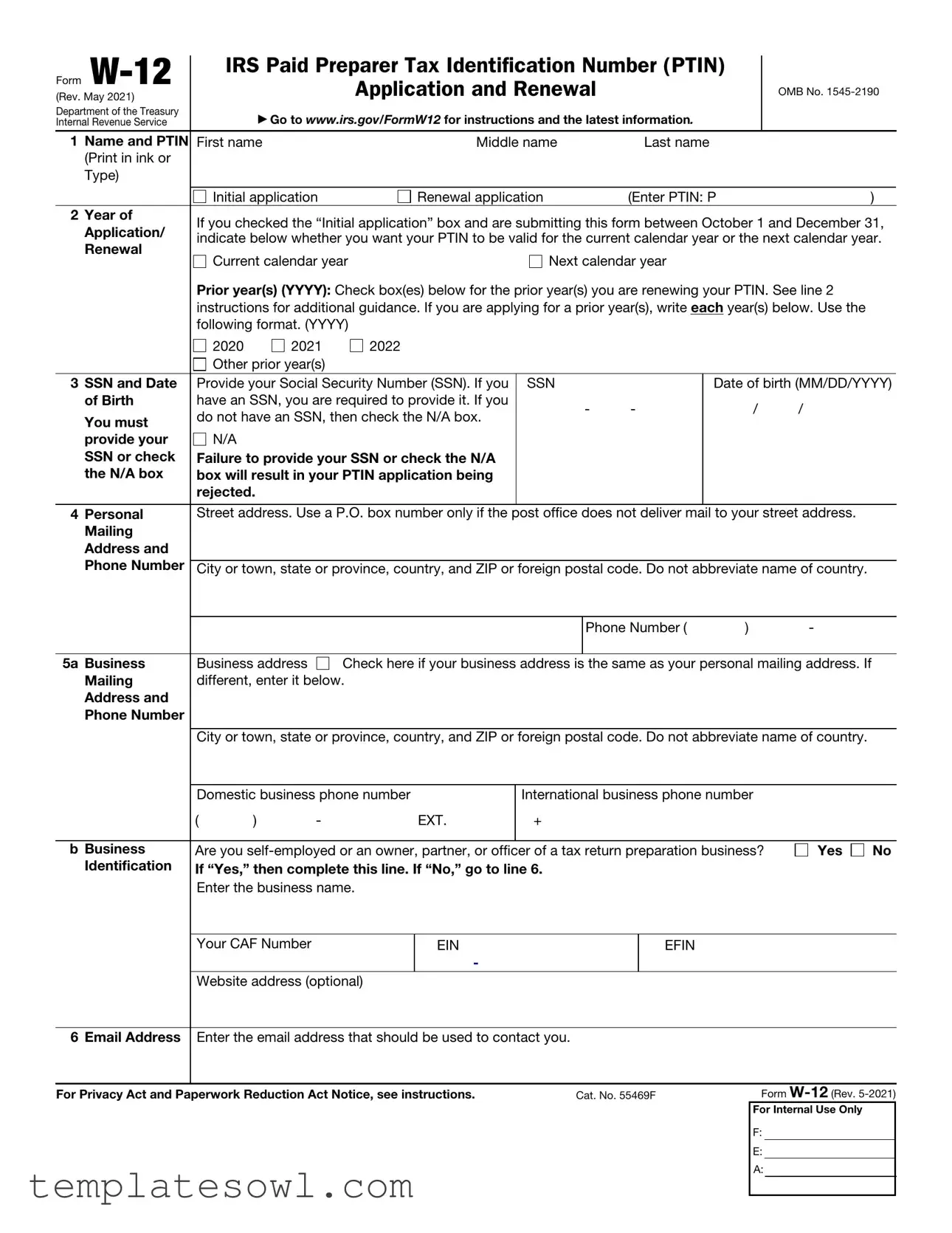

Fill Out Your Irs Gov Ptin Renewal Form

The IRS Paid Preparer Tax Identification Number (PTIN) Renewal Form, known as Form W-12, serves as a crucial component for tax preparers seeking to continue their practice. This form must be completed accurately, whether for an initial application or a renewal. The application requires key personal information such as name, mailing address, and Social Security Number (SSN). Tax preparers should indicate the validity period of the PTIN, selecting either the current or next calendar year. The form also addresses past felony convictions and checks compliance with federal tax obligations. To enhance transparency, it solicits details about professional credentials, ensuring that all tax professionals operate within the legal framework. Applicants should be mindful of the $35.95 fee associated with the PTIN application, which is nonrefundable and essential for processing. Filing can be completed online for quicker processing or via regular mail, with a typical turnaround time of 4 to 6 weeks. Each of these components is integral to maintaining the integrity of tax preparation services in the United States.

Irs Gov Ptin Renewal Example

Form

(Rev. May 2021)

Department of the Treasury

Internal Revenue Service

IRS Paid Preparer Tax Identification Number (PTIN)

Application and Renewal

▶Go to www.irs.gov/FormW12 for instructions and the latest information.

OMB No.

1 Name and PTIN First name |

|

|

Middle name |

|

Last name |

|

|

||||

|

(Print in ink or |

|

|

|

|

|

|

|

|

|

|

|

Type) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Initial application |

|

Renewal application |

|

(Enter PTIN: P |

|

) |

|||

2 |

Year of |

If you checked the “Initial application” box and are submitting this form between October 1 and December 31, |

|||||||||

|

Application/ |

||||||||||

|

indicate below whether you want your PTIN to be valid for the current calendar year or the next calendar year. |

||||||||||

|

Renewal |

||||||||||

|

Current calendar year |

|

Next calendar year |

|

|

||||||

|

|

|

|

|

|||||||

|

|

Prior year(s) (YYYY): Check box(es) below for the prior year(s) you are renewing your PTIN. See line 2 |

|||||||||

|

|

instructions for additional guidance. If you are applying for a prior year(s), write each year(s) below. Use the |

|||||||||

|

|

following format. (YYYY) |

|

|

|

|

|

|

|

||

|

|

2020 |

2021 |

|

2022 |

|

|

|

|

|

|

|

|

Other prior year(s) |

|

|

|

|

|

|

|

|

|

3 |

SSN and Date |

Provide your Social Security Number (SSN). If you |

SSN |

|

|

Date of birth (MM/DD/YYYY) |

|||||

|

of Birth |

have an SSN, you are required to provide it. If you |

|

- |

- |

|

/ |

/ |

|||

|

You must |

do not have an SSN, then check the N/A box. |

|

|

|||||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

provide your |

N/A |

|

|

|

|

|

|

|

|

|

|

SSN or check |

Failure to provide your SSN or check the N/A |

|

|

|

|

|

|

|||

|

the N/A box |

box will result in your PTIN application being |

|

|

|

|

|

|

|||

|

|

rejected. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

4 |

Personal |

Street address. Use a P.O. box number only if the |

post office does not deliver mail to your street address. |

||||||||

|

Mailing |

|

|

|

|

|

|

|

|

|

|

|

Address and |

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

||||||||

|

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country. |

||||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

Phone Number ( |

) |

- |

||

|

|

|

|

|

|||||||

5a |

Business |

Business address |

Check here if your business address is the same as your personal mailing address. If |

||||||||

|

Mailing |

different, enter it below. |

|

|

|

|

|

|

|

||

|

Address and |

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code. Do not abbreviate name of country.

|

Domestic business phone number |

|

|

International business phone number |

|

|

|||

|

( |

) |

- |

EXT. |

|

+ |

|

|

|

|

|

|

|

|

|

|

|||

b Business |

Are you |

Yes |

No |

||||||

Identification |

If “Yes,” then complete this line. If “No,” go to line 6. |

|

|

||||||

|

Enter the business name. |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Your CAF Number |

|

EIN |

|

|

EFIN |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

Website address (optional) |

|

|

|

|

|

|

||

6Email Address Enter the email address that should be used to contact you.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. |

Cat. No. 55469F |

Form |

|

|

|

For Internal Use Only |

|

|

|

F: |

|

|

|

E: |

|

|

|

A: |

|

|

|

|

|

Form |

Page 2 |

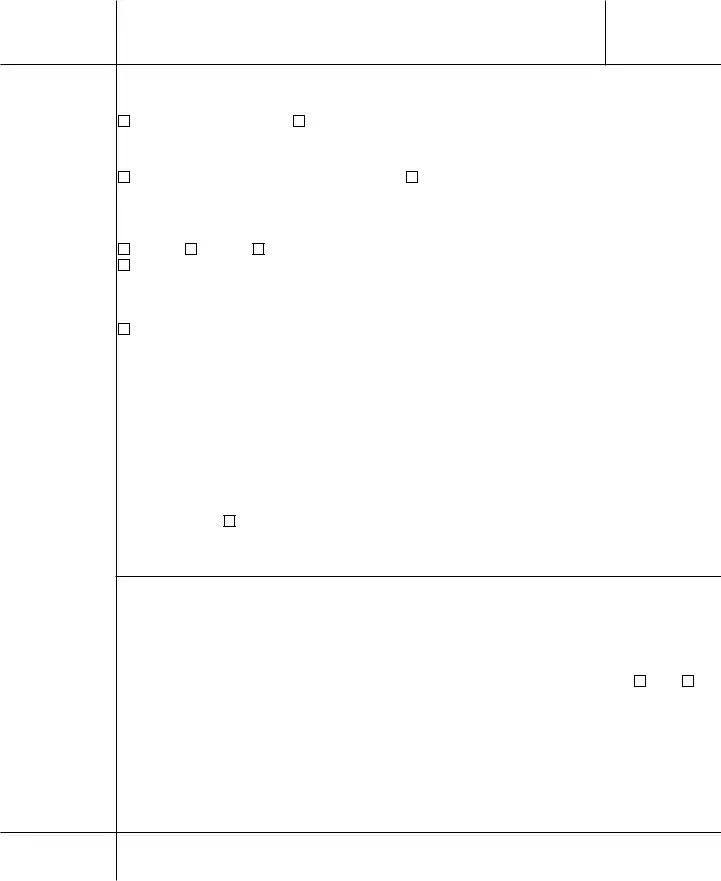

7Past Felony Convictions You must check a box. If “Yes,” you must provide an explanation.

Have you been convicted of a felony in the past 10 years?

If “Yes,” list the date and the type of felony conviction(s).

Yes No

If this is your initial application for a PTIN, continue to line 8. If you are renewing your PTIN, go to line 10.

8 |

Address of |

Enter the address used on your last U.S. individual income tax return you filed. |

|||

|

Your |

|

|

|

|

|

Last U.S. |

|

|

|

|

|

Individual |

|

|

|

|

|

Income Tax |

|

|

|

|

|

Check here if you have never filed a U.S. income tax return or do not have a U.S. income tax filing |

||||

|

Return Filed |

||||

|

requirement. See line 8 instructions for documents that must be submitted with this form and continue to |

||||

|

|

||||

|

|

line 10. |

|

|

|

|

|

|

|

|

|

9 |

Filing Status |

Single |

Head of Household |

||

|

and Tax Year |

|

|

|

|

|

on Last U.S. |

Married filing jointly |

Qualifying widow(er) with dependent child |

||

|

Individual |

|

|

|

|

|

Income Tax |

Married filing separately |

Tax Year (YYYY) |

|

|

|

Return Filed |

||||

|

Note: If your last return was filed more than 4 years ago, see instructions. |

||||

|

|

||||

|

|

|

|||

10 |

Federal Tax |

Are you current on both your individual and business federal taxes, including any corporate and employment |

|||

|

Compliance |

tax obligations? Note: If you have never filed a U.S. individual income tax return because you are not required |

|||

|

|

to do so, check the “Yes” box. |

|

|

Yes |

|

|

|

|

|

No |

|

|

If “No,” provide an explanation. |

|

|

|

11Data Security I am aware that paid tax return preparers must have a data security plan to provide data and system security Responsibilities protections for all taxpayer information.

Form

Form |

|

|

|

|

|

|

Page 3 |

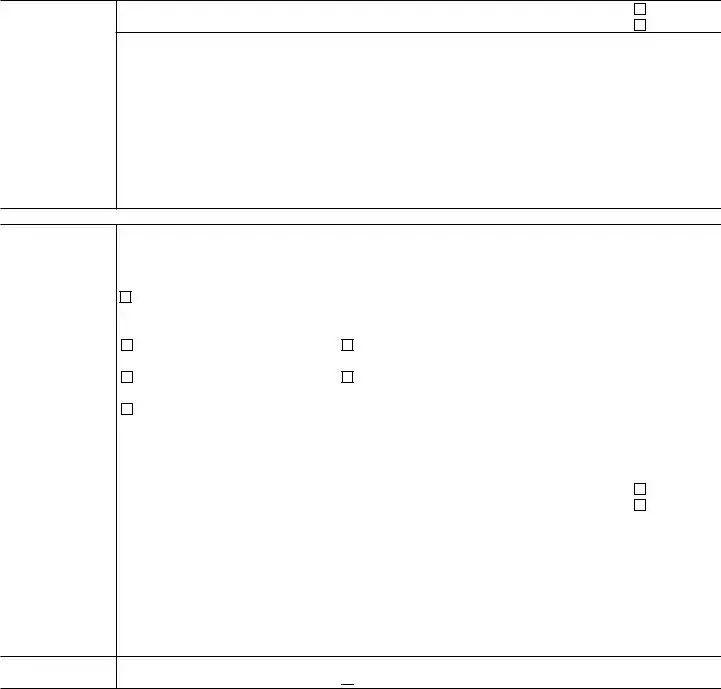

12 Professional |

Check all that apply. Note: DO NOT check any professional credentials that are currently expired or |

||||||

Credentials |

retired. Enter state abbreviation and appropriate number(s). If the expiration date is left blank or incomplete, |

||||||

|

then NO professional credential will be added when the application is processed. |

||||||

|

|

|

|

|

|

||

|

jurisdiction(s): |

Number(s): |

Expiration Date(s): |

||||

|

|

|

|

|

|

|

|

|

Certified Public Accountant (CPA)— |

|

|

|

|

|

|

|

Licensed in which jurisdiction(s): |

Number(s): |

Expiration Date(s): |

||||

|

|

|

|

|

|

|

|

|

Enrolled Agent (EA) |

Number(s): |

|

Expiration Date(s): |

|

||

|

Enrolled Actuary |

Number(s): |

|

Expiration Date(s): |

|

||

|

Enrolled Retirement Plan Agent (ERPA) |

Number(s): |

Expiration Date(s): |

||||

|

State Regulated Tax Return Preparer |

|

|

|

|

|

|

|

Number(s): |

Expiration Date(s): |

|||||

|

|

|

|

|

|

|

|

|

Certifying Acceptance Agent (CAA) |

Number: |

|

|

|||

|

None |

|

|

|

|

|

|

13 Fees |

If you are applying for a PTIN or renewing your PTIN, your fee is $35.95. The fee is an application processing |

||||||

|

fee and is nonrefundable. Full payment must be included with your application or it will be rejected. If your |

||||||

application is incomplete and you do not supply the required information upon request, the IRS will be unable

to process your application. Make your check or money order payable to IRS Tax Pro PTIN Fee. Do not

paper clip, staple, or otherwise attach the payment to Form

year you are applying for. No payment is due for 2020 and prior years.

|

Under penalties of perjury, I declare that I have examined this application and to the best of my knowledge and belief, it |

|||

Sign |

is true, correct, and complete. I understand any false or misleading information may result in criminal penalties and/or |

|||

the denial or termination of a PTIN. |

|

|

||

Here |

▲ |

Your signature (Please use blue or black ink) |

Date (MM/DD/YYYY) |

|

|

/ |

/ |

||

|

|

|

|

|

How To File

Online. Go to the webpage www.irs.gov/ptin for information. Follow the instructions to submit Form

By mail. Complete Form

IRS Tax Professional PTIN Processing Center PO Box 380638

San Antonio, TX 78268

Note: Allow 4 to 6 weeks for processing of PTIN applications. For additional information, refer to the separate Instructions for Form

For Internal Use Only |

Form |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Identification | This is the IRS Form W-12, specifically for the Paid Preparer Tax Identification Number (PTIN) application and renewal process. |

| Fee for Application | A non-refundable fee of $35.95 is required for applying or renewing a PTIN. This amount is mandatory for processing the application. |

| Processing Time | If you submit your application by mail, it generally takes 4 to 6 weeks to process. Online submissions provide immediate results. |

| Submission Methods | You can either file your application online through www.irs.gov/ptin or mail the completed Form W-12 to the IRS Tax Professional PTIN Processing Center. |

| SSN Requirements | Applicants must provide their Social Security Number (SSN). If you lack an SSN, you need to check the N/A box on the form. |

| Prior Year Renewals | If you're renewing your PTIN for prior years, ensure you list those specific years on the application. Include any prior years you wish to renew. |

| PENALTIES FOR FALSE INFORMATION | Providing false or misleading information on the application can lead to severe consequences, including criminal penalties or PTIN denial. |

Guidelines on Utilizing Irs Gov Ptin Renewal

Renewing your IRS Paid Preparer Tax Identification Number (PTIN) requires careful completion of Form W-12. After submitting your renewal, the IRS will process your application and, upon approval, provide you with your renewed PTIN. The renewal process is straightforward, but it is essential to fill out the form accurately to avoid delays.

- Go to the IRS website and download Form W-12.

- Complete your name and existing PTIN in the designated section.

- Indicate whether you are renewing your PTIN for the current year or for prior years.

- Provide your Social Security Number (SSN) or check the N/A box if you do not have one.

- Fill in your personal mailing address and phone number, ensuring it is accurate and complete.

- If applicable, enter your business address and phone number. Indicate if it is the same as your personal mailing address.

- Specify if you are self-employed or part of a tax return preparation business. Provide the necessary business information if applicable.

- Enter your email address for communication purposes.

- Answer the question regarding past felony convictions and provide explanations if necessary.

- Input the address from your last filed U.S. individual tax return. If applicable, indicate that you have never filed a return.

- Select your filing status for the last tax year filed.

- Confirm whether you are current on your individual and business federal taxes.

- Acknowledge that you understand the data security responsibilities required of paid preparers.

- Check any applicable professional credentials, ensuring you provide the expiration dates and jurisdiction.

- Calculate the required renewal fee of $35.95 and include full payment with your application. Make the check or money order payable to “IRS Tax Pro PTIN Fee.”

- Sign and date the form using blue or black ink.

- Choose your submission method: either online through the IRS website or by mailing the completed Form W-12 to the IRS Tax Professional PTIN Processing Center in San Antonio, Texas.

What You Should Know About This Form

What is the purpose of the PTIN Renewal Form?

The PTIN Renewal Form, officially known as Form W-12, is used by paid tax preparers to apply for or renew their Paid Preparer Tax Identification Number (PTIN). This number is essential for tax professionals as it is required for filing tax returns on behalf of clients. The renewal ensures that the PTIN remains active and valid for continued use in the upcoming tax years.

How do I know if I need to renew my PTIN?

If you have an existing PTIN that is set to expire or if you are applying for a new year, you will need to renew your PTIN. Typically, PTINs are valid for one calendar year. You should consider renewing especially if you plan to prepare taxes for clients. Mark your calendar for the renewal period, which generally is from October 1 to December 31 for the next calendar year.

What information do I need to provide on the PTIN Renewal Form?

The PTIN Renewal Form requires several key pieces of information such as your name, Social Security Number (SSN), mailing addresses, business information if applicable, and any prior felony convictions. Additionally, you'll need to select your filing status and confirm your compliance with federal tax obligations. Ensure that all information is accurate and complete to avoid delays.

Is there a fee to renew my PTIN?

Yes, there is a nonrefundable fee of $35.95 required to apply or renew your PTIN. This fee must accompany your application; otherwise, it will be rejected. Payment should be made out to IRS Tax Pro PTIN Fee. Keep in mind that no payment is necessary for prior years such as 2020 and before.

How can I submit my PTIN Renewal Form?

You can submit the form either online or by mail. If you choose to apply online, visit the IRS PTIN webpage and follow the instructions. Upon completion, your PTIN is typically provided immediately. If you prefer to mail your application, send it to the IRS Tax Professional PTIN Processing Center in San Antonio, Texas. Allow 4 to 6 weeks for processing if mailed.

What happens if I do not renew my PTIN on time?

Failure to renew your PTIN by the expiration date may result in the inability to prepare tax returns, potentially impacting your clients and your business. You will have to reapply for a new PTIN, which could delay your ability to serve clients in a timely manner. To avoid any disruptions to your practice, renew your PTIN as early as possible during the designated renewal period.

What should I do if my PTIN application is rejected?

If your PTIN application is rejected, you will receive information outlining the reasons for the rejection. It is crucial to review this information carefully. You may need to provide additional details or correct any errors. Take action promptly to address the issues identified, and resubmit your application to ensure you receive your PTIN without delay.

Common mistakes

When filling out the IRS PTIN Renewal Form (Form W-12), many individuals inadvertently make mistakes that can delay their application. One common error is not providing a Social Security Number (SSN). If you have an SSN, it is mandatory to include it. Skipping this step can lead to instant rejection of your application. If you do not have an SSN, make sure to check the N/A box clearly to avoid confusion.

Another frequent mistake involves the mailing address. Some applicants use a P.O. box instead of a street address when not applicable. It is vital to provide a physical address unless the post office indicates otherwise. Failing to do so may lead to communication issues down the road.

Providing incorrect information is also a common pitfall. Double-check that all names are written accurately in the correct boxes. A simple typo, especially in the last name, can create discrepancies that complicate your application process.

This form requires you to indicate whether you are applying for the current calendar year or the next. Some people forget to specify this, leading to delays. Take a moment to confirm your selection to ensure the IRS processes your application for the right time frame.

Another important but overlooked section is the email address. Applicants often enter an email that is either incorrect or not regularly checked. A valid and frequently used email address is essential since the IRS may use it to contact you regarding your application.

Don’t forget about past felony convictions. If applicable, you must check the corresponding box and provide an explanation. Omitting this could lead to the rejection of your application.

Make sure to review your tax compliance status. Some applicants check “Yes” without truly being current with their individual and business taxes. This misrepresentation can result in serious consequences, as the IRS takes compliance seriously.

When it comes to professional credentials, be careful not to list expired or retired licenses. If you fail to leave the expiration date blank or incomplete, the IRS will not recognize those credentials, wasting your time and effort.

Lastly, be mindful of the application fee. All required fees must accompany your submission. Some individuals forget to include payment or provide an incorrect amount, leading to automatic rejection of their application.

Taking the time to check these points can save you significant hassle. Thoroughly review your application to ensure all sections are complete and accurate before submission.

Documents used along the form

When renewing your IRS Paid Preparer Tax Identification Number (PTIN) using Form W-12, several documents may be relevant to your submission. These forms can provide additional information necessary for processing your application efficiently. Below is a list of documents commonly associated with the PTIN renewal process.

- Form 1040: This is the U.S. Individual Income Tax Return form. It shows your filing status, income, deductions, and tax liability for the year. Recent tax returns can verify your compliance with federal tax obligations.

- Form 8862: This form is used to claim the Earned Income Credit after disallowance. If your EIC was previously denied, this form is necessary to help restart your claims.

- Form 4506: A request for a transcript or copy of your tax return, this form can be used to obtain the necessary records if you do not have copies of your previously filed returns.

- Proof of Identity: This may include forms of identification like a driver's license or passport. It helps confirm your identity during the PTIN renewal process.

- CPAs or Credential Documentation: If applicable, you may need to provide proof of your credentials, such as state licensing information for Certified Public Accountants or tax preparers.

- Supporting Documents for Felony Convictions: If you have a felony conviction, additional documentation explaining the circumstances may be required.

- Business Formation Documents: If you operate as a business entity, documents such as articles of incorporation or partnership agreements can demonstrate your business legitimacy.

- Previous PTIN Verification: Any documents showing your last PTIN status can help ensure that all prior renewals meet the current requirements.

- Payment Information: Since a fee is required for PTIN renewal, confirming your payment method, such as checks or money orders, is essential.

Being prepared with these documents can help streamline the PTIN renewal process and reduce the risk of application delays. Review each requirement carefully to ensure that your application is complete and accurate. This diligence will contribute to a smoother experience when managing your tax preparation responsibilities.

Similar forms

- Form 1040: This is the standard individual income tax return form, similar to the PTIN renewal form in that it requires personal information like name and social security number. Both forms are essential for compliance with tax regulations.

- Form 8821: This form is used to authorize the IRS to release your tax information to a third party. Like the PTIN renewal form, it necessitates accurate identification details to ensure privacy and compliance.

- Form W-4: This employee's withholding allowance certificate determines federal income tax withholding. Similar to the PTIN form, it requires your name and social security number, reflecting the need for consistent identification across IRS forms.

- Form 8832: Used by entities to elect to be treated as a corporation or partnership for tax purposes, it shares similarities with the PTIN renewal form as both necessitate a clear understanding of the applicant's tax obligations.

- Form 941: This is the employer's quarterly federal tax return. Both forms require a confirmation of tax compliance, essentially assisting the IRS in tracking tax responsibilities.

- Form 4506-T: This is a request for a transcript of tax return information, necessitating personal details like your name and social security number. Both forms facilitate the IRS in delivering accurate tax-related services.

- Form SS-4: This application for an employer identification number also requires meticulous information about the entity or individual, aligning with the thorough identification requirements of the PTIN renewal.

- Form 8862: This is used to claim the Earned Income Tax Credit after it has been disallowed. Like the PTIN form, it involves confirming your eligibility through personal information and history.

- Form 1098: This form is used to report mortgage interest and requires identifying details, thus paralleling the need for accurate personal information seen in the PTIN renewal process.

- Form 4868: This is the application for an automatic extension of time to file a U.S. individual income tax return. It shares the requirement for personal information and reflects a commitment to adherence to filing deadlines.

Dos and Don'ts

When filling out the IRS PTIN Renewal form, consider the following best practices and common pitfalls.

- Double-check your information: Ensure all personal details, such as your name and address, are filled out correctly.

- Provide your SSN: If you have a Social Security Number, include it. Failure to do so may lead to application rejection.

- Select the correct application type: Mark whether you are applying for a renewal or an initial application accurately.

- Indicate your filing status: Check the appropriate box for your filing status to avoid processing delays.

- Don’t skip required fields: All mandatory sections, especially those regarding felony convictions, must be completed.

- Avoid using a P.O. box as your primary address: Provide your street address unless mail is not deliverable there.

- Do not attach payment improperly: Make payments separately, without attaching them to the form with clips or staples.

- Never omit any explanations required: If indicated, include details related to tax compliance or felony convictions.

Misconceptions

Misconceptions about the IRS PTIN Renewal Form can lead to confusion during the application process. Here are seven common misconceptions and clarifications regarding them:

- My PTIN is valid indefinitely once issued. This is incorrect. A PTIN must be renewed annually, and it is not a lifetime identification number.

- I can submit my renewal form any time of the year. While applications can be submitted throughout the year, it is advisable to renew timely before tax season to avoid delays.

- I don't need to provide my Social Security Number (SSN) if I have an Employer Identification Number (EIN). This is a misconception. Individuals must provide their SSN if they have one. The EIN does not replace this requirement.

- There is no fee for renewing my PTIN. This is not true. A processing fee of $35.95 is required each time a PTIN is renewed.

- It doesn’t matter if I omit some credentials on my application. Omitting required professional credentials can result in a delay or rejection. It is essential to provide accurate and complete information.

- If my past tax returns had issues, my renewal application will be automatically denied. Not necessarily. If there are issues, applicants may still be able to explain the circumstances. Each application is reviewed on a case-by-case basis.

- Once I apply online, I will receive my PTIN immediately. While many online applicants receive their PTIN immediately, some cases may require additional review, which could result in a delay.

Key takeaways

Filling out the IRS PTIN Renewal form can feel daunting, but understanding a few key points can simplify the process greatly. Here’s what you need to know:

- Eligibility: Ensure you check whether you’re applying for an initial PTIN or renewing an existing one. This determines how you fill out the form.

- Personal Information: Fill in your name, address, Social Security Number (SSN), and date of birth accurately. Incomplete information might lead to rejection.

- Prior Years: If renewing for previous years, list the specific years correctly using the format YYYY, such as 2020, 2021, or 2022.

- Fees: A fee of $35.95 is required for processing applications or renewals. Make sure to include payment, as forms submitted without it will be rejected.

- Data Security: Acknowledge your responsibility to maintain a data security plan for the protection of taxpayer information.

- Filing Method: Choose to file online for immediate PTIN provision or by mail, allowing 4 to 6 weeks for processing.

- Signature Required: Sign the form in blue or black ink, affirming the accuracy of the information provided. This step is crucial to avoid penalties.

Taking the time to ensure that your form is complete and accurate can save you from delays and complications down the road. Consider consulting the IRS website for the latest information and instructions.

Browse Other Templates

Direct Deposit Slip - This form is for enrolling in or changing direct deposit arrangements.

Unclaimed Savings Bonds Search by Name - The form addresses the management of bonds in cases where an owner is deceased.

Vendor Registration Form,Supplier Qualification Application,Retail Partnership Request,Vendor Enrollment Document,Merchant Information Submission,Supplier Information Form,Vendor Profile Application,Product Supplier Registration,Vendor Compliance Sub - Time spent in business is pertinent to assess experience and reliability.