Fill Out Your Isf Form

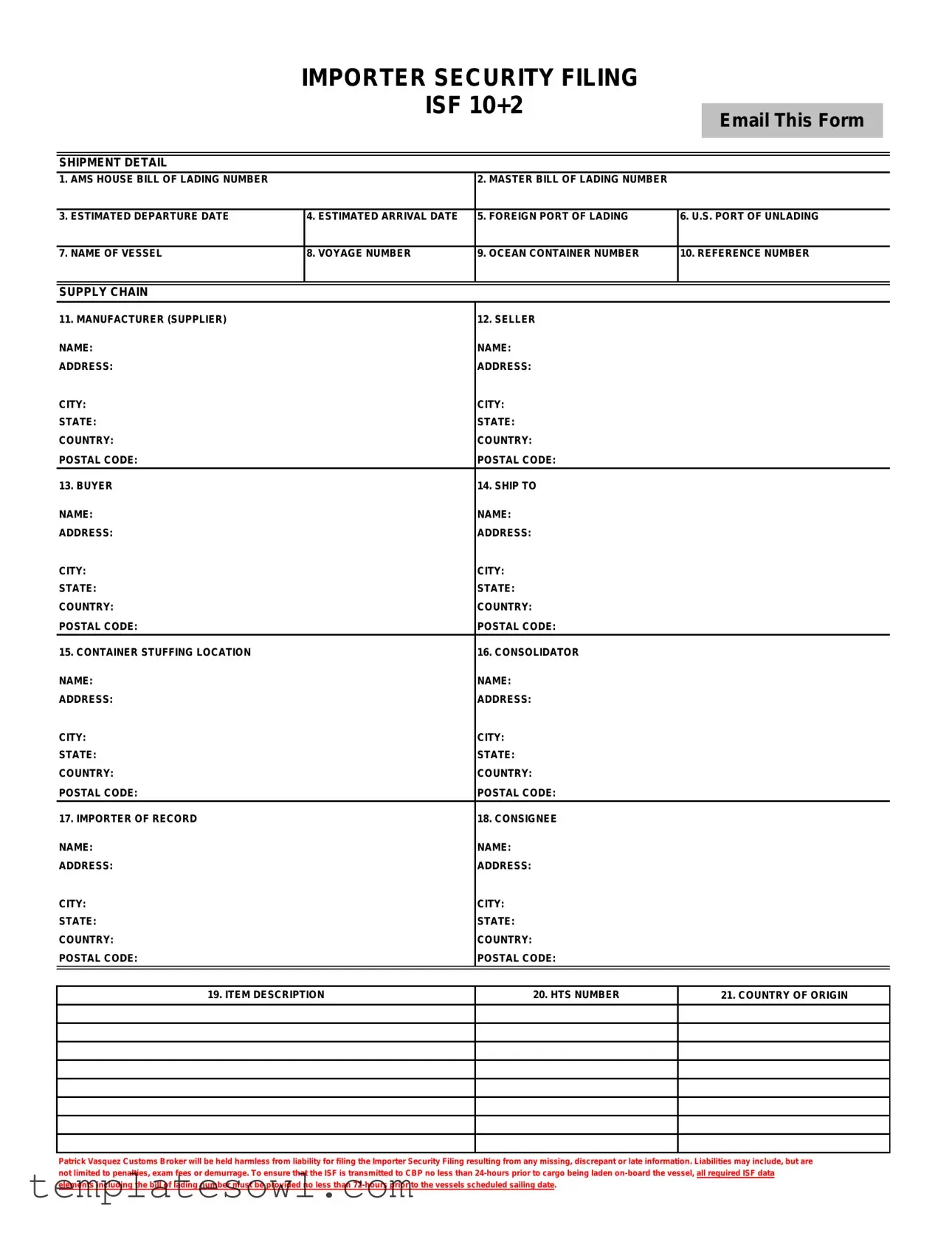

The Importer Security Filing, commonly referred to as ISF 10+2, is a crucial document that ensures compliance with U.S. Customs and Border Protection (CBP) regulations. This form plays a significant role in the safety and security of international trade by requiring essential shipment and supply chain details from importers before cargo is shipped to the United States. Key aspects of the ISF include the AMS House Bill of Lading number, estimated departure and arrival dates, as well as the names and addresses of manufacturers, sellers, buyers, and consignees. It's vital to provide details about the vessel, container number, and the items being imported, including their origin and HTS numbers. This form must be submitted at least 24 hours prior to the cargo loading onto the vessel, which means all relevant information should ideally be gathered and transmitted no less than 72 hours before the sailing date. Failure to comply can lead to penalties or delays, so proper attention to detailing each section is crucial for a smooth import process.

Isf Example

IMPORTER SECURITY FILING

|

ISF 10+2 |

|

|

|

|

|

|

Email This Form |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHIPMENT DETAIL |

|

|

|

|

|

1. AMS HOUSE BILL OF LADING NUMBER |

|

2. MASTER BILL OF LADING NUMBER |

|

|

|

|

|

|

|

|

|

3. ESTIMATED DEPARTURE DATE |

4. ESTIMATED ARRIVAL DATE |

5. FOREIGN PORT OF LADING |

6. U.S. PORT OF UNLADING |

||

|

|

|

|

|

|

7. NAME OF VESSEL |

8. VOYAGE NUMBER |

9. OCEAN CONTAINER NUMBER |

10. REFERENCE NUMBER |

||

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLY CHAIN |

|

|

|

|

|

11. MANUFACTURER (SUPPLIER) |

|

12. SELLER |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

13. BUYER |

|

14. SHIP TO |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

15. CONTAINER STUFFING LOCATION |

|

16. CONSOLIDATOR |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

17. IMPORTER OF RECORD |

|

18. CONSIGNEE |

|

|

|

NAME: |

|

NAME: |

|

|

|

ADDRESS: |

|

ADDRESS: |

|

|

|

CITY: |

|

CITY: |

|

|

|

STATE: |

|

STATE: |

|

|

|

COUNTRY: |

|

COUNTRY: |

|

|

|

POSTAL CODE: |

|

POSTAL CODE: |

|

|

|

|

|

|

|

|

|

19. ITEM DESCRIPTION

20. HTS NUMBER

21. COUNTRY OF ORIGIN

Patrick Vasquez Customs Broker will be held harmless from liability for filing the Importer Security Filing resulting from any missing, discrepant or late information. Liabilities may include, but are

not limited to penalties, exam fees or demurrage. To ensure that the ISF is transmitted to CBP no less than

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Importer Security Filing (ISF) ensures that U.S. Customs and Border Protection (CBP) has necessary information about a cargo shipment before it arrives in the country. |

| Filing Deadline | The ISF should be submitted no less than 24 hours before the cargo is loaded on the vessel, and all required data must be provided at least 72 hours prior to the scheduled sailing date. |

| Key Information Required | Important details include the AMS House Bill of Lading number, estimated departure and arrival dates, foreign port of lading, and U.S. port of unlading. |

| Liability Disclaimer | Patrick Vasquez Customs Broker is not liable for any issues arising from missing, incorrect, or late information submitted in the ISF. |

| Governing Law | The ISF process is governed by U.S. law, particularly regulations set forth by U.S. Customs and Border Protection. |

| Consequences of Non-compliance | Filing penalties and fees may be incurred for failing to meet ISF requirements, which may include exam fees or demurrage costs. |

Guidelines on Utilizing Isf

Completing the Importer Security Filing (ISF) form is crucial for timely cargo processing and compliance. This step-by-step guide will help ensure you provide all necessary information accurately and efficiently.

- Enter Shipment Details: Start by filling in the following fields:

- AMS House Bill of Lading Number

- Master Bill of Lading Number

- Estimated Departure Date

- Estimated Arrival Date

- Foreign Port of Lading

- U.S. Port of Unlading

- Name of Vessel

- Voyage Number

- Ocean Container Number

- Reference Number

- Provide Supply Chain Information: Fill in details regarding the following parties:

- Manufacturer (Supplier)

- Seller (include name, address, city, state, country, postal code)

- Buyer

- Ship To Location (include name, address, city, state, country, postal code)

- Container Stuffing Location

- Consolidator (include name, address, city, state, country, postal code)

- Importer of Record

- Consignee (include name, address, city, state, country, postal code)

- Detail Item Information: Complete the last section by specifying:

- Item Description

- HTS Number

- Country of Origin

Once you have filled out all sections of the ISF form, double-check for accuracy to avoid potential penalties or delays. Remember, it must be submitted at least 24 hours before your cargo is loaded onto the ship, ideally aiming for 72 hours in advance for smooth processing. This proactive approach will help you meet compliance obligations and mitigate risks associated with shipping.

What You Should Know About This Form

What is the Importer Security Filing (ISF) form?

The Importer Security Filing (ISF) form, often referred to as ISF 10+2, is a document required by U.S. Customs and Border Protection (CBP). It provides advance information about cargo entering the United States. This filing aims to enhance the security of the international supply chain and ensure that cargo does not pose a risk to U.S. safety and security. The ISF must be filed no less than 24 hours prior to the shipment being loaded onto the vessel.

What details are required in the ISF form?

The ISF form requests several key pieces of information that fall into two categories. The first category, often referred to as the "10," requires details such as the AMS house bill of lading number, master bill of lading number, estimated departure and arrival dates, foreign port of lading, U.S. port of unlading, name of vessel, voyage number, ocean container number, and reference number. The second category, or the "2," includes information about the manufacturer, seller, buyer, ship-to party, container stuffing location, consolidator, importer of record, consignee, item description, HTS number, and country of origin.

Who is responsible for filing the ISF?

What happens if the ISF is filed late or inaccurately?

If the ISF is submitted late or contains discrepancies, several consequences can arise. Importers may face penalties from CBP, such as fines or fees. Additionally, late filings can result in increased scrutiny of shipments, leading to examination fees or demurrage costs. Ultimately, accurate and timely submission of the ISF is crucial to avoid these potential liabilities.

When should the ISF be filed?

The filing process should ideally take place well before the cargo is loaded onto the vessel. The required ISF data elements must be provided at least 72 hours prior to the ship’s scheduled sailing date. This timeline allows for any necessary adjustments and ensures that the information is transmitted to CBP at least 24 hours before departure.

What should an importer include as part of the item description on the ISF?

The item description on the ISF form must be clear and detailed enough to identify the merchandise being shipped. This might include the product type, material composition, and any specific features that differentiate it from other items. A well-defined item description can facilitate smoother processing and customs review.

Is there a specific format for the HTS number?

Yes, the Harmonized Tariff Schedule (HTS) number requires a specific format consisting of at least 10 digits. This number is essential for classification purposes and helps determine the tariffs and duties that may apply to the imported cargo. Accurate HTS numbers ensure compliance with trade regulations.

What information is needed for the 'Importer of Record' section?

For the 'Importer of Record,' the ISF form requires the name, address, city, state, country, and postal code of the entity or individual responsible for ensuring compliance with customs regulations. This includes all obligations related to the importation of goods, including payment of duties and taxes.

What is the role of the customs broker regarding the ISF?

A customs broker like Patrick Vasquez can assist importers in preparing and submitting the ISF form accurately and on time. They provide expertise in navigating the complexities of customs regulations and can help ensure that all required information is included. However, it's important to note that while a customs broker can file the ISF, the ultimate responsibility remains with the importer.

Can I amend the ISF after it has been filed?

Yes, amendments can be made to the ISF if new information comes to light or if errors are discovered after submission. However, it is crucial to make these amendments as soon as possible to avoid potential penalties. Importers should work closely with their customs broker to ensure that all updates are addressed promptly and accurately.

Common mistakes

Completing the Importer Security Filing (ISF) form accurately is crucial for a smooth shipping process. However, many individuals encounter common pitfalls that can lead to delays or penalties. One frequent error is entering incorrect information for the AMS House Bill of Lading Number. This critical identifier must match the documents provided by the carrier. Mistakes in this field are easy to overlook but can create significant complications.

Another common mistake involves neglecting to include the estimated departure and arrival dates. These dates are necessary for not only the shipping process but also for compliance with U.S. Customs and Border Protection (CBP) regulations. Failing to provide accurate timing can lead to automatic fines.

Accurate detail regarding the foreign port of lading is essential. People often fill in this section with general information rather than the specific port used. Such inaccuracies can compound issues down the line, especially if a shipment is held for inspection.

Omitting information regarding the vessel name or voyage number can also derail the filing process. Each vessel and voyage provides unique identifiers in the logistics chain. These elements should always be double-checked for accuracy and completeness.

In the Supply Chain section, incorrect or incomplete addresses for the manufacturer or supplier can lead to confusion. Clear and specific addresses, including postal codes, help streamline the verification process and ensure compliance with regulations.

Another common error occurs in providing details for the buyer and ship-to address. These addresses should be distinct and accurate, reflecting where the goods will ultimately be delivered. Inconsistent information can result in delays in processing.

It is important not to overlook the container stuffing location. Failing to provide this detail, or providing vague information, may limit the ability of customs officials to track the shipment, thus resulting in increased scrutiny.

People often forget to fill out the importer of record and consignee information completely. Clear separation of these roles is vital, as it helps customs officials identify the responsible parties in the transaction.

Lastly, errors in the item description and the HTS number can cause significant issues. Each product must be accurately described, and the correct HTS number should be provided to avoid misclassification and potential penalties. Attention to detail is essential; a small oversight can lead to substantial fines and delays in the shipment.

Documents used along the form

The Importer Security Filing (ISF) is a crucial document in international shipping, helping to enhance U.S. security by providing detailed information about cargo before it arrives in the country. Several other forms and documents often accompany the ISF to ensure compliance with regulations and facilitate smooth customs processing. Below are four commonly used documents that complement the ISF.

- Bill of Lading: This document acts as a contract between the shipper and the carrier. It details the type, quantity, and destination of the goods being shipped. The bill of lading is essential for the payment and delivery of goods, serving as proof of ownership.

- Commercial Invoice: This invoice outlines the transaction between the buyer and the seller, detailing the products, quantities, prices, and terms of sale. It is pivotal for customs clearance, as it provides the necessary information to assess duties and taxes on imported goods.

- SDA (Shipper’s Declaration of Dangerous Goods): If the cargo includes hazardous materials, a Shipper’s Declaration of Dangerous Goods is required. This document provides vital information about the nature of the goods, including handling instructions and safety measures to be taken during transport.

- Customs Bond: A customs bond is a contract ensuring that duties, taxes, and penalties owed to Customs will be paid. This document is critical for companies that import goods into the U.S., as it protects the government from revenue loss and enables registered importers to take possession of their cargo.

Having these forms organized and readily available alongside the ISF declaration streamlines the importation process and helps avoid potential delays. Each document plays a vital role in ensuring compliance with U.S. customs regulations, facilitating smooth international trade.

Similar forms

The Importer Security Filing (ISF) is a critical document in international shipping, particularly for those importing goods into the United States. It has several similarities with other important shipping and customs documents. Below are seven documents that share characteristics with the ISF form:

- Bill of Lading: This document serves as a contract between the shipper and carrier. Like the ISF, it contains essential shipment details, including container numbers and destination information.

- Manifest: A manifest outlines all cargo loaded on a vessel, similar to how the ISF summarizes shipment data. Both are crucial for customs clearance and tracking shipments.

- Customs Declaration: This form provides detailed information about goods being imported. The ISF requires much of the same information for Customs and Border Protection (CBP) compliance.

- Import License: While the ISF focuses on security and data submission, an import license authorizes the importer to bring goods into the country, necessitating some of the same information found on the ISF.

- Export Declaration: Functioning as a counterpart to the import process, an export declaration requires similar data elements, ensuring information consistency across shipment documents.

- Air Waybill: This document is used in air freight shipments. Much like the ISF, it contains vital shipment details, including consignor and consignee information.

- Entry Summary (CBP Form 7501): The Entry Summary is completed after goods arrive in the U.S. and provides many of the same data points as the ISF, ensuring smooth processing through customs.

Understanding these documents and their connections to the ISF can help ensure compliance and streamline the importing process.

Dos and Don'ts

When filling out the Importer Security Filing (ISF) form, it is essential to follow certain best practices to avoid delays and complications. Here are five recommendations to consider.

- Do ensure all details are accurate. Double-check the AMS House Bill of Lading number and the Master Bill of Lading number to prevent discrepancies.

- Do submit the ISF no later than 72 hours before the vessel’s scheduled sailing date. This timeframe allows Customs and Border Protection (CBP) adequate time to process the filing.

- Do include a complete shipping address for all relevant parties, such as the seller and consignee. Missing information may result in delays or additional scrutiny.

- Do provide comprehensive item descriptions. Clear descriptions help CBP verify the contents of your shipment and facilitate a smoother inspection process.

- Do keep records of submitted filings. Documentation can protect you in case of disputes or questions from CBP.

In addition to best practices, certain actions should be avoided when completing the ISF form. Here are five things not to do.

- Don't wait until the last minute to complete the form. Procrastination can lead to rushed entries and potential errors.

- Don't omit any required data fields. Missing details can lead to penalties or delays in cargo processing.

- Don't underestimate the importance of the HTS Number and Country of Origin. Incorrect data in these fields can lead to legal complications.

- Don't neglect to consult with a customs broker if uncertainties arise. Expert advice can ensure compliance with regulations.

- Don't ignore potential consequences of discrepancies. Understand that penalties, exam fees, and demurrage can result from incomplete or inaccurate filings.

Misconceptions

There are several misconceptions about the Importer Security Filing (ISF) form. Understanding these can help ensure compliance and avoid unnecessary penalties. Here are seven common myths:

- Myth 1: The ISF only needs to be filed once.

- Myth 2: Filing the ISF is the same as filing customs documentation.

- Myth 3: Importers have unlimited time to file the ISF.

- Myth 4: You can submit the ISF even if all the information is not complete.

- Myth 5: Only the importer has to worry about ISF obligations.

- Myth 6: The penalty for a late ISF is small.

- Myth 7: If a customs broker files the ISF, the importer holds no responsibility.

Reality: The ISF must be submitted for each shipment. Each import requires its own ISF to ensure accurate tracking and security.

Reality: The ISF is a specific filing focused on security information. It complements customs documentation but is not a substitute.

Reality: The ISF must be filed at least 24 hours before the cargo is loaded onto the vessel. It's best to provide required data elements at least 72 hours before sailing.

Reality: Incomplete ISF submissions can lead to penalties. Ensure all required data elements, including the bill of lading number, are accurately filled out.

Reality: All parties in the supply chain, including the seller and manufacturer, should provide accurate information for the ISF.

Reality: Penalties can be substantial and may include fines, exam fees, or demurrage charges. Compliance is crucial to avoid these costs.

Reality: Responsibility ultimately lies with the importer. The broker can file the ISF, but the importer must ensure that all information is accurate and complete.

Key takeaways

Here are some key takeaways regarding the Importer Security Filing (ISF) form:

- Timely Submission: The ISF must be transmitted to CBP at least 24 hours before cargo is loaded onto the vessel.

- Preparation Time: All required ISF data elements, including the bill of lading number, should be provided at least 72 hours prior to the vessel's scheduled sailing date.

- Accurate Information: Ensure all details, such as addresses and names, are accurate to prevent discrepancies.

- Complete Data: All 10+2 data elements including shipment detail and supply chain information must be included on the form.

- Legal Responsibility: Incorrect or late submissions could result in penalties, examination fees, or demurrage costs.

- Importer of Record: Clearly identify the importer of record on the form to clarify responsibility.

- Consignee Details: Include complete consignee information, as it is crucial for customs processing.

- Item Description: Provide a detailed description of the items being imported for accurate classification.

- HTS Number: Ensure to include the Harmonized Tariff Schedule (HTS) number for better compliance and duty assessment.

- Liability Waiver: Note that Patrick Vasquez Customs Broker will not be liable for penalties resulting from any missing or incorrect information in the ISF.

Browse Other Templates

Prescription Fax Submission,Medication Order Fax Sheet,Cataramaran Rx Order Form,Cataramaran Medication Request Form,Prescription Transmission Form,Patient Prescription Fax Sheet,Cataramaran Rx Fax Application,Medication Requisition Fax,Cataramaran P - This form requires detailed information about the prescriber.

Cms 100 Form - Discover how completing a circuit is key to the functioning of electrical devices.