Fill Out Your Irs Insolvency Form

The IRS Insolvency Form, officially known as Form 982, plays a critical role for individuals and entities navigating the complexities of tax obligations following debt discharge. This form is designed for taxpayers who have discharged certain types of indebtedness and may be eligible to exclude that discharged amount from their gross income. By completing Form 982, taxpayers can identify the specific circumstances under which the discharge occurred, such as in a Chapter 11 bankruptcy case or due to insolvency. Additionally, the form provides options for how the discharged amount affects various tax attributes, such as net operating loss carryovers and general business credit carryovers. Parts I and II guide users through the required disclosures and the potential adjustments to the tax basis of their properties, ensuring compliance with applicable tax regulations. It is essential for taxpayers to carefully evaluate their unique situations and refer to the instructions provided by the IRS to ensure accurate completion of this form, thereby minimizing any unforeseen tax liabilities.

Irs Insolvency Example

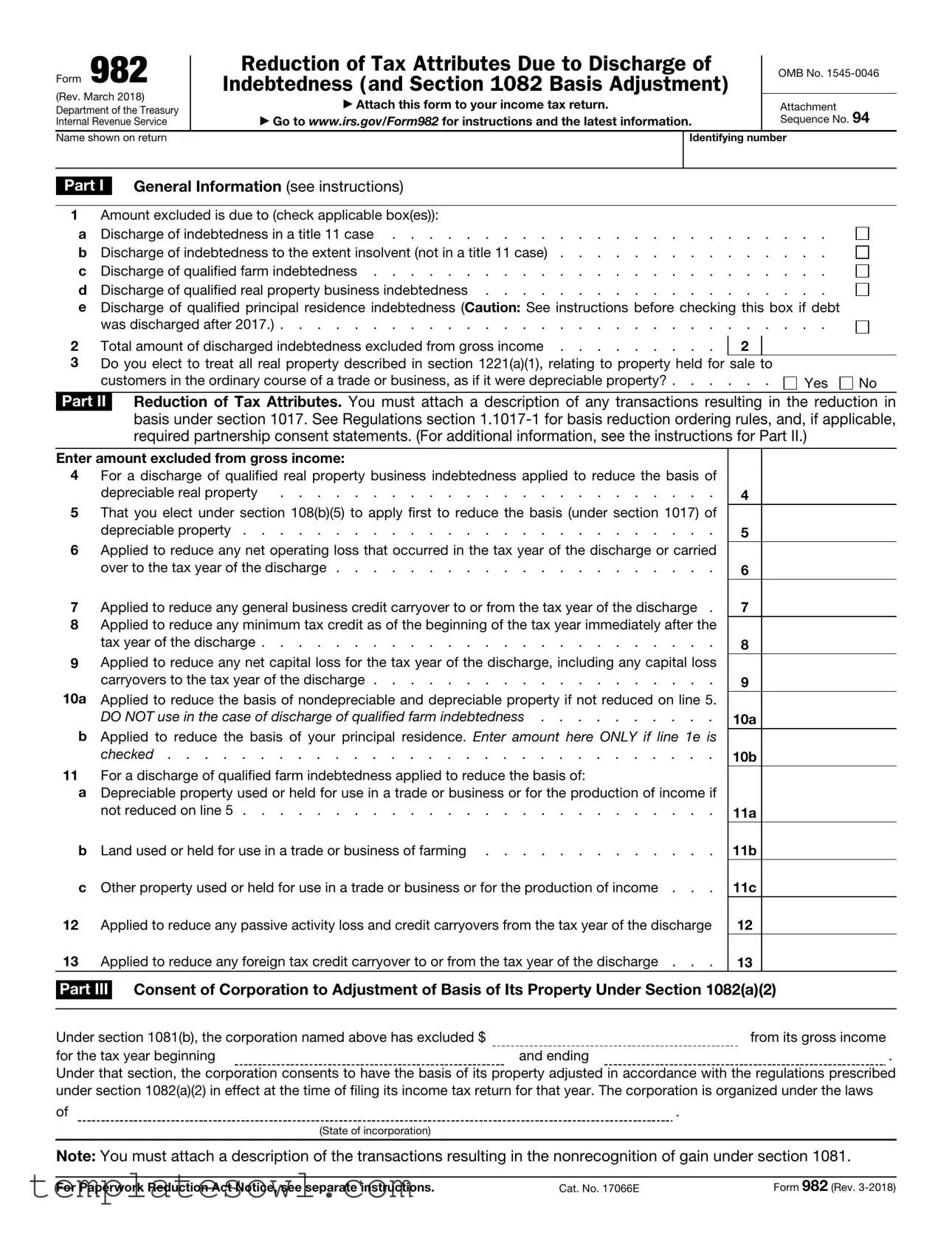

Form 982 |

|

Reduction of Tax Attributes Due to Discharge of |

|

OMB No. |

|

|

|

||||

|

Indebtedness (and Section 1082 Basis Adjustment) |

|

|

||

(Rev. March 2018) |

|

▶ Attach this form to your income tax return. |

|

Attachment |

|

Department of the Treasury |

|

|

|||

|

▶ Go to www.irs.gov/Form982 for instructions and the latest information. |

|

Sequence No. 94 |

||

Internal Revenue Service |

|

|

|||

Name shown on return |

|

|

Identifying number |

||

|

|

|

|

|

|

Part I General Information (see instructions)

1Amount excluded is due to (check applicable box(es)):

a |

Discharge of indebtedness in a title 11 case |

b |

Discharge of indebtedness to the extent insolvent (not in a title 11 case) |

c |

Discharge of qualified farm indebtedness |

d |

Discharge of qualified real property business indebtedness |

eDischarge of qualified principal residence indebtedness (Caution: See instructions before checking this box if debt

was discharged after 2017.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Total amount of discharged indebtedness excluded from gross income |

2 |

3Do you elect to treat all real property described in section 1221(a)(1), relating to property held for sale to

customers in the ordinary course of a trade or business, as if it were depreciable property? |

Yes |

No |

Part II Reduction of Tax Attributes. You must attach a description of any transactions resulting in the reduction in basis under section 1017. See Regulations section

Enter amount excluded from gross income:

4For a discharge of qualified real property business indebtedness applied to reduce the basis of

depreciable real property |

. . . . . . . . . . . . . . . . . . . . . . . . |

5That you elect under section 108(b)(5) to apply first to reduce the basis (under section 1017) of

depreciable property . . . . . . . . . . . . . . . . . . . . . . . . . .

6Applied to reduce any net operating loss that occurred in the tax year of the discharge or carried

over to the tax year of the discharge . . . . . . . . . . . . . . . . . . . . .

7 |

Applied to reduce any general business credit carryover to or from the tax year of the discharge . |

8Applied to reduce any minimum tax credit as of the beginning of the tax year immediately after the

tax year of the discharge . . . . . . . . . . . . . . . . . . . . . . . . .

9Applied to reduce any net capital loss for the tax year of the discharge, including any capital loss

carryovers to the tax year of the discharge . . . . . . . . . . . . . . . . . . .

10a Applied to reduce the basis of nondepreciable and depreciable property if not reduced on line 5. DO NOT use in the case of discharge of qualified farm indebtedness . . . . . . . . . .

bApplied to reduce the basis of your principal residence. Enter amount here ONLY if line 1e is

checked . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11For a discharge of qualified farm indebtedness applied to reduce the basis of:

aDepreciable property used or held for use in a trade or business or for the production of income if

not reduced on line 5 . . . . . . . . . . . . . . . . . . . . . . . . . .

b |

Land used or held for use in a trade or business of farming |

c |

Other property used or held for use in a trade or business or for the production of income . . . |

12Applied to reduce any passive activity loss and credit carryovers from the tax year of the discharge

13 |

Applied to reduce any foreign tax credit carryover to or from the tax year of the discharge . . . |

4

5

6

7

8

9

10a

10b

11a

11b

11c

12

13

Part III Consent of Corporation to Adjustment of Basis of Its Property Under Section 1082(a)(2)

Under section 1081(b), the corporation named above has excluded $ |

|

from its gross income |

for the tax year beginning |

and ending |

. |

Under that section, the corporation consents to have the basis of its property adjusted in accordance with the regulations prescribed under section 1082(a)(2) in effect at the time of filing its income tax return for that year. The corporation is organized under the laws

of |

. |

|

(State of incorporation) |

Note: You must attach a description of the transactions resulting in the nonrecognition of gain under section 1081.

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 17066E |

Form 982 (Rev. |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to reduce tax attributes due to the discharge of indebtedness, specifically in certain insolvency situations. |

| IRS Form Number | The official form number is 982, titled "Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment)." It's regularly updated, with the latest revision dated March 2018. |

| Submission Requirement | Taxpayers must attach Form 982 to their income tax return when they are claiming a reduction in tax attributes because of discharged debt. |

| Key Sections | The form includes multiple parts, with Part I focusing on general information about the discharge of indebtedness and Part II outlining the reduction in tax attributes. |

| Information Access | For additional guidance and the most current information, taxpayers can visit the IRS website at www.irs.gov/Form982. |

| State-Specific Law | While this form is federal, states may have specific laws regarding bankruptcy and discharge of debt, which can influence how the form is utilized. Understanding local state laws is crucial for compliance. |

Guidelines on Utilizing Irs Insolvency

Filling out the IRS Insolvency Form (Form 982) is an important step for those who have experienced a discharge of indebtedness. This form helps to reduce tax attributes due to discharge of indebtedness based on specific criteria. Below are the steps to complete the form correctly.

- Gather your tax return and any documents that support your discharge of indebtedness.

- Start with Part I: General Information. Enter the name shown on your tax return and your identifying number.

- In the first section, check the box(es) that apply to your situation regarding the discharged indebtedness.

- Provide the total amount of discharged indebtedness excluded from gross income in the designated space.

- Answer the question about whether you elect to treat real property as depreciable property. Indicate "Yes" or "No."

- Move to Part II: Reduction of Tax Attributes. Enter the amount excluded from gross income for each line item based on your financial situation. Fill out any applicable lines, such as those related to real property business indebtedness or operating losses.

- In Part III: Consent of Corporation, if applicable, fill in the amount excluded from gross income and specify the tax year. Indicate the state of incorporation as well.

- Review your entries for accuracy. Ensure all necessary attachments are included.

- Finally, sign the form and attach it to your income tax return before filing.

By following these steps, you'll efficiently complete Form 982. Make sure to stay updated with the IRS guidelines as regulations can change. Always consider consulting a tax professional if you’re unsure about the details related to your situation.

What You Should Know About This Form

What is IRS Form 982?

IRS Form 982 is used to reduce tax attributes due to the discharge of indebtedness and for section 1082 basis adjustments. It accounts for situations where a taxpayer has had debt forgiven, especially in cases of insolvency, bankruptcy, or certain qualified loans. The form must be attached to your tax return, and it helps ensure the correct amount of tax liability is reported.

Who needs to file Form 982?

Taxpayers who have had indebtedness discharged and who want to exclude that amount from their gross income should file Form 982. This includes individuals or businesses that have filed for bankruptcy under Title 11, those who are insolvent but not in bankruptcy, and those who have discharged specific types of qualified indebtedness, including certain farm or real property obligations.

How do I complete the relevant sections of the form?

To complete Form 982, identify the amount of discharged indebtedness you wish to exclude from gross income and check the applicable boxes that describe the nature of the discharge. You may also need to provide additional information regarding how the discharged amount impacts your tax attributes, such as basis reductions or operating losses, in the following sections of the form.

Where can I find additional information about completing Form 982?

Additional information and detailed instructions for completing Form 982 can be found on the IRS website at www.irs.gov/Form982. This resource provides guidance on the filing process, specific definitions, and any other requirements that may apply to your situation, ensuring that you complete the form correctly.

Common mistakes

Filling out the IRS Insolvency form, or Form 982, can be tricky. Many people make common mistakes that can lead to complications down the line. Understanding these mistakes can save time and avoid potential issues with the IRS.

One common error occurs in Section 1, where individuals must indicate the reason for excluding the amount of discharged indebtedness from gross income. People might check multiple boxes that don't apply to their situation. It’s essential to only check the applicable boxes to avoid confusion and ensure that the form accurately reflects the person's financial situation.

Another mistake often seen is in Section 2, where individuals are required to report the total amount of discharged indebtedness. Some fail to include all relevant figures or miscalculate the total amount. This oversight can lead to discrepancies and may prompt further inquiries from the IRS, resulting in delays or audits.

The form also requires a detailed description of any transactions that resulted in a reduction in basis, as per Section 1017. People sometimes neglect to provide adequate descriptions or omit the necessary documentation. This can hinder the IRS's ability to process the form correctly, potentially causing problems with tax filings.

Additionally, individuals often overlook the signature or consent requirements in Part III. Failing to sign the form or to include the necessary consents can render the form incomplete. Such mistakes can lead to rejection of the submission, meaning individuals might need to redo their paperwork, leading to delays in their tax process.

Finally, it is crucial to double-check that the form is attached to the correct income tax return before submitting it. Many make the mistake of submitting the form separately or with the wrong return. Ensuring that everything is filed together helps to keep records clear and streamlined. By paying attention to these common mistakes, individuals can navigate the IRS Insolvency form more effectively.

Documents used along the form

When filing the IRS Insolvency Form, it's important to also consider other documents that may be needed to complete the process. Collecting these forms ensures you comply with tax regulations and accurately provide all required information. Here’s a list of documents often used alongside the IRS Insolvency Form.

- Form 1040: This is your main individual income tax return form. You report your income, expenses, and calculate your taxes owed, or refund due.

- Form 1099-C: Use this form to report cancellation of debt. If a creditor forgives $600 or more of your debt, they must provide this form to you and the IRS.

- Form 982: This form reduces tax attributes due to discharge of indebtedness. Attach it with your income tax return as it relates directly to insolvency claims.

- Form 1065: If you're part of a partnership, this form is used for partnership tax reporting. Include this if the business debt is part of your tax filing.

- Schedule A: If you itemize deductions, this schedule is used for listing deductible expenses. This may include situations where debt affects your itemized deductions.

- Schedule C: This form is for reporting income or loss from business activities. If personal debts involve business income, include this form.

- Form 8862: If you've lost certain tax credits due to debt cancellation, this form helps you reapply for those credits after the necessary waiting period.

- Form 8889: This form is for Health Savings Account (HSA) reporting. If debts relate to medical expenses covered by HSA, you'll need this document.

- Schedule D: This schedule reports capital gains and losses. If your discharged debt impacts your investments, it may be necessary to file this.

- Form 4506-T: Use this form to request a transcript of your tax return. This can be helpful if you need a record of past filings to support your insolvency claim.

These documents play a crucial role in accurately reporting your financial situation to the IRS. Ensuring you have all the necessary forms completed and submitted can help streamline the process and reduce complications in managing your taxes.

Similar forms

- Form 1040: This is the standard individual income tax return form in the U.S. Both Form 982 and Form 1040 are used together to report various income adjustments, such as exclusions from gross income due to discharged debts.

- Form 1099-C: A cancellation of debt form that lenders must file when they forgive a debt. Similar to Form 982, it pertains to the exclusion of discharged debt from gross income.

- Form 6251: This form is used for calculating the alternative minimum tax (AMT) and can reflect adjustments from excluded income such as discharged indebtedness. Both forms aim to adjust taxable income.

- Form 6781: This form deals with gains and losses from Section 1256 contracts and straddles. It shares with Form 982 the function of adjusting taxable income but focuses on different types of financial instruments.

- Form 4797: Used to report the sale of business property, it can involve adjusted basis computations similar to those in Form 982. Both forms handle the tax implications of property transactions.

- Form 8862: This form is used to claim a tax credit after having been denied previously. While primarily focused on credits, it similarly addresses adjustments to taxable income from specific circumstances.

Dos and Don'ts

When filling out the IRS Insolvency Form 982, there are important guidelines to follow. Below is a list of recommended actions and those to avoid.

- Do ensure that you attach Form 982 to your income tax return.

- Do accurately check all applicable boxes regarding the discharge of indebtedness.

- Do provide the total amount of discharged indebtedness clearly in the designated space.

- Do include a detailed description of any transactions that result in a reduction in basis under section 1017.

- Do carefully review the instructions on the IRS website for the most current information.

- Do consider consulting with a tax professional to ensure accuracy.

- Don't neglect to read the instructions provided with the form before filling it out.

- Don't leave any sections unanswered unless specifically indicated as optional.

- Don't submit the form without checking for errors or missing information.

- Don't forget to double-check the year of discharge before stating it on the form.

- Don't assume that previous years’ filings will suffice; each year’s form must be independently completed.

- Don't overlook the implications of adjustments to your tax attributes; understand their impact on your future tax liabilities.

Misconceptions

- Only businesses need to use form 982. Many individuals who experience debt discharge, such as a mortgage or personal loan, can also use this form to report their insolvency situation. It’s not exclusively for corporations.

- If I file form 982, I won’t owe taxes anymore. Filing the form doesn’t automatically eliminate all tax liabilities. It only helps report excluded income due to discharged debts and adjusts tax attributes accordingly.

- Discharge of debts means I can't claim any deductions. While some deductions may be reduced, many taxpayers still qualify for various deductions even after discharging debts. It’s essential to understand which deductions are impacted and how.

- The form 982 is the same as filing bankruptcy. Form 982 is used in specific situations of debt discharge and insolvency. Bankruptcy is a legal process that can involve various forms, including but not limited to form 982.

- Filing the form guarantees an audit. While the IRS can always audit returns, filing form 982 alone does not trigger an audit. Behaving transparently and following IRS guidelines reduces audit risks.

- I'm not eligible for form 982 if my debt was small. Even if the debt discharged is minor, you can still file form 982 if it meets the requirements regarding insolvency and type of discharged debt.

- The form only applies to mortgage debt. Form 982 is applicable to various types of debt, including personal loans, credit cards, and even certain business debts. It’s about the discharge and your financial situation, not just mortgages.

- Once I submit the form, I don't need to keep records. You must maintain documentation supporting the insolvency claim and any debts discharged. Proper records are essential for potential future IRS inquiries.

- Using form 982 will hurt my credit score. While discharging debt can affect your credit, using form 982 itself won’t impact your score. It’s crucial to understand how different factors contribute to your credit rating.

- I can ignore the instructions for form 982. Ignoring the instructions can lead to mistakes in filing. Carefully following the instructions is vital for ensuring your form is completed correctly and accepted by the IRS.

Key takeaways

Filling out the IRS Insolvency Form (Form 982) requires careful attention to detail. Here are the key takeaways to keep in mind:

- Attach the Form: Always attach Form 982 to your income tax return. This ensures that the IRS can properly process your request.

- Know the Purpose: This form is used to reduce tax attributes due to the discharge of indebtedness, particularly if you are insolvent or have filed for bankruptcy.

- Discharge Types: Clearly indicate the reason for the discharge of indebtedness by checking the appropriate boxes for options such as Title 11, qualified farm debt, or principal residence debt.

- Report Discharge Amount: Accurately report the total amount of discharged indebtedness on the form. This figure must be excluded from your gross income.

- Election on Real Property: Decide if you want to treat all real property as depreciable. Mark “Yes” or “No” based on your situation.

- Details on Reductions: Provide a description of transactions that resulted in basis reductions, particularly when dealing with depreciable property.

- Be Aware of Limitations: Carefully read the instructions for each line item to understand any limitations, especially if your discharge involves property used in a business.

- Double-Check for Accuracy: Review all entries before submission to avoid mistakes that could lead to delays or issues with your tax return.

- Understand Consequences: Know that reducing your tax attributes could have future tax implications. Consider consulting a tax professional for guidance.

- Use the Latest Instructions: Always refer to the most recent instructions available on the IRS website to ensure compliance with current regulations.

By keeping these takeaways in mind, you can navigate Form 982 more effectively and ensure you meet your reporting obligations accurately.

Browse Other Templates

E10 Form - The Lc 3437 12 must be filed in the appropriate California superior court for valid processing.

Chabot College Transcript - The form is crucial for maintaining accurate academic records.

I 131 Form - An applicant’s acknowledgment of cardholder obligations is part of the agreement.