Fill Out Your It 203D Form

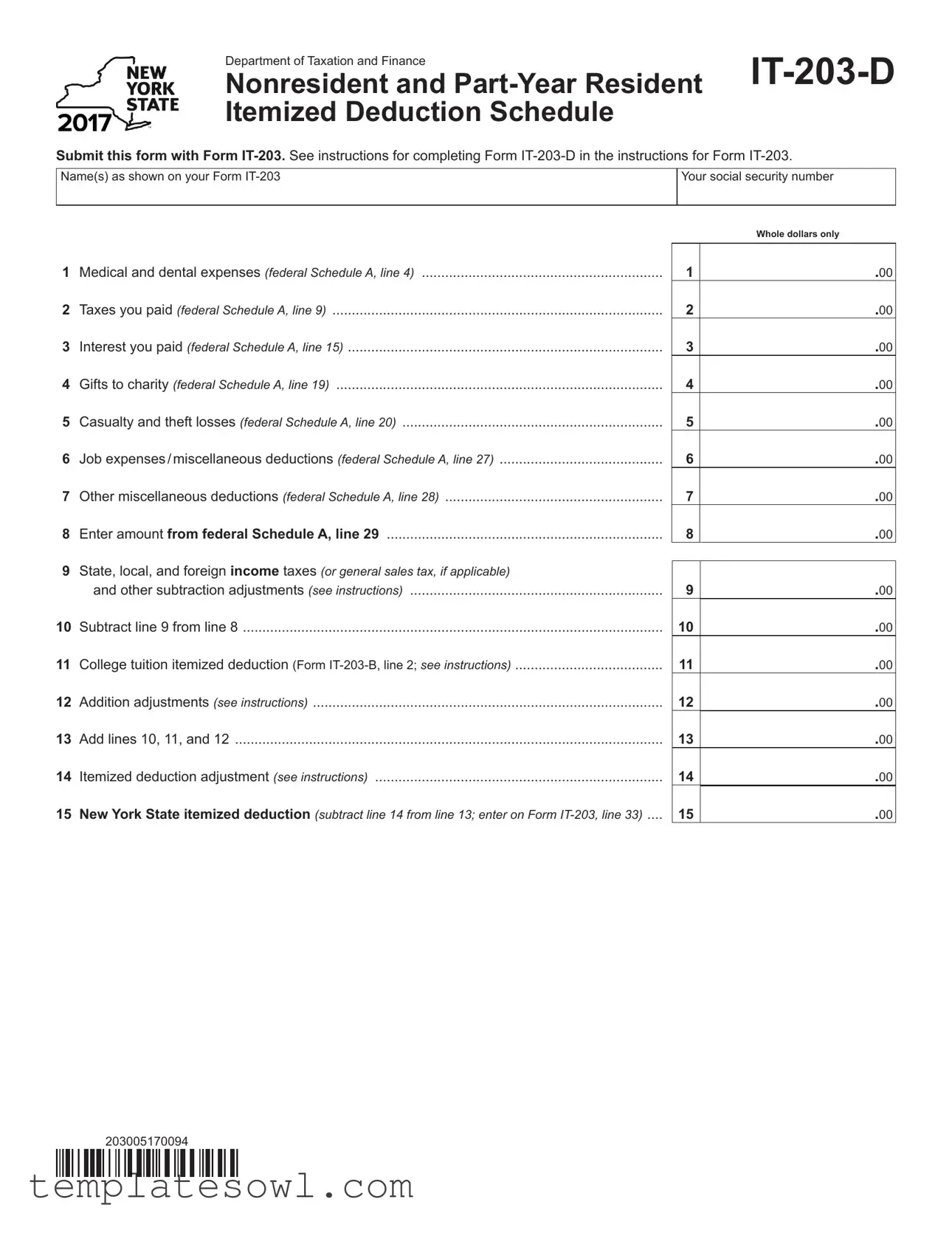

The IT-203-D form plays a crucial role for nonresident and part-year resident taxpayers in New York. This form is used to report itemized deductions when filing your tax return with Form IT-203. It requires you to detail various deductible expenses, such as medical and dental costs, taxes paid, and interest payments, all sourced from your federal Schedule A. You also have the opportunity to report charitable contributions, casualty or theft losses, job-related expenses, and other miscellaneous deductions. The form breaks down how to compute these amounts to arrive at your New York State itemized deduction. It’s important to complete the form accurately for a smooth filing process. Once you calculate your deductions, transfers are made to Form IT-203 to determine your overall tax liability in New York. Properly filling out the IT-203-D ensures you maximize your eligible deductions and comply with state tax regulations, supporting your financial well-being.

It 203D Example

Department of Taxation and Finance |

|

Nonresident and |

Itemized Deduction Schedule

Submit this form with Form

Name(s) as shown on your Form

Your social security number

|

|

|

Whole dollars only |

|

|

|

|

1 |

Medical and dental expenses (federal Schedule A, line 4) |

1 |

.00 |

2 |

Taxes you paid (federal Schedule A, line 9) |

2 |

.00 |

3 |

Interest you paid (federal Schedule A, line 15) |

3 |

.00 |

4 |

Gifts to charity (federal Schedule A, line 19) |

4 |

.00 |

5 |

Casualty and theft losses (federal Schedule A, line 20) |

5 |

.00 |

6 |

Job expenses/miscellaneous deductions (federal Schedule A, line 27) |

6 |

.00 |

7 |

Other miscellaneous deductions (federal Schedule A, line 28) |

7 |

.00 |

8 |

Enter amount from federal Schedule A, line 29 |

8 |

.00 |

9 |

State, local, and foreign income taxes (or general sales tax, if applicable) |

|

|

|

|

||

|

and other subtraction adjustments (see instructions) |

9 |

.00 |

10 |

Subtract line 9 from line 8 |

10 |

.00 |

11 |

College tuition itemized deduction (Form |

11 |

.00 |

12 |

Addition adjustments (see instructions) |

12 |

.00 |

13 |

Add lines 10, 11, and 12 |

13 |

.00 |

14 |

Itemized deduction adjustment (see instructions) |

14 |

.00 |

15 |

New York State itemized deduction (subtract line 14 from line 13; enter on Form |

15 |

.00 |

203005170094

Form Characteristics

| Fact Title | Details |

|---|---|

| Purpose of Form | The IT-203-D form is used by nonresidents and part-year residents of New York to itemize deductions and report specific expenses that impact their tax liability. |

| Submission Requirement | This form must be submitted alongside Form IT-203, which is for New York State personal income tax for nonresidents and part-year residents. |

| Governing Laws | The use of this form is governed by New York State Tax Law, specifically relating to personal income tax and the rules for nonresidents. |

| Itemization Instructions | Taxpayers must follow the instructions provided with Form IT-203, particularly for how to complete the various lines regarding deductions from federal Schedule A. |

Guidelines on Utilizing It 203D

Filling out the IT-203D form is a process that requires careful attention to detail. The correct information must be entered to ensure accurate reporting of itemized deductions for nonresident and part-year resident taxpayers. The following steps will guide you through completing the form.

- Write your name(s) exactly as shown on your Form IT-203.

- Fill in your social security number.

- Enter medical and dental expenses from federal Schedule A, line 4, in the space provided for line 1.

- For line 2, input the taxes you paid from federal Schedule A, line 9.

- On line 3, enter the interest you paid from federal Schedule A, line 15.

- Fill in the amount of gifts to charity on line 4 from federal Schedule A, line 19.

- Enter any casualty and theft losses for line 5 from federal Schedule A, line 20.

- For line 6, report job expenses or miscellaneous deductions from federal Schedule A, line 27.

- Input other miscellaneous deductions on line 7 from federal Schedule A, line 28.

- Enter the amount from federal Schedule A, line 29, on line 8.

- For line 9, report state, local, and foreign income taxes or general sales tax, if applicable.

- Subtract line 9 from line 8 and write the result on line 10.

- On line 11, fill in the college tuition itemized deduction from Form IT-203-B, line 2.

- For line 12, input any addition adjustments as per the instructions.

- Add lines 10, 11, and 12 together and write the total on line 13.

- For line 14, determine the itemized deduction adjustment based on the instructions provided.

- Finally, subtract line 14 from line 13 to find the New York State itemized deduction. This amount should be entered on Form IT-203, line 33, and recorded on line 15.

What You Should Know About This Form

What is the purpose of Form IT-203-D?

The IT-203-D form is designed for nonresidents and part-year residents of New York State who wish to itemize their deductions. This form must be submitted along with Form IT-203. It helps taxpayers accurately report various expenses, including medical and dental costs, taxes paid, interest, and charitable donations, among others. The information gathered on this form allows for a precise calculation of the New York State itemized deductions applicable to the taxpayer's situation.

Who should complete the IT-203-D form?

This form should be completed by individuals who are nonresidents or part-year residents of New York State. Those who have chosen to itemize deductions instead of taking the standard deduction on their federal tax return will need to file this form. It is imperative for taxpayers to include detailed expense information as listed on the federal Schedule A to ensure their state deductions are accurate.

What information is required on the IT-203-D form?

The IT-203-D form asks for personal information, including the name(s) of the taxpayer(s) as they appear on Form IT-203 and their social security number. Taxpayers must report various expenses such as medical and dental expenses, state and local taxes, interest paid, charitable gifts, and any casualty or theft losses incurred. Additionally, it asks for calculations regarding itemized deductions and any adjustments or additions that need to be applied. The final amount of the New York State itemized deduction must be transferred to Form IT-203.

Are there specific instructions for completing the IT-203-D form?

Yes, there are specific instructions for completing the IT-203-D form. These instructions can be found in the guidelines provided for Form IT-203. Taxpayers are encouraged to consult these instructions to ensure that they understand how to accurately report their deductions and complete calculations. This helps prevent errors that could lead to delays or complications in processing their tax return.

How do I submit the IT-203-D form?

The IT-203-D form must be submitted along with Form IT-203. Taxpayers are advised to ensure that both forms are completed accurately before submission. Forms can be mailed to the appropriate address specified in the Form IT-203 instructions. Alternatively, taxpayers may have the option to e-file if they use tax preparation software compatible with New York State tax filing. Always check for the most current submission guidelines to ensure compliance with tax regulations.

Common mistakes

Filling out the IT-203D form can be a straightforward process if you know what to look out for. However, several common mistakes can trip you up along the way. Paying attention to these can help ensure that your form is completed accurately and submitted without issues.

One frequent mistake is not including whole dollars only in the amounts listed. The form specifically states to enter "whole dollars only." Many people accidentally include cents, which could lead to confusion or a processing delay. Make sure to round to the nearest dollar if needed.

Another common issue arises from incorrect or missing personal information. Ensure that your name(s) and social security number are entered exactly as they appear on your primary tax form (Form IT-203). Any discrepancies can create problems, including delays in processing or issues with your tax account.

Another area where errors often occur is in the reporting of medical and dental expenses. People sometimes forget to check their federal Schedule A for accuracy or might calculate a different amount than what is actually listed. Always refer back to the Schedule A to confirm that you’ve captured the correct figure.

Submitting the form without being aware of your allowable deductions can lead to misreporting as well. For instance, when you claim taxes you paid or gifts to charity, refer closely to federal Schedule A. A wrong number can lead to an erroneous refund or additional tax liabilities.

Additionally, some filers overlook the instruction notes on the form. Not reviewing all the instructions, particularly regarding line 9, can lead to significant errors. This line involves state, local, and foreign income taxes or sales tax adjustments. It’s crucial to read the specific guidelines for this section carefully to avoid mistakes.

Another mistake is failing to carry forward the adjusted values properly across different lines of the form. For example, ensuring that the state itemized deduction is calculated correctly by subtracting the itemized deduction adjustment from the total of lines 10, 11, and 12 is essential. Miscalculating could affect your overall tax liability.

Lastly, submitting the IT-203D form without confirmation that it is attached to Form IT-203 is a mistake that can sideline your tax filing. Remember to double-check your submission to ensure all required documents are included before sending them off. This comprehensive attention to detail will help you avoid issues down the line.

Documents used along the form

The IT-203-D form is an important document for non-residents and part-year residents who want to claim itemized deductions. When filling out this form, you may also need to reference several other documents to ensure everything is completed accurately. Below are some commonly used forms that work alongside the IT-203-D.

- Form IT-203: This is the main income tax return form for non-residents and part-year residents in New York. You will need to submit the IT-203-D along with this form to claim your itemized deductions properly.

- Federal Schedule A: This form details your itemized deductions for federal tax purposes. The amounts you enter on the IT-203-D often come from this schedule, so it's important to complete it first.

- Form IT-203-B: This form is specifically for claiming the college tuition itemized deduction. You will find the relevant line referenced on the IT-203-D, making it essential for anyone eligible for this deduction to complete it.

- Form IT-201: Though primarily for full-year residents, it's helpful to be aware of this form. It may contain useful information or context for understanding residency and the tax implications that could affect itemized deductions.

Using these additional forms alongside the IT-203-D can help clarify your deductions and ensure you’re following the correct procedures. Properly filling everything out will save you time and reduce the chance of issues with your tax return.

Similar forms

- Form IT-203: The IT-203 form is the main tax return form for nonresidents and part-year residents. It summarizes all income, deductions, and credits, much like the IT-203-D, which specifically details itemized deductions. The IT-203 provides a broader overview, while the IT-203-D breaks down specific deductible expenses.

- Federal Schedule A: This form allows taxpayers to report their itemized deductions for federal income tax purposes. The IT-203-D draws on information from the federal Schedule A, as it asks for similar types of deductions, such as medical expenses and charitable contributions.

- Form IT-203-B: The IT-203-B provides a deduction for college tuition. Like the IT-203-D, this form is used in conjunction with the IT-203 to calculate specific deductions that affect overall tax liability for residents and nonresidents alike.

- Form 1040: The 1040 form is the standard individual income tax return form used in the U.S. While the IT-203-D is specific to New York State, both forms serve to enumerate deductions and tax obligations, showing a similar purpose in the income tax filing process.

- Schedule C: Used for reporting income or loss from a business, Schedule C allows self-employed individuals to itemize specific business deductions. The structure of itemizing expenses in Schedule C is akin to the itemization process found in the IT-203-D.

- Form 8889: This form is used for reporting Health Savings Account (HSA) contributions and distributions. Like the IT-203-D, it specifies how to report unique deductions that qualify under different health-related representatives.

- Form W-2: The W-2 form provides a summary of wages and tax withheld from employment. Although it serves a different purpose, the importance of accurate reporting and documentation resonates with the objectives of the IT-203-D, which also relies on precise financial information for deductions.

Dos and Don'ts

When completing the IT-203-D form, there are several important do's and don'ts to consider. Following these guidelines can help ensure that the process goes smoothly and that all necessary information is accurately submitted.

- Do ensure your name(s) match exactly with what is shown on your Form IT-203.

- Do enter whole dollars only. Avoid cents to ensure clarity and accuracy.

- Do maintain copies of all documents for your records after submission.

- Do double-check all amounts entered against the corresponding lines on your federal Schedule A.

- Do pay careful attention to any instructions related to adjustments and deductions.

- Don't leave any required fields blank. Every line must have an entry, even if it is zero.

- Don't submit the IT-203-D form without the accompanying Form IT-203.

- Don't forget to sign your form where indicated. An unsigned form is considered incomplete.

- Don't assume all deductions are accepted without verification. Check specific eligibility for each item.

Misconceptions

The IT-203-D form, which is the Nonresident and Part-Year Resident Itemized Deduction Schedule, is a vital component for those filing in New York. Despite its significance, several misconceptions surround it. Understanding these myths can clarify the filing process for nonresidents and part-year residents. Below are common misconceptions about the IT-203-D form.

- This form applies only to full-time residents. In reality, the IT-203-D is specifically designed for nonresident and part-year resident taxpayers. It allows these individuals to itemize certain deductions, even if they do not reside in New York for the entire tax year.

- You must have filed a federal itemized return to use this form. While the IT-203-D references federal Schedule A, you do not need to file a federal itemized deduction return to use it. However, completing the federal schedule can provide clarity on what you may claim on the IT-203-D.

- All expenses must be incurred in New York to qualify for deductions. This is a common misunderstanding. Taxpayers can deduct qualifying expenses that were incurred outside of New York, as long as they are reported on the federal Schedule A and are allowed under New York State tax law.

- The form needs to be filed independently from the IT-203. This form is not a standalone document; it must be submitted along with Form IT-203. Failing to include it can delay processing or result in missed deductions.

- You can only claim standard deductions; itemizing isn’t allowed. Contrary to this belief, nonresident and part-year resident taxpayers can choose to itemize their deductions using the IT-203-D. This option may often lead to lower taxable income when the itemized deductions exceed the standard deduction.

Key takeaways

- Form IT-203-D is specifically for nonresident and part-year residents who wish to claim itemized deductions.

- Ensure that you complete this form in conjunction with Form IT-203.

- Your name(s) must match exactly as shown on Form IT-203 to avoid processing delays.

- Include your Social Security number to establish your identity.

- Report all financial figures in whole dollars only. Decimal points are not required.

- Refer to federal Schedule A for the corresponding lines when entering information for medical expenses, taxes paid, interest paid, and other deductions.

- Remember to check the instructions carefully for any specific notes on your state, local, or foreign income taxes.

- Calculating your itemized deduction correctly is important; subtract line 9 from line 8 to derive an accurate figure.

- Include adjustments for college tuition using the specified line from Form IT-203-B.

- After completing all calculations, ensure that your New York State itemized deduction is accurately reported on Form IT-203, line 33.

Browse Other Templates

Dd 1853 - Timely submission of the form is encouraged to avoid last-minute complications.

What Does a Court Summons Look Like - Failure to respond can result in a default judgment against the defendant.