Fill Out Your Kcb Registration Form

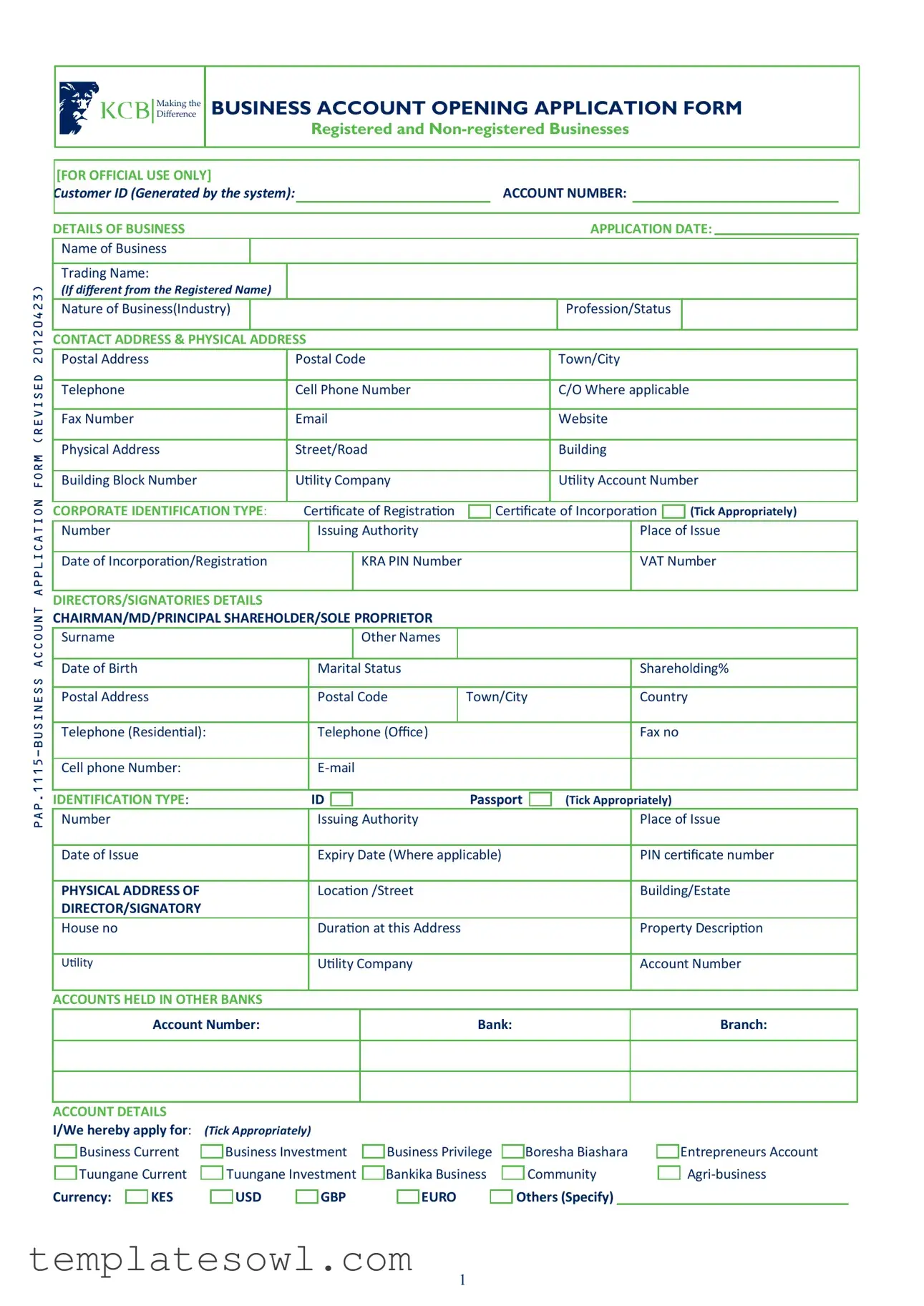

Opening a business account can be an intricate process, and the KCB Registration Form is a crucial step in this journey. This form serves multiple purposes by gathering essential information from both registered and non-registered businesses. As you complete it, you will be required to provide details about your business, including its registered name, trading name, and nature of the industry you operate in. Accurate contact information, such as postal and physical addresses, telephone numbers, and emails, is key to establishing effective communication. Additionally, corporate identification—such as a certificate of registration or incorporation—must be indicated, along with relevant numbers like the KRA PIN and VAT number. The form also requests detailed information about the directors and signatories of the business, including their names, birthdates, and contact details. When it comes to financial aspects, applicants will specify the type of account desired and expected transaction volumes, giving the bank a clearer picture of your financial activity. Furthermore, there are sections for cheque book requests and statement frequency preferences, addressing the unique needs of your business. Completing the KCB Registration Form with accuracy not only ensures a smooth application process but also demonstrates your readiness to engage in responsible banking practices.

Kcb Registration Example

Making the Difference

BUSINESS ACCOUNT OPENING APPLICATION FORM

Registered and

[FOR OFFICIAL USE ONLY] |

|

Customer ID (Generated by the system): |

ACCOUNT NUMBER: |

DETAILS OF BUSINESS |

|

|

APPLICATION DATE: |

|

||

|

|

|

|

|

|

|

Name of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading Name: |

|

|

|

|

|

|

(If different from the Registered Name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nature of Business(Industry) |

|

|

|

Profession/Status |

|

|

|

|

|

|

|

|

|

CONTACT ADDRESS & PHYSICAL ADDRESS |

|

|

|

|||

|

|

|

|

|

||

Postal Address |

Postal Code |

|

Town/City |

|||

|

|

|

|

|

||

Telephone |

Cell Phone Number |

|

C/O Where applicable |

|||

|

|

|

|

|

||

Fax Number |

|

Website |

||||

|

|

|

|

|

||

Physical Address |

Street/Road |

|

Building |

|||

|

|

|

|

|

||

Building Block Number |

Uility Company |

|

Uility Account Number |

|||

|

|

|

|

|

|

|

CORPORATE IDENTIFICATION TYPE: |

Cerificate of Registraion |

|

|

Cerificate of Incorporaion |

|

|

(Tick Appropriately) |

|||||||

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

Issuing Authority |

|

|

|

|

|

Place of Issue |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Incorporaion/Registraion |

|

|

|

KRA PIN Number |

|

|

|

|

|

VAT Number |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTORS/SIGNATORIES DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHAIRMAN/MD/PRINCIPAL SHAREHOLDER/SOLE PROPRIETOR |

|

|

|

|

|

|

|

|

|

|||||

Surname |

|

|

|

Other Names |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth |

|

Marital Status |

|

|

|

|

|

Shareholding% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Postal Address |

|

Postal Code |

|

Town/City |

|

|

Country |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone (Residenial): |

|

Telephone (Office) |

|

|

|

|

|

|

Fax no |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cell phone Number: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

IDENTIFICATION TYPE: |

|

ID |

|

|

|

|

Passport |

|

(Tick Appropriately) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

Issuing Authority |

|

|

|

|

|

Place of Issue |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Date of Issue |

|

Expiry Date (Where applicable) |

|

|

PIN cerificate number |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PHYSICAL ADDRESS OF |

|

Locaion /Street |

|

|

|

|

|

Building/Estate |

||||||

DIRECTOR/SIGNATORY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

House no |

|

Duraion at this Address |

|

|

|

|

|

Property Descripion |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Uility |

|

Uility Company |

|

|

|

|

|

Account Number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ACCOUNTS HELD IN OTHER BANKS

Account Number: |

Bank: |

Branch: |

|

|

|

|

|

|

|

|

|

ACCOUNT DETAILS

I/We hereby apply for: (Tick Appropriately)

|

Business Current |

|

|

Business Investment |

|

Business Privilege |

|

|

Boresha Biashara |

||||||||

|

Tuungane Current |

|

|

Tuungane Investment |

|

Bankika Business |

|

|

Community |

||||||||

|

|

|

|

|

|

||||||||||||

Currency: |

|

KES |

|

|

|

USD |

|

GBP |

|

|

|

EURO |

|

|

Others (Specify) |

||

|

|

|

|

|

|

|

|

|

|

||||||||

1

Entrepreneurs Account

FINANCIAL INFORMATION

Please ick in the relevant boxes below to indicate the expected normal range of acivity in your account

Value of Transacions |

|

|

|

|

|

|

|

|

|

|

|

|

Expected Range (KES. equivalent) |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

upto 100,000 |

|

|

500,001- 1,000,000 |

Over 1,000,000 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sum of all payments into account per month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total value of |

Local Currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

cash/cheque |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

deposits per month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Total value of |

Incoming |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

foreign remitances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outgoing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

per month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHEQUE BOOK REQUEST (Where Applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Cheque Book Size: (Tick Appropriately) |

|

|

|

50 Leaves |

|

|

100 Leaves Number of Books: |

|

|

|

|||||||||||

STATEMENT REQUEST (Tick Appropriately) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Statement Frequency: |

|

Daily |

|

Weekly |

|

Monthly |

|

|

Quarterly |

|

|

Annually |

|

||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Statement Delivery: |

|

|

Post Office Box |

|

|

|

|

Retain |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

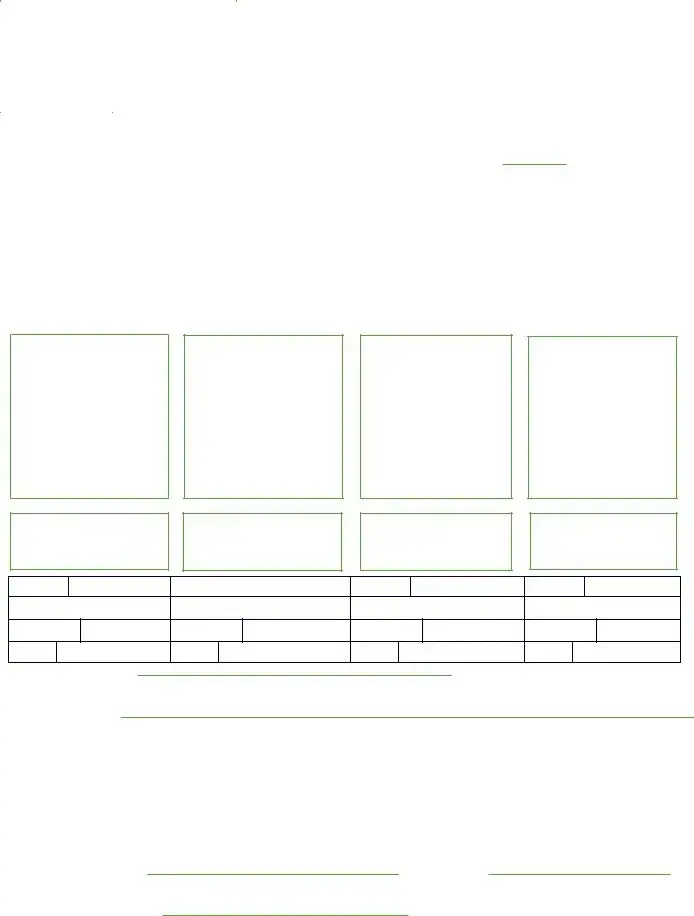

I/We confirm that the informaion given above is true to the best of my/our knowledge. By signing on this form I/We request you to open an account in my/our name (s). I/We agree that I/We have read, understood and accepted the terms and condiions of this account, supplied separately, and agree to be bound by them. I/We hereby authorize the Bank to disclose any informaion relaing to my/our account (s) to any credit reference agency, any other insituion or third party as it deems necessary.

1ST DIRECTOR/SIGNATORY |

2ND DIRECTOR/SIGNATORY |

3RD DIRECTOR/SIGNATORY |

4TH DIRECTOR/SIGNATORY |

AFFIX PHOTO

HERE

AFFIX PHOTO

HERE

AFFIX PHOTO

HERE

AFFIX PHOTO

HERE

Signature

Full Name

SignatureSignature

Full Name |

Full Name |

|

|

Signature

Full Name

Idenificaion

Idenificaion

Idenificaion

Idenificaion

Contact

Contact

Contact

Contact

Signed in the presence of |

|

|

|

|

|

|

Signed |

|

|

|

|

|

|||||

Date |

|

|

Branch’s Official Stamp |

|

|

|

|

|

|

||||||||

MODE OF SIGNING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

OFFICIAL USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name of Sales Staff: |

|

|

|

|

Sales Code(12x): |

|

|

Branch DAO: |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sector: |

Target: |

Customer Type: |

|

Risk Class: |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSTOMER INFORMATION CHECKLIST |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Valid Idenificaion documents obtained & authenicated |

|

|

Resoluion obtained |

|

Contact informaion available obtained |

|||||||||

|

|

|

|

|

|

||||||||||||

|

|

|

Document copies clear, complete & duly cerified |

|

|

|

Photographs obtained |

|

|

Alteraions countersigned |

|||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Physical Address Verificaion/Uility bill obtained |

|

|

|

Blacklist Checked |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

Authorizing Official’s Name: |

|

|

|

|

|

|

Signature No.: |

|

|

|

|

|

|||||

Signature & Branch Stamp:

2

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for opening business accounts for both registered and non-registered businesses. |

| Application Date | The application date must be clearly filled out on the form to ensure timely processing. |

| Required Identifications | The applicant must provide identification types, such as an ID or passport, and respective numbers. |

| Account Options | Applicants can choose from various business account types including Business Current and Investment accounts. |

| Financial Disclosure | Applicants need to indicate expected transaction ranges and provide financial activity details. |

| Signature Requirement | The signature section requires the consent of up to four directors or signatories for account opening. |

| Governing Laws | Account openings are governed by the local banking regulations specific to the state where the account is established. |

Guidelines on Utilizing Kcb Registration

After completing the Kcb Registration form, the next step involves submitting it to the appropriate banking institution for processing. Ensure all necessary information is clear and accurate to avoid delays.

- Begin by entering the customer ID and account number, as required by the system.

- Fill in the details of the business, including the business and trading name, application date, and nature of the business.

- Provide the contact address and physical address. Include postal details, telephone numbers, and any other relevant communication information.

- Tick the corporate identification type applicable to your business and provide the corresponding registration number and issuing details.

- Detail the directors/signatories, including their surnames, other names, date of birth, marital status, shareholding percentage, and contact information.

- Select and indicate the identification type for each director and provide their identification numbers and issuing details.

- If applicable, enter any accounts held in other banks along with the account numbers and bank branch information.

- Choose the account details you’re applying for. Select the appropriate business account type and currency.

- In the financial information section, indicate the expected range of transactions and provide estimates for deposits and remittances.

- If requesting a cheque book, specify the size and number of books needed.

- Choose the statement request frequency and delivery method.

- Confirm that the information provided is accurate and sign the form. Ensure that all directors/signatories also sign where required.

- Finally, if required, attach relevant photos and submit the form alongside any necessary documentation for verification.

What You Should Know About This Form

What is the KCB Registration Form used for?

The KCB Registration Form is essential for individuals or businesses looking to open a bank account with KCB Bank. This form collects a comprehensive set of information that includes your business details, contact information, corporate identification, financial activity expectations, and the types of accounts you wish to open. Completing this form accurately ensures that your banking needs are met and allows the bank to comply with legal and regulatory requirements.

What documents are required for the KCB Registration Form?

To complete the KCB Registration Form, certain documents must be provided. This includes a valid identification document such as an ID or passport, as well as copies of the business registration certificate and any relevant tax information, like the KRA PIN. Additionally, directors or signatories of the business need to provide identification documents and may be asked for proof of address, such as utility bills. Having these documents ready can facilitate a smooth account opening process.

How do I know which type of account to apply for?

The KCB Registration Form allows you to choose from various account types, including Business Current, Business Investment, and specialized accounts like the Entrepreneurs Account. Consider your business needs to determine which account best suits you. If you expect frequent transactions, a Business Current account may be appropriate. If you're looking to save, a Business Investment account could serve your purpose. Consulting with a bank representative can also provide clarity on which account type aligns with your financial activities.

Can I apply for an account online using the KCB Registration Form?

While the KCB Registration Form must be filled out, the submission process may vary depending on the bank's current protocols. In some cases, KCB might offer online account registration, allowing you to complete the form electronically before submitting it. However, it is advisable to check with the bank for the latest updates on online applications, as processes may evolve and differ by location.

What should I do if I encounter issues while filling out the KCB Registration Form?

If you face difficulties completing the KCB Registration Form, several options exist for assistance. First, consider seeking help from a knowledgeable individual, like an accountant or a business advisor. Additionally, KCB Bank's customer service representatives are available to assist with any queries related to the form. They can provide guidance on how to fill out specific sections or clarify any requirements that may be confusing.

Common mistakes

Filling out the KCB Registration form can be straightforward, but many people make common mistakes that can delay the process. These errors range from simple oversights to misunderstandings about the requirements. Here are five mistakes to keep an eye out for when completing this important document.

One frequent mistake is failing to provide all necessary contact information. Many applicants overlook the need to include a complete telephone number or email address. This can create issues later, especially if the bank needs to reach out for verification or further information. Always double-check that these details are accurate and up-to-date.

Another common issue is not ticking the appropriate boxes for identification types and account details. If you don't clearly indicate whether it is a Certificate of Registration or Certificate of Incorporation, your application might be delayed. Take a moment to review each section thoroughly before you submit to ensure all parts are completed properly.

Many applicants also underestimate the importance of the business details section. Providing vague descriptions or incorrect information about the nature of your business can lead to misunderstandings. Be specific about the industry and ensure your business name matches the registration documents precisely. This will help prevent unnecessary delays in processing your application.

Sometimes, individuals forget to sign the form or neglect to have the signatures witnessed. Absence of a signature can render the application invalid. Ensure that all required parties sign the document, and confirm that their signatures are dated and clear. This step is crucial for confirming that the information provided is accurate and agreed upon.

Finally, many forget the photographs. The requirement to affix photos is often overlooked. Not including these can lead to the application being returned. Keep in mind that using recent, clear photos can significantly streamline the process.

By avoiding these mistakes, you’ll save time and make the registration process smoother. Always remember to read through the form carefully before submitting it to ensure all information is complete and accurate.

Documents used along the form

When applying for a business account, the Kcb Registration form often accompanies several other important documents. Each of these documents helps the bank gather necessary information to process your application efficiently. Below is a brief description of seven key forms that are frequently required.

- Certificate of Registration: This document proves that your business is officially recognized and registered with the appropriate government authority. It may be required to verify your business name and legal status.

- Certificate of Incorporation: If your business is a corporation, this certificate shows that it has been legally incorporated. It also includes essential details like the incorporation date and the issuing authority.

- KRA PIN Certificate: This document is issued by the Kenya Revenue Authority and is necessary for tax purposes. It identifies your business for tax compliance and registration.

- VAT Registration Certificate: If your business is registered for Value Added Tax (VAT), this certificate confirms your registration and is essential for tax reporting.

- Directors Identification Documents: Each signatory or director should provide an identification document. This may include a passport or national ID, which helps to verify their identity.

- Utility Bill: A recent utility bill serves as proof of the physical address of your business. It helps the bank confirm your operational location.

- Bank Statement: If applicable, a recent bank statement from another institution may be requested. This document provides insight into your business's financial history.

Having these documents ready along with the Kcb Registration form can streamline the account opening process. Ensure you check that all required forms are complete and accurate to avoid delays in getting your business account established.

Similar forms

Loan Application Form: This document collects personal and business information, similar to the Kcb Registration form, to evaluate eligibility for a loan. Both forms require identification details and business information.

Business License Application: Just like the Kcb Registration form, this document asks for business details, owner identification, and contact information. It helps to legitimize a business.

Partnership Agreement Form: This form outlines partner information, similar to the Kcb form's detailed section on directors or signatories. It ensures all parties are aware of their roles and responsibilities.

Membership Registration Form: Used by organizations, this form gathers personal and contact details similarly to the Kcb Registration form, ensuring that all information is complete for membership processing.

Business Tax Registration Form: This collects similar business identification information, including KRA PIN numbers and the nature of the business, ensuring compliance with tax regulations.

Credit Card Application: This document also requests identification and financial details, paralleling the Kcb Registration form's need for similar basic information about the applicant and their business.

Vendor Registration Form: Similar in nature, this form collects essential information from vendors about their business and contact details, which is also seen in the Kcb Registration form.

Business Insurance Application: This document gathers business and owner details like the Kcb Registration form. It is necessary for assessing eligibility for insurance coverage.

Dos and Don'ts

When filling out the Kcb Registration form, it is crucial to follow specific guidelines to ensure accuracy and compliance. Here are four important do’s and don’ts:

- Do provide accurate information.

- Do double-check your identification documents.

- Don't leave any mandatory fields blank.

- Don't submit false information or misrepresent your business.

By adhering to these guidelines, you can avoid common pitfalls and ensure a smoother application process.

Misconceptions

Understanding the Kcb Registration form can be challenging due to various misconceptions. Below are eight common misunderstandings explained in detail.

- Misconception 1: The registration form is only for established businesses.

- Misconception 2: You need to provide a lot of financial data upfront.

- Misconception 3: There is a requirement to have a minimum deposit amount.

- Misconception 4: Only large businesses can benefit from a KCB Business Account.

- Misconception 5: You must have multiple directors to open a business account.

- Misconception 6: The form does not require personal identification.

- Misconception 7: Submitting the form guarantees account approval.

- Misconception 8: The Cheque Book Request is mandatory on the form.

This is not true; both registered and non-registered businesses can complete the Kcb Registration form. New entrepreneurs are encouraged to use the form to establish their accounts.

While financial data is part of the form, applicants can indicate expected activity ranges rather than providing exact figures. This flexibility aids in ease of registration.

The Kcb Registration form does not specify a minimum deposit. It primarily serves to gather information necessary for account establishment.

Various account options cater to different business sizes. Small businesses also find suitable choices listed in the form.

While the form provides space for multiple directors, a single signatory can also open an account. This is particularly relevant for sole proprietors.

The form explicitly asks for identification details for directors or signatories. This is essential for verification and compliance purposes.

Completion and submission of the Kcb Registration form do not automatically guarantee account approval. The bank conducts a review process to ensure eligibility.

Choosing whether to request a cheque book is optional. Applicants can tick the relevant boxes based on their specific needs.

Awareness of these misconceptions can facilitate a smoother application process when completing the Kcb Registration form.

Key takeaways

The Kcb Registration form is a crucial document for opening a business account. Here are some key takeaways to ensure a smooth application process:

- Complete all sections: Make sure to fill out every part of the form accurately to avoid delays.

- Use clear contact information: Provide a reliable phone number and email address for communication.

- Attach required documents: Include valid identification and proof of business registration.

- Tick the correct boxes: Carefully choose the appropriate account type and services you wish to use.

- Check financial details: Accurately indicate expected transaction volumes to meet bank requirements.

- Sign where necessary: Ensure all required directors and signatories provide their signatures on the form.

- Photo identification: Include clear photographs for all directors or signatories as specified.

- Review terms and condition: Read and understand the bank's terms and conditions before signing.

- Follow up: Keep track of your application status with the bank to ensure timely processing.

Be diligent in these steps to facilitate a successful account setup.

Browse Other Templates

Oregon Sui Rate - Use this form to report changes to previously submitted information.

Why Do Employers Ask About Disability - Participation helps build a supportive environment for all employees.

Excel Address Book Template - Our goal is to simplify how you manage and interact with your contacts.