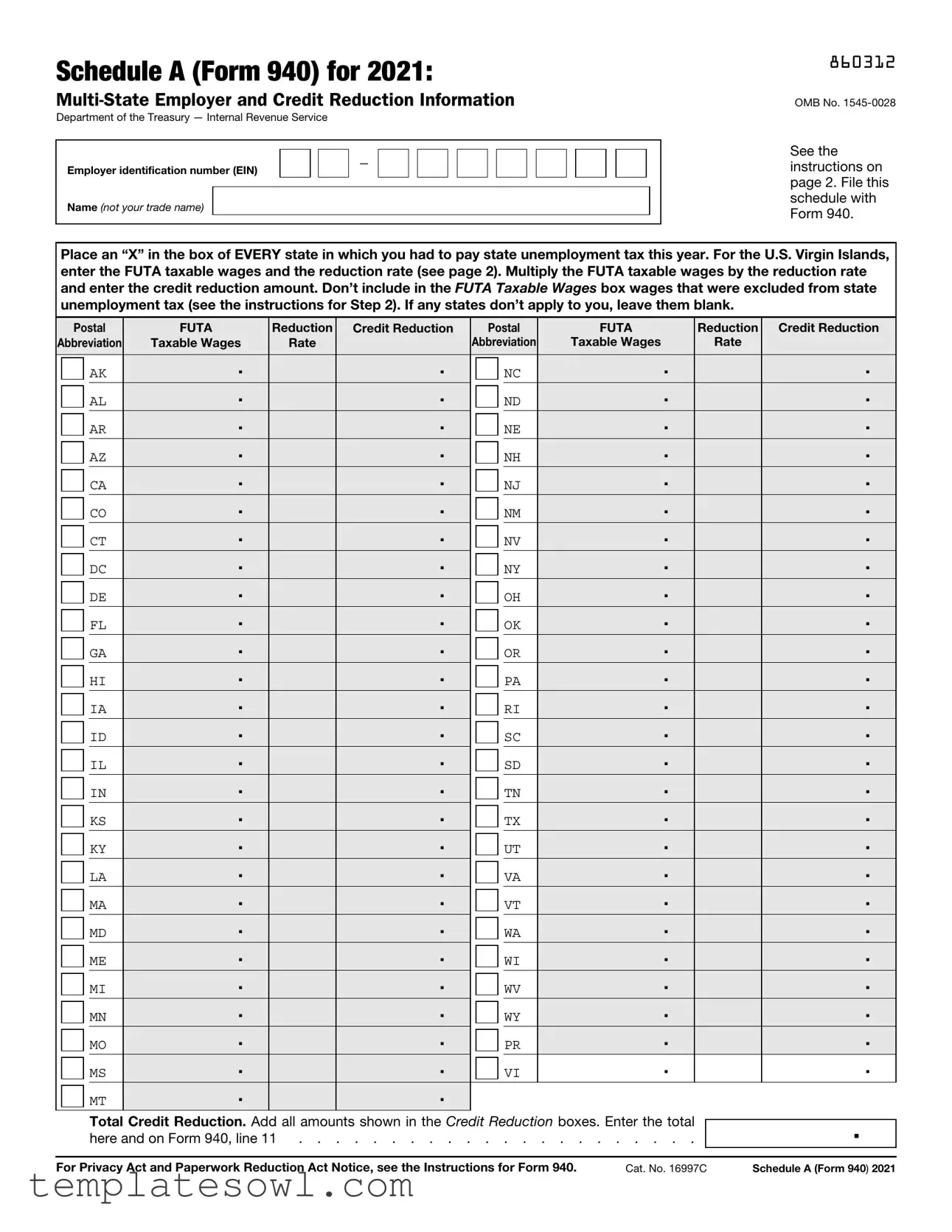

Fill Out Your Irs 940 Schedule A Form

The IRS Form 940 Schedule A is an essential document for employers who operate in multiple states and need to report their unemployment tax obligations. Designed for the convenience of businesses that have encountered state unemployment tax liabilities, this form captures critical information about the states in which employers have paid unemployment taxes during the tax year. The instructions guide the completion of this form, requiring employers to indicate each state where they paid state unemployment tax by marking an “X” in the corresponding box. Additionally, for employers operating in states subject to credit reductions, like the U.S. Virgin Islands for the year 2021, the form necessitates calculating and reporting credit reductions based on FUTA taxable wages. The document asks for specific data including employer identification information and the taxable wages paid, which does not include wages exempt from state unemployment tax. To ensure compliance, it is crucial for employers to sum their credit reductions across all states and accurately report this total on Form 940. Understanding these elements is vital for fulfilling federal and state payroll tax obligations and avoiding potential penalties.

Irs 940 Schedule A Example

Schedule A (Form 940) for 2021:

Department of the Treasury — Internal Revenue Service

Employer identification number (EIN) |

|

|

|

— |

|

|

|

|

Name (not your trade name)

860312

OMB No.

See the instructions on page 2. File this schedule with Form 940.

Place an “X” in the box of EVERY state in which you had to pay state unemployment tax this year. For the U.S. Virgin Islands, enter the FUTA taxable wages and the reduction rate (see page 2). Multiply the FUTA taxable wages by the reduction rate and enter the credit reduction amount. Don’t include in the FUTA Taxable Wages box wages that were excluded from state unemployment tax (see the instructions for Step 2). If any states don’t apply to you, leave them blank.

|

Postal |

FUTA |

Reduction |

Credit Reduction |

|

Postal |

FUTA |

Reduction |

Credit Reduction |

||||||

Abbreviation |

Taxable Wages |

Rate |

|

|

Abbreviation |

Taxable Wages |

Rate |

|

|||||||

|

|

|

AK |

|

. |

|

|

. |

|

|

|

NC |

. |

|

. |

|

|

|

|

|

|

|

|||||||||

|

|

|

AL |

|

. |

|

|

. |

|

|

|

ND |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

AR |

|

. |

|

|

. |

|

|

|

NE |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

AZ |

|

. |

|

|

. |

|

|

|

NH |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

CA |

|

. |

|

|

. |

|

|

|

NJ |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

CO |

|

. |

|

|

. |

|

|

|

NM |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

CT |

|

. |

|

|

. |

|

|

|

NV |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

DC |

|

. |

|

|

. |

|

|

|

NY |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

DE |

|

. |

|

|

. |

|

|

|

OH |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

FL |

|

. |

|

|

. |

|

|

|

OK |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

GA |

|

. |

|

|

. |

|

|

|

OR |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

HI |

|

. |

|

|

. |

|

|

|

PA |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

IA |

|

. |

|

|

. |

|

|

|

RI |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

ID |

|

. |

|

|

. |

|

|

|

SC |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

IL |

|

. |

|

|

. |

|

|

|

SD |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

IN |

|

. |

|

|

. |

|

|

|

TN |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

KS |

|

. |

|

|

. |

|

|

|

TX |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

KY |

|

. |

|

|

. |

|

|

|

UT |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

LA |

|

. |

|

|

. |

|

|

|

VA |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MA |

|

. |

|

|

. |

|

|

|

VT |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MD |

|

. |

|

|

. |

|

|

|

WA |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

ME |

|

. |

|

|

. |

|

|

|

WI |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MI |

|

. |

|

|

. |

|

|

|

WV |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MN |

|

. |

|

|

. |

|

|

|

WY |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MO |

|

. |

|

|

. |

|

|

|

PR |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MS |

|

. |

|

|

. |

|

|

|

VI |

. |

|

. |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

MT |

|

. |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Credit Reduction. Add all amounts shown in the Credit Reduction boxes. Enter the total here and on Form 940, line 11 . . . . . . . . . . . . . . . . . . . . . .

.

For Privacy Act and Paperwork Reduction Act Notice, see the Instructions for Form 940. |

Cat. No. 16997C |

Schedule A (Form 940) 2021 |

Instructions for Schedule A (Form 940) for 2021: |

860412 |

|

|

|

|

|

|

Specific Instructions: Completing Schedule A |

|

Step 1. Place an “X” in the box of every state (including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands) in which you had to pay state unemployment taxes this year, even if the state’s credit reduction rate is zero.

Note: Make sure that you have applied for a state reporting number for your business. If you don’t have an unemployment account in a state in which you paid wages, contact the state unemployment agency to receive one. For a list of state unemployment agencies, visit the U.S. Department of Labor’s website at https://oui.doleta.gov/unemploy/agencies.asp.

The table below provides the

|

Postal |

|

Postal |

State |

Abbreviation |

State |

Abbreviation |

|

|

|

|

Alabama |

AL |

Montana |

MT |

Alaska |

AK |

Nebraska |

NE |

Arizona |

AZ |

Nevada |

NV |

Arkansas |

AR |

New Hampshire |

NH |

California |

CA |

New Jersey |

NJ |

Colorado |

CO |

New Mexico |

NM |

Connecticut |

CT |

New York |

NY |

Delaware |

DE |

North Carolina |

NC |

District of Columbia |

DC |

North Dakota |

ND |

Florida |

FL |

Ohio |

OH |

Georgia |

GA |

Oklahoma |

OK |

Hawaii |

HI |

Oregon |

OR |

Idaho |

ID |

Pennsylvania |

PA |

Illinois |

IL |

Rhode Island |

RI |

Indiana |

IN |

South Carolina |

SC |

Iowa |

IA |

South Dakota |

SD |

Kansas |

KS |

Tennessee |

TN |

Kentucky |

KY |

Texas |

TX |

Louisiana |

LA |

Utah |

UT |

Maine |

ME |

Vermont |

VT |

Maryland |

MD |

Virginia |

VA |

Massachusetts |

MA |

Washington |

WA |

Michigan |

MI |

West Virginia |

WV |

Minnesota |

MN |

Wisconsin |

WI |

Mississippi |

MS |

Wyoming |

WY |

Missouri |

MO |

Puerto Rico |

PR |

|

|

U.S. Virgin Islands |

VI |

Credit reduction state. For 2021, the U.S. Virgin Islands (USVI) is the only credit reduction state. The credit reduction rate is 0.033 (3.3%).

Step 2. You’re subject to credit reduction if you paid FUTA taxable wages that were also subject to state unemployment taxes in the USVI.

In the FUTA Taxable Wages box, enter the total FUTA taxable wages that you paid in the USVI. (The FUTA wage base for all states is $7,000.) However, don’t include in the FUTA Taxable Wages box wages that were excluded from state unemployment tax. For example, if you paid $5,000 in FUTA taxable wages in the USVI but $1,000 of those wages were excluded from state unemployment tax, report $4,000 in the FUTA Taxable Wages box.

Note: Don’t enter your state unemployment wages in the FUTA Taxable Wages box.

Enter the reduction rate and then multiply the total FUTA taxable wages by the reduction rate.

Enter your total in the Credit Reduction box at the end of the line.

Step 3. Total credit reduction

To calculate the total credit reduction, add up all of the Credit Reduction boxes and enter the amount in the Total Credit Reduction box.

Then enter the total credit reduction on Form 940, line 11.

Example 1

You paid $20,000 in wages to each of three employees in State A. State A is subject to credit reduction at a rate of 0.033 (3.3%). Because you paid wages in a state that is subject to credit reduction, you must complete Schedule A and file it with Form 940.

Total payments to all employees in State A . . . . . . $60,000

Payments exempt from FUTA tax

(see the Instructions for Form 940) . . . . . . . . . . $0

Total payments made to each employee in

excess of $7,000 (3 x ($20,000 - $7,000)) . . . . . . . $39,000

Total FUTA taxable wages you paid in State A entered in

the FUTA Taxable Wages box ($60,000 - $0 - $39,000) . . . $21,000 Credit reduction rate for State A . . . . . . . . . . 0.033 Total credit reduction for State A ($21,000 x 0.033) . . . . $693.00

|

Don’t include in the FUTA Taxable Wages box wages |

▲ |

|

! |

in excess of the $7,000 wage base for each employee |

subject to state unemployment insurance in the credit |

|

CAUTION |

reduction state. The credit reduction applies only |

|

to FUTA taxable wages that were also subject to state unemployment tax.

In this case, you would write $693.00 in the Total Credit Reduction box and then enter that amount on Form 940, line 11.

Example 2

You paid $48,000 ($4,000 a month) in wages to Mary Smith and no payments were exempt from FUTA tax. Mary worked in State B (not subject to credit reduction) in January and then transferred to State C (subject to credit reduction) on February

1.Because you paid wages in more than one state, you must complete Schedule A and file it with Form 940.

The total payments in State B that aren’t exempt from FUTA tax are $4,000. Since this payment to Mary doesn’t exceed the $7,000 FUTA wage base, the total FUTA taxable wages paid in State B are $4,000.

The total payments in State C that aren’t exempt from FUTA tax are $44,000. However, $4,000 of FUTA taxable wages was paid in State B with respect to Mary. Therefore, the total FUTA taxable wages with respect to Mary in State C are $3,000 ($7,000 (FUTA wage base) - $4,000 (total FUTA taxable wages paid in State B)). Enter $3,000 in the FUTA Taxable Wages box, multiply it by the Reduction Rate, and then enter the result in the Credit Reduction box.

Attach Schedule A to Form 940 when you file your return.

Page 2

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | Schedule A (Form 940) is used by multi-state employers to report state unemployment tax payments and to calculate any applicable credit reductions. |

| FUTA Taxable Wages | Employers must enter the total FUTA taxable wages paid in each state where state unemployment taxes were incurred, excluding wages exempt from these taxes. |

| U.S. Virgin Islands | The U.S. Virgin Islands is the only state that has a credit reduction for 2021, with a reduction rate of 3.3%. |

| Employer Identification Number | Each filing must include the employer identification number (EIN) to ensure proper processing by the IRS. |

| State Selection | Employers must place an “X” in each box for states where they paid unemployment taxes, regardless of credit reduction rates. |

| Total Credit Reduction | The total credit reduction amount is calculated by adding the amounts shown in the Credit Reduction boxes and should be reported on Form 940. |

| FUTA Wage Base | The FUTA wage base for all states is $7,000. Employers must exclude any wages exceeding this limit when calculating taxable amounts. |

| Exclusion Criteria | Wages that are excluded from state unemployment tax cannot be included in the FUTA Taxable Wages box when completing the form. |

| State Unemployment Agencies | Employers should obtain a state reporting number from the relevant state unemployment agency if they do not yet have one. |

| Filing Requirement | Schedule A must be filed with Form 940 to ensure correct reporting of state unemployment taxes and any credit reduction amounts. |

Guidelines on Utilizing Irs 940 Schedule A

After gathering all necessary information, proceed to complete the IRS 940 Schedule A form. This form captures key details related to your state unemployment taxes and any applicable credit reduction for the U.S. Virgin Islands. Ensuring accuracy is essential, as this will affect your overall tax calculations on Form 940.

- Write your employer identification number (EIN) at the top of the form.

- Fill in your business name, avoiding trade names.

- Place an "X" in each box for the states you paid state unemployment taxes during the year. This includes the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

- If any states do not apply, leave those boxes blank.

- For the U.S. Virgin Islands, enter the FUTA taxable wages paid in the designated box.

- Calculate the reduction rate (0.033 for the U.S. Virgin Islands) and multiply it by the FUTA taxable wages entered in the previous step.

- Enter the resulting credit reduction amount in the Credit Reduction box.

- Add all amounts in the Credit Reduction boxes to get the total credit reduction.

- Record the total credit reduction in the designated Total Credit Reduction box.

- Transfer the total credit reduction amount to Form 940, specifically on line 11.

What You Should Know About This Form

What is IRS Schedule A (Form 940)?

IRS Schedule A (Form 940) is used by employers to report state unemployment tax payments when they operate in multiple states. If an employer is subject to credit reduction due to unpaid state unemployment taxes, this form helps to calculate the amount that affects their Federal Unemployment Tax Act (FUTA) liability. It must be attached to Form 940 when filing taxes.

When should I complete Schedule A?

Schedule A should be completed when you have paid state unemployment taxes in more than one state, including credits for any state that has a reduction rate. Specifically, it needs to be filled out if you paid wages in the U.S. Virgin Islands or any other credit reduction state, or if you must report and calculate the credit reductions applicable to your situation. Make sure it accompanies Form 940 when submitted to the IRS.

How do I calculate the total credit reduction?

To calculate the total credit reduction, you need to total the amounts in the Credit Reduction boxes for each state where you paid unemployment taxes. This involves taking the FUTA taxable wages reported, multiplying them by the state’s credit reduction rate, and then summing these figures. The final total should be entered in the Total Credit Reduction box and also on Form 940, line 11. For example, if you have taxable wages of $21,000 in a credit reduction state with a rate of 0.033, you would report a total credit reduction of $693.

What if I had no taxable wages in a credit reduction state?

If you did not have any taxable wages in a credit reduction state, you would leave the relevant boxes on Schedule A blank. However, you must still indicate that you operated in that state by placing an "X" in the appropriate box. This ensures all potential liabilities are disclosed and helps keep your reporting accurate, even if you are not subject to the credit reduction.

Common mistakes

Filling out the IRS Schedule A (Form 940) can be tricky, and mistakes can lead to serious issues. One common error is failing to place an “X” in the boxes for every state where state unemployment tax was paid. This oversight can happen easily, especially when dealing with multiple states. Every state, including the District of Columbia and Puerto Rico, should be checked, even if the credit reduction rate is zero. Missing a state can result in incorrect calculations and delays in processing.

Another frequent mistake is including wages that are excluded from state unemployment tax in the FUTA Taxable Wages box. It’s crucial to report only the wages subject to FUTA taxes. For example, if $5,000 of the wages paid included $1,000 that was excluded from state unemployment tax, only $4,000 should be entered. Entering the wrong amount can lead to an inaccurate credit reduction calculation, which can affect your overall tax liability.

Many people also confuse total credit reduction with individual state reductions. The total credit reduction must be calculated by adding up all the amounts shown in the Credit Reduction boxes. It is important to be meticulous in this step, as a small calculation error can lead to major discrepancies when filing Form 940. Always double-check your numbers before submitting to ensure accuracy.

Finally, a common error involves not attaching Schedule A to Form 940 when submitting your return. This oversight can be problematic and may lead to processing delays or penalties. Make sure to review all required attachments before filing to ensure compliance. Keeping a checklist can help prevent these mistakes.

Documents used along the form

The IRS 940 Schedule A form is used by multi-state employers to report state-specific unemployment tax information and any applicable credit reductions. Completing Schedule A accurately ensures compliance with federal regulations relating to unemployment taxes. In addition to this form, several other documents are commonly used in conjunction with the IRS 940 Schedule A. Below are some of these important forms and documents.

- Form 940: This is the Annual Federal Unemployment Tax Return. It summarizes the Federal Unemployment Tax Act (FUTA) liability of employers for the year and is the primary form filed alongside Schedule A to report unemployment taxes.

- Form 941: The Employer's Quarterly Federal Tax Return is used to report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. It provides insights into the payroll tax liabilities for each quarter and supports consistent reporting over the year.

- State Unemployment Tax (SUTA) Returns: Each state requires employers to file SUTA returns, which detail the wages paid and unemployment taxes collected. These forms vary by state but are crucial for determining eligibility and compliance with state unemployment tax requirements.

- W-2 Forms: These are wage and tax statements provided to employees at the end of each year, detailing the income earned and taxes withheld. W-2 forms are necessary for tax reporting and verifying unemployment compensation calculations.

When completing the IRS 940 Schedule A form, these accompanying documents provide essential information and ensure accurate reporting and compliance with both federal and state tax obligations. Accurate completion of all forms is vital for avoiding penalties and maintaining proper tax records.

Similar forms

- IRS Form 941: Similar to Schedule A, Form 941 requires employers to report wages paid and taxes withheld for federal income, Social Security, and Medicare. Both forms are essential for compliance with payroll tax obligations, but while Schedule A focuses on state unemployment taxes, Form 941 encompasses a broader range of federal responsibilities.

- IRS Form 940: The parent form to Schedule A, Form 940 is the annual return for Federal Unemployment Tax Act (FUTA) taxes. Essentially, Schedule A provides additional details specifically related to multi-state employers and any credit reductions, while Form 940 summarizes the overall FUTA tax liability.

- IRS Form 944: Similar to Form 941, Form 944 is used by small employers to report annual payroll tax liability. Both forms help ensure that employers fulfill their tax obligations, but Form 944 is specifically designed for businesses with lower payroll levels, simplifying their reporting requirements.

- IRS Form W-2: This form reports annual wages and the taxes withheld for each employee. Like Schedule A, the W-2 is crucial for tax compliance. However, while Schedule A provides information for federal tax credits on unemployment at the state level, W-2 summarizes individual employee earnings.

- IRS Form W-3: Accompanying Form W-2, Form W-3 aggregates data from all W-2s submitted for a given tax year. Both serve the purpose of reporting employee wages, yet Schedule A specifically addresses unemployment tax liabilities rather than income taxes.

- State Unemployment Tax Return (SUTA): Similar to Schedule A, this state-specific document reports unemployment taxes owed by employers. Schedule A outlines federal requirements for credit reductions, while SUTA focuses on state obligations based on wages and employment levels.

- IRS Form 1099: Used to report various types of income other than wages, this form helps maintain compliance with federal tax reporting. Although Schedule A deals exclusively with unemployment tax credits for employers, Form 1099 provides a broader perspective on income reporting.

- IRS Form 5300 Series: This includes various forms used to report different employee benefit plans. The complexity of these forms may reflect employer obligations in a realm related to compensation and benefits, similar to how Schedule A reflects obligations concerning unemployment taxes.

Dos and Don'ts

When filling out the IRS 940 Schedule A form, here are seven things you should and shouldn't do:

- Do double-check your Employer Identification Number (EIN) for accuracy.

- Don't leave any boxes unchecked for states where you paid state unemployment taxes.

- Do include only taxable wages in the FUTA Taxable Wages box.

- Don't enter wages that are exempt from state unemployment tax in the said box.

- Do ensure you apply for a state reporting number if you don't already have one.

- Don't forget to calculate the credit reduction amount accurately based on the reduction rate.

- Do file Schedule A with your Form 940 on time to avoid penalties.

Misconceptions

- Misconception 1: Only employers in credit reduction states need to file Schedule A.

- Misconception 2: Payments exempt from FUTA tax are reported on Schedule A.

- Misconception 3: Completing Schedule A is optional if the state credit reduction rate is zero.

- Misconception 4: The total credit reduction is not important to include on Form 940.

- Misconception 5: Employers can skip states they did not pay taxes in.

Many believe that only employers located in credit reduction states, like the U.S. Virgin Islands, are required to complete Schedule A. In reality, all employers who pay state unemployment taxes, regardless of credit status, must fill out this form and submit it with their Form 940.

Some employers incorrectly assume they can include all wage payments in the FUTA Taxable Wages box. Wages exempt from state unemployment taxes should not be reported at all. Only taxes that fell under the FUTA guidelines should be included.

A common error is thinking that if the credit reduction rate is zero, the form is unnecessary. This is false. Any employer who paid state unemployment taxes must still indicate this on Schedule A by marking the appropriate boxes.

Employers frequently overlook the importance of transferring the total credit reduction amount from Schedule A to Form 940, line 11. This step is crucial, as failure to do so can result in discrepancies that may lead to penalties or audits.

Some assume it is acceptable to leave out states where no unemployment taxes were paid. However, for clarity and accuracy, all boxes for states should be marked appropriately. If a state does not apply, it should be left blank.

Key takeaways

- Identify Required States: You must check every state where you had to pay state unemployment taxes, including the U.S. Virgin Islands. Even if you have no credit reduction in a state, be sure to mark it.

- Understand EIN Importance: Your Employer Identification Number (EIN) is essential. It identifies your business on the form, so it must be accurate.

- FUTA Taxable Wages: Only include wages subject to state unemployment tax in the FUTA Taxable Wages box. Avoid including any wages exempt from state unemployment tax.

- Credit Reduction State: Be aware that the U.S. Virgin Islands is currently the only credit reduction state. This means specific calculations will apply if you conducted business there.

- Calculate Reduction Rate: If you paid taxable wages in the U.S. Virgin Islands, multiply the total by the 3.3% credit reduction rate to determine your total credit reduction amount.

- Attach Schedule A: Schedule A must accompany Form 940. Submitting them together is mandatory to ensure your unemployment taxes are treated correctly.

- Seek Assistance: If you don’t have a state reporting number and paid wages in a state, contact that state’s unemployment agency immediately for guidance and registration.

- Follow Instructions Carefully: Always refer to the instructions for both Schedule A and Form 940. Compliance is key to avoiding penalties and ensuring accurate reporting.

Browse Other Templates

Online Divorce Nc - Simplifies the legal process for individuals seeking an uncontested divorce.

Strayer University Transcript Request - Students can opt for credit card payment via phone post-submission of the form.