Fill Out Your Joint Check Form

In the construction and contracting industries, managing payments and ensuring proper transactions can often be complex. A Joint Check form serves a critical role in simplifying this process. This agreement is typically executed by three parties: the owner or prime contractor, the subcontractor, and the supplier. The essence of the Joint Check Agreement is to ensure that payments made for materials and labor provided by the supplier are securely routed to them, rather than being funneled through the subcontractor. It outlines the responsibilities and expectations of each party, specifying that checks for services rendered will be issued jointly to both the subcontractor and the supplier. This provides a layer of protection for the supplier, ensuring they receive payment promptly for their contributions to specific projects. Alongside financial guarantees, the agreement also includes stipulations regarding notice for insufficient funds and clarifies that the subcontractor acts merely as a conduit for the payment due to the supplier. By establishing such arrangements, all parties involved can foster trust, minimize disputes, and promote smoother project operations, ultimately leading to more successful completion of construction projects.

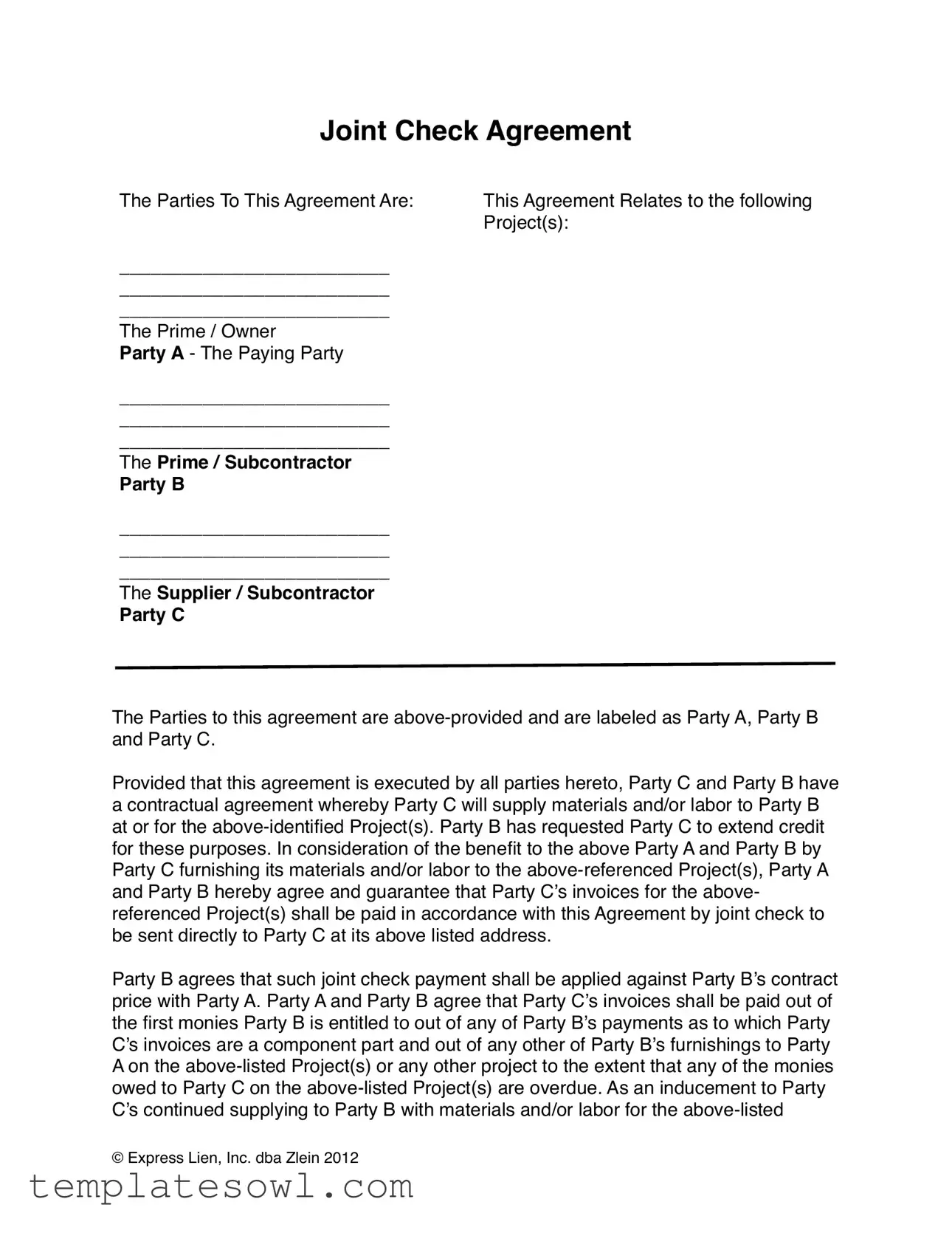

Joint Check Example

Joint Check Agreement

The Parties To This Agreement Are: |

This Agreement Relates to the following |

|

Project(s): |

__________________________ |

|

__________________________ |

|

__________________________ |

|

The Prime / Owner |

|

Party A - The Paying Party |

|

__________________________ |

|

__________________________ |

|

__________________________ |

|

The Prime / Subcontractor |

|

Party B |

|

__________________________ |

|

__________________________ |

|

__________________________ |

|

The Supplier / Subcontractor |

|

Party C |

|

The Parties to this agreement are

Provided that this agreement is executed by all parties hereto, Party C and Party B have a contractual agreement whereby Party C will supply materials and/or labor to Party B at or for the

Party B agrees that such joint check payment shall be applied against Party B’s contract price with Party A. Party A and Party B agree that Party C’s invoices shall be paid out of the first monies Party B is entitled to out of any of Party B’s payments as to which Party C’s invoices are a component part and out of any other of Party B’s furnishings to Party A on the

© Express Lien, Inc. dba Zlein 2012

Project(s), Party A herein agrees that if, at any time, there is insufficient monies left in Party B’s account to honor Party C’s invoices as submitted, Party A will so notify Party C in writing of such fact within ten (10) days of becoming reasonably aware of the same. Party C will rely on the absence of any such notification(s) as evidence that there are sufficient monies in Subcontractor's account for the

Party B has an affirmative duty to endorse any joint checks in favor of Party C paid under this Agreement upon receipt or presentation, as the case may be. Further, Parties A and B are prohibited from revoking this Joint Check Agreement without the written consent of Party C. Party B’s inclusion on any joint checks written in accordance with this Agreement is merely placing Party B in a position of holding the joint check in trust for the benefit of Party C, and Party B is a mere conduit for the payment due to Party C.

Nothing contained herein shall be construed to make Party C a party to, or in any way responsible for, any performance by either Party A or Party B that may be required under the terms of the contract between Party A and Party B, nor shall anything herein contained be construed to obligate Party C to extend future credit or furnish any materials and/or labor to any project whatsoever. Further, nothing herein contained shall be deemed to be a waiver of any rights of Party C to avail itself of any right or remedies that may be afforded to Party C under the provisions of the Uniform Commercial Code or mechanics lien laws, or the waiver of any rights whatsoever, this Agreement being in addition to any other legal rights available to Party C.

In the event of a default in payment of any amounts called for under this Agreement, Party A and Party B agree jointly and severally to pay Party C reasonable attorney’s fees and costs incurred by Party C in the enforcement of this Agreement. Party A and Party B acknowledge that this Agreement is entered into for valuable consideration and that each is specifically benefited by Party C’s furnishing of materials and/or labor to the

Signed: |

Signed: |

Signed: |

_____________________ |

_____________________ |

_____________________ |

Party A |

Party B |

Party C |

By: __________________ |

By: __________________ |

By: __________________ |

Title: _________________ |

Title: _________________ |

Title: _________________ |

Date: ___/___/_____ |

Date: ___/___/_____ |

Date: ___/___/_____ |

|

|

|

© Express Lien, Inc. dba Zlein 2012

Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Joint Check Agreement is a legal document used in construction and contracting situations, allowing payments to be made jointly to a contractor and a subcontractor or supplier. |

| Parties Involved | This agreement typically involves three parties: the Paying Party (Party A), the Subcontractor (Party B), and the Supplier (Party C). Each party has distinct roles regarding payment responsibilities. |

| Payment Method | Payments are made via joint checks to ensure that the supplier (Party C) receives payment directly, helping to protect against non-payment issues. |

| Contractual Nature | The contract establishes a binding agreement among the parties, outlining obligations and rights regarding payment and responsibilities related to the agreement. |

| Legal Framework | Joint Check Agreements are governed by state-specific contract laws, including principles from the Uniform Commercial Code where applicable. State laws may specify particular requirements. |

| Notification Requirement | Party A must inform Party C in writing if there are insufficient funds to cover the payments due to Party C, ensuring communication about financial matters related to the Agreement. |

Guidelines on Utilizing Joint Check

After preparing the Joint Check form, ensure all parties are ready to complete it accurately. This form requires clear information about the project, the parties involved, and their roles. Following these steps will help to ensure the form is filled out correctly.

- At the top of the form, identify "The Parties To This Agreement". Clearly list Party A (the Paying Party), Party B (the Prime/Subcontractor), and Party C (the Supplier/Subcontractor) with their full names and addresses.

- In the section labeled "This Agreement Relates to the following Project(s)", specify the projects for which the materials and/or labor will be supplied. Write the project names clearly.

- Next to each party's name, provide a signature line for Party A, Party B, and Party C. Each party must sign the form to confirm their agreement.

- Each party should print their name under their signature.

- In the designated "Title" section under each signature, include the title of each party representative who is signing the form.

- In the "Date" sections, fill in the date when each party signs the form. Use the format ___/___/_____ for clarity.

Once completed, keep copies for all parties involved. This ensures that all members have a record of the signed agreement. Send the original signed form to Party C promptly to confirm the arrangement regarding payments.

What You Should Know About This Form

What is a Joint Check Agreement?

A Joint Check Agreement is a legal document that establishes an arrangement between three parties: the paying party (Party A), the subcontractor (Party B), and the supplier (Party C). This agreement allows for payments made to Party C for materials and labor to be issued via a joint check between Party A and Party B, ensuring that Party C receives the funds directly for their contributions to a specified project.

Who are the Parties involved in a Joint Check Agreement?

In a Joint Check Agreement, there are three key parties involved. Party A is the Prime or Owner who is responsible for paying for the work being done. Party B is the Subcontractor who has contracted with Party A to perform work on a project. Party C is the Supplier or Subcontractor that provides materials or additional labor to Party B. Each party plays a distinct role in the agreement, and their cooperation is essential for payment to be processed smoothly.

How does the payment process work?

Under this agreement, Party A and Party B jointly guarantee that Party C’s invoices will be paid through a joint check process. When invoices are submitted by Party C for the work done on the identified projects, the payment will be issued in the form of a check signed jointly by Party A and Party B. This ensures that Party C is paid directly, reducing the risk of non-payment for the materials or labor provided.

What obligations do Parties A and B have regarding payment?

Party A and Party B are obligated to pay Party C's invoices out of the first funds available to Party B related to the project. If there are insufficient funds in Party B’s account to cover these invoices, Party A must inform Party C in writing within ten days. Furthermore, both parties have an affirmative duty to endorse the joint checks paid to Party C and cannot revoke this agreement without Party C's consent.

Can Party C seek additional legal rights under this Agreement?

Yes, Party C retains rights under the provisions of the Uniform Commercial Code as well as mechanics lien laws. This Agreement aims to protect Party C’s interests and does not waive any of the rights or remedies available to Party C. It is important to understand that the Joint Check Agreement is in addition to any other legal rights Party C may have regarding payment for materials or labor provided.

What happens if there is a default in payment?

In the event that Party A and Party B fail to make the payments as agreed, they jointly and severally agree to cover Party C’s reasonable attorney fees and costs incurred in enforcing the terms of the Joint Check Agreement. This provision serves as a safeguard for Party C, ensuring that they have financial recourse if payments are not made timely.

How is the Joint Check Agreement executed?

The Joint Check Agreement becomes effective once all three parties have signed it. Each party represents and binds themselves and their respective successors and assigns to the terms laid out in the agreement. The document may be executed in counterparts, meaning each party can sign separate copies, and any invalid provisions can be separated from the rest, allowing the agreement to remain intact.

Common mistakes

When it comes to filling out the Joint Check form, individuals sometimes make mistakes that could have serious implications for all parties involved. Here are five common errors to be aware of.

Failure to Complete All Sections is one of the most frequent mistakes. Incomplete forms lead to confusion and delays. Each section is designed to capture important information about the project and the parties involved. Neglecting even a single field can result in processing complications down the road.

Another critical error is the incorrect identification of parties. Clear identification of Party A, Party B, and Party C is essential. If one or more parties are mislabeled or inaccurately described, it can create legal challenges or misunderstandings that may delay payment. Checking that names and roles match the agreement is vital.

Additionally, failing to include accurate project details often leads to trouble. The form requires specific project information. Omitting this can result in payment being processed incorrectly or not at all. Pay careful attention to ensure that the project(s) are clearly stated and correct.

Neglecting Signatures is another common mistake. Each party must sign the agreement for it to be valid. This step cannot be overlooked. Without proper signatures, the entire agreement may lack enforceability, causing all parties to miss out on important protections. It’s crucial to confirm that all necessary signatures are obtained.

Lastly, not understanding the terms and obligations outlined in the form can lead to miscommunication and disputes later on. Each party should take the time to read and comprehend the responsibilities specified in the agreement. A misunderstanding could affect payment processes or responsibilities related to materials and labor.

In summary, attention to detail can make all the difference when completing the Joint Check form. By avoiding these common mistakes, all parties can help ensure a smooth partnership and timely payments.

Documents used along the form

The Joint Check Agreement is a vital tool in construction and contractual projects, fostering collaboration and ensuring financial security among all parties involved. Several other documents often accompany the Joint Check form to streamline communication and clarify obligations. Here’s a brief overview of these common forms:

- Subcontractor Agreement: This contract outlines the working relationship between the prime contractor and the subcontractor, detailing the scope of work, payment terms, and responsibilities. It serves as the foundational agreement for the subcontractor’s performance on a project.

- Payment Application: This document is submitted by the subcontractor or supplier to request payment for work completed or materials provided. It typically includes a breakdown of costs and ensures that all parties are aware of what is being billed before payment is made.

- Invoice: An invoice provides a detailed account of services rendered or materials supplied. It specifies amounts owed, due dates, and payment instructions. This document is essential for both tracking expenses and securing payments.

- Waiver of Lien: This form is used to relinquish a contractor's or subcontractor's right to file a lien against a property once they’ve been paid. It’s a safeguard for the property owner, ensuring that no liens can be placed on their property after payment has been made.

- Change Order: This document records any changes to the original construction agreement. It modifies the scope of work, costs, or timeline, ensuring that all parties agree to any updates in the project’s direction.

Using these documents in conjunction with the Joint Check Agreement helps maintain clarity and trust among all involved parties. Each form plays a crucial role in facilitating communication, ensuring payment processes are clear, and protecting the rights of all those contributing to a project.

Similar forms

- Contractor Agreement: Similar to a Joint Check Agreement, a Contractor Agreement establishes the roles, responsibilities, and payment terms between a contractor and a client. It clearly outlines what services will be provided and under what conditions payments will be made.

- Purchase Order: A Purchase Order serves as a formal request for goods or services, detailing quantities, prices, and delivery terms. Like the Joint Check Agreement, it can specify payment methods and timelines.

- Subcontractor Agreement: A Subcontractor Agreement formalizes the outsourcing of certain tasks to a subcontractor. It includes payment arrangements and expectations, similar to how the Joint Check Agreement addresses payments to suppliers.

- Authorization for Payment: This document authorizes specific payments to a vendor or supplier. Similarly, the Joint Check Agreement ensures that the payment due to a supplier is handled in a predetermined manner.

- Payment Bond: A Payment Bond guarantees that a contractor will pay subcontractors and suppliers. Like the Joint Check Agreement, it protects the financial interests of those supplying goods or services.

- Project Funding Agreement: Such agreements outline how funds will be managed and disbursed for a project. The focus on payment assurance in both documents serves to secure financial obligations.

- Escrow Agreement: An Escrow Agreement involves a third party holding funds until specific conditions are met. The Joint Check Agreement similarly regulates how payments are disbursed, with defined conditions for release.

- Supplier Agreement: This document outlines the terms and conditions between a supplier and a business. Like the Joint Check Agreement, it details payment and responsibility for fulfilling deliverables.

- Debt Acknowledgment Letter: This letter confirms the existence of a debt and payment terms. The Joint Check Agreement also acknowledges debts while laying out how payments will be executed.

Dos and Don'ts

When filling out the Joint Check form, it is important to pay attention to certain practices. Here are four essential dos and don'ts to consider:

- Do ensure all parties are clearly identified with their official names and titles.

- Don't leave any blank spaces in critical sections of the form.

- Do review the agreed payment terms to avoid misunderstandings.

- Don't attempt to make changes to the agreement without the consent of all parties involved.

Misconceptions

The Joint Check Agreement is often misunderstood. Here are seven common misconceptions:

- 1. Joint checks guarantee payment to everyone involved. Many believe that issuing a joint check automatically ensures payment to all parties. In reality, while it provides a method for payment, the agreement does not guarantee that all parties will receive their money if the paying party faces financial issues.

- 2. A joint check can replace a contract. Some think that a joint check can serve as a substitute for a contractual agreement. However, it merely provides a way to facilitate payments and does not replace the underlying contracts that define relationships and responsibilities.

- 3. Only the prime contractor can initiate a joint check. There is a misconception that only the prime contractor has the authority to initiate a joint check. Any party involved in the agreement can propose this method of payment, provided all parties consent.

- 4. Joint checks eliminate the need for an endorsement. Some individuals assume that receiving a joint check negates the need for endorsing it. In fact, the subcontractor must endorse the check to ensure proper transfer and acknowledgment of payment.

- 5. The agreement covers future projects automatically. It is a common belief that the Joint Check Agreement applies to all future projects without any additional consent. Each project typically requires its separate agreement to be valid and enforceable.

- 6. Joint checks establish a direct relationship between the supplier and the owner. Many think that receiving joint checks creates a direct contractual relationship between the supplier and the project owner. In truth, it simply facilitates payment through the prime contractor and does not modify the original contractual relationships.

- 7. The parties cannot cancel the joint check agreement. Some believe that once the Joint Check Agreement is signed, it is permanent. However, it can be revoked if all parties agree in writing, allowing for flexibility if circumstances change.

Understanding these misconceptions can help parties navigate their agreements more effectively and maintain clear lines of communication.

Key takeaways

When completing and using the Joint Check form, it is essential to follow these key guidelines:

- Identify all parties clearly. Ensure that Party A, Party B, and Party C are accurately named to avoid confusion.

- Detail the project. Clearly list the project(s) involved to ensure that all parties understand what is being referenced in the agreement.

- Understand payment obligations. Recognize that Party A and Party B guarantee payment for Party C’s invoices through joint checks.

- Maintain communication. If there are insufficient funds to cover invoices, Party A must inform Party C in writing within ten days.

- Endorse joint checks. Party B has a duty to endorse any joint checks made payable to Party C upon receipt, treating it as trust money for Party C.

- Signatures are crucial. This agreement becomes effective only when all parties have signed, and it is binding on their respective successors.

Browse Other Templates

Ga Police Report Overlay - Airbag deployment status is recorded for safety performance analysis.

What Are Architectural Drawings Called - It emphasizes sustainable practices across various stages of building construction.

Pregnancy Note From Doctor - The form is structured to maintain privacy and confidentiality.