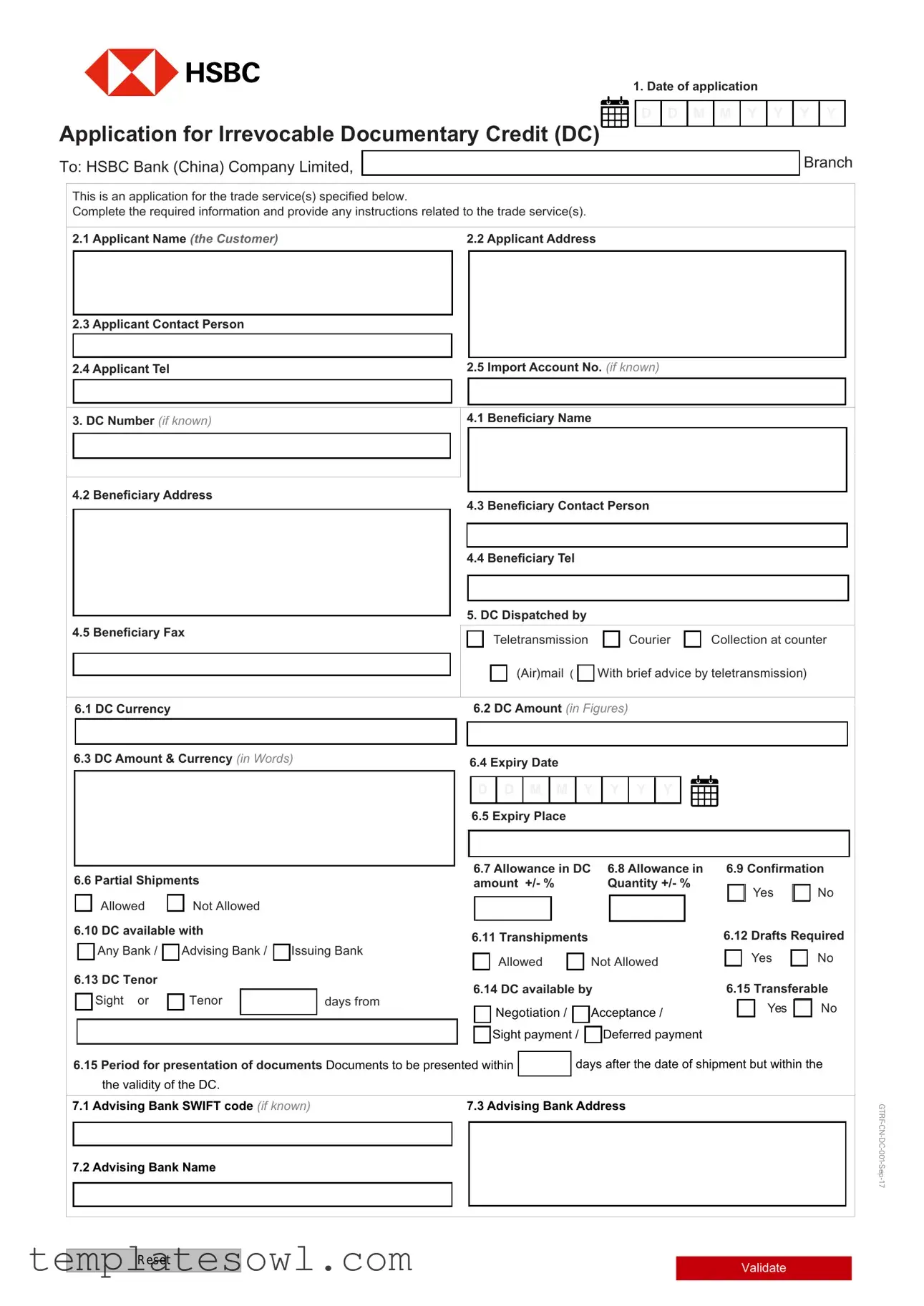

Fill Out Your Irrevocable Documentary Credit Form

The Irrevocable Documentary Credit form serves as a vital tool in international trade, ensuring that payments occur securely between buyers and sellers across borders. Designed to facilitate transactions, this form captures essential details about the parties involved, including the applicant and beneficiary’s names, addresses, and contact information. It also outlines specific trade services requested, which might involve handling of shipping documents and details of the goods exchanged. The form’s structure includes sections for the amount and currency of the credit, along with the expiry date and conditions regarding shipment. Notably, the form emphasizes the irrevocable nature of the credit, meaning changes or cancellations to the credit cannot occur without the mutual consent of all parties involved. Importantly, it allows for partial shipments and transhipments under certain conditions, adding flexibility to the arrangement. The understanding of the Incoterms, terms covering delivery responsibilities, and details about the required documentation, including invoices and shipping bills, ensure that both parties adhere to established trade practices. Overall, this form not only streamlines the payment process but also protects the interests of all stakeholders in the transaction.

Irrevocable Documentary Credit Example

1. Date of application

|

|

|

|

|

D |

D |

M |

M |

Y |

Y |

|

Y |

Y |

|

Application for Irrevocable Documentary Credit (DC) |

0 |

9 |

0 |

7 |

2 |

0 |

1 |

8 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Branch |

|||||||

To: HSBC Bank (China) Company Limited, |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This is an application for the trade service(s) specified below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete the required information and provide any instructions related to the trade service(s). |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.1 Applicant Name (the Customer) |

2.2 Applicant Address |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.3 Applicant Contact Person

2.4 Applicant Tel |

2.5 Import Account No. (if known) |

|

|

|

|

|

|

|

3.DC Number (if known)

4.2 Beneficiary Address

4.1 Beneficiary Name

4.3Beneficiary Contact Person

4.4Beneficiary Tel

5. DC Dispatched by

4.5 Beneficiary Fax |

Teletransmission |

Courier |

Collection at counter |

|||

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

(Air)mail ( |

|

With brief advice by teletransmission) |

|

|

|

|

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

6.1 DC Currency

6.3 DC Amount & Currency (in Words)

6.2 DC Amount (in Figures)

6.4 Expiry Date

D D M M Y Y Y Y

6.5 Expiry Place

6.6 Partial Shipments

|

Allowed |

Not Allowed |

|

|

|

6.10 DC available with |

|

|

|||

|

Any Bank / |

Advising Bank / |

Issuing Bank |

||

6.13 DC Tenor |

|

|

|

|

|

|

Sight or |

Tenor |

|

|

days from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.7 Allowance in DC |

6.8 Allowance in |

6.9 Confirmation |

||||||||||

amount +/- % |

Quantity +/- % |

|

|

|

Yes |

|

No |

|||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

6.12 Drafts Required |

||||||

6.11 Transhipments |

|

|

|

|||||||||

|

Allowed |

Not Allowed |

|

|

|

Yes |

|

No |

||||

6.14 DC available by |

6.15 Transferable |

|||||||||||

|

Negotiation / |

Acceptance / |

|

|

|

|

Yes |

|

No |

|||

|

Sight payment / |

Deferred payment |

|

|

|

|

|

|

|

|||

|

6.15 Period for presentation of documents Documents to be presented within |

|

days after the date of shipment but within the |

|

|

the validity of the DC. |

|

|

|

|

|

|

|

|

|

7.1 Advising Bank SWIFT code (if known) |

7.3 Advising Bank Address |

||

|

|

|

|

|

|

|

|

|

|

7.2 Advising Bank Name

Reset

Validate

|

8. Description of Goods (without excessive detail) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.1 Place of Taking in Charge/Receipt |

|

|

|

|

|

|

|

|

|

|

|

|

|

9.2 Port of Loading/Airport of Departure |

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.3 Port of Discharge/Airport of Destination |

|

|

|

|

|

|

|

|

|

|

|

9.4. Place of Final Destination/Place of Delivery |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.5 Latest date of Shipment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9.6 Incoterms |

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXW |

FCA |

FOB |

CFR |

|

|||||||||||||

|

D |

|

D |

M |

M |

|

Y |

Y |

|

Y |

|

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

9.7 Insurance to be covered by |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CIF |

CPT |

CIP |

DDP |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

Ultimate Buyer |

|

|

|

|

|

Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

HSBC to arrange insurance for us at our cost with an insurance company (including any HSBC Group member) acceptable to HSBC. |

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

HSBC is authorised to debit our Account No. |

|

|

|

|

|

|

|

|

|

|

|

for the insurance premium once the policy is effected at the rate agreed. |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insurance already/will be arranged by us. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Documents required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

10.1 Signed commercial invoice in |

|

|

|

|

|

originals |

|

|

|

copies. |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

10.2 Packing List in |

|

|

|

originals |

|

|

|

|

|

|

|

copies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.3 |

|

|

For shipment by sea, full set original clean “On Board” |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

bills of lading or |

|

|

|

multimodal or combined transport document made out to |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

the order of shipper and endorsed in blank; or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

marked: “Freight |

|

|

|

Prepaid” or |

|

|

|

|

“Collect” and “Notify |

|

|

|

|

|

|

|

” |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

mentioning the DC number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.4 |

|

|

For shipment by air, original Air Waybill marked “For the consignor/shipper” signed by the carrier or his agent, marked: |

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

“Freight |

|

Prepaid or |

|

|

|

|

Collect” showing flight number and date of despatch of goods, consigned to |

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and “Notify |

|

|

|

|

|

|

” |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

mentioning the DC number. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.5 |

|

|

Cargo Receipt issued and signed by the authorised signatory of Applicant (whose signature(s) must be in conformity with the |

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

record held in the Issuing Bank’s file) certifying that the Goods have been received in good order and condition, mentioning the DC |

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

number, date of receipt of the Goods, total value and quantity and description of Goods received. |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

Delivery Order |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10.6 |

|

|

Marine/ |

|

Air Insurance Policy or certificate in negotiable form and blank endorsed for full CIF/CIP value plus 10% covering ) |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Institute Cargo Clauses |

|

|

(A)/ |

|

|

|

Air), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

Institute War Clauses - ( |

|

|

|

Cargo/ |

|

|

|

|

Air Cargo), |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

Institute Strikes Clauses |

|

|

Cargo/ |

|

|

|

|

|

Air Cargo); |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

evidencing claims payable at destination in the currency of the DC. |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

10.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

Beneficiary’s certificate certifying that one set of shipping documents has been sent to applicant within |

|

day(s) |

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

after shipment. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.8 Additional Conditions / Other Documents required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reset

Validate

Charges to be paid by (A)Applicant/(B)Beneficiary |

A |

B |

|

|

|

|

|

|

A |

|

B |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.1 |

DC Opening Commission |

|

|

|

11.5 Transit interest charges |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11.2 |

Issuing bank other charges |

|

|

|

11.6 Delayed reimbursement commission for |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

usance DC only |

|

|

|

|

|

|

|

|

||

11.3 |

Correspondent bank charges |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.4 |

DC confirmation charges (if applicable) |

|

|

|

11.7 Bill Commission in Lieu of Exchange |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. Account No. for charges |

|

|

|

(Currency |

|

|

; A/C |

Current / |

Savings). |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. Back to Back DC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

This application is for a |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|||||||||||||

issued by |

|

(the “Master DC”). The original Master DC is |

enclosed / |

being held by HSBC. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14.Settlement instruction (if applicable)

Settle all amounts owing by the Applicant under this application by:

Account Debit. Debiting to account number |

|

|

|

currency |

A/C: |

Current / |

Savings ; for settlement. |

|

Master DC proceeds. Using the proceeds received by HSBC under the Master DC or any financing amount obtained by the Applicant in relation to the Master DC.

Loan. Drawing a buyer loan for |

|

days. |

|

|

|

Export transaction proceeds. Using the proceeds received by HSBC under the export trade transaction handled by HSBC or any financing amount obtained by the Applicant in relation to such export trade transaction.

Bill No./DC No. |

|

for settlement. |

Other (specify)

15.Additional Information and Instructions

16.Type of Trade

We refer to HSBC’s Standard Trade Terms (as amended from time to time) which can be accessed, read and printed by the Customer at/ from www.gbm.hsbc.com/gtrfstt or alternatively the Customer can request a copy from its Relationship Manager (the Standard Trade Terms)

This application incorporates and is subject to the Standard Trade Terms as though they were set out in full in this application, and together they form an important agreement.

By signing this application, the Customer:

yy irrevocably requests HSBC to provide the above trade service(s) in accordance with the instructions in this application; and

yy confirms that it has read and understood the Standard Trade Terms and agrees that this application incorporates the Standard Trade Terms and that the Standard Trade Terms applies to the above requested trade service(s).

Signed for and on behalf of the Customer:

Authorised Signatories and Company Chop

Reset |

|

|

|

Validate |

|

|

|

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Date of Application | The form requires the date when the application for Irrevocable Documentary Credit was submitted, formatted as DD/MM/YYYY. |

| Beneficiary Information | Details for the beneficiary must be included, including their name, address, contact person, and contact number. |

| DC Amount | The form specifies the amount and currency of the documentary credit both in figures and in words. |

| Governing Laws | The laws governing the documentary credit may vary by state, such as UCC Article 5 in the U.S., which may apply. |

Guidelines on Utilizing Irrevocable Documentary Credit

Completing the Irrevocable Documentary Credit form is a crucial part of setting up international trade transactions. By following the steps outlined below, you’ll ensure that you provide all the necessary details for processing your application smoothly.

- Start by entering the Date of application in the format of DD/MM/YYYY.

- Fill in the Applicant Name, the individual or company that is making the application.

- Provide the Applicant Address including street, city, state, and ZIP code.

- List the Applicant Contact Person who can be reached for clarifications.

- Fill in the Applicant Tel number for contact purposes.

- If known, include the Import Account No..

- If applicable, write in the DC Number you may have.

- For the Beneficiary Name, enter the recipient of the funds.

- Provide the Beneficiary Address details.

- List the Beneficiary Contact Person for follow-up queries.

- Include the Beneficiary Tel phone number.

- Decide on the method of dispatching the DC and note it by marking the appropriate option.

- Choose the DC Currency that will be used for the transaction.

- Enter the DC Amount in both figures and words.

- Specify the Expiry Date for the credit, again in DD/MM/YYYY format.

- Fill in the Expiry Place where the DC will expire.

- State if Partial Shipments are allowed or not.

- Indicate whether Transhipments are permitted.

- Mark the DC Tenor as either Sight or Tenor days.

- Provide details for the Advising Bank, including the SWIFT code if known.

- Describe the Goods without excessive detail.

- Complete the sections related to shipping details, including Port of Loading and Port of Discharge.

- Check and specify the Documents required for processing your application.

- Complete the section regarding charges to be paid by the Applicant or Beneficiary.

- Enter your Account No. for any charges incurred during the transaction.

- If applicable, denote if this is a Back to Back DC.

- Complete any Settlement instructions if they are applicable to your situation.

- Add any Additional Information and Instructions that may be necessary.

- Lastly, ensure an authorized representative signs the form on behalf of the applicant.

What You Should Know About This Form

What is an Irrevocable Documentary Credit?

An Irrevocable Documentary Credit (DC) is a financial document issued by a bank on behalf of a buyer. It guarantees payment to a seller as long as they meet the terms specified in the credit. Once issued, it cannot be changed or canceled without the agreement of all parties involved. This gives security to both the buyer and seller in international trade transactions.

How do I fill out the application form?

To fill out the application, start with the date of application at the top. Provide details about yourself as the applicant, including your name, address, contact person, and telephone number. Next, input the name and address of the beneficiary, who is the seller. Ensure to fill in the DC amount, currency, expiry date, and allow or disallow shipments as needed. Lastly, include descriptions of the goods and any additional instructions.

Who is the applicant and the beneficiary in this context?

The applicant is the person or business requesting the DC, usually the buyer. The beneficiary is the seller who will receive the payment once they present the required documents. Their details must be accurately provided as it will ensure smooth transactions and dealings.

What type of documents are required for processing?

Various documents are necessary, including a signed commercial invoice, packing list, and bills of lading or Air Waybills. Additionally, cargo receipts and insurance documents might be required. These documents help verify that goods were shipped and received as stipulated in the DC.

What does it mean if partial shipments are allowed?

If partial shipments are allowed, it means that the seller can send the goods in multiple deliveries rather than all at once. This flexibility can be helpful if the buyer requires the goods in stages, rather than waiting for the entire shipment to arrive at once.

What does the expiry date signify on the form?

The expiry date is crucial because it specifies how long the DC is valid. Once this date passes, the bank is no longer obligated to make payment under the DC, even if the conditions for payment were met prior to that date. Keeping track of this date ensures that all necessary shipments and documents are submitted on time.

Can the terms of the Documentary Credit change after issuance?

No, once a Documentary Credit is issued, it is considered irrevocable. This means its terms cannot be altered or canceled without consent from both the applicant and the beneficiary. This protects both parties in the transaction.

What should I do if I need to make changes to my application?

If adjustments are necessary, you need to communicate with the bank as soon as possible. Depending on the circumstances, the bank may allow for certain changes before the DC is issued. However, once the credit has been issued, modifications can only be made with agreement from both parties involved.

What role does the advising bank play?

The advising bank is responsible for notifying the beneficiary about the issuance of the credit and providing the beneficiary with financial advice. They act as intermediaries between the issuing bank and the beneficiary, helping to facilitate and validate the transaction.

How is the payment made under a Documentary Credit?

Payment is made after the beneficiary provides the required documents to the bank, following the terms laid out in the DC. The bank checks the documents for compliance with those terms. If everything is in order, the payment will be released to the beneficiary as specified, whether it’s immediate or deferred.

Common mistakes

Filling out the Irrevocable Documentary Credit form can seem straightforward, but mistakes are common and can cause significant delays or financial repercussions. One significant error occurs when applicants neglect to complete the applicant’s address and contact information. Providing incomplete contact information can lead to communication issues and delays in processing the application. All details, including the main contact person and their phone number, are crucial for smooth transactions.

Another mistake involves inaccurately stating the DC Amount or Currency. It's essential to ensure that both figures and words match and are error-free. A discrepancy here can result in misunderstandings and complications regarding the trade's financial terms. Additionally, applicants should be vigilant about the **expiry date**. Leaving this section incomplete or incorrectly filled out can result in an invalid credit, creating even more hurdles down the line.

Moreover, many applicants overlook the description of goods section. A vague or excessively detailed description can lead to confusion and potential disputes. A clear, concise description is necessary to avoid complications with customs or during shipment. Additionally, it's vital to keep in mind the Incoterms, which are essential for defining the roles and responsibilities of both parties. If the Incoterms are not specified correctly, it may lead to misunderstandings regarding payment and delivery logistics.

Lastly, failing to review all required documentation can undermine the entire application process. Each document listed in the requirements must be prepared accurately and submitted alongside the completed form. Missing documents can lead to substantial delays and may even cause the application to be rejected. Careful attention to detail in these areas can lead to a smoother application process and a successful transaction.

Documents used along the form

The Irrevocable Documentary Credit (DC) form is a crucial document used in international trade, ensuring that payment is secured when goods are shipped. Several other forms and documents are often associated with this process, each serving specific functions that support the trade transaction. Below are some of the commonly used documents.

- Commercial Invoice: This document details the transaction between the buyer and seller. It includes information about the goods, pricing, and terms of sale. The invoice serves as a request for payment and is integral for customs clearance.

- Packing List: The packing list outlines the contents of each package in detail. It typically includes item descriptions, dimensions, and weights. This document assists in verifying shipments and is useful in customs inspections.

- Bill of Lading: A bill of lading is a legal document issued by a carrier to acknowledge the receipt of goods for shipment. It serves as a contract and a document of title, allowing the transfer of ownership of the goods during transportation.

- Air Waybill: Similar to a bill of lading, the air waybill is specific to air cargo. It acts as a receipt of goods and outlines the terms of transport. This document is usually non-negotiable, meaning it does not transfer ownership like a bill of lading does.

- Marine Insurance Policy: This policy provides insurance coverage for goods in transit. It outlines the terms under which claims can be made and protects against loss, damage, or theft of goods while they are being shipped.

- Certificate of Origin: This document certifies the country where the goods were manufactured. It may be required for tariffs, import/export duties, and ensuring compliance with trade agreements between countries.

Overall, these documents work together to facilitate smooth international transactions. Proper management of these forms helps ensure compliance with regulatory requirements, protects the interests of all parties involved, and contributes to the efficiency of global trade operations.

Similar forms

- Letter of Credit (LC): Similar to the Irrevocable Documentary Credit, a Letter of Credit is a financial document issued by a bank guaranteeing a buyer's payment to a seller, provided that the seller meets specific conditions documented in the credit. Both instruments ensure that parties are protected in a transaction.

- Bank Guarantee: A Bank Guarantee is a promise issued by a bank to pay a certain amount if the borrower fails to fulfill contractual obligations. Like the Irrevocable Documentary Credit, it serves as a safety net, ensuring that obligations will be met or compensated.

- Documentary Collection: In a Documentary Collection, the bank acts as an intermediary and releases payment against specific documents. This process shares similarities with Documentary Credits as both require documentation to verify that the transaction is valid and that payment is due.

- Proforma Invoice: A Proforma Invoice serves as a preliminary bill of sale with a commitment of future delivery. It is similar in purpose to the Irrevocable Documentary Credit as both documents outline important transaction details prior to final payment.

- Purchase Order (PO): A Purchase Order is a commercial document that a buyer sends to a seller, indicating quantities and types of goods. This document can set the stage for a secure transaction akin to the guarantees provided by an Irrevocable Documentary Credit.

- Shipping Instructions: Shipping Instructions specify how and when the goods are to be shipped. This document parallels the requirements outlined in an Irrevocable Documentary Credit by detailing the flow of goods.

- Transport Document: A Transport Document, such as a bill of lading, acts as a receipt for the goods and proof of the contract of carriage. Like the Irrevocable Documentary Credit, it contains crucial details necessitated for payment and delivery verification.

- Insurance Certificate: An Insurance Certificate shows that an insurance policy covers the goods during transit. It complements the Irrevocable Documentary Credit by ensuring the involved parties' financial protection in the event of unforeseen damages.

- Export Declaration: An Export Declaration documents the shipment of goods exported from one country to another. It is closely related to an Irrevocable Documentary Credit, as it often serves as part of the documentation needed for securing payment and fulfilling legal obligations.

- Commercial Invoice: The Commercial Invoice contains details about the transaction, including a description of goods and payment terms. It is one of the critical documents associated with an Irrevocable Documentary Credit, serving to validate the terms of the sale.

Dos and Don'ts

When filling out an Irrevocable Documentary Credit form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here are some key do's and don'ts:

- Do write clearly and legibly to prevent misinterpretation.

- Do ensure all required fields are completed, including the date and applicant details.

- Do double-check amounts and currency to avoid discrepancies.

- Do attach necessary documents as specified in the instructions.

- Don’t leave any fields blank; provide 'N/A' where applicable.

- Don’t use excessive detail when describing goods; keep it concise.

- Don’t forget to review the completed form for errors before submission.

Misconceptions

- Irrevocable Means Unchangeable: Many believe that an irrevocable documentary credit cannot be amended at all. While it is termed "irrevocable," certain modifications can still occur if all parties agree.

- Only Banks Can Issue Credits: It is often thought that only banks can issue documentary credits. In reality, other financial institutions also have the capacity to provide this service.

- Beneficiaries Cannot Be Changed: Some assume that once a beneficiary is named, it cannot be changed. However, if the issuing bank and all parties involved consent, the beneficiary may be altered.

- It Guarantees Payment: A common misconception is that an irrevocable documentary credit guarantees payment regardless of circumstances. The credit provides a payment promise based on documentary compliance, not performance.

- One Type Fits All: Many think there is only one kind of documentary credit. In fact, various types exist, including standby letters of credit and transferable credits, offering different features for diverse situations.

- Can Be Used for Any Transaction: Some people believe documentary credits are suitable for all transactions. However, they are typically used for international trade and, in some cases, may not be appropriate for domestic dealings.

- It's Always Faster Than Other Payment Methods: There is a notion that using an irrevocable documentary credit always speeds up transactions. In practice, timing can depend on the efficiency of document handling and the banks involved.

Key takeaways

The application date is a critical entry point. It indicates when the application for the Irrevocable Documentary Credit (DC) was made.

Accurate information about the applicant and beneficiary is essential. This includes names, addresses, contact persons, and telephone numbers, ensuring smooth communication and verification.

The documentary credit amount should be clearly stated in both figures and words. This prevents discrepancies and confusion during transactions.

Specify the terms for shipment. Indicate whether partial shipments and transhipments are allowed, which can impact delivery schedules and logistics.

List the required documents for shipment carefully. Each essential document must meet specific criteria to ensure compliance with banking standards.

Familiarize yourself with the associated charges and payment responsibilities. The application outlines who is accountable for various costs, which aids in budgeting.

Review the Standard Trade Terms linked in the application. Understanding these terms is vital, as they form part of the contractual agreement with the bank.

Browse Other Templates

How to Ask for Letter of Recommendation - The applicant has shown consistency in their performance across various subjects.

Metro Pcs Rebate - Rebates are specifically for personal use and cannot be used commercially.