Fill Out Your Irs 8850 Form

Form 8850 plays a critical role in facilitating the Work Opportunity Tax Credit (WOTC), a federal incentive designed to encourage employers to hire individuals from specific target groups. This form is a pre-screening notice and certification request that job applicants must complete to determine if they qualify for this tax credit. Individuals filling out Form 8850 provide personal details such as their name, Social Security number, and address, and indicate whether they belong to certain qualifying groups, like veterans or those who have received government assistance. Employers also use this form to verify the applicant’s eligibility by completing the employer section, which includes the employer's information and a declaration that the applicant's information is accurate. By submitting Form 8850 to the appropriate state workforce agency, employers can seek confirmation of the applicant's targeted group status, which is essential for claiming the credit when filing taxes. This form not only assists employers in identifying and hiring eligible candidates but also supports individuals who may face barriers to employment in gaining access to job opportunities.

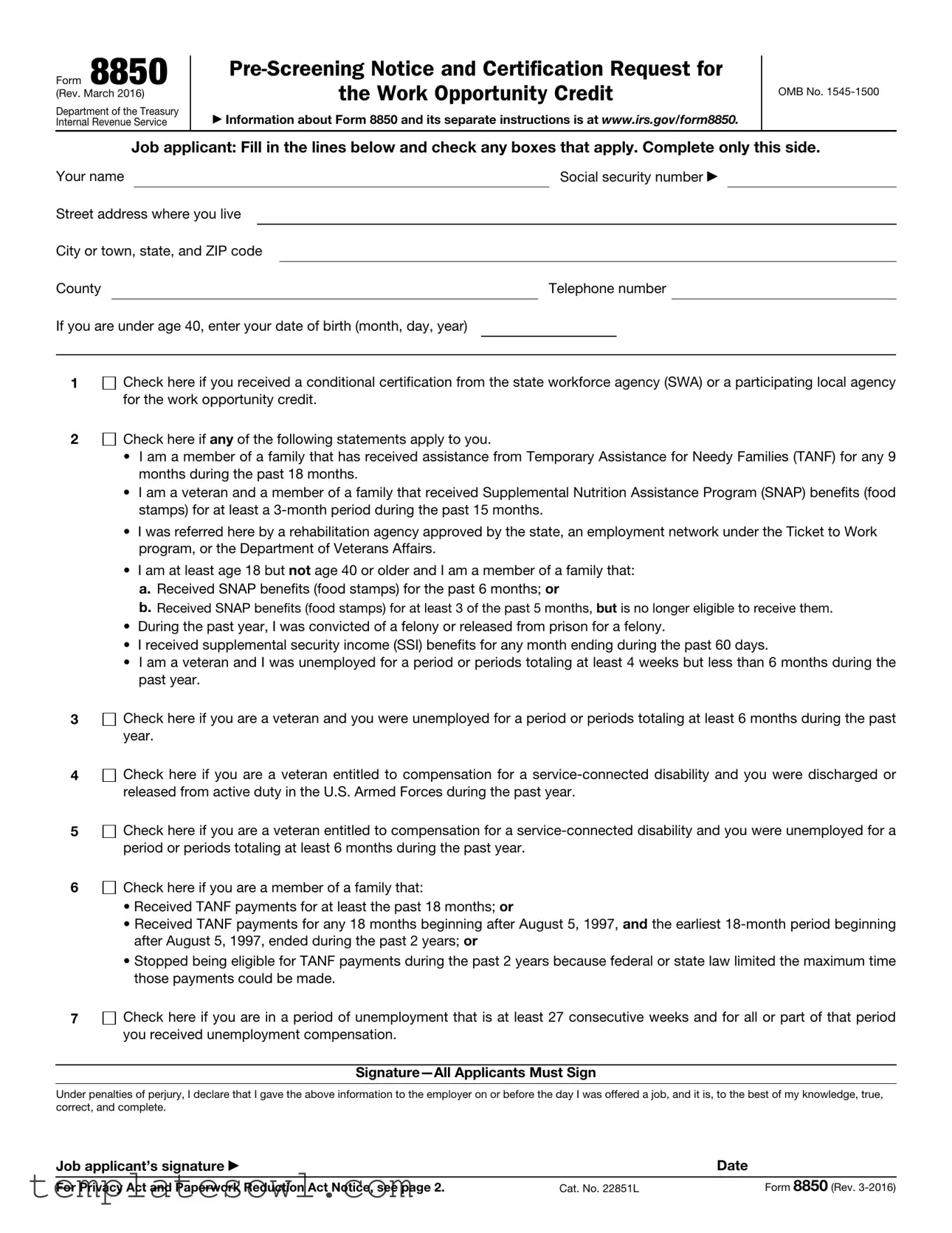

Irs 8850 Example

Form 8850

(Rev. March 2016)

Department of the Treasury

Internal Revenue Service

the Work Opportunity Credit

▶Information about Form 8850 and its separate instructions is at www.irs.gov/form8850.

OMB No.

Job applicant: Fill in the lines below and check any boxes that apply. Complete only this side.

Your name |

|

Social security number ▶ |

|

|

|

Street address where you live

City or town, state, and ZIP code

County |

|

Telephone number |

|

|

|

If you are under age 40, enter your date of birth (month, day, year)

1

2

3

4

5

6

Check here if you received a conditional certification from the state workforce agency (SWA) or a participating local agency for the work opportunity credit.

Check here if you received a conditional certification from the state workforce agency (SWA) or a participating local agency for the work opportunity credit.

Check here if any of the following statements apply to you.

Check here if any of the following statements apply to you.

•I am a member of a family that has received assistance from Temporary Assistance for Needy Families (TANF) for any 9 months during the past 18 months.

•I am a veteran and a member of a family that received Supplemental Nutrition Assistance Program (SNAP) benefits (food stamps) for at least a

•I was referred here by a rehabilitation agency approved by the state, an employment network under the Ticket to Work program, or the Department of Veterans Affairs.

•I am at least age 18 but not age 40 or older and I am a member of a family that:

a.Received SNAP benefits (food stamps) for the past 6 months; or

b.Received SNAP benefits (food stamps) for at least 3 of the past 5 months, but is no longer eligible to receive them.

•During the past year, I was convicted of a felony or released from prison for a felony.

•I received supplemental security income (SSI) benefits for any month ending during the past 60 days.

•I am a veteran and I was unemployed for a period or periods totaling at least 4 weeks but less than 6 months during the past year.

Check here if you are a veteran and you were unemployed for a period or periods totaling at least 6 months during the past year.

Check here if you are a veteran and you were unemployed for a period or periods totaling at least 6 months during the past year.

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a veteran entitled to compensation for a

Check here if you are a member of a family that:

Check here if you are a member of a family that:

•Received TANF payments for at least the past 18 months; or

•Received TANF payments for any 18 months beginning after August 5, 1997, and the earliest

•Stopped being eligible for TANF payments during the past 2 years because federal or state law limited the maximum time those payments could be made.

7 Check here if you are in a period of unemployment that is at least 27 consecutive weeks and for all or part of that period you received unemployment compensation.

Check here if you are in a period of unemployment that is at least 27 consecutive weeks and for all or part of that period you received unemployment compensation.

Under penalties of perjury, I declare that I gave the above information to the employer on or before the day I was offered a job, and it is, to the best of my knowledge, true, correct, and complete.

Job applicant’s signature ▶ |

|

Date |

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see page 2. |

Cat. No. 22851L |

Form 8850 (Rev. |

Form 8850 (Rev. |

|

|

|

|

|

|

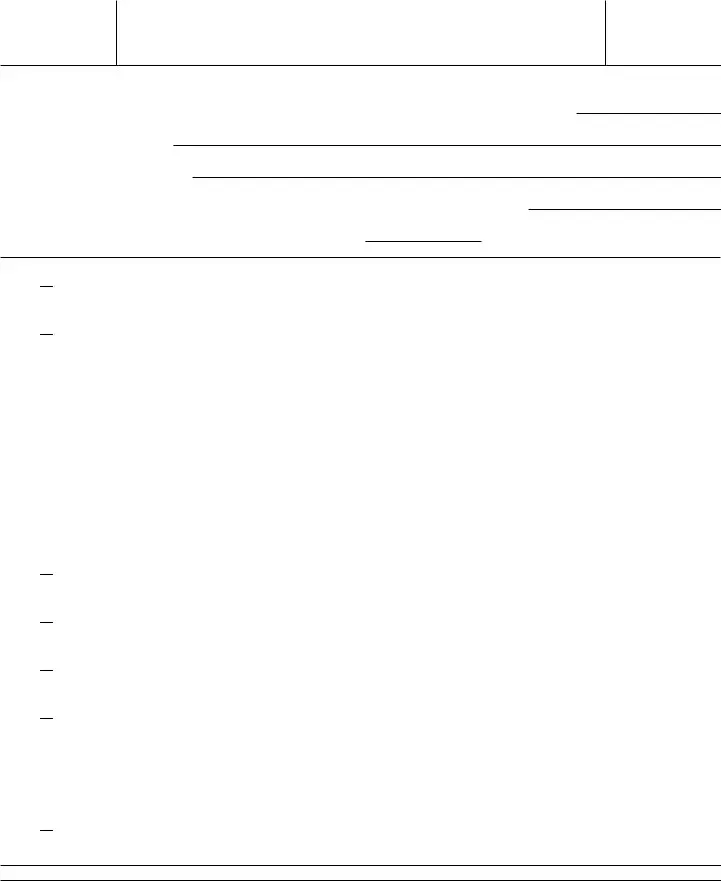

Page 2 |

|||

|

|

|

|

For Employer’s Use Only |

|

|

|

|

||

Employer’s name |

|

Telephone no. |

|

EIN ▶ |

||||||

|

|

|

|

|

|

|

|

|

|

|

Street address |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

Person to contact, if different from above |

|

|

|

Telephone no. |

||||||

Street address |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

||

City or town, state, and ZIP code |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

If, based on the individual’s age and home address, he or she is a member of group 4 or 6 (as described under Members of

Targeted Groups in the separate instructions), enter that group number (4 or 6) . . . |

. . . . . . . . . . . ▶ |

||||||||

Date applicant: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gave |

|

Was |

|

Was |

|

Started |

|||

information |

|

offered job |

|

hired |

|

|

job |

|

|

Under penalties of perjury, I declare that the applicant provided the information on this form on or before the day a job was offered to the applicant and that the information I have furnished is, to the best of my knowledge, true, correct, and complete. Based on the information the job applicant furnished on page 1, I believe the individual is a member of a targeted group. I hereby request a certification that the individual is a member of a targeted group.

Employer’s signature ▶ |

Title |

|

Date |

|

|

|

|

|

|

||||

Privacy Act and |

criminal litigation, to the Department of |

The time needed to complete and file |

||||

Paperwork Reduction |

Labor for oversight of the certifications |

this form will vary depending on |

|

|||

performed by the SWA, and to cities, |

individual circumstances. The estimated |

|||||

Act Notice |

states, and the District of Columbia for |

average time is: |

|

|

|

|

|

|

|

|

|||

|

use in administering their tax laws. We |

Recordkeeping |

. . |

6 hr., 27 min. |

||

Section references are to the Internal |

may also disclose this information to |

|||||

Learning about the law |

|

|

||||

Revenue Code. |

other countries under a tax treaty, to |

|

|

|||

Section 51(d)(13) permits a prospective |

federal and state agencies to enforce |

or the form |

. |

. 24 min. |

||

federal nontax criminal laws, or to |

Preparing and sending this form |

|||||

employer to request the applicant to |

||||||

federal law enforcement and intelligence |

||||||

complete this form and give it to the |

to the SWA |

. |

. 31 min. |

|||

agencies to combat terrorism. |

||||||

prospective employer. The information |

If you have comments concerning the |

|||||

You are not required to provide the |

||||||

will be used by the employer to |

||||||

accuracy of these time estimates or |

||||||

complete the employer’s federal tax |

information requested on a form that is |

|||||

suggestions for making this form |

||||||

return. Completion of this form is |

subject to the Paperwork Reduction Act |

|||||

simpler, we would be happy to hear from |

||||||

voluntary and may assist members of |

unless the form displays a valid OMB |

|||||

you. You can send us comments from |

||||||

targeted groups in securing employment. |

control number. Books or records |

|||||

www.irs.gov/formspubs. Click on “More |

||||||

Routine uses of this form include giving |

relating to a form or its instructions must |

|||||

Information” and then on “Give us |

||||||

it to the state workforce agency (SWA), |

be retained as long as their contents |

|||||

feedback.” Or you can send your |

||||||

which will contact appropriate sources |

may become material in the |

|||||

comments to: |

|

|

|

|||

to confirm that the applicant is a |

administration of any Internal Revenue |

|

|

|

||

|

|

|

|

|||

member of a targeted group. This form |

law. Generally, tax returns and return |

Internal Revenue Service |

|

|

||

may also be given to the Internal |

information are confidential, as required |

Tax Forms and Publications |

|

|||

Revenue Service for administration of |

by section 6103. |

1111 Constitution Ave. NW, |

||||

the Internal Revenue laws, to the |

|

Washington, DC 20224 |

|

|

||

Department of Justice for civil and |

Do not send this form to this address. |

|

|

|

Instead, see When and Where To File in |

|

the separate instructions. |

Form 8850 (Rev.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The IRS Form 8850 serves as a Pre-Screening Notice and Certification Request for the Work Opportunity Credit, enabling employers to claim tax credits for hiring individuals from targeted groups. |

| Eligibility Conditions | Individuals who complete Form 8850 may qualify for the credit if they meet specific criteria, such as being a veteran, receiving TANF, or having been unemployed for a certain period. |

| Filing Timeline | Employers need to submit Form 8850 to the state workforce agency (SWA) within 28 days after the job offer has been made to the applicant. |

| Governing Law | This form is governed by Section 51 of the Internal Revenue Code, which outlines the Work Opportunity Tax Credit program. |

Guidelines on Utilizing Irs 8850

Filling out the IRS Form 8850 is crucial for both job applicants and employers participating in the Work Opportunity Tax Credit program. It is important to ensure that the form is completed accurately and submitted on time. Below are the steps to guide you through filling out the form efficiently.

- Obtain the latest version of the IRS Form 8850. Ensure it is the correct revision date by checking the IRS website, www.irs.gov/form8850.

- On the top half of the form, locate the section designated for the job applicant. Fill in the following information:

- Your full name

- Your Social Security number

- Your street address

- Your city, state, and ZIP code

- Your county

- Your telephone number

- If under age 40, enter your date of birth (month, day, year)

- Check the box if you received a conditional certification from the state workforce agency or local agency related to the work opportunity credit.

- Evaluate your eligibility based on the statements provided in the form. Check any boxes that apply to your situation.

- Sign and date the form, certifying that the information provided is accurate. Remember, this signature is a declaration of your honesty regarding the information submitted.

- Turn over the form to complete the employer's section, if you are an employer filling it out. Fill in:

- Employer’s name

- Employer’s telephone number

- Employer’s EIN

- Employer’s street address

- City, state, and ZIP code

- Person to contact, if different from the employer

- Check the appropriate group number if applicable. This relates to the job applicant’s age and home address.

- Complete the remaining fields as required, providing the necessary details about when the information was provided to the applicant.

- Employers must also sign and date the form, confirming the information provided is true and requesting certification.

Once the form is completed, ensure that it is submitted to the appropriate state workforce agency (SWA) to begin the certification process. This is vital to secure any potential tax credits linked to hiring the individual. Adhering to submission deadlines will help facilitate a smooth experience for both parties involved.

What You Should Know About This Form

What is IRS Form 8850?

IRS Form 8850 is a document used for the Pre-Screening Notice and Certification Request for the Work Opportunity Credit. This credit is designed to incentivize employers to hire individuals from specific target groups that face barriers to employment.

Who needs to fill out Form 8850?

Job applicants who believe they qualify for the Work Opportunity Credit should complete Form 8850. It can help applicants demonstrate eligibility to potential employers based on their background or circumstances, such as receiving certain types of public assistance or being a veteran.

What information must be provided on the form?

The form requires basic personal information such as the applicant's name, Social Security number, address, date of birth, and phone number. Additionally, the applicant must indicate if they received a conditional certification from a state workforce agency or if any statements about their background apply to them, such as receiving TANF or SNAP benefits.

How does an applicant prove eligibility?

Applicants can prove eligibility by checking corresponding boxes on the form that reflect their circumstances. These may include factors like being a veteran, receiving disability compensation, or having a felony conviction. The state workforce agency will verify this information if required.

What are the target groups for the Work Opportunity Credit?

Several target groups are eligible for the Work Opportunity Credit, including veterans, recipients of Temporary Assistance for Needy Families (TANF), individuals with felony convictions, and those who have received Supplemental Nutrition Assistance Program (SNAP) benefits. Each group has specific criteria that must be met to qualify.

Do I need to submit Form 8850 with my job application?

While it is not mandatory to submit Form 8850 with every job application, it is advantageous if you believe you qualify for the Work Opportunity Credit. Doing so can help demonstrate your eligibility to employers and potentially increase your chances of being hired.

How do employers use Form 8850?

Employers use this form to request certification from the state workforce agency, verifying whether the individual is a member of a targeted group. This certification is necessary for employers to claim the Work Opportunity Credit on their tax returns, thereby potentially reducing their tax liability.

What happens after the form is submitted?

Once the employer submits Form 8850 to the state workforce agency, it will review the information provided. The agency will verify the applicant's eligibility and provide certification if the applicant meets the necessary criteria. Employers should keep a record of this information for their tax records.

Are there any penalties for providing false information on Form 8850?

Yes, all applicants must sign the form, declaring that the information provided is true, correct, and complete under penalties of perjury. Providing false information can lead to legal consequences and disqualification from the Work Opportunity Credit.

Where can I find more information about Form 8850?

For more details about IRS Form 8850 and its instructions, one can visit the IRS website at www.irs.gov/form8850. This resource contains comprehensive information about eligibility, completion, and submission of the form.

Common mistakes

Filling out IRS Form 8850 can be straightforward, but some common mistakes may lead to complications. One frequent error is failing to fill in all required information. Applicants sometimes overlook filling out their Social Security number or leave sections incomplete. This can delay processing or result in a denial of the work opportunity credit. Ensuring every relevant field is completed accurately is essential for a smooth application experience.

Another common mistake is misunderstanding the eligibility criteria. Certain categories must be checked to indicate whether the applicant falls into a specific group. If an individual doesn't carefully read these statements or mistakenly believes they qualify without checking the appropriate boxes, it can lead to unnecessary issues. It is helpful to understand what each statement entails and confirm eligibility before submitting the form.

Additionally, applicants may forget to sign the form. The signature is a crucial part of the submission process. Without it, the application cannot be considered valid. This simple and often overlooked step can cause delays or rejections, so taking a moment to double-check that all necessary signatures are present is wise.

Lastly, submitting the form to the wrong address is another mistake individuals make. The instructions specify where to send the completed form, but applicants sometimes ignore these details. Ensuring that the form is sent to the right location is vital for timely processing. Being diligent about following all instructions can prevent unnecessary setbacks in receiving the work opportunity credit.

Documents used along the form

The IRS Form 8850 is an important document for job applicants seeking the Work Opportunity Credit. However, there are other forms you may need to complete or understand in conjunction with this form. Here is a brief overview of some common documents that often accompany Form 8850.

- Form 9061: This form is used for the Member of a Targeted Group Certification. Employers submit this to verify that an applicant meets the criteria to receive the Work Opportunity Tax Credit (WOTC). It is crucial for ensuring applicants are eligible under the specific guidelines set forth by the IRS.

- Form 9062: This certification form is similar to Form 9061 but allows employers to self-certify an applicant's eligibility for the WOTC. If an employer has received a conditional certification from a participating local agency or state workforce agency, this form is necessary.

- Employer’s Tax Return: Employers must report the Work Opportunity Tax Credit on their tax return. This includes Form 941 or Form 1040 Schedule C, depending on the business structure. It is essential that all deductions and credits are accurately recorded as they directly affect tax liabilities.

- State Certification Forms: Some states require additional documentation for verifying eligibility for various credits. These forms differ by state, and it is important to check local requirements to ensure compliance and eligibility for state-level benefits.

- Payroll Records: Employers should maintain detailed payroll records that show qualifying wages paid to individuals for whom they are claiming the credit. This documentation supports claims made on tax returns and serves as proof during potential audits.

Being aware of these additional forms and documents will streamline the process of applying for the Work Opportunity Tax Credit. Ensuring proper completion and submission can make a significant difference in both the applicant's and employer’s experience with this important credit.

Similar forms

The IRS Form 8850 is a critical document for individuals seeking certification for the Work Opportunity Credit. Similar documents also play significant roles in various tax and employment contexts. Below is a list highlighting seven forms that share characteristics or purposes with Form 8850:

- IRS Form 5884: This form is also used to claim tax credits for employers who hire individuals from targeted groups. It quantifies the amount of credit based on qualified wages, making it similar in purpose to Form 8850, which pre-screens applicants for those credits.

- IRS Form 941: Employers use this employment tax form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. While not directly a credit application, it involves necessary information regarding the employment of targeted groups, indirectly affecting tax benefits.

- IRS Form 1065: Partnerships file this form to report income, deductions, gains, and losses. Similar to Form 8850, it provides details on the workforce but focuses on business entities rather than individual employees seeking tax credits.

- IRS Form 8862: This form is used by individuals who previously had their Earned Income Credit (EIC) denied. Like Form 8850, it aims to ensure that applicants qualify under specific criteria for tax benefits.

- IRS Form 1040: The standard individual income tax return form requires detailed personal and financial information. While it does not focus on employment credit, it serves as a comprehensive medium through which various tax credits, potentially including benefits related to hiring individuals from targeted groups, are claimed.

- IRS Form 1099: This form reports various types of income other than wages, salaries, and tips. While its primary use differs, it can be relevant for documenting employment that may relate to claiming certain tax credits outlined on Form 8850.

- IRS Form W-4: Employees fill this form to indicate their tax situation to employers. It is essential for withholding purposes but indirectly relates to Form 8850 as it informs the employer of the employee's potential eligibility for hiring credits.

Dos and Don'ts

When filling out the IRS Form 8850, there are specific actions to take and avoid to ensure accuracy and compliance. Consider the following list:

- Do read the instructions thoroughly before beginning the form.

- Do provide complete and accurate information in all fields.

- Do check applicable boxes to indicate your eligibility for the Work Opportunity Credit.

- Do sign and date the form to validate your application.

- Do submit the form to the employer in a timely manner to avoid any delays.

- Don't leave any sections blank unless instructed to do so.

- Don't provide false information or exaggerate claims regarding eligibility.

- Don't forget to keep a copy of the completed form for your records.

- Don't submit the form directly to the IRS; refer to the instructions for proper filing procedures.

- Don't miss the submission deadline specified for the tax year.

By adhering to these guidelines, applicants can enhance their chances for a successful submission of Form 8850.

Misconceptions

Misconception 1: The IRS 8850 form is only for people on public assistance.

This form is designed for various targeted groups, including veterans and individuals who face barriers to employment. It’s not limited to those receiving government assistance.

Misconception 2: Completing the form guarantees a job.

Submitting the IRS 8850 form does not secure employment. It’s a request for a tax credit for employers, which means it benefits the employer more than the job applicant directly.

Misconception 3: Only non-profit organizations can use this form.

Any employer can claim the work opportunity credit, regardless of their profit status, as long as they hire eligible employees who meet the criteria outlined.

Misconception 4: The IRS 8850 form is difficult to fill out.

While the form has specific sections, it’s straightforward. Most applicants only need to complete one side of the form with basic information.

Misconception 5: I need to fill out the form before applying for a job.

The form is filled out after a job offer is made, not as part of the application process. It's typically completed when the employer is seeking to claim the tax credit.

Misconception 6: My personal information will be widely shared if I submit the form.

The information provided on the form is confidential and is generally used only for the purpose of verifying eligibility for the work opportunity credit.

Misconception 7: This form is a government trick to keep people off welfare.

The purpose is to help certain individuals gain employment and provide an incentive for employers to hire those from targeted groups. It aims to expand, not limit, job opportunities.

Misconception 8: Only recent graduates can apply using this form.

Anyone who fits into the targeted group criteria can use the form, regardless of their educational background or graduation status.

Misconception 9: The IRS 8850 is only for people under 40.

While there’s a specific box for individuals under the age of 40, the form accommodates applicants of various age groups, including veterans and long-term unemployed individuals.

Misconception 10: The form is only relevant for certain industries.

The work opportunity credit applies to all sectors looking to hire qualified individuals, making it relevant across various industries.

Key takeaways

Here are some key takeaways about Form 8850, the Pre-Screening Notice and Certification Request for the Work Opportunity Credit:

- Purpose: This form helps job applicants determine if they qualify for the Work Opportunity Credit.

- Who Fills It Out: Typically, it is filled out by job applicants looking to secure employment and potentially receive tax credits.

- Eligibility Criteria: Certain groups, such as veterans or recipients of specific assistance programs, may qualify for the credit.

- Conditional Certification: If you have conditional certification from a state workforce agency, make sure to check the appropriate box on the form.

- Signature Requirement: All applicants must sign the form to affirm the accuracy of the information provided.

- Timeline: The form should be completed and provided to employers on or before a job offer is made.

- Employer's Role: Employers also fill out part of the form to confirm the applicant’s eligibility and request certification.

- Confidentiality: Information on this form is kept confidential, as required by law, and is mainly used for tax purposes.

- Filing Instructions: Do not send the form to the IRS directly; follow the separate instructions for proper submission.

Using Form 8850 can be an important step toward accessing valuable tax credits and support if you meet the necessary criteria.

Browse Other Templates

Hazmat Bol - Awareness of these changes can prevent costly errors and shipping interruptions.

Fs-6100-13 - Section A of the form requests the initial biweekly schedule.

Dmv Form Dl 44 - For applicants dealing with multiple dealers, a sample franchise agreement must be included.