Fill Out Your Irs 4421 Form

The IRS Form 4421 plays a crucial role in the administration of decedents' estates, specifically concerning the declaration of executor's commissions and attorney's fees. Executors and administrators must complete this form to confirm the total amounts they have agreed to pay for their services and those of their attorneys as they manage the estate. The form requires detailed disclosures, including the name and address of the payees, their Social Security numbers, and the amounts already paid or to be paid. Importantly, of the declared fees, only a portion may be claimed as an income tax deduction, necessitating careful record-keeping and reporting. Should there be any changes to the amounts reported or if a deduction is claimed on the estate tax return, the IRS must be notified promptly, underscoring the accountability expected from the estate's representatives. Additionally, the recipients of these payments must report them as income in the year they are received, ensuring compliance with tax obligations. Form 4421 not only simplifies the communication of compensation but also affirms the commitment to follow federal tax regulations, which are fundamental to the orderly administration of estates.

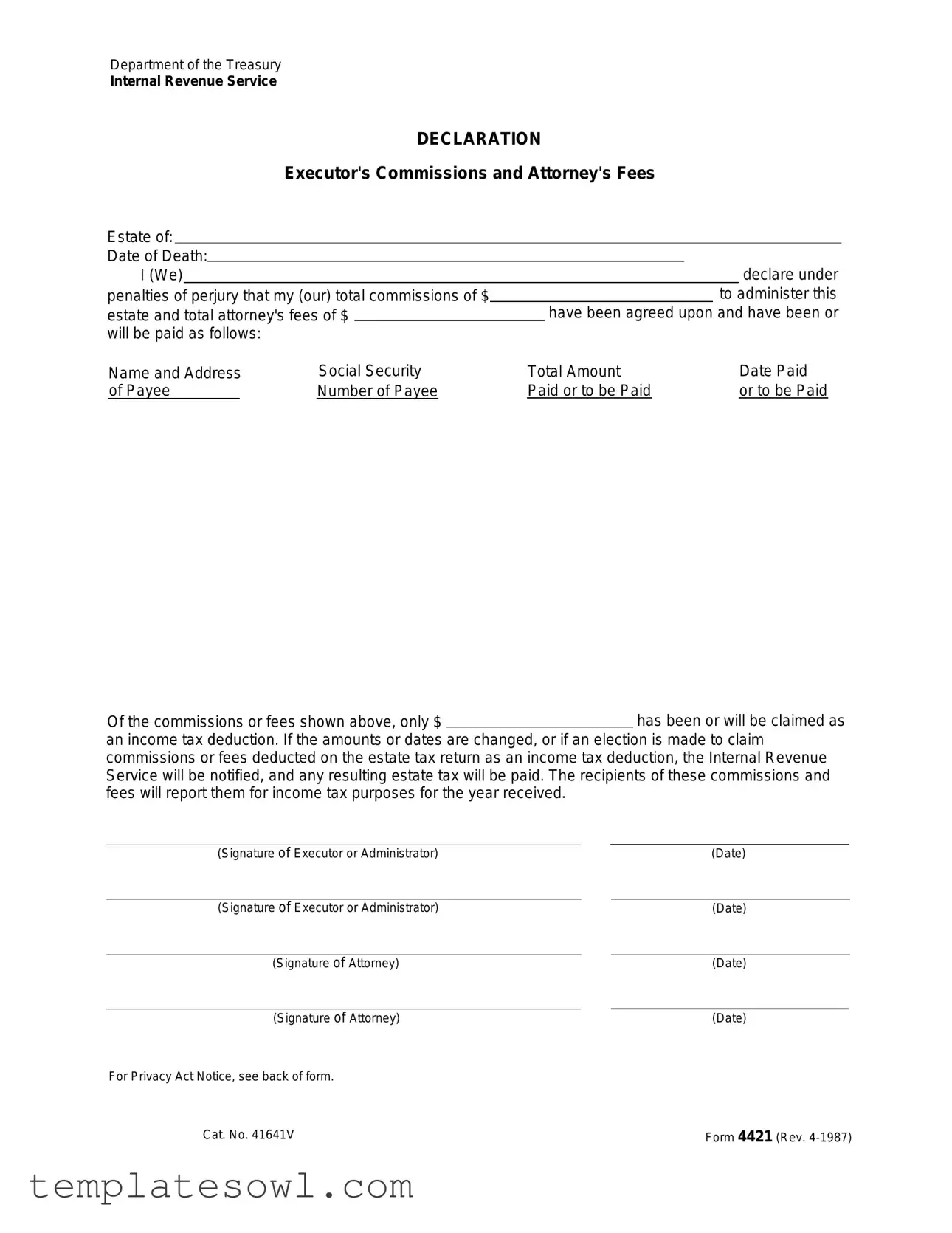

Irs 4421 Example

Department of the Treasury

Internal Revenue Service

DECLARATION

Executor's Commissions and Attorney's Fees

Estate of:

Date of Death: |

|

|

|

|

|

|

|

declare under |

|||

|

I (We) |

|

|

|

|

|

|

|

|||

penalties of perjury that my (our) total commissions of $ |

|

|

|

to administer this |

|||||||

estate and total attorney's fees of $ |

|

|

have been agreed upon and have been or |

||||||||

will be paid as follows: |

|

|

|

|

|

|

|

||||

Name and Address |

Social Security |

Total Amount |

|

|

Date Paid |

||||||

|

of Payee |

|

Number of Payee |

Paid or to be Paid |

|

|

or to be Paid |

||||

Of the commissions or fees shown above, only $has been or will be claimed as an income tax deduction. If the amounts or dates are changed, or if an election is made to claim commissions or fees deducted on the estate tax return as an income tax deduction, the Internal Revenue Service will be notified, and any resulting estate tax will be paid. The recipients of these commissions and fees will report them for income tax purposes for the year received.

(Signature of Executor or Administrator) |

|

(Date) |

|

|

|

|

|

(Signature of Executor or Administrator) |

|

(Date) |

|

|

|

|

|

(Signature of Attorney) |

|

(Date) |

|

|

|

|

|

(Signature of Attorney) |

|

(Date) |

|

For Privacy Act Notice, see back of form.

Cat. No. 41641V |

Form 4421 (Rev. |

Privacy Act Notice

Under the Privacy Act of 1974, we must tell you:

Our legal right to ask for the information and whether the law says you must give it.

Our legal right to ask for the information and whether the law says you must give it.

What major purposes we have in asking for it, and how it will be used.

What major purposes we have in asking for it, and how it will be used.

What could happen if we do not receive it.

What could happen if we do not receive it.

The law covers: Tax returns and any papers

filed with them. Any questions we need to ask

filed with them. Any questions we need to ask

you so we can:

you so we can:

Complete, correct, or process your return. Figure your tax.

Collect tax, interest, or penalties.

Our legal right to ask for information is Internal Revenue Code sections 6001, 601 1, and 6012(a), and their regulations. They say that you must file a return or statement with us for any tax you are liable for. Code section 6109 and its regulations say that you must show your social security number on what you file. This is so we know who you are, and can process your return and papers.

You must fill in all parts of the tax form that apply to you. But you do not have to check boxes for the Presidential Election Campaign Fund.

We ask for tax return information to carry out the In- ternal Revenue

We may give the information to the Department of Justice and to other Federal agencies, as provided by law. We may also give it to cities, States, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. And we may give it to foreign governments because of tax treaties they have with the United States.

If you do not file a return, do not provide the infor- mation we ask for, or provide fraudulent information, the law provides that you may be charged penalties and, in certain cases, you may be subject to criminal prosecution. We may also have to disallow the exemp- tions, exclusions, credits, deductions, or adjustments shown on the tax return. This could make the tax higher or delay any refund. Interest may also be charged.

Please keep this notice with your records. It may help you if we ask you for other information.

If you have questions about the rules for filing and giving information, please call or visit any Internal Revenue Service office.

This is the only notice we must give you to explain the Privacy Act. However, we may give you other notices if we have to examine your return or collect any tax, interest, or penalties.

Form Characteristics

| Fact | Description |

|---|---|

| Purpose | The IRS Form 4421 is used to declare executor's commissions and attorney's fees related to the administration of an estate. |

| Signatories | The form must be signed by the executor or administrator of the estate, as well as the attorney involved. |

| Date of Death | It requires the date of death of the estate owner to properly associate fees with the estate. |

| Income Tax Deduction | Only a portion of the commissions or fees can be claimed as an income tax deduction. |

| Method of Payment | The form outlines how and when the commissions and fees have been paid or will be paid. |

| Notification Requirement | If any changes occur regarding payments, the IRS must be notified promptly. |

| Tax Reporting | Recipients of commissions and fees must report these amounts for income tax purposes in the year they are received. |

| Privacy Act Notice | The form includes a notice explaining the Privacy Act and how information provided will be used by the IRS. |

| Legal Basis | The IRS's legal authority to request the information comes from the Internal Revenue Code sections 6001, 6011, and 6012(a). |

| Form Revision | The current version of Form 4421 was last revised in April 1987, indicating it may not reflect more recent tax law changes. |

Guidelines on Utilizing Irs 4421

Filling out IRS Form 4421 is an important step in managing the finances of an estate. This form allows executors and administrators to declare the commissions and attorney's fees associated with an estate. It is essential to complete this form accurately, as any discrepancies may lead to complications with the Internal Revenue Service.

- Gather necessary information. You will need the total commissions, total attorney's fees, names and addresses of payees, and their Social Security numbers.

- Enter the name of the estate and the date of death at the top of the form.

- Fill in the total commissions to administer the estate. Enter this amount in the designated space.

- Fill in the total attorney's fees in the appropriate section of the form.

- List the name and address of each payee in the provided space.

- Enter the Social Security number for each payee next to their name.

- Document the total amount paid or to be paid to each payee.

- Indicate the date that each commission or fee was paid or will be paid.

- Specify the amount that will be claimed as an income tax deduction.

- Ensure all signatures are included. Have the executor or administrator sign and date the form. If applicable, have the attorney sign and date it as well.

After completing the form, make copies for your records and submit the original to the IRS. It's advisable to keep a thorough documentation of all payments and agreements associated with the estate. If changes occur regarding amounts or payments, notify the IRS promptly to avoid issues.

What You Should Know About This Form

What is IRS Form 4421?

IRS Form 4421 is a declaration form used to report executor's commissions and attorney's fees related to the administration of an estate. This form is important for ensuring transparency and compliance with tax regulations as it outlines the payments made to executors and attorneys, which can have tax implications for the estate.

Who needs to file Form 4421?

The executor or administrator of an estate is responsible for filing this form. If you are handling the affairs of a deceased person's estate and have been authorized to manage their assets, pay debts, and distribute inheritance, you will need to complete and submit Form 4421 if there are commissions or attorney's fees involved.

What information must be included on Form 4421?

Form 4421 requires details such as the name of the estate, date of death, total commissions paid to the executor, total attorney's fees, and the amounts being claimed as income tax deductions. You also need to provide the names, addresses, and Social Security numbers of the recipients receiving these payments.

Is there a deadline for filing Form 4421?

While there is not a specific deadline for Form 4421 itself, it should be filed in conjunction with the estate's tax return. It’s crucial to complete the form promptly to ensure all parties involved can fulfill their tax obligations accurately without delay.

What happens if the amounts or payment dates change?

If there are any changes to the amounts or payment dates after filing Form 4421, you must notify the IRS. This responsibility ensures that any resulting tax implications are handled appropriately and that all parties involved are aware of their tax obligations based on the updated information.

How should the commissions and fees be reported for tax purposes?

The recipients of the commissions and fees must report these amounts as income for the year they are received. It’s vital to keep detailed records of these transactions for accurate reporting and compliance with tax laws.

What are the penalties for failing to file or provide false information?

Failing to file Form 4421 or providing false information can result in penalties imposed by the IRS, including higher taxes or potential criminal prosecution in severe cases. It's important to be honest and thorough when completing the form to avoid complications.

Can the information from Form 4421 be shared?

Yes, the information provided on Form 4421 may be shared with relevant government agencies for tax purposes. The IRS has the legal right to disclose this information to other federal, state, and local agencies as needed to enforce tax laws and regulations.

Where can I find help if I have questions about Form 4421?

If you have questions regarding IRS Form 4421 or need assistance with filling it out, you can contact the IRS directly or visit any local IRS office. They can provide guidance and support to help you navigate the process successfully.

Common mistakes

Completing the IRS Form 4421 can be a straightforward process if approached with care. However, many individuals make common mistakes that could lead to complications down the line. Understanding these pitfalls may help ensure the accurate submission of the form.

One frequent error is omissions of essential information. It is critical to fully complete all sections of the form, including the names and Social Security numbers of payees, as well as the total amounts being declared. Incomplete forms could lead to delays or even penalties from the IRS. A thorough review of each section can minimize the risk of oversight.

Another mistake involves inaccurately reporting the amounts paid. Individuals often mistakenly list incorrect figures for total commissions and attorney fees. Double-checking these amounts before submission can prevent confusion and ensure compliance with tax regulations. The figures reported are subject to verification, and discrepancies might result in additional inquiries from the IRS.

Failing to sign and date the form is another common issue. Many individuals overlook this important step. Having the signatures of all relevant parties, including executors and attorneys, is necessary for the form to be legally binding. Without proper signatures, the IRS may deem the form invalid.

Some individuals may also overlook the importance of notifying the IRS of any changes that occur after submitting the form. If the amounts or dates of payments change, or if an election is made regarding deductions, it is essential to communicate this promptly. Keeping the IRS informed can prevent misunderstandings and potential penalties.

Finally, neglecting to retain a copy of the submitted form can be a significant oversight. Keeping a copy for personal records is advisable in case of any future questions or audits from the IRS. This practice also aids in maintaining accurate financial records related to the estate.

By being aware of these mistakes, individuals can approach the completion of IRS Form 4421 with confidence and accuracy. Attention to detail can reduce the likelihood of complications, ensuring a smoother process during what can already be a challenging time.

Documents used along the form

The IRS Form 4421 is often accompanied by several other important documents when settling an estate. Each of these forms serves a specific purpose to ensure that all financial obligations are addressed properly. Below is a list of commonly used documents that work in conjunction with Form 4421.

- IRS Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. Executors file this form to report the estate’s gross value and determine any estate tax liability.

- IRS Form 1041: Known as the U.S. Income Tax Return for Estates and Trusts, this form is important for reporting income earned by the estate during the administration period.

- Form 8939: This form allows executors to make an election for valuation and to report gain or loss on the estate's assets for tax purposes.

- Letters Testamentary or Letters of Administration: These legal documents grant the executor or administrator the authority to act on behalf of the estate, facilitating the settling of debts and distribution of assets.

- Final Estate Accounting: This document outlines the financial activities of the estate, including all income, expenses, and distributions made during the administration.

- Beneficiary Distribution Report: This report details how the assets of the estate will be distributed among the beneficiaries, ensuring transparency and clarity in the process.

- Tax Clearance Certificate: Obtained from the IRS or state tax authority, this certificate certifies that all due taxes have been paid by the estate, allowing the executor to proceed with distributions.

- Form 8879: This IRS e-file Signature Authorization allows the executor or trust administrator to digitally sign and submit returns electronically for ease and efficiency.

- Form 4506: Known as the Request for Copy of Tax Return, this form may be used to obtain copies of previous tax returns to assist in preparing the estate tax return.

- Estate Plan Documents: These may include wills, trusts, and any changes made to estate documents that clarify how the decedent wished their assets to be managed and distributed.

These documents play a crucial role in the overall estate settlement process. Ensuring that each one is completed accurately can help prevent delays and complications for the executor and the beneficiaries. By understanding these forms, individuals involved in estate administration can navigate the process more effectively.

Similar forms

The IRS Form 4421 relates to certain financial disclosures and declarations in estate management. Several other forms share similar features or purposes in the realm of tax declarations and estate issues. Here are four forms that are comparable to the IRS 4421:

- IRS Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. Like Form 4421, it requires detailed reporting of estate-related financial information and deductions. Executors must disclose the value of the estate, including commissions and attorney fees, which can impact the overall tax liability.

- IRS Form 1041: This is the U.S. Income Tax Return for Estates and Trusts. Similar to Form 4421, it involves reporting income generated by the estate. Executors must report distributions made to beneficiaries along with any deductions for attorney fees or commissions as outlined in Form 4421.

- IRS Form 8821: This document is the Tax Information Authorization form. While it primarily authorizes third parties to receive tax information, it shares a common thread with Form 4421 regarding the flow of information about financial affairs of estates and the need for clear documentation for tax purposes.

- IRS Form 1099-MISC: This form is used to report miscellaneous income, which may include payments made for executor commissions or attorney fees. It aligns with the essence of Form 4421 where such payments need to be declared for accurate tax reporting.

Dos and Don'ts

When it comes to filling out the IRS Form 4421, there are several important guidelines to follow. These tips can help you ensure that your submission is accurate and complete.

- Make sure to provide your name and address clearly at the top of the form.

- Double-check the total commissions and attorney's fees, ensuring that the amounts are accurate and match any supporting documents.

- Use the exact date of the decedent's death as it appears on legal documents.

- Clearly indicate how much of the fees will be claimed as an income tax deduction.

- Keep a copy of the completed form for your records.

- Sign and date the form where indicated before submission.

- Contact the IRS or seek professional advice if you have any questions or uncertainties.

While you should do the above, there are also things to avoid when filling out the form.

- Don't leave any required fields blank; every section needs to be filled out or marked as not applicable.

- Avoid rounded figures; use the exact dollar amounts to eliminate any ambiguity.

- Never use erasers or correction fluid on the form, as this can lead to rejection of your submission.

- Don't forget to provide the Social Security numbers of each payee listed.

- Refrain from submitting the form without checking it for errors first.

- Do not send the form without the necessary signatures; all required parties must sign it.

- Avoid procrastination; submit the form in a timely manner to ensure compliance with IRS deadlines.

Misconceptions

Form 4421, used in relation to executor's commissions and attorney's fees, is often misunderstood. Clarifying these misconceptions can provide better insight into the form's purpose and usage. Here are six common misconceptions:

- Form 4421 is only needed for large estates. Many believe that only large estates require this form. In reality, it is relevant for any estate where commissions and fees are paid, regardless of size.

- Submitting Form 4421 guarantees tax deductions. Some individuals think that filing this form automatically allows for deducting fees or commissions. However, only the amounts specified and agreed upon can be deducted, and it must adhere to IRS rules.

- Only the executor needs to sign the form. While it is true that the executor's signature is essential, the form also requires signatures from attorneys involved. This is an important aspect often overlooked.

- Once filed, there’s no need for further updates. Many assume that after submitting this form, no changes are necessary. In fact, if any amounts or payment dates change, the IRS must be notified promptly.

- Form 4421 is not related to income tax reporting. A common belief is that this form only pertains to estate taxes. However, recipients of the fees must also report these amounts as income on their personal tax returns.

- The Privacy Act Notice can be ignored. Some individuals may disregard the Privacy Act Notice included with the form. It is essential to understand its contents, as it outlines rights and responsibilities regarding the information provided to the IRS.

Key takeaways

When using and completing the IRS Form 4421, several key points should be taken into consideration:

- The form is specifically designed to declare executor's commissions and attorney's fees for an estate.

- Ensure accurate reporting of all payments made to executors and attorneys, including the total amount and date paid.

- Be mindful that only a portion of the commissions or fees may be claimed as an income tax deduction.

- Notify the IRS promptly of any changes in amounts or dates that affect the reported commissions or fees.

- Understand that any recipients of these payments are responsible for reporting the income for the year it was received.

By carefully adhering to these guidelines, individuals can ensure compliance and avoid potential penalties associated with incorrect filings.

Browse Other Templates

Sba Debt Schedule - Correctly filling out the form can prevent processing delays.

Ca W/h - The form includes sections for both withholding agent and payee information.