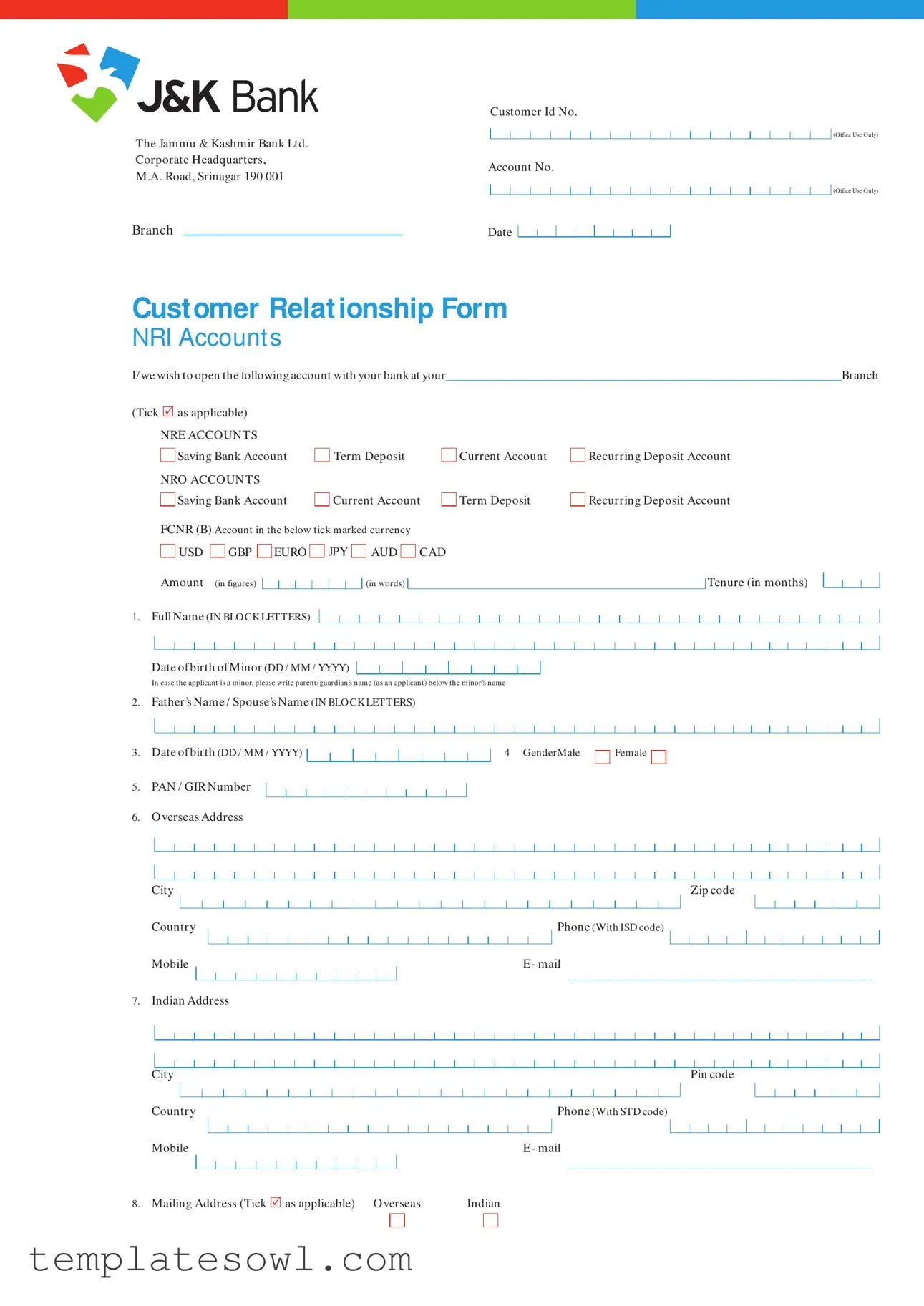

Fill Out Your Jk Bank Customer Relationship Form

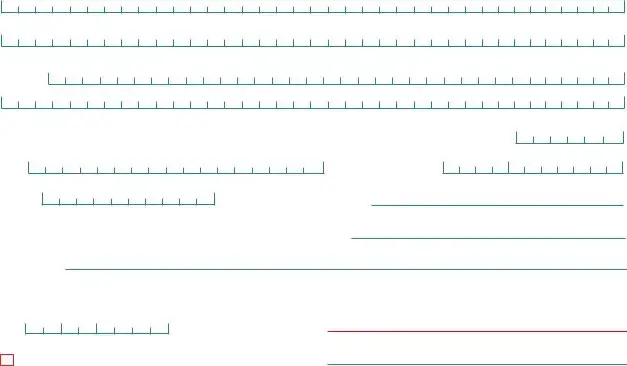

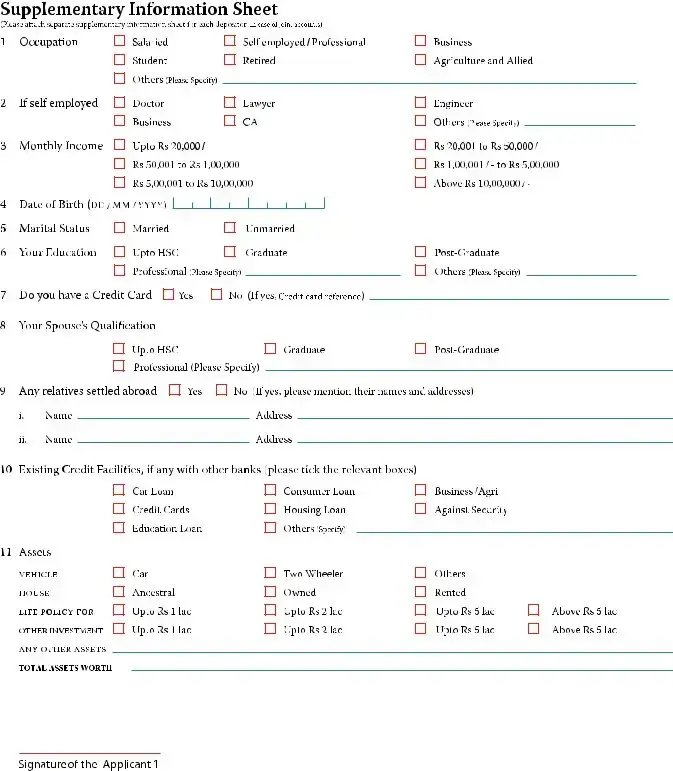

Opening an account with the Jammu & Kashmir Bank is an essential step for many individuals, including Non-Resident Indians (NRIs) looking to manage their finances effectively. The Customer Relationship Form is a vital document that captures a range of important information necessary for this process. It requires details such as the applicant's full name, date of birth, and gender, as well as their overseas and Indian addresses. Depending on the type of account—whether it be a Savings Bank Account, Current Account, or a Fixed Deposit—the form includes specific sections for the applicant to indicate their preferences, including the account tenure and the currency type. For joint account holders, additional sections detail the information of the second and third applicants, including their relationship to the first applicant. Notably, the form asks for identification documents such as passport copies and proof of address, ensuring a thorough verification process. Understanding the requirements of the Customer Relationship Form can simplify the account opening process, making it a less daunting experience.

Jk Bank Customer Relationship Example

Customer Id No.

(Office Use Only)

The Jammu & Kashmir Bank Ltd.

Corporate Headquarters,

Account No.

M.A. Road, Srinagar 190 001

(Office Use Only)

Branch |

|

Date |

|

Cust omer Relat ionship Form

NRI ACCOUNT S

I/ we wish to open the following account with your bank at your__________________________________________________________________Branch

(Tick Ρas applicable) |

|

NRE ACCOUNTS |

|

Saving Bank Account |

Term Deposit |

NRO ACCOUNTS |

|

Saving Bank Account |

Current Account |

FCNR (B) Account in the below tick marked currency |

|

USD GBP EURO |

JPY AUD CAD |

Current Account

Term Deposit

Recurring Deposit Account

Recurring Deposit Account

Amount (in figures)

1. Full Name (IN BLO CK LETTERS)

(in words)

Tenure (in months)

Date of birth of Minor (DD / MM / YYYY)

In case the applicant is a minor, please write parent/ guardian’s name (as an applicant) below the minor’s name

2. Father’s Name / Spouse’s Name (IN BLO CK LETTERS)

3. Date of birth (DD / MM / YYYY)

5.PAN / GIR Number

6.O verseas Address

4 GenderMale

Female

City

Country

Mobile

7.Indian Address

City

Country

Mobile

Zip code

Phone (With ISD code)

E - mail

Pin code

Phone (With STD code)

E - mail

8. Mailing Address (Tick Ρas applicable) |

O verseas |

Indian |

|||

|

|

|

|

|

|

|

|

|

|

|

|

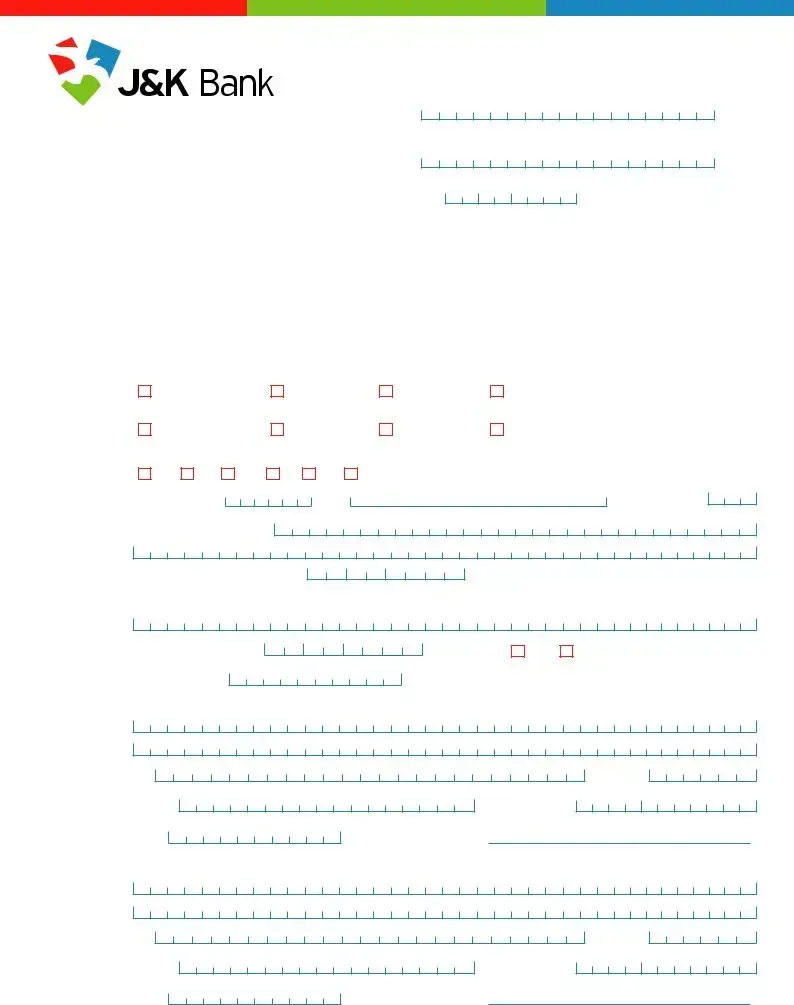

9.Passport Details

Passport Number

Place of issue

Nationality

10.Visa Details

Visa Number

Place of issue

Second Applicant (Applicable to Joint Account Holders only) 1. Full Name (IN BLO CK LETTERS)

Date of Issue

Date of Expiry

Date of Issue

Date of Expiry

Date of birth of Minor (DD / MM / YYYY)

In case the applicant is a minor, please write parent/ guardian’s name (as an applicant) below the minor’s name

2.Father’s Name / Spouse’s Name (IN BLO CK LETTERS)

3.Date of birth (DD / MM / YYYY)

5Relationship with 1st Applicant

4 GenderMale

Female

6. PAN / GIR Number

7.O verseas Address

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zip code |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone (With ISD code) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E - mail |

||||||||||||||||||||||||||

8.Indian Address

City

Pin code

Country |

|

|

|

|

|

|

Phone (With STD code) |

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile |

|

|

|

|

E - mail |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Mailing Address (Tick Ρas applicable) O verseas |

|

Indian |

|

|||||||||||||||||||||||||||||||||||||||

10.Passport Details

Passport Number

Date of Issue

Place of issue

Date of Expiry

Nationality

10.Visa Details

Visa Number

Place of issue

Third Applicant (Applicable to Joint Account Holders only) 1. Full Name (IN BLO CK LETTERS)

Date of Issue

Date of Expiry

Date of birth of Minor (DD / MM / YYYY)

In case the applicant is a minor, please write parent/ guardian’s name (as an applicant) below the minor’s name

2.Father’s Name / Spouse’s Name (IN BLO CK LETTERS)

3.Date of birth (DD / MM / YYYY)

5Relationship with 1st Applicant

4 GenderMale

Female

6.PAN / GIR Number

7.O verseas Address

City

Country

Mobile

8.Indian Address

City

Country

Mobile

Zip code

Phone (With ISD code)

E - mail

Pin code

Phone (With STD code)

E - mail

9. Mailing Address (Tick Ρas applicable) |

O verseas |

Indian |

|||

|

|

|

|

|

|

|

|

|

|

|

|

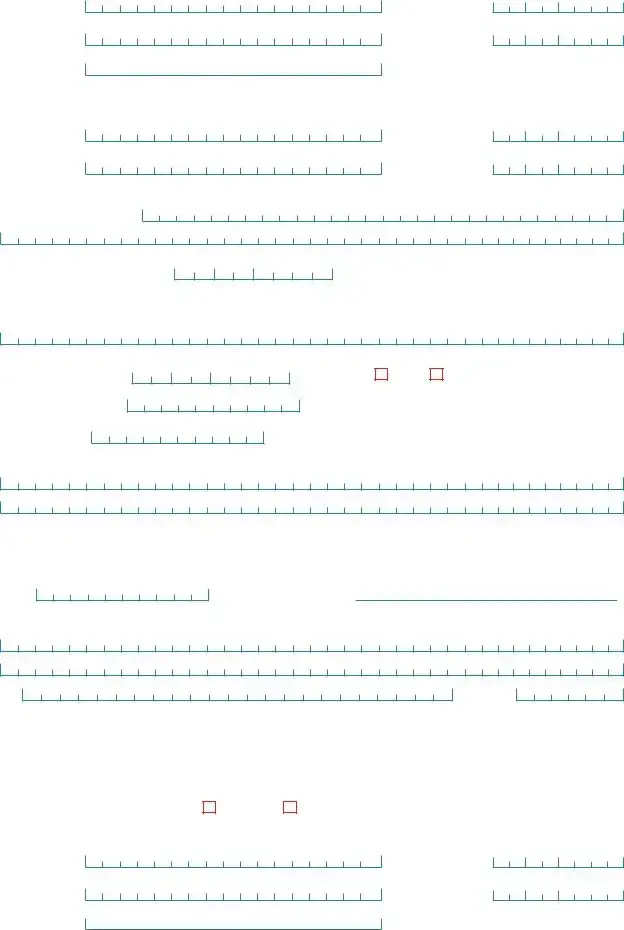

10.Passport Details

Passport Number

Place of issue

Nationality

11.Visa Details

Visa Number

Place of issue

Date of Issue

Date of Expiry

Date of Issue

Date of Expiry

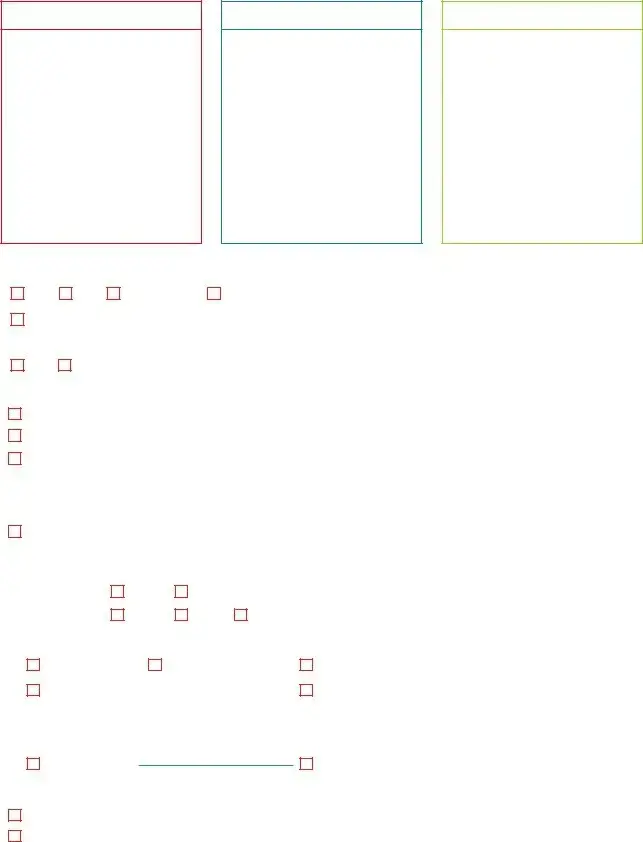

APPLICANT 1 (PHOTO GRAPH) |

APPLICANT 2 (PHOTO GRAPH) |

APPLICANT 3 (PHOTO GRAPH) |

Please sign across the photograph as well |

|

Please sign across the photograph as well |

|

Please sign across the photograph as well |

|

|

|

|

|

SPECIMEN SIGNATURE |

|

SPECIMEN SIGNATURE |

|

SPECIMEN SIGNATURE |

Operating Instructions (Tick Ρas applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Single |

Jointly |

Either or Survivor |

|

Anyone or Survivor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Any other (Please Specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Nomination Required? (Tick Ρas applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

No |

Yes (Name of Nominee) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please fill detailed nomination form separately |

|||||||||||||||||||||

Initial Payment Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Cash (Foreign Currency) Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rs. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Transfer from FCNR/ NRE (Fixed/ Savings/ Current) Account No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

DD/ Cheque No. |

|

|

|

|

|

|

|

|

|

Drawn on |

|

|

|

|

|

|

|

|

|

|

Bank |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Branch |

|

|

|

|

|

|

|

|

|

|

Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated |

|

|

|

|

|

|

|

|

|||||

for Rs / USD / GBP / EURO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be completed by branch as per |

|||||||||||||||

Inward TT reference No. |

|

|

|

|

|

|

Date of Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Statement date / Value date). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

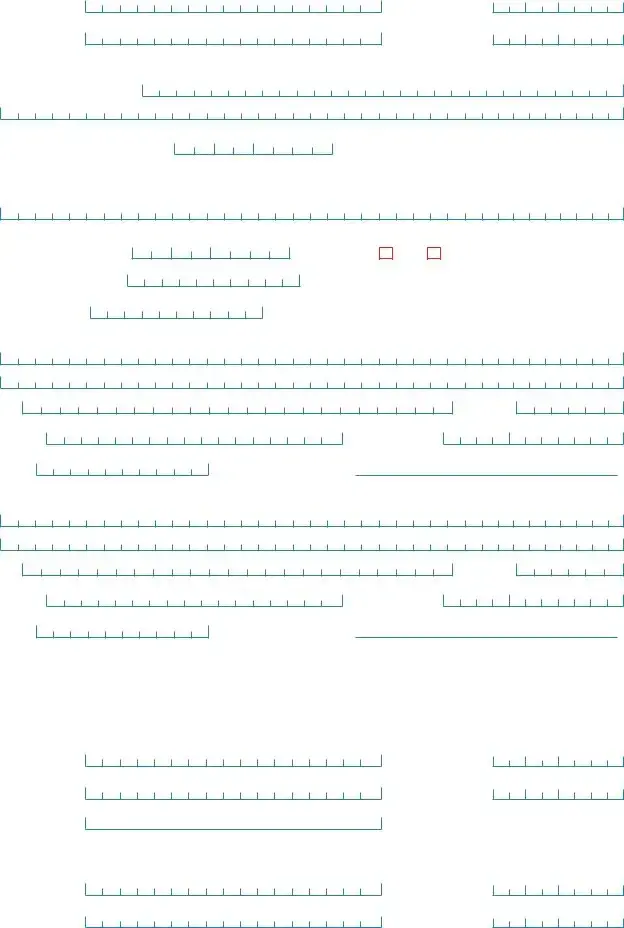

Statement of Account : Instructions (Tick Ρas applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Savings Account |

Quarterly |

Monthly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Current Account |

Quarterly |

Monthly |

|

Weekly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Maturity Instructions for fixed Deposits (Tick Ρas applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Renew Principal Only |

Renew Principal Plus Interest |

Issue DD/ Pay Order |

|||||||||||||||||||||||||||||||||||||||||

Credit to Account No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Others (Specify) |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

(Kindly note that in absence of instructions, the deposit will be renewed for the same period for which the extant deposit has already run or for 1 year, whichever is less)

Interest Payment Instructions (fill only in case of monthly/ quarterly interest payout and on maturity if the interest is not to be renewed with the principal)

Credit to Account No

Issue DD/ Pay order

Particulars of Introduction / Identification

(Tick Ρand fill as applicable)

Introduction by existing Banker (Please keep the relevant documents enclosed)

Introduction by existing J&K Bank Account Holder

Introducer’s Details

Full Name (IN BLO CK LETTERS)

Address

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pin code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State

Phone (With STD code)

Mobile

E - mail

Nature of Account |

|

Account Number |

Bank / Branch

I know the proposed account holder(s) for more than six months and confirm their address details given above.

Date

Signature

Self Introduction (In case of existing customers) Account Number

Documents Required

λTwo passport size photographs (two for each in case of joint account holders) signed across or at the reverse. Signatures can be attested by any one of the following :

υAn official authorised by the Indian Embassy or Consulate abroad. υNotar y.

υYour Banker.

υA person known to our Bank

λPhotocopy of relevant pages of the current passport where name, address, date of birth, date & place of issue, expiry date, photograph, signature & stamp regarding your stay outside India appear.

λA photocopy of Valid work permit/ employment visa.

(In case of expired visas, duly acknowledged petitions made to the Visa Authorities for renewal of visas will be accepted as a valid document .) λFor Persons of Indian Origin (PIO), Copy of PIO card or Copy of past Indian passport of self / parent /

declaration about Indian origin.

Any one of the following address proofs (For First Applicant only if the applicants are closely related). λUtility Bill.

λDriving License.

λResidence Permit (Govt . issued Identity card) λCredit Card Bills.

λRent Receipt .

λO verseas / Indian Bank Statement .

All Photocopies must be ATTESTED by any one of the following λAn official authorized by the Indian Embassy or Consulate abroad. λNotar y.

λYour Banker.

λA person known to our Bank. λSelf Attestation.

Declaration (applicable for Minor Accounts only)

Name of the Parent / Guardian

Minor’s date of birth (DD / MM / YYYY)

Relationship with Minor (Tick Ρas applicable)

Father

Mother

By court order (if yes, please affix a copy)

Other (please specify)

I shall represent the minor in all future transactions of any description in the above account till the said minor attains majority. I shall fully indemnity the bank against any claim of the above for any withdrawal/ transaction made by me in his/ her account .

Declaration

1.I am / We are Non Resident Indian(s) or persons of Indian Origin.

2.I / We under stand that the above account will be opened on the basis of the statements / declarations made by me / us and will be opened in the form and as per various Regulations framed under Foreign Exchange Management Act . 1999 and in particular. Foreign Exchange Management (Deposit) Regulations, 2000 as amended from time to time. I / We also agree that if any of the statements / declarations made herein is found to be not correct in material particulars, you are not bound to pay any interest on the deposit made by me / us and to discontinue the ser vice.

3.The account will be put into use only for bonafide transactions not involving any violations of the provisions of any Government / Exchange Control Regulation.

4.I/ We agree that the rate and the manner of interest to be paid shall be as per the Regulations and no claim will be made by me/ us for any interest on the deposits for any period after date/ s of maturity of the deposits.

5.I/ We agree to abide by the provisions of the FCNR/ NRE/ NRO Accounts scheme laid down by the RBI and as per the said act and the Regulations as emended from time to time.

6.I/ We hereby undertake to intimate you about my/ our return to India for permanent residence immediately on arrival.

7.I/ We authorise the Bank to automatically renew the deposit on due date for an identical period (unless otherwise specifically instructed before due date). The earlier receipt given to me will be treated as dicharged receipt on due date. I/ We understand that the interest applicable on renewals will be at the applicable ruling rates on the date of maturity and the renewed receipt will be made available on my/ our presenting the duly discharged origin receipt on the maturity date or later for payment . I/ We further understand that he renewal will be accordance with the provisions of the Reser ve Bank of India scheme in force at the time of renewal.

8.I/ We agree that if premature withdrawal is permitted at my/ our request the payment of interest on the deposit may be allowed in accordance with the prevailing stipulations laid down by the Reser ve Bank of India and J&K Bank in this regard.

9.I/ We shall not make available to any person resident in India, foreign currency against reimbursement in Rupees or in any other manner in India.

10.I/ We confirm that all debits/ credits to my/ our account shall be in accordance with the Regulations and are covered either by general or specific permission of Reser ve Bank of India.

11.I/ We will be liable to comply with the rules of the Foreign Exchange Management Act, 1999 and the Regulations and amendments thereof in force from time to time and as stipulated by the Reser ve Bank of India.

12.I/ We understand that the Bank may at its absolute discretion, discontinue any of the ser vices completely or partially without any notice to me/ us. I/ We agree that the Bank may debt my account for ser vice charges as applicable from time to time.

13.I/ We have read, understood and hereby accept & agree to the Terms and Conditions given for all the products and ser vices I have requested.

14.a) I/ We agree and undertake that in case of FNCR (B) Accounts, if the remittance from outside India is not in designated currency and the same is converted to the designated currency as stipulated in the Regulations, it shall be at my/ our entire risk and costs and I/ We shall not challenge the rate of conversion.

b)I/ We undertake that in case of premature payment and conversion into INRs of the FCNR (B) deposit is requested but within one year from the receipt of deposit, the deposit should be reversed at cash buying rate.

c)I/ We understand and affirm that in case at any time my/ our request for premature withdrawal of the FCNR (B) deposit is acceded to by the bank, the bank is authorised and entitled in its absolute discretion to levy penalty to recover the Swap cost from proceeds of the deposit paid prematurely.

15.I/ We hereby agree and confirm to bear any losses or claims that may arise directly/ indirectly on account of the Bank acting on any instructions received by it by fax or any electronic media given by me/ us or on my/ our behalf and agree to keep the Bank indemnified from any such losses and / or claims.

16.I/ We do hereby declare that the information furnished in this form is true to the best of my/ our knowledge and belief.

17.I/ We hereby indemnify and forever keep indemnified the Bank and its successors and assigns of, from and against any and all claims, actions, penalties that may be made, suffered or incurred by the bank by reason of my/ our

Signature of Applicant 1 |

Signature of Applicant 2 |

Signature of Applicant 3 |

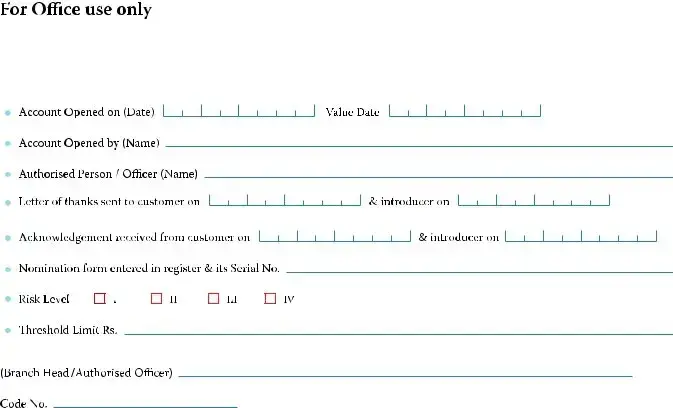

I/ We certify the particulars of the applicant/ s on the basis of documents provided by him and am / are satisfied with the

Form Characteristics

| Fact Name | Fact Detail |

|---|---|

| Account Types | The form allows customers to open various types of accounts, including NRE, NRO, and FCNR accounts, with options for savings, current, and term deposits. |

| Governing Law | This form is subject to the laws of Jammu and Kashmir, India, as applicable to the Jammu & Kashmir Bank. |

| Identification Requirements | Applicants must provide two passport-sized photographs, certified identification, and proof of Indian origin if applicable. |

| Operating Instructions | The form includes options for setting account operating instructions, such as single or joint account operation. |

Guidelines on Utilizing Jk Bank Customer Relationship

Filling out the JK Bank Customer Relationship Form is an important step in establishing your banking relationship with the bank. This form gathers essential information about you and your financial needs, enabling the bank to serve you better. Below are the steps to complete the form accurately.

- Write your Customer ID number in the designated area if you have one. This is for office use only.

- Indicate the branch where you wish to open your account by clearly writing the branch name.

- Choose the type of account you wish to open. Tick the appropriate option(s) for NRE, NRO, Current, or FCNR accounts.

- Specify the currency for your FCNR account by marking one or more of the currencies provided (USD, GBP, EURO, JPY, AUD, CAD).

- Enter the amount you wish to deposit for a Recurring Deposit Account in figures. Provide the tenure (in months) as well.

- Fill in your full name in block letters and, below that, write it in words.

- If applicable, provide the date of birth of a minor applicant and include the name of the parent or guardian as the applicant below the minor’s name.

- Write your father’s or spouse’s name in block letters.

- Provide your date of birth in the specified format (DD/MM/YYYY).

- Enter your PAN/GIR number.

- Provide your overseas address, including the city, country, mobile number, and email address. Make sure to fill in any other details required, like zip or pin code.

- Even if you have an overseas address, also include your Indian address with the necessary details.

- Indicate your preferred mailing address by ticking either “Overseas” or “Indian.”

- Fill in your passport details, including the passport number, place of issue, nationality, and visa details if applicable.

- If you are applying for a joint account, repeat the same information for each additional applicant. Each applicant should provide their details in the corresponding sections.

- Attach a recent passport-sized photograph of each applicant, signing across the photograph.

- Decide on operating instructions for the account. Tick the appropriate options based on your preference.

- Indicate whether you require a nomination, and provide the name of the nominee if you answer “Yes.”

- Fill out the details for the initial payment, whether it is cash, transfer, or a bank draft.

- Select your preferences for account statements and maturity instructions.

- If you’re being introduced by someone, fill in their details in the introduction section, or opt for self-introduction if you are an existing customer.

- Ensure all required documents are attached, including photographs, proofs of identity, and address, and that they are attested as needed.

Once you have completed the form, double-check your entries to ensure accuracy. Submitting the correctly filled form along with all necessary documents will facilitate a smooth account opening process with JK Bank. If you have any questions or need assistance, don’t hesitate to reach out to a bank representative.

What You Should Know About This Form

What is the purpose of the Jk Bank Customer Relationship form?

The form is designed for customers who wish to open various types of accounts with Jammu & Kashmir Bank. This includes NRI accounts, NRE accounts, and NRO accounts, among others. It collects essential personal and financial information needed to establish a banking relationship.

What type of accounts can I open using this form?

You can choose from several account types, including Saving Bank Accounts, Current Accounts, Term Deposits, and Recurring Deposit Accounts. Be sure to indicate which account type you are interested in on the form.

What information do I need to provide for each applicant?

Each applicant must provide personal details such as full name, date of birth, father's name or spouse’s name, PAN/GIR number, overseas and Indian addresses, contact numbers, and email addresses. Passport and visa details are also required if applicable.

Is there a specific format for filling in names and addresses?

Yes, names should be written in block letters. Addresses should include all relevant details, like city, country, and zip codes. Ensure clarity to avoid any processing delays.

What should I do if I am a minor?

For minor applicants, the form requires the name of a parent or guardian to be written alongside the minor's name. This person will serve as the applicant on behalf of the minor until they reach legal age.

What documents need to be submitted with the form?

You must attach certain documents, including two passport-sized photographs, a photocopy of your passport, a valid visa or work permit, and proof of address. The required documents may vary depending on your specific situation, so make sure to check the form for details.

How will my account details be processed after submission?

Once you submit the form along with the required documents, the bank will review them. If everything is in order, your application will be processed, and you will receive confirmation about your account status.

What is the significance of the ‘Specimen Signature’ section?

The 'Specimen Signature' section allows you to provide your signature for bank records. This signature will be used to authorize transactions, ensuring security and preventing fraud.

Can I submit the form if I already have an account with Jammu & Kashmir Bank?

Yes, existing customers can fill out this form to open additional accounts. In such cases, a self-introduction with your existing account number may be required.

Is a nomination required when opening a new account?

Nominating a person is optional, but it is strongly encouraged. If you choose to have a nominee, please provide their details on the form. If not, indicate "No" in the nomination section.

Common mistakes

When filling out the Jk Bank Customer Relationship form, many people make simple yet significant mistakes that can delay the account opening process. One common error is incomplete personal information. All sections, such as full name, address, and date of birth, must be filled accurately. Leaving out essential details leads to confusion and potential follow-up inquiries.

An additional mistake involves illegible handwriting. Forms filled out with messy or unclear writing can make it difficult for bank staff to process the application correctly. Using block letters is encouraged to ensure all information is readable. This applies to all entries, especially names and addresses.

A third mistake often seen is incorrect or missing identification numbers. Providing the correct PAN or GIR number is crucial. If this information is wrong or overlooked, it can result in a rejection of the application. Always double-check to ensure the numbers entered match official documents.

Another frequent issue arises from not ticking the appropriate boxes. The form has various options for selecting account types and preferences. Failing to indicate which account type is desired creates uncertainty and requires further clarification from the applicant.

People sometimes also forget to provide contact information, such as mobile numbers and email addresses. These details are vital for the bank to communicate effectively regarding the application status. Omissions can lead to missed updates or important notifications.

In some cases, applicants make the mistake of using expired documents. Submitting an expired passport or visa can be a critical error. Validity of all submitted documents is necessary for verification purposes, so always check expiration dates before submission.

Similarly, failing to include supporting documents can be problematic. The form requires specific identification and proof of address. Incomplete submissions may cause delays as the bank might need to reach out for additional documentation.

Another common oversight is incorrectly signing the application. The signature must match the name on the identification documents. Any discrepancies can raise flags during the approval process.

People sometimes also neglect the specimen signature section on the form. This area is important for the bank to confirm that the signature used on transactions matches what is provided in the application.

Lastly, applicants should be cautious with the nomination section. Failing to indicate whether a nomination is necessary, or not providing the nominee's details correctly, can create complications down the line. Clear instructions must be followed to ensure that this section is completed accurately.

Documents used along the form

The Jammu & Kashmir Bank Customer Relationship form is an essential document for individuals looking to open various types of accounts. Additionally, several other forms and documents are often associated with this process. These documents help to streamline the account opening procedure and ensure that all necessary information is collected. Below is a brief overview of some of the most commonly used forms.

- Identification Document: This typically includes a copy of the applicant’s passport or national identity card. It serves to verify the identity of the account holder and is a crucial element in preventing fraud.

- Proof of Address: Accepted documents like utility bills, credit card invoices, or rental agreements are necessary to confirm the applicant's current residence. This provides the bank with an accurate address for correspondence and account-related communications.

- Tax Identification Number (TIN) Form: This document is needed to report interest income to the tax authorities. It ensures that the bank complies with regulations by having tax identification details on file.

- Nomination Form: This form allows account holders to designate a person who will inherit the account balance in the event of their passing. It simplifies the process of transferring account ownership and ensures that the account holder's wishes are respected.

- Introductory Form: If the applicant has been introduced by an existing customer or banker, this document includes details about the introducer and helps to establish trust and credibility during the application process.

These supporting documents play a vital role in the account opening process at Jammu & Kashmir Bank. By providing clear and accurate information, applicants can greatly enhance their likelihood of a smooth and successful onboarding experience.

Similar forms

-

Bank Account Application Form: Similar to the J&K Bank Customer Relationship form, this document collects personal information needed to open a bank account. It includes sections for applicant details, identification, and account preferences.

-

Loan Application Form: This form is used when seeking a loan from a bank. Like the customer relationship form, it requires personal information, financial background, and sometimes the identification of co-applicants or guarantors.

-

Credit Card Application Form: Individuals need to provide their personal information, income details, and other identifying documents. This application is similar because it assesses the applicant's creditworthiness.

-

Insurance Policy Application: When applying for an insurance policy, applicants fill out a form that requires personal information and previous health history. This parallels the customer relationship form as it captures essential identifiers and details.

-

Mutual Fund Investment Application: Investors fill out this document to invest in mutual funds. It contains personal identification information, similar to what is found in the J&K Bank form, for tracking and regulatory compliance.

-

KYC (Know Your Customer) Form: Banks and financial institutions use this to verify the identity of their clients. This document bears resemblance to the customer relationship form, as both require identification details and proof of residence.

Dos and Don'ts

When filling out the Jk Bank Customer Relationship form, it is essential to approach the task thoughtfully. Here are some key dos and don'ts to guide you:

- Do fill out all required fields accurately to avoid delays.

- Do use block letters for clarity, especially for your name and address.

- Do double-check all details, particularly the date of birth and identification numbers.

- Do ensure that one photograph is signed appropriately and attached as specified.

- Don't leave any mandatory sections blank, as this can lead to rejection of the form.

- Don't use nicknames or informal expressions; stick to legal names as per documents.

- Don't submit unverified or incomplete documentation; make sure all copies are attested.

- Don't rush through the process; take your time to ensure everything is correct.

Misconceptions

Misconceptions about the Jammu & Kashmir Bank's Customer Relationship Form can lead to confusion and frustration during the account opening process. Clear understanding is essential to ensure a smooth experience. Here are seven common misconceptions:

- All applicants must be Indian citizens. Many believe that only Indian citizens can open accounts. In reality, the bank accepts applications from Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) as well.

- The form is only for opening savings accounts. While a savings account application is included, the form also covers various account types, such as term deposits and current accounts for both NRE and NRO categories.

- Only the primary applicant needs to provide information. For joint accounts, all applicants must provide their details, including personal information and identification documents.

- You don’t need to attach any documents if you fill out the form. This is incorrect. The form requires several important documents, such as identity proof, photographs, and others that must be submitted along with it.

- Signature on the form is optional. Signing the form is essential; it acts as a consent for opening the account and indicates acceptance of the bank's terms and conditions.

- Once submitted, the account will be opened instantly. Account opening is not immediate. The bank needs time to verify all submitted information and documents before account activation.

- The mailing address is not important if you choose only an overseas address. This is misleading. The mailing address is crucial for communication and account statements, and should be documented accurately regardless of residency status.

Understanding these misconceptions can help potential customers navigate the account opening process more effectively. When in doubt, reaching out directly to the bank or consulting with a financial advisor can provide clarity.

Key takeaways

Understanding how to fill out the J&K Bank Customer Relationship Form can enhance your banking experience. Here are key takeaways to help you navigate the process efficiently:

- The form is used for opening various accounts, including NRE, NRO, and FCNR accounts.

- Ensure that all names and addresses are written in block letters for clarity.

- If applying on behalf of a minor, include the name of the parent or guardian below the minor's name.

- Provide accurate identification numbers, such as PAN or GIR numbers, as they are crucial for processing.

- Be prepared to offer both overseas and Indian addresses, along with contact details including mobile and email.

- Include a current photograph for each applicant, which should be signed across.

- Indicate your choice for account operating instructions—whether you prefer it to be single or joint.

- Decide on the frequency of bank statements for your account, such as quarterly or monthly.

- Familiarize yourself with the necessary documents that need to be attached, including proof of identity and address.

Following these points will ensure a smoother application process. Taking the time to fill out the form accurately saves time and prevents delays in opening your new account.

Browse Other Templates

Utilization Certificate Format Pdf - The parameters set by the form guide authorized personnel in fund management.

Lien Notice Letter - This notice includes crucial financial information, including contract amounts and payments made.

8833 Instructions - Understanding Form 8833 can streamline the treaty claim process significantly.