Fill Out Your Kinns Vocabulary Form

The Kinn’s Vocabulary form acts as a vital educational tool for understanding key concepts in medical billing, fees, and collections. It encompasses various scenarios involving patient accounts, including account balances, credit adjustments, and guarantor responsibilities. For instance, it illustrates situations where patients owe outstanding balances after insurance reimbursements and how overpayments are processed. Essential terminology, such as "fiscal agent" or "third-party payer," aids in grasping the intricate relationships between patients, healthcare providers, and insurance companies. Additionally, the form highlights the importance of maintaining accurate records for business transactions and the nuances of fee schedules based on patient categories. By working through examples such as ledger entries and refunds, users can enhance their accounting skills while efficiently managing patient interactions. Ultimately, the Kinn’s Vocabulary form serves as a comprehensive guide for anyone navigating the complex landscape of healthcare administration.

Kinns Vocabulary Example

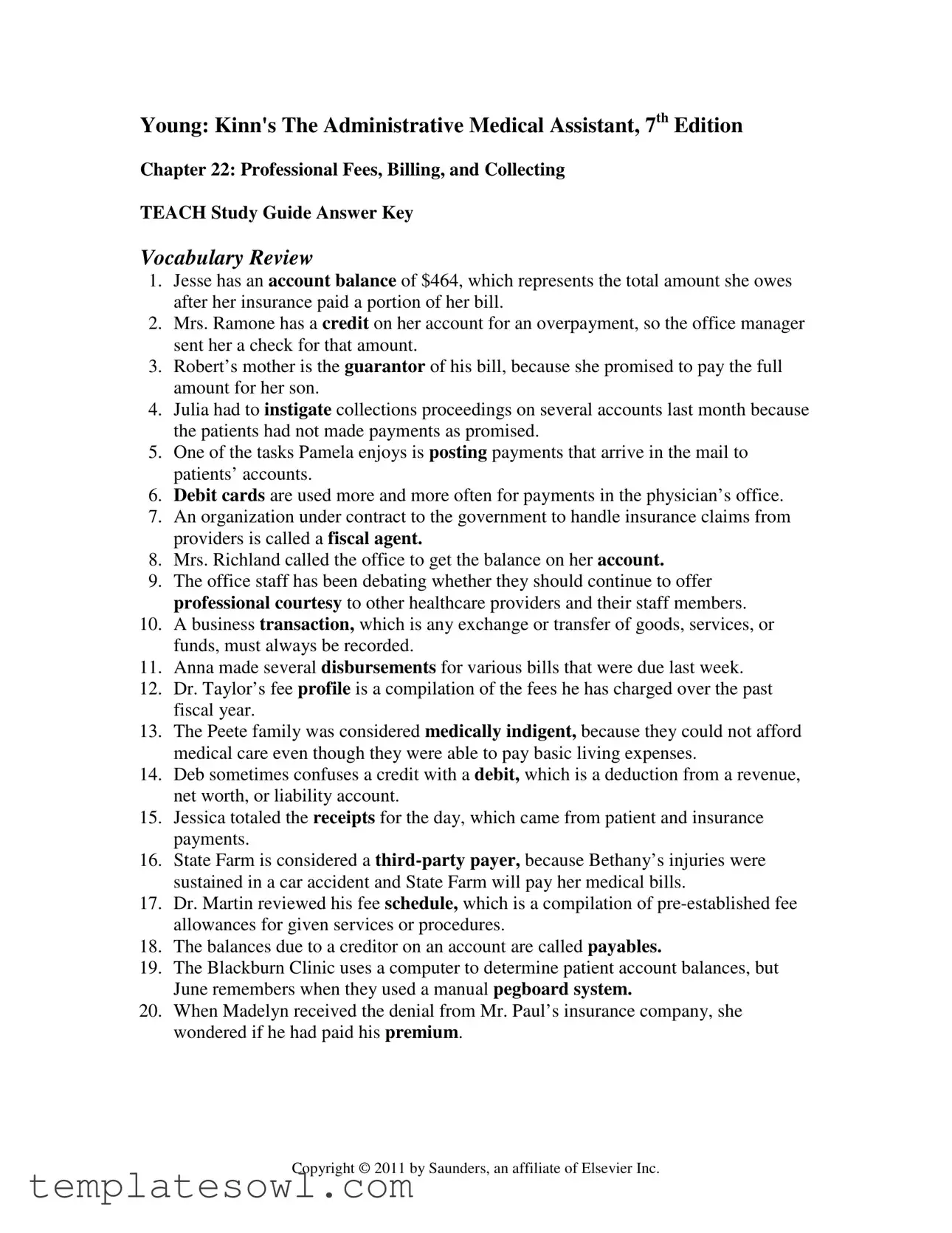

Young: Kinn's The Administrative Medical Assistant, 7th Edition

Chapter 22: Professional Fees, Billing, and Collecting

TEACH Study Guide Answer Key

Vocabulary Review

1.Jesse has an account balance of $464, which represents the total amount she owes after her insurance paid a portion of her bill.

2.Mrs. Ramone has a credit on her account for an overpayment, so the office manager sent her a check for that amount.

3.Robert’s mother is the guarantor of his bill, because she promised to pay the full amount for her son.

4.Julia had to instigate collections proceedings on several accounts last month because the patients had not made payments as promised.

5.One of the tasks Pamela enjoys is posting payments that arrive in the mail to patients’ accounts.

6.Debit cards are used more and more often for payments in the physician’s office.

7.An organization under contract to the government to handle insurance claims from providers is called a fiscal agent.

8.Mrs. Richland called the office to get the balance on her account.

9.The office staff has been debating whether they should continue to offer professional courtesy to other healthcare providers and their staff members.

10.A business transaction, which is any exchange or transfer of goods, services, or funds, must always be recorded.

11.Anna made several disbursements for various bills that were due last week.

12.Dr. Taylor’s fee profile is a compilation of the fees he has charged over the past fiscal year.

13.The Peete family was considered medically indigent, because they could not afford medical care even though they were able to pay basic living expenses.

14.Deb sometimes confuses a credit with a debit, which is a deduction from a revenue, net worth, or liability account.

15.Jessica totaled the receipts for the day, which came from patient and insurance payments.

16.State Farm is considered a

17.Dr. Martin reviewed his fee schedule, which is a compilation of

18.The balances due to a creditor on an account are called payables.

19.The Blackburn Clinic uses a computer to determine patient account balances, but June remembers when they used a manual pegboard system.

20.When Madelyn received the denial from Mr. Paul’s insurance company, she wondered if he had paid his premium.

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

Skills and Concepts

Part I: Fee Schedules and Billing Forms

1.Examine the fee schedule on the next page and answer the following questions.

Answer:

a.What is the charge for a

b.What is the charge for a

c.Why is the charge different for a 99213?

Answer: 99203 is the charge for a new patient; 99213 is the charge for an established patient.

d.What is the most expensive procedure on the list? CPT

e.Which injection is more expensive, insulin or vitamin

Use the same fee schedule to complete the billing forms in Work Products

2.Work Product

Answers:

•

•Total Fees: $78

•Diagnosis code: 463

3.Work Product

Answers:

•

•Total fees: $305

•Diagnosis code: 786.50

4.Work Product

Answers:

•

•Total fees: $83

•Diagnosis code: 715.90

Part II: Ledgers and Computing Patient Balances

Work through the following information and record it on the ledger cards presented in the corresponding work product pages. Use one ledger for each exercise.

Ledger 1 (Work Product

Patient name: Meagan Joy Reynolds

Address: 5534 Joe Pool Lake Road #233

City: Cedar Hill State: Texas |

Zip: 75884 |

Home phone: |

Cell phone: |

MR# REYM3341 |

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

|

|

|

Account Ledger |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

Entry # |

Date |

Reference |

Service |

Charge |

Payment |

Adj |

Balance |

1 |

4.12.XX |

CK#7110 |

NP, |

375.00 |

375.00 |

0 |

0 |

|

|

|

|

|

|

|

|

2 |

4.21.XX |

Surgery |

7500.00 |

0 |

0 |

7500.00 |

|

|

|

|

|

|

|

|

|

3 |

4.30.XX |

CK#7261 |

OV |

150.00 |

150.00 |

0 |

7500.00 |

|

|

|

|

|

|

|

|

4 |

5.2.XX |

Prudential |

ROA Ins |

0 |

6200.00 |

0 |

1300.00 |

|

|

CK#617761 |

|

|

|

|

|

5 |

5.3.XX |

CK#7313 |

ROA |

0 |

300.00 |

0 |

1000.00 |

|

|

|

|

|

|

|

|

6 |

5.14.XX |

CK#7512 |

OV |

75.00 |

50.00 |

0 |

1025.00 |

|

|

|

|

|

|

|

|

7 |

5.27.XX |

SW United |

ROA Ins |

0 |

800.00 |

0 |

225.00 |

|

|

CK#8710 |

|

|

|

|

|

8 |

6.2.XX |

CK#7915 |

ROA |

0 |

125.00 |

0 |

100.00 |

|

|

|

|

|

|

|

|

9 |

6.17.XX |

CK#8116 |

OV, lab |

352.00 |

150.00 |

0 |

302.00 |

|

|

|

|

|

|

|

|

10 |

6.20.XX |

CK#8411 |

ROA |

0 |

100.00 |

0 |

202.00 |

|

|

|

|

|

|

|

|

11 |

6.26.XX |

CK#8626 |

OV |

85.00 |

50.00 |

0 |

237.00 |

|

|

|

|

|

|

|

|

12 |

6.30.XX |

OV |

85.00 |

0 |

0 |

322.00 |

|

|

|

|

|

|

|

|

|

13 |

7.5.XX |

Prudential |

ROA Ins |

0 |

276.00 |

0 |

46.00 |

|

|

CK#721146 |

|

|

|

|

|

14 |

7.18.XX |

SW United |

ROA Ins |

0 |

124.00 |

0 |

<78.00> |

|

|

CK#9210 |

|

|

|

|

|

15 |

7.31.XX |

Refund |

Refund |

0 |

0 |

78.00 |

0 |

|

|

CK#9425 |

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How much was the refund check? |

|

|

|

|

|

||

Answer: $78.00 |

|

|

|

|

|

|

|

Ledger 2 (Work Product |

|

|

|

|

|

||

Patient name: Zachary Paul Staley |

|

|

|

|

|

||

Address: 2324 Hill Avenue Plaza |

|

|

|

|

|

||

City: Grosse Pointe |

State: MI |

Zip: 48230 |

|

|

|

|

|

Home phone: |

Cell phone: |

|

|

||||

MR# STAZ9823 |

|

|

|

||||

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

Account Ledger

|

|

|

|

|

|

|

Current |

Entry # |

Date |

Reference |

Service |

Charge |

Payment |

Adj |

Balance |

1 |

6.6.XX |

CK#126 |

NP |

215.00 |

15.00 |

0 |

200.00 |

|

|

|

|

|

|

|

|

2 |

6.12.XX |

Permian |

ROA Ins |

0 |

180.00 |

0 |

20.00 |

|

|

CK#21617 |

|

|

|

|

|

3 |

6.15.XX |

CK#214 |

OV, lab |

128.00 |

15.00 |

0 |

133.00 |

|

|

|

|

|

|

|

|

4 |

6.15.XX |

CK#217 |

OV |

70.00 |

15.00 |

0 |

188.00 |

|

|

|

|

|

|

|

|

5 |

7.7.XX |

Permian |

ROA Ins |

0 |

142.00 |

0 |

46.00 |

|

|

CK#36171 |

|

|

|

|

|

6 |

7.7.XX |

Adj |

0 |

0 |

7.00 |

39.00 |

|

|

|

|

|

|

|

|

|

7 |

7.26.XX |

CK#310 |

OV |

156.00 |

15.00 |

0 |

180.00 |

|

|

|

|

|

|

|

|

8 |

8.1.XX |

OV |

70.00 |

0 |

0 |

250.00 |

|

|

|

|

|

|

|

|

|

9 |

8.16.XX |

Permian |

ROA Ins |

0 |

102.00 |

0 |

148.00 |

|

|

CK#41217 |

|

|

|

|

|

10 |

8.21.XX |

Permian |

ROA Ins |

0 |

55.00 |

0 |

93.00 |

|

|

CK#42168 |

|

|

|

|

|

11 |

8.30.XX |

CK#561 |

ROA |

0 |

40.00 |

0 |

53.00 |

|

|

|

|

|

|

|

|

12 |

9.6.XX |

CK#587 |

OV |

70.00 |

15.00 |

0 |

108.00 |

|

|

|

|

|

|

|

|

13 |

9.9.XX |

CK#620 |

ROA |

0 |

40.00 |

0 |

68.00 |

|

|

|

|

|

|

|

|

14 |

9.9.XX |

Permian |

ROA Ins |

0 |

98.00 |

0 |

<30.00> |

|

|

CK#53121 |

|

|

|

|

|

15 |

10.3.XX |

CK#681 |

ROA |

0 |

20.00 |

0 |

<50.00> |

|

|

|

|

|

|

|

|

16 |

10.3.XX |

Refund |

Refund |

0 |

0 |

50.00 |

0 |

|

|

CK#9999 |

|

|

|

|

|

How much was the refund check?

Answer: $50.00

Ledger 3 (Work Product

City: Sacramento State: CA |

Zip: 94203 |

Home phone: |

Cell phone: |

MR# WILL8845 |

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

|

|

|

Account Ledger |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

Entry # |

Date |

Reference |

Service |

Charge |

Payment |

Adj |

Balance |

1 |

7.7.XX |

CK#1205 |

OV |

125.00 |

125.00 |

0 |

0 |

|

|

|

|

|

|

|

|

2 |

7.12.XX |

CK#1314 |

OV |

89.00 |

20.00 |

0 |

69.00 |

|

|

|

|

|

|

|

|

3 |

7.19.XX |

Adj |

0 |

0 |

9.00 |

60.00 |

|

|

|

|

|

|

|

|

|

4 |

7.23.XX |

Aetna |

ROA Ins |

0 |

85.00 |

0 |

<25.00> |

|

|

CK7611493 |

|

|

|

|

|

5 |

7.23.XX |

Refund |

Refund |

0 |

0 |

25.00 |

0 |

|

|

CK#5612 |

|

|

|

|

|

6 |

8.1.XX |

CK#1517 |

OV |

284.00 |

20.00 |

0 |

264.00 |

|

|

|

|

|

|

|

|

7 |

8.18.XX |

Aetna |

ROA Ins |

0 |

200.00 |

0 |

64.00 |

|

|

CK8267484 |

|

|

|

|

|

8 |

8.31.XX |

CK#1622 |

ROA |

0 |

64.00 |

0 |

0 |

|

|

|

|

|

|

|

|

9 |

9.12.XX |

NSF Fee |

NSF Check |

0 |

0 |

94.00 |

94.00 |

|

|

30.00 |

|

|

|

|

|

10 |

9.20.XX |

Cashiers |

ROA |

0 |

94.00 |

0 |

0 |

|

|

Check |

|

|

|

|

|

11 |

10.15.XX |

Cash |

Surgery |

750.00 |

20.00 |

0 |

730.00 |

|

|

|

|

|

|

|

|

12 |

2.12.XX |

CK#2612 |

ROA |

0 |

20.00 |

0 |

710.00 |

|

|

|

|

|

|

|

|

13 |

4.10.XX |

CK#2711 |

ROA |

0 |

5.00 |

0 |

705.00 |

|

|

|

|

|

|

|

|

14 |

5.12.XX |

CK#2781 |

ROA |

0 |

5.00 |

0 |

700.00 |

|

|

|

|

|

|

|

|

15 |

7.15.XX |

Adj |

0 |

0 |

700.00 |

0 |

|

|

|

|

|

|

|

|

|

16 |

9.12.XX |

Check |

To |

0 |

0 |

0 |

0 |

|

|

100.00 |

Collections |

|

|

|

|

How much was written off of this account?

Answer: $700.00

How is the payment noted on the account that was received after the

Completing a Day Sheet

Complete the proofs in Work Product

Answers:

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

Daily

Arithmetic Posting Proof

Column E

Plus Column A

Subtotal

Minus Column B

Subtotal

Minus Column C

Equals Column D

4309.00

896.00

5205.00

1643.00

3562.00

36.00

3526.00

Month to Date – Box Two

Accounts Receivable Proof

Accounts Receivable |

|

Previous Day |

7923.00 |

Plus Column A |

896.00 |

Subtotal |

8819.00 |

Minus Column B |

1643.00 |

Subtotal |

7176.00 |

Minus Column C |

36.00 |

Accounts Receivable |

|

End of Day |

7140.00 |

Part III: Short Answers

1.Define the following terms.

Answers:

•Usual: The physician’s usual fee for a given service is the fee an individual physician most frequently charges for the service.

•Customary: The customary fee is a range of the usual fees charged for the same service by physicians with similar training and experience practicing in the same geographic and socioeconomic area. The tendency is growing for fees to be determined by national trends rather than by local custom.

•Reasonable: The term reasonable usually applies to a service or procedure that is exceptionally difficult or complicated, requiring extraordinary time or effort on the part of the physician.

2.List two billing methods commonly used in the physician’s office.

Answers may include:

•

•Encounter form

•Typewritten statement

•Photocopied statement

3.What notation should be made under the return address on statement envelopes? Answer: Address Correction Requested

4.Briefly explain cycle billing.

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

Answer: The cycle billing system calls for the billing of certain portions of the accounts receivable at given times during the month instead of the preparation of all statements at the end of each month. The accounts are separated into fairly equal divisions, with the number of divisions depending on how many times billing will be done during a month. For example, if the office expects to bill twice a month, the accounts are divided into two equal groups; for weekly billing, they are divided into four groups; and for daily billing, they are divided into 20 groups. Statements are mailed out in these cycles. This system promotes a constant flow of income into the physician’s office.

5.What are the pitfalls of fee adjustments?

Answer: Patients may begin to expect that fees will be reduced in all circumstances. They may even doubt the competency of a physician who habitually reduces fees. The family of a deceased patient may suspect that the fee was reduced because the physician knows he or she made an error. A fee should never be reduced on the basis of a poor result or as a means of obtaining payment to avoid the use of a collection agency. A reduction for these reasons degrades the physician and the practice of medicine.

6.What three values are considered in determining professional fees? Answer:

•Time

•Judgment

•Services

7.Why are estimates useful in patient treatment?

Answer:

•They may help prevent staff members from forgetting that a fee was quoted.

•They may help eliminate the possibility of later misquoting of the fee.

•They may help simplify collection by preventing misunderstanding and charges.

8.List five general rules to follow for telephone collecting.

Answers may include the following:

•Call between 8 AM and 9 PM.

•Determine the identity of the person with whom you are speaking. If you ask, “Is this Mrs. Noble?” and she answers, “Yes,” it could be the patient’s

•Be dignified and respectful. One can be friendly and formal at the same time.

•Ask the patient if it is a convenient time to talk. Unless you have the attention of the called party, there is little to be gained by continuing. If told that it is an inopportune time, ask for a specific time to call back or get a promise that the patient will call the office at a specified time.

•After a brief greeting, state the purpose of the call. Make no apology for calling, but state the reason in a friendly, businesslike way. The physician

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

expects payment, and the medical assistant is interested in helping the patient meet the financial obligation. Open the call with a phrase such as, “This is Alice, Dr. Wallace’s financial secretary. I’m calling about your account.” A

•Assume a positive attitude. For example, convey the impression that the patient intended to pay and it is only a matter of working out some suitable arrangements.

•Keep the conversation brief and to the point; do not make threats of any kind.

•Try to get a definite commitment; that is payment of a certain amount by a certain date.

•Follow up on promises. This is best accomplished by a tickler file or a note on the calendar. If the payment does not arrive by the promised date, remind the patient with another call. If you fail to do this, the whole effort has been wasted.

9.List four ways that payment for medical services is accomplished.

Answer:

•Payment at the time of service

•Internal billing when extension of credit is necessary

•Internal insurance or other

•Outside billing and collection assistance

10.Explain why patients sometimes fail to pay their accounts.

Answers may include the following:

•Lost job

•Emergencies

•Temporary difficulty meeting obligations

•Simple refusal to pay (rare)

11.What is professional courtesy and why is it less common now than in years past? Answer: Traditionally, physicians do not charge professional colleagues or their immediate dependents for medical care. Professional courtesy often extended is beyond fellow physicians and their dependents. Most physicians treat their own medical assistants, and often their families, without charge and grant discounts to nurses and medical assistants not in their direct employ. The practice is less common today because many managed care plans forbid the discounting of fees, and doing so would be a violation of the physician’s contract with the company.

12.Briefly explain how “skips” can be traced.

Answer: Do not wait until the next billing time to attempt to trace the debtor. Tracing skips is a challenge to any medical assistant. A certified letter can be sent; for additional fees, you can ask the Postal Service to obtain a receipt that includes the address where the letter was delivered. The certified letter may be sent in a plain envelope so that the patient will not refuse to accept the letter because of the return address. If all attempts fail, turn the account over to a collection agency without

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

TEACH Study Guide Answer Key |

delay. Do not keep a skip account too long, because the trail may become so cold as time elapses that even collection experts will be unable to follow it.

CASE STUDY

Read back through the information about Lynn Annette Wilson on Ledger 3. How could the medical assistant help Lynn Annette to keep her account out of collections? What could be said to her during a friendly phone call to encourage her to be regular with her payments? Write two collection letters to Lynn Annette. Make the first letter a gentle reminder. The second letter should express that the account will be placed for collection if regular payments are not forthcoming. Use the stationery provided in Work Products

Student answers will vary.

WORKPLACE APPLICATIONS

Mr. Sanchez comes to the desk to check out after seeing the physician. When Sarah tells him that his bill is $95, he complains that he only saw the physician for 10 minutes. The fee is in accordance with the evaluation and management guidelines. Explain the fees to Mr. Sanchez. Use the space below to write what you would say to him as an explanation of his fees.

Student answers will vary.

Use the space below to write a dialogue that can be used to ask a patient for payment as he or she is checking out.

Student answers will vary.

Copyright © 2011 by Saunders, an affiliate of Elsevier Inc.

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Account Balance | Jesse's account shows a balance of $464 after her insurance made a partial payment. |

| Overpayment Refund | Mrs. Ramone received a refund check for an overpayment on her account. |

| Guarantor | Robert's mother is responsible for his bill as the guarantor. |

| Collections Proceedings | Julia initiated collection actions due to non-payments from several patients. |

| Payment Posting | Pamela enjoys the task of posting payments received via mail to accounts. |

| Debit Card Usage | In physician's offices, the use of debit cards for payments is increasing. |

| Fiscal Agent | A fiscal agent is a contracted organization that manages insurance claims from providers. |

| Account Balance Inquiry | Mrs. Richland contacted the office to inquire about her account balance. |

| Professional Courtesy | The office staff is debating the continuation of professional courtesy to other healthcare providers. |

Guidelines on Utilizing Kinns Vocabulary

Completing the Kinn's Vocabulary form requires attention to detail, as each section captures essential data that supports administrative processes in medical settings. Once filled out, this form will help facilitate a better understanding of medical billing and patient account management for both professionals and students alike.

- Obtain a copy of the Kinn’s Vocabulary form.

- Begin by entering your name and date at the top of the form.

- Refer to the provided content and read through the vocabulary words and definitions carefully.

- Fill in the corresponding answers for each statement, ensuring clarity and accuracy. For example:

- “Jesse has an account balance of…” to be matched with the applicable context or definition.

- For any multi-part questions, make sure that you have addressed each part fully. For instance, when referencing charges for specific procedures, ensure that all codes and descriptions are included.

- Continue filling out the form by reviewing the billing information outlined in the Work Products section, noting any entries in your ledger based on the details given.

- Double-check the entries made for any typographical errors or inconsistencies.

- Once satisfied, save your work and print out a legible copy if necessary.

- Submit the completed form to your instructor or relevant department as required.

What You Should Know About This Form

What is the purpose of the Kinns Vocabulary form?

The Kinns Vocabulary form serves as an educational tool designed to enhance understanding of key terms and concepts relevant to medical billing and professional fees. Through a variety of scenarios, individuals can familiarize themselves with common financial situations encountered in a medical office. This resource is particularly useful for administrative medical assistants, as it prepares them to handle billing inquiries and manage patient accounts effectively. By engaging with the terminology, they can communicate more proficiently with colleagues and patients, fostering a smoother billing process.

How do I properly interpret a fee schedule as presented in the Kinns Vocabulary form?

Interpreting a fee schedule requires attention to detail and an understanding of the services provided. Each entry typically includes a service description, a corresponding code, and the associated charge. For instance, new patient consultations may have different fees compared to established patients. The Kinns Vocabulary form demonstrates this with clear examples, such as the differing charges for different patient types coded as 99203 and 99213. By studying these examples, individuals can learn to navigate fee schedules confidently, ensuring accurate billing and effective communication regarding costs.

What steps should be taken if a patient experiences a denial from their insurance company?

If a patient receives a denial from their insurance company, it is essential to remain calm and methodical in addressing the issue. First, review the details of the denial letter to understand the reasons behind it. Common explanations include coverage issues or errors in billing codes. It may be necessary to contact the insurance company for clarification or to submit any missing documentation. Encouraging patients to keep a record of correspondence can be invaluable for resolving disputes. Ultimately, supporting patients through this process helps them navigate the sometimes-complex landscape of health insurance and medical billing.

How does the Kinns Vocabulary form help in understanding payment methods in a medical office?

The Kinns Vocabulary form illustrates various payment methods, including the increasing use of debit cards in medical offices. By listing examples of payments, like those made through insurance or directly by patients, the form highlights the importance of tracking financial transactions accurately. Understanding these payment methods can aid administrative staff in managing accounts effectively, ensuring that payments are recorded correctly, and addressing any discrepancies promptly. In an ever-evolving payment landscape, being informed of different methods promotes smoother operations within the medical office.

Common mistakes

Filling out the Kinn's Vocabulary form can seem straightforward, but many people make common mistakes that can lead to confusion or inaccuracies. One such mistake is not reading the instructions carefully. When individuals fail to understand what is required, they may skip essential components or misinterpret questions. This oversight often results in incomplete or incorrect answers, drawing red flags during review.

Additionally, using unfamiliar terminology without clarification can be detrimental. The form includes specific terms related to billing and account management. If a person is unsure about a term like "fiscal agent," they may misrepresent their understanding in the answers. Clarifying these terms before completing the form ensures accurate submissions and demonstrates a grasp of the material.

Another frequent error is miscalculating fees and charges. It's essential to ensure all figures are accurate, especially when dealing with various patient transactions and diagnosis codes. Simple arithmetic errors can lead to compounded inaccuracies in later sections of the form. Double-checking calculations can save time and prevent mistakes from reverberating through the entire process.

Failing to maintain consistency with patient categorization is a common pitfall. Participants may confuse established patients with new ones, leading to incorrect billing codes being applied. This confusion can not only affect the accuracy of the form but also impact the office's financial health. Understanding the distinctions between different patient types is crucial for accurate billing and compliance.

Poor organization during the completion of the form can also cause problems. Attempting to complete various sections without a systematic approach can lead to misplaced information or forgotten tasks. Keeping notes and checking off completed sections as one progresses ensures that all parts of the form are addressed effectively.

Moreover, neglecting to review entries before submission is a critical mistake. Rushing through the process can lead to overlooked errors such as typographical mistakes or incorrect codes. Taking the time for a thorough review allows for catching potential mistakes and ensures clarity and precision in the final submission.

Lastly, not asking for help when needed can hinder success. Individuals often hesitate to seek clarification or assistance. Resources such as colleagues or supervisors can provide valuable insight that enhances understanding and increases accuracy. Engaging with available resources fosters a greater comprehension of the requirements and minimizes the risk of errors on the form.

Documents used along the form

In medical office management, several forms and documents work alongside the Kinns Vocabulary form to facilitate the billing and collection process effectively. Understanding these documents can streamline operations and enhance communication between patients and healthcare providers. Here’s a look at some commonly used forms.

- Fee Schedule: This document outlines the costs associated with various medical services and procedures. It helps administrators set prices for consultations, exams, and treatments, ensuring transparency for patients.

- Patient Ledger: A ledger tracks all financial transactions related to a specific patient’s account. It includes charges, payments, adjustments, and balances, providing a clear financial history.

- Superbill: A superbill serves as a detailed invoice for services rendered and includes codes for diagnoses and treatments. It is frequently submitted to insurance companies for reimbursement.

- Encounter Form: This form is used during patient visits to note the services provided. It includes diagnostic codes and helps the medical assistant to quickly capture necessary billing information.

- Assignment of Benefits Form: This document authorizes the insurance company to send payment directly to the healthcare provider. It simplifies the billing process and ensures that the provider receives payment promptly.

- Insurance Verification Form: This form is used to confirm a patient’s eligibility and coverage before services are provided. It helps the office avoid unexpected costs for patients and ensures they understand their financial responsibilities.

- Payment Plan Agreement: When patients cannot afford their bills, this document establishes a structured payment plan. It outlines terms, payment amounts, and schedules, easing financial burdens for patients.

- Refund Request Form: This form is submitted when a patient or insurance company requests a refund for overpayments. It ensures proper tracking and accountability in the handling of financial adjustments.

- Notification of Denial Form: Used when an insurance claim is denied, this form explains the rationale behind the denial. It guides patients on what steps to take next, fostering clear communication.

Utilizing these documents alongside the Kinns Vocabulary form can enhance efficiency in medical office practices. Streamlined billing processes ultimately lead to better patient satisfaction and improved financial management for healthcare providers.

Similar forms

- Fee Schedule: The Kinn's Vocabulary Form is similar to a fee schedule in that both include detailed listings of charges for services. Both documents help to clarify the costs associated with medical procedures and appointments.

- Billing Statement: Just like a billing statement, the Kinn’s Vocabulary Form tracks amounts owed by patients. Each document identifies the nature of charges and payments, ensuring transparency in financial interactions with healthcare providers.

- Insurance Claim Form: The similarities with an insurance claim form lie in the necessity to report services provided and costs involved. Both require accurate detailing of procedures for proper processing by insurance companies.

- Patient Ledger: A patient ledger functions much like the Kinn’s Vocabulary Form in that it maintains a record of all transactions related to a patient’s account. Each supports tracking payments, balances due, and any adjustments made.

- Payment Receipt: Payment receipts are akin to the Kinn’s Vocabulary Form because they confirm payments made by patients. Both documents serve as proof of financial exchanges in the healthcare setting.

- Account Summary: The Kinn’s Vocabulary Form shares characteristics with an account summary, as both provide an overview of financial activity related to patient accounts. They help patients and office staff monitor financial status efficiently.

- Collections Report: A collections report and the Kinn's Vocabulary Form both outline outstanding balances and account statuses. Each document highlights actions taken when patients do not fulfill payment obligations.

- Financial Policy Statement: Similarities exist between the Kinn's Vocabulary Form and a financial policy statement, as both communicate costs and expectations regarding payment. They set the framework for financial interactions in medical environments.

Dos and Don'ts

Things to Do:

- Read the instructions carefully before filling out the Kinns Vocabulary form.

- Use clear and legible handwriting or type the information if possible.

- Double-check all entries for accuracy before submitting the form.

- Provide complete details for each patient as requested in the form.

Things Not to Do:

- Do not leave any blank spaces unless instructed to do so.

- Avoid using abbreviations that are not standard or widely recognized.

- Do not rush through the form; take your time to ensure each detail is correct.

- Never submit the form without reviewing for any errors or omissions.

Misconceptions

The Kinn's Vocabulary form is a useful resource, but misconceptions about it can lead to confusion. Here are nine common misconceptions:

- It's just a glossary. Many believe the form is only a list of terms. However, it provides essential definitions and context for healthcare billing and administrative processes as seen in the detailed examples.

- It's only for medical professionals. While tailored for administrative medical assistants, anyone interested in understanding medical billing can benefit from this vocabulary form.

- All terms are technical and hard to understand. Although some terms can be complex, most are explained in straightforward language, making the content accessible for non-experts.

- It's outdated. This resource is based on the latest edition and adheres to current billing practices, ensuring its relevance in today's healthcare environment.

- You don't need to read the context. Many think they can just memorize the terms. In reality, understanding the context around each term enhances comprehension and application in real situations.

- It substitutes for training. The vocabulary form is a reference tool, not a replacement for comprehensive training in billing or administrative practices.

- All the examples are fictitious. Although many examples illustrate concepts, they can reflect real-world scenarios encountered in medical billing, offering practical insights.

- Using it is time-consuming. Many assume that reviewing the vocabulary is a lengthy process. However, the clear organization allows for quick reference and review of terms.

- It’s the only resource needed. While valuable, this form should be used in conjunction with other resources and training materials to fully understand the complexities of medical billing.

Key takeaways

Filling out and using the Kinns Vocabulary form can be straightforward if you keep in mind a few key points. Here’s a helpful list to guide you through the process:

- Understand terms and definitions. Knowing what words like guarantor and disbursement mean will help you complete the form more efficiently.

- Focus on accuracy. Ensure that all amounts, services, and patient details are entered correctly to avoid discrepancies later on.

- Follow the provided examples. The Kinns guide includes examples that can clarify what information you need to input.

- Utilize the fee schedule efficiently. Familiarize yourself with the charges associated with various services to fill in billing forms accurately.

- Identify patient status. Knowing whether a patient is new or established helps determine the correct codes to use.

- Record each transaction promptly. Maintaining up-to-date ledgers allows for better tracking of account balances and payments.

- Review entries regularly. A quick review of your entries can help catch any mistakes before they become a larger issue.

- Remember the importance of patient privacy. Always handle patient information respectfully and confidentially.

- Be aware of reimbursement cycles. Understanding how and when payments are made can help you manage accounts better.

By keeping these takeaways in mind, you can navigate the Kinns Vocabulary form more easily and effectively contribute to administrative processes in a medical setting.

Browse Other Templates

Estimated Taxes 2023 - Engage with tax professionals if you have complex situations requiring detailed understanding.

Proof of Identity - Inclusivity of your documents is necessary to ensure no critical information is overlooked.