Fill Out Your Irs 56 Form

Form 56, known as the Notice Concerning Fiduciary Relationship, plays a crucial role in the landscape of U.S. tax law. Used primarily for informing the Internal Revenue Service (IRS) about the establishment or termination of a fiduciary relationship, this form is essential for individuals acting on behalf of someone else in a financial context. The form covers various situations, including court appointments for testate or intestate estates, guardianship roles, and arrangements involving trusts or bankruptcies. It requires detailed information about both the person for whom the fiduciary acts and the fiduciary themselves, ensuring that the IRS maintains accurate records. The form has several sections that address the nature of tax liabilities, the types of federal tax forms involved, and the authority under which the fiduciary operates. In addition, Form 56 allows for the revocation or termination of previous notices related to fiduciary relationships, offering a structured process for changing fiduciaries as necessary. Proper completion of this form is critical for compliance and ensures that the IRS is informed about any fiduciary arrangements that may affect tax obligations.

Irs 56 Example

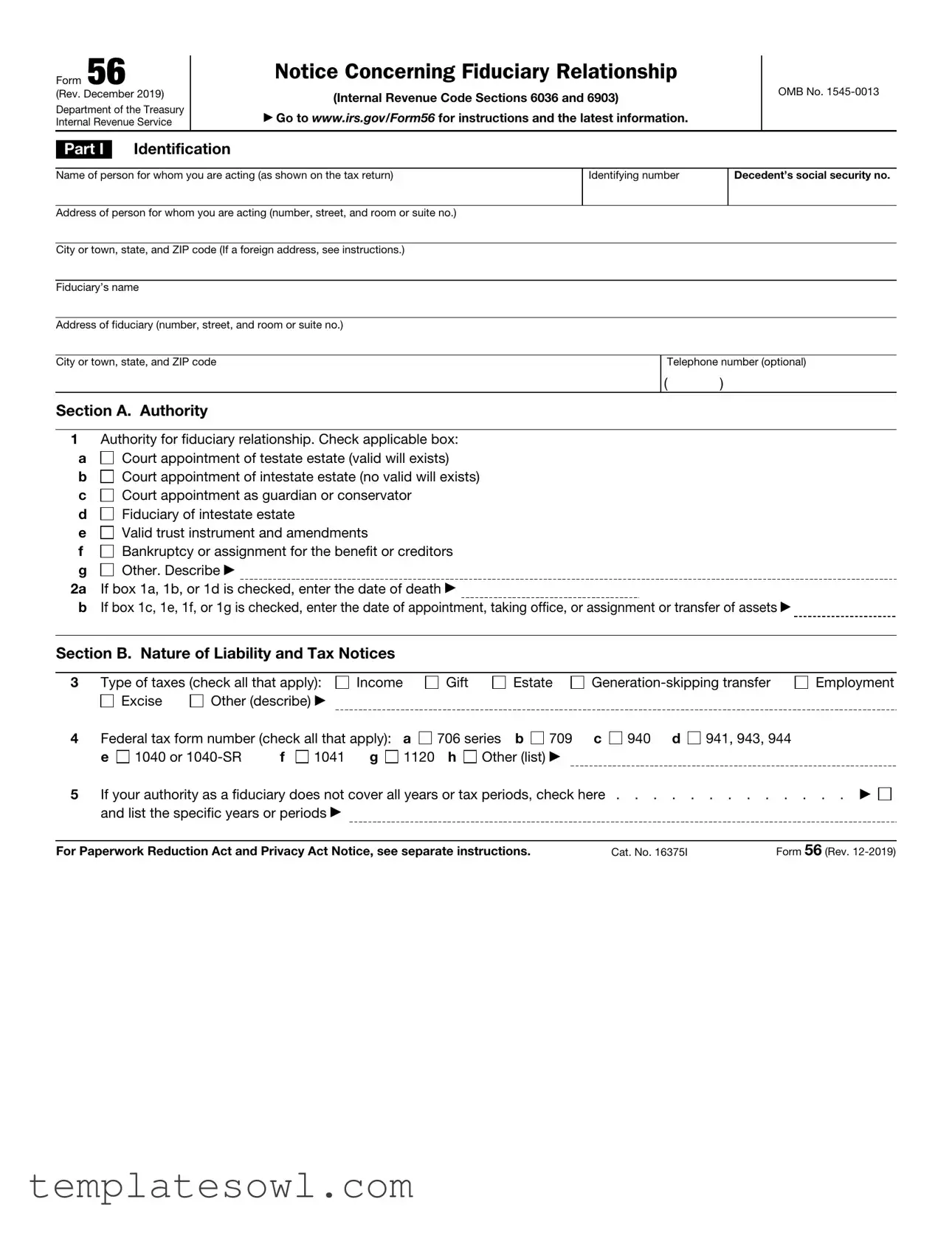

Form 56 |

|

|

Notice Concerning Fiduciary Relationship |

|

|

|

|||

|

|

|

|

|

|||||

(Rev. December 2019) |

|

(Internal Revenue Code Sections 6036 and 6903) |

|

|

OMB No. |

||||

|

|

|

|

||||||

Department of the Treasury |

|

▶ Go to www.irs.gov/Form56 for instructions and the latest information. |

|

|

|

||||

Internal Revenue Service |

|

|

|

|

|||||

|

|

Identification |

|

|

|

|

|

|

|

Part I |

|

|

|

|

|

|

|||

|

|

|

|

|

|||||

Name of person for whom you are acting (as shown on the tax return) |

Identifying number |

|

Decedent’s social security no. |

||||||

|

|

|

|

|

|

||||

Address of person for whom you are acting (number, street, and room or suite no.) |

|

|

|

|

|

||||

|

|

|

|

|

|

||||

City or town, state, and ZIP code (If a foreign address, see instructions.) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|||

Fiduciary’s name |

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

Address of fiduciary (number, street, and room or suite no.) |

|

|

|

|

|

||||

|

|

|

|

||||||

City or town, state, and ZIP code |

|

|

Telephone number (optional) |

||||||

|

|

|

|

|

|

( |

) |

|

|

Section A. Authority

1Authority for fiduciary relationship. Check applicable box:

a Court appointment of testate estate (valid will exists)

Court appointment of testate estate (valid will exists)

b Court appointment of intestate estate (no valid will exists)

Court appointment of intestate estate (no valid will exists)

c Court appointment as guardian or conservator

Court appointment as guardian or conservator

d Fiduciary of intestate estate

Fiduciary of intestate estate

e Valid trust instrument and amendments

Valid trust instrument and amendments

f Bankruptcy or assignment for the benefit or creditors

Bankruptcy or assignment for the benefit or creditors

g Other. Describe ▶

Other. Describe ▶

2a If box 1a, 1b, or 1d is checked, enter the date of death ▶

bIf box 1c, 1e, 1f, or 1g is checked, enter the date of appointment, taking office, or assignment or transfer of assets ▶

Section B. Nature of Liability and Tax Notices

3 |

Type of taxes (check all that apply): |

Income |

|

Gift |

|

Estate |

||||||||

|

|

Excise |

Other (describe) ▶ |

|

|

|

|

|

|

|

|

|

||

4 |

Federal tax form number (check all that apply): |

a |

706 series |

b |

709 |

c |

940 d |

941, 943, 944 |

||||||

|

e |

1040 or |

f |

1041 |

g |

1120 |

h |

Other (list) ▶ |

|

|

|

|||

Employment

5If your authority as a fiduciary does not cover all years or tax periods, check here . . . . . . . . . . . . . ▶

and list the specific years or periods ▶

and list the specific years or periods ▶

For Paperwork Reduction Act and Privacy Act Notice, see separate instructions. |

Cat. No. 16375I |

Form 56 (Rev. |

Form 56 (Rev. |

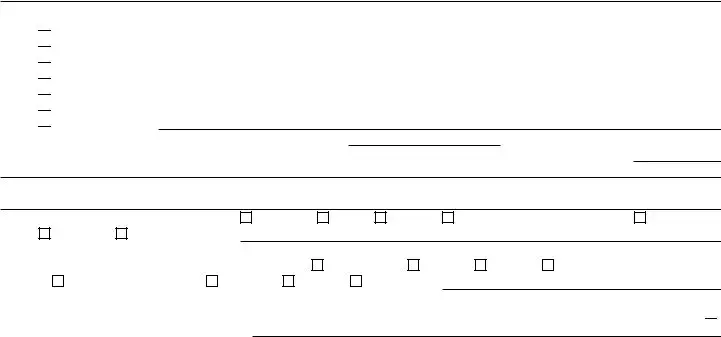

Page 2 |

|

|

|

|

|

Revocation or Termination of Notice |

|

Part II |

|

|

Section

6Check this box if you are revoking or terminating all prior notices concerning fiduciary relationships on file with the Internal

Revenue Service for the same tax matters and years or periods covered by this notice concerning fiduciary relationship ▶

a b c

Reason for termination of fiduciary relationship. Check applicable box:

Court order revoking fiduciary authority

Court order revoking fiduciary authority

Certificate of dissolution or termination of a business entity Other. Describe ▶

Section

7a Check this box if you are revoking earlier notices concerning fiduciary relationships on file with the Internal Revenue Service for the same tax matters and years or periods covered by this notice concerning fiduciary relationship . . . . . . ▶

bSpecify to whom granted, date, and address, including ZIP code.

▶

Section

8Check this box if a new fiduciary or fiduciaries have been or will be substituted for the revoking or terminating fiduciary and

specify the name(s) and address(es), including ZIP code(s), of the new fiduciary(ies) . . . . . . . . . . . . ▶

▶

Part III |

Court and Administrative Proceedings |

|

|

|

|

|

|

|

|

|

|

||

Name of court (if other than a court proceeding, identify the type of proceeding and name of agency) |

Date proceeding initiated |

|||||

|

|

|

|

|

||

Address of court |

|

Docket number of proceeding |

||||

|

|

|

|

|

|

|

City or town, state, and ZIP code |

Date |

|

Time |

a.m. |

Place of other proceedings |

|

|

|

|

|

|

p.m. |

|

|

|

|

|

|

|

|

Part IV

Please

Sign

Here

Signature

Under penalties of perjury, I declare that I have examined this document, including any accompanying statements, and to the best of my knowledge and belief, it is true, correct, and complete.

▲ |

|

|

|

|

|

Fiduciary’s signature |

|

Title, if applicable |

|

Date |

Form 56 (Rev.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The IRS Form 56 is used to notify the IRS of the creation or termination of a fiduciary relationship. |

| Governing Law | This form is governed by Internal Revenue Code Sections 6036 and 6903. |

| Identification Requirements | Completing Form 56 requires the identification of both the fiduciary and the person for whom they are acting. |

| Authority Section | The form includes a section to specify the authority under which the fiduciary relationship exists. |

| Type of Taxes | Form 56 allows fiduciaries to indicate the types of taxes they are responsible for, including income and estate taxes. |

| Revocation Procedures | A fiduciary can revoke prior notices by checking the appropriate box on Form 56. |

| Signature Requirement | The form must be signed by the fiduciary under penalties of perjury, affirming the truthfulness of the information provided. |

Guidelines on Utilizing Irs 56

After gathering all necessary information, you'll need to complete the IRS Form 56 carefully. This form is crucial for establishing a fiduciary relationship with the IRS. Ensure accuracy in each section to avoid delays or complications.

- Identify the person for whom you are acting: Fill in their name as it appears on their tax return, along with their identifying number and Social Security number if applicable.

- Provide the address: Include the full address of the person you represent, including city, state, and ZIP code.

- Enter fiduciary information: Write your name as the fiduciary, along with your address and optional telephone number.

- Establish authority: In Section A, check the box that applies to your fiduciary authority. Provide the date of death or appointment accordingly.

- Detail the nature of liability: In Section B, indicate the type of taxes involved and check relevant federal tax form numbers.

- Specify years or periods: If your authority doesn’t cover all tax years, check the box and list the specific years or periods.

- Revocation or termination: If applicable, complete Part II to revoke or terminate any previous notices. Provide the reason and check the appropriate boxes.

- Court and administrative proceedings: Fill in the name of the court, date of proceedings initiated, address, and any relevant docket number.

- Sign the form: Your signature is required in Part IV, along with your title and date. Ensure you are aware that this signature attests to the truthfulness of the information provided.

Completing these steps accurately will help establish your role clearly with the IRS. It is advisable to review the filled form closely before submission to ensure no details are overlooked.

What You Should Know About This Form

What is Form 56, and when should it be used?

Form 56, officially known as the Notice Concerning Fiduciary Relationship, is a document used to inform the IRS of a fiduciary relationship. If someone passes away, or if a trust is established, a fiduciary—like an executor or trustee—must manage the relevant taxes. This form helps ensure that the IRS knows who is responsible for handling tax matters for the deceased person or the trust. It can be used in various situations, including estates, guardianships, and trusts.

Who qualifies as a fiduciary, and what roles do they play?

A fiduciary is an individual or entity tasked with managing someone else's assets or interests. Common examples include executors of estates, guardians appointed by a court, or trustees managing a trust. The fiduciary has a legal duty to act in the best interest of the beneficiary, which can involve filing taxes, settling debts, or distributing assets according to a will or trust document.

What types of taxes can be reported on Form 56?

Form 56 is versatile when it comes to tax liabilities. It can cover a variety of taxes, including income, gift, estate, and generation-skipping transfer taxes. If you check the box for "Other," you should specify the types of taxes relevant to your situation. This helps the IRS understand which tax matters the fiduciary is responsible for managing.

Is there a deadline for submitting Form 56?

While there isn’t a strict deadline for filing Form 56, it is strongly advised to submit it as soon as you assume your role as a fiduciary. Timely filing allows the IRS to update their records and facilitates smoother tax management for the estate or trust. Each situation may vary, so it’s wise to consult with a tax professional to ensure compliance.

How can a fiduciary terminate their relationship, and what does that require?

A fiduciary can terminate their relationship with the estate, trust, or guardianship through Form 56 by indicating their intent to revoke any previous notices with the IRS. You would check the appropriate box on the form to signal a total or partial termination of the fiduciary responsibilities. Additionally, providing a reason—such as a court order or a dissolution certificate—will help clarify the termination for the IRS.

What happens if a new fiduciary is appointed?

If a new fiduciary is appointed, the outgoing fiduciary should file Form 56 to notify the IRS of this change. This step ensures that the IRS records reflect the correct person managing the estate or trust. The new fiduciary can then take responsibility for the tax matters going forward. Providing the new fiduciary’s contact details on the form is essential for maintaining clear communication with the IRS.

Common mistakes

When filling out IRS Form 56, it’s easy to overlook details that can lead to mistakes. One common error involves not providing the correct identifying number for the person you are representing. This number is crucial for the IRS to link the form to the appropriate tax records. It’s essential to double-check this number, especially if you are dealing with a decedent's social security number.

Another frequent issue arises from the authority section. People often fail to select the appropriate authority type or check the wrong box. Each box signifies a different type of fiduciary relationship, and selecting the wrong one can cause confusion. Ensure you understand whether your authority comes from a court appointment, a trust agreement, or another source.

In Section B, you will also need to indicate the types of taxes that apply. It’s common for filers to skip this part or misidentify the applicable taxes. Remember, checking all that apply is necessary to provide the IRS with a complete picture of the taxpayer's obligations. Failure to do so might delay the processing of the form.

Some also forget to specify if their authority as a fiduciary is limited to certain years or tax periods. This can lead to an incomplete submission. If you are only acting as a fiduciary for specific periods, make sure to indicate those years clearly. Without this information, the IRS may have trouble determining the scope of your authority.

When it comes to termination or revocation notices, many make the mistake of not checking the right boxes or providing detailed reasons for termination. For instance, if you are ending a fiduciary relationship due to a court order, you must check the appropriate box and provide additional details. This clarity can help avoid unnecessary follow-ups from the IRS.

Additionally, individuals often neglect to include accurate court information when applicable. This includes providing the name of the court, docket number, and other related details. Missing this information can lead to complications in proceedings and could result in the form being deemed incomplete.

Lastly, one of the most critical steps is the signature. Many people forget to sign or date the form, which can render the submission invalid. Always take a moment to review the form for completeness, ensuring that your signature is present. A signed document confirms the information's accuracy and helps prevent delays in processing.

Documents used along the form

The IRS Form 56, known as the Notice Concerning Fiduciary Relationship, is often complemented by several other documents. These forms provide additional context and are essential for managing fiduciary responsibilities effectively. Understanding these documents allows fiduciaries to navigate the requirements laid out by the IRS and ensures compliance with tax obligations.

- Form 706: The United States Estate (and Generation-Skipping Transfer) Tax Return is required for estates exceeding a certain value threshold. It calculates and reports estate tax liability.

- Form 709: This is the United States Gift (and Generation-Skipping Transfer) Tax Return. It must be filed by individuals who made taxable gifts during the year, detailing the gifts given and calculating any gift tax owed.

- Form 1041: This form is the U.S. Income Tax Return for Estates and Trusts. It reports income, gains, losses, deductions, and credits for estates and trusts and is essential for tax reporting purposes.

- Form 1040: The U.S. Individual Income Tax Return is filed by individuals, including fiduciaries for beneficiaries who must report personal income. It includes various income sources and deductions.

- Form 941: This form is used to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and to payments made to the IRS. It’s crucial for fiduciaries managing employee withholdings.

- Form 940: The Employer's Annual Federal Unemployment (FUTA) Tax Return, which reports annual unemployment tax liability and ensures compliance with unemployment tax requirements.

Each of these forms plays a critical role in the fiduciary process, ensuring proper tax management and compliance with federal regulations. By understanding and utilizing these documents effectively, fiduciaries can fulfill their responsibilities and protect the interests of those they serve.

Similar forms

- Form 2848 - Power of Attorney and Declaration of Representative: This form allows you to authorize someone to act on your behalf in tax matters, similar to the fiduciary relationship established by Form 56. Both forms require identification details of the individual involved and specify the type of authority granted.

- Form 706 - United States Estate (and Generation-Skipping Transfer) Tax Return: This document involves estate tax and shows the relationship between the taxpayer and fiduciary. It shares the requirement for detailed information regarding the decedent and the fiduciary, just as Form 56 does.

- Form 709 - United States Gift (and Generation-Skipping Transfer) Tax Return: Like Form 56, this form deals with specific tax liabilities. It requires disclosure of personal information and the nature of the tax obligation, emphasizing the fiduciary's authority as relevant to tax matters.

- Form 1041 - U.S. Income Tax Return for Estates and Trusts: This form is used for reporting income generated by an estate or trust. It parallels Form 56 in that both necessitate the identification of the fiduciary and outline the fiduciary’s responsibilities toward tax filings.

Dos and Don'ts

Completing IRS Form 56 requires attention to detail. Here are some dos and don’ts to consider:

- Do review the instructions thoroughly before filling out the form.

- Don’t leave any required fields blank; incomplete forms can lead to delays.

- Do provide accurate identifying information, including Social Security numbers and addresses.

- Don’t use outdated versions of the form; make sure you have the latest revision.

- Do double-check the information entered for accuracy before submission.

- Don’t assume all the information is correct; mistakes can have serious implications.

- Do sign and date the form to validate its authenticity.

- Don’t forget to keep a copy of the completed form for your records.

Misconceptions

- Form 56 is only for estate administrators. Many people think that the IRS Form 56 is solely for those overseeing estates. While it is commonly used in that context, it also applies to guardians, conservators, and fiduciaries of trusts. Anyone managing tax-related matters for another person or entity might need this form.

- Filing Form 56 means I am filing taxes. Some assume that submitting Form 56 signals that they are also filing taxes on behalf of the person they represent. However, the form is merely a notification to the IRS of your fiduciary status. It does not in itself involve the submission of tax returns.

- Once filed, Form 56 can’t be changed. There's a misconception that once you file Form 56, you cannot make any alterations. In reality, you can revoke or amend the form if your situation changes, such as if a new fiduciary is appointed or if you need to clarify the liability covered.

- All taxpayers need to file Form 56. Not every taxpayer is required to submit Form 56. It is specifically for those who have a fiduciary duty. If you don’t manage someone else's tax matters or assets, you likely do not need to file this form.

- Form 56 is only for deceased individuals. Many individuals believe that Form 56 can only be used when someone has passed away. This is not true. The form can be used for living persons as well, especially when a fiduciary is appointed to manage their affairs, such as in cases of incapacity.

Key takeaways

When completing and using the IRS Form 56, there are several important aspects to keep in mind. Below are key takeaways to ensure compliance and proper usage of this form.

- Identify the Appropriate Authority: Be sure to check the correct box in Section A that corresponds to your authority as a fiduciary. This establishes your legal basis for acting on behalf of another party.

- Provide Accurate Information: Enter all relevant details accurately, including identification numbers, addresses, and dates. Any inaccuracies could lead to complications in tax matters.

- Specify the Nature of Liability: In Section B, clearly indicate the type of taxes related to the fiduciary relationship. This step is crucial for the IRS to understand your tax obligations.

- Revocation or Termination Process: If you need to revoke or terminate a fiduciary relationship, complete Part II correctly. This includes providing reasons and specifics about any new fiduciaries involved.

Understanding these points will facilitate the effective use of Form 56 and assist in maintaining compliance with IRS regulations.

Browse Other Templates

What Is W4 - Completion of the IWO form is essential for maintaining the accountability of income withholding.

Website Validation for Business Bank Account - Receiving alerts when deposits are made helps you manage funds better.