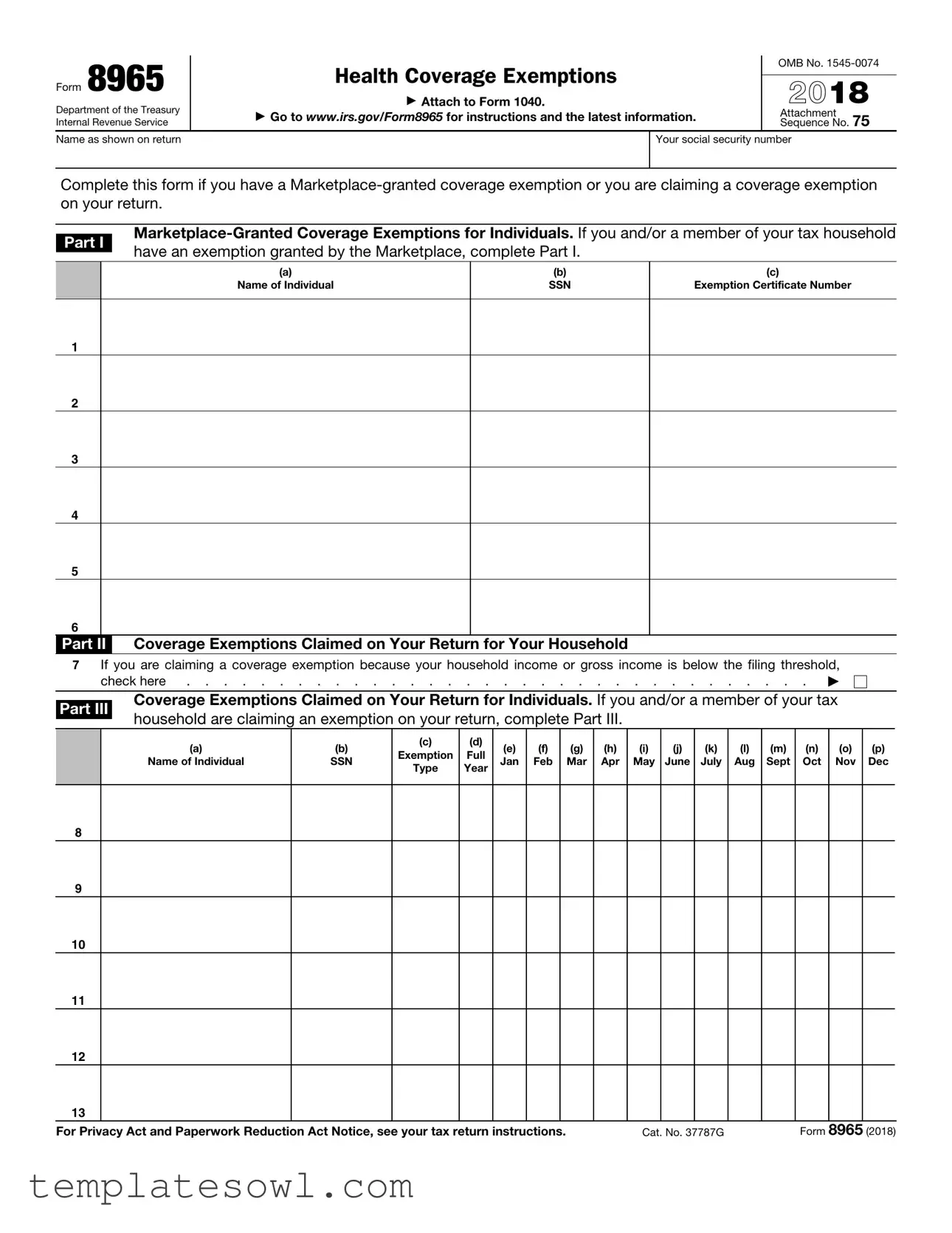

Fill Out Your Irs 8965 Form

Form 8965 plays a crucial role in determining health coverage exemptions for taxpayers in the United States. This form, known as the Health Coverage Exemptions form, must be attached to an individual's Form 1040 when filing taxes. Taxpayers can report two types of exemptions using this form: Marketplace-granted exemptions and coverage exemptions claimed directly on their tax return. For instance, if individuals or members of their tax household received an exemption from the Health Insurance Marketplace, they need to complete Part I of the form, listing pertinent details such as names and exemption certificate numbers. Conversely, those whose household income falls below the filing threshold or who are claiming other specific exemptions must fill out Part II and Part III. By accurately completing Form 8965, individuals ensure they meet the necessary requirements and avoid potential penalties related to the Affordable Care Act's individual mandate. Timely submission and correct completion of this form aid in efficient tax processing and reflect one's compliance with federal health insurance laws.

Irs 8965 Example

Form 8965 |

Health Coverage Exemptions |

OMB No. |

||

|

||||

2018 |

||||

Department of the Treasury |

▶ Attach to Form 1040. |

|||

▶ Go to www.irs.gov/Form8965 for instructions and the latest information. |

Attachment |

|||

Internal Revenue Service |

Sequence No. 75 |

|||

Name as shown on return |

|

Your social security number |

||

|

|

|

|

|

Complete this form if you have a

|

|

||||

Part I |

|||||

have an exemption granted by the Marketplace, complete Part I. |

|

||||

|

|

|

|||

|

|

(a) |

(b) |

(c) |

|

|

|

Name of Individual |

SSN |

Exemption Certificate Number |

|

|

|

|

|

|

|

1 |

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

Part II |

Coverage Exemptions Claimed on Your Return |

for Your Household |

|

||

7If you are claiming a coverage exemption because your household income or gross income is below the filing threshold,

|

check here |

. . . . . . . . . |

. . . . . |

. . . . |

. |

▶ |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coverage Exemptions Claimed on Your Return for Individuals. If you and/or a member of your tax |

|

|||||||||||||||

Part III |

|

|||||||||||||||||

household are claiming an exemption on your return, complete Part III. |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

(a) |

(b) |

(c) |

(d) |

(e) |

(f) |

|

(g) |

(h) |

(i) |

(j) |

(k) |

(l) |

(m) |

(n) |

(o) |

(p) |

|

|

Exemption |

Full |

|

||||||||||||||

|

|

Name of Individual |

SSN |

Jan |

Feb |

|

Mar |

Apr |

May |

June |

July |

Aug |

Sept |

Oct |

Nov |

Dec |

||

|

|

Type |

Year |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see your tax return instructions. |

|

|

Cat. No. 37787G |

|

|

Form |

8965 |

(2018) |

||||||||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | Form 8965 is used to claim health coverage exemptions on your tax return. |

| Who Should File | Individuals with a Marketplace-granted exemption or claiming an exemption on their return must complete this form. |

| Parts of the Form | The form consists of three parts, each addressing different types of coverage exemptions. |

| Part I | Complete Part I for Marketplace-granted exemptions. Provide names, Social Security Numbers, and exemption certificate numbers. |

| Part II | Part II is for claiming exemptions based on household income that falls below the tax filing threshold. |

| Part III | In Part III, list individuals in your household claiming exemptions on the return, including their exemption types. |

| Attachment | This form must be attached to Form 1040 when submitting your federal tax return. |

| Deadline | Form 8965 must be filed by the tax return deadline, usually April 15, unless an extension has been granted. |

| Resources | For more information, visit www.irs.gov/Form8965. |

| Privacy Notice | The form includes a Privacy Act and Paperwork Reduction Act Notice in the tax return instructions. |

Guidelines on Utilizing Irs 8965

Completing IRS Form 8965 is essential for taxpayers claiming coverage exemptions, particularly for those with Marketplace-granted exemptions or additional exemptions on their tax returns. Follow these steps to fill out the form accurately.

- Obtain Form 8965. You can download it from the IRS website or get a physical copy.

- At the top of the form, fill in your name exactly as it appears on your tax return.

- Enter your Social Security Number (SSN) in the provided space.

- For Part I, list each member of your tax household who has a Marketplace-granted exemption:

- Write the name of each individual in the first column.

- Fill in each individual's SSN in the second column.

- Input the exemption certificate number assigned by the Marketplace in the third column.

- Move to Part II: If your household income is below the filing threshold, check the appropriate box.

- In Part III, begin listing individuals claiming an exemption on your return:

- For each person, enter their full name in the first column.

- Add their SSN in the next column.

- Mark which months they were covered by exemptions in the corresponding columns (January to December).

- Specify the type of exemption claimed in the last column.

- After completing all relevant sections, review the form for accuracy.

- Attach Form 8965 to your Form 1040 when filing your tax return.

What You Should Know About This Form

What is IRS Form 8965?

IRS Form 8965 is used to claim a health coverage exemption. This form is essential for individuals who qualify for an exemption from the Affordable Care Act’s requirement to have health insurance. It should be attached to your Form 1040 when you file your federal tax return.

Who needs to fill out Form 8965?

You need to complete Form 8965 if you or any member of your tax household received an exemption granted by the Marketplace. Additionally, if you are claiming a coverage exemption directly on your tax return, this form is also required.

What exemptions can be claimed on Form 8965?

There are several exemptions that can be claimed using Form 8965. These include situations where your household income is below the filing threshold, a coverage exemption granted by the Marketplace, or other specific circumstances, such as being homeless or having a short-term health insurance policy.

How do I complete Form 8965?

Form 8965 consists of several parts. Part I is for those with Marketplace-granted exemptions. You will need to list the names, social security numbers, and certificate numbers for individuals granted exemptions. Part II is for claiming exemptions based on household income. Part III is where you’ll enter details for any additional exemptions claimed on your return.

What information do I need to provide in Part I?

In Part I, you are required to provide your name, social security number, and the names, social security numbers, and exemption certificate numbers of any individuals in your tax household who received a Marketplace-granted exemption.

What if my household income is below the filing threshold?

If your gross income is below the required filing threshold, you should check the corresponding box in Part II of Form 8965. You won’t need to provide additional details, but this declaration is essential to qualify for the exemption.

Can I file Form 8965 online?

Yes, you can file Form 8965 online if you are using tax software or working with a tax preparer. Most online filing options will include built-in prompts to assist you in completing the form as part of your overall tax return process.

Where can I find instructions for filling out Form 8965?

Instructions for completing Form 8965 can be found on the IRS website. Visit www.irs.gov/Form8965 for the latest updates and detailed guidance on each section of the form.

What happens if I don’t file Form 8965 when required?

If you are required to file Form 8965 but do not do so, you may face penalties. Additionally, the IRS may assess that you owe a Shared Responsibility Payment for not having health insurance coverage, unless you qualify for another exemption.

Common mistakes

Filling out IRS Form 8965 can be a daunting task, but avoiding common mistakes can simplify the process. One significant error people often make is failing to provide correct information for all individuals in their household. Each person's name and Social Security Number must be listed accurately in the appropriate sections. Missing or incorrect details can lead to the rejection of the form.

Another mistake is overlooking the specific coverage exemptions available. People sometimes forget to check whether they qualify for a Marketplace-granted exemption. When completing Part I, individuals must ensure they include all relevant information about any exemptions they received from the Marketplace. This step is crucial for a smooth filing experience.

Inconsistent reporting of income is a frequent issue as well. Individuals claiming a coverage exemption due to low income must be careful to check the correct box in Part II. The income threshold can change annually, so it’s vital to confirm current limits. Checking the wrong box can lead to unintended tax consequences.

Additionally, some fail to keep thorough records. When claiming a coverage exemption, maintaining documentation, such as exemption certificates and income statements, can be essential. The IRS may request this information later, and being prepared can save time and potential penalties.

Missing signatures is another common oversight. After filling out the form, it’s important for taxpayers to sign and date it. Some people rush through the final steps and forget this critical part, which can delay processing and create complications with their tax return.

Moreover, not attaching the form to the correct tax return can lead to issues. Form 8965 should always be attached to Form 1040. Failure to do so may result in delays or denials of claims for coverage exemptions.

Lastly, confusion surrounding the deadlines can result in missed opportunities for exemptions. It’s crucial to submit Form 8965 on time, along with the tax return. Familiarity with the deadlines, especially during tax season, can prevent complications down the line.

Being aware of these mistakes can ease the burden of navigating IRS Form 8965. A careful, attentive approach can lead to a smoother filing process and peace of mind.

Documents used along the form

When completing your tax return and claiming a coverage exemption with IRS Form 8965, several other forms and documents may be necessary. These additional documents help clarify your eligibility for exemptions and ensure your tax filing process goes smoothly.

- Form 1040: This is the standard individual income tax return form that all taxpayers must file. You will attach Form 8965 to your Form 1040 when claiming a health coverage exemption.

- Form 1095-A: If you purchased health insurance through the Health Insurance Marketplace, this form provides information about your coverage. It shows the monthly premium amount and any premium tax credits or subsidies you received.

- Form 1095-B: This form is used to report health coverage provided by insurance companies or employers. It confirms whether you had qualifying health coverage throughout the year.

- Form 1095-C: If you work for an applicable large employer, this form reports whether you were offered health insurance coverage. It can assist in documenting your health coverage status.

- Form 4506-T: Use this form if you need a transcript of your tax return, which can help verify your income if you claim a coverage exemption due to low income.

- Proof of Exemption Documentation: Depending on your situation, you may need supporting documents, such as income statements or notices from the Marketplace, to prove your exemption eligibility.

Gathering all required forms and documents ahead of time will make filing your taxes easier. Each piece serves a purpose in ensuring you understand your coverage and any exemptions available. Being prepared and organized can streamline the process, allowing you to focus on other important areas of your tax return.

Similar forms

The IRS Form 8965 is designed for individuals seeking exemptions from the Affordable Care Act's health coverage requirements. Several other documents serve similar functions in various capacities, reflecting individual circumstances when it comes to healthcare and taxes. Here are five documents that are comparable:

- Form 1040: This is the primary individual income tax return form used by taxpayers to report their income to the IRS. While Form 8965 is an attachment to Form 1040, both documents help determine eligibility for certain tax benefits and exemptions.

- Form 8862: This form is used to claim the Earned Income Tax Credit after prior disallowance. Like Form 8965, it addresses eligibility and provides details necessary for the IRS to evaluate tax benefits based on individual circumstances.

- Form 8889: If you have a Health Savings Account (HSA), this form is required to report contributions and distributions. It similarly focuses on health-related tax matters, ensuring that individuals meet their obligations and understand their rights regarding health expenses.

- Form 1095-A: Issued by the Health Insurance Marketplace, this form provides details about your health coverage, including premium tax credits. Both Form 8965 and Form 1095-A are integral to ensuring compliance with health coverage requirements and exemptions.

- Form 8949: Used to report sales and other dispositions of capital assets, this form is similar in that it requires detailed information to establish eligibility for tax credits or deductions. Both forms serve to clarify individual circumstances to the IRS for accurate tax assessment.

Dos and Don'ts

When filling out the IRS Form 8965, it’s important to follow proper guidelines to ensure accuracy. Here are ten points to consider:

- Do: Fill in your name and social security number accurately at the top of the form.

- Don’t: Leave any section blank that applies to your situation. Every part must be considered.

- Do: Attach the completed form to your Form 1040 when you submit your taxes.

- Don’t: Use the form if you do not have any exemptions. Only those with exemptions need to complete it.

- Do: Double-check all exemption certificate numbers for accuracy.

- Don’t: Forget to review the latest instructions on the IRS website for updates.

- Do: Indicate if your household income is below the filing threshold, if applicable.

- Don’t: Assume a member of your household is automatically exempt without verifying their eligibility.

- Do: Submit the form by the tax deadline to avoid penalties.

- Don’t: Leave the form incomplete; provide all necessary information for each individual seeking an exemption.

Following these guidelines will help ensure a smoother filing process. Careful attention to detail will help prevent errors or delays in your tax return.

Misconceptions

Understanding IRS Form 8965 is essential for those navigating health coverage exemptions. However, there are several misconceptions that can lead to confusion. Below is a list of common misunderstandings regarding this form.

- Form 8965 is only for those with Marketplace coverage. Many believe this form can only be used if you have health coverage through the Marketplace. In fact, it can also be used to claim exemptions for individuals without any Marketplace coverage.

- Completing Form 8965 is optional. Some people think they can ignore this form if they qualify for an exemption. However, if you are claiming an exemption, you must complete and attach it to your Form 1040 when filing your taxes.

- Only certain individuals can qualify for exemptions. There is a belief that only a select group qualifies for exemptions. Actually, exemptions can apply to many individuals based on various criteria, not just those in specific situations.

- All income levels require filing Form 8965. A common misconception is that if your income is low, you must still file this form. If your income is below the tax filing threshold, you generally do not need to file Form 8965.

- The exemption certificate number is mandatory for all situations. Some think that without an exemption certificate number, they cannot file Form 8965. While the number is required for Marketplace-granted exemptions, it is not necessary for exemptions based on income.

- Form 8965 guarantees a refund. There is a misconception that filing this form will automatically result in a tax refund. Filing the form does not guarantee a refund; it merely addresses exemptions for the Affordable Care Act.

- Form 8965 is only needed once. Some individuals believe they only need to file this form a single time. In reality, it is required every tax year in which you are claiming a health coverage exemption.

- Health coverage exemptions expire after one year. There is confusion about whether exemptions last indefinitely. Exemptions are specific to the tax year they are claimed and do not automatically carry over.

- All tax preparers know how to handle Form 8965. While many tax professionals are familiar with this form, not all of them may fully understand the nuances of health coverage exemptions. It is important to choose a preparer knowledgeable in this area.

Clarifying these misconceptions can help ensure a smoother experience when filing taxes and claiming health coverage exemptions.

Key takeaways

When filling out and using the IRS Form 8965, understanding its purpose and requirements is essential. Here are some key takeaways:

- Eligibility for Exemptions: Complete this form if you qualify for a Marketplace-granted coverage exemption or if you are seeking an exemption based on personal circumstances on your federal tax return.

- Part I and Part II: Use Part I for Marketplace-granted exemptions. List the names, social security numbers, and exemption certificate numbers for individuals in your household. Part II is for claiming exemptions based on household income levels.

- Details Required: Ensure that you provide accurate information, including full names and social security numbers. Incomplete or incorrect data can delay processing.

- Filing Guidelines: Attach Form 8965 to your Form 1040 when you file your taxes. For any updates or detailed instructions, refer to the IRS website at www.irs.gov/Form8965.

Browse Other Templates

American Nurses Credentialing Center - Candidates must complete their section before submitting it to their Program Director.

California Workmans Comp - The DWC 1 form is available in both English and Spanish to accommodate diverse workers.