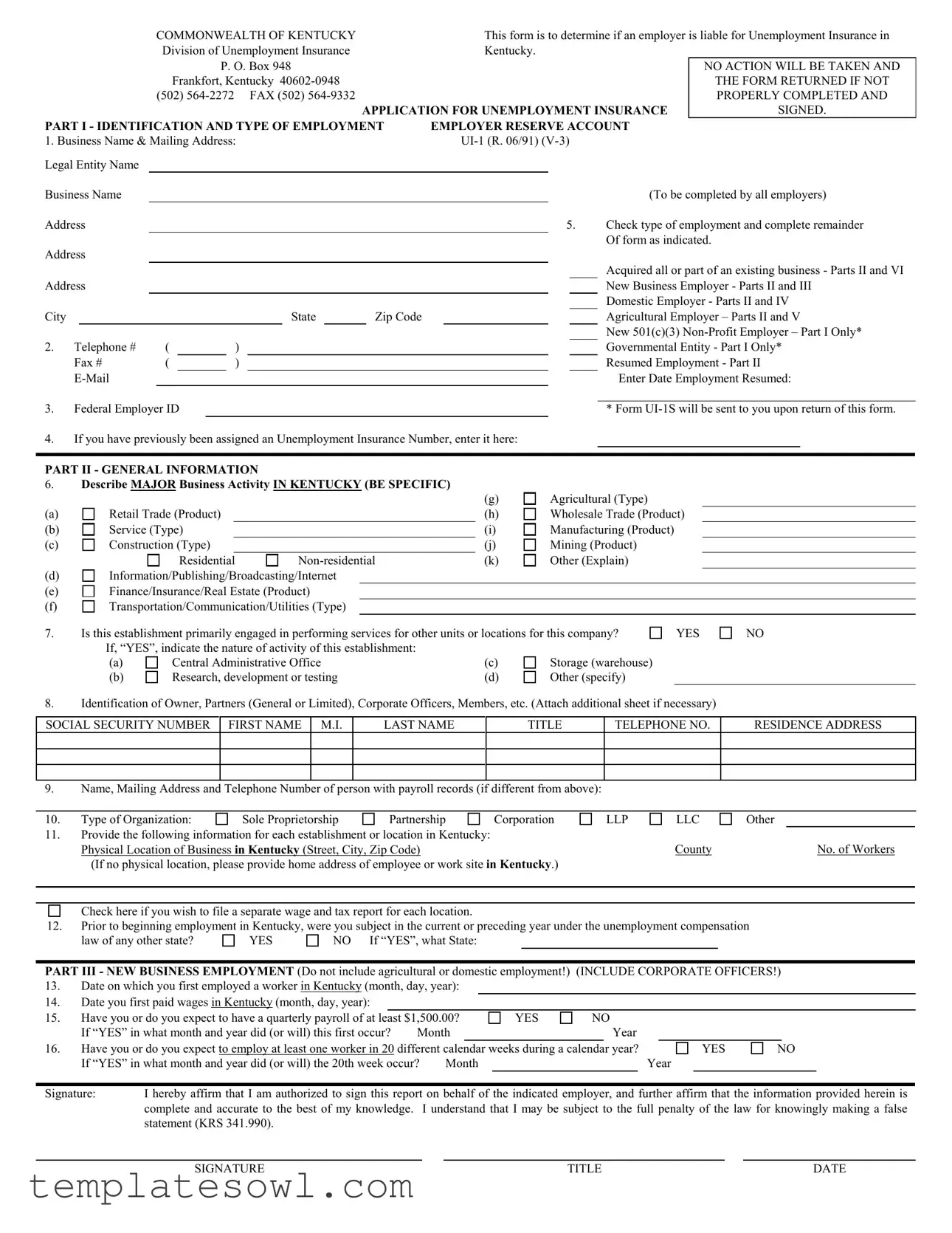

Fill Out Your Kentucky Ui 1 Form

The Kentucky UI-1 form is a crucial document used to assess an employer's liability for Unemployment Insurance in the state. Designed specifically for entities in Kentucky, this form serves several significant purposes. It collects essential information about the business, including the legal entity's name, address, and type of employment. Additionally, it helps identify the business activities taking place within Kentucky while capturing details about the employer’s structure, such as whether it’s a corporation or sole proprietorship. Part of the form focuses on new businesses, requiring information about when they first employed workers and their payroll expectations. For employers involved in domestic or agricultural employment, specific sections ensure that these unique activities are adequately reported. Finally, if a business is acquired, provisions in the form enable the previous and new owners to document this change clearly and effectively. Understanding this form's requirements and sections is vital for compliance with state laws and regulations, ensuring that all necessary data is accurately provided to the Division of Unemployment Insurance.

Kentucky Ui 1 Example

|

|

|

|

COMMONWEALTH OF KENTUCKY |

|

|

|

This form is to determine if an employer is liable for Unemployment Insurance in |

||||||||||

|

|

|

|

Division of Unemployment Insurance |

|

|

|

Kentucky. |

|

|

||||||||

|

|

|

|

|

|

P. O. Box 948 |

|

|

|

|

|

|

|

NO ACTION WILL BE TAKEN AND |

||||

|

|

|

|

Frankfort, Kentucky |

|

|

|

|

|

|

|

THE FORM RETURNED IF NOT |

||||||

|

|

|

|

(502) |

|

|

|

|

|

|

|

PROPERLY COMPLETED AND |

||||||

|

|

|

|

|

|

|

|

|

|

|

APPLICATION FOR UNEMPLOYMENT INSURANCE |

SIGNED. |

||||||

PART I - IDENTIFICATION AND TYPE OF EMPLOYMENT |

EMPLOYER RESERVE ACCOUNT |

|

||||||||||||||||

1. Business Name & Mailing Address: |

|

|

|

|

|

|||||||||||||

Legal Entity Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Business Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be completed by all employers) |

|||

Address |

|

|

|

|

|

|

|

|

|

|

5. |

Check type of employment and complete remainder |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Of form as indicated. |

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquired all or part of an existing business - Parts II and VI |

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Business Employer - Parts II and III |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Employer - Parts II and IV |

|

City |

|

|

|

|

|

|

|

|

State |

|

Zip Code |

|

|

|

|

Agricultural Employer – Parts II and V |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New 501(c)(3) |

|

2. |

Telephone # |

( |

|

|

) |

|

|

|

|

|

|

|

|

|

Governmental Entity - Part I Only* |

|||

|

Fax # |

( |

|

) |

|

|

|

|

|

|

|

|

|

Resumed Employment - Part II |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter Date Employment Resumed: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

3. |

Federal Employer ID |

|

|

|

|

|

|

|

|

|

|

|

* Form |

|||||

4.If you have previously been assigned an Unemployment Insurance Number, enter it here:

PART II - GENERAL INFORMATION

6.Describe MAJOR Business Activity IN KENTUCKY (BE SPECIFIC)

|

|

|

|

(g) |

Agricultural (Type) |

(a) |

Retail Trade (Product) |

|

|

(h) |

Wholesale Trade (Product) |

(b) |

Service (Type) |

|

|

(i) |

Manufacturing (Product) |

(c) |

Construction (Type) |

|

|

(j) |

Mining (Product) |

|

Residential |

(k) |

Other (Explain) |

||

(d)

Information/Publishing/Broadcasting/Internet

Information/Publishing/Broadcasting/Internet

(e) |

Finance/Insurance/Real Estate (Product) |

|

|

|

|

|

|

(f) |

Transportation/Communication/Utilities (Type) |

|

|

|

|

|

|

7. |

Is this establishment primarily engaged in performing services for other units or locations for this company? |

YES |

NO |

||||

|

If, “YES”, indicate the nature of activity of this establishment: |

|

|

|

|

||

|

(a) |

Central Administrative Office |

(c) |

Storage (warehouse) |

|

|

|

|

(b) |

Research, development or testing |

(d) |

Other (specify) |

|

|

|

8.Identification of Owner, Partners (General or Limited), Corporate Officers, Members, etc. (Attach additional sheet if necessary)

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

TITLE

TELEPHONE NO.

RESIDENCE ADDRESS

9.Name, Mailing Address and Telephone Number of person with payroll records (if different from above):

10. |

Type of Organization: |

Sole Proprietorship |

Partnership |

Corporation |

11.Provide the following information for each establishment or location in Kentucky: Physical Location of Business in Kentucky (Street, City, Zip Code)

(If no physical location, please provide home address of employee or work site in Kentucky.)

LLP

LLC

County

Other

No. of Workers

Check here if you wish to file a separate wage and tax report for each location.

12.Prior to beginning employment in Kentucky, were you subject in the current or preceding year under the unemployment compensation

law of any other state? |

YES |

NO If “YES”, what State: |

PART III - NEW BUSINESS EMPLOYMENT (Do not include agricultural or domestic employment!) (INCLUDE CORPORATE OFFICERS!)

13.Date on which you first employed a worker in Kentucky (month, day, year):

14.Date you first paid wages in Kentucky (month, day, year):

15. |

Have you or do you expect to have a quarterly payroll of at least $1,500.00? |

YES |

NO |

|

|

|

|

|

|

||||||

|

If “YES” in what month and year did (or will) this first occur? |

Month |

|

|

|

Year |

|

|

|

|

|

|

|||

16. |

Have you or do you expect to employ at least one worker in 20 different calendar weeks during a calendar year? |

|

|

YES |

NO |

||||||||||

|

If “YES” in what month and year did (or will) the 20th week occur? |

Month |

|

|

|

|

Year |

|

|

|

|

||||

|

|

||||||||||||||

Signature: |

I hereby affirm that I am authorized to sign this report on behalf of the indicated employer, and further affirm that the information provided herein is |

||||||||||||||

|

|

complete and accurate to the best of my knowledge. I understand that I may be subject to the full penalty of the law for knowingly making a false |

|||||||||||||

|

|

statement (KRS 341.990). |

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

TITLE |

DATE |

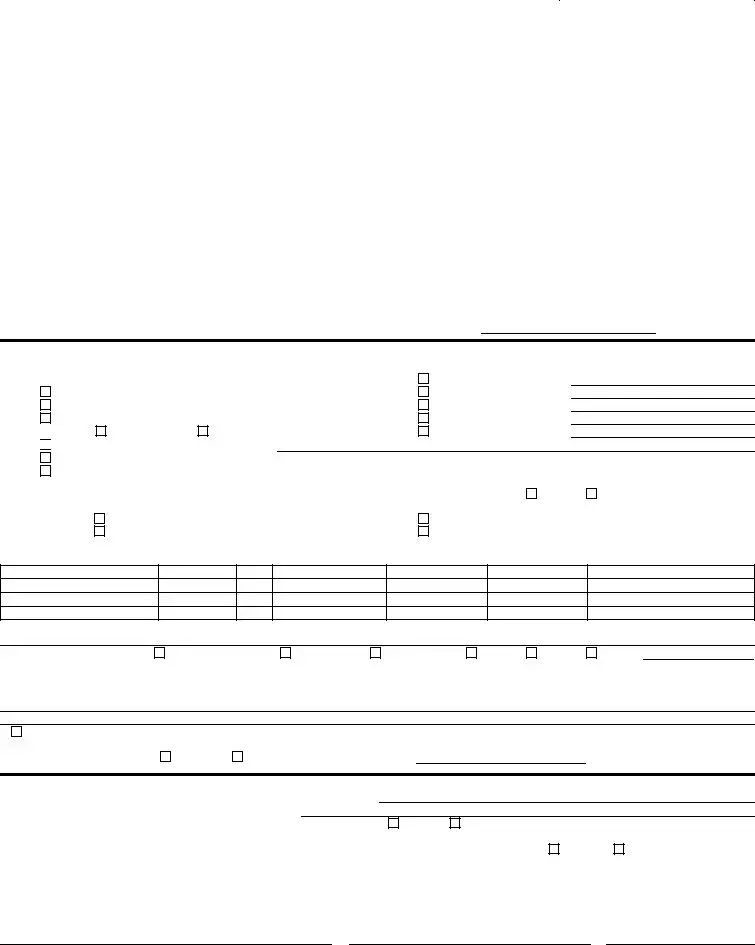

PART IV - DOMESTIC (HOUSEHOLD) EMPLOYMENT

17.Date on which you first employed a worker in domestic employment in Kentucky (month, day, year):

18.Have you or do you expect to have a quarterly domestic (household) payroll of at least $1,000.00?

If yes, in what month and year did (or Will) this first occur? |

Month |

YES Year

NO

PART V - AGRICULTURAL EMPLOYMENT (INCLUDE CORPORATE OFFICERS!)

19.Date on which you first employed a worker in agricultural employment in Kentucky (month, day, year):

20.Have you or do you expect to have a quarterly agricultural payroll of at least $20,000.00; or, have you or do you

expect to employ at least 10 agricultural workers in 20 different weeks during a calendar year? |

YES |

|||

If yes, in what month and year did (or will) this first occur? |

Month |

|

|

Year |

NO

PART VI - ACQUISITION OF EXISTING BUSINESS - To be completed by both the transferring and acquiring parties.

21.ENTER DATE OF TRANSFER AND STATUS OF OWNERSHIP PRIOR TO TRANSFER

DATE OF TRANSFER |

|

|

EMPLOYER NO. |

FEDERAL NO. |

|

||

Names of Owner/s or Officer/s Phone |

( |

) |

|

TYPE OF OWNERSHIP |

REASON FOR CHANGE |

|

|

|

|

|

|

|

Proprietorship |

Sold |

Leased |

|

|

|

|

|

Partnership |

|

|

|

|

|

|

|

Corporation |

Lease Reverted |

Other (Explain) |

|

|

|

|

|

Other (Explain) |

|

|

|

|

|

|

|

|

TYPE OF CHANGE |

|

Trade or Business Name & Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Transferred in Entirety (ALL KY OPERATIONS)... |

|

|

|

|

|

|

|

(Complete #22 - Both Parties Must Sign) |

|

|

|

|

|

|

|

Transferred in Part |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(Complete #22, 23, 24, 25 & 26 - Both Parties Must Sign |

|

|

|

|

|

|

|

||

22. |

ENTER DATA FOR NEW OWNERSHIP |

|

EMPLOYER NO. |

FEDERAL NO. |

|

||

Name, Address & S.S. # of Owner/s or Officer/s

TYPE OF OWNERSHIP

Proprietorship

Partnership

Corporation

Other (Explain)

TRADE OR BUSINESS NAME, ADDRESS & ZIP CODE

Location of Business in Kentucky (Street, City, Zip Code) |

Phone ( |

) |

Principal Activity |

Principal Product |

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

ENTER DATA FOR RETAINED PORTION |

|

EMPLOYER NO. |

FEDERAL NO. |

|

Name, Address & S.S. # of Owner/s or Officer/s

TYPE OF OWNERSHIP

Proprietorship

Partnership

Corporation

Other (Explain)

TRADE OR BUSINESS NAME, ADDRESS & ZIP CODE

Location of Business in Kentucky (Street, City, Zip Code) |

Phone ( |

) |

Principal Activity |

Principal Product |

24. |

Portion of prior owner/operator’s reserve account to be transferred: |

|

% |

25.Percentage of reserve transferred must be based on payroll or number of employees transferred. Please indicate which basis has been used.

26.Predecessor’s date of first employment for transferred portion.

Signature & Title of Transferor or |

Signature & Title of Transferee or |

Date |

Disposing Employer Shown in Part 1 |

Acquiring Employer Shown in Part 2 |

|

(Owner or Officer) |

(Owner or Officer) |

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose | The Kentucky UI-1 form is used to determine an employer's liability for unemployment insurance in the state. |

| Data Submission | If not properly completed and signed, no action will be taken, and the form will be returned. |

| Governing Law | The form is governed under KRS 341, which outlines the laws related to unemployment insurance in Kentucky. |

| Employer Information | Employers must provide detailed identification information, including name, address, and telephone number. |

| Business Activity | The form requires a detailed description of the major business activity conducted in Kentucky. |

| Initial Employment Dates | Employers must report the date on which they first employed a worker and the date wages were first paid in Kentucky. |

| Domestic Employment | For domestic employment, a separate section deals specifically with household payroll records and requirements. |

| Agricultural Employment | Specific provisions apply for agricultural employers, including quarterly payroll requirements of $20,000 or employing 10 workers. |

| Ownership Transfer | When acquiring an existing business, both transferring and acquiring parties must complete parts relevant to ownership transfer. |

| Confidentiality and Accuracy | The individual signing the form affirms that the provided information is complete and understands the penalties for false statements. |

Guidelines on Utilizing Kentucky Ui 1

Filling out the Kentucky UI-1 form is essential for determining your liability for Unemployment Insurance in Kentucky. Once you complete this form, you will submit it to the Division of Unemployment Insurance. Keep in mind that failure to properly fill out this form may result in no action taken, and the form will be returned to you.

- Identify Your Business: Fill in the Business Name and Mailing Address in Part I. Include the legal entity name and all contact information.

- Provide Contact Information: Include your Telephone and Fax numbers, as well as your E-Mail.

- Federal Employer ID: Enter your Federal Employer ID in the designated space and add any previous Unemployment Insurance Number if applicable.

- Specify Type of Employment: Check the appropriate box for the type of employment and continue to complete the corresponding parts of the form as indicated.

- Describe Major Business Activity: In Part II, clearly outline your Major Business Activity in Kentucky. Be specific about your business operations.

- Ownership and Contact Information: Fill in the Identification of Owners or partners including their social security numbers, titles, and contact information.

- Type of Organization: Indicate whether your business is a Sole Proprietorship, Partnership, Corporation, or another type.

- Employment Dates: Provide the date on which you first employed a worker in Kentucky, and the date when you first paid wages.

- Payroll Information: Answer questions regarding your expectations of having a quarterly payroll above the specified thresholds. Fill in any required dates for future expectations.

- Sign and Date: Before submitting, ensure that you sign the form, verify your title, and include today’s date. This affirms the information is accurate.

What You Should Know About This Form

What is the Kentucky UI-1 form?

The Kentucky UI-1 form is a document used to determine an employer's liability for Unemployment Insurance in Kentucky. It serves as an application for unemployment insurance and collects essential information about the employer and their business operations. Completing this form correctly is crucial for setting up unemployment insurance accounts in accordance with state law.

Who is required to complete the Kentucky UI-1 form?

All employers in Kentucky, including new businesses, agricultural, domestic, and governmental entities, must complete the Kentucky UI-1 form if they meet certain criteria regarding hiring and payroll. This includes any employer who anticipates a quarterly payroll of $1,500 or more or employs at least one worker in 20 different weeks during a calendar year.

What information is needed to complete the form?

To complete the Kentucky UI-1 form, employers must provide their business name, mailing address, and Federal Employer ID Number. They also need to indicate the type of business, detail major business activities in Kentucky, and identify key personnel associated with the organization. Specific payroll and employment information is also necessary, including dates for when the business first employed workers or paid wages.

What happens if the form is not completed correctly?

If the Kentucky UI-1 form is not filled out properly, the state will not take action on the application's submission. Instead, the form will be returned to the employer for correction. It is essential to pay close attention to all instructions and ensure that all required fields are completed accurately to avoid delays.

How is the UI-1 form submitted?

The completed Kentucky UI-1 form must be submitted to the Division of Unemployment Insurance via mail to the address provided on the form. Alternatively, employers may opt to send the form by fax using the number listed. It is advisable to retain a copy of the submitted form for personal records.

Are there any penalties for providing false information on the form?

Yes, there are legal repercussions for knowingly submitting false information on the Kentucky UI-1 form. Employers may face penalties under Kentucky Revised Statutes, specifically KRS 341.990, for making false statements. Such penalties can include fines or other legal actions.

Can an employer file separate wage and tax reports for different locations?

Employers can choose to file separate wage and tax reports for each establishment or location in Kentucky. If this is the option they wish to pursue, they should indicate this preference on the form. This allows for more precise tracking of employment and payroll across different business locations.

What should be done if the business structure changes after submitting the form?

If there are changes to the business structure, such as a sale or change in ownership, the employer should complete the appropriate sections of the UI-1 form to report these changes. It's critical to communicate these shifts promptly to avoid disruptions in unemployment insurance coverage and compliance with state laws.

What is the timeframe for processing the UI-1 form?

The processing time for the Kentucky UI-1 form can vary depending on several factors, including the volume of applications being handled by the Division of Unemployment Insurance. Employers may expect a timeline of several weeks. It is advisable to check for confirmation of receipt and any follow-up actions required.

Common mistakes

Filling out the Kentucky UI-1 form can seem straightforward, but many people make common mistakes that can lead to delays. One major error is not providing the correct business name and mailing address. This information is crucial, as it identifies the employer and ensures that the form is processed correctly. If the name or address is incorrect, the submission could be returned or delayed.

Another frequent mistake is failing to check the type of employment. The form has different sections based on whether the business is a new employer, a governmental entity, or another type. Not indicating the right category can cause confusion during the evaluation process. Employers should carefully consider their status to ensure they fill out all relevant parts of the form.

People often overlook the general information section as well, especially when describing the major business activity. A vague or unclear description can lead to misunderstandings about the nature of the business. It's important to be specific and detailed to help the authorities make the right determinations.

Missing information is another key issue. Some individuals neglect to provide all required data, such as the Social Security numbers of owners or partners. Incomplete forms can be sent back, requiring the person to start over. Always double-check that everything is filled in before submitting.

Furthermore, people sometimes forget to sign the form. Without a signature, the application is not valid and won't be processed. Remember that it's vital to sign and date the form, confirming that the information provided is accurate.

Finally, many fail to keep copies of their submissions. Not having a record can lead to confusion if there are questions later on. It is advisable for employers to save a copy of the completed form for their own reference. This way, they can easily recall what was submitted if any issues arise down the line.

Documents used along the form

The Kentucky UI 1 form is a crucial document for employers in the state. It helps determine whether they are liable for Unemployment Insurance. To properly complete this process, other forms and documents are often needed. Here’s a quick overview of four common forms that accompany the UI 1.

- UI-1S Form: After submitting the UI 1 form, employers receive the UI-1S form. This document serves as an Unemployment Insurance account number confirmation. It is essential for tracking the employer’s unemployment insurance duties.

- Wage and Tax Report: Employers must use this report to detail wages paid to employees. It is typically filed quarterly and is necessary for keeping accurate records of both wages and unemployment contributions.

- Employer's Payroll Records: Maintaining payroll records is vital for employers. These records show hours worked and wages paid. They may be requested for verification of employment status and payroll information.

- Unemployment Insurance Appeals Form: If there are disagreements or issues regarding unemployment claims, employers may need this form. It allows them to formally appeal decisions made by the unemployment office.

Having the right documents helps ensure compliance with Kentucky's unemployment insurance regulations. Proper preparation leads to a smoother process for employers and better support for their employees.

Similar forms

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). Similar to the Kentucky UI-1 form, it gathers details about the business entity, including the business name, address, and type of organization.

- IRS Form 941: This is the Employer's QUARTERLY Federal Tax Return. It requires reporting of employee wages and tax withholdings. Like the UI-1, it focuses on a business’s payroll activities and obligations.

- IRS Form 940: This form is used for reporting annual Federal Unemployment Tax Act (FUTA) tax. It is comparable to the UI-1 in that it assesses a business's unemployment insurance responsibilities at the federal level.

- State Unemployment Tax Registration Form: Each state has a similar form to register with its unemployment agency. These forms require business details, much like the UI-1, to determine eligibility for unemployment insurance.

- W-2 Form: This form reports annual wages and tax withholdings for employees. It serves a similar purpose in tracking employee compensation, which is a key factor in determining unemployment tax liabilities.

- Form I-9: This Employment Eligibility Verification form requires information about the employee and employer, ensuring compliance with immigration laws. This underscores the employment relationship, aligning with the UI-1's purpose of verifying employer details.

- Business License Application: This document is needed by many states and localities for operating a business legally. Similar to the UI-1, it collects fundamental information about the business structure and operations.

- State Business Tax Registration: This registration form collects business information needed for state taxation purposes. It also shares similarities with the UI-1 in that it helps to establish the business's financial obligations to the state.

Dos and Don'ts

Here are important guidelines to consider while completing the Kentucky UI 1 form. Following these tips will help ensure that your form is correctly processed.

- Do: Provide accurate business name and mailing address in the identification section.

- Do: Clearly describe your major business activity in Kentucky to avoid confusion.

- Do: Include complete information for each establishment or location, ensuring that every detail is correct.

- Do: Ensure your signature is present at the end of the form, affirming the information provided is accurate.

- Do: If applicable, indicate whether you expect to meet payroll thresholds, as this information is vital.

- Don't: Leave any section blank; each part of the form must be filled out.

- Don't: Provide outdated or incorrect Federal Employer ID numbers; ensure that this information is current.

- Don't: Forget to attach additional sheets if you have multiple owners or corporate officers.

- Don't: Submit the form without double-checking for accuracy; mistakes may delay processing.

Misconceptions

Understanding the Kentucky UI 1 form can be challenging. Many people have misconceptions that may lead to confusion. Here are four common misconceptions:

- The UI 1 form is only for new businesses. While it is essential for new employers to complete this form, it also applies to existing businesses that have acquired new operations or have undergone changes in ownership.

- All employers need to fill out every section of the form. In reality, different types of employers have specific sections they must complete. For instance, agricultural or domestic employers will find certain parts relevant only to them.

- Submitting the form guarantees unemployment insurance benefits for employees. Completing the UI 1 form does not automatically ensure that unemployment benefits will be provided. It merely establishes liability for unemployment insurance, which is a separate process.

- Once submitted, there is no follow-up needed. Completing the form is just the first step. Employers may need to provide additional information or documents if requested by the Division of Unemployment Insurance.

Clarifying these misconceptions can help employers navigate the responsibilities associated with the Kentucky UI 1 form more effectively.

Key takeaways

Filling out the Kentucky UI-1 form is an important step for employers to determine their liability for Unemployment Insurance. Here are some key takeaways to keep in mind while completing and using this form:

- Accurate Information is Crucial: Ensure all details provided, such as the business name, addresses, and contact information, are accurate. Incomplete or incorrect information can lead to delays or rejection of the application.

- Identify the Type of Business: It’s essential to check the appropriate box for the type of employment. Know whether you're a new business, acquiring an existing business, or resuming operations to fill out the correct sections accordingly.

- Understand Payroll Requirements: Be aware of the payroll thresholds. For example, if you expect quarterly payrolls to reach $1,500 or more, ensure this is clearly indicated. This information affects your liability under unemployment laws.

- Signature Matters: The form must be signed by someone authorized to represent the business. Accurately signing the document affirms that the information is truthful and complete, with penalties for false statements being a possibility.

Browse Other Templates

Tax Free Gift Limit 2024 - Beneficiaries might need to refer to previous years' tax forms and income rates when filling out this form.

Website Validation for Business Bank Account - Funds can be transferred automatically to cover purchase shortfalls.