Fill Out Your Irs 14242 Form

Form 14242 serves as a crucial tool for individuals seeking to report suspected abusive tax promotions or tax preparers engaged in illegal schemes. Released by the Internal Revenue Service (IRS), this form is designed to facilitate the collection of information on tax avoidance schemes that may violate federal tax laws. It provides a structured format for reporters to detail their observations and suspicions, including descriptions of the schemes being promoted, the promoters involved, and any promotional materials received. Collecting accurate and thorough information is essential, as this evidence aids the IRS in investigating potentially harmful tax practices. Individuals can also claim a reward for information submitted via a separate form, thereby incentivizing the reporting process. The form includes specific questions about how the reporter became aware of the promotion and their relationship with the promoter or preparer. This aspect is significant because it helps the IRS assess the credibility and relevance of the provided information. To protect the privacy of individuals filing the form, it also allows the option to remain anonymous. Submission can be made either by fax or by mail, making the reporting process accessible. Those who provide false information, however, may face penalties, emphasizing the importance of honesty and accuracy. By understanding the functionalities and requirements of Form 14242, individuals can effectively contribute to combating tax fraud and protecting the integrity of the tax system.

Irs 14242 Example

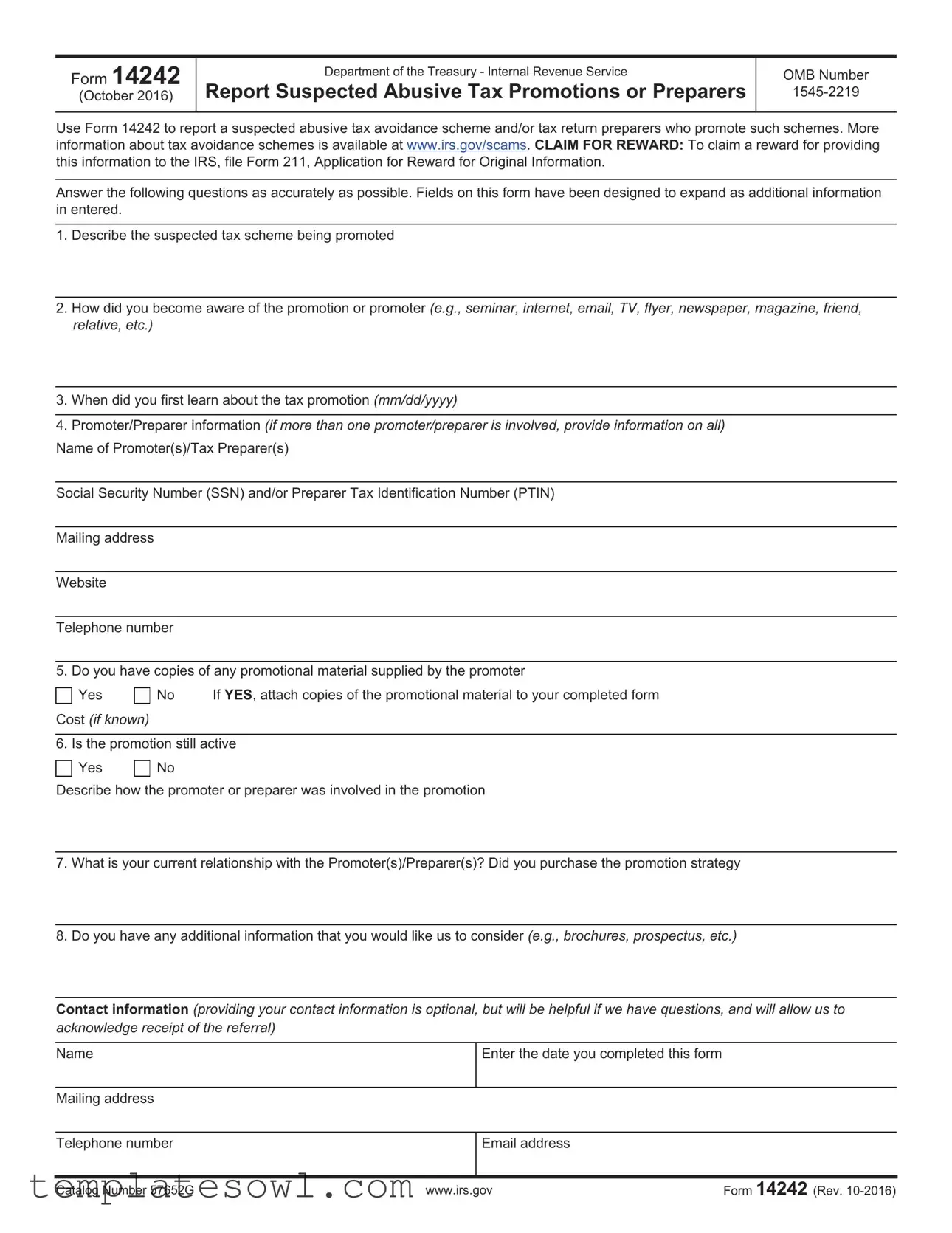

Form 14242

(October 2016)

Department of the Treasury - Internal Revenue Service

Report Suspected Abusive Tax Promotions or Preparers

OMB Number

Use Form 14242 to report a suspected abusive tax avoidance scheme and/or tax return preparers who promote such schemes. More information about tax avoidance schemes is available at www.irs.gov/scams. CLAIM FOR REWARD: To claim a reward for providing this information to the IRS, file Form 211, Application for Reward for Original Information.

Answer the following questions as accurately as possible. Fields on this form have been designed to expand as additional information in entered.

1.Describe the suspected tax scheme being promoted

2.How did you become aware of the promotion or promoter (e.g., seminar, internet, email, TV, flyer, newspaper, magazine, friend, relative, etc.)

3.When did you first learn about the tax promotion (mm/dd/yyyy)

4.Promoter/Preparer information (if more than one promoter/preparer is involved, provide information on all)

Name of Promoter(s)/Tax Preparer(s)

Social Security Number (SSN) and/or Preparer Tax Identification Number (PTIN)

Mailing address

Website

Telephone number

5. Do you have copies of any promotional material supplied by the promoter

Yes

Cost (if known)

No |

If YES, attach copies of the promotional material to your completed form |

6. Is the promotion still active

Yes

No

Describe how the promoter or preparer was involved in the promotion

7.What is your current relationship with the Promoter(s)/Preparer(s)? Did you purchase the promotion strategy

8.Do you have any additional information that you would like us to consider (e.g., brochures, prospectus, etc.)

Contact information (providing your contact information is optional, but will be helpful if we have questions, and will allow us to acknowledge receipt of the referral)

Name

Enter the date you completed this form

Mailing address

Telephone number

Email address

Catalog Number 57652G |

www.irs.gov |

Form 14242 (Rev. |

Page 2 of 2

FAX your completed form to: (877)

Mail the completed form to:

Internal Revenue Service

Lead Development Center Stop MS5040

24000 Avila Road

Laguna Niguel, CA 92677

(IRS Employees ONLY SHOULD

Privacy Act and Paperwork Reduction Act Notice

This information is solicited under authority of 5 U.S.C. 301, 26 U.S.C. 7801 and 26 U.S.C. 7803. The primary purpose of this form is to report violation of the Internal Revenue laws.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal

Providing this information is voluntary. Not providing all or part of the information will not affect you. Providing false or fraudulent information may subject you to penalties.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is: Preparing and sending the form to the IRS should involve 10 minutes. If you have comments concerning the accuracy of the time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to the IRS at the address listed in the Instructions.

Catalog Number 57652G |

www.irs.gov |

Form 14242 (Rev. |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | Use Form 14242 to report suspected abusive tax avoidance schemes or tax return preparers involved in such promotions. |

| Claiming a Reward | To claim a reward for information provided, submit Form 211, Application for Reward for Original Information. |

| How to Report | Answer questions on the form about the tax scheme, promoter, and any promotional materials. |

| Active Promotion Status | Indicate whether the promotion is still active when completing the form. |

| Information Confidentiality | Information reported is typically confidential under section 6103 of the Internal Revenue Code. |

| Estimated Completion Time | Filling out and submitting the form should take approximately 10 minutes. |

| Contact Information | Providing your contact information is optional but is recommended if follow-up is necessary. |

| Fax and Mail Submission | Completed forms can be faxed or mailed to the IRS Lead Development Center in Laguna Niguel, CA. |

Guidelines on Utilizing Irs 14242

Once you have gathered the necessary information, you can begin filling out the IRS Form 14242. Your responses should be clear and reflective of the details surrounding the suspected abusive tax promotion. After completing the form, you'll be ready to submit it to the IRS for consideration.

- Download the IRS Form 14242 from the official IRS website.

- Begin by providing a detailed description of the suspected tax scheme in the first field.

- Indicate how you learned about the promotion or promoter. Use options like seminar, internet, or friends.

- Fill in the date when you first became aware of the tax promotion by entering it in mm/dd/yyyy format.

- For promoter/preparer information, include the name, Social Security Number (SSN) or Preparer Tax Identification Number (PTIN), mailing address, website, and telephone number.

- If you have copies of any promotional material, check "Yes" and attach those materials to your form. If you don’t, select "No."

- State whether the promotion is still active by checking either "Yes" or "No." Provide a brief description of the promoter's or preparer’s involvement.

- Clarify your current relationship with the promoter or preparer. Note if you purchased the promotion strategy.

- Offer any additional information that might be useful, such as brochures or a prospectus.

- Optionally, provide your contact information (name, mailing address, telephone number, and email address) to facilitate any follow-up communications.

- Finally, enter the date you completed the form.

Once you have filled out the form, fax it to (877) 477-9135, or mail it to the address provided: Internal Revenue Service, Lead Development Center, Stop MS5040, 24000 Avila Road, Laguna Niguel, CA 92677.

What You Should Know About This Form

What is Form 14242 used for?

Form 14242 is utilized to report suspected abusive tax avoidance schemes and tax return preparers who promote such schemes. Individuals can use this form to inform the Internal Revenue Service (IRS) about potentially fraudulent activities related to tax preparation or avoidance. More information about tax avoidance schemes can be found on the IRS website.

How do I file Form 14242?

To file Form 14242, complete all sections of the form with as much accurate information as possible. Once the form is completed, individuals can either fax it to (877) 477-9135 or mail it to the Internal Revenue Service Lead Development Center at the specified address in Laguna Niguel, California.

Do I need to provide my contact information when submitting Form 14242?

Providing your contact information is optional. However, it is recommended to include it since it will be helpful for the IRS if they have further questions or need to acknowledge receipt of your referral.

What information should I include about the suspected promoter or tax preparer?

When reporting the suspected promoter or tax preparer, you should include their name, mailing address, telephone number, and website. If known, provide their Social Security Number (SSN) or Preparer Tax Identification Number (PTIN) as well. If there are multiple promoters or preparers, information on all involved should be reported.

Can I claim a reward for providing information using Form 14242?

Yes, individuals can claim a reward by filing Form 211, which is the Application for Reward for Original Information. To potentially receive a reward, one must provide information on violations of Internal Revenue laws that leads to actionable results.

What should I do if I have promotional materials from the suspected promoter?

If you have copies of any promotional materials provided by the promoter, you should indicate this on Form 14242. Attach copies of the materials to the completed form when submitting it to the IRS.

What happens if I provide false information on Form 14242?

Providing false or fraudulent information may lead to penalties. It is crucial to ensure that the information reported is accurate and truthful to avoid legal repercussions.

Common mistakes

Completing IRS Form 14242 can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One prevalent error is providing incomplete information about the suspected tax scheme. It is crucial to describe the scheme clearly and in detail. Omitting relevant facts can hinder the investigation and leave the IRS with more questions than answers.

Another mistake is failing to indicate how you learned about the promoter or promotion. This section is essential, as it helps the IRS trace the source of the information. Whether you were informed through a seminar, an advertisement, or a friend, providing this context can significantly aid the case.

People sometimes forget to include accurate dates. For instance, when asked when you first heard about the promotion, it’s important to provide the exact date in the required format (mm/dd/yyyy). A simple error in the date format can cause confusion and delay processing your report.

Providing incorrect personal information about the promoter or tax preparer is another common issue. Ensuring that you have the correct name, Social Security Number (SSN), and contact details is critical. Missing or wrong information can render your submission ineffective in initiating an investigation.

One often-overlooked area is the promotional materials section. If you have copies of these materials, it’s vital to attach them when submitting Form 14242. People sometimes skip this step and lose an opportunity to strengthen their report with supporting evidence.

Indicating whether the promotion is still active can also cause issues. Marking the wrong response, either "Yes" or "No," can have significant implications for how the IRS prioritizes your case. It’s important to be honest about the current status of the promotion.

A common oversight occurs when reporting your relationship with the promoter. Clearly stating your connection is important. Was it a friend? Did you purchase a promotion strategy? Lack of clarity in this area can lead to misunderstandings regarding your motives for reporting.

Lastly, failing to provide contact information can be detrimental. Although sharing your information is optional, it could benefit you if the IRS needs to ask follow-up questions or acknowledge receipt of your report. Leaving it out might result in missed communication that could aid in the investigation process.

Documents used along the form

When reporting suspected abusive tax promotions or preparers, it’s important to have the right forms ready. Alongside the IRS Form 14242, there are several other documents that may be useful in the process. Below is an overview of forms that often accompany Form 14242.

- Form 211: This form is used to apply for a reward for providing original information about tax fraud. If you believe your information could lead to a significant enforcement action, complete this form to potentially receive a financial reward.

- Form 3949-A: Use this form to report suspected tax law violations by individuals or businesses. It allows for the submission of detailed information and evidence regarding fraudulent activities.

- Form 1040: This is the standard individual income tax return form. If you’ve been involved in a questionable tax scheme, it might be necessary to review or amend prior tax returns to ensure compliance with the law.

- Form 8821: This form allows you to authorize someone to discuss your tax information with the IRS. If you're working with a representative regarding a tax scheme, this form may be essential for them to access your details.

Using the appropriate forms correctly can facilitate better communication with the IRS, ensuring your concerns are properly addressed. It enhances your ability to provide all necessary information regarding suspicions of abusive tax practices.

Similar forms

The IRS Form 14242 is a valuable tool for individuals wanting to report suspected abusive tax promotions or preparers. Several other IRS forms serve similar purposes, focusing on various aspects of tax compliance, fraud reporting, and reward claims. Below is a list outlining these related documents:

- Form 211: This form is used to apply for a reward for original information provided to the IRS about violations of the Internal Revenue laws, similar to the reward claim process in Form 14242.

- Form 3949-A: Use this form to report suspected tax law violations, including fraud, which aligns with the purpose of Form 14242 in investigating tax scams.

- Form 13909: This form serves to report tax-exempt organization fraud, targeting misrepresentation in nonprofit sectors, similar to addressing issues within abusive tax promotions.

- Form 8862: This application is for individuals who need to prove their eligibility to claim a tax credit, focusing on compliance and fraud avoidance that is echoed in Form 14242.

- Form 8911: This form is used to claim a credit for alternative fuel vehicle refueling property, which can also be scrutinized under potential abusive practices, paralleling the use of Form 14242.

- Form 1099: Generally used to report various income types, it can be tied to investigations of improper income statements, similar to the intent of Form 14242 in addressing suspicious activities.

- Form 4559: This is the “Application for Third Party Designee” which allows third parties to discuss a tax return with the IRS, tying into the broader concept of accountability in tax matters as seen with the use of Form 14242.

- Form 5471: This form is related to foreign corporations and includes reporting requirements that can expose abusive tax schemes involving international elements, similar to the domestic issues reported in Form 14242.

Each of these forms plays a role in the larger framework of reporting and preventing tax fraud and abusive practices. Understanding these documents can enhance vigilance in identifying and addressing tax-related issues.

Dos and Don'ts

- Do read all instructions carefully before filling out the form.

- Do provide complete and accurate information to the best of your knowledge.

- Do describe the suspected tax scheme in detail.

- Do attach any promotional materials if you have them.

- Do include your contact information to assist the IRS if they have questions.

- Don't omit any questions that are relevant to the suspicion being reported.

- Don't provide false information, as this could lead to legal consequences.

- Don't forget to keep a copy of the completed form for your records.

- Don't delay submitting the form, as prompt reporting is encouraged.

Misconceptions

Misperception 1: The IRS Form 14242 is only for individuals in the IRS.

This is incorrect. Anyone can use this form to report suspected abusive tax promotions or preparers. You do not need to be an IRS employee to alert the agency about potential tax fraud. Your voice matters, and every report can help combat tax schemes in the community.

Misperception 2: Completing Form 14242 will result in negative consequences for the reporter.

In reality, reporting suspected tax abuses is voluntary and can often be done anonymously. While providing your contact information may facilitate follow-up questions from the IRS, it is not required. As a result, you can share important information without fearing repercussions.

Misperception 3: You must have firsthand experience with a tax scheme to fill out this form.

This is a common misunderstanding. Even if you simply heard about a scheme from a friend, saw it advertised online, or stumbled upon it in a magazine, you can still report it. The IRS encourages anyone with knowledge of potential scams to come forward as this information can be crucial in investigations.

Misperception 4: There are strict requirements for the information you need to provide.

While providing accurate details is important, the form is designed to accommodate various levels of information. If you don’t have all the answers, that’s okay. The fields expand to accommodate any additional information you might have. What's essential is that you report what you know, even if it’s limited.

Key takeaways

Filling out the IRS Form 14242 can seem daunting at first, but understanding its purpose and requirements can simplify the process. Here are some key takeaways:

- Purpose of the Form: Form 14242 is used to report suspected abusive tax avoidance schemes and the promoters who market such schemes.

- Claiming Rewards: If you provide information that leads to a successful enforcement action, you can claim a reward by using Form 211, the Application for Reward for Original Information.

- Information Required: You must accurately describe the suspected tax scheme and detail how you learned about it. This may include mentioning sources like seminars, emails, or friends.

- Promoter Details: The form requires specific information about the promoter or preparer, including their name, Social Security Number or Preparer Tax Identification Number, and contact information.

- Evidence Submission: If you have promotional materials related to the scheme, you should attach copies with your submission.

- Current Relationship: The form asks about your relationship with the promoter and whether you have purchased the promotional strategy.

- Confidentiality and Use of Information: Reported information may be shared with federal agencies and international authorities, but your personal information remains largely confidential.

This form serves as a crucial tool for ensuring tax compliance and protecting the integrity of the tax system. By reporting suspicious activities, you can contribute to combating fraud and possibly earn a reward for your efforts.

Browse Other Templates

What Form Does My Doctor Need to Fill Out for Disability - Fax this form to 1-800-880-9325 or mail it to the provided address in Columbia, SC.

Calorie Count Sheet Printable - Use this form to communicate openly about the patient's eating behaviors and preferences.

Asbestos License Application,Asbestos Handling Permit,New York State Asbestos Certification,Asbestos Management License,Asbestos Work Authorization,Asbestos Handling Registration,NYS Asbestos Handler Form,Asbestos Contractor License Application,Licen - The completed form must be submitted along with appropriate fees.