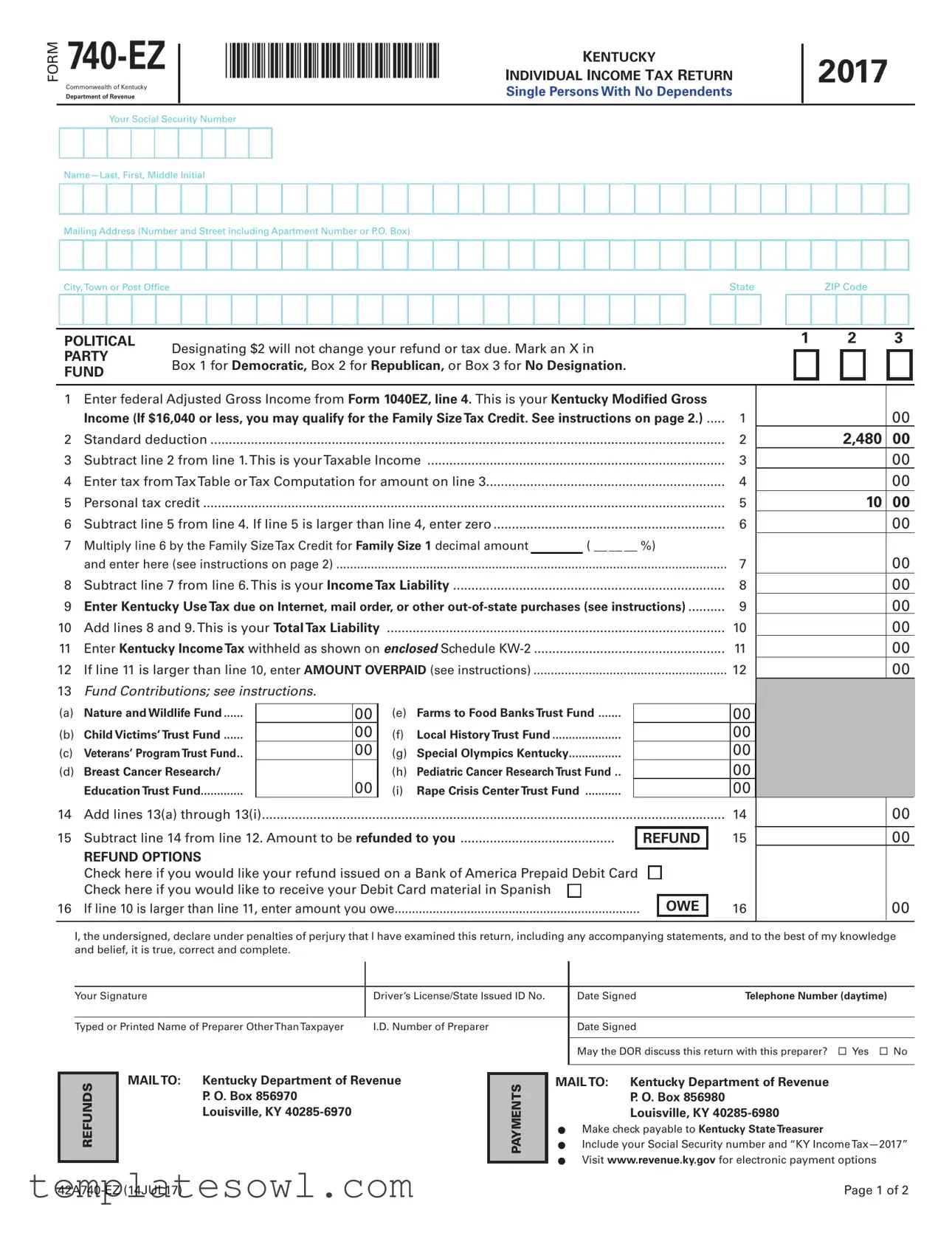

Fill Out Your Kentucky 740Ez Form

The Kentucky 740EZ form simplifies the process for single individuals who have no dependents and meet specific criteria for filing their state income tax return. Designed for those who filed federal Form 1040EZ, this form requires straightforward entries concerning income, deductions, and tax credits. Taxpayers will first input their federal adjusted gross income, followed by a standard deduction, to determine their taxable income. The form facilitates the application of various tax obligations, including state tax liability and potential credits, such as the Family Size Tax Credit for qualifying individuals. Taxpayers are also given the option to contribute a portion of their tax to various funds, which support local community initiatives. Essential information, such as Social Security numbers and payment instructions, is required to ensure that the return is processed promptly and correctly. This dedicated form is not only a financial necessity but also an opportunity to engage with the state's tax support systems.

Kentucky 740Ez Example

Commonwealth of Kentucky

Department of Revenue

*1700030003* KENTUCKY

INDIVIDUAL INCOME TAX RETURN

Single Persons With No Dependents

2017

Your Social Security Number

Mailing Address (Number and Street including Apartment Number or P.O. Box)

City,Town or Post OfficeStateZIP Code

POLITICAL |

Designating $2 will not change your refund or tax due. Mark an X in |

1 |

2 |

3 |

|

||

PARTY |

|

|

|

|

|

|

|

Box 1 for Democratic, Box 2 for Republican, or Box 3 for No Designation. |

|

|

|

|

|

|

|

FUND |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Enter federal Adjusted Gross Income from Form 1040EZ, line 4. This is your Kentucky Modified Gross |

|

|

Income (If $16,040 or less, you may qualify for the Family Size Tax Credit. See instructions on page 2.) |

1 |

2 |

Standard deduction |

2 |

3 |

Subtract line 2 from line 1.This is yourTaxable Income |

3 |

4 |

Enter tax fromTaxTable orTax Computation for amount on line 3 |

4 |

5 |

Personal tax credit |

5 |

6 |

Subtract line 5 from line 4. If line 5 is larger than line 4, enter zero |

6 |

7Multiply line 6 by the Family SizeTax Credit for Family Size 1 decimal amount __ . __ __ ( __ __ __ %)

|

and enter here (see instructions on page 2) |

7 |

8 |

Subtract line 7 from line 6.This is your Income Tax Liability |

8 |

9 |

Enter Kentucky Use Tax due on Internet, mail order, or other |

9 |

10 |

Add lines 8 and 9.This is your Total Tax Liability |

10 |

11 |

Enter Kentucky Income Tax withheld as shown on enclosed Schedule |

11 |

12 |

If line 11 is larger than line 10, enter AMOUNT OVERPAID (see instructions) |

12 |

13Fund Contributions; see instructions.

(a) |

Nature and Wildlife Fund |

|

00 |

(e) |

Farms to Food Banks Trust Fund |

|

|

|

|

00 |

(b) |

Child Victims’ Trust Fund |

|

00 |

(f) |

Local History Trust Fund |

|

|

|

|

00 |

(c) |

Veterans’ Program Trust Fund.. |

|

00 |

(g) |

Special Olympics Kentucky |

|

|

|

|

00 |

(d) |

Breast Cancer Research/ |

|

00 |

(h) |

Pediatric Cancer Research Trust Fund .. |

|

|

|

|

00 |

|

Education Trust Fund |

|

(i) |

Rape Crisis Center Trust Fund |

|

|

|

|

00 |

|

14 |

Add lines 13(a) through 13(i) |

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|||||

15 |

..........................................Subtract line 14 from line 12. Amount to be refunded to you |

|

REFUND |

|

15 |

|||||

|

REFUND OPTIONS |

|

|

|

|

|

|

|

|

|

|

Check here if you would like your refund issued on a Bank of America Prepaid Debit Card |

|

|

|

|

|||||

|

Check here if you would like to receive your Debit Card material in Spanish |

|

|

|

|

|||||

16 |

If line 10 is larger than line 11, enter amount you owe |

|

|

OWE |

|

16 |

||||

|

00 |

2,480 |

00 |

|

00 |

|

00 |

10 |

00 |

|

00 |

|

00 |

|

00 |

|

00 |

|

00 |

|

00 |

|

00 |

|

00 |

|

|

|

00 |

|

00 |

|

|

I, the undersigned, declare under penalties of perjury that I have examined this return, including any accompanying statements, and to the best of my knowledge and belief, it is true, correct and complete.

|

|

|

( ) |

Your Signature |

Driver’s License/State Issued ID No. |

Date Signed |

Telephone Number (daytime) |

|

|

|

|

Typed or Printed Name of Preparer OtherThanTaxpayer |

I.D. Number of Preparer |

Date Signed |

|

|

|

|

|

|

|

May the DOR discuss this return with this preparer? ¨ Yes ¨ No |

|

|

|

|

|

REFUNDS |

MAIL TO: Kentucky Department of Revenue

P. O. Box 856970

Louisville, KY

PAYMENTS |

MAIL TO: Kentucky Department of Revenue

P. O. Box 856980

Louisville, KY

lMake check payable to Kentucky State Treasurer

lInclude your Social Security number and “KY

lVisit www.revenue.ky.gov for electronic payment options

Page 1 of 2 |

Form |

Page 2 of 2 |

Who May Use Form

you were a Kentucky resident for the entire year;

you are filing federal Form 1040EZ;

your filing status is single;

you do not claim additional credits for being age 65 or over, blind, or a member of the Kentucky National Guard at the end of 2017; and

you had only wages, salaries, tips, unemployment compensation, taxable scholarship or fellowship grants, and your taxable interest was $1,500 or less.

If you do not meet all five of the above requirements, see Form 740 instructions.

When to

Social Security

COMPLETING FORM

Please print your numbers inside the boxes with black ink. Do not use dollar signs.

Political Party Fund

Line

If you are not required to file a federal income tax return, enter the total income from sources within and without Kentucky.

Line

Line

If taxable income is: |

Tax before credit is: |

|||

$ |

0 |

— |

$3,000 |

................. 2% of taxable income |

$ |

3,001 |

— |

$4,000 |

................. 3% of taxable income minus $30 |

$ |

4,001 |

— |

$5,000 |

................. 4% of taxable income minus $70 |

$ |

5,001 |

— |

$8,000 |

................. 5% of taxable income minus $120 |

$ |

8,001 |

— $75,000 |

................. 5.8% of taxable income minus $184 |

|

$75,001 and up |

6% of taxable income minus $334 |

|||

Example: (Taxable income) $8,500 x 5.8%

Note: An optional tax table is available online at www.revenue.ky.gov or by calling the Department of Revenue, (502)

Line

Enter in the space provided the decimal amount from the following table.

Family Size |

Percent ofTax |

|

||

One |

|

as Family SizeTax Credit |

|

|

|

|

|

||

If the Kentucky modified |

Enter decimal amount |

|

||

gross income (Line 1) is: |

on Line 7 |

|

||

|

|

|

|

|

over |

but not over |

|

|

|

$ 0 |

$12,060 |

1.00 |

(100%) |

|

$12,060 |

$12,542 |

0.90 |

(90%) |

|

$12,542 |

$13,025 |

0.80 |

(80%) |

|

$13,025 |

$13,507 |

0.70 |

(70%) |

|

$13,507 |

$13,990 |

0.60 |

(60%) |

|

$13,990 |

$14,472 |

0.50 |

(50%) |

|

$14,472 |

$14,954 |

0.40 |

(40%) |

|

$14,954 |

$15,316 |

0.30 |

(30%) |

|

$15,316 |

$15,678 |

0.20 |

(20%) |

|

$15,678 |

$16,040 |

0.10 |

(10%) |

|

|

|

|

|

|

Multiply amount on Line 6 by decimal amount. Enter result on Line 7. This is your Family Size Tax Credit.

Line 9, Kentucky

Line 11, Kentucky Tax

Line

Line

(i)the Rape Crisis Center Trust Fund. Donations are voluntary and amounts donated will be deducted from your refund.

Enter the amount(s) you wish to contribute on Lines 13(a) through 13(i). The total of these amounts cannot exceed the amount of the overpayment.

Line

Underpayment of Estimated

Interest and

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Criteria | The Kentucky 740-EZ form is designed for single taxpayers without dependents who were Kentucky residents for the full year and meet specific income requirements. |

| Filing Deadline | Taxpayers must submit the form by April 17, 2018, to avoid penalties and interest on any owed taxes. |

| Tax Computation | Tax liability is calculated based on the taxpayer's taxable income, using a graduated rate schedule specific to Kentucky. |

| Political Fund Designation | Taxpayers can designate $2 of their taxes to a political party without affecting their refund or tax due by selecting the appropriate box on the form. |

| Governing Law | The Kentucky 740-EZ form is governed by the Kentucky Revised Statutes, specifically KRS 141.020 concerning income tax obligations. |

Guidelines on Utilizing Kentucky 740Ez

Filling out the Kentucky 740EZ form requires careful attention to your income and deductions to ensure accurate reporting. Each step must be completed in order, and any errors can lead to delays or issues with your tax return. Follow these steps to effectively complete your form.

- Begin by entering your Social Security Number in the designated box.

- Fill in your Name, including your last name, first name, and middle initial.

- Provide your Mailing Address, which should include your street number, apartment number (if applicable), city, state, and ZIP code.

- Indicate your political party preference by marking an X in the appropriate box for Democratic, Republican, or No Designation.

- For Line 1, enter your federal Adjusted Gross Income from Form 1040EZ, Line 4.

- The Standard Deduction of $2,480 is preprinted on Line 2. If your itemized deductions exceed this amount, consider filing Form 740 instead.

- On Line 3, subtract Line 2 from Line 1 to calculate your Taxable Income.

- Calculate the tax for Line 4 using the tax rate schedule provided.

- On Line 5, enter your Personal Tax Credit.

- Subtract Line 5 from Line 4 on Line 6. If Line 5 is larger, enter zero.

- For Line 7, multiply Line 6 by the Family Size Tax Credit decimal based on your income, then enter the result.

- Subtract Line 7 from Line 6 to determine your Income Tax Liability, and enter that amount on Line 8.

- On Line 9, enter any Kentucky Use Tax due for purchases made out of state.

- Add lines 8 and 9 on Line 10 to find your Total Tax Liability.

- On Line 11, enter the amount of Kentucky Income Tax Withheld as shown on your Schedule KW-2.

- On Line 12, if Line 11 is larger than Line 10, calculate the overpaid amount and enter it here.

- On Line 13, enter any voluntary contributions you wish to make to various funds.

- Add the contributions listed in Line 13 on Line 14.

- Subtract Line 14 from Line 12 to find the amount to be refunded to you on Line 15.

- If your total tax liability is larger than the tax withheld, calculate the amount owed on Line 16 and prepare to make a payment.

- Sign the form in the designated area, providing your signature, driver's license number, and date signed.

After completing the form, be sure to keep a copy for your records. The completed form and any associated schedules should be mailed to the appropriate addresses provided, ensuring they are postmarked by the deadline to avoid penalties.

What You Should Know About This Form

What is the purpose of the Kentucky 740-EZ form?

The Kentucky 740-EZ form is used by individual residents of Kentucky who are filing their state income tax return and meet specific criteria. This form is for single individuals without dependents and simplifies the tax filing process by providing a straightforward way to report income, calculate tax owed, and determine potential refunds.

Who is eligible to use the Kentucky 740-EZ form?

You may use Form 740-EZ if you meet all of the following criteria: you were a Kentucky resident for the entire tax year, you filed federal Form 1040EZ, your filing status is single, and you do not claim additional credits for being age 65 or older, blind, or a member of the Kentucky National Guard. Additionally, your income should only include wages, salaries, tips, unemployment compensation, and certain taxable scholarship or fellowship grants, with taxable interest not exceeding $1,500.

When is the Kentucky 740-EZ form due?

The 740-EZ form and any associated tax payments must be postmarked by April 17, 2018, to avoid penalties and interest. Ensure that you send your completed form in a timely manner to fulfill your filing obligation.

How should I report my income on the Kentucky 740-EZ form?

Report your federal adjusted gross income from Line 4 of your federal Form 1040EZ on Line 1 of the 740-EZ form. If your income is $16,040 or less, you may be eligible for the Family Size Tax Credit, so be sure to check the associated instructions for calculating that credit.

What if I overpaid my Kentucky taxes?

If your Kentucky income tax withheld, as shown on Schedule KW-2, exceeds your total tax liability, you will be eligible for a refund. Subtract your total tax liability (found on Line 10) from the amount withheld (Line 11) and enter the difference on Line 12 as the amount overpaid. This amount will be refunded to you after processing.

Can I make contributions to charitable funds using the Kentucky 740-EZ form?

Yes, if you have an overpayment on Line 12, you may choose to make voluntary contributions to various funds such as the Nature and Wildlife Fund or the Veterans' Program Trust Fund. Enter the desired contribution amounts on Lines 13(a) through 13(i), noting that the total cannot exceed your overpayment amount.

What do I do if I owe taxes?

If the total tax liability (Line 10) is greater than the amount withheld (Line 11), you will owe additional tax. Enter this amount on Line 16. To pay, make your check payable to the Kentucky State Treasurer, and include your Social Security number and the notation “KY Income Tax–2017” on the check.

Common mistakes

Filling out the Kentucky 740EZ form can seem straightforward, but errors can lead to processing delays or incorrect tax liabilities. One common mistake is failing to provide accurate personal information. This includes not entering the correct Social Security number or misspelling names. Ensuring this information matches official records is crucial, as discrepancies can delay processing or result in rejected returns.

Another frequent error occurs in reporting income. Taxpayers may confuse federal adjusted gross income with federal taxable income. Line 1 specifically requires the adjusted gross income from Form 1040EZ, and mixing these figures can lead to incorrect tax calculations. Those unfamiliar with tax terms may inadvertently enter the wrong figure, which could impact the entire filing.

Many individuals overlook the significance of the Family Size Tax Credit. For those eligible, correctly calculating this credit can reduce taxable income significantly. Skipping Line 7 or misunderstanding its requirements can result in a higher tax liability than necessary. It's important to reference the specific income thresholds provided in the instructions to determine applicability accurately.

Lastly, a common mistake is related to the payment process. Taxpayers sometimes fail to pay attention to the mailing instructions. The form instructs individuals on where to send payments or refunds. Ignoring these directions could cause further delays in processing. Making checks payable to the correct entity and including necessary identifiers, such as a Social Security number, ensures smoother processing of any payments owed.

Documents used along the form

The Kentucky 740EZ form is essential for individuals filing their state income tax return. Along with this form, several other documents often accompany it to ensure complete and accurate filing. Below is a list of related forms and documents you may need to consider.

- Form 1040EZ: This is the federal income tax return that serves as the basis for the Kentucky 740EZ. It includes your Adjusted Gross Income and requires reporting of wages, salaries, and tips.

- Schedule KW-2: This document provides information about the Kentucky income tax that has been withheld from your wages throughout the year and must be submitted with the 740EZ form.

- Form 740: If you do not qualify to use the 740EZ form, the standard Kentucky income tax return, Form 740, is required. It allows for itemized deductions and is more detailed.

- Form 2210-K: This form is used to calculate underpayment penalties for individuals who did not pay enough tax during the year. It is often necessary if the owed tax exceeds certain thresholds.

- Form 740-V: This form is the deposit for individuals who owe tax when filing. It helps ensure that your payment is applied correctly to your account.

- Form 740-ES: For estimated tax payments, this form is used to report and pay estimated taxes on income that may not have tax withheld, such as self-employment income.

- Proof of Contributions: Documentation confirming any contributions to state funds, such as the Nature and Wildlife Fund, if you choose to make donations from your refund.

- Taxpayer Service Center Contact Information: While not a form, having contact details for local taxpayer service centers can provide crucial assistance should you have questions regarding your filing.

Gathering these documents efficiently will help streamline the process of filing your taxes and ensure compliance with state requirements. Always check the most current guidelines, as forms and regulations may change annually.

Similar forms

- Kentucky Form 740: Unlike the 740EZ, this form is for Kentucky residents who require a more detailed return. It accommodates additional tax credits and deductions, including those for age or disability.

- Federal Form 1040: This is the standard individual income tax return form used in the U.S. The 740EZ closely resembles the 1040EZ, which is specifically designed for those with simpler tax situations.

- Federal Form 1040EZ: This form is intended for taxpayers who meet specific criteria, similar to those for the 740EZ. Both forms apply to single filers without dependents and have straightforward calculations.

- Kentucky Form 741: This form is designated for part-year and non-resident income tax filers. While meant for different populations, it still serves the purpose of calculating Kentucky income tax in a concise format.

- Kentucky Form 740-NP: This is similar to Form 740 but is designed for non-residents. It helps calculate taxes for those who earn income in Kentucky without being full-time residents.

- Kentucky Use Tax Form: Used for reporting state use tax on out-of-state purchases, this form shares similarities in reporting tax liabilities based on income or sales.

- Kentucky Schedule A: Used by filers who itemize deductions. While the 740EZ does not allow for itemization, both forms are part of the Kentucky tax return process.

- Kentucky K-1: This form is utilized for reporting income from partnerships and S corporations. It provides details on the income that may flow to an individual's tax return, similar to income calculations in the 740EZ.

- Kentucky Child Victims’ Trust Fund Contribution Form: This allows taxpayers to contribute part of their refund to a specific fund. It's similar to the donation lines in the 740EZ, which allow for contributions to various funds.

- Kentucky Property Tax Returns: While different in purpose, both the property tax return process and the 740EZ emphasize the accurate calculation of tax liabilities based on specific criteria.

Dos and Don'ts

Filling out the Kentucky 740EZ form is an important step for individuals required to file their state income taxes. To make this process smooth and effective, here is a list of things to do and avoid when completing the form.

- Make sure your information is accurate. Check that your name, address, and Social Security number are correct to avoid processing delays.

- Double-check your federal adjusted gross income. This figure is critical and any mistake can lead to incorrect tax liability calculations.

- Use black ink. Fill in the boxes using black ink and avoid dollar signs, following the instructions closely.

- Include all necessary documentation. Ensure you attach the Schedule KW-2 to validate your Kentucky income tax withheld.

- Don’t rush the process. Take your time to read the instructions before starting to fill out the form.

- Don’t forget to sign the form. Your signature is crucial for declaring under penalties of perjury that the information provided is accurate.

- Avoid leaving any fields blank. If a section does not apply to you, write “N/A” instead of leaving it empty.

- Do not submit the form without reviewing it. A thorough review can save you from potential errors and penalties.

Misconceptions

- Anyone can use the 740EZ form. Only specific taxpayers can use this form. You must meet five criteria, including filing federal Form 1040EZ and having no dependents.

- Filing the 740EZ form guarantees a refund. A refund depends on your income, tax withheld, and actual tax liability. Not everyone who files gets a refund.

- The standard deduction applies to everyone. The standard deduction of $2,480 is only available for those using the 740EZ form. If your itemized deductions are higher, you should use Form 740 instead.

- Political party designation affects my taxes. Designating $2 to a political party does not change your tax refund or liability. It is simply a voluntary donation.

- I can use the 740EZ form if I have multiple sources of income. You can only file using this form if you have wages, salaries, tips, unemployment compensation, and limited taxable interest.

- The 740EZ form does not require my Social Security number. You must provide your Social Security number. It is important for establishing your identity for tax purposes.

- All forms must be submitted with W-2s and other tax documents. It is no longer necessary to submit W-2s, 1099s, and W2-Gs with the 740EZ return. Keep these forms for your records instead.

- If I owe money, I can take my time to pay. To avoid penalties and interest, any tax due must be paid by the filing deadline. You must submit your payment along with the form.

Key takeaways

Filling out the Kentucky 740EZ form is an essential process for individuals with straightforward tax situations. Here are five key takeaways to keep in mind:

- Eligibility Requirements: Ensure you meet all five criteria to use the 740EZ form, including being a Kentucky resident and having only certain forms of income. If any criteria are unmet, you may need to use a different form.

- Filing Deadline: The form must be postmarked by April 17, 2018, to avoid penalties and interest. Timely submission is critical for compliance.

- Income Reporting: Enter your federal adjusted gross income from Form 1040EZ accurately on the 740EZ form. It is vital to distinguish between adjusted gross income and taxable income.

- Tax Credits: Review your eligibility for tax credits, particularly the Family Size Tax Credit for those with a modified gross income of $16,040 or less.

- Refund and Payment Options: Decide how to receive any refund, whether through a Prepaid Debit Card or another method. If you owe taxes, make sure to follow the specified payment instructions to avoid additional fees.

Understanding these points can help simplify your filing experience and ensure compliance with Kentucky tax laws.

Browse Other Templates

Odometer Disclosure Statement Indiana - This form protects both parties in the leasing transaction.

Tsc - Accurate data collection helps to enhance service delivery in education.