Fill Out Your Irs 4598 Instructions Form

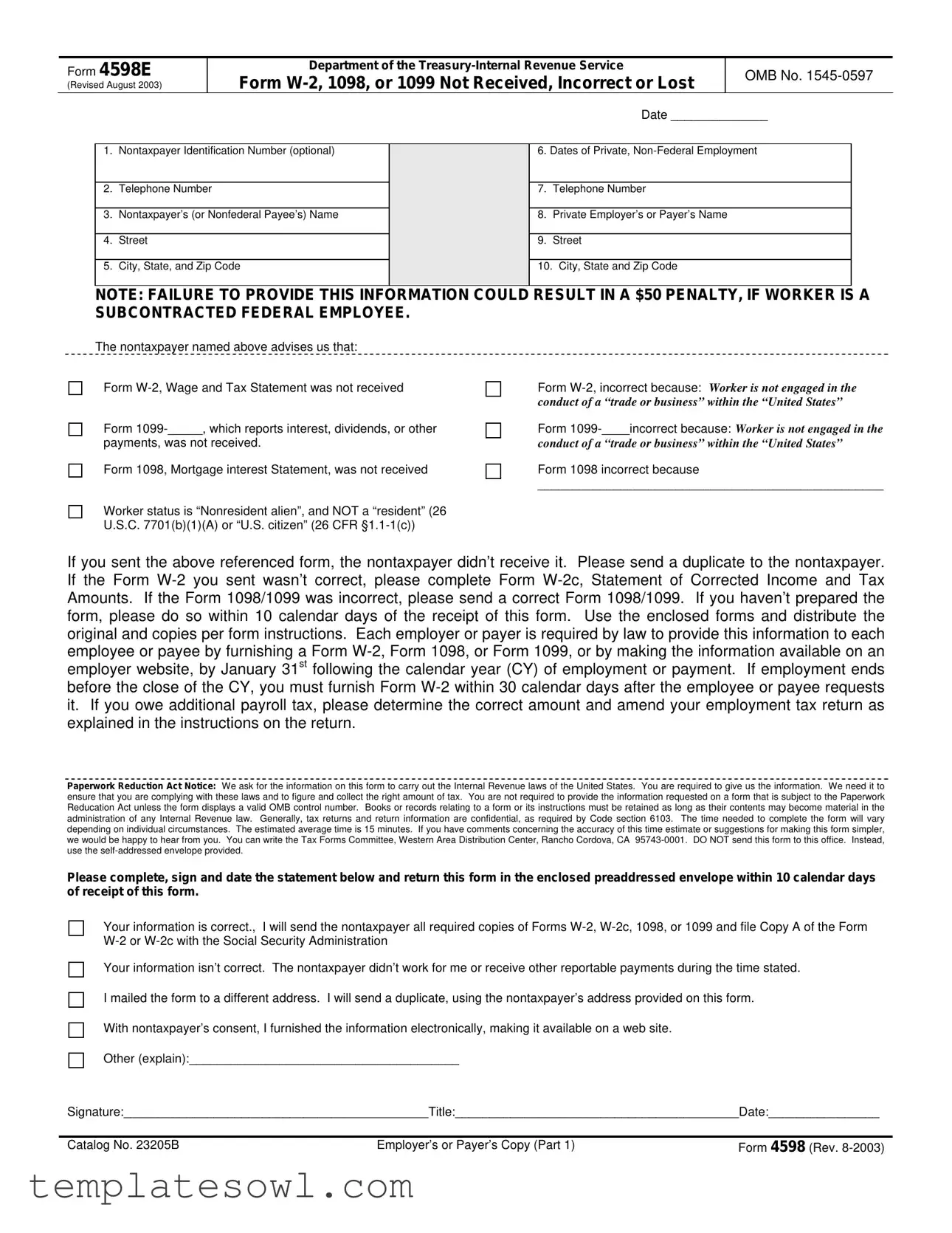

The IRS Form 4598 serves a critical function for individuals who have not received or have received incorrect versions of essential tax documents such as Forms W-2, 1098, or 1099. This form is particularly important for nontaxpayers, including nonresident aliens, to clarify their tax reporting status and ensure compliance with U.S. tax laws. Individuals must provide their contact information and details about the missing or incorrect forms on the form. For instance, they will need to specify why a Form W-2 is incorrect, citing reasons such as not engaging in a trade or business within the United States. On the employer or payer's side, timely responses are necessary to correct the records and provide the required duplication of forms to the nontaxpayer. Alongside these procedural elements, the form also emphasizes deadlines, such as the requirement to furnish the necessary information to each employee or payee by January 31st following the calendar year of employment or payment. By adhering to these guidelines, nontaxpayers can avoid potential penalties and ensure proper reporting of their financial activities for tax purposes, showcasing the form’s role in reinforcing compliance within the tax system.

Irs 4598 Instructions Example

Form 4598E

(Revised August 2003)

Department of the

Form

OMB No.

|

|

|

|

Date ______________ |

|

|

|

|

|

1. |

Nontaxpayer Identification Number (optional) |

|

6. Dates of Private, |

|

|

|

|

|

|

2. |

Telephone Number |

|

7. |

Telephone Number |

|

|

|

|

|

3. |

Nontaxpayer’s (or Nonfederal Payee’s) Name |

|

8. |

Private Employer’s or Payer’s Name |

|

|

|

|

|

4. |

Street |

|

9. |

Street |

|

|

|

|

|

5. |

City, State, and Zip Code |

|

10. |

City, State and Zip Code |

|

|

|

|

|

NOTE: FAILURE TO PROVIDE THIS INFORMATION COULD RESULT IN A $50 PENALTY, IF WORKER IS A SUBCONTRACTED FEDERAL EMPLOYEE.

The nontaxpayer named above advises us that:

Form

Form

payments, was not received.

Form 1098, Mortgage interest Statement, was not received

Form

Form

conduct of a “trade or business” within the “United States”

Form 1098 incorrect because

__________________________________________________

Worker status is “Nonresident alien”, and NOT a “resident” (26

U.S.C. 7701(b)(1)(A) or “U.S. citizen” (26 CFR

If you sent the above referenced form, the nontaxpayer didn’t receive it. Please send a duplicate to the nontaxpayer. If the Form

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reducation Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete the form will vary depending on individual circumstances. The estimated average time is 15 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Please complete, sign and date the statement below and return this form in the enclosed preaddressed envelope within 10 calendar days of receipt of this form.

Your information is correct., |

I will send the nontaxpayer all required copies of Forms |

|

|

||

Your information isn’t correct. The nontaxpayer didn’t work for me or receive other reportable payments during the time stated. |

||

I mailed the form to a different address. I will send a duplicate, using the nontaxpayer’s address provided on this form. |

||

With nontaxpayer’s consent, I furnished the information electronically, making it available on a web site. |

|

|

Other (explain):_______________________________________ |

|

|

Signature:____________________________________________Title:_________________________________________Date:________________ |

||

|

|

|

Catalog No. 23205B |

Employer’s or Payer’s Copy (Part 1) |

Form 4598 (Rev. |

Form 4598E

(Revised August 2003)

Department of the

Form

OMB No.

|

|

|

|

Date ______________ |

|

|

|

|

|

1. |

Nontaxpayer Identification Number (optional) |

|

6. Dates of Private |

|

|

|

|

|

|

2. |

Telephone Number |

|

7. |

Telephone Number |

|

|

|

|

|

3. |

Nontaxpayer’s (or Payee’s) Name |

|

8. |

Private Employer’s or Payer’s Name |

|

|

|

|

|

4. |

Street |

|

9. |

Street |

|

|

|

|

|

5. |

City, State, and Zip Code |

|

10. |

City, State and Zip Code |

|

|

|

|

|

NOTE: FAILURE TO PROVIDE THIS INFORMATION COULD RESULT IN A $50 PENALTY, IF WORKER IS A SUBCONTRACTED FEDERAL EMPLOYEE.

The nontaxpayer named above advises us that:

Form

Form

payments, was not received.

Form 1098, Mortgage interest Statement, was not received

Form

Form

conduct of a “trade or business” within the “United States”

Form 1098 incorrect because

__________________________________________________

Worker status is “Nonresident alien”, and NOT a “resident” (26

U.S.C. 7701(b)(1)(A) or “U.S. citizen” (26 CFR

If you don’t receive the Form

If you have already filed a return on which you estimated your wages, payments, interest, dividends, and withholdings, we will process it based upon the information it contains.

If you later receive the Form

Paperwork Reduction Act Notice: We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete the form will vary depending on individual circumstances. The estimated average time is 15 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Catalog No. 23205B |

NONTaxpayer’s Copy (Part 2) |

Form 4598 (Rev. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | Form 4598E is used for reporting issues related to Form W-2, 1098, or 1099, such as not receiving or having an incorrect version of these tax forms. |

| Issued By | This form is issued by the Department of the Treasury, Internal Revenue Service (IRS), ensuring compliance with federal tax laws. |

| Submission Deadline | Individuals must return this form within 10 calendar days of receipt to avoid complications in reporting income. |

| Potential Penalties | A failure to provide accurate information could result in a $50 penalty, particularly applicable when the worker is a subcontracted federal employee. |

| Average Completion Time | The estimated average time required to complete Form 4598E is approximately 15 minutes, varying based on individual circumstances. |

| Governing Law Reference | This form operates under U.S. federal tax law, particularly sections 26 U.S.C. 7701 and 26 CFR §1.1-1 concerning taxpayer status. |

Guidelines on Utilizing Irs 4598 Instructions

Once you have the IRS Form 4598 ready to fill out, you will provide information related to wage and tax statements that may not have been received or may be incorrect. Following these steps ensures that the process is completed accurately.

- Fill in the date at the top of the form.

- Enter the Nontaxpayer Identification Number (optional).

- Provide your telephone number for contact purposes.

- Input the Nontaxpayer’s (or Nonfederal Payee’s) name.

- Write the street address of the Nontaxpayer.

- Include the city, state, and zip code of the Nontaxpayer.

- Document the dates of Private, Non-Federal Employment.

- Input the telephone number of the Private Employer or Payer.

- Enter the name of the Private Employer or Payer.

- Fill in the street address of the Private Employer or Payer.

- Provide the city, state, and zip code for the Private Employer or Payer.

Next, explain why the form is being submitted. Indicate if Forms W-2, 1098, or 1099 were not received, were incorrect, or state if the worker status is a “Nonresident alien.” Finally, sign and date the statement confirming the information, and return the form in the provided preaddressed envelope within 10 calendar days.

What You Should Know About This Form

What is Form 4598 used for?

Form 4598 is used to report situations when you have not received your Form W-2, Form 1098, or Form 1099, or when these forms contain incorrect information. This form helps to notify the employer or payer of these issues, prompting them to take corrective actions. It's important for ensuring that all necessary income and tax information is properly documented to help you in filing your taxes accurately.

Who should fill out Form 4598?

This form should be completed by the nontaxpayer or payee who did not receive their expected tax documents, or who received incorrect documents. It's specifically useful for nonresident aliens and others who have questions about the forms they should receive. If you believe you haven't received the correct forms, this is the step to take.

What information needs to be included on Form 4598?

You will need to provide the nontaxpayer's name, street address, city, state, and ZIP code, as well as a telephone number. While not mandatory, you may also include a nontaxpayer identification number. Additionally, you will need to specify which forms were not received or were incorrect and explain why they are deemed incorrect. Accurate information will help expedite the resolution process.

What should I do if I have not received Form W-2 or a corrected version?

If you have not received your Form W-2 or W-2c by the time your tax return is due, it is advisable to file your tax return with a Form 4852. This form allows you to estimate your income and withholding until the correct forms are received. Be sure to keep a record of this process to ensure accurate reporting.

What happens if I provide incorrect information on Form 4598?

Providing incorrect information could lead to delays in processing your request. Additionally, if you are a subcontracted federal employee, failing to provide accurate information could potentially result in a $50 penalty. It's essential to make sure that all details are correct before submitting the form to avoid any complications.

How long does it take to complete Form 4598?

On average, it takes about 15 minutes to complete Form 4598. However, the exact time may vary based on individual circumstances and the complexity of your situation. It's a good idea to gather all necessary information before you begin filling out the form, to make the process smoother.

Where should I send Form 4598 once it is completed?

You should send the completed Form 4598 using the self-addressed envelope that accompanies the form. Do not send it to the Tax Forms Committee directly. Ensure that you complete, sign, and date the statement and include any additional documentation, if necessary, before mailing your form.

Common mistakes

Many individuals face challenges when completing the IRS Form 4598. One common mistake is not including essential contact information. It's crucial to provide a telephone number where you can be reached. Without this detail, the IRS may struggle to contact you with any follow-up questions or concerns about your submission.

Another frequent error pertains to the Nontaxpayer's Name section. Failing to provide the correct name leads to confusion and delays. Make sure to double-check the spelling and accuracy of the name you enter. Even minor errors can cause significant issues down the line.

Many people also overlook the importance of detailing the nature of the incorrect or missing form. Simply stating "not received" is not enough. It's essential to specify why Form W-2, 1098, or any 1099 is incorrect. Providing clarity here will help the IRS expedite your request.

Lastly, people often forget to sign and date the form. This seems minor, but it's a vital step. Without a signature and date, the submission may not be considered complete. Take a moment to ensure that you have signed and dated your form before sending it off. Each of these mistakes can lead to penalties or delays, so be thorough and attentive while filling out the form.

Documents used along the form

When dealing with IRS Form 4598, various other forms and documents typically come into play. These documents help ensure accurate reporting of income, taxes, and any discrepancies that may arise. Here is an overview of some commonly associated forms.

- Form W-2: This form reports an employee's annual wages and the taxes withheld. Employers must send it to the IRS and provide copies to employees by January 31st each year.

- Form W-2c: This is a corrected version of Form W-2. It is used to fix mistakes on the original W-2, such as incorrect income or tax amounts that were reported.

- Form 1099-MISC: This form reports various types of income other than wages, salaries, and tips. It is commonly used for independent contractors and freelancers receiving $600 or more during the tax year.

- Form 1099-INT: This form is used to report interest income. Financial institutions are required to provide this information to account holders and the IRS.

- Form 1098: This form documents the amount of mortgage interest paid during the year. Homeowners receive this information from their lenders for tax reporting purposes.

- Form 4852: If a taxpayer does not receive their Form W-2 or 1099, they can use this substitute form to estimate their earnings and tax withheld when filing their tax return.

Understanding these forms is crucial for accurate tax completion and ensuring compliance with IRS regulations. Each form serves a specific purpose in the broader context of income reporting and tax obligations.

Similar forms

- Form W-2: This document is issued by employers to report wages paid and taxes withheld for employees. Like Form 4598, it addresses issues surrounding the non-receipt or inaccuracy of tax-related information reported to the IRS.

- Form 1099: Used to report various types of income, including freelance work, interest, and dividends. Similar to Form 4598, it helps taxpayers correct incomplete or lost information regarding payments received.

- Form 1098: This form is used to report mortgage interest paid by an individual, aiding taxpayers in claiming their deductions. It parallels Form 4598 in addressing the absence of a critical financial document.

- Form W-2c: This is a corrected version of the W-2 form. Like Form 4598, it corrects inaccuracies in previously issued wage statements, ensuring tax records reflect accurate information.

- Form 4852: This form serves as a substitute for missing W-2s and 1099s, allowing taxpayers to estimate their income and taxes withheld. Its purpose aligns with Form 4598, which also addresses issues surrounding missing forms.

- Form 1040X: Used to amend previously filed tax returns, this form allows taxpayers to adjust their filings based on newly received information, similar to the corrections facilitated by Form 4598.

- Form 8822: This form updates the IRS about a change of address. It is related as it ensures the IRS has current contact information to send important tax documents, echoing the intent of Form 4598 to rectify informational issues.

Dos and Don'ts

When filling out the IRS Form 4598, it's crucial to follow certain guidelines to avoid errors that could lead to delays or penalties. Below is a list of things you should and shouldn't do:

- Do: Fill in all required fields completely, including the nontaxpayer's name, address, and identification number if applicable.

- Do: Double-check that the information matches the supporting documentation to ensure accuracy.

- Do: Submit the form within the specified 10-calendar-day window to avoid penalties.

- Do: Keep a copy of the completed form for your records after sending it to the IRS.

- Don't: Ignore the specific details about the nontaxpayer's status (e.g. nonresident alien vs. U.S. citizen) on the form.

- Don't: Forget to include any necessary explanatory notes if the nontaxpayer’s status or information is incorrect.

Following these suggestions will help streamline the process and ensure compliance with IRS requirements.

Misconceptions

Misconceptions about tax forms can lead to missed deadlines and potential penalties. Form 4598, used for reporting issues related to Forms W-2, 1098, or 1099, is no exception. Here are six common misconceptions about this form:

- It's only for employees. Many people believe that Form 4598 is exclusively for individuals classified as employees. In reality, it can apply to independent contractors and nonemployees as well, especially those receiving Forms 1099.

- It's only necessary for missing forms. While the primary use of Form 4598 is to address missing forms, it can also be utilized when the received forms contain incorrect information. Thus, it’s crucial for all taxpayers who identify discrepancies to take action.

- You can file it any time during the year. Some assume that this form can be submitted at any time. However, the best practice is to file it promptly after realizing there is an issue, as there are deadlines that may impact tax filings.

- The penalties are insignificant. Another misconception is that any penalties for failure to provide accurate information are minor. In fact, failing to submit Form 4598 and related information can lead to penalties, including fines that could reach $50.

- All forms need to be manually sent to the IRS. Many believe that they must mail in Form 4598 to the IRS. In some cases, especially when consent is provided, information may also be furnished electronically, simplifying the process.

- The process is overly complicated. There is a common belief that filling out Form 4598 is a daunting task. While it may seem dense, the form is designed to collect specific information and can generally be completed within approximately 15 minutes.

Understanding these misconceptions can save time and stress when addressing tax-related concerns. Always ensure to verify details and consult appropriate resources when needed.

Key takeaways

Here are some key takeaways about filling out and using the IRS Form 4598:

- Form Purpose: This form is designed to report issues like missing or incorrect Forms W-2, 1098, or 1099.

- Identification Information: It's crucial to include accurate identification details, such as the nontaxpayer's name and address.

- Contact Details: Providing a telephone number is optional but can facilitate communication.

- Timeliness Matters: Complete and return the form within 10 calendar days of receipt to avoid penalties.

- Correcting Errors: If forms were issued inaccurately, corrections must be made using Form W-2c or the appropriate corrected 1098/1099.

- Employer Responsibilities: Employers must furnish the correct forms to each employee or payee by January 31st of the following calendar year.

- Filing Returns: If you don’t receive the necessary forms on time, you may estimate your wages or income when filing your tax return.

- Understand Penalties: Failing to provide requested information can lead to a $50 penalty, especially if the worker is a subcontracted federal employee.

- Record Keeping: Retain copies of all related forms and records for as long as they may influence any tax matters.

Browse Other Templates

What Is Use Tax in Arizona - Proper reasoning must be noted on the form to justify the claimed exemption.

Mortgage Payoff Request - For agents or representatives submitting the form, include their details for proper communication.

Hoa Proxy Vote Template - The form ensures that all homeowners have a say, regardless of meeting attendance.