Fill Out Your Itemized Deductions Checklist Form

The Itemized Deductions Checklist form serves as an essential tool for individuals looking to maximize their tax benefits by detailing eligible expenses that can be deducted from taxable income. This comprehensive form guides users through a variety of common deductions, starting with medical expenses, which can be claimed if they surpass a certain percentage of income, particularly benefiting those over 65. Various medical costs, from treatments and medications to long-term care and special devices, are specified for clarity. Additionally, the checklist addresses the tax deductibility of property, real estate, and state or local taxes, emphasizing which are fully deductible. Interest expenses, notably from home mortgages and certain business loans, are also outlined, along with rules governing allowable charitable contributions to recognized organizations. Furthermore, it includes guidance on claiming casualty and theft losses, highlighting the criteria that must be met for these claims to be valid. Lastly, various miscellaneous deductions are categorized, with particular attention to those that require exceeding 2% of adjusted gross income. By organizing these deductions effectively, the Itemized Deductions Checklist empowers taxpayers to navigate the complexities of tax preparation confidently.

Itemized Deductions Checklist Example

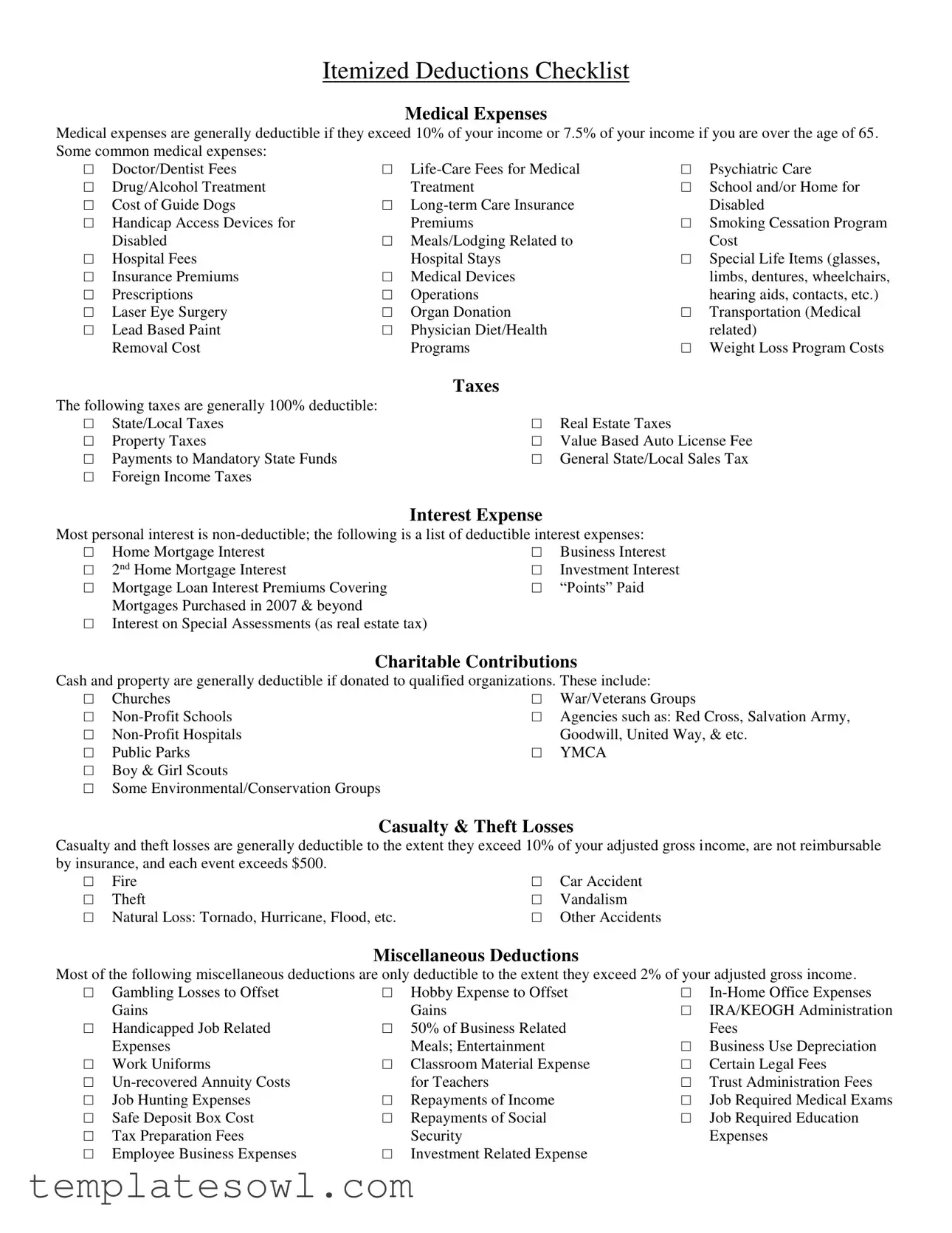

Itemized Deductions Checklist

Medical Expenses

Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65.

Some common medical expenses: |

□ |

□ |

|

||

□ |

Doctor/Dentist Fees |

Psychiatric Care |

|||

□ |

Drug/Alcohol Treatment |

□ |

Treatment |

□ School and/or Home for |

|

□ Cost of Guide Dogs |

□ |

Disabled |

|||

□ Handicap Access Devices for |

□ |

Premiums |

Smoking Cessation Program |

||

□ |

Disabled |

Meals/Lodging Related to |

|

Cost |

|

Hospital Fees |

□ |

Hospital Stays |

□ Special Life Items (glasses, |

||

□ |

Insurance Premiums |

Medical Devices |

|

limbs, dentures, wheelchairs, |

|

□ |

Prescriptions |

□ |

Operations |

□ |

hearing aids, contacts, etc.) |

□ |

Laser Eye Surgery |

□ |

Organ Donation |

Transportation (Medical |

|

□ |

Lead Based Paint |

□ |

Physician Diet/Health |

|

related) |

|

Removal Cost |

|

Programs |

□ Weight Loss Program Costs |

|

|

|

Taxes |

The following taxes are generally 100% deductible: |

□ Real Estate Taxes |

|

□ |

State/Local Taxes |

|

□ |

Property Taxes |

□ Value Based Auto License Fee |

□ Payments to Mandatory State Funds |

□ General State/Local Sales Tax |

|

□Foreign Income Taxes

|

|

Interest Expense |

|

Most personal interest is |

|||

□ |

Home Mortgage Interest |

□ |

Business Interest |

□ 2nd Home Mortgage Interest |

□ |

Investment Interest |

|

□ |

Mortgage Loan Interest Premiums Covering |

□ |

“Points” Paid |

Mortgages Purchased in 2007 & beyond

□Interest on Special Assessments (as real estate tax)

Charitable Contributions

Cash and property are generally deductible if donated to qualified organizations. These include:

□ |

Churches |

□ |

War/Veterans Groups |

□ |

□ Agencies such as: Red Cross, Salvation Army, |

||

□ |

□ |

Goodwill, United Way, & etc. |

|

□ |

Public Parks |

YMCA |

|

□Boy & Girl Scouts

□Some Environmental/Conservation Groups

Casualty & Theft Losses

Casualty and theft losses are generally deductible to the extent they exceed 10% of your adjusted gross income, are not reimbursable

by insurance, and each event exceeds $500. |

□ |

|

|

□ |

Fire |

Car Accident |

|

□ |

Theft |

□ |

Vandalism |

□ Natural Loss: Tornado, Hurricane, Flood, etc. |

□ |

Other Accidents |

|

Miscellaneous Deductions

Most of the following miscellaneous deductions are only deductible to the extent they exceed 2% of your adjusted gross income.

□ Gambling Losses to Offset |

□ Hobby Expense to Offset |

□ |

|||

□ |

Gains |

|

Gains |

□ |

IRA/KEOGH Administration |

Handicapped Job Related |

□ 50% of Business Related |

□ |

Fees |

||

□ |

Expenses |

□ |

Meals; Entertainment |

Business Use Depreciation |

|

Work Uniforms |

Classroom Material Expense |

□ |

Certain Legal Fees |

||

□ |

□ |

for Teachers |

□ |

Trust Administration Fees |

|

□ |

Job Hunting Expenses |

Repayments of Income |

□ Job Required Medical Exams |

||

□ Safe Deposit Box Cost |

□ |

Repayments of Social |

□ |

Job Required Education |

|

□ |

Tax Preparation Fees |

□ |

Security |

|

Expenses |

□ |

Employee Business Expenses |

Investment Related Expense |

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Itemized Deductions Checklist form helps taxpayers identify and report their eligible deductions, which can lower taxable income. |

| Medical Expenses | Medical expenses can only be deducted if they exceed 10% of the individual's income, or 7.5% if the individual is over 65. |

| Tax Deduction Eligibility | Some taxes, such as state and local taxes and real estate taxes, are fully deductible under federal law. |

| Charitable Contributions | Contributions made to qualified organizations are generally deductible, including gifts to non-profits and educational institutions. |

| Casualty & Theft Losses | Losses from theft or casualty can be deducted if they exceed 10% of adjusted gross income, are not covered by insurance, and each event exceeds $500. |

| Miscellaneous Deductions | Many miscellaneous deductions are only deductible if they exceed 2% of the taxpayer's adjusted gross income. |

| Filing Requirement | Taxpayers may choose to itemize deductions instead of taking the standard deduction if it results in a greater tax benefit. |

Guidelines on Utilizing Itemized Deductions Checklist

After gathering your documents and receipts, you’re ready to fill out the Itemized Deductions Checklist form. This checklist will help you compile all applicable deductions to ensure nothing is overlooked. Follow these steps carefully to ensure you provide all necessary information.

- Personal Information: Start by filling in your name and relevant personal information at the top of the form.

- Medical Expenses: Check the box next to each medical expense you incurred that qualifies for deductions. Remember, these expenses must exceed certain income thresholds.

- Taxes: Move on to the taxes section. Mark all applicable taxes that you paid, which are generally 100% deductible.

- Interest Expense: Identify and check any deductible interest expenses. Be sure to read through each item carefully.

- Charitable Contributions: List contributions made to qualified organizations. Mark all donations that qualify for deductibility.

- Casualty & Theft Losses: Review the occurrences of casualty and theft that you may have experienced and check the relevant boxes.

- Miscellaneous Deductions: Finally, go through the miscellaneous deductions section. Tick the applicable deductions, remembering that many of these must exceed 2% of your adjusted gross income.

- Review: Once you've filled everything out, carefully review your checklist to confirm that all applicable boxes are checked and that your totals are accurate.

Completing the checklist accurately will help simplify your tax preparation process. Ensure all information is precise and that you have all necessary documentation ready for submission.

What You Should Know About This Form

What is an Itemized Deductions Checklist?

The Itemized Deductions Checklist is a tool designed to help you track and identify expenses that you may deduct from your taxable income. By itemizing your deductions, you can potentially lower your tax bill if your total deductions exceed the standard deduction available for taxpayers.

Who should use the Itemized Deductions Checklist?

This checklist is beneficial for taxpayers who have expenses such as medical costs, mortgage interest, property taxes, and charitable contributions that could exceed the standard deduction. If you own a home, have significant medical bills, or frequently donate to charity, you may find itemizing your deductions advantageous.

What types of medical expenses can I deduct?

You can generally deduct medical expenses that exceed 10% of your adjusted gross income (AGI) or 7.5% if you're over 65. Deductible expenses include life-care fees, doctor and dentist fees, hospital stays, and prescription medications, among others. It's important to keep detailed records of all your medical expenses to support your deductions.

How do I handle charitable contributions for deductions?

Cash and property donations to qualified organizations are deductible. Common eligible charities include churches, non-profits, and various humanitarian organizations. Ensure that you have receipts for your donations, as you may need to prove your contributions were made to qualified entities.

What can I do if I experience casualty or theft losses?

Casualty and theft losses can be deducted if they exceed 10% of your AGI and are not covered by insurance. Each theft or casualty event must be assessed individually, and any loss exceeding $500 is reportable as a deduction. Be sure to document your losses thoroughly and note the circumstances surrounding each incident.

What kind of taxes can I deduct?

You can deduct several types of taxes, including real estate taxes, state and local taxes, and property taxes. Certain fees, like value-based auto license fees and payments to mandatory state funds, are also deductible. Keeping track of these payments throughout the year will simplify the process when you file your taxes.

Are there any deductions related to interest expenses?

Yes, specific interest expenses are deductible. These include home mortgage interest, business interest, and investment interest. Generally, personal interest is not deductible. You’ll need to have documentation such as mortgage statements to prove the interest paid for your deductions.

What are some common miscellaneous deductions?

Miscellaneous deductions may be deductible to the extent they exceed 2% of your AGI. Examples include expenses for a home office, job-hunting costs, and certain legal fees. Tracking these relatively smaller expenses can add up, so keep all relevant receipts and documentation to ensure you maximize your deductions.

Common mistakes

Filling out the Itemized Deductions Checklist form can be a straightforward process, but several common mistakes can lead to missed deductions or inaccuracies. One prevalent error occurs when individuals miscalculate their medical expenses. Medical expenses are deductible only if they exceed a certain percentage of your income. People often overlook this threshold and include all medical costs regardless of their total income. This mistake can result in the exclusion of valid deductions and a potential increase in tax liability.

Another common mistake is failing to provide adequate documentation for charitable contributions. Donors may assume that their cash or property donations qualify for deductions without retaining appropriate records. It is essential to gather receipts or written acknowledgments for all contributions made to qualified organizations. Without these documents, the IRS may disallow the deductions, which can affect the overall tax return.

Some people incorrectly assume that all expenses related to their home office qualify as deductions. While in-home office expenses can be deductible, only certain expenses directly tied to business use are eligible. Many taxpayers fail to accurately determine the portion of their home that is used for business, leading to inflated or unjustified claims. This error can trigger scrutiny from tax authorities and may result in additional stress during the audit process.

A final area of concern involves the treatment of miscellaneous deductions. Taxpayers often do not realize that these deductions are only allowable to the extent they exceed 2% of adjusted gross income. Consequently, they may list various deductions without considering this limit, leading to possible disallowance by the IRS. It is critical to review and calculate these deductions carefully as a miscalculation could diminish the intended tax benefits.

Documents used along the form

When preparing your taxes and using the Itemized Deductions Checklist form, it’s helpful to have several other important documents at hand. Each document serves a specific purpose in ensuring your deductions are properly accounted for and can substantiate your claims. Here’s a list of commonly used forms and documents.

- W-2 Forms: This form reports your annual wages and the taxes withheld from your paycheck. It is essential for verifying your income when calculating deductions.

- 1099 Forms: Various versions of this form (like 1099-INT for interest income or 1099-MISC for freelance work) report additional income that might not be reflected on a W-2.

- Receipts and Invoices: Keep detailed receipts for all deductible expenses, including medical bills, charitable contributions, and any other qualifying costs to support your claims.

- Tax Returns from Previous Years: Reviewing prior tax returns can provide insight into consistent deductions you may claim again, ensuring you don’t miss any documentation.

- Bank and Credit Card Statements: These statements can help track your expenses throughout the year, proving useful for confirming deduction amounts, especially for recurring payments.

By gathering these documents along with the Itemized Deductions Checklist form, you can streamline your tax preparation process and enhance your accuracy. Make sure to double-check all figures against your records to maximize your deductions effectively.

Similar forms

- Schedule A (Form 1040): This form is used to report itemized deductions, including medical expenses, taxes, interest, and charitable contributions. Similar to the Itemized Deductions Checklist, it helps taxpayers determine which expenses can reduce their taxable income.

- Form 8862: This form is filed by taxpayers who need to reapply for the Earned Income Tax Credit (EITC) after it was disallowed. Both the checklist and this form require documentation to establish eligibility for deductions and credits.

- Form 1040X: This is the amended U.S. Individual Income Tax Return form. Like the Itemized Deductions Checklist, it lists changes in deductions and requires supporting details about prior returns.

- Form 8889: Used for Health Savings Accounts (HSAs), it details contributions and distributions. Both documents track medical expenses, supporting the deduction for medical-related costs under specific guidelines.

- Schedule C (Form 1040): As used by sole proprietors, this form outlines business income and expenses. It shares similarities with the deductions checklist in its role to itemize relevant expenses for tax purposes.

- Form 2119: This form is for reporting the sale of a home. Just like the checklist, it helps taxpayers document costs that can affect their tax liabilities, particularly in relation to medical expenses if applicable.

- Form 8880: This form allows taxpayers to claim a credit for contributions to retirement plans. It parallels the checklist by needing documentation of expenses that may qualify for tax benefits.

- Schedule E (Form 1040): Used for reporting income or loss from rental real estate, royalties, partnerships, estates, and trusts. Similar to the checklist, it breaks down applicable expenses impacting taxable income.

- Form 8863: A form for education credits that requires recipients to list qualified expenses related to education. This mirrors the checklist’s requirement to substantiate claims for medical and miscellaneous deductions.

- Form 1098: This form is used to report mortgage interest paid, which is a deductible expense. Both the Itemized Deductions Checklist and Form 1098 are vital for determining the tax impact of interest payments.

Dos and Don'ts

When filling out the Itemized Deductions Checklist form, there are important dos and don’ts to keep in mind. Here’s a straightforward list to guide you.

- Do include all medical expenses that exceed the applicable percentage of your income.

- Do document charitable contributions with receipts or bank statements.

- Do ensure all relevant taxes are included, such as real estate or state taxes.

- Do keep a record of interest expense documentation for mortgages.

- Do report casualty and theft losses accurately if they meet the criteria.

- Don’t claim personal interest expenses that are not deductible.

- Don’t forget to check if your deductions exceed the necessary income thresholds.

- Don’t overlook to include any necessary documentation for miscellaneous deductions.

- Don’t rely solely on memory; keep all related receipts and documents handy.

- Don’t forget to review instructions of the form for any updates or specific requirements.

Misconceptions

Misconceptions about the Itemized Deductions Checklist can lead to confusion, ultimately affecting tax filings. Below are some common misunderstandings and clarifications regarding this important document.

- All Medical Expenses are Deductible: Many people assume that any medical cost can be deducted. In reality, only those expenses that exceed 10% of adjusted gross income (AGI), or 7.5% for individuals over 65, qualify for deductions. This means that only the costs above these thresholds are eligible.

- Interest Deduction Applies to All Loans: There is a belief that all kinds of interest payments are deductible. However, most personal interest is non-deductible. Exceptions include home mortgage interest, investment interest, and certain business-related interest, which must meet specific requirements.

- Charitable Donations are Always Fully Deductible: Some individuals think that any donation made to a charity can be deducted entirely. In truth, while cash and property donations to qualified organizations are generally deductible, they may not be fully deductible if they exceed certain limits or are not properly documented.

- Every Loss is Deductible Under Casualty and Theft Losses: Many mistakenly believe that all losses from accidents or theft can be deducted. In fact, for deductions to apply, the loss must exceed 10% of AGI, must not be covered by insurance, and each incident must be valued at over $500.

Understanding these misconceptions can give taxpayers clarity and confidence in their tax preparation. It's essential to consult the detailed guidelines or seek professional assistance as needed to ensure accurate filings.

Key takeaways

Here are some key takeaways for effectively using the Itemized Deductions Checklist form:

- Understand the thresholds: For medical expenses, remember that deductions start only if your costs exceed 10% of your income (or 7.5% if you're over 65 years old). Keeping track of all eligible medical expenses can lead to significant savings.

- Be mindful of donation eligibility: When considering charitable contributions, ensure that the organizations you donate to are qualified. Common eligible groups include churches, non-profit hospitals, and recognized charities like the Red Cross.

- Deductions vary by category: Different categories of deductions have unique rules. For example, casualty and theft losses can only be deducted if they surpass $500 for each event and exceed 10% of your adjusted gross income.

- Keep accurate records: Documenting your expenses meticulously is crucial. Store receipts and statements to ensure you can substantiate your deductions if needed, especially for categories that require proof of payment or qualifying amounts.

Browse Other Templates

Fillable Da Form 638 - The structured format of the DA Form 638 minimizes errors during the submission of award nominations.

Naa Lease Agreement - Provide your previous supervisor's name and phone number for references.