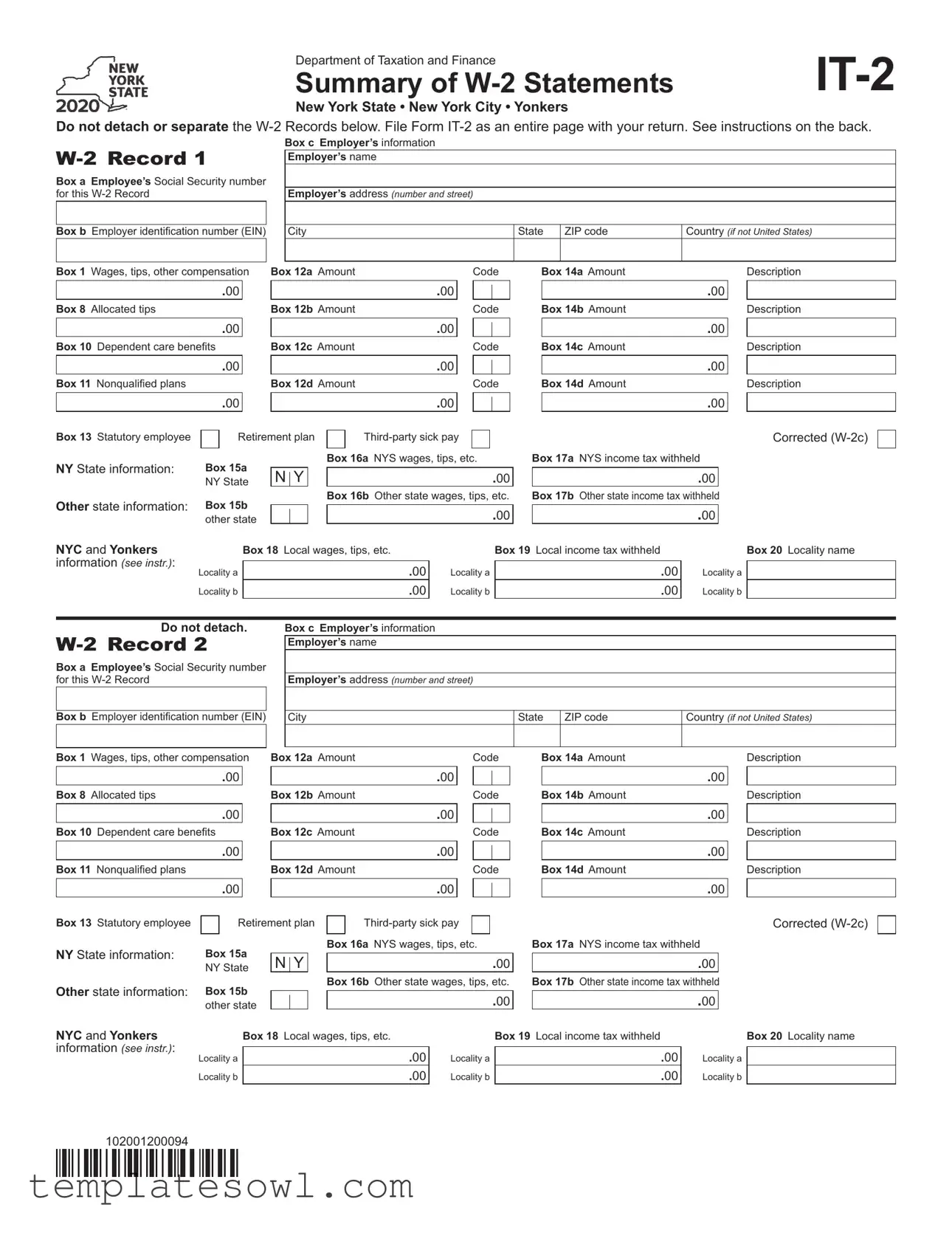

Fill Out Your It 2 Form

The IT-2 form plays a crucial role in the tax filing process for New York State residents. It serves as a summary of W-2 statements, helping taxpayers accurately report their income and withholdings from multiple employers. Understanding the IT-2 is vital, especially for individuals who have received federal Form W-2s, whether for traditional employment or foreign earned income. The form requires specific information from your W-2 records, including your employer's details, your wages, tips, and any allocated tips you may have received. Additionally, it captures important tax information such as amounts withheld for state and local taxes, making it an essential component for ensuring compliance with NYS tax obligations. If you file jointly with a spouse, the form must reflect each of your W-2s as well. All entries must be complete, using whole dollar amounts, creating a clear record of your earnings and tax contributions. Accessible instructions guide users in accurately filling out each section, ensuring that all necessary details are captured and submitted with your income tax return. Remember, completing your IT-2 accurately can streamline your tax experience, aiding in a smooth filing process and avoiding potential discrepancies with your state tax return.

It 2 Example

Department of Taxation and Finance

Summary of

New York State • New York City • Yonkers

Do not detach or separate the

Box a Employee’s Social Security number for this

Box c Employer’s information Employer’s name

Employer’s address (number and street)

Box b Employer identification number (EIN)

City

State

ZIP code

Country (if not United States)

Box 1 Wages, tips, other compensation |

Box 12a Amount |

Code |

Box 14a Amount |

Description |

.00

Box 8 Allocated tips

|

.00 |

|

|

|

Box 12b Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14b Amount |

|

|

Description |

.00

Box 10 Dependent care benefits

.00

Box 11 Nonqualified plans

|

.00 |

|

|

|

Box 12c Amount |

|

|

Code |

|

|

.00 |

|

|

|

Box 12d Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14c Amount |

|

|

Description |

|

.00 |

|

|

Box 14d Amount |

|

|

Description |

|

.00 |

|

|

|

|

.00 |

|

|

|

|

||

Box 13 Statutory employee |

|

Retirement plan |

|

|

|

|

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

NY State information: |

Box 15a |

|

|

|

Box 16a NYS wages, tips, etc. |

|||||||

|

NY State |

N |

Y |

|

.00 |

|||||||

Other state information: |

Box 15b |

|

|

|

Box 16b Other state wages, tips, etc. |

|||||||

|

other state |

|

|

|

.00 |

|||||||

.00

Corrected

Box 17a NYS income tax withheld

.00

Box 17b Other state income tax withheld

.00

NYC and Yonkers information (see instr.):

Locality a

Locality b

Box 18 Local wages, tips, etc.

.00

.00

Locality a

Locality b

Box 19 Local income tax withheld

.00

.00

Box 20 Locality name

Locality a

Locality b

Do not detach.

Box a Employee’s Social Security number for this

Box c Employer’s information Employer’s name

Employer’s address (number and street)

Box b Employer identification number (EIN)

City

State

ZIP code

Country (if not United States)

Box 1 Wages, tips, other compensation |

Box 12a Amount |

Code |

Box 14a Amount |

Description |

.00

Box 8 Allocated tips

.00

Box 10 Dependent care benefits

|

.00 |

|

|

|

Box 12b Amount |

|

|

Code |

|

|

.00 |

|

|

|

Box 12c Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14b Amount |

|

|

Description |

|

.00 |

|

|

Box 14c Amount |

|

|

Description |

.00

Box 11 Nonqualified plans

|

.00 |

|

|

|

Box 12d Amount |

|

|

Code |

|

|

.00 |

|

|

Box 14d Amount |

|

|

Description |

|

.00 |

|

|

|

|

.00 |

|

|

|

|

||

Box 13 Statutory employee |

|

Retirement plan |

|

|

|

|

||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

NY State information: |

Box 15a |

|

|

|

Box 16a NYS wages, tips, etc. |

|||||||

|

NY State |

N |

Y |

|

.00 |

|||||||

Other state information: |

Box 15b |

|

|

|

Box 16b Other state wages, tips, etc. |

|||||||

|

other state |

|

|

|

.00 |

|||||||

.00

Corrected

Box 17a NYS income tax withheld

.00

Box 17b Other state income tax withheld

.00

NYC and Yonkers information (see instr.):

Locality a

Locality b

Box 18 Local wages, tips, etc.

.00

.00

Locality a

Locality b

Box 19 Local income tax withheld

.00

.00

Box 20 Locality name

Locality a

Locality b

102001200094

Instructions

General instructions

Who must file this form – You must complete Form

tax return and you received federal Form(s)

If you received foreign earned income but did not receive a federal Form

Specific instructions

How to complete each

Multiple

Entering whole dollar amounts – When entering amounts, enter whole dollar amounts only (zeros have been preprinted). Use the following rounding rules when entering your amounts; drop amounts below 50 cents and increase amounts from 50 to 99 cents to the next dollar. For example, $1.39 becomes $1 and $2.50 becomes $3.

Enter in box a your entire

Box 1 – Enter federal wages, tips, and other compensation shown in Box 1 of federal Form

Boxes 8, 10, and 11 – If applicable, enter the amounts from federal Form

Boxes 12a through 12d – Enter the amount(s) and code(s), if any, shown in the corresponding boxes on federal Form

Box 13 – If your federal Form

Corrected

Boxes 14a through 14d – Enter the amount(s) and description(s), if any, shown in box 14 of federal Form

Boxes 15a through 17a (NYS only) – Complete only for New York State wage and withholding information (the corresponding box 15a has been prefilled with NY). Enter in box 16a the New York State wages exactly as reported on federal Form

Boxes 15b through 17b (Other state information) – If the federal Form

Boxes 18 through 20 (NYC or Yonkers only) – Complete the locality boxes 18 through 20 only for NYC or Yonkers (or both) wages and withholding, if reported on federal Form

Transfer the tax withheld amounts to your income tax return. Include the total NYS tax withheld amounts, the total NYC tax withheld amounts, and the total Yonkers tax withheld amounts from all your Form(s)

•NYS tax withheld – Include on Form

•NYC tax withheld – Include on Form

•Yonkers tax withheld – Include on Form

Submit Form(s)

102002200094

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The IT-2 form summarizes W-2 statements for taxpayers filing a New York State income tax return. |

| Filing Requirement | This form must be completed if you received federal W-2 forms, even if no New York State wages or taxes were reported. |

| Multiple Records | Each W-2 form requires a separate W-2 Record section on the IT-2 form. |

| Foreign Income | If you had foreign earned income but did not receive a W-2, you must still complete the IT-2 form. |

| Instructions Access | Detailed instructions for completing the IT-2 form can be found on its back page. |

| Local Tax Reporting | For taxpayers in NYC or Yonkers, local wages and tax withheld must be reported in specific boxes on the form. |

| Correction of W-2s | If using a corrected W-2 (W-2c), mark the appropriate box on the IT-2 and provide corrected information. |

| Tax Computation | Include totals for NYS, NYC, and Yonkers taxes withheld on proper lines of your income tax return. |

| Governing Law | The IT-2 form is governed by the New York State Department of Taxation and Finance regulations. |

Guidelines on Utilizing It 2

Completing the IT-2 form is an essential step when filing your New York State income tax return. This form summarizes your W-2 statements, providing the New York State Department of Taxation and Finance with necessary information regarding your income and withholdings. Below is a clear, structured approach to help you through the process of filling out the IT-2 form.

- Begin by gathering all your federal Form W-2s that report your income and taxes withheld.

- In Box a, enter your Social Security number as it appears on your federal W-2.

- Fill in Box b with your employer's identification number (EIN).

- In Box c, provide your employer's name and address, including ZIP code.

- In Box 1, input your federal wages, tips, and other compensation as reported on your W-2.

- Enter amounts in Box 8, Box 10, and Box 11 if applicable, for allocated tips, dependent care benefits, and nonqualified plans, as shown on your W-2.

- Complete Boxes 12a-12d with any amounts and corresponding codes as per your W-2.

- If necessary, check Box 13 for any applicable status such as statutory employee or retirement plan.

- If your W-2 is a corrected version, mark Box 13 appropriately.

- For any amounts listed under Boxes 14a-14d, fill those in as described on your W-2.

- In Boxes 15a-17a, enter the New York State wages and taxes withheld, ensuring to input the figures exactly as in W-2.

- Complete Boxes 15b-17b for any wages and withholdings from states other than New York.

- If applicable, fill Boxes 18-20 with figures for NYC or Yonkers wages and local taxes.

- After verifying that all information is correct, submit the entire IT-2 form with your New York State income tax return, keeping a copy for your records.

What You Should Know About This Form

What is the purpose of the IT-2 form?

The IT-2 form, also known as the Summary of W-2 Statements, is required for individuals filing a New York State (NYS) income tax return. This form summarizes the information from Federal W-2 forms, which report an employee's wages and the taxes withheld from their paycheck. By submitting the IT-2 form, you ensure that the New York tax authorities have a comprehensive view of your income and taxes paid. It's essential to include this form when you file your NYS return to accurately reflect your earnings and withholding information.

Who needs to file the IT-2 form?

You must complete the IT-2 form if you are filing a NYS income tax return and received one or more federal Form W-2s. This requirement applies even if the W-2 does not display any New York, New York City (NYC), or Yonkers wages or withheld taxes. If you received foreign earned income, but have not received a federal Form W-2, you are still obligated to complete the IT-2 form to report that income.

How do I complete the IT-2 form?

To complete the IT-2 form, you need to fill out one W-2 Record section for each federal Form W-2 you received. Each box on the IT-2 corresponds to the similarly numbered boxes on the federal W-2. Carefully enter the information from your federal Form W-2 into the appropriate boxes on the IT-2. If you received more than four amounts in certain boxes, additional W-2 Record sections must be completed. Make sure to review all entries for accuracy before submitting.

What if I have W-2C forms?

If you have received a W-2C, which is a corrected W-2, you will need to indicate this on the IT-2 form. Mark the corrected box on the W-2 Record and fill in the corrected information as provided on the W-2C. It is important to include both the corrected W-2 information and any additional details as required in the other boxes on the form.

How do I file the IT-2 form with my tax return?

When you file your New York State income tax return, include the completed IT-2 as a full page; do not separate any W-2 Records from it. You do not need to send your federal W-2 forms with your tax return; instead, keep them for your records. Be sure to verify that the W-2 information aligns with your NYS income tax return and enter the relevant tax withheld amounts in the designated lines of your income tax form.

Common mistakes

Completing the IT-2 form can be straightforward, but there are common mistakes that people often make. One frequent error is failing to include all necessary W-2 records. Each federal Form W-2 requires a corresponding section on the IT-2, even if there is no New York-specific information. Neglecting to complete every W-2 Record can lead to complications with tax processing.

Another mistake involves incorrectly entering the Social Security number. It is essential to ensure that the entire 9-digit Social Security number is accurate and complete. Omitting or misplacing a single digit can cause significant delays or issues with your filing.

Many individuals neglect to fill out the employer information correctly. Boxes b and c should reflect the Employer Identification Number (EIN) and the employer's name and address as shown on the federal Form W-2. Inaccuracies here can result in further inquiries from tax authorities.

Equally important is entering the right amounts in the corresponding boxes. For example, forgetting to include wages or omitting codes for specific benefits can misrepresent one's taxable income. Always refer back to the federal Form W-2 to ensure that the amounts entered in boxes 1 through 20 are precise and match correctly.

Another common oversight involves reporting amounts in the wrong format. It is vital that only whole dollar amounts are used. Cents and decimals should be dropped or rounded according to the provided rules. Miscalculating or misrepresenting these amounts can lead to confusion during tax calculations.

Some filers mistakenly submit the IT-2 without completing all applicable boxes. Certain boxes, such as boxes for local income tax withheld, should only be filled if the information is relevant. Leaving unrelated boxes blank helps maintain clarity and aids in the processing of returns.

Beyond accuracy, another critical yet overlooked detail is the requirement to submit the IT-2 as a complete page. Individuals sometimes tear off the W-2 records or separate them from other pages of their returns. This action can lead to significant processing delays, as tax authorities may require the full documentation.

Finally, maintaining a clear understanding of whether additional forms are needed is important. Those who receive multiple federal W-2 forms or have unique income situations should complete and submit additional IT-2 forms as necessary. Overlooking this requirement could result in unreported income, which may lead to future complications.

Documents used along the form

The IT-2 form, which serves as a summary of W-2 statements for New York State, is often filed alongside various other forms and documents that facilitate a comprehensive tax return process. Each of these documents plays a crucial role in ensuring accurate and complete reporting of income and deductions. Below is a list of commonly associated forms and a brief description of their functions.

- W-2 Form: The Wage and Tax Statement that employers provide to their employees. It outlines the wages earned and taxes withheld during the year, and serves as the primary source of income reporting for employees.

- IT-201: The New York State Resident Income Tax Return form that allows residents to report their income, calculate their tax liability, and claim any applicable credits and deductions.

- IT-203: This form is the Nonresident and Part-Year Resident Income Tax Return used by individuals who worked in New York State but are not permanent residents. It ensures proper taxation according to the amount of income earned in the state.

- IT-205: The New York State Estate Tax Return form that must be filed by the estate executors to report any applicable estate taxes owed, ensuring compliance with state tax laws.

- IT-214: This form is used to claim the New York State School Tax Relief (STAR) credit. Homeowners may use it to reduce their property tax burden based on income and residency criteria.

- IT-201-V: The Payment Voucher for Income Tax Returns in New York State. Taxpayers who owe tax must submit this voucher along with their payment, ensuring timely processing of their payment.

- IT-140: This form is for claiming an additional New York City credit for taxes withheld or estimated, specifically for those working in the city but residing elsewhere.

- Form 4868: The Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. While this is a federal form, many individuals in New York use it to secure additional time for filing their state returns as well.

- Form NYS-45: The quarterly combined withholding, wage reporting, and unemployment insurance return form. Employers must file this to reconcile the taxes withheld and the wages paid to each employee within the state.

- IT-9: A form used to claim the Non-Resident Earned Income Credit for eligible taxpayers who qualify under specific criteria related to their New York earnings.

These forms and documents collectively support the accurate assessment of tax liability, ensure compliance with regulations, and protect taxpayer rights. Keeping a thorough record of each relevant document is essential for both tax planning and filing integrity.

Similar forms

-

W-2 Form - The IT-2 form is directly tied to the W-2 form. It serves as a summary of the W-2 statements that an employee receives, detailing wages, taxes withheld, and additional compensation. Each box on the IT-2 corresponds to a box on the W-2, allowing for a clear and organized summary of all income earned and taxes deducted.

-

W-2c Form - This form is used to correct errors on a previously issued W-2. Like the IT-2, it includes similar boxes for reporting wages and taxes; however, the W-2c specifically handles corrections, which the IT-2 records in the appropriate sections if a corrected W-2 is included in the summary.

-

1040 Form - This is the individual income tax return form used in the United States. While the IT-2 is a summary of W-2s, the 1040 form consolidates an individual’s overall income, including wages reported on the IT-2. Information from the IT-2 helps determine the total taxable income that flows to the 1040.

-

1099 Form - Unlike W-2s, which report salaries, the 1099 form reports income earned from non-employment sources such as freelance work. In certain cases, if you submit a 1099 alongside an IT-2, you may include both forms when calculating total income for your tax return.

-

Schedule A - This form is used to itemize deductions on the 1040 tax return. The IT-2 can provide essential data on income that may affect taxable income, which could, in turn, impact the decision to itemize or take a standard deduction.

-

Schedule C - For self-employed individuals, this form details profit or loss from business activities. If an individual earns income reported through a W-2 and additional income through self-employment, both forms can help provide a complete financial picture when filing taxes.

-

Form 8889 - This is used to report Health Savings Account (HSA) contributions and distributions. The IT-2 summarizes W-2 earnings that might help determine eligibility for HSA contributions, thus affecting potential tax benefits.

-

Form 4868 - This form is an application for an automatic extension of time to file a U.S. individual income tax return. If taxpayers expect additional income that isn’t fully reported on the IT-2 and W-2, they may opt to apply for an extension to have more time to prepare and report accurately.

-

Form 1065 - Used by partnerships to report income, deductions, and other relevant information, while the IT-2 details individual employee earnings. If an individual is a partner in a business that issues a K-1 (the equivalent of a W-2 for partnerships), the IT-2 may help flesh out the total income for tax purposes.

-

Form 941 - This form is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It provides insight into how much tax was withheld, which aligns with information reported on the IT-2 based on the W-2 forms submitted.

Dos and Don'ts

When filling out the IT-2 form, there are some important actions to consider that can help ensure accuracy and compliance. Here’s a list of five dos and don’ts:

- Do complete a W-2 Record section for each W-2 form you received, even if there is no New York State wage listed.

- Do enter amounts from your federal W-2 into the corresponding boxes on the IT-2 form accurately.

- Do round whole dollar amounts according to the specified rules to ensure correctness.

- Do check for and mark any relevant boxes, such as those for statutory employee or retirement plans, if applicable.

- Do submit the IT-2 form as a complete page; do not detach W-2 records.

- Don’t leave any boxes blank if the federal W-2 contains relevant information.

- Don’t file more than one W-2 Record for the same W-2 unless instructed for specific excess items.

- Don’t include any information from other states in the New York State locality boxes.

- Don’t forget to keep your federal W-2 for your records; do not submit it with your IT-2 form.

- Don’t misunderstand the rounding rules; ensure you follow them precisely when entering amounts.

Misconceptions

Understanding the IT-2 form, which serves as a summary of W-2 statements for New York State, is crucial for anyone filing a New York State income tax return. However, several misconceptions often arise. Here are a few of the most common misunderstandings:

- The IT-2 form is only for residents of New York City. Many believe that the IT-2 form applies solely to New Yorkers living in NYC. In reality, this form must be completed by all New York State residents, whether they live in New York City, Yonkers, or elsewhere in the state. The instructions explicitly state that it’s required for anyone receiving federal Form W-2.

- You don’t need to file the IT-2 if there are no NYS taxes withheld. Some individuals think that the IT-2 isn't necessary if their W-2 doesn’t show New York State wages or withholding. However, the form is still required to report any W-2 income received. It’s important to complete the IT-2 even if no taxes are withheld, as it provides a complete record of income.

- Only one W-2 Record is needed regardless of employment history. It’s a misconception that a single W-2 Record suffices for anyone who has multiple W-2s from different employers. Each federal Form W-2 received must be reported. The IT-2 requires a separate W-2 Record section for every W-2, ensuring that all income is accurately reflected and reported.

- Errors on the IT-2 won’t affect your tax return. Many think that mistakes made on the IT-2 won’t have repercussions on their overall tax return. However, inaccuracies can lead to issues with tax calculations or possible audits. As such, it’s important to meticulously enter the information from W-2 forms to avoid complications with tax authorities.

Clearing up these misconceptions helps ensure a smooth filing process and accurate tax reporting. Understanding the vital role of the IT-2 form supports taxpayers in managing their obligations correctly.

Key takeaways

- Complete for Each W-2: You need to fill out a W-2 record for each federal Form W-2 you receive. This includes all forms received by you and your spouse if filing jointly, even if they don't show any New York State wages or taxes withheld.

- Use Correct Information: Carefully transfer the information from your W-2 to the IT-2 form. Each box on the IT-2 corresponds to a box on the W-2. Double-check names, addresses, and amounts to avoid any errors.

- Rounding Rules Apply: When filling out the form, ensure you round whole dollar amounts correctly. Drop amounts under 50 cents and round up amounts from 50 to 99 cents. For example, enter $2.50 as $3.

- Don’t Detach W-2 Records: Always file the IT-2 as an entire page without detaching the W-2 records. This ensures that your tax return is correctly processed and reduces the chances of confusion.

- Submit with Your Tax Return: Attach your completed IT-2 to your New York State income tax return. Remember, you do not need to submit your federal W-2 forms; keep those for your personal records.

Browse Other Templates

VA Education Benefits Application,VA Educational Assistance Form,VA Benefits Application Form,VA Training Benefits Request,Veterans Education Benefits Application,Application for Military Education Assistance,Educational Benefits Enrollment Form,GI B - Completing the form is an excellent step toward securing the necessary funding for your education or training needs.

American Opportunity Tax Credit - Carefully assess each line to ensure no detail is overlooked.

Child Care Payment Review Request,Provider Payment Discrepancy Form,Child Care Provider Invoice Review,Payment Resolution Submission Form,Child Care Facility Payment Inquiry,Child Care Invoice Adjustment Request,Provider Payment Evaluation Form,Child - Providers need to note specific discrepancies when entering the reasons for review on the form.