Fill Out Your Kyc Application Form

The KYC Application Form is a crucial document used for verifying the identity of individuals and entities engaging in financial transactions. Designed to prevent fraud and identify potential risks, it requires applicants to provide personal details such as their name, date of birth, and nationality. The form also mandates the submission of proof of identity and address, which could include documents like a passport or utility bill. For non-individuals, additional information is necessary, including the date of incorporation and the names of directors or partners. Applicants must guarantee that all information is accurate, signing a declaration to affirm their honesty. With its clear structure, the KYC Application Form plays an essential role in maintaining integrity and compliance within financial institutions, demonstrating a commitment to transparency and accountability.

Kyc Application Example

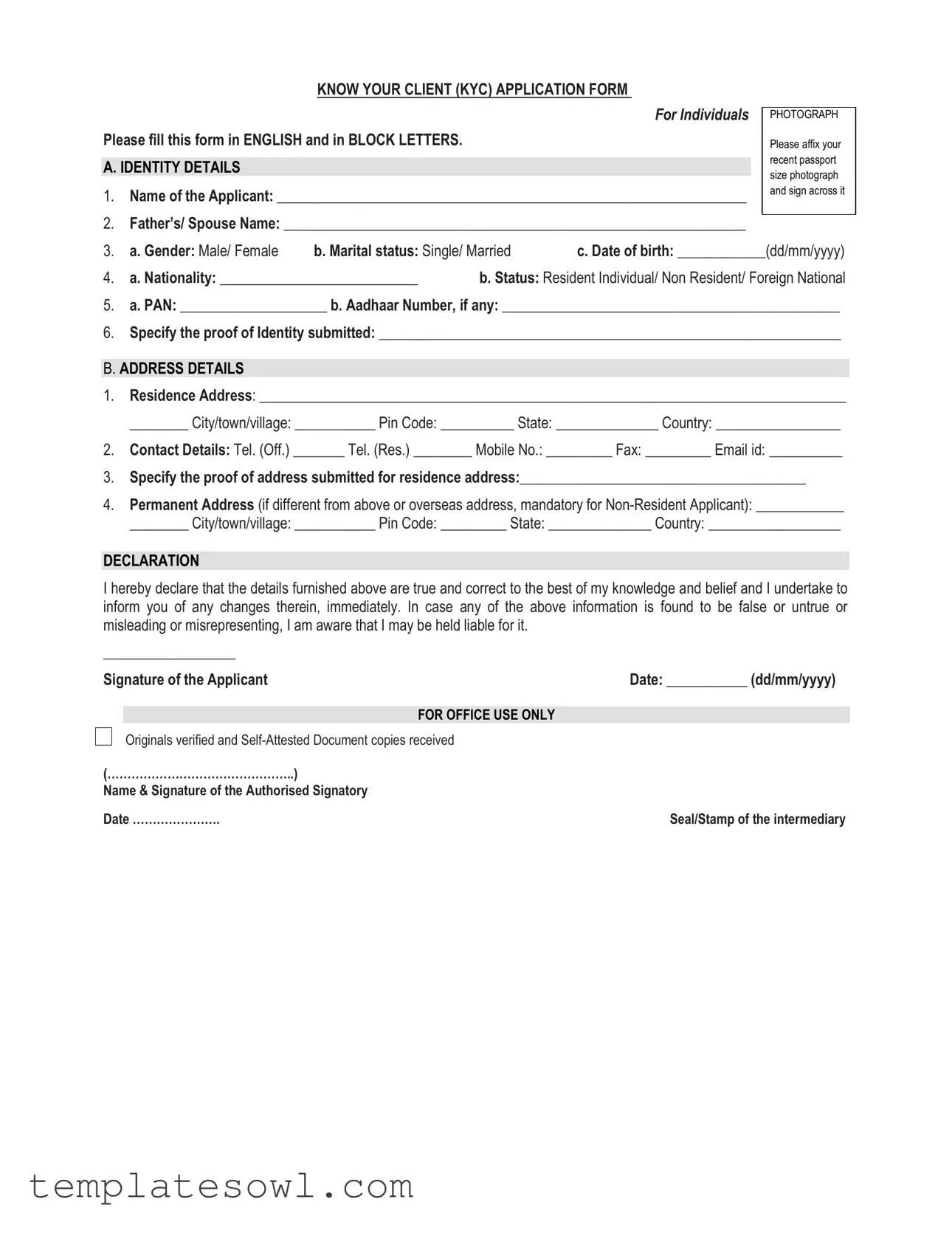

KNOW YOUR CLIENT (KYC) APPLICATION FORM |

|

|

|

FOR INDIVIDUALS |

|

|

|

|

PHOTOGRAPH |

||

Please fill this form in ENGLISH and in BLOCK LETTERS. |

|

Please affix your |

|

|

|

recent passport |

|

A. IDENTITY DETAILS |

|||

|

size photograph |

||

|

|

||

1. Name of the Applicant: ________________________________________________________________ |

|

and sign across it |

|

|

|

||

|

|

|

2.Father’s/ Spouse Name: _______________________________________________________________

3. |

a. Gender: Male/ Female |

b. Marital status: Single/ Married |

c. Date of birth: ____________(dd/mm/yyyy) |

|

4. |

a. Nationality: ___________________________ |

b. Status: Resident Individual/ Non Resident/ Foreign National |

||

5.a. PAN: ____________________ b. Aadhaar Number, if any: ______________________________________________

6.Specify the proof of Identity submitted: _______________________________________________________________

B. ADDRESS DETAILS

1.Residence Address: ________________________________________________________________________________

________ City/town/village: ___________ Pin Code: __________ State: ______________ Country: _________________

2.Contact Details: Tel. (Off.) _______ Tel. (Res.) ________ Mobile No.: _________ Fax: _________ Email id: __________

3.Specify the proof of address submitted for residence address:_______________________________________

4.Permanent Address (if different from above or overseas address, mandatory for

________ City/town/village: ___________ Pin Code: _________ State: ______________ Country: __________________

DECLARATION

I hereby declare that the details furnished above are true and correct to the best of my knowledge and belief and I undertake to inform you of any changes therein, immediately. In case any of the above information is found to be false or untrue or misleading or misrepresenting, I am aware that I may be held liable for it.

__________________ |

|

|

Signature of the Applicant |

Date: ___________ (dd/mm/yyyy) |

|

|

|

|

|

FOR OFFICE USE ONLY |

|

|

Originals verified and |

|

(………………………………………..) |

|

|

Name & Signature of the Authorised Signatory |

|

|

Date …………………. |

Seal/Stamp of the intermediary |

|

KNOW YOUR CLIENT (KYC) APPLICATION FORM |

|

|

FOR |

|

|

|

PHOTOGRAPH |

|

Please fill this form in ENGLISH and in BLOCK LETTERS. |

|

Please affix the |

|

|

|

|

|

recent passport |

A. IDENTITY DETAILS |

|

|

|

size photographs |

|

1. Name of the Applicant: ________________________________________________________________ |

|

|

|

and sign across it |

2.Date of incorporation: _______________(dd/mm/yyyy) & Place of incorporation: ________________

3.Date of commencement of business: ______________________________________________________ (dd/mm/yyyy)

4.a. PAN: _______________________________ b. Registration No. (e.g. CIN): _________________________________

5.Status (please tick any one):

Private Limited Co./Public Ltd. Co./Body Corporate/Partnership/Trust/Charities/NGO’s/FI/ FII/HUF/AOP/ Bank/Government

B. ADDRESS DETAILS

1.Address for correspondence: ________________________________________________________________________

_________ City/town/village: _____________ Pin Code: _________ State: ______________ Country: _______________

2.Contact Details: Tel. (Off.) _______ Tel. (Res.) _______ Mobile No.: ________ Fax: ___________ Email id: __________

3.Specify the proof of address submitted for correspondence address: ______________________________________

4.Registered Address (if different from above): ____________________________________________________________

_________ City/town/village: _____________ Pin Code: _________ State: _____________ Country: ________________

C. OTHER DETAILS

1.Name, PAN, residential address and photographs of Promoters/Partners/Karta/Trustees and whole time directors:

_________________________________________________________________________________________________

2.a) DIN of whole time directors: _______________________________________________________________________

b) Aadhaar number of Promoters/Partners/Karta:______________________________________________

DECLARATION

I/We hereby declare that the details furnished above are true and correct to the best of my/our knowledge and belief and I/we undertake to inform you of any changes therein, immediately. In case any of the above information is found to be false or untrue or misleading or misrepresenting, I am/we are aware that I/we may be held liable for it.

_____________________________________ |

|

Name & Signature of the Authorised Signatory |

Date: ___________ (dd/mm/yyyy) |

|

FOR OFFICE USE ONLY |

|

|

Originals verified and |

|

(………………………………………..) |

|

|

Name & Signature of the Authorised Signatory |

|

|

Date …………………. |

Seal/Stamp of the intermediary |

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The KYC application form is used to establish the identity of individuals or organizations for compliance with regulatory requirements. |

| Language Requirement | Applicants must fill out the form in English and in block letters to ensure clarity and consistency. |

| Photograph Requirement | A recent passport-sized photograph must be affixed to the form, enhancing identity verification. |

| ID Proof Submission | Applicants are required to specify the identity proof submitted along with the form, contributing to the verification process. |

| Address Details | The form collects comprehensive address information, including residence and permanent addresses, to ensure full identification. |

| Declaration Statement | There is a declaration section where the applicant confirms that the provided information is true. This adds a layer of accountability. |

| Office Use Section | A designated section for office use indicates if original documents have been verified and self-attested copies received. |

| Governing Laws | The specific KYC forms may vary by state, and compliance is governed by respective state laws and federal regulations. |

| Variations for Non-Individuals | There is a separate KYC application form for non-individuals, which includes additional information about incorporation and business operations. |

Guidelines on Utilizing Kyc Application

Once you have gathered all the necessary documents, you are ready to fill out the KYC Application Form. Carefully follow these steps to ensure accurate completion of the form.

- Print the KYC Application Form.

- Use English and block letters throughout the form.

- Paste a recent passport-sized photograph at the designated spot and sign across it.

- Fill in the identity details:

- Applicant's name

- Father’s or spouse's name

- Select gender and marital status

- Provide date of birth in dd/mm/yyyy format

- Indicate nationality and residency status

- Add PAN and Aadhaar number, if applicable

- Specify proof of identity submitted

- Complete the address details:

- Provide residence address

- Fill in city/town/village, pin code, state, and country

- Add contact details, including office and residential telephone, mobile number, fax, and email address

- Specify proof of address submitted for residence address

- Include permanent address if different or if you are a non-resident applicant

- Sign the declaration, affirming that the information is true and accurate to the best of your knowledge.

- Include the date of signature in dd/mm/yyyy format.

- Ensure the form is submitted with self-attested document copies, as required.

What You Should Know About This Form

What is the purpose of the KYC application form?

The Know Your Client (KYC) application form serves to verify the identities of individuals or entities engaging in financial transactions. This verification process helps prevent fraud, money laundering, and other illegal activities. Financial institutions and other organizations utilize the KYC form to gather essential personal and financial information about their clients, ensuring compliance with regulatory requirements.

Who needs to fill out a KYC application form?

Both individuals and non-individuals, such as companies, trusts, and NGOs, must complete a KYC application form. Individuals will provide their personal details, including name, address, and identification numbers, whereas non-individuals must input company-related information, such as date of incorporation and registration number. Each category requires specific documentation to establish identity and address.

What information must I provide in the KYC application form?

The KYC application form requires various pieces of information. For individuals, you should provide your full name, father's or spouse's name, gender, marital status, nationality, and proof of identity. You must also include your residence and permanent addresses, along with contact details. Non-individual applicants must submit details like the name of the entity, date of incorporation, PAN, and address for correspondence. Additional details regarding directors or partners may also be necessary.

What identification documents do I need to submit?

Identification documentation varies based on whether you are applying as an individual or a non-individual. Typically, individuals need to provide documents such as a passport, Aadhaar card, or driver's license for identity verification. Non-individuals may need to submit a PAN card, registration certificate, or articles of incorporation, along with proof of address for their registered location. Ensure that any documents you provide are self-attested as required.

How should I fill out the form?

When completing the KYC application form, make sure to use English and write in block letters for clarity. Affix a recent passport-sized photograph in the designated area. Take your time to fill in all required details accurately. It is important to review your information before submission to minimize the chances of errors, which could delay the processing of your application.

What happens after I submit my KYC application form?

Once you submit your KYC application, the relevant authority will assess the provided information and documents for completeness and accuracy. Depending on the organization, verification may take some time. If everything is in order, you will receive confirmation of your KYC status. If any discrepancies arise or additional information is needed, the authority will reach out to you for clarification.

Common mistakes

Completing a Know Your Client (KYC) application form requires attention to detail and clarity. One of the common mistakes individuals make is providing incomplete information. Omitting key details, such as the applicant’s name, date of birth, or address, can lead to delays in processing. Each section of the form must be filled out thoroughly to avoid any issues.

Another frequent error is using inconsistent formats for dates or numbers. For instance, applicants might write the date of birth in one format in one part of the form and another format in a different section. Such inconsistencies can confuse the reviewers and may result in the need for resubmission or further inquiries.

Some individuals fail to sign the application form where required. The declaration section must contain a signature to validate the information. Without this, the form may be rejected. All signatures should be placed directly across the affixed photograph when necessary, ensuring all requirements are met.

Neglecting to provide proof of identity and address is another mistake. Individuals must ensure that the proof submitted aligns with the information on the KYC form. This means that the address on utility bills or bank statements must match the residence address listed on the application.

Additionally, many applicants do not double-check for typos or errors in their entries. Simple mistakes, such as misspellings or numeric errors in PAN or Aadhaar numbers, can lead to significant delays. Careful proofreading before submission is essential to prevent such mistakes.

Lastly, individuals sometimes ignore the requirement to update their information. If there are changes in marital status, address, or other factors after the form is submitted, they must inform the relevant authority immediately. Failure to do so may result in legal repercussions. Awareness and diligence during this process can make a considerable difference in the KYC experience.

Documents used along the form

The Know Your Client (KYC) Application Form is a vital document in the verification of individual and organizational clients. Alongside this form, several other documents are frequently required for comprehensive identification and assessment. Below is a list of these forms and documents, each with a brief description of its purpose.

- Proof of Identity: A government-issued document such as a passport, driver's license, or national ID card that verifies the client's identity.

- Proof of Address: Documents like utility bills, bank statements, or lease agreements that confirm the client's residential or business address.

- Tax Identification Number (TIN): This number is essential for tax purposes and may be required to verify a client's tax status.

- Business Registration Documents: For non-individual clients, documents like articles of incorporation or business licenses that prove the legitimacy of the organization.

- Shareholder Information: Details about the ownership structure of a business, including names, identification, and percentage of ownership held by shareholders.

- Director Identification Number (DIN): For companies, this number identifies directors and is essential for corporate governance verification.

- Partnership Agreements: Documents that outline the terms of a partnership if the client is a partnership, specifying rights, responsibilities, and profit-sharing ratios.

- Trust Deeds: For clients acting as trustees, these documents detail the terms and conditions under which the trust operates.

- Financial Statements: Recent statements may be required for entities to assess financial stability and business operations.

- Compliance Certificates: Documents that confirm adherence to regulatory requirements, particularly for financial institutions or companies in regulated sectors.

Collectively, these forms and documents enhance the KYC process, ensuring that institutions have a clear understanding of their clients and comply with regulatory standards. This thoroughness fosters trust and security in financial transactions and relationships.

Similar forms

Tax Identification Number (TIN) Application Form: This form requires personal details similar to KYC, including name, address, and identification numbers, facilitating tax-related purposes.

Bank Account Opening Form: The bank form solicits identity information, contact details, and proof of address, just like KYC, to establish a customer's profile for banking services.

Business License Application: This document also gathers essential identity details and proofs to verify the legitimacy of businesses planning to operate legally.

Insurance Application Form: Customers provide personal details, including identification and contact information, to assess eligibility for insurance products.

Voter Registration Form: Individuals must fill out personal data, including identification proof and residence, which is essential for voter eligibility, akin to KYC processes.

Healthcare Enrollment Form: Patients are required to submit personal identity and address information, resembling KYC requirements, to enroll in health plans.

Credit Card Application: This form collects personal details, identification numbers, and contact information to assess creditworthiness, similar to KYC protocols.

Social Security Application Form: Individuals must provide details like name, date of birth, and address which are necessary to establish identity and eligibility for benefits.

Real Estate Rental Application: This includes identity verification and proof of income for tenants, closely aligning with KYC requirements for rental agreements.

Employment Application Form: Job seekers submit personal details and identification to verify qualifications, a process reflecting the identity verification aspect of KYC.

Dos and Don'ts

When filling out the KYC Application form, following a clear set of guidelines can help ensure accuracy and completeness. Below are ten essential do's and don’ts for completing the application.

- Do fill out the form in English and in block letters.

- Do affix a recent passport size photograph in the designated area.

- Do provide accurate and truthful information throughout the form.

- Do double-check all details before submitting the form.

- Do include all necessary supporting documents for proof of identity and address.

- Don’t leave any mandatory fields blank.

- Don’t use abbreviations or shorthand when filling out fields.

- Don’t submit outdated or incorrect documents.

- Don’t ignore the declaration section; sign and date it appropriately.

- Don’t rush through the process; take your time to ensure everything is completed correctly.

Misconceptions

Misunderstandings about the KYC Application Form can lead to unnecessary confusion. Here are some common misconceptions, along with clarifications to help clear things up:

- Only Businesses Need to Fill Out KYC Forms: While it's true that businesses often need to fill out KYC forms, individuals also play a crucial role. Anyone creating a financial relationship must provide identity verification, ensuring transparency and fraud prevention.

- KYC Forms Are Only Required Once: Many assume that one submission suffices for all time. However, financial institutions may require updates if there are changes in personal information, such as a change of address or name.

- Filling Out KYC Forms Is a Lengthy Process: Though it may seem daunting, completing the KYC form is usually straightforward. Most people can fill in the necessary information in a reasonable amount of time with the right documents at hand.

- All KYC Forms Are the Same: Not all KYC forms are created equal. There are different forms based on the nature of the client, whether individual or non-individual, as well as potential sector-specific requirements.

- Providing Personal Information Is Unsafe: While privacy concerns are valid, reputable institutions prioritize security and confidentiality. The information is gathered for compliance with legal requirements and protections against fraud.

- Proof of Identity Is Unnecessary: Some believe that simply providing a name suffices. In fact, submitting specific identification documents is essential to validate identity and ensure regulatory compliance.

- Once KYC Is Done, There’s No Need to Think About It Again: The idea that KYC is a “set it and forget it” process is misleading. Financial institutions regularly review KYC information to ensure it remains current, and clients must report changes as required.

Key takeaways

Filling out a Know Your Client (KYC) application form is crucial for establishing financial relationships responsibly. Here are some key takeaways to keep in mind:

- Clarity Matters: Always fill out the form in English and use block letters. Clear handwriting prevents misinterpretations.

- Recent Photograph: Attach a recent passport-sized photograph. Ensure it is affixed properly to avoid any delays in processing.

- Comprehensive Identity Details: Provide complete information about your identity, including name, gender, marital status, and date of birth.

- Proof of Identity: Submit acceptable proof of identity. This may include documents like a passport or national identification card.

- Accurate Address: Fill in both your residence and permanent addresses accurately. If you are a non-resident, it's mandatory to provide your overseas address.

- Contact Information: Include all relevant contact details. This helps intermediaries reach you while processing your application.

- Declaration is Key: Signing the declaration at the end of the form confirms that all information provided is true and correct.

- Office Use Section: Be aware that there’s a section for office use. Ensure that the authorized signatory verifies and stamps your document.

- Stay Updated: If any of your information changes, inform the intermediary immediately to keep your records current.

Take these points seriously to ensure a smooth KYC process. Your timely and accurate submission can make a significant difference.

Browse Other Templates

G-7 Quarterly Return - Understanding the G-7's requirements minimizes the risk of financial penalties.

Brokerage Agreement Template - This agreement is crucial for establishing a professional relationship between the broker and applicant.

Home Care Edison - Public assistance program participation can help you qualify for the CARE program.