Fill Out Your Jamaica Life Certificate Form

The Jamaica Life Certificate form serves an essential purpose for individuals claiming salary or pension benefits. It requires the claimant to provide their full name, address, office designation, and the nature of the claim, whether for salary or pension. The form also indicates the period for which the benefits are being claimed, making it clear that this certificate should not be filled out before the conclusion of that period. Claimants must add their signature to certify personal identification as a part of the process. To validate the form, a certified individual, such as a magistrate, minister, notary public, or banker, must confirm the identity of the claimant by signing the document. Additionally, information about the certifying person's name, address, and qualifications is also necessary. Individuals can obtain this certificate from various locations, including the Office of the Crown Agents in London, the Accountant General's Department in Jamaica, and Jamaica's consulates and high commissions. It is important to remember that specific quarter periods end on the last days of March, June, September, and December, highlighting the need for timely submission.

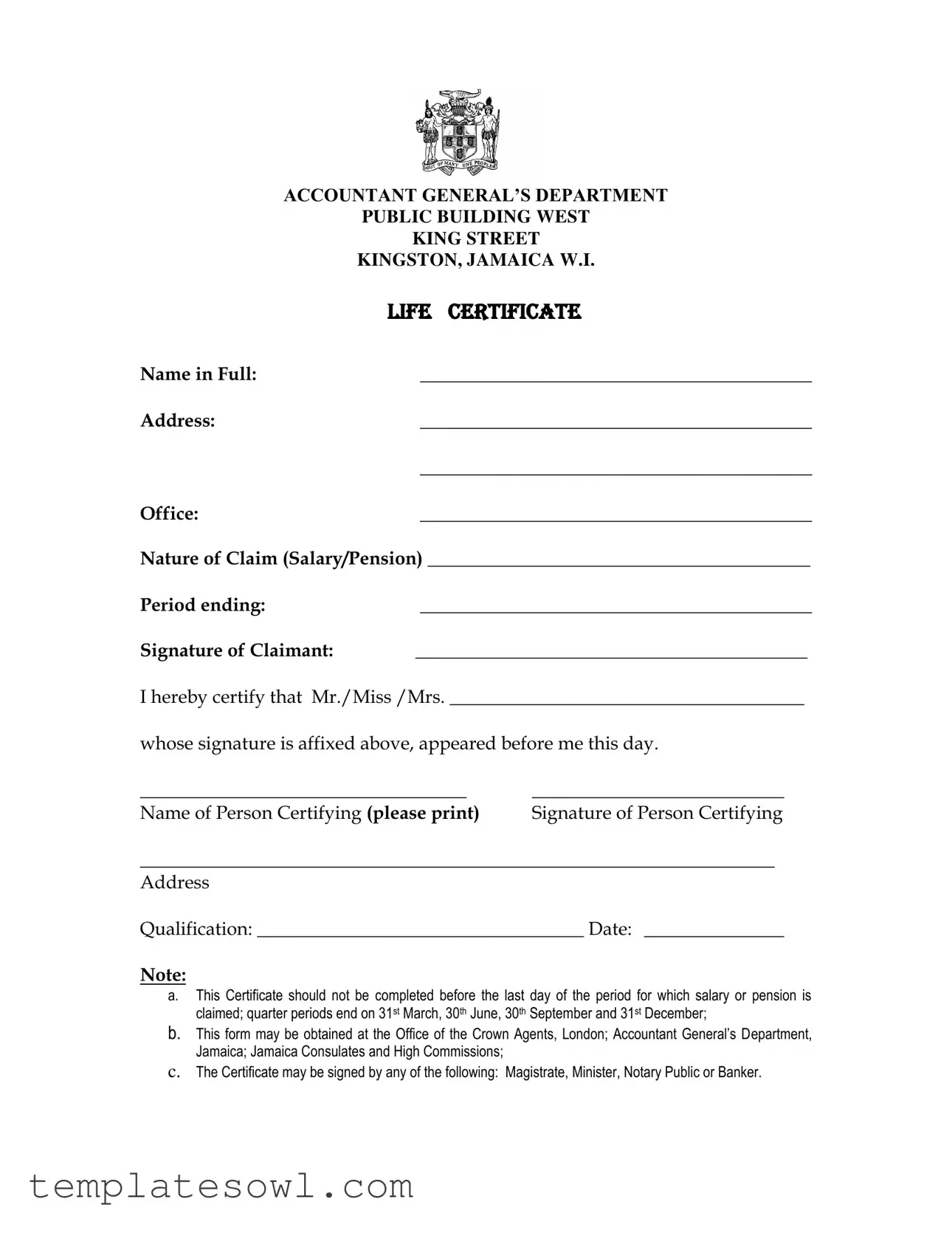

Jamaica Life Certificate Example

|

ACCOUNTANT GENERAL’S DEPARTMENT |

|

PUBLIC BUILDING WEST |

|

KING STREET |

|

KINGSTON, JAMAICA W.I. |

|

LIFE CERTIFICATE |

Name in Full: |

__________________________________________ |

Address: |

__________________________________________ |

|

__________________________________________ |

Office: |

__________________________________________ |

Nature of Claim (Salary/Pension) _________________________________________

Period ending: |

__________________________________________ |

Signature of Claimant: |

__________________________________________ |

I hereby certify that Mr./Miss /Mrs. ______________________________________

whose signature is affixed above, appeared before me this day.

___________________________________ |

___________________________ |

Name of Person Certifying (please print) |

Signature of Person Certifying |

____________________________________________________________________

Address

Qualification: ___________________________________ Date: _______________

Note:

a.This Certificate should not be completed before the last day of the period for which salary or pension is claimed; quarter periods end on 31st March, 30th June, 30th September and 31st December;

b.This form may be obtained at the Office of the Crown Agents, London; Accountant General’s Department, Jamaica; Jamaica Consulates and High Commissions;

C. The Certificate may be signed by any of the following: Magistrate, Minister, Notary Public or Banker.

Form Characteristics

| Fact Name | Details |

|---|---|

| Name Requirement | The full name of the claimant must be provided on the form. |

| Address Requirement | Claimants must include their complete address. |

| Nature of Claim | Specify whether the claim is for salary or pension. |

| Certification Entity | A Magistrate, Minister, Notary Public, or Banker can certify the form. |

| Submission Timing | This certificate cannot be completed before the claim period ends. |

| Obtaining the Form | The form is available at various locations, including the Accountant General's Department in Jamaica. |

Guidelines on Utilizing Jamaica Life Certificate

After completing the Jamaica Life Certificate form, you will need to submit it to the appropriate authority for processing. Make sure you keep a copy for your records. Follow these steps to fill out the form correctly.

- Begin by entering your name in full in the designated space at the top of the form.

- Next, enter your address, ensuring to be as complete and accurate as possible.

- Provide the name of your office in the appropriate section.

- Specify the nature of the claim you are submitting, whether it is for salary or pension.

- Indicate the period ending date for which you are claiming the salary or pension.

- Sign your name in the signature of claimant section.

- Next, the form will require the certification details. Enter the name of the person certifying your claim along with their signature.

- List the address of the person certifying your claim.

- Provide the qualification of the person certifying your claim.

- Finally, write the date of filling out the form.

Once you have completed all sections, review your form for accuracy, and then proceed to submit it as instructed.

What You Should Know About This Form

What is the Jamaica Life Certificate form used for?

The Jamaica Life Certificate form is used to verify the life status of an individual who is claiming a salary or pension. It serves as proof that the claimant is alive and eligible to receive their due payments.

Who needs to fill out the Jamaica Life Certificate form?

The Life Certificate form must be completed by anyone who is claiming a salary or pension from Jamaica, including retirees and beneficiaries of government payments.

What information is required on the form?

The form requires basic information such as the claimant's full name, address, office, nature of the claim (salary or pension), and the period for which the claim is being made. Additionally, the signature of the claimant and the person certifying the document is necessary.

Who can certify the Life Certificate?

The certificate can be signed by a range of individuals, including a magistrate, minister, notary public, or banker. It’s essential that the certifier is a recognized officer to ensure the document's validity.

When should the Life Certificate be filled out?

This certificate should be completed only after the last day of the period for which the salary or pension is claimed. Quarter periods end on March 31, June 30, September 30, and December 31.

Where can the Life Certificate form be obtained?

You can obtain the Life Certificate form from multiple locations. These include the Office of the Crown Agents in London, the Accountant General's Department in Jamaica, and Jamaican consulates and high commissions worldwide.

What happens if the form is not completed correctly?

If the form is filled out incorrectly, it may delay the processing of your claim. This could mean a longer wait for your salary or pension payments to be issued.

Is there a deadline for submitting the Life Certificate?

Can I submit the form electronically?

Currently, the Jamaica Life Certificate form needs to be submitted physically. It is important to ensure that the necessary parties sign the document before submitting it to the appropriate office.

Common mistakes

Completing the Jamaica Life Certificate form is a crucial step for individuals seeking salary or pension benefits. However, several common mistakes can lead to delays or even rejection of the form. Understanding these pitfalls can save time and reduce frustration.

One significant mistake involves filling out the name in full section improperly. Claimants often abbreviate their names or use nicknames. Always use the full legal name as it appears on official records. This ensures that your identity is clearly established and matches the records held by the relevant authorities.

Another frequent error occurs in the address section. Incomplete or incorrect addresses can hinder the processing of the application. It is essential to provide a complete address, including any apartment numbers or specific details that ensure accurate delivery and identification.

Many individuals neglect to specify the nature of claim. It is vital to explicitly state whether the claim is related to salary or pension. A vague or missing description can lead to confusion and potential delays in processing the claim.

Failing to adhere to the timeline for completion is a common oversight. The instructions clearly indicate that the certificate should not be filled out before the last day of the period for which the claim is being made. Filling it out too early may result in the form being deemed invalid, requiring resubmission.

Additionally, there are issues regarding the signature of the claimant. Some individuals forget to sign the certificate or do not use their official signature. The signature must match the one on other legal documents to validate the claim. Any discrepancies could lead to further scrutiny or rejection.

Lastly, those certifying the document also make mistakes. It is critical that the person certifying includes their name, signature, and qualification. Omitting this information can render the certificate incomplete, impacting the legitimacy of the claim.

By being aware of these errors and taking care to address each section properly, individuals can enhance the chances of a smooth and successful claim process.

Documents used along the form

The Jamaica Life Certificate form is an essential document used primarily to verify the identity and status of a claim for salary or pension benefits. When completing this form, individuals may also require several other forms and documents that complement the life certification process. Below are some commonly associated documents.

- Identification Proof: This document serves to establish the identity of the claimant. It could include a passport, driver's license, or any government-issued ID. This proof ensures that the person claiming benefits is indeed the entitled individual.

- Claimant Affidavit: This is a sworn statement by the claimant affirming the truthfulness of the information provided in the life certificate. An affidavit adds a layer of legal reliability, often required by financial institutions or pension boards.

- Benefit Claim Form: This form outlines the specific details regarding the benefits being claimed, whether for salary or pension. It usually includes information about the claimant's employment history, the benefits sought, and other relevant details.

- Death Certificate (if applicable): In the case of a pension claim due to the death of the member, this document is critical. It officially records the member's passing and is required by dependents or beneficiaries to access entitled benefits.

- Proof of Residence: This document verifies the claimant's current address. Utilities bills, lease agreements, or government documents displaying the name and address can meet this requirement. It ensures that communications regarding the benefits reach the correct location.

Each of these documents plays a specific role in ensuring a smooth processing of claims related to pensions or salaries. Understanding the importance of these forms can significantly ease the process for all parties involved.

Similar forms

- U.S. Social Security Administration Form SSA-11: This form is used to apply for Social Security benefits. Similar to the Jamaica Life Certificate, it verifies the identity and eligibility of the claimant, requiring a signature from an authorized official.

- Notarized Affidavit: A notarized affidavit serves as a written statement confirmed by oath or affirmation. Both documents require the presence and signature of an official to validate a person's identity and claim.

- Pension Application Form: This document is submitted to claim pension benefits. Like the Jamaica Life Certificate, it confirms the identity of the claimant and may require certification by an official.

- Affidavit of Support: Used in immigration cases, this affidavit requires an authorized party to certify financial support, mirroring the Jamaica Life Certificate's need for an official's signature to confirm authenticity.

- Certificate of Good Standing: This document verifies that a business entity is compliant with state regulations. Similar to the life certificate, it needs certification from an official body to assert its validity.

- Certificate of Existence: Issued by a state’s secretary of state, this certificate confirms that a business structure is active. Both require confirmation by an official entity.

- Verification of Employment Form: Used by employers to confirm an employee’s employment status, it necessitates a signature from a representative, similar to the Jamaica Life Certificate.

- Claim Form for Life Insurance: This form allows beneficiaries to claim proceeds from a life insurance policy. Like the life certificate, it must be signed by an insured person and verified by an official.

- Veteran's Affairs Claim Form: This form is used by veterans to claim benefits. It also requires verification by officiants who certify the claimant's identity.

- Establishing Power of Attorney Document: This document grants authority to act on another's behalf. Like the Jamaica Life Certificate, it typically needs to be signed and notarized to ensure its authenticity.

Dos and Don'ts

When filling out the Jamaica Life Certificate form, keeping a few key points in mind can make the process smoother. Here are five things you should and shouldn't do:

- Do complete the form after the last day of the claiming period.

- Don't rush; take your time to ensure all information is accurate.

- Do include your full name and address clearly.

- Don't forget to have the certificate signed by an authorized person.

- Do check for any additional requirements based on your claim type.

Following these tips can help you avoid delays and ensure your claim is processed efficiently.

Misconceptions

Understanding the Jamaica Life Certificate form can be crucial for those applying for salary or pension claims. However, several misconceptions often lead to confusion. Here are ten common misunderstandings about this important document:

- It's only for pension claims. Many believe the Jamaica Life Certificate is used only for pension claims, but it is applicable for both salary and pension requests.

- It can be completed any time during the claim period. Some think they can fill out the form anytime. In reality, it should not be completed before the last day of the period for which the claim is made.

- Only Jamaican citizens can use the form. This form is not limited to citizens. Resident non-citizens eligible for salary or pension can also use it.

- The form is valid indefinitely. There’s a misconception that the Life Certificate lasts forever. It’s important to fill it out for each new claim period.

- Any signature can certify the form. People often think any signature can validate the document. Only specific individuals like magistrates, ministers, or notaries public can certify it.

- You can find the form anywhere. Contrary to what some might believe, the Life Certificate is available only at specific locations such as the Accountant General’s Department and Jamaica Consulates.

- One certificate covers multiple claim periods. Many believe one certificate suffices for several claims. In fact, a new certificate is required for each claim period.

- Certifying someone is a simple task. People may think certifying a form is an easy job. Certifiers bear the responsibility to ensure the accuracy of the details provided.

- There are no qualifications needed to certify. It’s a common belief that anyone can verify the form. However, certifiers must possess specific qualifications, which need to be detailed on the form.

- Once submitted, it cannot be changed. Many worry that errors mean a form cannot be revised. If you find a mistake, it’s important to address it before final submission.

Each of these misconceptions can lead to mistakes that may delay claims or create unnecessary obstacles. Understanding the correct information can help ensure a smoother process for everyone involved.

Key takeaways

When dealing with the Jamaica Life Certificate form, here are some key takeaways to keep in mind:

- Complete After the Period Ends: Make sure you fill out the certificate only after the last day of the period for which you are claiming salary or pension.

- Quarterly Periods: Note that quarter periods conclude on March 31, June 30, September 30, and December 31.

- Obtain the Form Easily: You can get this form from various locations, including the Office of the Crown Agents in London, the Accountant General’s Department in Jamaica, and Jamaica Consulates and High Commissions.

- Signature Requirement: The form must be certified by a professional such as a Magistrate, Minister, Notary Public, or Banker.

- Accurate Information: Fill in your name, address, office, and nature of the claim clearly and accurately to avoid any processing delays.

- Personal Appearance: The claimant must appear in person before the person certifying the document.

- Keep Records: Always retain a copy of the completed certificate for your records, as it may be needed for future reference.

- Signatures Matter: Ensure that both your signature and the signature of the person certifying are clear and legible on the document.

Being mindful of these details will help ensure a smooth process when filing your claim.

Browse Other Templates

Icwa California - Legal representatives submit the ICWA-020 form on behalf of the child or parent.

Owcp - The physician provides insight on any expected permanent effects from the injury.