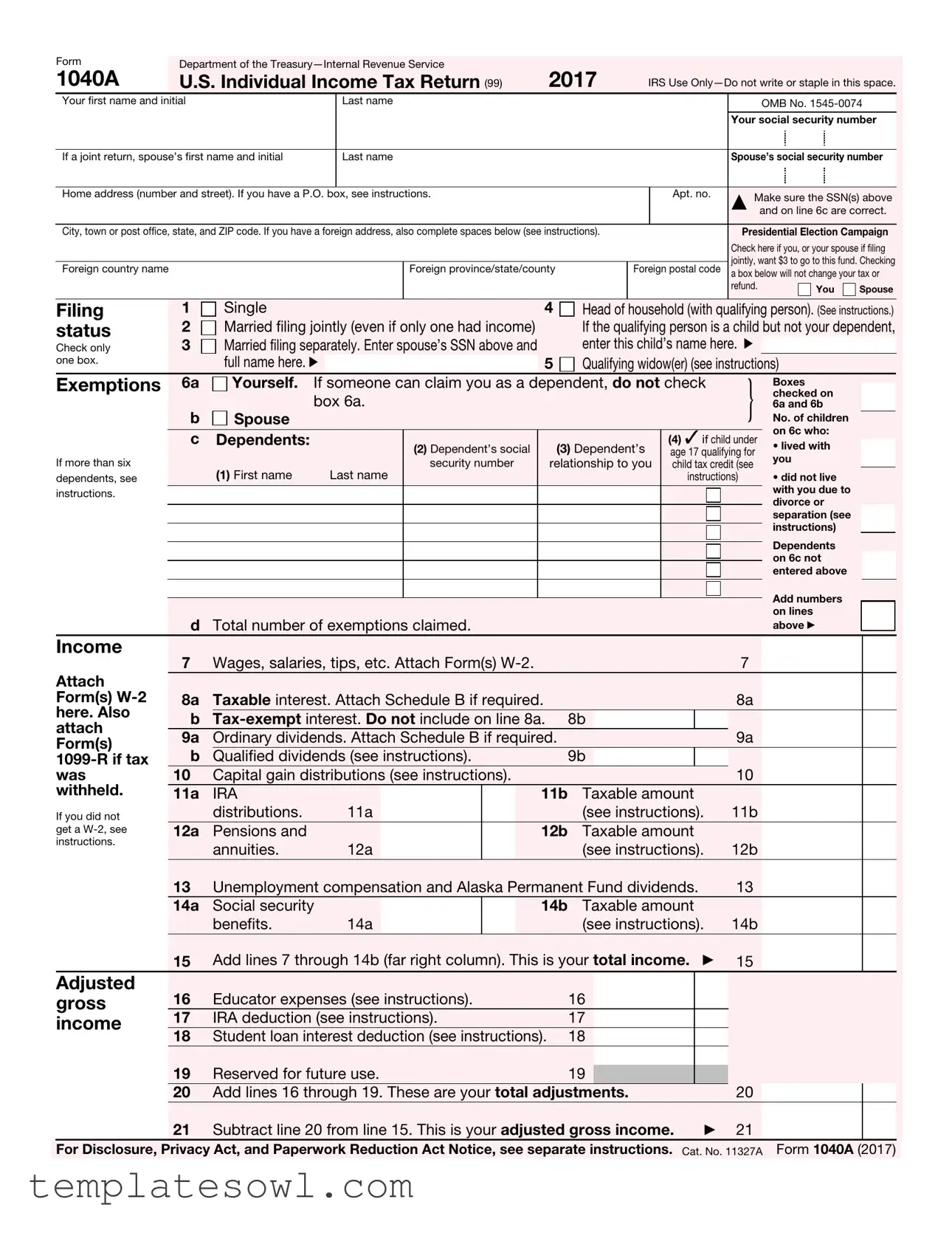

Fill Out Your Irs 1040A Form

The IRS 1040A form serves as a simplified version of the U.S. Individual Income Tax Return, enabling taxpayers to efficiently report their income and claim various deductions and credits. Designed for individuals with straightforward tax situations, the form encompasses essential sections such as personal information, income reporting, and exemptions. Taxpayers fill out details like wages, interest, and dividends, combining these amounts to determine their total income. Beyond income reporting, the form allows for adjustments, which could include educator expenses or student loan interest deductions. The 1040A also includes the standard deduction, which many people opt for, as well as credits related to child care and education. At the conclusion of the form, taxpayers will calculate their total tax due or any refund owed, making this a crucial document for millions of filers each tax season. By using this form, eligible individuals can navigate the complexities of federal tax obligations with relative ease.

Irs 1040A Example

Form |

Department of the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

1040A |

U.S. Individual Income Tax Return (99) |

2017 |

IRS Use |

||||||||||||||||||||||||||

Your first name and initial |

|

|

|

|

|

|

Last name |

|

|

|

|

|

|

|

|

|

|

|

OMB No. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social security number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

If a joint return, spouse’s first name and initial |

|

|

Last name |

|

|

|

|

|

|

|

|

|

Spouse’s social security number |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Home address (number and street). If you have a P.O. box, see instructions. |

|

|

|

|

|

|

Apt. no. |

▲ Make sure the SSN(s) above |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and on line 6c are correct. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). |

|

|

|

|

|

Presidential Election Campaign |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you, or your spouse if filing |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

jointly, want $3 to go to this fund. Checking |

||||||||

Foreign country name |

|

|

|

|

|

|

|

|

Foreign province/state/county |

|

|

|

Foreign postal code |

a box below will not change your tax or |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

refund. |

|

|

|

|

You |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing |

1 |

|

|

Single |

|

|

|

|

4 |

|

|

Head of household (with qualifying person). (See instructions.) |

|||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

status |

2 |

|

|

Married filing jointly (even if only one had income) |

|

|

|

If the qualifying person is a child but not your dependent, |

|||||||||||||||||||||

3 |

|

|

Married filing separately. Enter spouse’s SSN above and |

|

|

|

enter this child’s name here. ▶ |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Check only |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

one box. |

|

|

|

full name here. ▶ |

|

|

|

5 |

|

|

Qualifying widow(er) (see instructions) |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exemptions |

6a |

|

|

|

Yourself. |

If someone can claim you as a dependent, do not check |

} |

|

|

Boxes |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

box 6a. |

|

|

|

|

|

|

|

|

|

|

|

checked on |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6a and 6b |

|

|

||||||||

|

|

|

b |

|

|

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of children |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on 6c who: |

|

|

|||

|

|

|

c |

|

|

Dependents: |

|

|

|

|

|

|

|

|

|

|

(4) ✓ if child under |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

(2) Dependent’s social |

|

(3) Dependent’s |

|

|

• lived with |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

age 17 qualifying for |

|

|

|

|

|||||||||||||

If more than six |

|

|

|

|

|

|

|

|

|

|

|

you |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

security number |

relationship to you |

child tax credit (see |

|

|

|

|

|||||||||||||||

|

|

|

(1) First name |

|

Last name |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

dependents, see |

|

|

|

|

|

|

|

|

|

|

|

|

instructions) |

|

|

• did not live |

|

|

|||||||||||

instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

with you due to |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

divorce or |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

separation (see |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instructions) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependents |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on 6c not |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

entered above |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add numbers |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

on lines |

|

|

|||

|

|

|

d Total number of exemptions claimed. |

|

|

|

|

|

|

|

|

|

|

|

|

above ▶ |

|

|

|||||||||||

Income

Attach Form(s)

If you did not get a

7 |

Wages, salaries, tips, etc. Attach Form(s) |

7 |

8a |

Taxable interest. Attach Schedule B if required. |

8a |

b

9a |

Ordinary dividends. Attach Schedule B if required. |

|

|

|

9a |

||||

b Qualified dividends (see instructions). |

9b |

|

|

|

|||||

10 |

Capital gain distributions (see instructions). |

|

|

|

10 |

||||

11a |

IRA |

|

|

|

11b |

Taxable amount |

|

||

|

distributions. |

11a |

|

|

|

(see instructions). |

11b |

||

12a |

Pensions and |

|

|

|

12b |

Taxable amount |

|

||

|

annuities. |

12a |

|

|

|

(see instructions). |

12b |

||

13 |

Unemployment compensation and Alaska Permanent Fund dividends. |

13 |

|||||||

14a |

Social security |

|

|

|

14b |

Taxable amount |

|

||

|

benefits. |

14a |

|

|

|

(see instructions). |

14b |

||

15 Add lines 7 through 14b (far right column). This is your total income. ▶ 15

|

Adjusted |

16 |

Educator expenses (see instructions). |

16 |

|

|

|

|

|

|

|

|

|

|

gross |

|

|

|

|

|

|

|

|

|

|||

|

17 |

IRA deduction (see instructions). |

17 |

|

|

|

|

|

|

|

|

|

|

|

income |

|

|

|

|

|

|

|

|

|

|||

|

18 |

Student loan interest deduction (see instructions). |

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

19 |

Reserved for future use. |

19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

20 |

Add lines 16 through 19. These are your total adjustments. |

20 |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21 |

Subtract line 20 from line 15. This is your adjusted gross income. |

|

▶ 21 |

|

|

|

|

||||

|

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 11327A Form 1040A (2017) |

|||||||||||

|

Form 1040A (2017) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 |

|||||||||||

|

Tax, credits, |

22 |

Enter the amount from line 21 (adjusted gross income). |

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Check |

|

|

|

You were born before January 2, 1953, |

|

|

|

Blind |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

23a |

|

|

|

|

|

|

Total boxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

and |

|

if: |

{ |

|

|

Spouse was born before January 2, 1953, |

|

|

|

Blind }checked ▶ 23a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

b |

If you are married filing separately and your spouse itemizes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

deductions, check here |

|

|

|

|

|

|

|

|

|

|

▶ 23b |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Standard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

Deduction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

24 |

Enter your standard deduction. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

|

|

|

|

|

|||||||||||||||||||||||

|

for— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

• People who |

|

|

|

25 |

Subtract line 24 from line 22. If line 24 is more than line 22, enter |

|

|

|

|

|

|

25 |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

check any |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

26 |

Exemptions. Multiply $4,050 by the number on line 6d. |

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

box on line |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

23a or 23b or |

|

|

|

27 |

Subtract line 26 from line 25. If line 26 is more than line 25, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

who can be |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

This is your taxable income. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

claimed as a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

dependent, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

see |

|

|

|

28 |

Tax, including any alternative minimum tax (see instructions). |

28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

29 |

Excess advance premium tax credit repayment. Attach |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

• All others: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

Form 8962. |

|

|

|

|

|

|

29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Single or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

Married filing |

|

|

|

30 |

Add lines 28 and 29. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

||||||||||||||||||||||||

|

separately, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

$6,350 |

|

|

|

|

|

31 |

Credit for child and dependent care expenses. Attach |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Married filing |

|

|

|

|

Form 2441. |

|

|

|

|

|

|

31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

jointly or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

32 |

Credit for the elderly or the disabled. Attach |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

widow(er), |

|

|

|

|

Schedule R. |

|

|

|

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

$12,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Head of |

|

|

|

33 |

Education credits from Form 8863, line 19. |

|

|

|

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

household, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

34 |

Retirement savings contributions credit. Attach Form 8880. |

34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

$9,350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

35 |

Child tax credit. Attach Schedule 8812, if required. |

35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

36 |

Add lines 31 through 35. These are your total credits. |

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

Subtract line 36 from line 30. If line 36 is more than line 30, enter |

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

38 |

Health care: individual responsibility (see instructions). |

|

|

|

|

|

|

38 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

39 |

Add line 37 and line 38. This is your total tax. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

40 |

Federal income tax withheld from Forms |

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

41 |

2017 estimated tax payments and amount applied |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

If you have |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

from 2016 return. |

|

|

|

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

a qualifying |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

child, attach |

|

|

|

|

42a |

Earned income credit (EIC). |

|

|

|

|

|

|

42a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

EIC. |

|

|

b |

Nontaxable combat pay election. 42b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

43 |

Additional child tax credit. Attach Schedule 8812. |

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

44 |

American opportunity credit from Form 8863, line 8. |

44 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

45 |

Net premium tax credit. Attach Form 8962. |

|

|

|

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

46 |

Add lines 40, 41, 42a, 43, 44, and 45. These are your total payments. |

▶ |

46 |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

Refund |

47 |

If line 46 is more than line 39, subtract line 39 from line 46. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

This is the amount you overpaid. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47 |

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

Direct |

48a |

Amount of line 47 you want refunded to you. If Form 8888 is attached, check here ▶ |

|

|

|

|

48a |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

deposit? |

▶ b |

Routing |

|

|

|

|

|

|

|

|

|

|

|

▶ c Type: |

|

|

|

Checking |

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

See |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

instructions |

|

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

and fill in |

▶ d |

Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

48b, 48c, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

and 48d or |

|

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Form 8888. |

49 |

Amount of line 47 you want applied to your |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

2018 estimated tax. |

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

Amount |

50 |

Amount you owe. Subtract line 46 from line 39. For details on how to pay, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

see instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

▶ |

50 |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

you owe |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

51 |

Estimated tax penalty (see instructions). |

|

|

|

|

|

|

51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Third party designee

Do you want to allow another person to discuss this return with the IRS (see instructions)? |

|

Yes. Complete the following. |

|

No |

|||||||||||

Designee’s |

|

|

Phone |

|

|

|

Personal identification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

name |

▶ |

|

no. |

▶ |

|

|

number (PIN) |

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign |

|

|

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge |

|

||||||||||||||||

|

|

|

and belief, they are true, correct, and accurately list all amounts and sources of income I received during the tax year. Declaration of preparer (other |

||||||||||||||||||

|

here |

|

|

than the taxpayer) is based on all information of which the preparer has any knowledge. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

▲ |

Your signature |

|

|

Date |

Your occupation |

|

Daytime phone number |

|

|

|||||||||||

|

|

|

|

|

|

|

|||||||||||||||

|

Joint return? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Keep a copy |

Spouse’s signature. If a joint return, both must sign. |

|

Date |

Spouse’s occupation |

|

If the IRS sent you an Identity Protection |

|

|

||||||||||||

|

|

|

|

|

|

|

|

PIN, enter it |

|

|

|

|

|

|

|

|

|

||||

|

for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

here (see inst.) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Paid |

|

|

Print/Type preparer’s name |

Preparer’s signature |

|

Date |

Check ▶ |

|

if |

PTIN |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name ▶ |

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|

|

|

|

|

|

|

|||

|

use only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Firm’s address ▶ |

|

|

|

|

|

Phone no. |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Go to WWW.IRS.GOV/FORM1040A for instructions and the latest information. |

|

|

|

|

|

|

|

Form 1040A (2017) |

||||||||||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The IRS Form 1040A is a simplified U.S. Individual Income Tax Return designed for taxpayers with uncomplicated tax situations. |

| Eligibility Criteria | Taxpayers must have a taxable income of $100,000 or less and cannot claim itemized deductions to file Form 1040A. |

| Filing Status Options | Form 1040A accommodates several filing statuses, including Single, Married Filing Jointly, and Head of Household. |

| Standard Deduction | The standard deduction for 2017 is $6,350 for single filers and $12,700 for married couples filing jointly, which reduces taxable income. |

| Dependent Exemptions | Each dependent reduces taxable income by $4,050, allowing for significant tax savings for eligible taxpayers. |

| Income Reporting | Form 1040A requires taxpayers to report various types of income, such as wages, interest, dividends, and pensions. |

| Tax Credits | Taxpayers can claim credits like the Child Tax Credit and the Earned Income Credit, which directly reduce tax liability. |

| State-Specific Considerations | State income tax returns may have unique forms and governing laws. Taxpayers should reference their state tax authority for specific requirements. |

Guidelines on Utilizing Irs 1040A

Filling out the IRS 1040A form requires careful attention to detail. This form is used to report income, calculate tax liability, and determine whether a refund is due. Follow these steps to accurately complete the form and ensure your information is submitted correctly.

- Gather your documents, including any W-2 forms and 1099 forms. Ensure you have Social Security numbers and other personal information for yourself and your spouse, if applicable.

- Fill out your first name, last name, and Social Security number at the top of the form.

- If filing jointly, enter your spouse’s information, including name and Social Security number.

- Provide your home address, including city, state, and ZIP code. If you have a foreign address, ensure to fill in the additional requested spaces.

- Check the box if you or your spouse would like to contribute $3 to the Presidential Election Campaign Fund.

- Choose your filing status by checking the appropriate box. Options include single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Report exemptions. Check the box if you can claim yourself and your spouse. List any dependents, providing their names, Social Security numbers, and relationships to you.

- Enter income details. Collect all W-2 forms and report wages, interest, dividends, and any other income on the corresponding lines.

- Calculate total income by adding all amounts from lines 7 to 14b.

- List any adjustments to income, such as educator expenses or IRA deductions, and sum these adjustments.

- Subtract the adjustments from your total income to get your adjusted gross income (AGI).

- Enter your AGI in the appropriate line.

- Apply the standard deduction for your filing status. Subtract this deduction from your AGI to determine your taxable income.

- Calculate any taxes owed or credits applicable to you and complete any necessary additional forms for these calculations.

- Determine your total payments, including federal income tax withheld and any estimated tax payments made.

- If your payments exceeded your tax liability, calculate your refund. Otherwise, determine the amount you owe.

- Sign the tax return, including your spouse's signature if filing jointly. Include the date and your occupation.

- If applicable, fill out the section for a third-party designee with their phone number and identification details.

- Keep a copy of the completed form for your records and submit the original to the IRS.

What You Should Know About This Form

What is the IRS Form 1040A?

The IRS Form 1040A is a simplified version of the U.S. Individual Income Tax Return. It allows taxpayers with straightforward tax situations to report their income and claim certain credits and deductions. It is specifically designed for those who do not itemize deductions and have a limited amount of income sources.

Who is eligible to file Form 1040A?

Form 1040A can be filed by individuals with a taxable income below $100,000, those who claim certain credits, and those who can only report income from wages, salaries, and a few other sources. However, it is not suitable for individuals with more complex tax situations or multiple income sources.

What are the main sections of Form 1040A?

The form consists of several key sections: personal information (name, Social Security numbers, and address), income (reporting wages, interest, dividends, and other income), adjustments to income, standard deductions, exemptions, tax credits, and payments. Each section is designed to capture specific financial information to calculate the overall tax obligation.

How do I determine my standard deduction?

The standard deduction amount varies based on filing status and whether the taxpayer is age 65 or older or blind. For the tax year 2017, the amounts were $6,350 for single filers and $12,700 for married couples filing jointly. Review the instructions on the form to identify the appropriate deduction based on individual circumstances.

Can I e-file using Form 1040A?

Yes, Form 1040A can be e-filed using approved tax software or through a tax professional. E-filing can expedite the processing of your tax return and often increases the speed at which refunds are issued.

What should I do if I made a mistake on my Form 1040A?

If you discover an error after submitting your Form 1040A, you can amend your tax return by filing Form 1040X. This will allow you to correct mistakes related to income, deductions, or credits claimed. It’s essential to act promptly to minimize any potential penalties or interest that may accrue as a result of the error.

Where can I find help if I have questions about Form 1040A?

Assistance is available through the IRS website, where detailed instructions and resources are provided. Additionally, taxpayers can contact the IRS directly via phone or seek the help of tax professionals for personalized guidance with Form 1040A.

Common mistakes

Filling out the IRS 1040A form can be a straightforward task, but there are common mistakes that can lead to problems. One frequent error occurs when individuals fail to verify the accuracy of their Social Security Number (SSN). Each taxpayer must ensure that their SSN and that of their spouse (if filing jointly) are entered correctly on the form. An incorrect SSN can delay processing and potentially affect the tax refund.

Another common mistake is overlooking the selection of filing status. Taxpayers often miss checking the appropriate box for their filing status, such as "Single," "Married filing jointly," or "Head of household." This oversight can lead to significant discrepancies in tax calculations and the potential for reduced deductions or credits.

Additionally, some filers do not include all dependents when reporting exemptions on line 6c. It is crucial to review dependent qualifications thoroughly. Disregarding those who qualify can result in missed tax benefits. Always remember to list dependents accurately with their name, Social Security Number, and relationship to you.

Accurate income reporting is also essential. Some individuals either overlook income sources entirely or misreport figures from Form W-2 or 1099. This can lead to underreporting income, which may raise red flags with the IRS. It is important to gather all relevant documents and ensure that every source of income is accounted for before submitting the form.

Finally, failing to sign the tax return is a common mistake that cannot be overlooked. Both taxpayers must sign and date the form, or the IRS will consider it invalid. This step is critical, especially for joint returns, and can lead to significant delays in processing if omitted.

Documents used along the form

When filing your taxes with the IRS Form 1040A, having the right additional forms and documents on hand can make the process smoother. Here’s a list of commonly used forms that you might need as you complete your tax return.

- Form W-2: This form reports your wages and the taxes withheld by your employer. You'll receive a W-2 from every employer you've worked for during the tax year.

- Schedule A: This supplemental form allows you to itemize your deductions instead of claiming the standard deduction. Use it if your total itemized deductions exceed the standard deduction amount.

- Form 1099: There are various types of 1099 forms, such as 1099-MISC for freelance income or 1099-INT for interest earned. These documents report income received that isn't reported on a W-2.

- Form 8862: If you've previously been denied the Earned Income Tax Credit (EITC), you need this form to claim the credit again, along with evidence that you meet the eligibility requirements.

- Form 8863: Claim education credits using this form to help your dependents pay for qualified education expenses. It covers the American Opportunity Credit and the Lifetime Learning Credit.

- Form 8880: If you made contributions to a retirement account, this form allows you to claim the Retirement Savings Contributions Credit. It can help reduce your overall taxable income.

- Schedule B: Use this form if you need to report interest and ordinary dividends, especially if you have over a certain amount of income in these categories.

Having these forms ready can streamline your tax preparation process and ensure you maximize credits and deductions. Always double-check to ensure you have everything necessary before filing.

Similar forms

The IRS Form 1040A is a simplified version of the standard tax return form, specifically designed for individual taxpayers. Several other forms share similarities with the 1040A, either in function or structure. Here are ten such forms:

- Form 1040: This is the standard individual income tax return form used by most taxpayers. While 1040A is simplified, Form 1040 allows for more complex tax situations and deductions.

- Form 1040EZ: This was the easiest tax form for individuals with simple financial situations. It allowed for a streamlined filing process, similar to Form 1040A, but was discontinued in 2018.

- Form 1040-NR: This form is for non-resident aliens who are required to file a U.S. income tax return. Like the 1040A, it summarizes income and tax owed but caters to non-residents.

- Form 1040X: This is an amended return form. It can be used to correct errors on a previously filed Form 1040 or 1040A. Both forms summarize income and offer a clear tax calculation.

- Form 8880: This is the Retirement Savings Contributions Credit form. Taxpayers fill it out when claiming a credit on retirement contributions and attach it to their 1040 or 1040A.

- Form 8862: This form is used to claim the Earned Income Credit (EIC) after it has been disallowed in a previous year. It can accompany Form 1040 or 1040A to validate eligibility for the credit.

- Schedule A (Form 1040): This is used for itemizing deductions, which can also affect taxable income. While 1040A allows for the standard deduction only, both require similar initial income reporting.

- Schedule B (Form 1040): This is used to report certain interest and dividend income. Taxpayers file it with their 1040 or 1040A if applicable, providing detailed income sources.

- Schedule C (Form 1040): This is filed by self-employed individuals to report income or loss from a business. Both forms allow income reporting, but Schedule C provides additional business details.

- Form 8863: This form is for education credits. Taxpayers can claim eligible education expenses when filing either Form 1040 or 1040A, highlighting deductions related to education expenses.

Dos and Don'ts

When filling out the IRS 1040A form, it's important to follow certain Do's and Don'ts to ensure accuracy and compliance. Here's a helpful list.

- Do double-check your Social Security numbers to prevent delays.

- Do carefully read the instructions for each line, as they provide essential guidance.

- Do report all sources of income accurately, including wages, tips, and interest.

- Do sign and date your return; an unsigned return can be considered invalid.

- Do keep a copy of your completed form and any attached documents for your records.

- Don’t leave blanks; if a question does not apply, write "0" or "N/A."

- Don’t forget to attach all necessary forms and schedules, like W-2s or 1099s.

- Don’t ignore the deadlines; submit your form on time to avoid penalties.

- Don’t submit your return without checking for errors first; mistakes can lead to audits or delays.

Misconceptions

Here are five common misconceptions about the IRS Form 1040A:

- Everyone can use Form 1040A. Many people believe that Form 1040A is applicable to all taxpayers. However, this form is only available for those with a simpler tax situation, typically involving income below a certain threshold and without complex deductions.

- Form 1040A is the same as Form 1040. There's a misunderstanding that Form 1040A is just a simplified version of Form 1040. While 1040 and 1040A serve similar purposes, they cater to different filing scenarios. Form 1040 offers more flexibility for deductions and various income types.

- You can't claim any credits with Form 1040A. Some believe that using Form 1040A means they forfeit their right to claim tax credits. This is incorrect. Taxpayers can claim certain credits, such as the Child Tax Credit and the Earned Income Credit, even when using Form 1040A.

- Filing Form 1040A is always faster. Many think that using Form 1040A guarantees a quicker refund. In reality, the time it takes to process a refund depends more on the accuracy of the submitted information and the method of filing rather than the form used.

- Form 1040A is for everyone filing jointly. There’s a misconception that all married couples should opt for Form 1040A when filing jointly. In fact, couples with more complicated tax situations or higher income may find that Form 1040 is more suitable.

Key takeaways

When filling out the IRS 1040A form, there are several key points to keep in mind to ensure accurate completion and proper use of the form.

- Eligibility: You can only use the 1040A form if you have a taxable income below a specified limit, do not itemize deductions, and meet certain other criteria.

- Personal Information: Be thorough in entering your personal information, including your name, social security number, and address, along with your spouse’s (if applicable).

- Filing Status: Select your correct filing status carefully. The options include Single, Married Filing Jointly, Married Filing Separately, or Head of Household.

- Exemptions: Understand how exemptions work. Make sure to accurately count yourself, your spouse, and any dependents to determine the number of exemptions you can claim.

- Income Reporting: Report all sources of income clearly, including wages, interest, and dividends. Use appropriate forms as necessary to support your entries.

- Deductions: Take advantage of standard deductions available for your filing status. Make sure to subtract these from your total income to arrive at your adjusted gross income.

- Credits: Identify any tax credits you may qualify for, such as the Earned Income Credit or Child Tax Credit, as these can significantly reduce your tax liability.

- Signature and Submission: Ensure you sign and date your return before submission. If filing jointly, both you and your spouse must sign the form.

By keeping these takeaways in mind, you can navigate your tax filing more effectively and avoid potential issues with the IRS.

Browse Other Templates

Tax Registration Application,Self-Employed Registration Form,Business Registration Document,TIN Application Form,Mixed Income Tax Registration,Non-Resident Alien Registration Form,Estate and Trust Registration Form,Professional Registration Applicati - Stay updated on any changes to BIR regulations affecting tax registration.

Wellpoint Prior Authorization Form - Documentation supporting the claim should be organized and clearly labeled.

Philadelphia Electric Installation Application - This form is essential for both residential and commercial electrical projects.