timesheets. One timesheet is needed for each pay period.

- Service codes must be correctly indicated for each type of service provided.

- Any hours worked beyond the authorized limit are not guaranteed payment.

- Signatures from both the participant and the worker are mandatory, ensuring accountability for the recorded hours.

Browse Other Templates

Roof Condition Report - Proper maintenance post-certification is essential for the roof's longevity.

Mn St3 2023 - It's vital for sellers to be diligent about checking the legitimacy of provided exemption claims to avoid penalties.