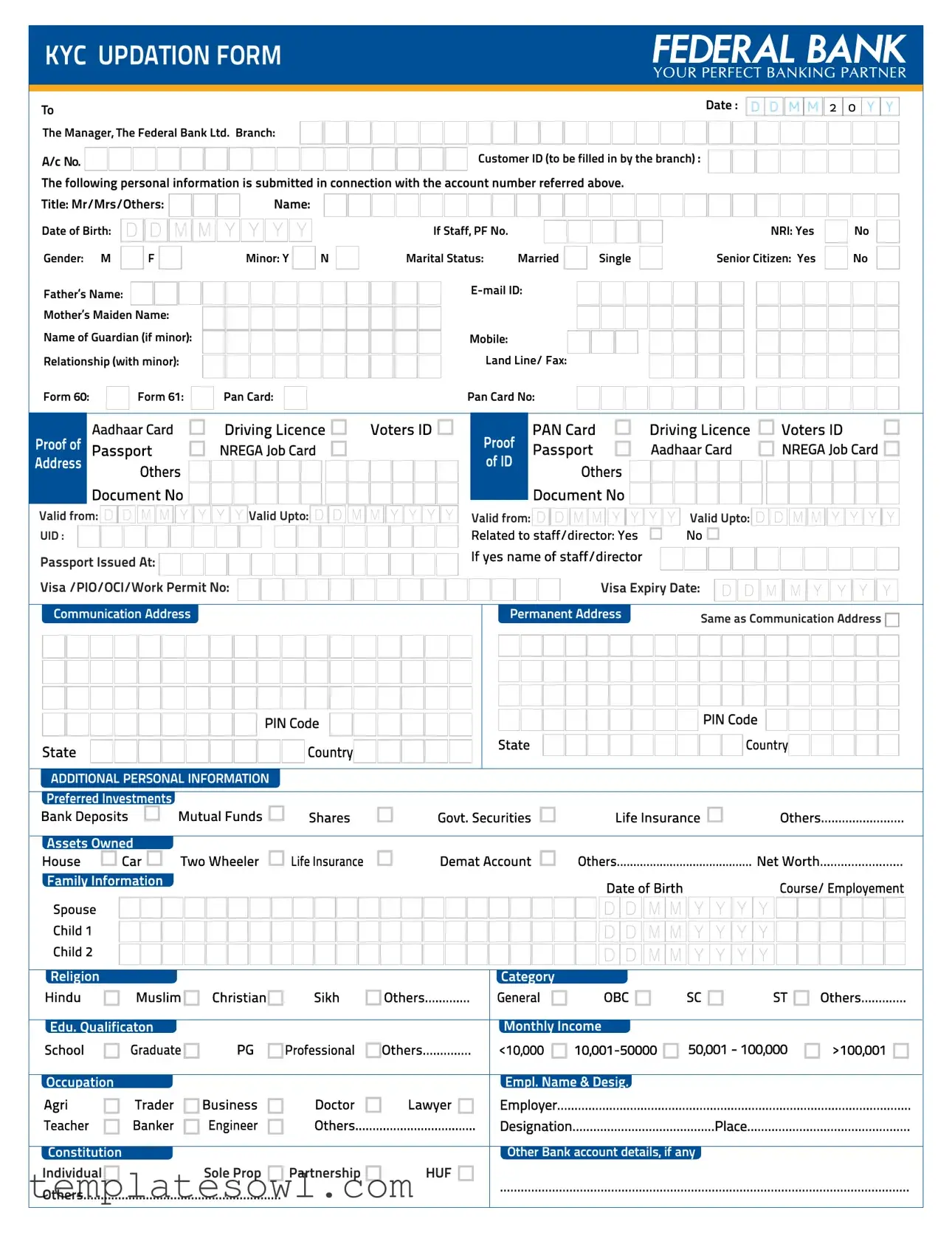

Fill Out Your Kyc Federal Bank Form

The Know Your Customer (KYC) process is an essential component for banks, including The Federal Bank, aimed at building a transparent relationship between the institution and its customers. The KYC updation form is designed to collect critical personal information to verify the identity and address of account holders, ensuring compliance with financial regulations. Customers are required to provide details such as their name, date of birth, gender, and relationship information. Additional sections address marital status, contact details, and identification documents like PAN and Aadhaar cards. The form also inquires about prior account details and employment information to gain a comprehensive understanding of the customer's profile. With various options for identity and address proof, such as the driver's license or passport, the form provides flexibility while maintaining rigorous standards. It is important to ensure that all required documents are submitted in original for verification. Moreover, specific instructions guide customers on how to complete the form, highlighting the necessity for clarity and accuracy, underscoring the significance of transparency in financial transactions.

Kyc Federal Bank Example

KYC UPDATION FORM

To

The Manager, The Federal Bank Ltd. Branch:

A/c No.

Date : D  D

D

M

M  M

M

2

2  0

0  Y

Y  Y

Y

Customer ID (to be filled in by the branch) :

The following personal information is submitted in connection with the account number referred above.

Title: Mr/Mrs/Others: |

|

|

|

Name: |

Date of Birth: |

|

Gender: M |

F |

Father’s Name:

Mother’s Maiden Name: Name of Guardian (if minor): Relationship (with minor):

Mother’s Maiden Name: Name of Guardian (if minor): Relationship (with minor):

Form 60: |

|

Form 61: |

|

|

|

Minor: Y

Pan Card:

N

If Staff, PF No.

Marital Status: |

Married |

Mobile:

Land Line/ Fax:

Pan Card No:

Single

NRI: Yes Senior Citizen: Yes

No No

Aadhaar Card

NREGA Job Card

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Valid from: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Valid Upto: |

|

|

|

|

|

|

|

|

|

|

|

|

Valid from: |

|

|

|

|

|

|

|||||

UID : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Aadhaar Card |

|

|

NREGA Job Card |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Valid Upto:

Passport Issued At: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Visa /PIO/OCI/Work Permit No: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Visa Expiry Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Communication Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permanent Address |

Same as Communication Address |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PIN Code

PIN Code

PIN Code

ADDITIONAL PERSONAL INFORMATION

|

|

|

|

|

|

|

|

|

|

|

50,001 - 100,000 |

|

|

|

|

|

|

|

|

|

|

Employer |

|

|

|

|

|

Designation |

Place |

|

|

|

|

|

|

Constitution |

|

|

|

Other Bank account details, if any |

|

Individual |

Sole Prop |

Partnership |

HUF |

...................................................................................................................... |

|

Others |

|

|

|||

|

|

|

|

||

|

|

|

|

|

|

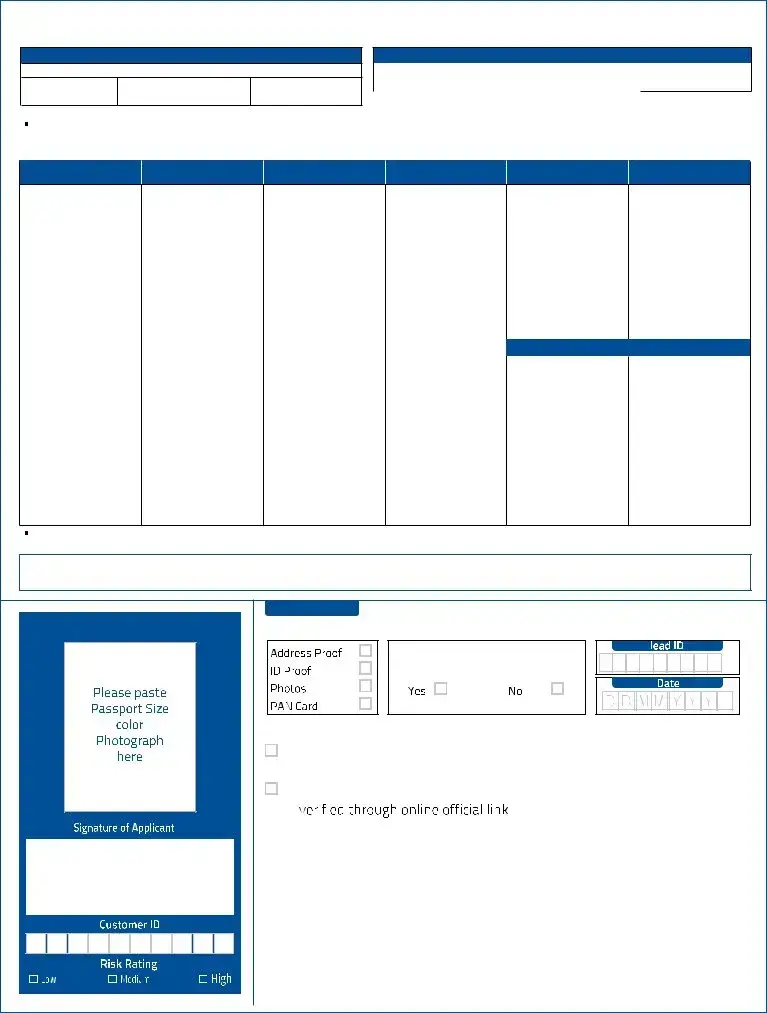

INSTRUCTIONS TO CUSTOMERS

Please complete all sections with black ink, in BLOCK LETTERS and tick boxes wherever applicable.

Identity Proof

Job card issued by NREGA duly signed by an officer of the State Government

Voter’s Identity Card |

Aadhaar letter |

Driving license |

|

|

|

Passport |

Permanent A/c No (PAN) Card |

|

Please note that the original documents must be presented for verification.

Address Proof

Passport |

Driving license |

Aadhaar letter |

|

Voter’s Identity Card |

Job card issued by NREGA duly signed by an officer of the State Government |

||

|

|

|

|

Documents to be enclosed with this form:

In addition to the above documents, the following documents/copies (the list is not exhaustive) are also required, depending on the constitution of the customer as described bellow:

Trusts

Associations /Society

Company

International Clubs (Rotary, Lions, Jaycees)

Individuals

Sole proprietorship firm

two documents in the name of the firm

Copy of Trust Deed Copy of the Registration certificate

List of Trustees

Copy of the resolution of the trusteesAuthorising the members concerned to open and operate the account

Copy of PAN

Tax Exemption Registration Certificate from Income Tax if applicable

Photographs, Identity and Address proof of the persons operating the account

Copy of the Certificate of the Registration

List of office Bearers

Copy of the resolution by the board authorising the members concerned to open and operate the account

Copy of PAN

Tax Exemption Registration Certificate from Income Tax if applicable

Photographs, Identity and Address proof of the persons operating the account

Copy of Certificate of Incorporation.

Copy of Memorandum and Articles of Association certified as the

Copy of Certificate of Commencement of business in applicable cases.

A certified copy of the resolution of the Board of Directors appointing the Bank as the Company's banker.

A certified copy of the resolution of the Board of Directors authorizing the officers to open and operate accounts.

Balance sheets of the Company for the last 3 years or all the previous Balance Sheets, if the company is not three years old.

PAN card in the name of Company.

Copy of the telephone bill confirming the address.

Copy of International Charter of the Club

Copy of resolution to open and operate the account signed by district governor/ president/ any two authorisedsignatories

List of office Bearers of the Clubs

Tax Exemption Registration Certificate from Income Tax if applicable

Photographs, Identity and Address proof of the persons operating the account

Photograph

Identity Proof

Address Proof

Copy of PAN card or duly Filled Form 60/61

Copy of duly acknowledged Form 49 A where Form 60 is filled with the reason Applied for PAN

HUF Account

Photographs, Identity and Address proof of the Karta.

Prescribed Joint Hindu Family Letter signed by all the adult coparceners. (C392)

Registration certificate / License issued by the by govt authorities.

Sales Tax Returns / CST/VAT certificate

Certificate/ registration document issued by Sales Tax/ Service tax/ Professional tax authorities.

The complete income tax return (not just the acknow ledgement) in the name of the sole proprietor where the firm's income is reflected.

Utility bills such as electricity, water and landline telephone bills in the name of the proprietary concern.

Partnership firm

Copy of partnership deed / Registration Certificate, if registered.

Partnership letter in the prescribed form (C231) signed by all the partners in their individual capacity.

Power of Attorney granted to a partner or an employee of the firm to transact business on its behalf.

PAN card/ Form60 in the name of partnership firm.

Copy of telephone / utility bill in the name of firm / partners.

NOC from the lending banker, if customer enjoys credit facilities.

Please ensure that latest photograph of the account holder is affixed.

”I/We declare that the information provided hereinabove is

Signature(s):

Office use only

kyc norms complied

Customer search made, multiple Cust ID do not exists in the name of the applicant.

KYC documents

Clerk |

Asst. Manager |

Principal Officer. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The KYC Updation Form is used to collect personal information from customers to comply with Know Your Customer regulations. |

| Required Information | Customers need to provide details such as name, date of birth, address, and identity proof for verification. |

| Signatory Requirements | The form must be signed by the account holder, confirming the accuracy of the provided information. |

| Proof Documents | Original documents, including identity and address proof, must be presented for verification at the bank. |

| State Regulations | This form is governed by the federal laws applicable in the United States, as KYC requirements vary by state. |

| Usage Frequency | This form should be updated regularly or whenever there are changes in personal information to maintain compliance. |

Guidelines on Utilizing Kyc Federal Bank

Filling out the KYC Federal Bank form accurately is crucial for maintaining up-to-date records with the bank. Proper completion helps ensure compliance with regulations and facilitates smooth banking transactions. Below are the steps to follow for filling out the form.

- Begin by addressing the form with "To The Manager" followed by "The Federal Bank Ltd."

- Enter the branch name and your account number.

- Write the current date in the format DD/MM/YYYY.

- Leave the Customer ID section blank; it will be filled in by the bank staff.

- Fill in your title (Mr/Mrs/Others) and your full name.

- Provide your date of birth in the required format.

- Select your gender by ticking the appropriate box (M/F).

- Fill in your father's name and your mother’s maiden name.

- If you are a minor, provide your guardian's name and the relationship.

- Indicate if you are submitting Form 60 or Form 61 by ticking the relevant box.

- State your marital status (Married/Single/NRI/Senior Citizen) by ticking the appropriate box.

- Enter your email ID and mobile number.

- If applicable, provide your land line/fax number.

- Fill in your PAN card number and Aadhaar details, including the UID.

- Complete the communication and permanent address sections, ensuring both are filled accurately with PIN codes.

- Provide additional personal information, including your employer, designation, and nature of your current account.

- Assemble the required identity and address proof documents, ensuring you include originals for verification.

- Affix a recent photograph of yourself where indicated.

- Carefully read the declaration statement and sign it to confirm the accuracy of the information provided.

Once you have filled out the KYC form, be sure to gather all necessary documentation required for verification. Present everything together at your branch, as processing will depend on the completeness of your submission. Make sure to keep a copy for your records.

What You Should Know About This Form

What is the KYC Federal Bank form and why is it important?

The KYC (Know Your Customer) Federal Bank form is a document required by the bank to verify the identity and address of its customers. It is crucial for maintaining transparency and avoiding fraudulent activities. Banks must collect this information to comply with regulatory requirements. By filling out the form accurately, customers ensure that their accounts stay active and secure.

What information do I need to provide on the KYC form?

When completing the KYC Federal Bank form, you will need to provide personal details such as your name, date of birth, gender, and contact information. Additionally, information about your parents or guardians, employment details, and financial data must be included. It is also essential to furnish identity and address proof, like your PAN card or Aadhaar card. Make sure to complete all sections clearly and correctly to prevent any delays.

How do I submit the KYC form?

You can submit the KYC Federal Bank form at your local Federal Bank branch. Make sure to bring the original documents for verification along with the completed form. If you are unable to visit in person, check if your branch has alternative submission options, such as online submission or postal service.

What happens if I don’t update my KYC information?

If you fail to update your KYC information, your bank account may face restrictions. This could include limitations on transactions, withdrawals, or even account closure in some cases. Keeping your KYC information up-to-date ensures that you can continue to use your banking services without interruptions. It’s in your best interest to handle this as soon as possible.

Common mistakes

Filling out the KYC Federal Bank form requires careful attention to detail. One common mistake is providing inaccurate or incomplete personal information. For instance, failing to include the correct spelling of a name or leaving out important identifiers like a mother's maiden name can lead to delays. Ensure that all sections of the form are filled completely and accurately to avoid complications.

Another frequent error occurs when individuals neglect to tick the appropriate boxes or omit crucial selections. This may seem trivial, but it can lead to misunderstandings about one's marital status, residency, or other important categories. Always review the form to confirm that each box is appropriately checked or filled in, as this helps in processing the application smoothly.

Using the wrong type of ink or handwriting style can also cause issues. The instructions specifically state to use black ink and BLOCK LETTERS. Submitting the form in a different color or style may hinder the clarity of information presented. Always follow the guidelines closely to ensure that your form is easy to read and process.

Additionally, overlooking document requirements is a common pitfall. It is crucial to ensure that all necessary identity and address proof documents are included with the form. Missing even one required document could result in delays or rejection of the application. Double-check the required list of documents before submission.

Finally, many individuals forget to affix a recent photograph on the form. The latest photograph is a necessary part of the identity verification process. Without this, the application may not be considered complete. Make it a point to include a sharp, clear photograph to avoid unnecessary setbacks in your KYC process.

Documents used along the form

When completing the KYC Federal Bank form, individuals often need to provide additional documentation to support their identity and address verification. Here is a list of other common forms and documents that may be required:

- Proof of Identity: This document confirms the individual's identity. Acceptable forms include a passport, driving license, voter’s ID card, or Aadhaar card. Each document should include a recent photo and relevant personal details.

- Proof of Address: To verify the individual’s residence, documents like utility bills, bank statements, or rental agreements may be submitted. These should reflect the current address and be dated within the last few months.

- Form 60/61: These forms are used when individuals do not have a PAN card or need to provide additional information regarding their income. They must be filled out completely and accurately to avoid delays.

- Partnership Deed: For partnership firms, this legal document outlines the agreement between partners. It typically includes details on the partnership's structure, ownership stakes, and responsibilities of each partner.

- Trust Deed: This document is required for trusts and details how the trust operates, including information on trustees, beneficiaries, and the trust’s purpose. A current and signed copy is necessary.

- Memorandum and Articles of Association: For companies, these documents outline the company’s objectives, structure, and rules for operation. An updated version with all amendments must be provided.

Providing accurate and complete documentation not only facilitates the verification process but also enhances the overall banking experience. Ensure that all forms are signed and any required additional paperwork is included to avoid unnecessary delays.

Similar forms

-

W-9 Form: Like the KYC Federal Bank form, the W-9 form collects essential personal information, such as name, address, and taxpayer identification number. Both forms are used to verify the identity of individuals and help prevent fraud.

-

Passport Application Form: This form requires personal details, including date of birth, address, and nationality. Similar to the KYC form, it aims to establish the identity and eligibility of the applicant.

-

Loan Application Form: When applying for a loan, individuals must provide personal details, income information, and employment history. The goal here is to determine the applicant's creditworthiness, akin to how the KYC form assesses identity and financial standing.

-

Credit Card Application Form: This form requires similar personal information, including name, address, and financial details. Both forms serve to verify identity and assess financial risk before granting access to a financial service.

-

Employment Verification Form: Employers often request personal details and identification from prospective employees. Just as the KYC form seeks to validate identity, this form establishes the credibility of potential hires.

-

Insurance Application Form: Personal information regarding health, status, and history is required for obtaining insurance. Like the KYC form, it is designed to ensure accurate identification for risk assessment purposes.

-

Tenant Application Form: This document gathers personal details, income, and previous rental history. Much like the KYC form, it aims to evaluate the identity and reliability of an individual before entering into a contractual agreement.

Dos and Don'ts

Things You Should Do:

- Fill out all sections completely and accurately.

- Use black ink and write in BLOCK LETTERS.

- Tick the boxes where applicable to indicate your choice clearly.

- Present original documents for verification when submitting your form.

- Ensure that you include all required supporting documents based on your account type.

Things You Shouldn't Do:

- Do not leave any sections blank; incomplete forms may cause delays.

- Avoid using pencil or any ink color other than black.

- Do not forget to affix your most recent photograph.

- Do not submit false or misleading information.

- Never ignore the specific requirements for your account type, as they can vary.

Misconceptions

Misconceptions about the KYC Federal Bank form can lead to confusion for many customers. Below are seven common misunderstandings along with explanations to clarify each point.

- The form is only for new account holders. Many believe only new customers must complete this form. However, existing customers also need to update their KYC information periodically to comply with regulations.

- Providing a PAN card is optional. Some think that presenting a PAN card when filling out the form is not mandatory, but it is essential for individuals and entities as it helps verify identity for tax purposes.

- Online submissions are acceptable. There is a misconception that the KYC form can be submitted online. In reality, customers must present the form and original documents in person at their bank branch.

- All documents must be submitted at once. Customers often feel pressured to have every document ready during their first visit. Instead, they can submit the form and other required documents later as informed by the bank staff.

- Only personal accounts require KYC compliance. Another misunderstanding is that only personal accounts need to fill out this form. In fact, all types of accounts, including those for trusts and companies, must adhere to KYC regulations.

- KYC forms are the same for all banks. Some individuals assume that the KYC form format is uniform across all banks. Each bank may have different requirements and layouts for its KYC forms.

- My information is confidential, so no verification is necessary. Customers may think their details are private and do not require confirmation. However, banks must verify the information presented in the KYC form against official documents to ensure accuracy and prevent fraud.

Understanding these misconceptions can streamline the KYC process and ensure compliance. Engaging with the bank for clear guidance can also alleviate concerns.

Key takeaways

Filling out the KYC (Know Your Customer) Federal Bank form is an essential task for account holders. Here are ten important considerations to keep in mind:

- Accurate Information: Ensure that all personal details, such as name, date of birth, and address, are filled out accurately to avoid delays in processing.

- Compliance: The form must be completed in accordance with the instructions provided to meet KYC requirements.

- Documentation: Original identity and address proof documents should be presented along with the form to facilitate verification.

- Section Completion: Fill out all sections of the form using black ink and block letters. This ensures legibility and clarity.

- Form Submission: Be sure to submit the form along with any required supporting documents based on your account type.

- Signatures: All necessary signatures should be present, confirming that the information provided is accurate and complete.

- Photograph Requirement: Ensure that a recent photograph is affixed appropriately, as this may be mandatory for processing.

- Form 60/61: If applicable, be ready to fill out Form 60 or 61, especially if you don’t have a Permanent Account Number (PAN).

- Special Considerations: Minor accounts require additional information about guardians and relationships, which must be clearly specified.

- Record Keeping: It is advisable to keep copies of all submitted documents for your personal records and future reference.

Completing the KYC Federal Bank form correctly not only fulfills legal requirements but also helps in safeguarding your financial transactions. Take the time to gather the necessary documents and review your entries before submission. Your diligence will contribute to a smoother banking experience.

Browse Other Templates

St 5 Form - Part 1 should be completed by the exempt organization itself.

EFT Authorization Form,Electronic Funds Transfer Agreement,EFT Change Request,Employer Bank Account Update Form,EFT Participation Registration,Bank Account Transfer Notice,Financial Institution Authorization Form,EDD EFT Enrollment Form,Electronic Pa - Each section of the form serves a specific purpose, make sure to follow accordingly.

Printable Blank Football Depth Chart Pdf - Keland McElrath plays right guard and is a junior transfer from Ripley, Tennessee.