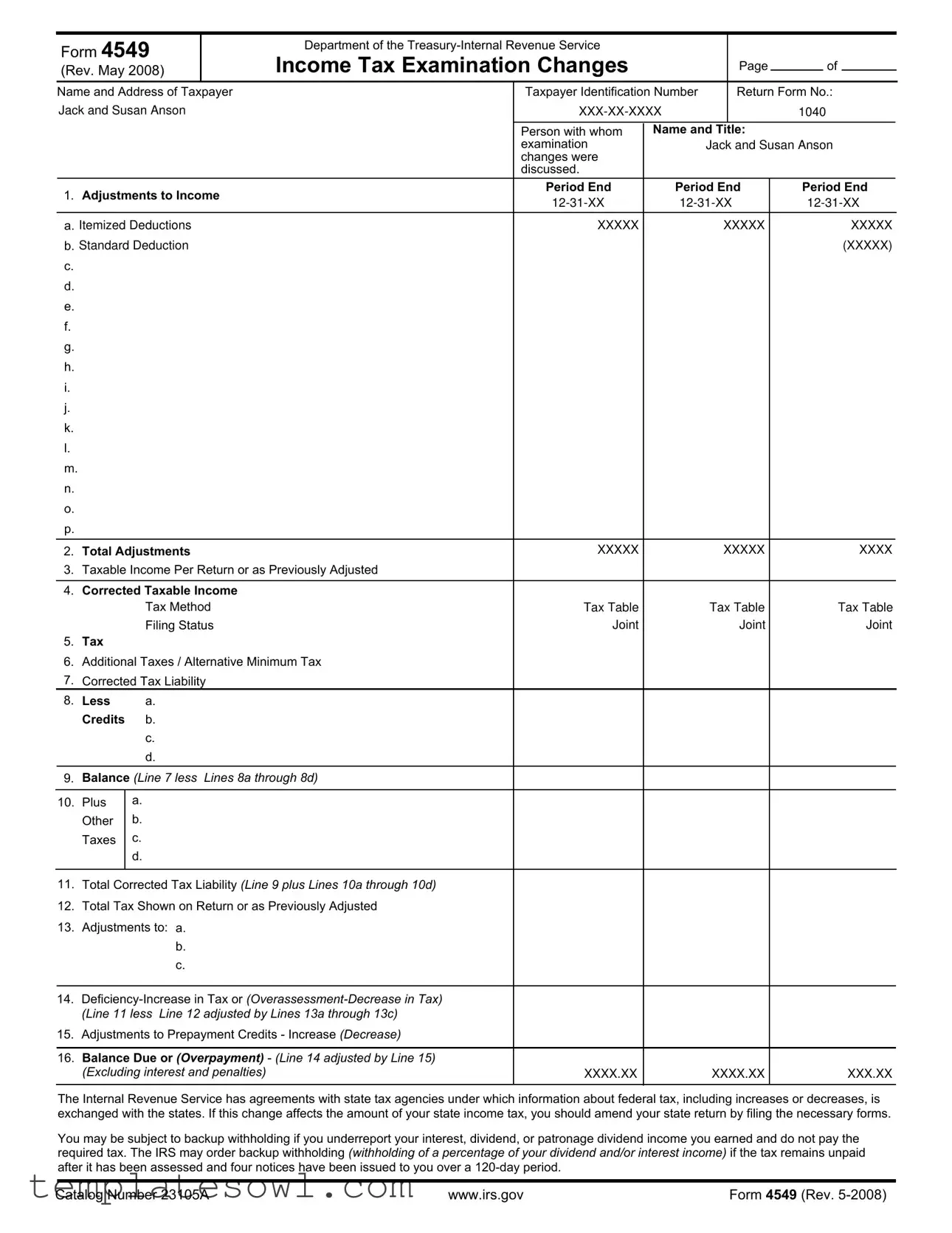

Fill Out Your Irs 4549 Form

The IRS Form 4549 is a critical document for taxpayers who have undergone an income tax examination, often translating complex tax adjustments into a clear summary. This form outlines the changes proposed by the IRS during an audit, detailing adjustments to income, tax liabilities, and any penalties that may apply. Included within the form are specific calculations regarding taxable income and a breakdown of tax liabilities, both corrected and as originally reported. Additionally, the form alerts taxpayers to the implications these changes might have on state taxes and warns about potential backup withholding due to underreporting income. Significantly, taxpayers are also provided with an area to consent to the proposed changes, waiving their right to appeal. Understanding Form 4549 is crucial, as it can affect your financial outcomes, from owed taxes to potential refunds. As you navigate this landscape, recognizing the importance of each section will empower you to respond effectively to the IRS's findings.

Irs 4549 Example

Form 4549 |

|

Department of the |

|

|

|

|

|

|

|

|

||

|

Income Tax Examination Changes |

|

|

|

Page |

|

of |

|

|

|||

(Rev. May 2008) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||

Name and Address of Taxpayer |

|

Taxpayer Identification Number |

|

Return Form No.: |

||||||||

Jack and Susan Anson |

|

|

|

|

1040 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Person with whom |

Name and Title: |

|

|

|

|

|||

|

|

|

|

examination |

|

|

Jack and Susan Anson |

|||||

|

|

|

|

changes were |

|

|

|

|

|

|

|

|

|

|

|

|

discussed. |

|

|

|

|

|

|

|

|

1. |

Adjustments to Income |

|

Period End |

|

Period End |

Period End |

||||||

|

|

|||||||||||

|

|

|

|

|

||||||||

a. Itemized Deductions |

|

XXXXX |

|

|

XXXXX |

|

|

XXXXX |

||||

b. Standard Deduction |

|

|

|

|

|

|

|

|

(XXXXX) |

|||

c. |

|

|

|

|

|

|

|

|

|

|

|

|

d. |

|

|

|

|

|

|

|

|

|

|

|

|

e. |

|

|

|

|

|

|

|

|

|

|

|

|

f. |

|

|

|

|

|

|

|

|

|

|

|

|

g. |

|

|

|

|

|

|

|

|

|

|

|

|

h. |

|

|

|

|

|

|

|

|

|

|

|

|

i. |

|

|

|

|

|

|

|

|

|

|

|

|

j. |

|

|

|

|

|

|

|

|

|

|

|

|

k. |

|

|

|

|

|

|

|

|

|

|

|

|

l. |

|

|

|

|

|

|

|

|

|

|

|

|

m. |

|

|

|

|

|

|

|

|

|

|

|

|

n. |

|

|

|

|

|

|

|

|

|

|

|

|

o. |

|

|

|

|

|

|

|

|

|

|

|

|

p. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. |

Total Adjustments |

|

XXXXX |

|

|

XXXXX |

|

|

XXXX |

|||

3.Taxable Income Per Return or as Previously Adjusted

4.Corrected Taxable Income

Tax Method |

Tax Table |

Tax Table |

Tax Table |

Filing Status |

Joint |

Joint |

Joint |

5.Tax

6.Additional Taxes / Alternative Minimum Tax

7.Corrected Tax Liability

8.Less a. Credits b. c. d.

9.Balance (Line 7 less Lines 8a through 8d)

10.Plus a. Other b. Taxes c. d.

11.Total Corrected Tax Liability (Line 9 plus Lines 10a through 10d)

12.Total Tax Shown on Return or as Previously Adjusted

13.Adjustments to: a.

b.

c.

14.

15.Adjustments to Prepayment Credits - Increase (Decrease)

16.Balance Due or (Overpayment) - (Line 14 adjusted by Line 15)

(Excluding interest and penalties) |

XXXX.XX |

XXXX.XX |

XXX.XX |

The Internal Revenue Service has agreements with state tax agencies under which information about federal tax, including increases or decreases, is exchanged with the states. If this change affects the amount of your state income tax, you should amend your state return by filing the necessary forms.

You may be subject to backup withholding if you underreport your interest, dividend, or patronage dividend income you earned and do not pay the required tax. The IRS may order backup withholding (withholding of a percentage of your dividend and/or interest income) if the tax remains unpaid after it has been assessed and four notices have been issued to you over a

Catalog Number 23105A |

www.irs.gov |

Form 4549 (Rev. |

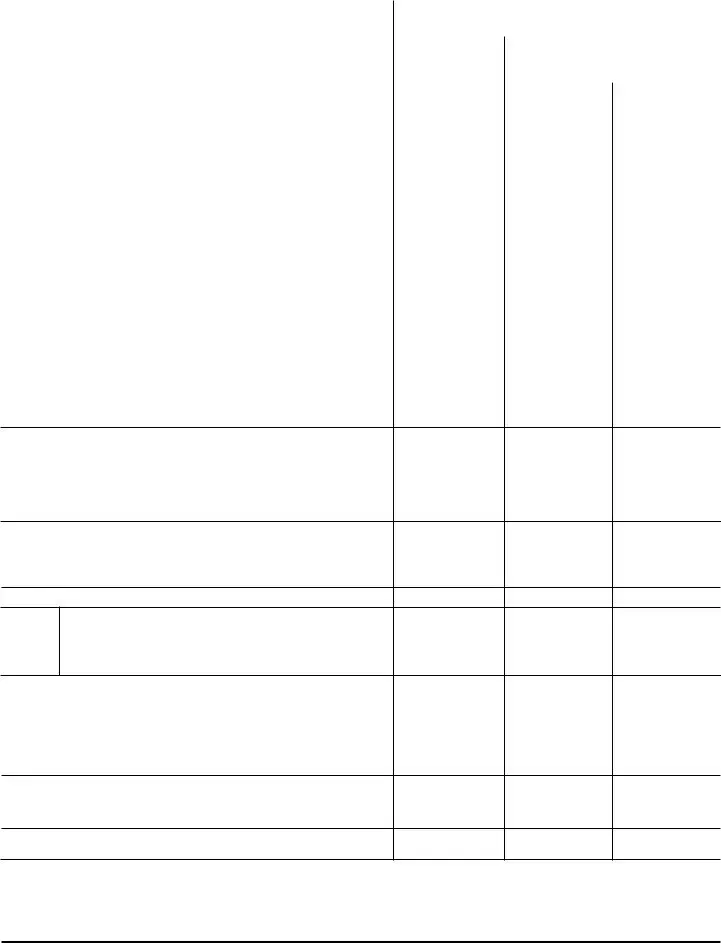

Form 4549 |

|

|

Department of the |

|

|

|

|

|

|

|

|

|

Income Tax Examination Changes |

|

|

Page |

|

of |

|

|

|

||

(Rev. May 2008) |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||

Name of Taxpayer |

|

Taxpayer Identification Number |

|

Return Form No.: |

|

||||||

Jack and Susan Anson |

|

|

|

|

1040 |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period End |

Period End |

Period End |

|

|||||

17. Penalties/ Code Sections |

|

|

|||||||||

a. Accuracy Related Penalty - IRC 6662 |

XXX.XX |

|

XXX.XX |

|

|

XX.XX |

|

||||

b. |

|

|

|

|

|

|

|

|

|

|

|

c. |

|

|

|

|

|

|

|

|

|

|

|

d. |

|

|

|

|

|

|

|

|

|

|

|

e. |

|

|

|

|

|

|

|

|

|

|

|

f. |

|

|

|

|

|

|

|

|

|

|

|

g. |

|

|

|

|

|

|

|

|

|

|

|

h. |

|

|

|

|

|

|

|

|

|

|

|

i. |

|

|

|

|

|

|

|

|

|

|

|

j. |

|

|

|

|

|

|

|

|

|

|

|

k. |

|

|

|

|

|

|

|

|

|

|

|

l. |

|

|

|

|

|

|

|

|

|

|

|

m. |

|

|

|

|

|

|

|

|

|

|

|

n. |

|

|

|

|

|

|

|

|

|

|

|

18.Total Penalties

Underpayment attributable to negligence: (19811987) A tax addition of 50 percent of the interest due on the underpayment will accrue until it is paid or assessed.

Underpayment attributable to fraud: (19811987)

A tax addition of 50 percent of the interest due on the underpayment will accrue until it is paid or assessed.

Underpayment attributable to Tax Motivated Transactions (TMT). The interest will accrue and be assessed at 120% of the under payment rate in accordance with IRC §6621(c)

19.Summary of Taxes, Penalties and Interest:

a. |

Balance due or (Overpayment) Taxes - (Line 16, Page 1) |

XXXX.XX |

XXXX.XX |

XXX.XX |

|

b. |

Penalties (Line 18) - computed to |

|

XXX.XX |

XXX.XX |

XX.XX |

c. |

Interest (IRC § 6601) - computed to |

|

XXX.XX |

XXX.XX |

XX.XX |

d. |

TMT Interest - computed to |

(on TMT underpayment) |

|

|

|

e. |

Amount due or (refund) (sum of Lines a, b, c and d) |

XXXX.XX |

XXXX.XX |

XXXX.XX |

|

Other Information:

Examiner's Signature:

Employee ID:

XXXXXXX

Office:

SBSE- Exam

Date:

Consent to Assessment and Collection- I do not wish to exercise my appeal rights with the Internal Revenue Service or to contest in the United States Tax Court the findings in this report. Therefore, I give my consent to the immediate assessment and collection of any increase in tax and penalties, and accept any decrease in tax and penalties shown above, plus additional interest as provided by law. It is understood that this report is subject to acceptance by the Area Director, Area Manager, Specialty Tax Program Chief, or Director of Field Operations.

PLEASE NOTE: If a joint return was filed. BOTH taxpayers must sign

Signature of Taxpayer |

Date: |

Signature of Taxpayer |

|

|

|

Date:

By:

Title:

Date:

Catalog Number 23105A |

www.irs.gov |

Form 4549 (Rev. |

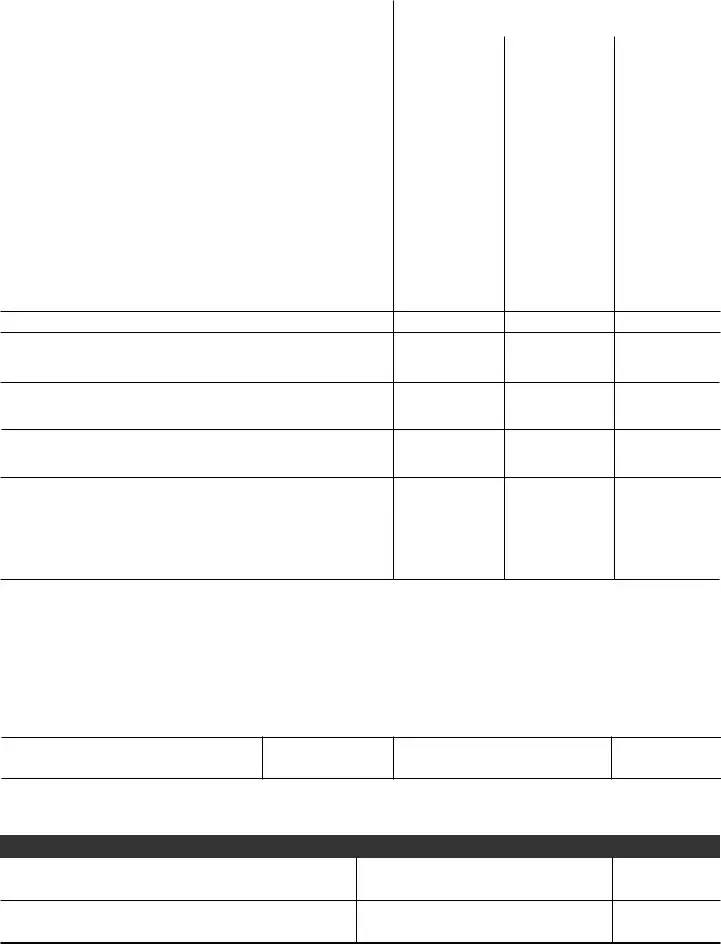

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | Form 4549 is used by the IRS to report changes made to a taxpayer's income tax return after an audit. |

| Taxpayer Identification | It includes the taxpayer's name, address, and taxpayer identification number for precise identification. |

| Details of Adjustments | The form details adjustments to income, including itemized and standard deductions. |

| Tax Corrections | Corrections in taxable income and tax liability are outlined, helping taxpayers understand their new tax obligations. |

| Penalties | The form provides information on potential penalties, referencing relevant codes such as IRC 6662. |

| Backup Withholding | If necessary, it warns taxpayers about backup withholding due to underreported income. |

| State Interaction | The IRS may share information with state tax agencies, which could lead to changes in state tax filings. |

| Consent to Assessment | Taxpayers can consent to the immediate assessment and collection of any increased taxes or penalties. |

| Revision Date | This version of Form 4549 was revised in May 2008, indicating it may not reflect the most current laws or practices. |

Guidelines on Utilizing Irs 4549

Once you have your IRS Form 4549 ready, it’s vital to ensure that all necessary information is correctly filled in. Completing this form accurately is essential for addressing any adjustments that may have been identified during your income tax examination. The following steps will guide you through the process.

- Gather Required Information: Before starting, have all relevant tax documents handy, including your original return and any notices received from the IRS.

- Fill Out Taxpayer Information: In the first section, write your name(s) and address, followed by your Taxpayer Identification Number and the return form number (e.g., 1040).

- List Adjustments: For each applicable period (indicated on the form), enter adjustments to income, including itemized deductions and the standard deduction.

- Calculate Taxable Income: On the next line, provide the taxable income from your return or previous adjustments and compare it to the corrected taxable income field.

- Detailed Tax Calculations: Document the tax and any additional taxes you owe, including the Alternative Minimum Tax.

- Input Corrected Tax Liability: Compute and enter the corrected tax liability by calculating any credits to be applied against this total.

- Determine Balance: Calculate the balance owed or any potential overpayment by subtracting your total credits from your corrected tax liability.

- Include Other Adjustments: Make sure to list any other necessary adjustments or taxes that may affect your final liability.

- Calculate Total Corrected Tax Liability: Add the amounts from the previous balances and any other taxes to determine the total corrected tax liability.

- Complete Penalties and Interest Section: If applicable, fill in details regarding penalties and interest as required.

- Final Summary: In the summary section, consolidate all relevant figures to determine the overall tax situation, including any refunds or amounts due.

- Sign and Date the Form: Ensure that both taxpayers sign and date the form if a joint return was filed.

Now that the form is filled out, review everything for accuracy. Any mistakes can lead to further inquiries or complications, so double-check each line. If you’re unsure about any specific entries, consider seeking assistance to ensure compliance and to address any potential tax implications effectively.

What You Should Know About This Form

What is Form 4549 and why is it used?

Form 4549, titled "Income Tax Examination Changes," is a document issued by the Internal Revenue Service (IRS) that outlines adjustments made during an income tax audit. This form details any changes in income, deductions, credits, and ultimately affects the taxpayer's overall tax liability. Taxpayers receive this form when the IRS identifies discrepancies between the reported tax return and the IRS's findings during the examination process.

Who receives Form 4549?

Form 4549 is typically sent to individuals or entities who have undergone an income tax examination by the IRS. In many cases, this includes taxpayers who have filed a joint return. The form contains specific information about the examination results and outlines any adjustments made, which must be reviewed and acknowledged by the taxpayer.

What should I do if I receive Form 4549?

If you receive Form 4549, it is crucial to carefully review the changes highlighted by the IRS. Understand each adjustment and determine whether you agree or disagree with the findings. If you agree, you may need to sign the form and consent to the changes. If you disagree, you have the option to contest the findings. In such cases, consider seeking legal or tax professional assistance to evaluate your options and potentially appeal the decision.

Will receiving Form 4549 result in additional taxes?

Receiving Form 4549 can lead to additional tax liabilities if the IRS has determined that your previous tax return understated your income or deductions. The form outlines any increases in taxable income, tax liability, penalties, and interest if applicable. Taxpayers should be prepared to address any balance due that the IRS documents on this form.

What happens if I do not respond to Form 4549?

Failure to respond to Form 4549 can result in the IRS proceeding with the assessments outlined in the form. This may include collection actions and possible penalties. Ignoring the form could lead to complications such as increased tax liability and interest accrual. It is essential to address the form in a timely manner to avoid further issues with the IRS.

Common mistakes

Filling out the IRS Form 4549 can be a daunting task, and mistakes can lead to complications with your tax return. One common mistake is providing incorrect identification information. It is crucial that the name and taxpayer identification number match your official documents exactly. A simple typo can result in delays or even penalties, as the IRS may struggle to match your form to their records.

Another frequent error is failing to report all income adjustments accurately. When completing the adjustments section, it’s essential to ensure that every piece of income, including bonuses, side jobs, or even interest from savings accounts, is included. Omitting any income can trigger an audit or lead to additional fines, as the IRS will expect full disclosure.

Often, taxpayers overlook the importance of signing the form. If you are filing jointly, both parties need to provide their signatures. Neglecting this step can cause your return to be deemed incomplete, leading to processing delays and potential penalties.

Additionally, some individuals make the mistake of misclassifying deductions. It’s important to know whether you qualify for itemized deductions or the standard deduction. Choosing the wrong option can significantly impact your taxable income and might result in higher tax liabilities than necessary. Carefully review your expenses and consult the appropriate guidelines to maximize your deductions.

Finally, people sometimes miscalculate their total tax liability. Ensure that every calculation is verified, including taxes owed and any credits applied. Double-checking math, whether done by hand or using software, can help avoid discrepancies that might attract attention from the IRS. Remember, accuracy is key to ensuring a smooth filing process.

Documents used along the form

The IRS Form 4549 is used to report income tax examination changes. Alongside this form, several other documents may be required to effectively address taxpayer adjustments, credits, and liabilities. Below is a list of forms often used with IRS Form 4549, each serving a specific purpose in the tax process.

- IRS Form 1040: This is the standard individual income tax return form that taxpayers use to report their annual income and determine their tax liability.

- IRS Form 8888: This form allows taxpayers to designate how they would like their federal tax refund distributed among different accounts or used for various purposes.

- IRS Form 941: Employers complete this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages, along with the employer’s portion of Social Security and Medicare taxes.

- IRS Form 8862: This form is used by taxpayers to claim the Earned Income Credit after it was disallowed in a previous year, helping to reinstate their eligibility.

- IRS Form 9465: Taxpayers use this form to request a monthly installment plan if they cannot pay their tax bill in full by the due date.

- IRS Form 2106: Employees use this form to deduct unreimbursed business expenses related to their profession, important for self-employed individuals or employees without reimbursement procedures in place.

- IRS Form 1139: This form allows businesses to apply for a quick refund of taxes by carrying back an unused general business credit to an earlier tax year.

- IRS Form 4506: Taxpayers utilize this form to request a copy or transcript of their previous tax returns from the IRS, often necessary for verifying prior year income.

- IRS Form W-2: Employers provide this form to employees, detailing their yearly wages and the taxes withheld, essential for individual tax returns.

These forms complement the IRS Form 4549, addressing different aspects of tax liabilities and adjustments. Having a clear understanding of each document can streamline the filing process and ensure compliance with IRS requirements.

Similar forms

The IRS Form 4549 is used primarily for documenting income tax examination changes. There are several other forms that serve similar purposes in tax reporting and compliance. Here is a list of nine documents that are comparable to Form 4549, highlighting the similarities:

- Form 4549-A: This form is another version of the income tax examination changes. It also outlines adjustments made during the examination and provides a summary of corrections to the taxpayer’s financial situation.

- Form 886-A: The Explanation of Items form assists taxpayers in understanding specific adjustments made to their tax returns. It details the reasons for the adjustments, similar to how Form 4549 communicates changes.

- Form 1040X: This is the Amended U.S. Individual Income Tax Return. Like Form 4549, it is used to report changes to previously filed returns, although it allows taxpayers to make their own adjustments rather than detailing changes made by the IRS.

- Form CP2000: This notice informs taxpayers of discrepancies between their reported income and the income IRS records show. How adjustments are communicated is somewhat similar to the notices received through Form 4549.

- Form 1099: This form reports various types of income that may not be subject to withholding. While not focused on adjustments, it serves a similar role in providing detailed income information to the IRS.

- Form 1040: The standard individual income tax return form directly relates to Form 4549, as it is the original document being examined and adjusted during the tax examination process.

- Form 4439: This form is used for requesting a refund of overpayment. While it serves a different purpose, it connects to the corrections noted in Form 4549, particularly regarding adjustments that lead to overpayments.

- Form 941: The Employer’s Quarterly Federal Tax Return is crucial for businesses. It details adjustments to federal tax obligations due to changes in employee compensation, akin to how Form 4549 addresses adjustments for individual taxpayers.

- Form 990: Organizations use this form to report financial information to the IRS. Similar in structure, it accounts for changes in the organization’s income and tax liabilities, resembling the adjustments reported in Form 4549.

Understanding these forms helps taxpayers navigate through their obligations and the IRS processes more effectively. Each form plays a critical role, whether it is about directly making changes, explaining discrepancies, or reporting income.

Dos and Don'ts

When filling out the IRS Form 4549, there are important things to keep in mind. Adhering to proper protocols and guidelines can simplify the process. Here are four dos and don'ts:

- Do ensure accuracy: Double-check all entries for mistakes or omissions.

- Do provide complete information: Include all required data to avoid delays in processing.

- Don’t ignore instructions: Carefully read the instructions that accompany the form.

- Don’t submit without reviewing: Review the completed form to ensure it reflects your current tax situation.

Misconceptions

Understanding the IRS Form 4549 can be challenging due to common misconceptions. Below is a list of nine prevalent myths about this form, along with clarifications to ensure accurate information is conveyed.

-

Misconception #1: The IRS Form 4549 is only for audits.

Many individuals believe this form is exclusively associated with audits. However, it is utilized for various situations such as changes in tax liability, assessments, and appeals.

-

Misconception #2: Signing Form 4549 means you agree with the IRS's findings.

Some think that signing the form equates to accepting the IRS's conclusions without question. In reality, a signature can indicate consent to an assessment but does not preclude the right to dispute findings.

-

Misconception #3: Completing the form is optional for the taxpayer.

While taxpayers may wish to contest an assessment, failing to complete Form 4549 may hinder the process of addressing discrepancies effectively.

-

Misconception #4: Form 4549 results are permanent once filed.

This form represents a moment in time. It can be amended or challenged through the appropriate channels if new information arises.

-

Misconception #5: Form 4549 is only for high-income earners.

Taxpayers of all income levels can receive Form 4549 if their returns involve adjustments or discrepancies, regardless of overall income.

-

Misconception #6: All adjustments on Form 4549 are due to fraud.

Not every adjustment signifies wrongdoing. Adjustments can stem from honest errors, misinterpretations of the tax code, or missing documentation rather than intentional fraud.

-

Misconception #7: You should automatically amend state returns after receiving Form 4549.

While the form advises state tax amendment if federal changes affect state tax obligations, it is not a requirement. Taxpayers should assess their unique situation before proceeding.

-

Misconception #8: Form 4549 only impacts federal taxes.

The implications of this form can extend to state taxes, depending on the nature of the adjustments. States may exchange information with the IRS, impacting state income tax liability.

-

Misconception #9: You can ignore Form 4549 if you disagree with it.

Disregarding the form can lead to penalties. If there are disagreements, taxpayers should engage with the IRS as outlined in the form’s instructions rather than ignoring it.

By dispelling these misconceptions, individuals can better navigate their tax situations and ensure compliance with regulations regarding the IRS Form 4549.

Key takeaways

Form 4549 is used by the IRS to communicate changes resulting from a tax examination.

This form outlines adjustments to your income, tax liability, and any penalties that may be assessed.

Filing status is crucial; ensure it accurately reflects your situation, as it impacts your tax calculation.

Joint filers must both sign the form if applicable, indicating their consent to the findings.

Be proactive about state taxes. If federal changes affect your state income tax, amend your state return accordingly.

The form specifies if there are additional taxes or credits that may adjust your overall liability.

Understand the implications of penalties; they can significantly increase your total amount due.

In the event of an audit, keep a copy of this form and any correspondence related to your case for your records.

Browse Other Templates

What Is an Unincorporated Nonprofit Association - Submit completed forms to the Secretary of State’s Document Filing Support Unit in Sacramento.

Emissions Test Extension - The vehicle identification number (VIN) is required for precise tracking.