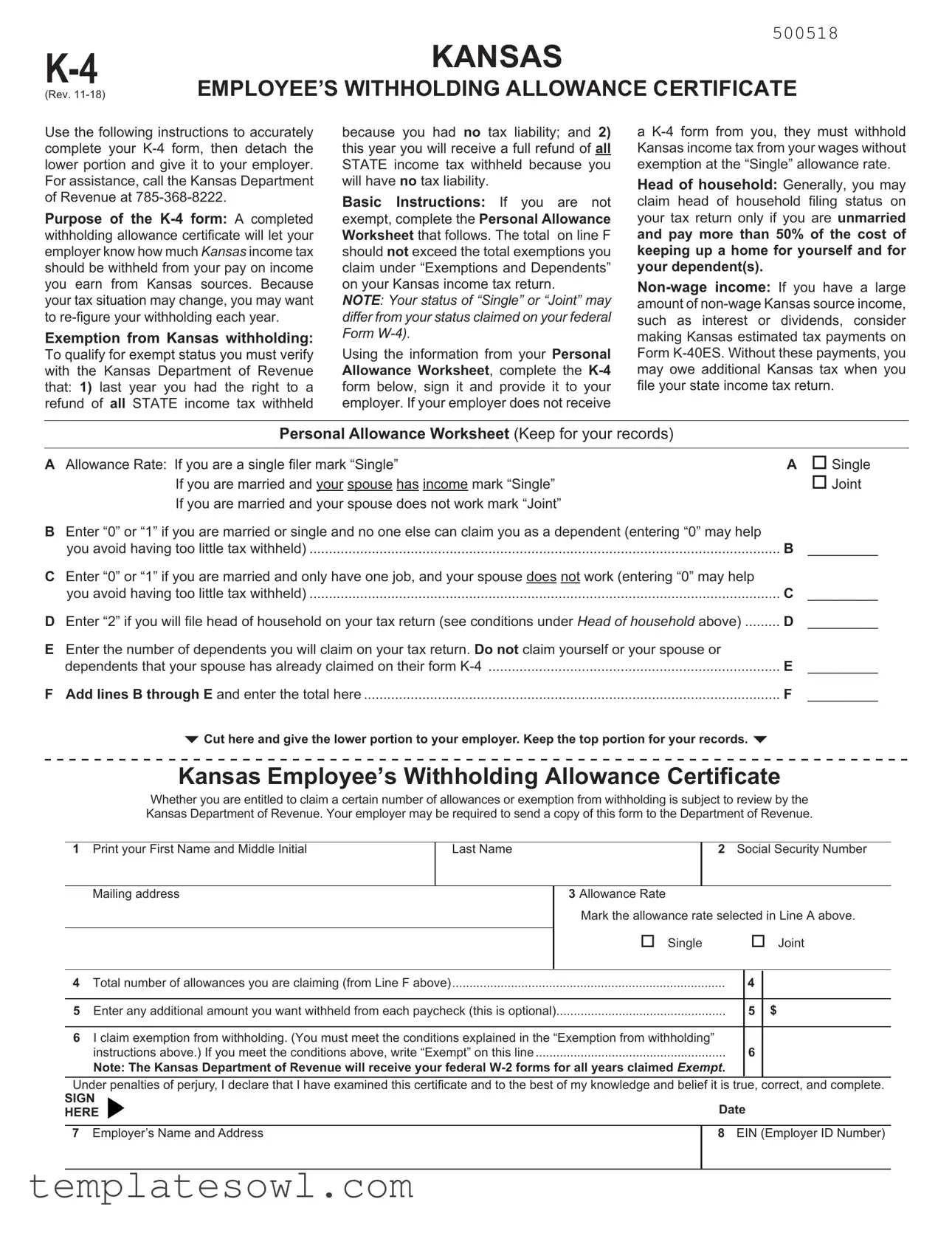

Fill Out Your Kansas K 4 Form

The Kansas K-4 form, also known as the Employee’s Withholding Allowance Certificate, plays a crucial role in determining the amount of state income tax withheld from an employee's paycheck. It is essential for anyone earning income from Kansas sources to complete this form accurately. By providing the necessary information on the K-4, employees inform their employers of their tax situation, allowing for appropriate withholding. The form includes a Personal Allowance Worksheet, designed to help individuals calculate their withholding allowances based on various factors such as filing status and number of dependents. For those who qualify, there is also the option to claim exemption from Kansas withholding, but certain requirements must be met to maintain this status. Completing the form is straightforward; once filled out, it should be submitted to the employer. Failure to provide a completed K-4 means that the employer will default to withholding at the “Single” allowance rate, potentially leading to a higher tax deduction. Moreover, understanding the implications of non-wage income and estimated tax payments can further impact overall tax liability. After considering these aspects, completing the K-4 becomes a vital step in managing one's finances and anticipating tax responsibilities.

Kansas K 4 Example

KANSAS |

500518 |

|

|

||

(Rev. |

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE |

|

Use the following instructions to accurately complete your

Purpose of the

Exemption from Kansas withholding:

To qualify for exempt status you must verify with the Kansas Department of Revenue that: 1) last year you had the right to a refund of all STATE income tax withheld

because you had no tax liability; and 2) this year you will receive a full refund of all STATE income tax withheld because you will have no tax liability.

Basic Instructions: If you are not exempt, complete the Personal Allowance Worksheet that follows. The total on line F should not exceed the total exemptions you claim under “Exemptions and Dependents” on your Kansas income tax return.

NOTE: Your status of “Single” or “Joint” may differ from your status claimed on your federal Form

Using the information from your Personal Allowance Worksheet, complete the

a

Head of household: Generally, you may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the cost of keeping up a home for yourself and for your dependent(s).

Personal Allowance Worksheet (Keep for your records)

A Allowance Rate: If you are a single filer mark “Single” |

A o Single |

If you are married and your spouse has income mark “Single” |

o Joint |

If you are married and your spouse does not work mark “Joint” |

|

BEnter “0” or “1” if you are married or single and no one else can claim you as a dependent (entering “0” may help

you avoid having too little tax withheld) |

B _________ |

CEnter “0” or “1” if you are married and only have one job, and your spouse does not work (entering “0” may help

you avoid having too little tax withheld) |

C |

_________ |

D Enter “2” if you will file head of household on your tax return (see conditions under Head of household above) |

D |

_________ |

EEnter the number of dependents you will claim on your tax return. Do not claim yourself or your spouse or

dependents that your spouse has already claimed on their form |

E |

_________ |

F Add lines B through E and enter the total here |

F |

_________ |

Cut here and give the lower portion to your employer. Keep the top portion for your records.

Kansas Employee’s Withholding Allowance Certificate

Whether you are entitled to claim a certain number of allowances or exemption from withholding is subject to review by the Kansas Department of Revenue. Your employer may be required to send a copy of this form to the Department of Revenue.

1 |

Print your First Name and Middle Initial |

|

Last Name |

|

2 |

Social Security Number |

||

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

3 Allowance Rate |

|

|

||

|

|

|

|

|

Mark the allowance rate selected in Line A above. |

|||

|

|

|

|

|

o Single |

o Joint |

||

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

4 |

Total number of allowances you are claiming (from Line F above) |

............................................................................... |

|

|

|

4 |

|

|

|

|

|

|

|

|

|

||

5 Enter any additional amount you want withheld from each paycheck (this is optional) |

................................................. |

|

5 |

$ |

||||

6I claim exemption from withholding. (You must meet the conditions explained in the “Exemption from withholding”

instructions above.) If you meet the conditions above, write “Exempt” on this line |

6 |

Note: The Kansas Department of Revenue will receive your federal |

|

Under penalties of perjury, I declare that I have examined this certificate and to the best of my knowledge and belief it is true, correct, and complete.

SIGN |

Date |

HERE |

7Employer’s Name and Address

8EIN (Employer ID Number)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The K-4 form informs your employer how much Kansas income tax to withhold from your pay based on your income and personal allowance information. |

| Exemption Criteria | To qualify for exemption from withholding, you must meet specific conditions related to previous and current tax liabilities. |

| Filing Status | Your filing status can impact the allowance rate. For instance, mark "Single" if you are unmarried or "Joint" if you are married. |

| Personal Allowance Worksheet | Use the worksheet to calculate your withholding allowances. Line F's total should reflect your claims under “Exemptions and Dependents” from your Kansas income tax return. |

| Governing Law | The K-4 form is governed by Kansas state tax laws as outlined by the Kansas Department of Revenue. |

Guidelines on Utilizing Kansas K 4

Completing the Kansas K-4 form involves several straightforward steps. Be sure to provide accurate information, as this form will determine how much state income tax is withheld from your paychecks. After filling it out, submit the form to your employer.

- Obtain a copy of the Kansas K-4 form.

- In the first section, fill out your First Name and Last Name, along with your Social Security Number.

- Enter your Mailing Address.

- In Line 3, mark the allowance rate that applies to you: Single or Joint.

- Calculate the total number of allowances you are claiming. Refer to the Personal Allowance Worksheet and enter the total in Line 4.

- If you wish to have an additional amount withheld from each paycheck, write that amount in Line 5. This step is optional.

- If you qualify for exemption from withholding, write “Exempt” in Line 6, following the guidelines provided.

- Sign and date the form at the designated spot. This affirms that the information you provided is correct.

- Detach the lower portion of the form and give it to your employer. Keep the top portion for your records.

What You Should Know About This Form

What is the purpose of the Kansas K-4 form?

The Kansas K-4 form serves as the Employee’s Withholding Allowance Certificate. When you complete it, your employer will know how much Kansas state income tax to withhold from your pay. Since everyone's tax situation can change, it's advisable to revisit this form annually to ensure accurate withholdings.

Who needs to complete the K-4 form?

If you earn income from Kansas sources and your tax situation is not exempt, you will need to complete the K-4 form. This includes most employees whose employers pay them through wages or salaries but may not include individuals with income sources that meet specific exemption criteria.

How can I determine my withholding allowances?

Your withholding allowances are calculated based on information you provide in the Personal Allowance Worksheet included on the K-4 form. This worksheet considers factors such as your filing status, number of jobs, and dependents. Make sure that the allowances you claim correlate with your declared exemptions on your Kansas income tax return.

Can I claim exemption from Kansas withholding?

Yes, you can claim exemption from withholding if you meet specific criteria. These include having no tax liability last year and expecting none this year. To claim this exemption, you must confirm your eligibility with the Kansas Department of Revenue and clearly write “Exempt” on the K-4 form.

What happens if I don’t submit a K-4 form to my employer?

If you do not provide your employer with a completed K-4 form, they are required by law to withhold Kansas income tax at the "Single" allowance rate, without any exemptions. This means you might end up having more tax withheld than necessary, which could affect your take-home pay.

What should I do if my tax situation changes?

If you experience any changes in your tax situation—such as a change in marital status, income, or number of dependents—it is important to update your K-4 form accordingly. This will help ensure that your employer withholds the correct amount of state income tax from your paychecks.

How do I submit the K-4 form?

Once you have completed the K-4 form, detach the lower portion and submit it directly to your employer. Keep the top part for your records. If you have any questions while filling out the form, consider reaching out to the Kansas Department of Revenue for assistance.

Common mistakes

Filling out the Kansas K-4 form can seem straightforward, but there are common mistakes that individuals often make. Understanding these pitfalls can help ensure accurate completion and proper income tax withholding.

One common error is failing to mark the correct allowance rate. The K-4 form allows filers to select either "Single" or "Joint." Choosing the wrong option can lead to incorrect withholding amounts. If you are married and your spouse has income, marking “Single” instead of “Joint” could result in more taxes being withheld than necessary.

Another frequent mistake involves the calculation of the total number of allowances. On line F, it’s crucial to add lines B through E accurately. If this total exceeds the exemptions claimed on your Kansas income tax return, you may face issues later when filing your taxes. For those unfamiliar with the process, this calculation can be tricky.

People often overlook the requirement to adjust their allowances or claims based on their filing status. It's important to remember that your status on the K-4 form may differ from what you indicate on your federal Form W-4. Not accounting for these differences can also create discrepancies in tax withholding.

Additionally, failing to complete the Personal Allowance Worksheet can lead to inaccurate entries on the K-4 form. This worksheet is designed to guide you in determining the proper number of allowances. Skipping this step or not keeping it for your records can result in errors that may have been easily avoided.

Many individuals also forget to provide their employer with a completed K-4 form. If you don't submit the form, your employer will automatically withhold taxes at the “Single” allowance rate, which might not reflect your actual tax situation. This can lead to over-withholding and potential refunds when you file your taxes.

Lastly, misunderstanding the exemption qualifications can lead to significant mistakes. To claim exemption on line 6, you must genuinely meet the criteria detailed in the instructions. Misrepresenting your eligibility could have financial repercussions, so it’s essential to verify your status beforehand.

Documents used along the form

When navigating the tax landscape in Kansas, several forms and documents often accompany the K-4 form. These documents can play a crucial role in ensuring that your tax situation is accurately reported and your withholdings align with your financial situation. Below is a list of essential forms frequently used together with the K-4 form.

- Kansas Individual Income Tax Return (Form K-40): This is the main form used by residents of Kansas to report their income for state tax purposes. It allows filers to report wages, interest, and other income, and to calculate the amount of tax owed or refund due.

- Kansas Nonresident Income Tax Return (Form K-40NR): Nonresidents use this form to report income that is earned from Kansas sources. It is crucial for ensuring nonresidents pay the appropriate taxes on income sourced from the state.

- Kansas Estimated Tax Payment Voucher (Form K-40ES): This document is used to make estimated tax payments, particularly useful for individuals who have significant non-wage income, such as dividends or investment income, to ensure they do not owe excessive tax at year-end.

- IRS Form W-4: While the K-4 is specific to Kansas, many individuals also complete the federal W-4 form to dictate how much federal income tax should be withheld from their paychecks. This can influence your overall tax situation.

- Kansas Employer Health Care Coverage Declaration (Form K-4E): This form provides details on employer-sponsored health care coverage, impactfully influencing tax credits related to health insurance.

- Kansas Credit for Taxes Paid to Other States (Form K-40) Schedule S: If you’ve paid taxes to another state, this schedule allows you to claim a credit on your Kansas tax return, preventing double taxation.

- Kansas Property Tax Relief Application: This application may be used by eligible individuals to seek relief on their property taxes, often involving income calculations that may require K-4 data.

- Kansas Child and Dependent Care Expenses Credit (Schedule CR): Taxpayers can utilize this form to claim a credit for expenses related to the care of children or dependents, further impacting overall tax liability.

- Kansas 529 Education Savings Plan Contribution Form: For those saving for education, this form documents contributions to a 529 plan, which may have tax implications for deductions and credits.

- Kansas Personal Property Tax Return: Personal property owners are required to file this return to report and pay taxes on personal properties, providing additional context to one’s financial landscape.

Understanding these forms will empower you to accurately report your taxes and make informed decisions. Each document serves a distinct purpose, helping to ensure you stay compliant with Kansas tax laws and optimize your tax situation. Always consider seeking professional guidance when dealing with tax matters to navigate the complexities effectively.

Similar forms

- Form W-4: Similar to the K-4 form, the W-4 is used by employees to inform their employer about how much federal income tax to withhold. It also allows for adjustments based on filing status and dependents.

- Form K-40: This is Kansas's individual income tax return. While the K-4 helps determine withholding, the K-40 is where you finally report income and calculate your tax liability at the end of the year.

- Form 1099: This document is issued by payers to report various types of income other than wages, salaries, and tips. Both forms, K-4 and 1099, are concerned with income types that might affect your withholding and tax obligations.

- Form K-40ES: Similar to the K-4, this is the estimated tax payment form for Kansas. If you anticipate earning income not subject to withholding, like dividends, this form helps you pay tax in advance.

- Form K-5: This is a Kansas exemption certificate for vendors. While it serves a different purpose than the K-4, both forms deal with determining tax statuses and exemptions relevant to specific activities or income.

- Form 1040: The federal income tax return template, the 1040 collects information on your overall tax situation. It reflects the information provided on your W-4 and K-4 forms regarding withholding allowances.

- Form K-120: This form is for corporate income tax in Kansas. Though it targets businesses, both K-4 and K-120 involve reporting income and calculating tax liabilities based on income earned in Kansas.

- Form K-11: The Kansas Partnership Return of Income. Similar to K-4, it focuses on income reporting but is specifically designed for partnerships rather than individual employees.

- Form K-40S: This is the Kansas income tax return for partnerships, much like the K-4 form helps individuals manage their tax withholdings. Both ensure income is accurately reported to the state.

Dos and Don'ts

When filling out the Kansas K-4 form, attention to detail is crucial. Here are five important things you should do and avoid to ensure accuracy and compliance:

- Do complete the Personal Allowance Worksheet accurately before filling out the K-4 form.

- Do double-check that the total on line F does not exceed your exemptions claimed on your Kansas income tax return.

- Do sign and date the form before submitting it to your employer.

- Do provide the employer with the lower portion of the K-4 form while keeping the top portion for your records.

- Do verify your filing status before marking the appropriate allowance rate on the K-4 form.

- Don’t claim exemptions if you do not meet the criteria specified for exempt status.

- Don’t leave any required fields blank, as this may delay processing.

- Don’t ignore the need to adjust your withholding if your tax situation changes throughout the year.

- Don’t forget to consider non-wage income, such as interest or dividends, and think about making estimated tax payments if applicable.

- Don’t assume that your federal Form W-4 status will be the same for the Kansas K-4 form; they can differ.

By following these guidelines, you can navigate the K-4 form submission process with confidence.

Misconceptions

Understanding the Kansas K-4 form is essential for employees in managing their state income tax withholdings. However, there are several misconceptions that often lead to confusion. Here are ten common misconceptions about the Kansas K-4 form explained:

- The K-4 form is the same as the federal W-4 form. While both forms help employers determine tax withholdings, they serve different purposes and apply to different tax jurisdictions—state versus federal.

- Anyone can claim exempt status simply by writing "Exempt" on the form. Claiming exemption requires meeting specific criteria, including having no tax liability the previous year and expecting none for the current year.

- Once you fill out the K-4 form, it’s permanent. Your tax situation can change, so it’s advisable to review and update your K-4 annually or whenever your circumstances change.

- Only married people can file jointly. While married individuals do have the option to file jointly, the term "joint" used on the K-4 refers to the allowance rate and can apply to income situations not specifically tied to marital status.

- If I don’t submit a K-4, my employer will withhold taxes at the lowest rate. Actually, without a K-4 form, employers are required to withhold at the "Single" allowance rate, which may not necessarily be the lowest for your situation.

- I can claim any number of allowances I want. Claims for allowances must accurately represent your situation and should not exceed the exemptions you declare on your state income tax return.

- Head of household status can be claimed by anyone. To qualify, you must be unmarried and meet specific requirements, including providing more than half the cost of maintaining a home for yourself and dependents.

- The K-4 form must be filled out every month. The K-4 does not require monthly updates; instead, it should be revised annually or when significant life changes occur, like marriage or birth.

- Completing the Personal Allowance Worksheet is optional. This worksheet is critical for determining the appropriate amount to enter on your K-4 form and helps prevent under-withholding.

- Non-wage income doesn’t affect my K-4 form. If you have substantial non-wage income, you may need to consider estimated tax payments separately to avoid potential tax liabilities when you file your state return.

By addressing these misconceptions, individuals can better navigate the process of completing their Kansas K-4 form, making it easier to manage tax withholdings and plan their finances effectively.

Key takeaways

Understanding how to fill out and utilize the Kansas K-4 form can make your tax life easier. Here are some key takeaways to keep in mind:

- Purpose of the K-4 form: This form helps your employer determine how much Kansas state income tax to withhold from your paycheck based on your individual tax situation.

- Exemption qualifications: If you believe you should be exempt from withholding, you must verify certain conditions with the Kansas Department of Revenue, including having no tax liability the previous year.

- Personal Allowance Worksheet: Fill out this worksheet before completing the K-4. It helps calculate your allowances. Ensure that the total doesn’t exceed the exemptions you claim on your Kansas income tax return.

- Submission importance: If you don’t provide a completed K-4 to your employer, they must withhold tax from your pay at the “Single” allowance rate, which might not be in your best interest.

- Head of household status: You can only claim this status if you're unmarried and pay over 50% of your home’s costs for yourself and qualifying dependents.

- Non-wage income consideration: If you have substantial non-wage income, such as dividends or interest, consider making estimated tax payments to avoid owing additional taxes when you file your return.

- Record-keeping: Always keep the top portion of the K-4 for your records. It’s essential to maintain documentation that reflects your withholding allowances and tax status.

Being informed and thorough in completing the K-4 can help you manage your finances more effectively. Don't hesitate to reach out to the Kansas Department of Revenue for assistance if you need clarification.

Browse Other Templates

Wrap Around Mortgage - This document helps facilitate financing when a property already has an existing primary mortgage.

Cbt Tax - The CBT-150 supports corporate financial planning by requiring systematic estimated tax payment management.