Fill Out Your Itr 1 Illinois Form

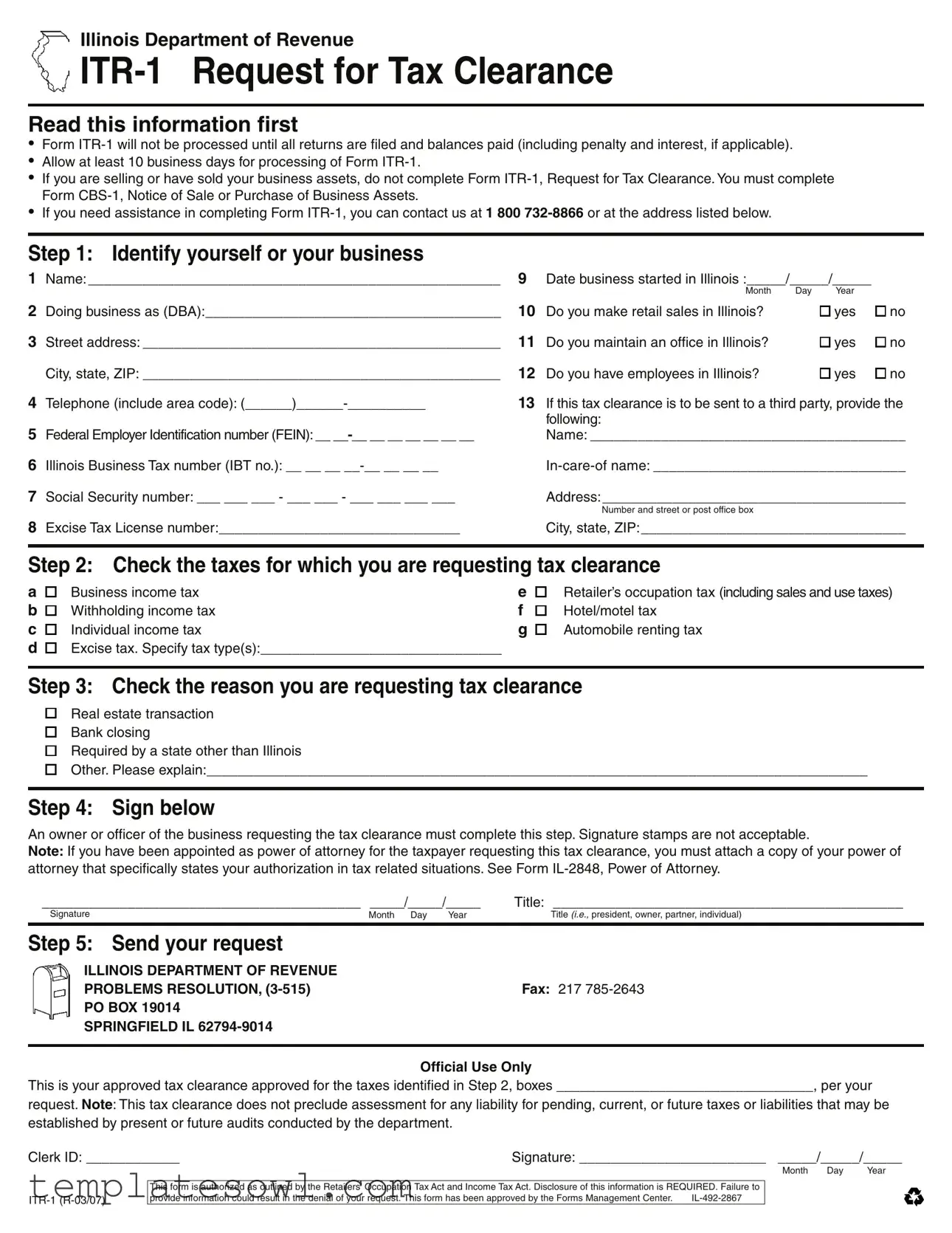

The Illinois ITR-1 form, officially known as the Request for Tax Clearance, serves a specific purpose in ensuring compliance with state tax regulations. Individuals and businesses must understand that this form will not be processed until all relevant tax returns are filed and any outstanding balances are paid, including any applicable penalties and interest. Processing requests typically takes at least ten business days. It's important to note that if business assets have been sold, the ITR-1 is not applicable; in such cases, the CBS-1 form must be completed instead. The form requires detailed identification information about the business, including its name, address, and various tax identification numbers. Furthermore, applicants must indicate which taxes they are seeking clearance for and provide a reason for this request, whether for real estate transactions, bank closings, or state requirements outside of Illinois. Finally, the form must be signed by a business owner or officer, and appropriate supporting documentation, such as a power of attorney, may be required if someone else is filing on behalf of the taxpayer. The completed form must then be submitted to the Illinois Department of Revenue for processing.

Itr 1 Illinois Example

Illinois Department of Revenue

Read this information first

•Form

•Allow at least 10 business days for processing of Form

•If you are selling or have sold your business assets, do not complete Form

•If you need assistance in completing Form

Step 1: Identify yourself or your business

1 |

Name: _____________________________________________________ |

9 |

Date business started in Illinois :_____/_____/_____ |

|

||

|

|

|

Month |

Day |

Year |

|

2 |

Doing business as (DBA):______________________________________ |

10 |

Do you make retail sales in Illinois? |

|

yes |

no |

3 |

Street address: ______________________________________________ |

11 |

Do you maintain an office in Illinois? |

|

yes |

no |

|

City, state, ZIP: ______________________________________________ |

12 |

Do you have employees in Illinois? |

|

yes |

no |

4 |

Telephone (include area code): |

13 |

If this tax clearance is to be sent to a third party, provide the |

|||

|

|

|

following: |

|

|

|

5 |

Federal Employer Identification number (FEIN): __ |

|

Name: ________________________________________ |

|||

6 |

Illinois Business Tax number (IBT no.): __ __ __ |

|

||||

7 |

Social Security number: ___ ___ ___ - ___ ___ - ___ ___ ___ ___ |

|

Address: _______________________________________ |

|||

|

|

|

Number and street or post office box |

|

|

|

8 |

Excise Tax License number:_______________________________ |

|

City, state, ZIP: __________________________________ |

|||

|

|

|

|

|

|

|

Step 2: Check the taxes for which you are requesting tax clearance

a b c d

Business income tax |

e |

Withholding income tax |

f |

Individual income tax |

g |

Excise tax. Specify tax type(s):_______________________________ |

|

Retailer’s occupation tax (including sales and use taxes) Hotel/motel tax

Automobile renting tax

Step 3: Check the reason you are requesting tax clearance

Real estate transaction Bank closing

Required by a state other than Illinois

Other. Please explain:_____________________________________________________________________________________

Step 4: Sign below

An owner or officer of the business requesting the tax clearance must complete this step. Signature stamps are not acceptable.

Note: If you have been appointed as power of attorney for the taxpayer requesting this tax clearance, you must attach a copy of your power of attorney that specifically states your authorization in tax related situations. See Form

_________________________________________ |

_____/_____/_____ |

Title: _____________________________________________ |

Signature |

Month Day Year |

Title (i.e., president, owner, partner, individual) |

|

|

|

Step 5: Send your request

ILLINOIS DEPARTMENT OF REVENUE |

|

PROBLEMS RESOLUTION, |

Fax: 217 |

PO BOX 19014 |

|

SPRINGFIELD IL |

|

|

|

|

Official Use Only |

This is your approved tax clearance approved for the taxes identified in Step 2, boxes _________________________________, per your

request. Note: This tax clearance does not preclude assessment for any liability for pending, current, or future taxes or liabilities that may be established by present or future audits conducted by the department.

Clerk ID: ____________ |

Signature: ________________________ _____/_____/_____ |

Month Day Year

This form is authorized as outlined by the Retailers’ Occupation Tax Act and Income Tax Act. Disclosure of this information is REQUIRED. Failure to

provide information could result in the denial of your request. This form has been approved by the Forms Management Center. |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The ITR-1 form is a Request for Tax Clearance from the Illinois Department of Revenue. |

| Processing Requirement | All tax returns must be filed, and all balances paid (including penalties and interest, if applicable) before the form can be processed. |

| Processing Time | It typically takes at least 10 business days to process the ITR-1 request once submitted. |

| Alternative Form for Asset Sales | If selling or having sold business assets, the appropriate form to complete is CBS-1, not ITR-1. |

| Contact Information | Assistance for completing the form can be obtained by calling 1-800-732-8866. |

| Verification of Business | Required information includes the name, DBA, address, and FEIN (Federal Employer Identification Number) of the business. |

| Types of Taxes | Tax clearances can be requested for various taxes, including business income tax and sales tax. |

| Signature Requirement | An owner or officer must sign the ITR-1, as signature stamps are not acceptable. |

| Governing Laws | The form is authorized under the Retailers’ Occupation Tax Act and the Income Tax Act. |

| Disclosure Note | Disclosure of the requested information is mandatory; non-compliance may result in denial of the request. |

Guidelines on Utilizing Itr 1 Illinois

Filling out the ITR-1 Illinois form requires careful attention to detail. This document is essential for individuals or businesses seeking tax clearance from the Illinois Department of Revenue. Ensure that all necessary information is provided accurately to avoid processing delays.

- Identify Yourself or Your Business

Complete the following sections:- Name: ____________________________________

- Doing business as (DBA): __________________________________

- Street address: ____________________________________________

- City, state, ZIP: __________________________________________

- Telephone (include area code): (______)______-__________

- Federal Employer Identification number (FEIN): __ __-__ __ __ __ __ __ __

- Illinois Business Tax number (IBT no.): __ __ __ __-__ __ __ __

- Social Security number: ___ ___ ___ - ___ ___ - ___ ___ ___ ___

- Excise Tax License number: ______________________________

- Check the Taxes for Which You Are Requesting Tax Clearance

Indicate the relevant taxes by checking the appropriate boxes:- Business income tax

- Withholding income tax

- Individual income tax

- Excise tax (specify tax type): ______________________

- Retailer’s occupation tax (including sales and use taxes)

- Hotel/motel tax

- Automobile renting tax

- Check the Reason You Are Requesting Tax Clearance

Select the reason for your request:- Real estate transaction

- Bank closing

- Required by a state other than Illinois

- Other (please explain): ______________________________________________________

- Sign Below

An owner or officer of the business must sign the form. Note: Signature stamps are not acceptable. If applicable, attach a copy of the power of attorney.- Signature: _______________________________________

- Title: ____________________________________________

- Date: _____/_____/_____ (Month/Day/Year)

- Send Your Request

Mail or fax the completed form to:

ILLINOIS DEPARTMENT OF REVENUE

PROBLEMS RESOLUTION, (3-515)

Fax: 217 785-2643

PO BOX 19014

SPRINGFIELD IL 62794-9014

What You Should Know About This Form

What is the ITR-1 form used for?

The ITR-1 form is a request for tax clearance in Illinois. It is used to confirm that a business has filed all necessary tax returns and paid any owed taxes, penalties, or interest before engaging in specific transactions, such as selling business assets or closing a bank deal.

How long does it take to process the ITR-1 form?

Processing the ITR-1 form typically takes at least 10 business days. It's important to plan ahead and submit your request well in advance of any deadlines or transactions.

What should I do if I have sold my business assets?

If you have sold or are planning to sell your business assets, do not fill out the ITR-1 form. Instead, you need to complete Form CBS-1, which is specifically for reporting the sale or purchase of business assets.

What information do I need to provide on the ITR-1 form?

You will need to provide information such as your name, business name, address, contact information, tax identification numbers, and details about your business activities. This information helps to identify your business and the reason for the tax clearance request.

Can I request tax clearance for multiple tax types?

Yes, the ITR-1 form allows you to check multiple tax types for which you are requesting tax clearance. This may include business income tax, withholding income tax, individual income tax, and various excise tax types.

Who must sign the ITR-1 form?

The form must be signed by an owner or officer of the business requesting the tax clearance. Signature stamps are not accepted, and if a power of attorney is being used, a copy must be attached to authorize the request.

What if I need help completing the ITR-1 form?

If you need assistance while filling out the ITR-1 form, you can contact the Illinois Department of Revenue at 1-800-732-8866. They can help guide you through the process and answer any questions you may have.

Where do I send the completed ITR-1 form?

Once you have completed the ITR-1 form, send it to the Illinois Department of Revenue, Problems Resolution, at the address listed on the form: PO Box 19014, Springfield, IL 62794-9014. You can also fax it to the number provided (217-785-2643).

Does receiving tax clearance guarantee I owe no taxes in the future?

No, receiving tax clearance does not prevent future assessments for tax liabilities. The tax clearance only confirms your status at the time of request and does not shield you from pending, current, or future taxes or liabilities resulting from audits.

Common mistakes

When completing the ITR-1 Illinois form, individuals may encounter various pitfalls that can hinder the processing of their tax clearance requests. One common mistake is not providing all necessary returns and payments. The Illinois Department of Revenue stipulates that Form ITR-1 will not be processed until all returns are filed and any due balances, including penalties and interest, are settled. Failing to comply with this requirement can delay the approval process significantly.

An additional error involves selecting the wrong form for certain transactions. Specifically, if a business owner is selling or has sold business assets, they should not use Form ITR-1. Instead, the appropriate form is CBS-1, which pertains specifically to the sale of business assets. This oversight can result in the denial of the clearance request.

Many applicants also make mistakes in accurately identifying themselves or their business. Inaccurate or incomplete information in fields such as the name, address, or federal employer identification number can cause processing delays. Proper completion of each section is essential for the clarity and efficiency of the application.

People often overlook the required information regarding tax types. It is crucial to check all relevant taxes for which tax clearance is being requested. Missing this information can lead to an incomplete application, which the Illinois Department of Revenue will not process until clarified.

Another frequent error revolves around the signature requirement. An owner or an authorized officer must sign the form. Use of signature stamps is unacceptable. Without a proper signature, the request is invalidated, requiring resubmission and additional waiting time.

Individuals may also neglect to check the reason for requesting the tax clearance. The form provides multiple options, and selecting the correct reason aids in the processing of the application. If a respondent chooses “Other” without elaborating adequately, it may lead to confusion and further delays.

Finally, improper submission of the form can be a significant mistake. Form ITR-1 must be sent to the correct address, and failing to follow submission guidelines may result in the form not reaching the intended department in a timely manner. It is advised to verify that all details are complete and accurate before mailing the form to ensure swift processing.

Documents used along the form

The ITR-1 form is essential for those seeking tax clearance in Illinois. However, it is often accompanied by other documents to ensure compliance with state tax laws. Here are five important forms that may be used along with the ITR-1. Each serves a specific purpose in the tax clearance process.

- CBS-1, Notice of Sale or Purchase of Business Assets: Use this form if you are selling or have sold your business assets. It notifies the state about the change in ownership or assets sold, which is crucial for tax purposes.

- IL-2848, Power of Attorney: This form allows another person to act on your behalf regarding tax matters. If you have designated someone to manage your tax issues, you must include a copy of this form with your ITR-1 submission.

- Form ST-1, Illinois Sales and Use Tax Registration: If your business sells taxable goods or services, this registration form is needed. It ensures that you have a proper permit to collect sales tax from customers.

- Form IL-941, Illinois Withholding Income Tax Return: Employers in Illinois must report income tax withheld from their employees' wages. Submitting this form helps confirm that withholding taxes have been properly managed.

- Form IL-1065, Partnership Replacement Tax Return: Partnerships must file this form to report income and expenses. This document is necessary for tax clearance if your business operates as a partnership in Illinois.

Understanding these forms and their purposes can simplify the tax clearance process. Properly completing and submitting all necessary documents ensures compliance and helps avoid delays with your request.

Similar forms

The ITR-1 Illinois form, designed for requesting tax clearance, shares similarities with a few other documents aimed at business and tax management. Here's a quick overview of four forms that bear resemblance to the ITR-1:

- Form CBS-1: Notice of Sale or Purchase of Business Assets - Unlike the ITR-1, which is used for business tax clearance, the CBS-1 is specifically for reporting the sale or acquisition of business assets. This form helps ensure that the Illinois Department of Revenue is aware of any changes in ownership or control of a business’s assets.

- Form IL-2848: Power of Attorney - While the ITR-1 requires a signature from the business owner or officer, the IL-2848 enables someone else to act on behalf of the business for tax matters. It’s essential to attach this form if an authorized representative is completing the ITR-1 on your behalf.

- Form ST-1: Sales and Use Tax Registration - Similar to the ITR-1 in its focus on taxes, this form is used to register for the collection of sales and use taxes. Businesses need to file this form to begin collecting taxes on their sales, which is a crucial step before seeking a tax clearance like the ITR-1.

- Form IL-941: Illinois Withholding Income Tax Return - Both the ITR-1 and IL-941 relate to tax compliance, but the IL-941 focuses specifically on withholding taxes from employees’ wages. Filing the IL-941 correctly is critical for maintaining good standing with the Illinois Department of Revenue, just as filing the ITR-1 does for overall business tax clearance.

These forms each play a unique role in the tax and business management process, yet they share the common goal of ensuring compliance with state tax laws.

Dos and Don'ts

When filling out the ITR-1 Illinois form, it is important to approach the task with care. Here’s a checklist of things to do and avoid to ensure your submission is complete and accurate.

- Do ensure all previous tax returns are filed before submitting Form ITR-1.

- Do allow a minimum of 10 business days for processing your request.

- Do use your legal business name as it appears on official documents.

- Do confirm that your business has no outstanding tax liabilities.

- Do provide accurate contact information, including your telephone number.

- Don't complete Form ITR-1 if you are selling your business assets; use Form CBS-1 instead.

- Don't sign the form electronically unless specified; signature stamps will not be accepted.

- Don't leave any required fields blank, as this may lead to processing delays.

- Don't submit your form without checking for accuracy. Small errors can lead to significant issues.

- Don't forget to attach any required documentation, such as power of attorney if applicable.

Misconceptions

Here are eight common misconceptions about the ITR-1 Illinois form, along with clarifications to help you understand the process better.

- ITR-1 can be submitted without filing all tax returns. This is incorrect. Form ITR-1 will not be processed until all related tax returns are filed and all balances are paid, including penalties and interest.

- Processing time is immediate. Many people believe their requests will be handled right away. In reality, you should allow at least 10 business days for processing of Form ITR-1.

- You can use ITR-1 to settle sale of business assets. If you are selling or have sold your business assets, you should not use Form ITR-1. Instead, you must complete Form CBS-1, which is specifically designed for this purpose.

- Form ITR-1 is necessary for all tax clearances. This form is only for specific tax clearances. Ensure that it applies to your situation before completing it.

- Signature stamps are acceptable on the form. This is a misconception. Only a personal signature by an owner or officer of the business will be accepted. Signature stamps cannot be used.

- Submitting the form guarantees no future audits. Submitting an approved Form ITR-1 does not prevent future assessments or audits. The department can still audit for any pending, current, or future tax liabilities.

- Help is readily available. Some believe that assistance is hard to come by. However, if you need help completing Form ITR-1, assistance is available by contacting the Illinois Department of Revenue.

- The form is optional for tax clearance requests. This is false. If you require tax clearance for specific transactions—such as a real estate transaction or bank closing—submitting Form ITR-1 is mandatory.

Understanding these points can lead to a smoother experience when dealing with tax clearance in Illinois. It’s important to ensure you meet all requirements and understand the limitations of Form ITR-1.

Key takeaways

Filling out and using the ITR-1 form in Illinois requires attention to detail to ensure a smooth process. Here are nine key takeaways:

- Completion of Returns: The ITR-1 form will not be processed until all tax returns are filed and any outstanding balances, including penalties and interest, are paid.

- Processing Time: Expect a minimum of 10 business days for the processing of the ITR-1 form after submission.

- Business Asset Sales: If your business has sold its assets, do not use the ITR-1 form. Instead, you should complete the CBS-1 form.

- Assistance: For help in filling out the form, you can contact the Illinois Department of Revenue at 1-800-732-8866.

- Identification: Accurately provide your name, business name, and relevant identification numbers such as your FEIN and IBT number.

- Tax Types: When completing the form, clearly check the boxes for all applicable taxes for which you are requesting clearance.

- Reason for Request: Clearly indicate the reason for requesting the tax clearance. This should be done in the designated section on the form.

- Signature Requirement: An owner or authorized officer must sign the form. Note that signature stamps are not permissible.

- Sending the Form: After completing the form, send it to the address provided, ensuring you have included all necessary information to avoid delays in processing.

Browse Other Templates

When You Start a New Job, How Would You Sign Up for Direct Deposit? - Direct deposit reduces the risk of missing or stolen checks.

Final Expense Claim Form,Life Insurance Benefit Claim Form,Insurance Benefits Request Form,Claim Application for Deceased Insured,Insurance Death Benefit Submission Form,Posthumous Benefit Claim Form,Decedent's Claims Application,Bereavement Insuranc - The date of death must be clearly indicated to avoid processing delays.

Frederick County Permit - Permits can be requested for new construction, additions, or existing structures.