Fill Out Your Kansas Lc 50 Form

The Kansas LC 50 form is essential for Limited Liability Companies (LLCs) in the state to remain compliant with state regulations. Each year, LLCs must submit this form, which serves as their annual report. Fulfilling this requirement involves paying a filing fee of $55 and providing accurate information about the company. Key details included in the form are the business entity ID, name of the LLC, tax closing date, state of organization, and member information for those owning 5% or more of the capital. It’s important to remember that this document must be completed and sent to the Kansas Secretary of State, along with the appropriate fee. Deadlines are critical; the form must be filed in line with the annual Kansas tax return due date, or the business may face forfeiture. If penalties arise due to late filing or non-compliance, companies can seek reinstatement, but this process also carries fees. Avoid common pitfalls, such as submitting cash or using staples when mailing this form, as they can lead to processing delays. Overall, staying organized and meeting deadlines will help LLCs maintain good standing in Kansas.

Kansas Lc 50 Example

Please |

|

|||

Not |

|

|||

DoStaple |

|

kansas secretary of state |

||

LC |

||||

|

|

|||

|

|

Limited Liability Company or |

||

|

50 |

Series Limited Liability Company |

||

|

|

|

Annual Report |

|

|

|

|

|

|

|

|

|

GENERAL FILING |

|

|

|

|

INSTRUCTIONS |

|

|

|

|

|

|

The following form must be complete and accompanied by the correct filing fee or the document will not be accepted for filing.

Save time and money by filing your forms online at sos.ks.gov. There, you can also stay

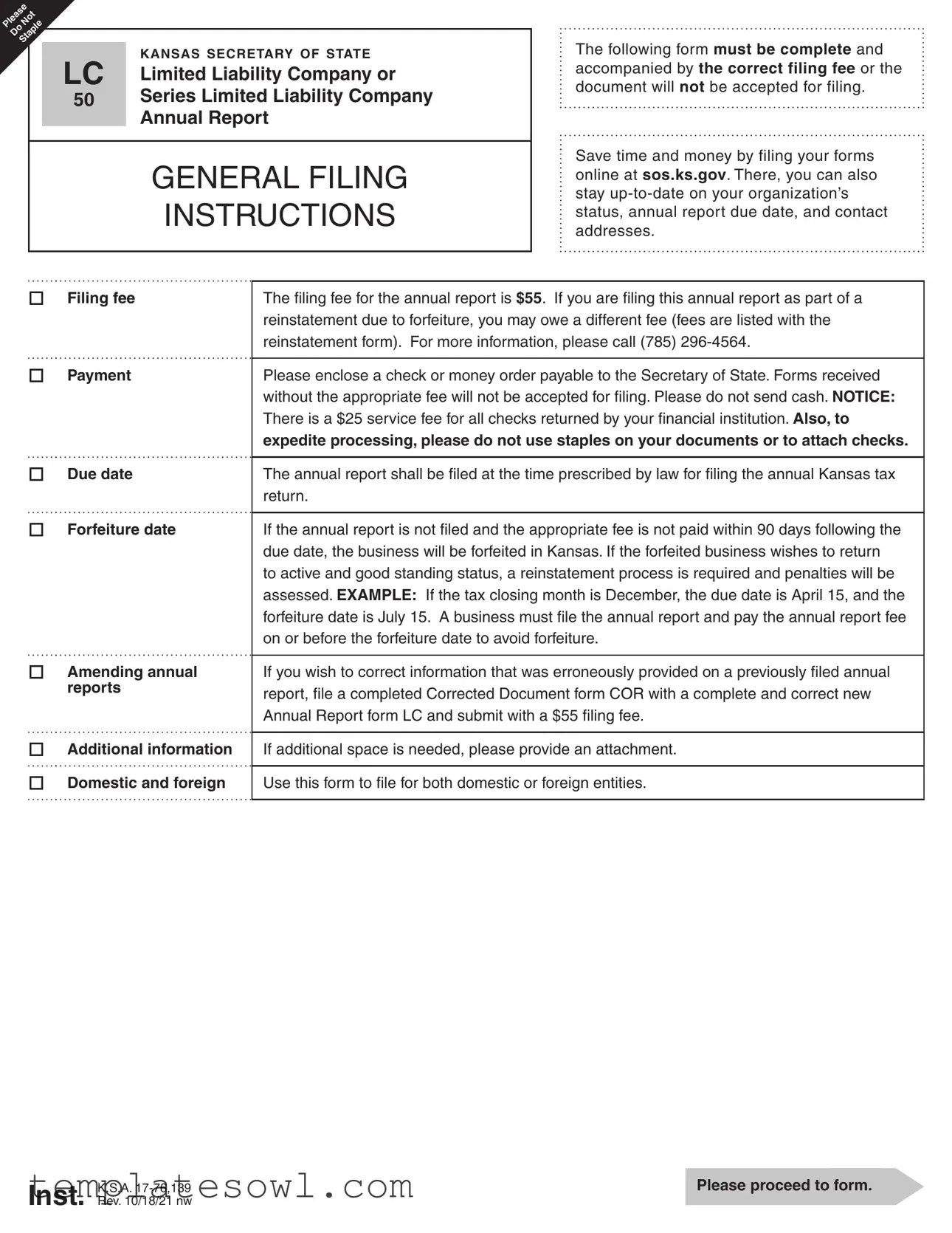

oFiling fee

oPayment

oDue date

oForfeiture date

oAmending annual reports

oAdditional information

oDomestic and foreign

The filing fee for the annual report is $55. If you are filing this annual report as part of a reinstatement due to forfeiture, you may owe a different fee (fees are listed with the reinstatement form). For more information, please call (785)

Please enclose a check or money order payable to the Secretary of State. Forms received without the appropriate fee will not be accepted for filing. Please do not send cash. NOTICE: There is a $25 service fee for all checks returned by your financial institution. Also, to expedite processing, please do not use staples on your documents or to attach checks.

The annual report shall be filed at the time prescribed by law for filing the annual Kansas tax return.

If the annual report is not filed and the appropriate fee is not paid within 90 days following the due date, the business will be forfeited in Kansas. If the forfeited business wishes to return to active and good standing status, a reinstatement process is required and penalties will be assessed. EXAMPLE: If the tax closing month is December, the due date is April 15, and the forfeiture date is July 15. A business must file the annual report and pay the annual report fee on or before the forfeiture date to avoid forfeiture.

If you wish to correct information that was erroneously provided on a previously filed annual report, file a completed Corrected Document form COR with a complete and correct new Annual Report form LC and submit with a $55 filing fee.

If additional space is needed, please provide an attachment.

Use this form to file for both domestic or foreign entities.

Inst. |

K.S.A. |

Please proceed to form. |

Rev. 10/18/21 nw |

|

Please |

|

|

|||

Not |

|

|

|||

DoStaple |

|

kansas secretary of state |

|||

LC |

|||||

|

|

||||

|

|

Limited Liability Company or |

|||

|

50 |

Series Limited Liability Company |

|||

|

|

|

Annual Report |

||

|

|

|

|

|

|

|

|

Memorial Hall, 1st Floor |

(785) |

||

|

|

120 S.W. 10th Avenue |

kssos@ks.gov |

||

|

|

Topeka, KS |

sos.ks.gov |

||

|

|

|

|

|

|

1. |

Business entity ID/file |

This is not the Federal Employer ID |

|

number |

Number (FEIN). |

2. |

Name of LLC or |

Must match name on record with |

|

series LLC |

Kansas Secretary of State. |

|

Reset |

|

|

|

|

Please complete the form, print, sign and mail to the Kansas Secretary of State with the filing fee. Selecting 'Print'will print the form and 'Reset'will clear the entire form.

THIS SPACE FOR OFFICE USE ONLY.

3.Tax closing date

Month

Year

4.State of organization

5.Name and address of each member who owns 5% or more of capital*

If additional space is needed, please provide attachment.

*Foreign

Name |

Address |

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

Name |

Address |

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

Name |

Address |

|

|

|

|

|

|

City |

State |

Zip |

Country |

|

|

|

|

6.I declare under penalty of perjury pursuant to the laws of the state of Kansas that the foregoing is true and correct.

Signature of Authorized Person

X

Name of Signer (printed or typed)

Phone Number (Not required)

Please note that information provided on documents filed with the Secretary of State is public record that is subject to public access and disclosure (per K.S.A.

1 / 1 |

K.S.A. |

Please review to ensure completion. |

Rev. 10/18/21 nw |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Kansas LC 50 form is used to file the Annual Report for Limited Liability Companies (LLCs) in Kansas. |

| Filing Fee | To file the LC 50 form, a fee of $55 must be submitted. Different fees apply if filing during reinstatement due to forfeiture. |

| Due Date | The annual report filing is due on or before the date of the Kansas tax return, generally April 15 for businesses whose tax closing month is December. |

| Forfeiture Consequences | If the form is not filed within 90 days of the due date, the LLC will face forfeiture in Kansas. |

| Reinstatement Process | A forfeited business must go through a reinstatement process and may incur additional penalties to regain good standing. |

| Correcting Errors | To correct errors from a previous report, file a Corrected Document form COR along with a new LC 50 form and the filing fee. |

| Public Record | Information provided on the LC 50 is considered public record and may be accessed and disclosed as per K.S.A. 45-215 through K.S.A. 45-223. |

| Contact Information | For further assistance, contact the Kansas Secretary of State's office at (785) 296-4564 or visit their website at sos.ks.gov. |

Guidelines on Utilizing Kansas Lc 50

Filling out the Kansas LC 50 form involves several steps to ensure that all necessary information is correctly provided. This ensures compliance with state requirements. Carefully follow the instructions below for a smooth process.

- Obtain the Kansas LC 50 form from the Kansas Secretary of State's website or your local office.

- Enter your Business Entity ID/File Number. Remember, this is not the Federal Employer Identification Number.

- Input the name of your LLC or Series LLC as it appears on record with the Kansas Secretary of State.

- Specify the tax closing date by filling in the month and year.

- Indicate the state of organization for your LLC.

- List the names and addresses of each member who owns 5% or more of the capital. Attach an additional document if more space is needed. *Foreign LLCs can skip this step.

- Sign the form, certifying that the information provided is true and correct under penalty of perjury.

- Print the signed form.

- Mail the completed form and a check or money order for the filing fee of $55 to the Kansas Secretary of State. Do not send cash or use staples.

After submitting the form, keep track of your filing and payment to avoid any further action. Make sure to file your annual report by the due date to maintain good standing. If corrections are needed later, use the Corrected Document form along with a new LC form.

What You Should Know About This Form

What is the Kansas LC 50 form?

The Kansas LC 50 form is an annual report required for limited liability companies (LLCs) in Kansas. This report must be submitted to the Kansas Secretary of State to maintain the company's good standing. The form collects essential information about the LLC, including its name, business entity ID, tax closing date, and details about members owning 5% or more of the capital.

What are the filing requirements for the LC 50 form?

To file the LC 50 form, you must complete it accurately and include the appropriate filing fee of $55. The form should be signed and mailed to the Kansas Secretary of State's office. It is essential to avoid staples when submitting the form or attaching the payment. Proper completion and timely filing are critical to avoid penalties or forfeiture of the business status.

When is the LC 50 form due?

The LC 50 form is due at the same time as your Kansas tax return. If the tax closing month is December, for example, the due date for the annual report will be April 15. If the report is not filed by the forfeiture date, which is typically 90 days after the due date, the LLC may be declared forfeited.

What happens if I miss the filing deadline?

If you miss the filing deadline, your business may face forfeiture in Kansas. If this occurs, you will need to go through a reinstatement process to return to active status. This process may involve additional fees and penalties. Therefore, it is crucial to file on time to prevent these consequences.

How do I correct an error on a previously filed LC 50 form?

If you need to correct an error, you can do so by filing a Corrected Document form (COR) along with a new and corrected LC 50 form. Ensure that both forms are accompanied by the $55 filing fee. If you require additional space for member information, you may provide an attachment.

Where can I find more information about the LC 50 form?

For more information, you should visit the Kansas Secretary of State's website at sos.ks.gov. You can also contact their office at (785) 296-4564 for further assistance. It is beneficial to stay informed about your organization's status and annual report due dates through the website.

Common mistakes

Filling out the Kansas LC 50 form can be straightforward, but many people make critical mistakes that can complicate the filing process. One of the most common errors is submitting the form without completing the necessary information. Omitting details such as the business entity ID or the exact name of the LLC as recorded with the Kansas Secretary of State can lead to immediate rejections. It's vital to double-check the accuracy of every entry before submission.

Another frequent mistake involves payment issues. Often, filers forget to include the appropriate filing fee of $55. If the payment is missing, the form will not be accepted. Furthermore, using cash is a common error, as the Secretary of State expressly advises against it. Always remember to send a check or money order payable to the Secretary of State to ensure smooth processing.

People sometimes also confuse their Federal Employer ID Number (FEIN) with the business entity ID required on the form. This confusion can delay the filing and lead to unnecessary complications, as the two identifiers serve different purposes. It's important to clearly understand which number is needed and ensure it is provided accurately.

Failing to account for the proper due date is another mistake that can have serious consequences. The annual report must be filed in line with the state tax return deadline. If filed late, the business risks forfeiture if the report and fee are not submitted within 90 days of the due date. Knowing these dates is crucial to maintaining active status.

In addition, several filers overlook the requirement to declare ownership. The form asks for the names and addresses of members who hold 5% or more of the capital. Omitting this information can lead to a rejection, especially for domestic LLCs. Foreign LLCs are exempt from disclosing this information, so it’s important to know whether the rules apply based on the entity's origin.

Finally, people often neglect to check for required signatures. The statement under penalty of perjury necessitates an authorized individual’s signature. Forms submitted without this crucial affirmation can be deemed incomplete and could delay the reinstatement or filing process. Always ensure that the signature is provided where necessary to validate the filing.

Documents used along the form

When filing the Kansas LC 50 form for your Limited Liability Company (LLC), there are several other forms and documents that are commonly required. Below is a list of these important documents, along with a brief description of each. Understanding these can streamline the filing process and ensure compliance with Kansas state regulations.

- Form COR - Corrected Document: This form is necessary if you need to amend a mistake on a previously filed annual report. It should be submitted along with a new LC form and the appropriate filing fee.

- Reinstatement Form: If your LLC has been forfeited due to failure to file the annual report, this form allows you to request reinstatement. It includes details on fees and penalties that may apply.

- Certificate of Good Standing: This document confirms that your LLC is in compliance with state regulations. It may be required for certain business transactions or applications.

- Foreign LLC Application: If your company is registered in another state and wishes to operate in Kansas, this form must be completed and submitted. It involves additional fees and documentation.

- Annual Tax Return: The annual report must be filed simultaneously with your state tax return. Keeping the due date in mind is crucial to avoid forfeiture of your business status.

- Filing Fee Payment Document: Ensure you include payment along with your forms. This could be a check or money order made out to the Secretary of State, as failure to pay the required fees can delay processing.

By familiarizing yourself with these documents, you can ensure your LLC remains in good standing and can operate smoothly within Kansas. Proper preparation will save time and help prevent future complications.

Similar forms

The Kansas LC 50 form serves as a critical document for the reporting requirements of limited liability companies (LLCs) in Kansas. Similar documents exist across various jurisdictions, reflecting comparable responsibilities and compliance measures for businesses. Here are nine documents that share similarities with the Kansas LC 50 form:

- Annual Report Form (California) - Like the Kansas LC 50, California's annual report form must be filed by LLCs to maintain their active status. This form similarly requires updates on the business's contact information and ownership structure.

- Form 500 (New York) - This document, filed by LLCs in New York, serves the same purpose as the Kansas LC 50 form. It collects essential information about the business and must be submitted annually to avoid penalties.

- Annual Statement (Florida) - Florida’s annual statement requires Florida LLCs to provide information comparable to that required by the Kansas LC 50. Failure to file can lead to administrative dissolution, mirroring the forfeiture consequences in Kansas.

- Annual Report (Texas) - This report is essential for maintaining an LLC’s good standing in Texas, much like the Kansas LC 50. It collects details on members and managers, along with other pertinent information about the business.

- Foreign LLC Registration (Ohio) - Ohio's form for foreign LLCs outlines requirements similar to those in Kansas. It addresses the need for reporting and updating business information when operating in a different state.

- Business License Renewal Application (Illinois) - While not an exact match, this document requires businesses to confirm their operations and compliance, echoing the reporting responsibilities of the Kansas LC 50.

- Form LLC-2 (Nevada) - This document serves a similar function by requiring LLCs to report their business address and members. It reflects the same periodic filing requirements as the Kansas LC 50 form.

- Annual Registration (Virginia) - Virginia's annual registration for LLCs aims to keep state records updated, just like the Kansas LC 50 form does. Both documents necessitate payment of fees and timely submission to preserve status.

- Business Entity Report (Colorado) - This report collects similar information regarding ownership, structure, and activities of LLCs, paralleling the requirements found in the Kansas LC 50 form.

These forms reinforce the importance of transparency and compliance within the business landscape, ensuring that organizations fulfill their legal obligations while maintaining active status in their respective states.

Dos and Don'ts

When filling out the Kansas LC 50 form, there are important guidelines to follow. Adhering to these will ensure a smooth filing process.

- Do complete the form with accurate information.

- Do ensure the name of the LLC matches the records with the Kansas Secretary of State.

- Do submit the form along with the correct filing fee, which is $55.

- Do check your calculations to avoid mistakes that could delay processing.

- Do file a corrected document if errors are found in a previously submitted report.

- Don’t send cash as payment for the filing fee.

- Don’t use staples on the document or to attach checks.

Following these dos and don’ts can help you avoid common pitfalls and ensure timely processing of your annual report.

Misconceptions

-

Misconception 1: The Kansas LC 50 form is the same as the Federal Employer ID Number (FEIN).

Many people mistakenly believe that the business entity ID number on the LC 50 form is the same as the FEIN. In reality, these are two distinct identifiers. The entity ID is assigned by the Kansas Secretary of State, while the FEIN is issued by the IRS.

-

Misconception 2: Filing the LC 50 form is optional for businesses in Kansas.

Some assume that filing the LC 50 is not mandatory. However, every LLC operating in Kansas is required to submit this annual report. Failure to do so can lead to serious penalties, including forfeiture of the business.

-

Misconception 3: You can file your LC 50 form anytime during the year.

It's a common misunderstanding that businesses can file this form at their convenience. In truth, the annual report must be filed by a specific deadline, which corresponds with the due date for the Kansas tax return. Missing this deadline can result in forfeiture of your business status.

-

Misconception 4: You can pay the filing fee in cash.

Many think that cash payments are acceptable for the filing fee. However, the Secretary of State’s office instructs that only checks or money orders are permissible. Cash should never be sent through the mail.

-

Misconception 5: Staping the LC 50 form can help with organization.

Some individuals believe that using staples will help in organizing their submission. However, this is explicitly discouraged. Stapling the form can lead to processing delays and may cause the documents to be rejected.

Key takeaways

Here are some important points to consider when filling out and using the Kansas Lc 50 form:

- Filing Fee: Ensure you include the correct filing fee of $55 or the form will be rejected. If filing for reinstatement after forfeiture, check the reinstatement form for potential different fees.

- No Staples: Avoid stapling the form or attaching checks with staples, as this can delay processing.

- Timing is Crucial: File your annual report by the due date to avoid forfeiture of your business. If you miss this date by 90 days, your business may lose its good standing.

- Correcting Errors: If you made mistakes on a previous report, submit a corrected document along with the new annual report and the $55 fee.

- Public Information: Be aware that any information provided on this form becomes public record, which can be accessed by anyone.

- Contact Information: For any questions, you can reach out to the Kansas Secretary of State’s office at (785) 296-4564 or via email at kssos@ks.gov.

Browse Other Templates

Secondary Dependent Navy - Members must explain any discrepancies or required clarifications in the remarks section.

Texas Franchise Tax Public Information Report Instructions - Provide all necessary names under the “Other Names Used” section.